Aadhaar was used as Proof of Identity, Proof of Address and date of Birth. Now you can use Aadhaar for electronic Know your Customer (eKYC) or electronic Signature(e Sign). Aadhaar eKYC initiated by the Government of India allows citizens to sign any document remotely. Anyone with a valid Aadhaar card and a registered mobile number can use this service for OTP to be generated and sign documents or fulfill Know your Customer(requirements) from anywhere, anytime. This article talks about Aadhar used for eKYC and eSign in applying for PAN, opening NPS account, doing eKYC for investing in Mutual Funds, buying Insurance Policy Online.

Table of Contents

Aadhaar eKYC,eSign

Aadhaar was used as Proof of Identity, Proof of Address and date of Birth. Now you can use it for electronic Know your Customer (eKYC) or electronic Signature(e Sign). If you have an Aadhaar number, you can opt for e-KYC or eSign. Anyone with a valid Aadhaar card and a registered mobile number can use this service to sign documents from anywhere, anytime. Give your Aadhaar number and an OTP authenticates you. In 2016, Aadhaar enrolment figures crossed 1 billion, making it the largest biometric database in the world—and the foundation for India’s digital transformation. Our article What is Aadhaar, How to enrol,Check Aadhaar status,Download e Aadhaar talks about how to get Aadhaar.

- Aadhaar and PAN The Central Board of Direct Taxes (CBDT), in a circular dated 22 July 2016, said that a new permanent account number (PAN) card can be applied for online, using an application form that can be e-signed using the Aadhaar linked e-signature.

- Aadhar and eNPS: Now you can open eNPS account using Aadhar KYC. The completely online process is based on Aadhar verification which is possible provided your mobile number is linked to Aadhar card.

- Aadhaar and Investments in Mutual Funds SEBI circular currently permits investment of Rs 50,000 per Financial Year per Mutual Fund for Aadhaar based eKYC using OTP verification. Once you enter your Aadhaar number, you will get a one-time password (OTP) on your mobile number. Once you enter this, you are said to be KYC-compliant and you are good to invest.

- Aadhar and Buy Insurance Policy Online You can buy a policy online using Aadhaar eKYC

- Aadhaar and Mobile: From Aug 2016 Aadhaar-based authentication APIs power subscriber enrolment in telecom companies, allowing them to deploy e-KYC (know your customer) solutions that rely on biometrics instead of documents to verify identity. It is estimated that this has reduced the cost from Rs1,500 per subscriber to just Rs 10. Customers can now walk in with their AADHAR card to get new mobile connections with instant activations, following an approval from the government, which cleared electronic-Know Your Customer (e-KYC) rules using the card.

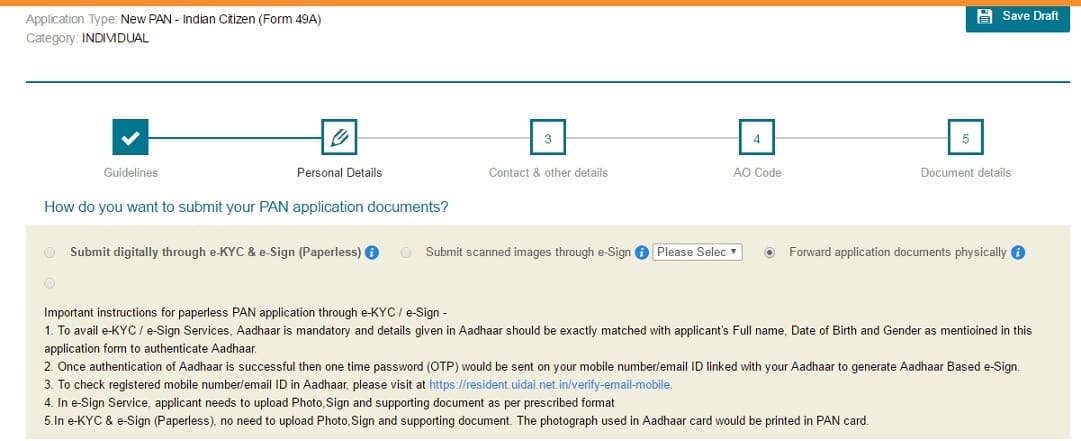

Apply PAN Online using Aadhaar

New online PAN application facility has been launched for PAN applicants with an option of paperless submission of application using Aadhaar based e-Sign

Applicant can select any one of the following options while filling online PAN application: Submit Digitally through e-KYC and e-Sign(paperless), Submit Scanned images through e-Sign, Forward application documents Physically

To avail e-Sign,e-KYC Aadhaar is mandatory and details given in Aadhaar should match PAN application

- Submit Scanned images through e-Sign, an applicant needs to upload scanned images (as per defined parameters) of photo, signature and supporting documents while applying.

- Submit Digitally through e-KYC and e-Sign(paperless): no need to upload Photo, sign and scanned images. photograph used in Aadhaar card would be used in PAN card as well.

- Forward application documents Physically: Old process of sending documents physically

Open eNPS account using Aadhar KYC

Till Dec 2016 an NPS account could be opened online via eNPS portal but the printout of the application submitted online had to be sent to the PFRDA’s Central Recordkeeping Agency

(CRA) to open the account. The Pension Fund Regulatory and Development Authority (PFRDA) has issued a circular dated December 15th, 2016 directing that in the case of NPS accounts being opened online on the basis of Aadhar verification followed by esignature, a physical printout of the application need not be sent.

There are two ways to open an NPS account. One method has now been made totally online and the other method is partially online and partially physical. The completely online process is based on Aadhar verification which is possible provided your mobile number is linked to Aadhar card. The steps in this fully online process are:

- Click on the Registration and select ‘register with Aadhar’ Option.

- Enter the Aadhar Number and click on “Generate OTP” option

- The OTP will be sent to your registered mobile number linked to Aadhar Card.

- Enter the OTP number and fill in your personal details, Nomination details, bank details.

- On the ‘Photograph and Signature’ tab, your photograph will be shown same as on the Aadhar card. Upload your signature in the ‘jpeg’ format.

- Click on the ‘esignature’ option. Once again the OTP will be generated and sent to your mobile number.

- Enter the OTP to verify your signature and make payment.

Once the application is successfully submitted, your PRAN will be allotted instantly

Aadhar eKYC and Mutual Funds

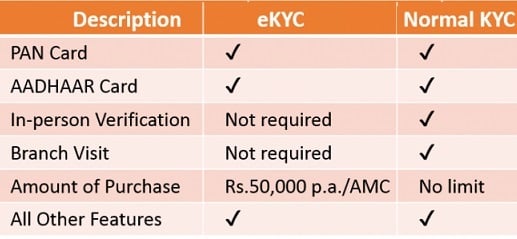

KYC completion, a mandatory requirement for investing in MFs, involved submission of paper forms, ID and address and proofs and In Person Verification (IPV). SEBI allowed eKYC, or “electronic Know Your Customer” process in 2013, whereby investors could submit the KYC requirements online. A few Mutual Funds launched acceptance of Aadhaar as ID and address proof followed by video-based IPV for authentication and verification purpose. The eKYC makes the entire procedure paperless and, hence, more convenient for investors while cutting down the verification time drastically The objectives of eKYC are to

- reduce the turnaround time for customer verification, which used to take anywhere between one and three weeks with the existing KYC process, which requires documents in hard copy format.

- Mutual fund penetration with citizens, especially in tier-2 and tier-3 towns can be accelerated with Aadhaar-based eKYC.

- The younger generation who prefer digital experience can start investing with a complete digital solution for instant account opening.

- A person with eKYC verification can invest up to Rs 50,000 per year in a mutual fund, which comes to a SIP of around 4,000 per month. If you want to invest higher than 50,000 annually, you have to go through normal route of KYC compliance and appear for IPV.

- Note: The details such as address registered as per Aadhaar would be captured as the address for your KYC. If there is any change in Personal Details while applying for eKYC, you need to get that fixed from UIDAI and then apply for eKYC.

Note: The e-KYC facility is only for those who have not initiated KYC enrollment yet. For those who have already initiated or are KYC compliant, there is no need of the process

eKYC is an online and paperless Aadhaar card based process for fulfilling KYC requirements to start investing in Mutual Funds without submission of any documents.The following image shows the difference between Normal KYC and eKYC using Aadhaar

You must have below information to get started : Aadhaar Number, PAN Number, Mobile Number, Email-Id.

Process of using Aadhar for eKYC

- Enter your Aadhaar number and required details

- Submit your details. UIDAI will generate an OTP which will be sent your registered mobile number with UIDAI

- Enter OTP and your web form will get auto-populated with your Aadhaar data.

- Fill required fields and submit the form

Aadhaar eKYC and buy Insurance Policy Online

The process of buying insurance policies online has become simpler as the regulator, IRDA allowed for one-time password (OTP) to be used for authentication(Ref http://bit.ly/2crzpHA )

When you buy an insurance policy online, you need to give your details. For instance, when you buy a term plan online, you start by filling up a proposal form. A proposal form seeks all the relevant information from you, such as your personal details, financial details, information about nominee and your health record. Along with the form, you also need to submit know your customer (KYC) documents such as address and identity proofs. There are two ways of doing this.

- If you have an Aadhaar number, you can opt for e-KYC. Give your Aadhaar number and an OTP authenticates you. The insurer can process the KYC details from the Unique Identification Authority of India (UIDAI) database.

- The other option is to submit the KYC documents. Insurers allow you to scan and upload these. Once KYC is done, the process of underwriting starts.

Whether you are buying insurance online or offline, insurers will now have to offer digital policies for big-ticket covers. These policies can either be issued by the insurer, emailed to you as a PDF document that is digitally signed by the insurer, or sent to your e-insurance account. If the insurer sends you the e-policy directly, it will still have to send you the physical policy documents. If you get the policy in your demat account, then the insurer does not have to send you a hard copy.

- With life plans, for instance, if annual premium is Rs10,000 or more, or the sum assured is Rs1 lakh (Rs10 lakh for pure term plans), the insurer has to issue e-policies.

- In the case of motor insurance, all policies have to be issued electronically.

- For life plans, if annual premium is more than Rs.10,000, or the sum assured is Rs.1 lakh (Rs.10 lakh for pure term plans), the insurer has to issue e-policies.

- For non-life policies—barring health, motor and travel insurance—electronic policies are mandatory if premium is more than Rs.5,000 or the sum insured is Rs.10 lakh or more.

- For health insurance, the premium or sum insured thresholds are Rs.10,000 and Rs.5 lakh, respectively.

- For personal accident and domestic travel insurance, this limit is Rs.5,000, or a sum insured exceeding Rs.10 lakh.

Aadhaar useful for Government Process

For the year 2017, CBSE has changed the eligibility requirement a bit for filling up the JEE Main application forms. According to the official website of JEE Main 2017, aspirants planning to take the exam should hold an Aadhaar Card issued by UIDAI. Candidates from Assam, Meghalaya, and Jammu & Kashmir would not require an Aadhaar Card to fill JEE Main 2017 application forms.

- Acquisition of Passport : Obtaining a passport includes getting an appointment with the authorities, processing your application, dispatching of the passport and police verification checks. It usually takes multiple weeks to complete all processes and avail a passport, but thanks to the increased uses of an Aadhar Card, passports can now be availed by applicants within 10 days. Individuals who wish to obtain a passport can apply for the same online by simply attaching their Aadhaar Card as the only residence and identity proof along with their application. Within three days of submission, you will receive an appointment and the processing and dispatching of the passport will be complete within seven days. Police verification checks will then be scheduled for a later date.

- Opening Bank Accounts Aadhaar can be used for KYC, identification and verification purposes. Financial institutions and banks consider Aadhaar Cards as valid address and photo ID proofs during the time of opening a bank account.

- Digital Life Certificate The Jeevan Praman for Pensioners or the Digital Life certificate as it is also called, was initiated by Narendra Modi, the Prime Minister of India. The aim of the certificate was to abolish the need for the pensioner to be physically present in order to receive pension for the continuation of their scheme. Pensioners can now avail pension without having to leave their homes as their details can be digitally accessed by the agency through their Aadhar Card numbers.

- Receipt of Monthly Pension The benefits provided by an Aadhaar Card can be availed by retired government officials too. The Aadhar Card numbers of pensioners will have to be registered with their respective departments so that timely pension payments can be received.

- Jan Dhan Yojna : The Jan Dhan Yojna accepts Aadhaar Card Number as the only document for the opening of a bank account.

- Provident Fund : Individuals who link their Aadhar Card to their Pension Accounts can have their provident fund disbursed directly to their accounts through their PF organisation.

- LPG Subsidy : The Aadhaar-based Direct Benefit Transfer is followed by the LPG subsidy wherein the distributor for your particular area will link your Aadhar Card with your LPG connection and will be able to reach your bank account directly through the 12-digit unique identification number.

Is Aadhaar mandatory?

Is the Aadhar Card mandatory for the citizens of India? Well, no. But its mighty handy to have. Aadhaar has been linked to gas connections, Voter ID, PAN card, and bank accounts. What is noteworthy in this context are two interim orders passed by the Supreme Court on August 11, 2015, and October 10, 2015.

The order of August 11, 2015, states that obtaining Aadhaar shall not be mandatory. It states the following:

1. The Union of India shall give wide publicity in the electronic and print media including radio and television networks that it is not mandatory for a citizen to obtain an Aadhaar card

2. The production of an Aadhaar card will not be condition for obtaining any benefits otherwise due to a citizen;

However, the order also clarifies that Aadhaar can be “used” by the Centre for PDS scheme and LPG distribution scheme. “The Unique Identification Number or the Aadhaar card will not be used by the respondents for any purpose other than the PDS Scheme and in particular for the purpose of distribution of foodgrains, etc. and cooking fuel, such as kerosene. The Aadhaar card may also be used for the purpose of the LPG Distribution Scheme.”

Related Articles:

- How to Update or Correct Details in Aadhaar

- What is Aadhaar, How to enrol,Check Aadhaar status,Download e Aadhaar

- JAM Trinity: Jan Dhan Yojana, Aadhaar and Mobile number

- Digital India

- Know Your Customer or KYC

- For EPS Aadhaar made mandatory, Is Aadhaar mandatory?

Reasons to get an Aadhar Card Aadhaar card is a widely accepted form of identification. Even though it is not mandatory, an Aadhar card can qualify you instantly, making the process easier and quicker.

30 responses to “Aadhaar eKYC,eSign: Paperless for PAN, eNPS, Mutual Funds,Insurance”

Very informative blog and i will definitely read all your future post, and also i recommend you to others.

PDF Digital Signature

esign aadhaar is an aadhar based electronic signature service initiated by the Government of India. eSign Electronic Signature Service enables any Aadhaar-holder to electronically sign documents using Aadhaar eKYC services.

Hi, I applied PAN card through E-KYC, but in the card i have not got my signature in the signature box. It was also mentioned on the card that, “The card is not valid unless physically signed”. Can i make my signature on the card my self with a pen…????

Hi I applied for Pan application with ekyc and esign(paperless).

And pan card status showing is:- (Your PAN application with Aadhaar based e-Sign option is received and is under verification)

Note- Do I require to send documents physically..?

My first name in aadhar contains as (S S) but this pan application not accepting such format of first name what I have to do now.

Stick to one format of the name. As you have got Aadhaar stick to name in Adhaar.

The online PAN application utility does NOT accept initials.

You cannot fill the online PAN card application with Initial as Surname or First Name. You need minimum two characters in the field.

You can visit the PAN Facilitation centre for applying PAN card through offline mode. In offline mode, you may get the PAN card with initial. Search your nearest centre here : PAN Centre.

Watch this video to know more about PAN Correction

https://youtu.be/MIsFdIDSl9A

Self ke hi finger print jo khud pan cad banasake apne hi biometrc se kahi na jake

Esi Suvidha honi Chahiye NSDL Par

Since You have exceed OTP Regeneration Limit.You cannot proceed with E-sign.Kindly proceed with generating physical application and sent the application to the mentioned address in next page

भाई बार बार सही OTP डालने के बाद भी ये सब कुछ हो गया अब कोई SOLUTION है क्या

What are you trying to use Aadhaar KYC for? ex PAN/NPS

How many times have you regenerated OTP?

मुझे pan अगर ऑफिस address पे लाना हे ,तो address प्रूफ क्या देणा होगा… ई kyc मे तो आधार का address अपने आप लेगा

By using ekyc the digital signature is not showing in the form 49A. Is this ok or. Will. Any thing.

That is correct. If you use eKYC then you do not need Digital Signature.

Hello,

I’ve applied for PAN using e-KYC. But, I’m not getting the signature in the signature box of PAN Card.Should i need to re-apply for change or correction

YE GOVERNMENT SITE HAI BHAIYA. ONLINE APPLY KAROGE TO THODA PAISA OR TIME SAVE KAR LOGE BUT GOVT. EMPLOYEE TO YE CHAHTE NAHI HAI NA……. SO KISI DALAL KO PAKDO YA PAN CENTER JAO TAKI INKA KAMISAN KHATAM NA HO……

i have applied pan application using eKYC mode. Do i need to send the acknowledgement number form and documents physically to NSDL ?

No you don’t have to send any form or documents to anywhere

I filled the form online. But after downloading it.. the signature optn in not filled. I used ekyc. Do i need to sign it manually and send to nsdl?

is pancard mandatory for opening a savings bank account according to ekyc.

if the person doesnot have pancard and he is a individual of minimum income level ,can he provide form60

I am unable to link my aadhaar card to my PAN CARD as the site is too slow and shows that ” Aadhaar Card is valid but not active” What does this mean and what can I do?I had recently done aadhar verification,can anyone help me.

There is no such facillity to activate the AADHAR. However, while linking AADHAR with PAN, if you see any such message that says your AADHAR is not active, that could be either due to non-generation of your AADHAR number or due to some technical issue. So, in this situation, 1st check the status of your AADHAR here If your AADHAR is active and still you are not able to link the same with your PAN, then contact Income Tax Department for the same.

I applied for PAN card correction and submitted application digitally through e-KYC and e-Sign(paperless). My application submitted successfully but after few days status changed to following message. Do I still need to send physical documents.

We have not yet received the supporting documents with respect to your application for ‘New PAN Card or/and Changes or Correction in PAN Data’. Kindly submit the requisite documents to NSDL to enable us to process your PAN application at the earliest. For further details, please read the guidelines and instructions or contact TIN Call Center at 020 – 27218080

Token no.0006623421, if got following end remarks.

Your e-KYC based request has failed hence you cannot proceed the application with e-KYC mode. Kindly generate new token and proceed with physical mode. Kindly note that you will get refund of the PAN application in next seven working days.

What could be the reason for this failure ? Why system should allow to go upto payment screen?

Reply from informed friend would be highly appreciated.

Suresh Basate

Good morning sir.

Can illiterate esign pan card apply with aadhar?

e-kyc done for pan card but no e-sign available then what next step

Your e-KYC based request has failed hence you cannot proceed the application with e-KYC mode. Kindly generate new token and proceed with physical mode. Kindly note that you will get refund of the PAN application in next seven working days.

token no. 00031116108

problem shove mi

ur e-KYC based request has failed hence you cannot proceed the application with e-KYC mode. Kindly generate new token and proceed with physical mode. Kindly note that you will get refund of the PAN application in next seven working days.

token. No. 0002684492 dated : 2017-01-18 12:50:10.47

Inbox

x account num 63049362014 satyanarayan nath 9752470622

mere sath bhi aisa hua 20 din baad bhi refund nahi aaya

PAY NOW

TO GET FREE STOCK FUTURE TIPS VISIT BEST STOCK FUTURE TIPS