The Sukanya Samriddhi account can be transferred from the post office to bank, from one bank to another, to another post office in India. This article talks about the process to transfer a Sukanya Samriddhi Yojna account from the post office or bank to another bank.

Table of Contents

How to transfer Sukanya Samriddhi Yojna Account

Sukanya Samriddhi Yojana is a government-backed savings scheme as part of the “Beti Bachao, Beti Padhao Yojana” for the benefit of the girl child.

It can be opened by the parents of a girl child below the age of 10. A Sukanya Samriddhi Account has a tenure of 21 years or until the girl child marries after the age of 18. From April 2020, this scheme offers an interest rate of 7.6% compounded annually. Flexible investment with a minimum deposit of Rs.250 and a maximum of Rs.1.5 lakh p.a. Eligible for Tax deductions under Section 80C up to Rs.1.5 Lakh

Our article Sukanya Samriddhi Yojna account covers Sukanya Sukanya Samriddhi Yojna account in detail.

Reasons for transferring the SSY account

Reasons for transferring the SSY account are given below

- You want to deposit money online but Post Office may not be connected to the Core Banking Solution(CBS) facility

- You are moving to a different city or a different part of the city. You want the account in the city where you live or nearest to your stay.

- The Bank or Post Office is not providing you proper service.

Process to transfer a Sukanya Samriddhi Yojna Account

To transfer from a Post office to bank or from bank to post office one has to pay a charge of Rs. 100. The transfer can be done only once a year. However, the transfer of SSY account from one post office to another post office is free.

The child in whose name the account is opened need not visit the bank/post office unless she is operating the account on her own.

- Visit the branch where you have a Sukanya Samriddhi account with your passbook and KYC documents.

- Tell the post office/bank executive that you want to transfer your Sukanya Samriddhi account to a particular bank. Fill out a Sukanya Samriddhi Yojana transfer request

- Surrender the passbook given to you at the time of account opening.

- After that, the concerned representative will close the account opened at the post office and give you the required documents that you need to submit to the new bank bank. Documents such as a certified copy of the account, the Account Opening Application, specimen signature etc along with a cheque/ Demand Draft for the outstanding balance in the SSY account. They may also send the documents to the bank branch where you want to open the account.

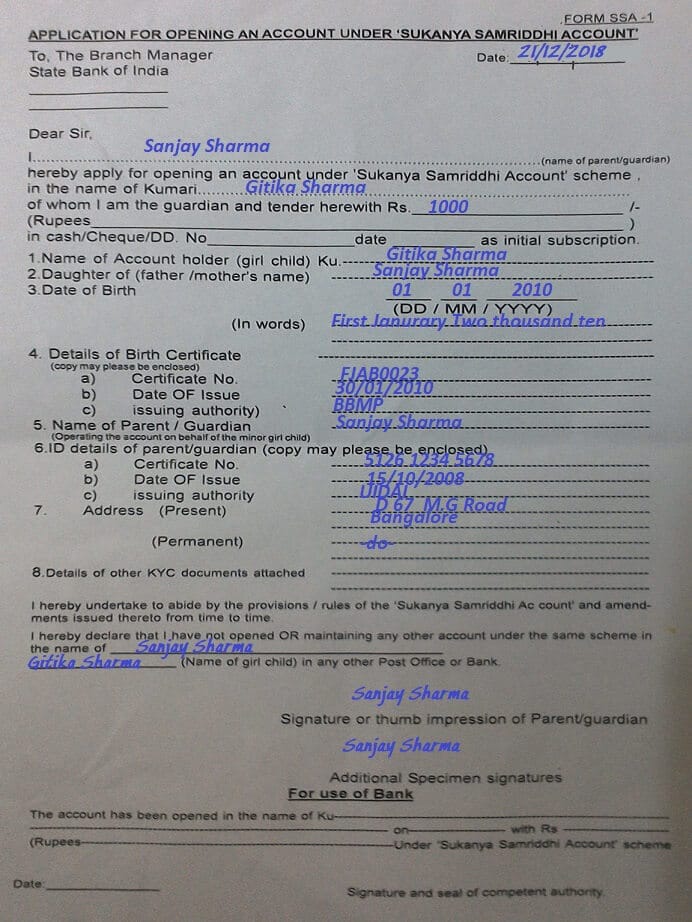

- Visit the particular branch of the bank where you want to transfer your account and submit the required documents collected from the post office/other banks. The customer will have to fill up an SSY account opening form and provide KYC documents to complete the transfer procedure. (sample filled form is shown in the image below). A list of documents is as follows

- Birth Certificate of the beneficiary

- Guardian’s address proof

- Identity Proof of the guardian

- Passport photographs for the beneficiary

Note that

- The new bank will open a new account. The new account will be opened from the date your previous account was closed. For eg, if your SSY was transferred on 01.01.2017 by closing your account, your new bank will open the new account from 01.01.2017 only. This is because the maturity date of the account cannot be changed as per scheme policy.

- Bank will create a new passbook which would contain all your personal details and the carried forward balance from your previous account.

- Your new bank will give you interest from the date of the new account opening so that there is no interest loss.

List of Authorized banks for opening Sukanya Samriddhi Account

The banks where one can open a Sukanya Samriddhi Account is given below.

- State Bank Of India (SBI)

- State Bank Of Patiala (SBP)

- State Bank of Bikaner & Jaipur

- State Bank of Travancore (SBT)

- State Bank of Hyderabad (SBH)

- State Bank of Mysore (SBM)

- Andhra Bank

- Allahabad Bank

- Bank of Baroda (BOB)

- Bank of India (BOI)

- Punjab & Sind Bank

- Bank of Maharashtra

- Canara Bank

- Central Bank of India

- Corporation Bank

- Dena Bank

- Indian Bank

- Indian Overseas Bank (IOB)

- Punjab National Bank (PNB)

- Syndicate Bank

- UCO Bank

- Oriental Bank of Commerce (OBC)

- Union Bank of India (UBI)

- United Bank of India (UBI)

- Vijaya Bank

- Axis Bank Ltd

- ICICI Bank Ltd.

- IDBI Bank Ltd.

Related Articles:

Sukanya Samriddhi Account : A scheme for Girl Child

The process of transferring Sukanya Samriddhi account is very simple. The two main things you need to keep ready are your KYC documents and the account passbook.

19 responses to “How to transfer Sukanya Samriddhi Yojna Account”

Hello Sir,

I want to transfer my daughters (Samruddhi Sukanya Yojana) account to SBI. Can you please tell me normally how much time(days) will it take for existing bank to prepare the documents for transfer.

Hello sir, I have a joint account with wife in HDFC bank.also I have SSY account for my daughter (now 13 yrs old) with the same bank linked with my saving joint account(as told by Bank). Now there is a KYC issue with the name of my wife ie secondary account holder, Mine is Ok.I am suggested by bank to close the account and open a fresh one. How can I transfer the SSY account to SBI/PNB/Union bank of india or to a post office, Bank staff are not having adequate knowledge of the procedure. Pls give your kind guidance, thank you.

The process is explained in the article.

If there is some doubt do let us know?

Does the SSY program has name of both the parents?

Can one transfer SSY account from existing lets say ICICI one bank to another bank account say SBI for different location and city. If yes, what is the procedure

मायने आपने लड़की की ssy मे खाता खुलवाया है पास बुक मे सही दिख रहा है पर कम्पूटर मे एन्ट्री नहीं दिखा रहे हैं ओर दूसरा रासी जमा करने के लिए गया था पर बोलते हैं कि नहीं होगा may केया करू

मेरा नाम शिव कुमार कुशवाहा है mp se है

Sad to hear about it.

Where do you Sukanya account – bank or post office?

I was Open ssy account in 2016 and i deposited some amount but now idnt wont to continue to in post office if i am not deposit any amount so wht will hapn to my account or my previous balance plz tel me

Do you not want to continue SSY account at all?

Or do you not want it to continue in Post office?

If you don’t want to continue in Post office, you can transfer to the bank.

If you don’t want to continue at all you need to contact Post office.

From what we found:

a request for the premature closure of an SSY account can be put forward after the completion of five years of the account opening. This too will be allowed, as per the rules, on extreme compassionate grounds such as medical support in life-threatening diseases. Still, if the account has to be closed for another reason, it will be allowed, but the entire deposit will only get interest of a Post Office Savings Bank account.

Hi,

I had recently initiated the transfer of my daughter’s SSA account from Post office to SBI branch, Madurai, India.

The formalities are already done from POST OFFICE side. Now all the required documents and cheque amount are also sent to SBI branch by Post office department.

Question:-

In my SBI branch they are not sure how to open a new SSA account with outstanding amount which is exceeding 1.5 lac

since only maximum of 1.5 lacs can be transferred to SSA account per Financial year ?

Could any one you please be so kind and let me know the process/any links on the same, it would be easy for me to share it to SBI branch and get the work done since my request is pending with them last couple of weeks.

Awaiting for your reply.

Thanks,

Madhavan K

You are not opening a new account.

You are just transferring an old SSA account.

There is a difference between opening and transferring.

You need to surrender the documents you got from post office

Such as a certified copy of the account, the Account Opening Application, specimen signature etc along with a cheque/ Demand Draft for the outstanding balance in the SSY account. They may also send the documents to the bank branch where you want to open the account.

SBI just have to do KYC.

Try asking private banks like HDFC Bank/ICICI Bank/Axis Bank for transfer process

Details of transfer of account at ICICI are available here

Hi,

Please see my in-line reply;

You are not opening a new account.

You are just transferring an old SSA account.

There is a difference between opening and transferring.

You need to surrender the documents you got from post office

Such as a certified copy of the account, the Account Opening Application, specimen signature etc along with a cheque/ Demand Draft for the outstanding balance in the SSY account. They may also send the documents to the bank branch where you want to open the account.

Madhavan:- Yes all done, post office (source) team had directly sent this to SBI brach (target)

SBI just have to do KYC.

Madhavan:- yes, i already filled-up account opening form in SBI and submitted my KYC as well.

Try asking private banks like HDFC Bank/ICICI Bank/Axis Bank for transfer process

Details of transfer of account at ICICI are available here

Madhavan:- Thanks. If possible try sending the related link/process reference details for SBI.

Thanks,

Madhavan K

no one knows in SBI how to transfer SSA with outstanding amount which is exceeding 1.5 lacs.

I need to know the details of any nationalized bank who had recently done this SSA transfer (>1.5 lacs) .

Could anyone please be so kind and assist me on this.

Thanks,

Madhavan K

Try raising the issue on SBI Social media channel.

But please don’t leave your phone number there

(A fraudster can misuse it)

SBI Twitter handle: TheOfficialSBI

Can I transfer SBI SSY account to another SBI branch online

I initiated the transfer request of SSA from post office to HDFC bank. Bank (HDFC) is denied to transfer the account saying “you cannot transfer Sukanya accout to hdfc bank”. Please advise what needs to be done..

Please raise the issue with HDFC Bank branch

Kya ssk post office se dusre bank mei transfer kar sakhte paisa nikhal sakte schòol mei jama karna education ki liye

kya old sukanya acount ko close krk phir se new sukanya acount open kia ja sakta hai

?

Can i pay online sukkanya summrudhi account