Invest in stocks, shares, equity. Infact no talk on investment is complete without mention, if not discussion, of stock market. Investing in equities over a long period is one of the best ways to stay ahead of inflation. But Stock Market thy name is volatility! List of articles on Basics such as what is Stock market, What is Index? Ups and Downs of Sensex, Comparing investing in Stock Market vs Mutual Funds, How to start investing in Stock market.

In India Sensex is an index that captures the increase or decrease in prices of stocks of 30 companies that are traded on the BSE.

Table of Contents

Why should one invest in equities, stock market?

Why should one invest in equities? Inflation! Inflation erodes the savings of citizens. So if the inflation rate is 8%, a Rs 100 earned will be worth just Rs 92 after a year if it is not invested. So If you invest Rs. 1 lakh (1,00,000 @ 12% p.a.), with the annual inflation rate being 5% in the economy, then the real return on your deposit is 12%(nominal rate) minus 5%(inflation rate), i.e. 7% p.a.(real rate)

Equities have the potential to increase in value over time. Research studies have proved that equity returns have outperformed the returns of most other forms of investments in the long term.

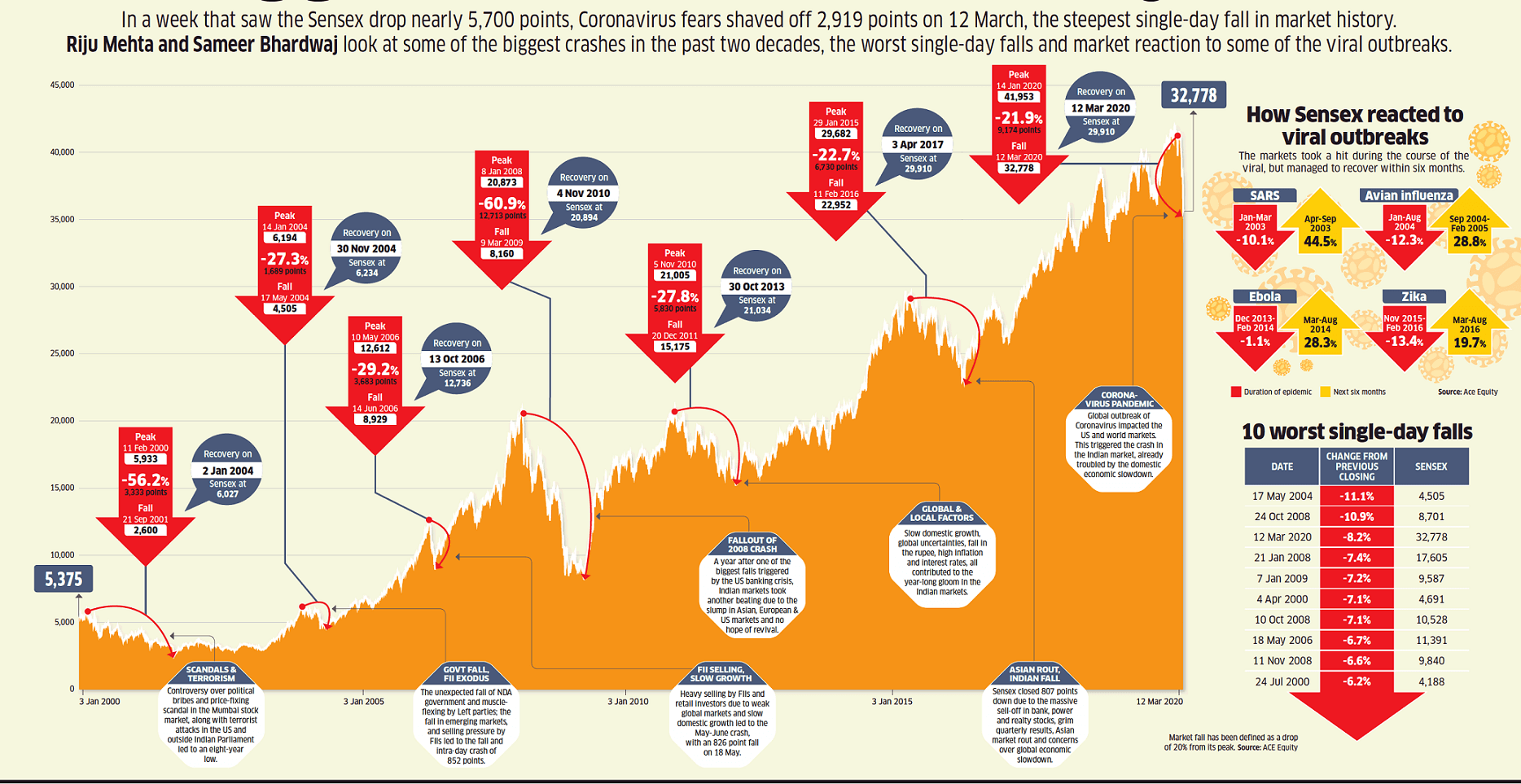

But the Stock market is volatile. The image below shows the ups and downs of the stock market. It is not for weak hearted who lose sleep when stock market go up and down

If one wants to invest in equities there are two ways, Stocks and Mutual Funds.

Both mutual funds and direct equity have their own pros and cons. For beginners in equity market and those who don’t have adequate time to monitor their investment, it is recommended, they should invest in equity market through mutual funds as mutual funds provide various benefits as Professional management, Portfolio Diversification, Liquidity, Convenient options.

Basics of Stock Market

- Stock Market Index: The Basics

- Stock exchange: What is it, Who owns, controls

- Returns of Stock Market, Gold, Real Estate,Fixed Deposit

- Investing in Equities: Stocks vs Mutual Funds

- Stocks, Bonds, and Mutual Funds. What’s the Difference?

- Ups and Downs of Sensex

- Difference Between NSE and BSE, Listing of company on Stock Exchange

- Indians Invest in US Stock Market: Why, DOW, NASDAQ, How to invest

- SME IPOs on BSE SME and NSE Emerge Platforms

Opening a Demat Account, NSDL-CDSL,

- How to start investing in Stock Market?

- Transaction costs while buying or selling shares or stocks

- Investing in Stock Market: Open Demat account and Trading account

- How to choose a stockbroker? Where to open a Demat Account?

- When you open a Demat Account using a link of YouTuber or Blogger

- UPSTOX:A FAST AND SMART TRADING PLATFORM

- What is NSDL and CDSL? What is difference between NSDL & CDSL?

Analyzing Stocks

- Blue Chips Stocks and Penny Stocks

- About Buyback of Shares: Types, process, why

- What is Bull Market and Bear Market?

- Understanding Ratios for the Fundamental Analysis of Listed Companies

- Top Websites for Indian Stocks Market Investors, Stock selection

- Technical Analysis and Fundamental Analysis of Stocks

- Type of Recessions and Recovery: V, U, W, and L Shaped, Great Depression

- Dividends of Stocks: Pros & Cons, Compounding

- Best Index Mutual Funds and ETF for 2021: Passive Investing

- Market Prediction using INDIA VIX – All You Need To Know

- What are HeadWinds and TailWinds in Stocks?

How to buy and sell stocks

- How to buy Stock: Delivery or Intraday,Market or Limit,T+2

- Buy or Sell Stock at your Price: GTT of Zerodha, ICICIDirect VTC, HDFC Securities GTD

Stock Market

IPO

- IPO: Process,Types of Investors, Allotment, Lucky Draw for Retails investors

- IPO in 2021: What IPO are open, performance, Lessons

Tax and Stock Market

From 1 Apr 2018, capital gain on stocks is changed.

Long Term Capital Gain tax of 10%, without indexation, for capital gains exceeding one lakh from all direct equity and equity mutual funds. However, all capital gains until 31 Jan 2018 will be grandfathered.

Short-term capital gains tax remains at 15%.

- Capital Gain Calculator from FY 2017-18 with CII from 2001-2002

- BSE Stock Price on 31 Jan 2018 for LTCG on Shares

- Dividend and Tax: DDT, Dividend from Stocks, Mutual Funds from FY 2020-21

International Stocks and Tax

RSU or Restricted Stock Units are shares of the company given to employees free of cost but with some restrictions. What are RSUs? Why are RSUs given? What is vesting date? When are RSU taxed? I

- RSU of MNC, perquisite, tax , Capital gains, ITR, eTrade

- Are ESPP,ESOP in MNC to be filed in ITR as Foreign Assets?

Stock Market Gurus

- Rakesh Jhunjhunwala: His stock market journey, hits & misses, Scam 1992

- Vijay Kedia: Ace Indian Investor, His love for stock market, learnings, quotes

Books on Stock Markets

- One Up On Wall Street by Peter Lynch: Book Review

- Psychology of Money by Morgan Housel: A must read book

- How we make decisions: Behavioral Finance

11 responses to “All About Stocks, Equities,Stock Market, Investing in Stock Market”

A comprehensive resource of information about stock market investments. Thank you for sharing your knowledge.

Hi,

Thanks for sharing this valuable piece of trading information through your blog post. Helpful for all investors.

Thanks for sharing Article. Please Click Trading website in India

Thanks for sharing this Article. Any one tell me Which is the Best Telegram Channel for Medium Term Trading. ?

Thanks for sharing Article. Please visit https://stockoption.co.in/ for Open Free Demat Account.

Thanks for sharing Article. Please Click Online stock trading

Thanks for sharing Article. Please visit http://stockoption.co.in/ for Open Free Demat Account.

Thanks for the informative post. The way you narrated the post is good and understandable. After reading the post I learned some new things about stock market investing. Keep posting. Please let me know for the upcoming posts.

[…] All About Stocks, Equities,Stock Market, Investing in Stock Market […]

Among multiple investment options such as fixed deposits, mutual funds, SIP, stocks, all seems not looking much attractive. There are commodities such as Gold and Silver and Currencies seem to be great options till the pandemic covid-19 doesn’t disappear. As we see dollar still consistently increasing, and investing in dollar to rupee can be a good and safe idea.

Forget password