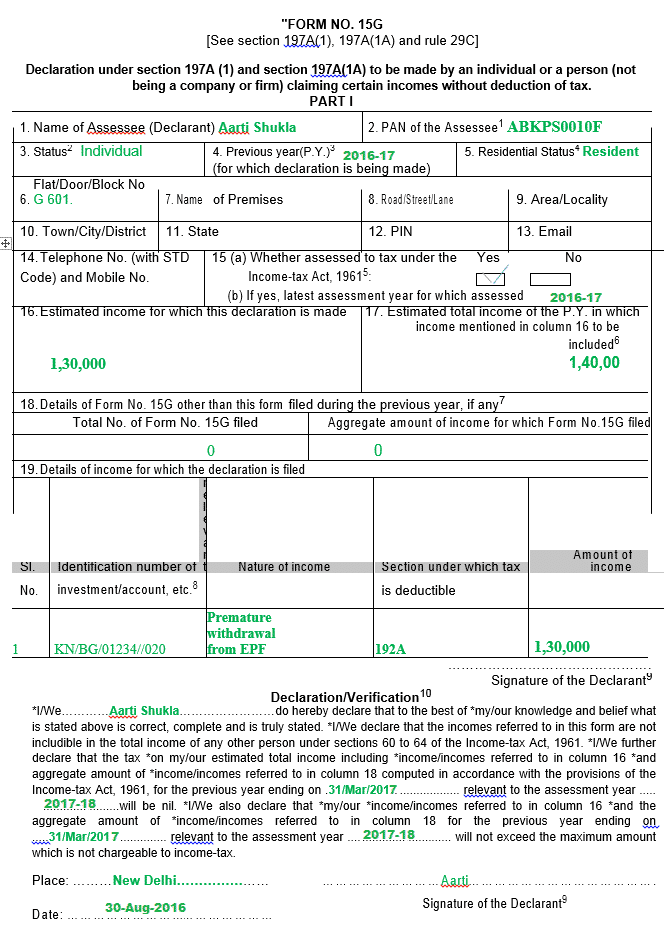

Filled Form 15G for EPF Withdrawal

YouTube Videos on Income Tax

Learn Income Tax

FREE FREE FREE

Subscribe to All Our Posts

Subscribe for Income Tax Posts

Connect with us Social Media

Our most popular posts

- How to File ITR for FY 2020-2021 or AY 2021-2022

- Online EPF Withdrawal: How to do Full or Partial EPF Withdrawal Online

- Tax on Selling Mutual Funds

- Tax on Selling Shares

- Truth of Things Do After Death

- RSU of MNC, perquisite, tax , Capital gains, ITR, eTrade covers RSU in detail.

- Is Cryptocurrency banned in India?

- UAN and Registration of UAN

- Salary, Net Salary, Gross Salary, Cost to Company

- All About EPF,EPS,EDLIS, Employee Provident Fund

- Pay and perks of Indian MP, MLA and Prime Minister

- How to Fill Form 15G/15H

How can we calculate (Point No – 17) estimated total income P.Y in which income mentioned in column 16 to be included..???

Add you EPF Withdrawal amount + Other income of this FY year(Income from salary, Income from House(if you are getting rent) + Income from the sale of stocks, mutual funds, property + Income from Business or Profession + Income from other sources)