The stock exchange has 1000s of companies listed. Just as the average marks in a class test tells you how the students in class has fared in the test, the stock index tells you the general health of the stock market. Sensex is an index that captures the increase or decrease in prices of stocks of largest 30 companies that are traded on the Bombay Stock Exchange. Nifty is the Sensex’s counterpart on the National Stock Exchange and comprises of 50 companies. This article is about the index. What is index? How is it calculated?

Table of Contents

What is stock exchange?

A stock exchange is an organization or association which hosts a market where stocks, bonds, options and futures, and commodities are traded. It can be thought of as a market where stocks are sold and bought. If a particular company is traded on an exchange, it is referred to as “listed”.

Just as there are many supermarkets in an area or many Khans in Bollywood, a country can have more than one stock exchange. Two famous stock exchanges of India are Bombay Stock Exchange(BSE), National Stock Exchange(NSE). In Stock exchange : What is it, Who owns, controls itwe had discussed about what is stock, what is stock exchange, the stock exchanges in the world, who owns and controls the stock exchange, how stock exchanges have evolved from trading floor to online trading.

What is Sensex or Nifty?

Sensex and Nifty are two of the prominent market indexes in India.

- The Sensex, also known as S&P BSE Sensex or S&P Bombay Stock Exchange Sensitive Index or BSE 30, is a free-float market-weighted stock market index of 30 well-established and financially sound companies listed on Bombay Stock Exchange.

- Published since January 1, 1986, the Sensex is regarded as the pulse of the domestic stock markets in India.

- One of the oldest market indexes for equities,

- The word Sensex comes from sensitive index and was coined by Deepak Mohoni.

- Sensex represents about 45 per cent of the index’s free-float market capitalization.

The S&P CNX Nifty or Nifty 50 or simply Nifty is NSE’s benchmark stock market index for Indian equity market.

- Nifty includes 50 shares listed on the NSE,

- It was launched on April 21, 1996.

- Word Nifty comes from NSE and Fifty.

- It is owned and managed by India Index Services and Products (IISL), which is a wholly owned subsidiary of the NSE Strategic Investment Corporation Limited.

| Description | Sensex | Nifty 50 |

| Exchange | Bombay stock exchange(BSE) | National Stock Exchange(NSE) |

| Number of companies | 30 | 50 |

| Launched on | January 1, 1986 | Apr 21, 1996 |

| Starting value | 100 On 1 April 1979 and its base year as 1978–79 | 1000 on 3 November 1995 |

| Special | Oldest market index. First ever stock exchange in Asia established in 1875 as The Native Share & Stock Brokers under the banyan tree | Most actively traded |

| Managed by | Board of Directors. | India Index Services and Products (IISL) |

| Website | www.bseindia |

www.nseindia |

| Origin of word | Sensitive index and was coined by Deepak Mohoni | Word Nifty comes from NSE and Fifty. |

How is stock market index calculated?

An index can be calculated in various ways. Some of them are as follows:

- Price Weighted index: Ex: Dow Jones Industrial Average,Nikkei 225 A stock index in which each stock influences the index in proportion to its price per share

- Market value weighted or capitalization-weighted: Ex: NASDAQ Composite, NASDAQ-100, It’s individual components are weighted according to their market capitalization,

- Free Float Market Capitalisation Weighted: Sensex, Nifty-50, FTSE-100, CAC 40 Based on number of shares freely available in the market ie excludes shares held by promoters

Price Weighted Index

Market-value weighted or capitalization-weighted

Such index ex:Hang Seng Index factors in the size of the company. It’s individual components are weighted according to their market capitalization, so that larger components carry a larger percentage weighting. Some investors feel that this over-weighting toward the larger companies gives a distorted view of the market, but the fact that the largest companies also have the largest shareholder bases makes the case for having the higher relevancy in the index.

Free Float Market Capitalization Weighted

Free Float Market Capitalization Weighted is calculated by taking the stock price and multiplying it by the number of shares readily available in the market. Instead of using all of the shares outstanding like the full-market capitalization method, the free-float method excludes locked-in shares such as those held by promoters and governments.

Nifty-50 and Sensex Calculation

Why do we need Index?

Stock market indexes are useful for a variety of reasons. Some of them are :

- They provide a historical comparison of returns on money invested in the stock market against other forms of investments such as gold or debt.

- They can be used as a standard against which to compare the performance of an equity fund.

- In It is a lead indicator of the performance of the overall economy or a sector of the economy

- Stock indexes reflect highly up to date information

- Modern financial applications such as Index Funds, Index Futures, Index Options play an important role in financial investments and risk management.

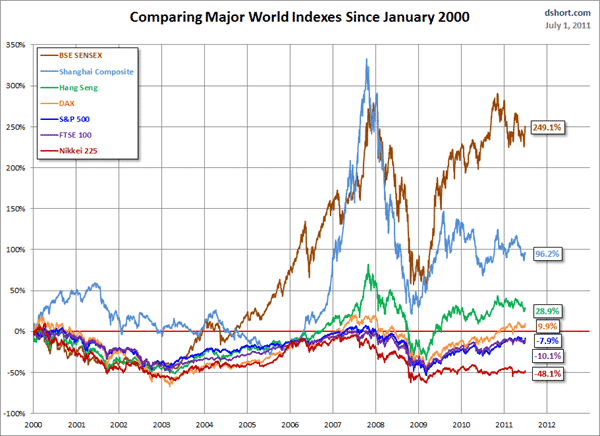

Comparison of Indices of the World

Interesting Read:Good Bad and Ugly of Index

Why don’t we put all the stocks of the exchange into the index?

There is little to gain by diversifying, beyond a point. Putting more stocks into an index yields more diversification but there are diminishing returns to diversification. Going from 10 stocks to 20 stocks gives a sharp reduction in risk. Going from 50 stocks to 100 stocks gives very little reduction in risk. Going beyond 100 stocks gives almost zero reduction in risk. Secondly If the stock is illiquid, the observed prices yield would contain contaminated information and actually worsen an index. Hence Sense has 30 stocks and Nifty 50 stocks.

How many indices can a Stock exchange have?

- Broad based Indices like SENSEX, BSE-100, BSE-200, BSE-500, BSE Mid-Cap and BSE Small-Cap index

- Sector Indices like:BSE Auto Index, BSE BANKEX, BSE Capital Goods Index, BSE Consumer, Durables Index, BSE FMCG Index, BSE Healthcare Index, BSE IT Index, BSE Metal Index, BSE Oil & Gas Index, BSE Power Index, BSE Realty Index

And NSE has following indices:

- Major indices like: S&P CNX Nifty, CNX Nifty Junior, CNX 100,Nifty Midcap 50

- Sectoral Indices like CNX Auto,CNX Bank, CNX Energy

- Thematic indices like: CNX Commodities, CNX Consumption, CNX PSE

Index is not static-it’s dynamic

It’s not that once index is made it is frozen. Its composition changes. The world changes, so the index should change.For example:

The change is not sudden – for that would disrupt the character of the index. Exchange use clear, researched and publicly documented rules for index revision. These rules are applied regularly, to obtain changes to the index set. Index reviews are carried out ensure that each security in the index fulfills all the laid down criteria. IDBI was once not listed; SBI was once illiquid; Infosys was once an obscure software startup. A stock may be replaced from an index for the following reasons:

- Compulsory changes like corporate actions, delisting etc. In such a scenario, the stock having largest market capitalization and satisfying other requirements related to liquidity, turnover and free float will be considered for inclusion.

- When a better candidate is available in the replacement pool, which can replace the index stock i.e. the stock with the highest market capitalization in the replacement pool has at least twice the market capitalization of the index stock with the lowest market capitalization.

Who Regulates the Stock Market

- Securities and Exchange Board of India (SEBI)

- Department of Economic Affairs (DEA)

- Department of Company Affairs (DCA)

- Reserve Bank of India

- Stock exchanges

Governance

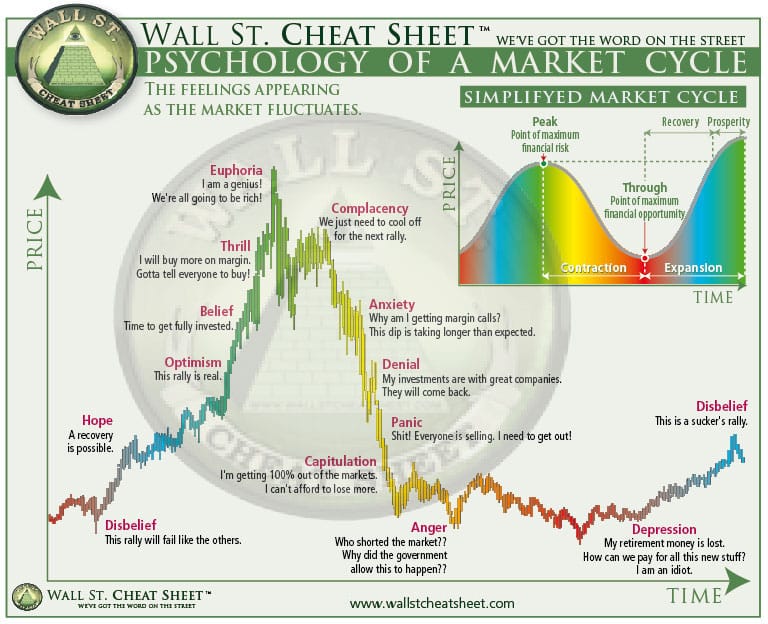

Psychology of the Stock Market Cycle

Trackbacks/Pingbacks