Everything is a just a click away. With the Government push towards becoming a cashless economy gaining traction, the number of people expected to transact and bank online is expected to continue to grow. But how do you keep your money safe in a world where getting lost money back is a mammoth, even impossible, task? Article talks of Practices to Keep your Money Safe when you are using ATM, Online Banking,Cards, Phones Computers.

Table of Contents

Bank accounts

- Register your mobile and email id with your bank : The RBI mandates banks to send online alerts for all card transactions. Update your phone number and email id with your bank.

- Set limits : Transaction limits on every card are a must to limit loss. Banks allow setting separate limits for transactions such as e-commerce, PoS and ATM. One can have a different limit for each.

- Have two bank accounts : Primary account and Secondary account

- Keep all your money in Primary and never use it for online transactions.

- Never use Primary Debit card anywhere.

- Use the Secondary account for all the spending and withdrawing money from ATM. Transfer money from Primary account when needed and keep balance under Rs 10,000.

- Register your mobile and email id with your bank : The RBI mandates banks to send online alerts for all card transactions. Update your phone number and email id with your bank.

- Set limits : Transaction limits on every card are a must to limit loss. Banks allow setting separate limits for transactions such as e-commerce, PoS and ATM. One can have a different limit for each.

- Among security questions banks ask is your sibling’s name, pet’s name etc. and these can be easily fished out from your social media accounts. So please Revisit privacy settings on social media Change settings on sites such as Facebook so that only close friends and family members can access information.

Use Credit Cards

Use Credit Card as much as possible So that the liability is on banks. Debit cards means your money is gone. In credit card payments banks can delay or revert the fraudulent payment but not in case of debit card payment. So credit card is safer choice for transactions. If you aren’t earning a handsome salary or have bad credit score just put an FD of 25,000 and get a Credit Card against it. Never ever use your Debit Card for online shopping or at POS terminals.

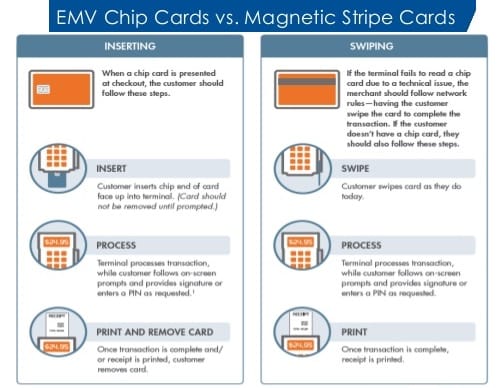

- Get a safer chip based card: A duplicate copy of magnetic cards can be made in minutes, chip based cards cannot be copied easily. Difference between EMV (Europay, Master Card Visa) and Magnetic Chip Card is shown in image below.

- Never let your cards out of your sight : When paying bills at some restaurant, ask them to bring the POS machine to you or you yourself go to the machine. Also grab that receipt, check, and tear.

- Always hide the keypad : Those devices that you swipe that card have walls to hide your fingers so that no one can see what you’re typing, that isn’t adequate, cover the top of your hand as well. Don’t punch in the numbers by making a fist and taking the index fingers out. Instead, type like a person playing the piano, i.e: all four fingers resting or hovering over the keypad.

ATM

- Always go and inspect the ATM thoroughly It hardly takes 15-20 seconds to ensure there’s no skimmer in the slot, no camera of device watching your pin etc. The people behind you can wait.

- Always tear up ATM receipts into pieces before you throw into the dustbin

- Never display or show off with the money you just got from ATM

- When the machine gives you cash, count and put that cash inside your wallet or purse while being in the ATM itself, don’t do so while coming out of the ATM or outside.

Phones and Computers

- Install apps from official stores like Google play store or Apple store Don’t use pirated apps on your phone, it could be infected with adwares and spywares.

- Always update your browsers, apps and antivirus definitions on your computer

- Always check for HTTPS in your browser when making online transactions

- Never click on links that arrive in text messages, emails, WhatsApp. Some of them run scripts and can send all your info to the hacker.

- If a friend sends you link to check out something on Flipkart, better go and search that thing yourself instead of clicking the link

- Never use any device other than your personal device to access your account. You’ll often find people suggesting you not to use public computer systems to access your accounts, but whenever I see any of my relatives’ or sometimes friends’ systems, they tend to have some sort of malware or unwanted but suspicious browser extensions installed. You cannot be sure how technically sound your relatives/friends are in protecting their computers, so best to avoid their devices for banking transactions.

- Use two-factor authentication if your bank provides that option: Make sure your phone is locked and SMS that you get aren’t visible on the locked screen. If you do not take care of this part, having a two-factor authentication kind of loses it’s purpose, since gaining access to your unlocked phone pretty much gives someone access to your email ID (to reset password) and SMS (for two-factor authentication).

Passwords

- Change your netbanking password, ATM pin regularly (3 months)

- Never reuse banking passwords in other sites

- Always have separate banking passwords for all accounts and make sure they are not even similar.

- If you’re the kind of person who cannot remember passwords, write down password hints for yourself such that only you can figure out what the password is from that hint. This means you cannot use passwords hints like “son’s name + wife’s DOB”.

- Use password manager if you are tech savvy. Otherwise write your passwords on a paper and keep it very very safe

Others

- Stop giving out your phone number and email id.

- Do not register your phone numbers at places where it’s not needed.

- Online offers that look too good to be true like ’50 lucky registered winners will get free iPhone 7′ actually are too good to be true.

- Shopper’s stop or Reliance fresh asking you for your phone number during checkout? Don’t give it to them! Your number ends up in their spamming database. And if any of these numbers end up in the hands of a company that specializes in scamming, that can land you in trouble.

- I’ve gotten calls from people multiple times claiming they’re calling from my bank (they knew my bank name, my phone number and my name, so I would suspect they were who they claimed they were). But then they ask you to verify yourself by telling you your address and other details. Slowly they’ll make their way to your debit card number.

- Do not give out such sensitive details to anyone on phone, even if they claim they’re from your bank, no matter how genuine they sound.

- Don’t share your email id, birth date on social media. If you have FB, then hide them.

Unlist from TrueCaller

Founded in 2009, TrueCaller is world’s largest verified mobile phone community. It is a global phone directory that lets you to search details about a given phone number. The TrueCaller application has a caller ID using which it is able to tell you the name of the person who is called even before you pick up the call. In order to get this feature, one should have a 3G connection or some other fast internet access so that the application can search for the number in its database quickly. You can get name, address and the Facebook, Twitter profile links by just entering mobile number. Many smart phone users are using Truecaller to trace out a lot of spam calls they get everyday.

How exactly does Truecaller help the scammers you ask?

- They get your Phone Number from someplace.

- They get your Name from TrueCaller.

- Then they Internet Search your name, Get your info like DOB, PAN

- With this information they get duplicate sims from your cellphone provider and Reset your passwords.

Go to https://www.truecaller.com/unlist to unlist. Please note, you are required to have a registered account at TrueCaller and you can remove only your number.

Some Pros and Cons of TruCaller

- Allows you to find mobile phone location of the number in phone number search.

- ‘Who viewed my profile’ functionality is also provided by Truecaller application. You can keep a track on who is viewing your number.

- You can find caller from phone number. Similar to reverse phone lookup

- It allows you to block such spam numbers and report them to Truecaller database to mark it as spam so that others may also not suffer from this number

Cons

- Caller ID does not work in all areas

- Truecaller requires Internet connection for it to work

- No guarantee of information security

- It infringes on privacy issues.

Always be safe with money

There are people inside a bank, one that marks other people taking out money, other, that’s outside and puts a game on you. These guys are pro’s, if they’ve targeted you, then chances are there’s a very good reason for it. They see you are weakling and either steal or dacoit, that is what they will do. Rare, but still happens.

A young bodied guy is less likely to get duped, but your mom, aunt, grandma/pa is a bull’s eye for them thieves. Accompany them if you can. Money is a strange thing, and people will do anything to have more of it.

Some Common Terms

- Phishing: sending fake mails to steal sensitive data such as bank account numbers and passwords

- Skimming: use a device to steal card information at shops for swiping cards technically called Point of Sales(PoS) terminals

- Vishing making a person divulge personal/financial details over the phone

- ATM skimming tampering with ATM machines to collect data of cards

- Card cloning data of original card imprinted on another card