The ITR for Financial Year 2014-15 or Assessment Year 2015-16 were notified by The Central Board of Direct Taxes (CBDT). There are some changes related to Filing of returns. This article covers about Filing of Income Tax Returns for FY 2014-15 or AY 2015-16

Table of Contents

Filing Income tax return for FY 2015-16

A brief summary of Changes are given below. Please note last date for filing Income Tax Returns has been extended from 31 Jul 2015 to 31 Aug 7 Sep 2015 due to delay as Forms were available only on 23 Jun 2015 dropping the controversial provision for mandatory disclosure of foreign trips and dormant bank accounts

- Provide Aadhaar number if available. If provided one does not have to send ITR-V.

- A new Form ITR 2A is available which can be filed by an individual or HUF who does not have capital gains, income from business/profession or foreign asset/foreign income. Now taxpayers who own more than one house property but don’t have any capital gains shall file ITR 2A.

- ITR 2 and ITR 2A – will have only three pages

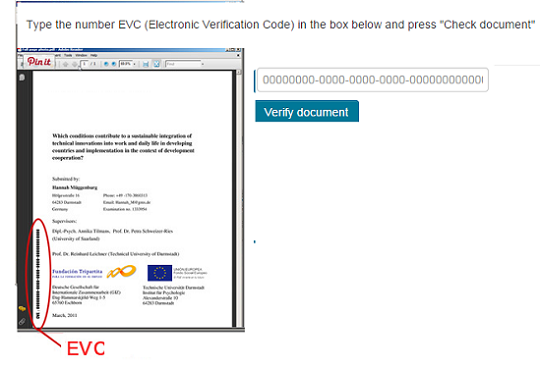

- Introduction of Electronic Verification Code(EVC) as option of NOT sending ITR-V to CPC Banaglore. This would use either Aadhaar Number,or Login through Net Banking facility of the person, Digital Signature,Mobile OTP(One time password) Any One of the above methods can be availed by a person filing its income tax return online to avoid sending a physical copy of ITR-V to Bangalore. Our article E-verification of Income Tax Returns and Generating EVC through Aadhaar, Net Banking explains the process in detail.

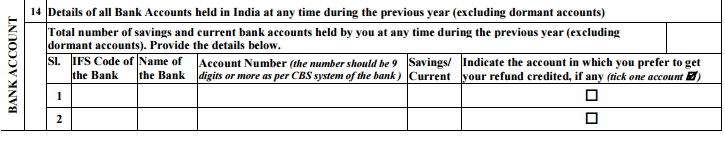

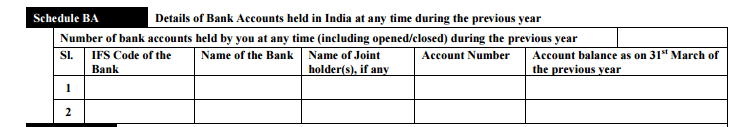

- Providing Details of all bank accounts with Bank name, IFSC Code,

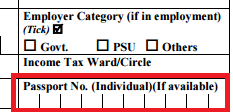

Name of Joint Holder, if any, Account number,Account balance as on 31.03.2015 is mandatory.Even those accounts which are closed during the year for ITR2. Disclosure of details of dormant accounts which are not operational during the last three years has been done away with. - For foreign travel details only Passport Number, if available, would be required to be given in Forms ITR-2 and ITR-2A. Details of foreign trips or expenditure thereon are not required to be furnished as shown in image below

- Individuals having exempt income without any ceiling (other than agricultural income exceeding Rs 5,000) can now file Form ITR 1 (Sahaj). Similar simplification is also proposed for individuals/HUF in respect of Form ITR 4S (Sugam).

- An individual, who is not an Indian citizen and is in India on a business, employment or student visa (expatriate), it’s not mandatory to report the foreign assets acquired by him during the previous years in which he was non-resident and if no income is derived from such assets during the relevant previous year

Bank account details being asked currently . Now Income tax department is not asking for dormant accounts and joint holder names if you compare it with the details that were being asked earlier

Bank account details being asked earlier in ITR

ITR for FY 2014-15 or AY 2015-16

One can read official Notification at Income tax website CBDT No. 41/2015 Dated 15.04.2015

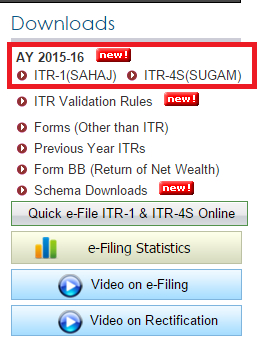

ITR Forms(pdf) can be downloaded from Income Tax website http://www.incometaxindia.gov.in/Pages/downloads/income-tax-return.aspx

Excel and Java Utility for Income Tax AY 2015-16 or FY 2014-15 from https://incometaxindiaefiling.gov.in/ as shown in images below

Click on ITR1 or ITR 4S . Note :ITR 2/ITR2A is not available for e-filing as on 27 Jun 2015

Click on Download For Excel or Java utility to download

Tax slabs for Financial year 2014-15 or Assessment Year 2015-16

Every individual whose total income before allowing deductions under Chapter VI-A of the Income-tax Act, exceeds the maximum amount which is not chargeable to income tax is obligated to furnish his return of income. The maximum amount not chargeable to income tax in case of different categories of individuals is as follows:

| TAX | MEN and WOMEN | SENIOR CITIZEN(Between 60 yrs to 80 yrs) | For Very Senior Citizens(Above 80 years) |

| Basic Exemption | 250000 | 300000 | 500000 |

| 10% tax | 250001 to 500000 | 300001 to 500000 | – |

| 20% tax | 500001 to 1000000 | 500001 to 1000000 | 500001 to 1000000 |

| 30% tax | above 1000000 | above 1000000 | above 1000000 |

| Surcharge | 10% of the Income Tax, where total taxable income is more than Rs. 1 crore | ||

| Education Cess | 3% on Income-tax plus Surcharge. | ||

Videos for e-filing ITR

The video(10 min) by Income tax department giving an overview of the e-filing website,how to register for e-filing, brief introduction to the process of e-filing

A video (14 min) by bemoneyaware on Understanding what is income and Income slabs

What is CBDT?

The Central Board of Direct Taxes (CBDT) is a part of the Department of Revenue in the Ministry of Finance, Government of India.It provides essential inputs for policy and planning of direct taxes in India and is also responsible for administration of the direct tax laws through Income Tax Department. One can read about CBDT at Income Tax webpage Central Board of Direct Taxes

WHAT IS THE ELECTRONIC VERIFICATION CODE?

The electronic verification code comprises a string of characters in the form of a locator number that give a unique identifier to electronic documents.

Income tax department has introduced electronic verification code method for verifying a person’s identity while filing the income tax return online. If this method is availed then a person need not send a signed copy of the acknowledgement (ITR-V) to Bangalore office of the Income Tax Department. His return will be treated complete by completing the verification method. The different verification method introduced by the government are:

- Aadhaar Number

- Login through Net Banking facility of the person

- Digital Signature

- Mobile OTP

One of the above methods can be availed by a person filing its income tax return online to avoid sending a physical copy of ITR-V to Bangalore. Our article E-verification of Income Tax Returns and Generating EVC through Aadhaar, Net Banking explains the process in detail.

Changes for Filing ITR for AY 2015-16 or FY 2014-15

General

- ITR-1 (SAHAJ) & ITR-4S (Sugam) cannot be filed by individual who has earned any income from source outside India.

- Introduction of EVC for verification of return of income filed as an option to send ITR-V to CPC, Bangalore.

- Super Senior citizen are now allowed to file Income Tax return(ROI) in paper form even though their income exceed Rs 5 lakhs subject to other conditions.

Our article Filling ITR-1 : Bank Details, Exempt Income, TDS Details explains filling ITR1 in detail.

ITR-1

- Introduction of furnishing Aadhaar Card Number in ROI. Which will be used for EVC system introduced as mentioned above.

- Details of all bank accounts with Bank name, IFSC Code, Name of Joint Holder, if any, Account number,

Account balance as on 31.03.2015 mandatorily to be provided. Even those accounts which are closed during the year. - Individuals having exempt income without any ceiling (other than agricultural income exceeding Rs 5,000) can now file Form ITR 1 (Sahaj).

ITR-2A

At present individuals/HUFs having income from more than one house property and capital gains are required to file Form ITR-2.

A simplified form for these individuals/HUFs, a new Form ITR 2A is proposed which can be filed by an individual or HUF who does not have capital gains, income from business/profession or foreign asset/foreign income.

ITR-2

- Introduction of furnishing Aadhar Card Number in ROI. Which will be used for EVC system introduced as mentioned above.

- Details of Foreign Travel made if any (For resident and non resident both) includes, Passport No, Issued at, name of country, number of times travelled and expenditure

- Details of utilization of amount deposited in capital gain account scheme for years preceding to last two assessment years. Particulars asked include year of utilization, amount utilized, amount unutilized lying idle in capital gain account scheme till the date of filing of return of income.

- In case of LTCG & STCG not chargeable to tax to Non-resident on account of DTAA benefit, It is required to furnish Country name, Article of DTAA, TRC obtained or not?,

- For Non-resident, Income from other sources, If any income chargeable to tax at special rate provided in DTAA, It is now required to provide details of Name of Country, Relevant article of DTAA, Rate of Tax, Whether TRC obtained or not?, Corresponding rate of tax under income tax act.

- Details of all bank accounts with Bank name, IFSC Code, Name of Joint Holder, if any, Account number, Account balance as on 31.03.2015 mandatorily to be provided. Even those accounts which are closed during the year.

- In schedule FA- Foreign assets disclosure, Following details added.

- Foreign Bank accounts details: It is now further require to furnish Account number, account opening date, Interest/income accrued from such account, If any along with details of head of income and schedule under which such income is shown, if offered to tax in India.

- In similar manner, details of income from Financial interest in any entity outside India along with details of income offered to tax in ITR-2 from such income.

- Similar disclosure requirement is also required for Immovable property outside India, capital asset held outside India, trust held outside India

ITR-4S

- Introduction of furnishing Aadhar Card Number in ROI. Which will be used for EVC system introduced as mentioned above.

- Details of all bank accounts with Bank name, IFSC Code, Name of Joint Holder, if any, Account number, Account balance as on 31.03.2015 mandatorily to be provided. Even those accounts which are closed during the year.

Articles to help you for filing Income Tax Return

- Income Tax Overview

- Income Tax Calculator

- Understanding Income Tax Slabs,Tax Slabs History

- Income Tax articles organized

- Understanding Form 16: Part I,

- Understanding Form 16 – Part 3

- Viewing Form 26AS on TRACES

- What to Verify in Form 26AS?

- Income From Other Sources :Saving Bank Account, Fixed Deposit,RD and ITR

- How to file Income Tax Return Online : Incometaxefiling,CA,efiling Websites

- HRA Exemption,Calculation,Tax and Income Tax Return

- Cost Inflation Index,Indexation and Long Term Capital Gains

- Fixed Deposit , Interest , TDS, Tax,Income Tax Return, Refund

- Filing on Income Tax

- E-Filing of Income Tax Return,

- E-filing : Excel File of Income Tax Return,

- Which ITR Form to Fill?

- Filling ITR-1 : Bank Details, Exempt Income, TDS Details

- Fill Excel ITR1 Form : Income, TDS, Advance Tax

- Filling Individual ITR Form: Fields A1 to A22

- How To Fill Salary Details in ITR2, ITR1

- Fill Excel ITR1: 80G, Exempt Income,Calculation of Tax

- How To Fill Salary Details in ITR2, ITR1

- How to Fill ITR when you have multiple Form 16

- Tax Exempt Allowances in Salary Schedule S in ITR2

- Interest on Saving Bank Account : Tax, 80TTA

- Exempt Income and Income Tax Return

- Income from House Property and Income Tax Return

- After filing Income tax returns

This article gave overview of Income Tax for FY 2014-15 or AY 2015-16. While filing income tax return is no rocket science, it takes a little bit of hard work. Even if you get your returns filed by your Chartered Account, other party please make sure you understand what has been filled in, if something is left out.

40 responses to “Income Tax for AY 2015-16: Tax slabs, ITR Forms”

Your good knowledge and kindness in playing with all the pieces were very useful.

Useful and informative post… Thanks for sharing 🙂

which section of form 2 do I fill for allowance received in foreign income for tour and some amount has been saved.

which section of form 2 do I fill for allowance received in foreign income for tour and some amount has been saved.

Sir,

I have given out my house property on rent for Rs.25000 per month to a partnership firm. The firm used to deduct 10% (2500) as TDS and deposit Rs.22500/- into my account.

I checked my form 26AS through TRACES and saw that the Firm has still not deposited the TDS with the tax authorities. On checking with them, they say that they have a cashflow problem and do not have money to deposit the TDS deducted.

As filing for individuals is due, what should I put as my income? Should I put 270000 (22500 x 12) or 300000 (25000 x 12). I am assuming that I can only show in the TDS schedule only as it appears on form 26AS.

Thank you for your assistance.

Did they issue Form 16 or Form 16A?

Now you can carry forward TDS deducted to the next year from FY 2013-14

the Schedule TDS/TCS introduces two new columns:

Unclaimed TDS/TCS brought forward

Financial Year in which deducted/collected

Amount brought forward

TDS/TCS being claimed this year from amount brought forward or from TDS/TCS of current financial year.

Thank you very much Sir.

No, they have not given me Form 16 or 16A. When I spoke to them last week they said that since the last date for them to deposit online has passed, they have deposited it manually. Not sure if I can believe them.

Now, with the revision in the ITR form that you pointed out, I guess I will just put zero under “Amount out of (6) or (7) being claimed this year”…. Thank you!

Can I also please ask you one other thing:

Am I right in thinking that I do not have to pay tax on long term capital gain obtained by way of sale of shares that I have held for about 7 years? The shares were bought in 2008 through HDFC Securities and I have paid the STT as noted under section 10(38).

We would suggest talking to your employer, if you postpone claiming TDS this year you will have to pay tax on 300000 (25000 x 12)

For an employer there is penalty if Form 16 is not given

In case an employer fails to provide you a Form 16 after having deducted TDS – the minimum penalty that the employer will pay is Rs 100 for every day the default continues. You can write about this failure of your employer to the Assessing Officer who may take appropriate action against the employer, including levying penalty as mentioned above and also carrying out further proceedings against the employer.

Your Form 26AS, will have details of TDS deducted by your employer, you can check your TDS details from there – if the details don’t show up, well it means the employer deducted TDS from you and didn’t deposit with the government! In this case, you may have to pay tax to the government on your income yourself and later on claim from your employer.

Regarding shares, yes long term capital gains are exempt from tax so you don’t have to pay tax but show them as exempt income in ITR.

Thanks a ton!

Really appreciate your assistance and guidance.

Sir,

I have given out my house property on rent for Rs.25000 per month to a partnership firm. The firm used to deduct 10% (2500) as TDS and deposit Rs.22500/- into my account.

I checked my form 26AS through TRACES and saw that the Firm has still not deposited the TDS with the tax authorities. On checking with them, they say that they have a cashflow problem and do not have money to deposit the TDS deducted.

As filing for individuals is due, what should I put as my income? Should I put 270000 (22500 x 12) or 300000 (25000 x 12). I am assuming that I can only show in the TDS schedule only as it appears on form 26AS.

Thank you for your assistance.

Did they issue Form 16 or Form 16A?

Now you can carry forward TDS deducted to the next year from FY 2013-14

the Schedule TDS/TCS introduces two new columns:

Unclaimed TDS/TCS brought forward

Financial Year in which deducted/collected

Amount brought forward

TDS/TCS being claimed this year from amount brought forward or from TDS/TCS of current financial year.

Thank you very much Sir.

No, they have not given me Form 16 or 16A. When I spoke to them last week they said that since the last date for them to deposit online has passed, they have deposited it manually. Not sure if I can believe them.

Now, with the revision in the ITR form that you pointed out, I guess I will just put zero under “Amount out of (6) or (7) being claimed this year”…. Thank you!

Can I also please ask you one other thing:

Am I right in thinking that I do not have to pay tax on long term capital gain obtained by way of sale of shares that I have held for about 7 years? The shares were bought in 2008 through HDFC Securities and I have paid the STT as noted under section 10(38).

We would suggest talking to your employer, if you postpone claiming TDS this year you will have to pay tax on 300000 (25000 x 12)

For an employer there is penalty if Form 16 is not given

In case an employer fails to provide you a Form 16 after having deducted TDS – the minimum penalty that the employer will pay is Rs 100 for every day the default continues. You can write about this failure of your employer to the Assessing Officer who may take appropriate action against the employer, including levying penalty as mentioned above and also carrying out further proceedings against the employer.

Your Form 26AS, will have details of TDS deducted by your employer, you can check your TDS details from there – if the details don’t show up, well it means the employer deducted TDS from you and didn’t deposit with the government! In this case, you may have to pay tax to the government on your income yourself and later on claim from your employer.

Regarding shares, yes long term capital gains are exempt from tax so you don’t have to pay tax but show them as exempt income in ITR.

Thanks a ton!

Really appreciate your assistance and guidance.

i am getting pension under employees provident scheme-1975 every month rs 1824.

Total Rs.21888.00.when i am filling income tax reruns ,under which class/catagery i have to account it

Sir, Pension is treated as Income from Salary, and is taxable. It would come as Income from Salary/Pension

i am getting pension under employees provident scheme-1975 every month rs 1824.

Total Rs.21888.00.when i am filling income tax reruns ,under which class/catagery i have to account it

Sir, Pension is treated as Income from Salary, and is taxable. It would come as Income from Salary/Pension

I am having terms deposit in in three different banks. Interest received in two bank is less than 10000/- PA , therefore TDS not deducted. In third bank tds deducted.

what is new rules in 2014-15 FY for tax on investment in bank fixed deposit? Interest earlier was Rs.10000/- in particular Bank in per branch and not to club other bank interest .

What is new rule to clubed all the bank term deposit interest of different bank a/c and if interest amount is Rs.10000/- and above by clubing then it is taxable for the whole interest amount ? please clearfy. thanks

Sir interest from FD is taxable. How much TDS is deducted is another question.

From 1st June, 2015 if the cumulative interest income from FDs across all the branches of a bank exceeds Rs 10,000 then TDS will be deducted @ 10%.

I am having terms deposit in in three different banks. Interest received in two bank is less than 10000/- PA , therefore TDS not deducted. In third bank tds deducted.

what is new rules in 2014-15 FY for tax on investment in bank fixed deposit? Interest earlier was Rs.10000/- in particular Bank in per branch and not to club other bank interest .

What is new rule to clubed all the bank term deposit interest of different bank a/c and if interest amount is Rs.10000/- and above by clubing then it is taxable for the whole interest amount ? please clearfy. thanks

Sir interest from FD is taxable. How much TDS is deducted is another question.

From 1st June, 2015 if the cumulative interest income from FDs across all the branches of a bank exceeds Rs 10,000 then TDS will be deducted @ 10%.

You should take into account intermediate expenses involved between purchase and sale such as Registration, brokerage, improvement and taxes etc., which are not chargeable to capital gains. A.R.Mahendra

You should take into account intermediate expenses involved between purchase and sale such as Registration, brokerage, improvement and taxes etc., which are not chargeable to capital gains. A.R.Mahendra

sir.

1 am a sole proprietor. my profit is 230000/-(financial year 2014-15).

i am filed it return or no

sir.

1 am a sole proprietor. my profit is 230000/-(financial year 2014-15).

i am filed it return or no

full details required for filing of income return for the AY 2015-16 thanks

full details required for filing of income return for the AY 2015-16 thanks

which form i hav to fill if i hav gain from shares/stocks.

pl guide

which form i hav to fill if i hav gain from shares/stocks.

pl guide

please giv me 2015-16 itr-v itr-1 cxcel formet

The forms will be available from mid june so you need to wait as the forms are getting revised.

please giv me 2015-16 itr-v itr-1 cxcel formet

The forms will be available from mid june so you need to wait as the forms are getting revised.

For the purpose of Section 10(14)(i) & Section 10(14)(ii), following are few allowances which are exempted from income tax to the limit as mentioned against each:-

Children education allowance- Rs.100 p/m

Counter insurgency allowance- Rs 3,900 p/m

Transport Allowance- Rs.800 p/m

etc

please guide as to which column of ITR-1 is used for mentioning such amount and is there any other form used for claiming rebate on such allowances as there are only two types of forms available on e-filing, one is ITR-1 and other ITR-4S

For the purpose of Section 10(14)(i) & Section 10(14)(ii), following are few allowances which are exempted from income tax to the limit as mentioned against each:-

Children education allowance- Rs.100 p/m

Counter insurgency allowance- Rs 3,900 p/m

Transport Allowance- Rs.800 p/m

etc

please guide as to which column of ITR-1 is used for mentioning such amount and is there any other form used for claiming rebate on such allowances as there are only two types of forms available on e-filing, one is ITR-1 and other ITR-4S

Useful information. Thanks for sharing. Would like to invite you to join Blogger India group on LinkedIn. Best. Somali K Chakrabarti

Useful information. Thanks for sharing. Would like to invite you to join Blogger India group on LinkedIn. Best. Somali K Chakrabarti