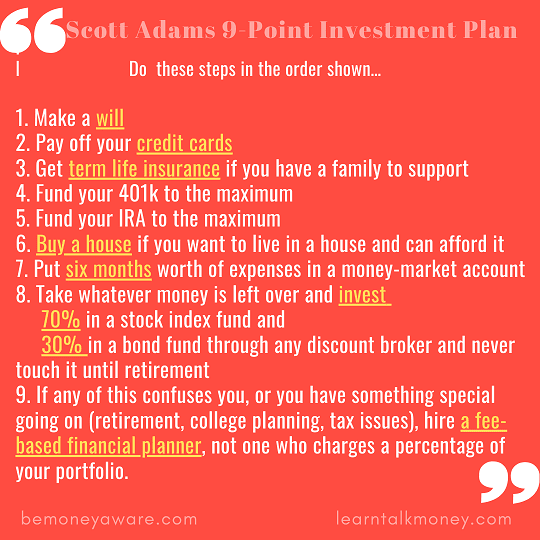

Scott Adams, the cartoonist famous for creating Dilbert list on personal finance covers the basics in around 120 words given below. You can check out his Dilbert cartoons at dilbert.com

Table of Contents

Modifying Scott Adams Personal finance Advice for Indian Context

Capitalmind came up with the modification of Scott Adam’s personal finance advice in the Indian context. Quoting from CapitalMind’s 9 Point Financial Plan, Indian Edition and Comic Strips would modify to put in the Indian context as follows. Do these steps in the order shown…

- Make a will, but also, buy things in joint names.

- Pay off your credit cards, and your personal loans. But keep a credit card.

- Get term life insurance if you have a family to support. And don’t expect “money back”.

- Fund your retirement EPF or NPS account to the maximum

- Fund your IRA to the maximum (India has no IRAs) An investment that sounds too good to be true, is. Say no.

- Buy a house if you want to live in a house and can afford it. (“can afford it”=loan EMI less than 30% of post-tax income)

- Put six months worth of expenses in a liquid mutual fund.

- Take whatever money is left over and invest 70% in a stock index fund and 30% in a bond fund through the DIRECT mode and never touch it until retirement.

- If any of this confuses you, or you have something special going on (retirement, college planning, tax issues), hire a fee-based financial planner, not one who charges a percentage of your portfolio, or one that gets commission from your investments

Dhirendra Kumar of Valuresearchonline in EconomicTimes Just 87 words by Scott Adams will tell you all about financial planning says

And these sentences do successfully encapsulate everything you need to know in order to plan your life’s savings and investments. Of course, in India you would replace the 401(k) and the IRA with Indian equivalents. 401(k) and IRA are retirement planning tax-saving investments that are available in the US. In India, you would replace them with your mandatory PF and other investments that are available under Section 80C. Now, you would also add the RGESS to the list.

As for the investment advice in the last sentence, it’s actually even easier. Adams’ advice is to invest 70% of your savings in an equity fund and 30% in a fixed income fund. If you actually do that, you will have to track the returns of the two and keep rebalancing them to maintain this split. That’s cumbersome and, in India, not very tax-efficient. As it happens, this split of 70% equity and 30% is almost precisely what balanced funds offer in India. So all you have to do is to choose two or three balanced funds and invest in them. That’s all you have to do and your ‘Dilbert Portfolio’ is up and running.

Does Scott Adams personal finance advice make sense in US context?

Scott Adams deliciously cynical take on the workplace is published in more than 2,000 newspapers, in 65 countries, and 22 languages.

Quoting from Vanguard’s The Dilbert guide to personal finance

Another fan is Vanguard Chairman and CEO John J. Brennan. He said he found Adams’ list the kind of clear and direct advice that might help a grown child get off on the right foot financially. “When I look at ‘no credit card debt,’ hallelujah,” Brennan said. “A will and life insurance—absolutely. And then when you get down to his more specific investment information, it’s right on the money for me. He gets it.”

Dee Lee, a Certified Financial Planner from the town of Harvard, Massachusetts, also said she found Adams’ rules to be “good solid advice.” Dee noted, however, that some of Adams’ rules might be costly to follow. Adams advises saving the maximum to a 401(k) and IRA each year. Dee noted that would require $19,000 to fully fund both accounts this year. “That’s a lot of disposable income,” Lee said. “If they don’t make the megabucks, they should not get discouraged but try to work on each of the issues.”

Lee also suggested one additional rule for Adams’ list—obtain health insurance. Reached by e-mail, Adams said he agreed with Lee’s suggestion that obtaining health insurance would be a worthy addition to his list.

Does Scott Adams live by his financial rules?

Quoting from Vanguard’s The Dilbert guide to personal finance

For the most part he does. Adams said he’s allergic to debt and makes a habit of saving half of his income. “I found that people who had massive credit card debt were asking me how they could invest in stocks, or how they could borrow money from their credit card to invest in stocks,” the cartoonist recalled.

However, Adams said he no longer follows his rule to invest 70% in a stock index fund and 30% in a bond fund. The best-selling author says he invests primarily in municipal bonds today, which are tax-exempt, and also owns land in his adopted home state of California. “I’m kind of a special case,” Adams added. “The best way to use this advice is to understand the framework. If you have no special situation, this framework works great.”

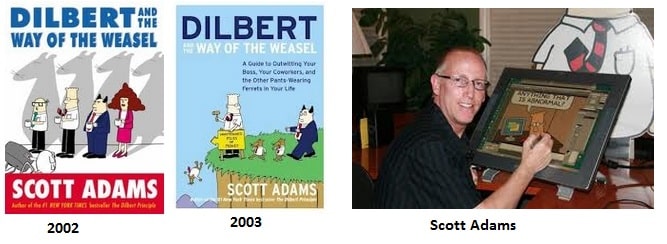

Scott Adams Background and Books

Scott Adams said that even as a child growing up in New York’s Catskill Mountains he had a fascination for finance. He took his bachelor’s degree in economics at Hartwick College in 1979. After college, he worked at a bank for eight years and earned an MBA from the University of California at Berkeley.

Adams’ formula was originally published in book “Dilbert and the Way of the Weasel” (2002). The book, a mix of sardonic text and cartoons, describes what Adams has dubbed the Weasel Zone–“a gigantic gray area between good moral behavior and outright felonious activities.” A weasel is “anyone trying to get away with something“. In the Weasel Zone, where most people reside, everything is misleading, but not exactly a lie. Building on his popular comic strip, Adams looks into work, home and everyday life and exposes the way of the weasel for everyone to see. With appearances from all the regular comic strip characters, Adams and Dilbert are at the top of their game – master satirists who expose the truth while making us laugh our heads off. (pg 171-180 in 2002 edition)

By the way, Dictionary describes weasel as :

- Any of various carnivorous mammals of the genus Mustela, having a long slender body, a long tail, short legs, and brownish fur that in many species turns white in winter.

- A person regarded as sneaky or treacherous.

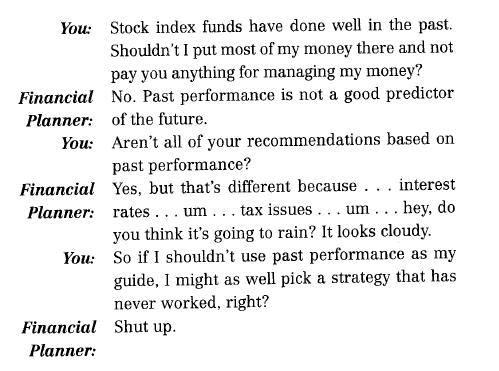

The part of book in which he gives advice comes under the chapter of Financial Weasels and section Financial Planners. Quoting from his book

“I once tried to write a book about personal investing. It was supposed to be geared toward younger people who were investing for the first time. After extensive research on all topics related to personal investing, I realized I had a problem. I could describe everything that a young first time investor needs to know on one page. No one wants to buy a one-page book even if that page is well written. As a consumer you’d feel you were paying mostly for the binding. If God materialized on earth and wrote the secret of universe on one page he wouldn’t be able to get the publisher. People would look at it and say “That’s all well and good, but I am paying mostly for the cover”

Conversation with Financial Planner

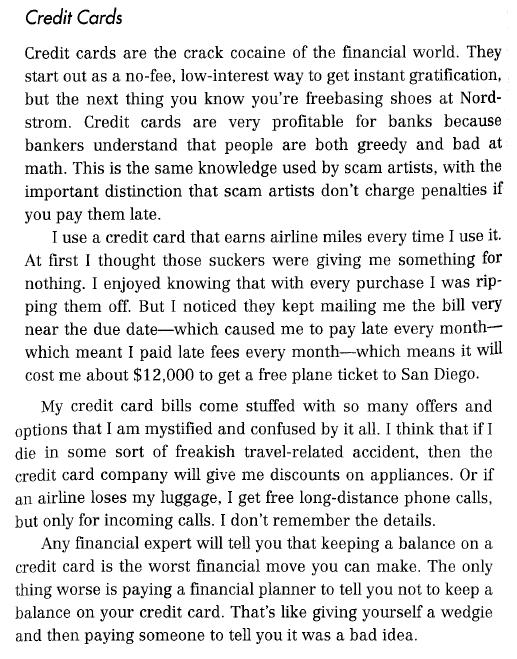

Scott Adams on Credit Cards

We just loved the section on Credit Cards

Some cartoons from the Financial Weasels part. You can also view Dilbert cartoons at Dilbert.com

What does bemoneyaware says?

We read about the advice in EconomicTimes Just 87 words by Scott Adams will tell you all about financial planning (my father-in-law sent an SMS praising the article) and then tried to find more which led us to the book Dilbert and the Way of the Weasel” (2002) List is simple and yes to most extent makes sense.

- Yes, pay off your credit card (and personal loans). Our article Credit Card Debt , Life of Debt – Responsibly talks about in detail.

- Yes, get a term plan insurance. Our article Mixing Insurance with Investment talks of why one should not complicate life by combining investment and insurance in one.

- Yes contribute to EPF, PPF Our article Taxation of investments : EEE, ETE, TEE.., Understanding Public Provident Fund, PPF, Basics of Employee Provident Fund: EPF, EPS, EDLIS covers it in detail

- Yes, Have emergency fund!

- Yes, Buy a house if you want to live in a house and you can afford it.

- For other points – it depends. For example Get a financial planner if you want (a fee based than commission based) but be aware of what is being suggested and why? (It’s your money after all)

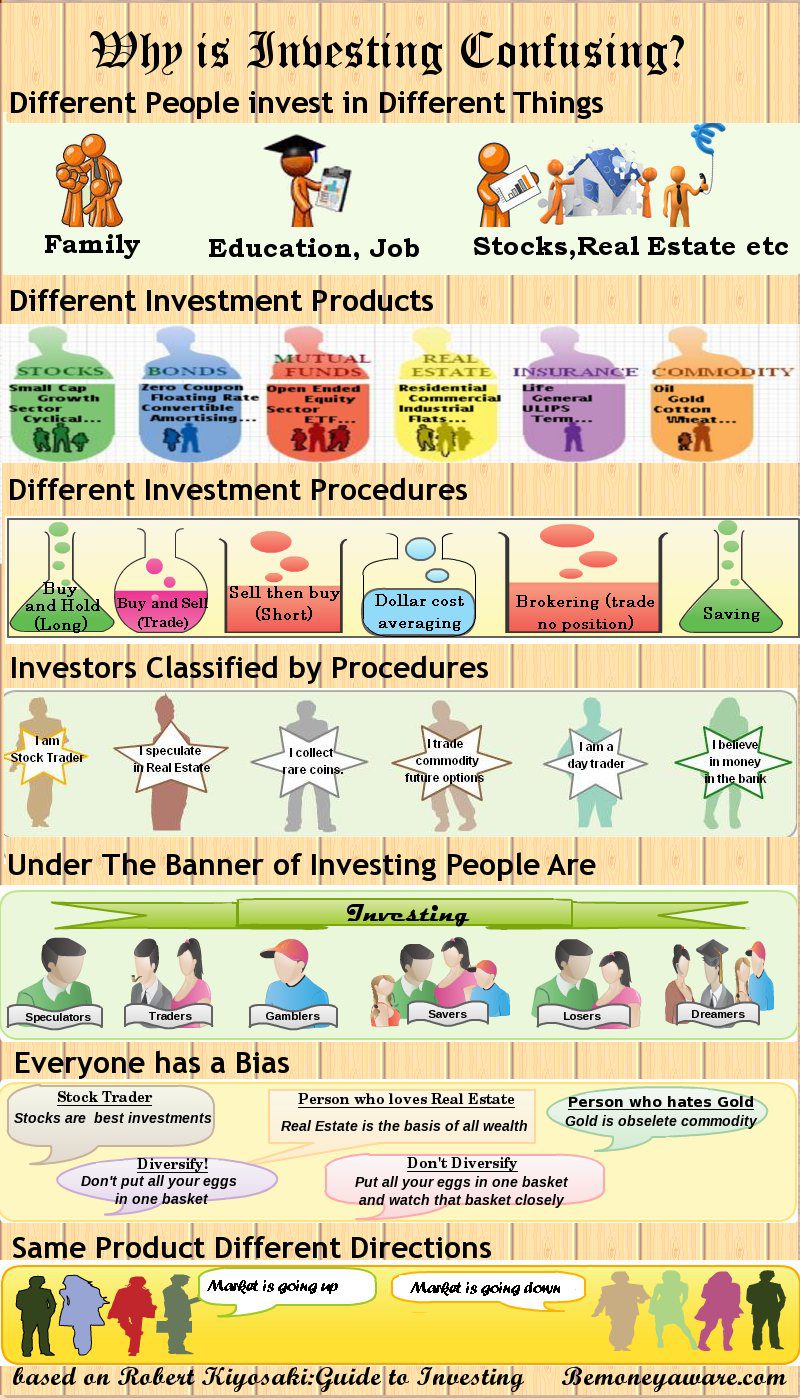

As explained in Why Is Investing Confusing?An infographic (given below. Click to enlarge) Investing is confusing because it is a very large subject. With many different people having as many different opinions. As explained in What is Investing? Investing is a plan not a product or a procedure. Before investing in any product think of Think about Liquidity,Safety,Returns,Risk,Tax and whether it suits you. As Rich father of Robert Kiyosaki’s Rich Dad, Poor Dad says Investing is a very personal plan. It should be as personal, as unique as you are!

Read about personal finance (it’s your money and your finance is very personal) but don’t take anything that you read (including at our site) at face value. We read and appreciated words advice of Scott Adams but then we found out that it’s more than 87 words! In our article Tax Saving Deposits,Yields and Ads of SBI,UCO we talk about how at times advertisements don’t tell the full truth. In our article Indian Subhash Shihohra Will Not be the First to Have Flying Car-Transition! we talked about how the news spreads without confirming the facts!

Find if it makes sense, why it makes sense and most important whether it makes sense for you! Take responsibility for your actions Mis-Selling or Mis-Buying: It’s My Money, My Responsibility. In our article Tax Saving Deposits,Yields and Ads of SBI,UCO we talk about how at times advertisements don’t tell the full truth and onus is on you Fact or opinion:Do Due Diligence

Learn from your mistakes ( we all will make mistakes hopefully not big ones) but as we said in Oops I did it! It is not the mistake but the attitude towards making mistakes. Mistakes are how we learn. Every time we make a mistake, it is an opportunity to learn something new, learn something about myself, and we often meet new people we would never have met. It is said, “When you come to the boundaries of what you know, it’s time to make some mistakes”. Winston Churchill said, “Success is the ability to go from one failure to another with no loss of enthusiasm.”

Related articles :

- Cyber Crime : Credit Card Fraud,Bank Account Hacked

- Gangnam Style

- Income Tax for Beginner

- Tax Saving Deposits,Yields and Ads of SBI,UCO

- Kumbh Mela : Number, Scale, Organization

- Booking Tatkal Ticket

Does Scott Adams advice make sense? What financial advice/plan do you follow? What do you find most difficult part in personal finances? What is the most important rule you follow in your personal finance?

One response to “Personal Finance and Scott Adams,Dilbert”

Nice Blog! This blog is actually unique for me, I have never seen of such kind of blog before, but now I know about it and it is really amazing, I have actually not heard about Dilbert, what it is, But I enjoyed reading your blog. Thank you for sharing, Keep Posting.