Indian philosophers use the Sanskrit term Simhavalokana to denote the retrospective gaze of a lion. It is said that as the lion traverses some distance in the jungle, he looks back to examine the path he chose and how he covered that distance. As the year 2013 ends we might as well spend some time to reflect how the year was and what lessons we can learn from it.

Recap of 2013

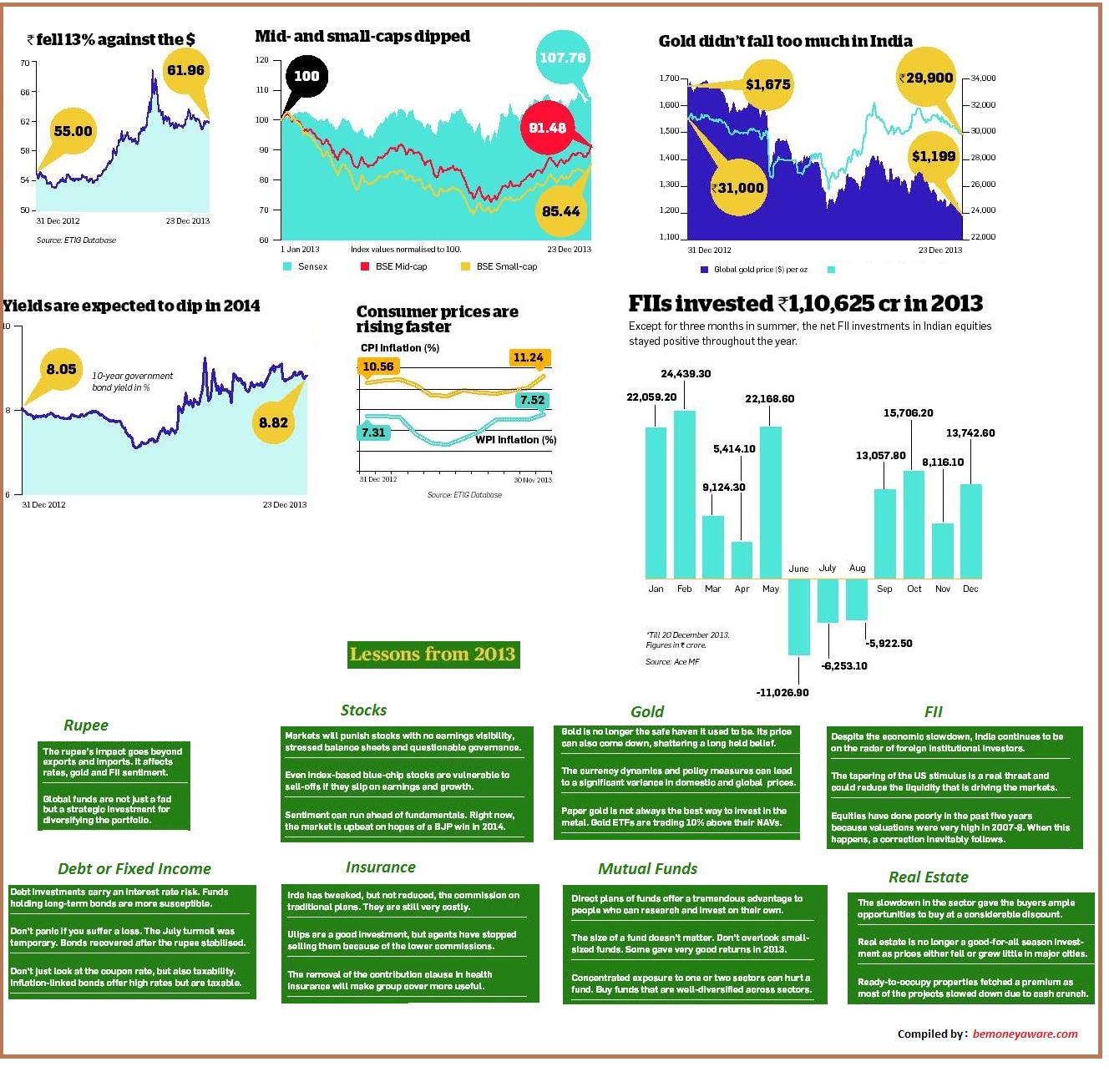

Rupee : The rupee played a pivotal role during 2013. We learnt that it affects nearly every other investment. The RBI raised interest rates to buoy the rupee and the capital markets went into a tailspin. The falling rupee also kept gold prices high in India when global prices crashed. After remaining relatively stable for several years, the Indian rupee went into a freefall in 2013. From around 54 per dollar at the beginning of May, it fell nearly 27% to nearly 69 by the end of August. It recovered a bit in the following months, but is still down almost 13% for 2013.

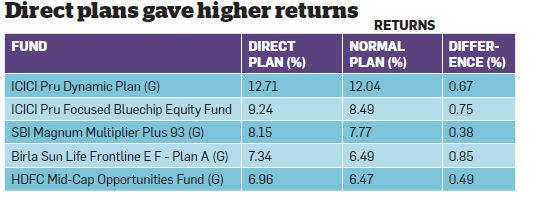

Stock market:The stock markets remained volatile during the year and the Sensex touched an all-time high. However, this euphoria was confined to large-cap stocks. The mid- and small-cap stock indices closed the year with losses, underlining the need to be choosy while investing. The Indian stock market rose more than counterparts in Russia, China and Brazil did in 2013 and attracted the most fund flows from foreign investors after Japan.

FII: Despite India’s many macroeconomic travails, foreign institutional investors (FIIs) remained bullish on the Indian equity markets in 2013. Their optmism holds lessons for retail investors who consistently pulled money out of equities during the year. By 20 December, the net FII investment in Indian equities had touched Rs 1,10, 626 crore. Only in June, July and August, when all emerging markets witnessed capital outflow after the Fed chairman spoke of tapering, did FIIs pull money out of the Indian equity markets. Once the fear of tapering died down in September, the net inflow was strong once again. Between June and August, foreign institutional investors pulled out more than 23,000 crore from the equity markets.

Debt Funds: When the RBI raised the short-term borrowing rates to stem the slide in the rupee, the debt market went into a tailspin. While long-term debt funds bore the brunt, the spike in overnight rates forced even liquid funds to report significant marked-to-market losses. The RBI also launched its much-hyped inflation-indexed bonds (IIBs). These instruments are supposed to protect savings from inflation. The first tranche of IIBs did not evoke much interest from investors because they were linked to the Wholesale Price Index-based inflation, not the Consumer Price Index-based inflation. The RBI then came out with the Inflation Indexed National Saving Securities-Cumulative (IINSS-C), which are based on the combined CPI.

Gold : The global price of gold crashed almost 28% in 2013, but the fall in the rupee restricted the loss to 3.5% in India due to the fall in the rupee. The government introduced certain measures that pushed up the domestic price of the metal. Import duty on gold was hiked from 2% to 10%, increasing the landed cost of gold. Quantitative restrictions were also imposed on gold imports, such as the RBI’s 20:80 scheme, which mandates that 20% of imports need to be re-exported.

Inflation: Inflation was relentless during the year and even uncut onions brought tears to the eye. With high inflation the new normal, investors will need to alter their financial planning. Don’t go by 7-8%, but a more realistic 9-10% inflation rate, while setting long-term goals.

Real Estate : The economy slowing down, job losses mounting and salary increments pared to the bare minimum impacted the real estate sector. High property prices and interest rates on home loans also took a toll on affordability. The high interest rates have pushed real estate beyond the reach of many people. The key lesson is not to buy property as an investment. You would be paying 11-12% per annum on a loan to buy an asset that will grow only 5-6% in value in a year. Only if the value of the property is expected to appreciate by more than 12% per year does it make sense to invest in it.

Insurance : New guidelines for traditional life insurance plans, which were supposed to kick in from 1 October, but will now be effective from 1 January 2014. The new guidelines ensure a higher surrender value for policyholders, reduce the minimum period and mandate that policies offer a higher life cover. However, Irda has not brought down the commission payable to the agent, though it has linked the agents’ commissions to the premium paying term of the policy. Irda also laid down new guidelines for health insurance companies in 2013. The key changes include raising the minimum entry age to 65, lifelong renewal and provision to port from a group plan to an individual policy. Insurers must have standardised definitions of terms, exclusions and critical illnesses as stipulated by Irda. The contribution clause, under which a policyholder who had more than one health policy could claim a proportionate amount, has also been abolished.

In picture the recap of 2013 and lessons from it Ref : ET Investing lessons and strategies for 2014 (Click on image to enlarge) Interested readers may read Livemint’s What’s in store for the markets in 2014

Bemoneyaware and 2013

In 2013, more than 10 lakh people read this blog. Every day, I’m grateful for a chance to share an idea, strategy or challenge with you. I appreciate the attention and trust of my readers, it would be impossible to do this without you. . We thank you all for being a part of bemoneyaware’s exciting awareness journey. As we approach the end of 2013, it is time to reflect, look back, count our blessings and make plans for the year ahead. So if you have benefitted from our information do please consider giving something back to help us grow. Your feedback.

- What kind of posts you want to read on bemoneyaware? (If possible name one or two posts that you really really liked on our blog)

- What kind of posts you DON’T WANT TO READ on our blog? (If possible name one or two posts that you did not like on our blog)

- How to increase interactions from the readers? (Though many people read the blog daily we don’t have many comments 🙁 )

Related Posts :

Wishing you a Happy New year!

4 responses to “Recap of Year 2013”

Wish you a happy new year. Looking forward to lots of insightful financial posts from you.

Wish you a happy new year too. Thanks for your wishes.

Wish you a happy new year. Looking forward to lots of insightful financial posts from you.

Wish you a happy new year too. Thanks for your wishes.