Owning a home comes with responsibility and costs. Owning a home or property is not as simple as signing the mortgage agreement and moving in; there are all kinds of costs to account for and be prepared for. The best way to combat unnecessary home expenses is to prepare thoroughly for them. There are numerous ways to avoid major home expenses and with a little thought and common sense, you can save money too.

Home Insurance

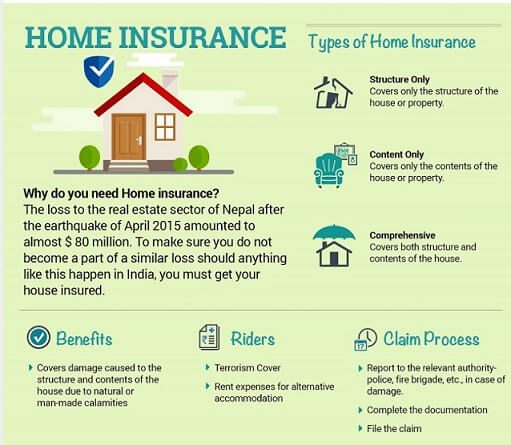

Your home can be damaged by a number of factors. Robbers might rob your house. House can catch fire due to a faulty electronic appliance. It can get damaged due to any natural calamity like earthquake, lightning, storm, etc. Any damage to your house can drain you financially as well as emotionally. If, God forbid, there is a major loss to your property; you might find it daunting to restore everything with the high amount of money involved.

Many consider insuring the house as a waste of money though we spend lakhs on constructing and decorating our houses.. As per the report of the global reinsurer Swiss Re, during the floods that wrecked Chennai in 2015, the city reported a financial loss of more than Rs 14,709 crore. Of this, only 34% were insured, amounting to a huge loss of Rs 5,049 crore.

One should buy home insurance. It shields your house and its content against natural and man-made risks. It also covers the loss in case the valuable content of your house gets damaged or stolen. Like a health insurance policy that safeguards your finances against soaring medical costs, home insurance shields your house . Image below gives overview of Home Insurance

The most costly mistake you could make is cancelling or allowing your insurance policy on your home to lapse. Sometimes, a house insurance company may cancel your policy before you do, and you are out of pocket in a serious way.

Many people are not even aware that their policy may have lapsed and they go into a blind panic, such as one reader who thought he wouldn’t be able to afford the new rate his insurer would offer him because of subsidence on his property. Luckily, his story had a happy ending. Not everyone will be this lucky though!

Imagine having to put in an insurance claim when your basement has flooded, only to be told that you are in fact not covered and there is no viable claim to be made. This situation could cost you a small fortune and you would be liable for the entire cost. It is always better to be safe than sorry when it comes to home insurance.

It is of vital importance to check with your insurer on an annual basis if you are still insured and what your insurance covers exactly. Think of additions, moving or weather patterns that may have changed in your area and ensure that you are covered all year through.

Home Maintenance

A maintained home is a cost-saving home. Yes, this costs money and time to do, but in the long run, maintaining your home saves you much more money. Regular home maintenance is absolutely necessary to avoid the pitfalls of what time, wear and tear or extreme weather conditions can cause to your home.

Think of rusted and broken gutters, how that affects not only your roof but the actual building too. Now think of an insurance assessor seeing this and not paying out a storm damage claim because you failed to maintain your gutters. This could be seen as throwing caution to the wind and losing financially.

Make home maintenance an annual or seasonal exercise and you will save money if emergencies happen or you need to claim from your insurer.

Saving For A Rainy Day

One should always have a savings account which you cannot access too easily, to save for circumstances you either could not be prepared for or are out of your control. Putting away a small sum of money monthly can be a huge relief if something unforeseen happens and you need extra funding to solve your crisis.