When you change job in a financial year you need to make sure that the deductions and exemptions regarding tax liability are made only once. In our article Changing Jobs and Tax, Form 12B We explained how basic exemption is accounted by two employers, the correct way to calculate tax when one switches jobs, how Form 26AS will have multiple entries, how Form 12B may be used to declare income from previous employer. But what if one does not declare income from previous employer to new employer by filling Form 12B. Then he will have Form 16 from each of the employer. Another way where one can have multiple Form 16 is when one is working for multiple employers. In case of multiple Form 16 How to fill the Income Tax Return?

Table of Contents

Instructions to fill Salary Details in ITR

From Instructions to fill Fill ITR2 (pdf)

Schedule-S : In case there were more than one employer during the year, please give the details of the last employer. Further, in case, there were more than one employer simultaneously during the year, please furnish the details of the employer from whom you have got more salary. Fill the details of salary as given in TDS certificate(s) (Form 16) issued by the employer(s). However, if the income has not been computed correctly in Form No. 16, please make the correct computation and fill the same in this item. Further, in case there was more than one employer during the year, please furnish in this item the details in respect of total salaries from various employers. In the case of salaried employees, perquisites have to be valued by the employee in accordance with the notification No. SO.3245(E) dated 18.12.2009, for the purposes of including the same in their salary income

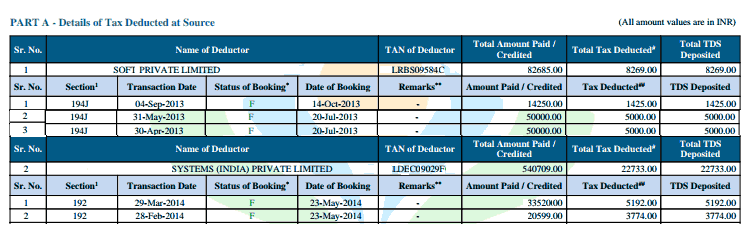

Form 26AS in case of Multiple Employers

How would the Government know that I have switched job or I have multiple jobs? All tax deducted against your PAN number is recorded. The employer submits(or is supposed to submit) TDS to Government. So when you change jobs or have multiple jobs , the partA of Form 26AS has multiple entries as shown in excerpt from image below. There are 2 deductors with their TAN and information on tax deducted. To know more about structure of Form 26AS you can read our article Understanding Form 26AS and What to Verify in Form 26AS? Click on image to enlarge

Filling Salary Details in ITR for an Individual

An individual with Salary typically fills ITR1 or ITR2. Difference between the two forms is shown in table below. Our article Which ITR Form to Fill? explains difference in various ITR forms. Based on types of income earned one should choose the appropriate ITR form. If you have to choose between ITR1 and ITR2 please note that Scope of ITR-1 (Sahaj) form has been reduced since AY 2013-14 significantly. So please make sure that you are filling the correct ITR. In case of doubt Please go for ITR2 . Yes it is longer than ITR1 and seems complicated (it’s not Sahaj which means easy in Hindi) but it asks for more details .

| ITR-1 SAHAJ | Individual | 1. Income from salary/pension: or 2. Income from one house property 3. Income from other sources( excluding winnings from lottery and income from races horses) |

| ITR-2 | Individual/HUF | 1. Income from salary/pension 2. Income from house property(s) 3. Income from other sources( excluding winnings from lottery and income from races horses) 4.Income from Capital Gains. 5. Income from foreign assets. They should not have Income from Business or Profession. |

Our article How To Fill Salary Details in ITR2, ITR1 explains how to fill the Salary details from one company by individual in Income Tax Return, ITR1 and ITR2 .

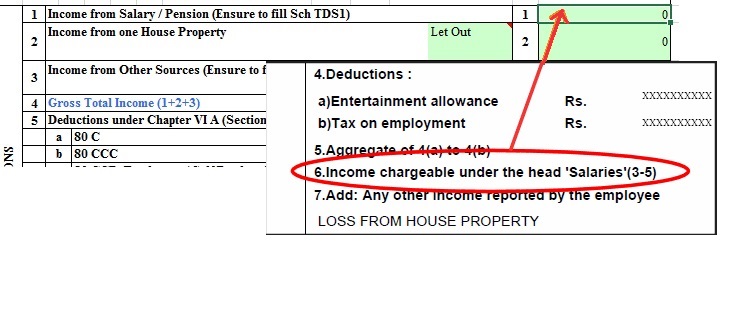

ITR1 has only one field for filling Income From Salary as shown in image below. So the Income chargeable under the head Salaries in your Form 16( point 6 in Form 16) is filled in Income from Salary in ITR1,(it’s not the Gross Salary which is point 1 in Form 16). Our article Understanding Form 16: Tax on income explains Form 16 in detail.

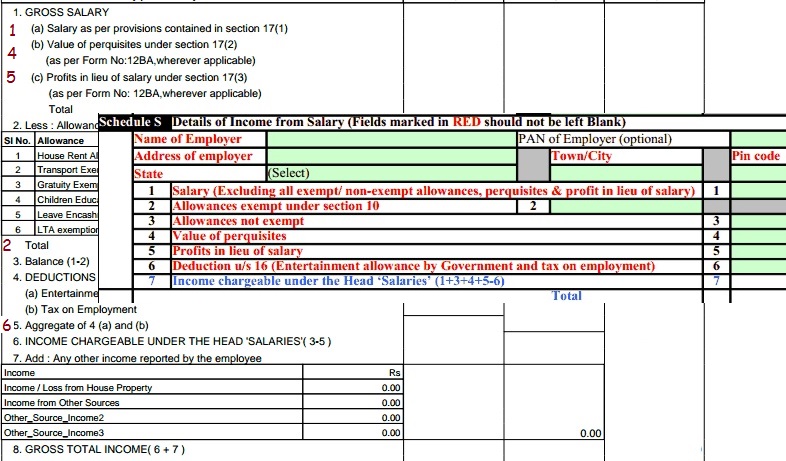

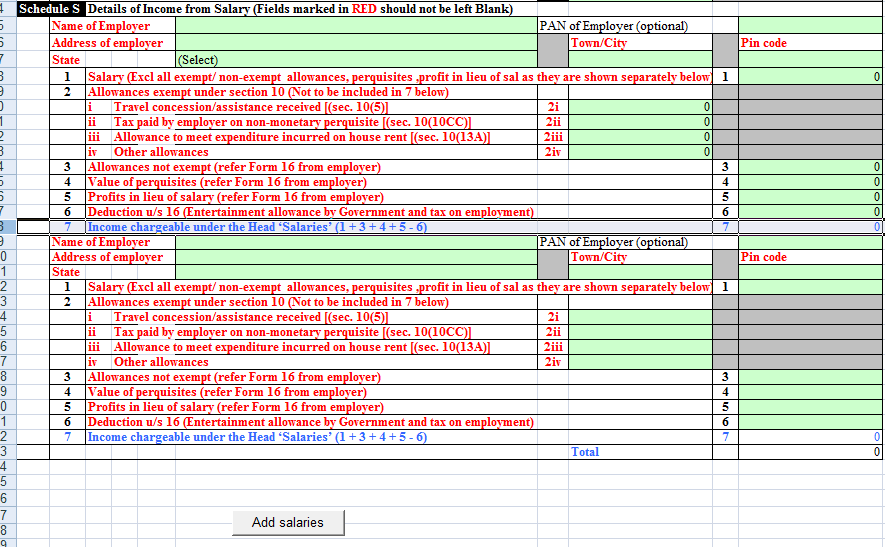

While in ITR2, a separate section called Schedule S has to be filled in which asks for more details. For an individual with Form 16 following information has to be filled in.

- Fill in row numbered 1 Salary (Excluding all exempt/non-exempt allowances,perquisites & profit in lieu of salary ) in Schedule S a from (a) of Gross Salary in Form 16 – Professional Tax – HRA

- Fill in row numbered 2 Allowances exempt under section 10 :Total of all the allowance exempt(ex: House Rent Allowance, Transport Allowance,) from Total of (2) Less : Allowance to the extent exempt u/s 10 . This consists of Allowances shown in Form 16 + HRA calculated

- Fill in row numbered 4 Value of Perquisites in Schedule S a from (c) (b) Value of perquisites under section 17(2) 21600.00 (as per Form No:12BA,wherever applicable) in Form 16.

- Fill in row numbered 5 Profits in Lieu of Salary in Schedule S a from (c) Profits in lieu of salary under section 17(3) 0.00 (as per Form No: 12BA,wherever applicable) 5(in color maroon) in Form 16.

Multiple Form 16

A person can have multiple Form 16 in two cases

- A person switches a job in the same financial year.

- A person is working with multiple employers simultaneously

If Form 16 is not issued by the one employer as there was no tax deduction or for any other reason,you should yourself consider the salary received and tax deducted. You can get this information from the monthly salary slips or or salary statements. This information along with the Form 16 issued by the other employer(s) can be used to file the personal tax return.

For Filling employer details in ITR1 or paper ITR2 for Multiple Form 16

ITR1 has just one row for filling in the details as shown in image of filling Salary Details in ITR1 above and no employer details. So you to do calculation yourself of consolidated income, tax deduction etc. So your consolidated salary would be sum of Income chargeable under the head Salaries (point 6 in your Form 16) from all your Form 16. Use the sum as salary in income tax calculations. You can check with our income tax Calculator .

For filling ITR2 in paper or offline form(not online,excel or java utility) there is only one section to fill in employer details. Please remember that e-Filing of Returns/Forms is mandatory for Any assessee having total income of Rs. 5 Lakhs and above from AY 2013-14 and subsequent Assessment Years. For more details read our article Income Tax for AY 2014-15:Tax slabs, ITR Forms

Income tax instructions are as follows

- A person switches a job in the same financial year : In case there were more than one employer during the year, please give the details of the last employer. So In Name and Address of employer please fill in details of employer from your last employer i.e current employer.

- A person is working with multiple employers simultaneously : please furnish the details of the employer from whom you have got more salary. So In Name and Address of employer please fill in details of employer from whom you have got more salary.

Further, in case there was more than one employer during the year, please furnish in this item the details in respect of total salaries from various employers

For Salary details you need to add both the salaries , see if exemption is take care of twice and calculate tax.

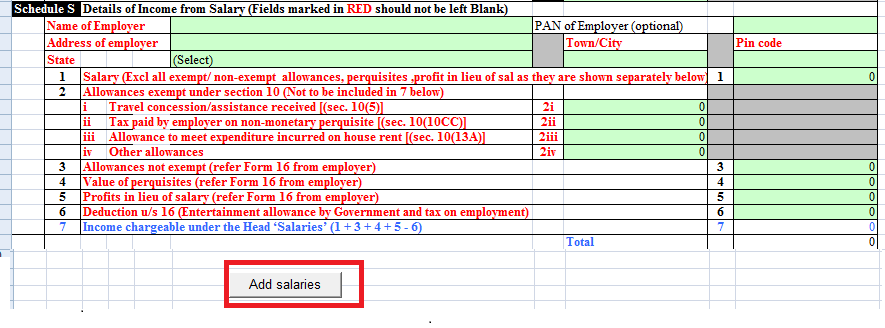

Filling Salary details in ITR2 for Multiple Form 16

Excel utility of ITR2 allows you to add more employers by clicking on Add Salaries as shown in image below (marked by red box) Click on image to enlarge.

After clicking Add Salaries Another set of details is added which can be used for filling details from second employer as shown in image below. So fill in Information from different Form 16 in different sections.

Check if you have to pay Self Assessment Tax

While calculating income tax especially if your new employer has not taken care of old employer tax details, you might end up owing tax i.e you have paid less tax than what is required. In such a case Please pay your tax due by filling Challan 280 Our article Challan 280: Payment of Income Tax explains in detail. Pay the tax due. If you find it difficult please contact a Our article How to file Income Tax Return Online : Incometaxefiling,CA,efiling Websites compares various options like CA and TRPS.

Tax Return Preparer Scheme(TRPS) seeks to assist small and marginal taxpayers in preparing and filing their tax returns. Tax Return Preparers (TRPs) are professionally trained individuals by Income Tax Department who can come to your doorstep and assist you in filing your income tax return. TRPs will receive 3% of the tax paid on the returns prepared & filed for every new assessee in the 1st year (subject to a maximum of Rs. 1000), 2% in the second year and 1% in the third year and Rs. 250 for the returns prepared & filed for the old assessees.

You can also refer to our articles E-Filing of Income Tax Return, Fill Excel ITR form : Personal Information,Filing Status for how to fill Excel ITR1 Form. All articles are arranged at our website bemoneyaware.com/income-tax/

Disclaimer:Please do not construe this as professional financial advice. You should consult a qualified financial person(tax advisor/financial advisor) prior to making any actual tax or investment or trading decisions. We accept no liability for any interpretation of articles or comments on this blog being used for actual investments/taxation purposes!

Related articles:

- Viewing Form 26AS on TRACES

- Income Tax Overview

- Paying Income Tax Online: Challan 280

- Changing Jobs and Tax, Form 12B

- E-Filing of Income Tax Return

- Fill Excel ITR form : Personal Information,Filing Status

When you join a new organisation, you should furnish your TDS details from the previous employer to your current employer. This will help your current employer in deducting tax accordingly. If you haven’t done please make sure that deduction and exemptions are NOT availed more than once.

17 responses to “How to Fill ITR when you have multiple Form 16”

Get expert consultation from GSBTaxation for ITR filing online, gst return filing and other tax preparation services/ accounting in India. We have served a number of clients to shorten their operational cost in account process.

Hi,

Financial year 2017-18 up to December I worked in one organisations after that I was resigned that organisations and joined in other organisations remaining 3months in new organisations there is no tax because of gross amount is less then 2,50000 shall I fill ITR-1 up to December or what??? Give reply sir

Though you worked in 2 organizations your income is still income from salary.

You can file ITR1

Hi

I m a government employee earning about 120000 per annum. At the same time I also joined a private company to work during off hours and weekends and earned two months salary about 4 lakhs. Now I am not clear how to file income tax return.would it be bad if I continue working for private company in off hours.

Kindly reply

You should tell your employer.

Most employers are OK if you are not working in the same domain.

Else if it comes out they have a reason to fire you.

So think carefully before you approach your manager/HR.

If you earned you need to pay tax.

Is this income coming up in Form 26AS?

Is any TDS dedcuted?

Will your second employer issue

Form 16 in which case it is treated as Income from salary

or Form 16A where you are shown as a consultant?

I have a question. I am a salaried employee in pvt. sector. also I am getting pension from central govt. since pension is paid through bank, they deduct TDS & issue form-16, my employer also issues form-16. how to prepare income tax return in this case, if both bank & employer consider exemption of Rs. 2.5L.

Team,

I have two TAN numbers in my form 16, but employer is one and tax is deducted under two TAN numbers.

Total salary is shown consolidated.

Please advise the process to file tax return.

Regards

Raj Kumar

Same issue for me too as my company is changed. Please advice how to fill TDS. What should be filled under “INCOME CHARGEABLE UNDER THE HEAD SALARIES”.

i have 3 form 16 as i switched my job twice. in this case can i fill ITR 1(sahaj). I will have to add everything from all 3 forms while filing return?

Maam, yes but you have to make sure that you take care of 80C deductions etc.

Nice article. I was looking for information on consolidating incomes earned from two employers. Just adding the values from the row “INCOME CHARGEABLE UNDER THE HEAD “SALARIES”” did the trick. Thank you!

Hi,

I am employed with a company where my salary is 53200 pm…. I also have a business from where I generate approx. 30000 pm profit… I also have made investments in the stock market which are worth a few lakhs… Once or twice a month I also work as a freelancer… there my income is approx. 10000….. I also, get rental income from my property 16000 pm… Now , my company pays the income tax on my behalf… How do I pay the income tax for the rest of my income.. I don’t want to show my other income in my company, please suggest ?

You do not have to tell your employer.

The income that you earn is income from business or profession.

If it is less than income from salary you can fill ITR2. Else you need to fill ITR4.

Calculation of tax etc is in same as way as for the income from salary.

Basically you need to calculate total income and take care of deductions and then pay due tax. If TDS is deducted in freelance etc you can also take it into account while calculating and filing ITR.

If tax on income is more than 10,000 Rs you need to pay advance tax. 30% by 15 Sep,30% by Dec 15 and 30% by Mar. Our article Advance Tax: When, How,Why discusses it in detail.

You can read more about incometax for freelancer at clear tax also.

if we have multiple in the same financial year. as packages were different.

And I remove tax details from income tax website.

will it be safe?

Hi,

I worked in some XYZ company from 1st April 2015 to 08 May 2015 and I changed the Job to ABC company from 11 May 2015. My previous company (XYZ) computed tax exemption based on Financial year 2014 declaration which is NO TAX (Same declaration is not possible in FY15, Since i have other investment plans). I dont know the details of previous employer (PAN,TAN etc). I have only payslip for 1st April 2015 to 08 May 2015 . (For now ,My current employer does not include salary from previous employer. but i could correct it by requesting them .) Now , Do i need to fill form No 12 B and submit to current employer ? or Get form 16’s from previous employer after 1 year ( i may get form 16 in May 2016) and current employer (in may 2016), then proceed for corrected income tax filing ? which is the best way , please help me out .

Nice post Kirti!

I’ve a question: Is Leave encashment from previous employer[after resigning] is taxable?

My understanding is “Exemption from Tax with limitation”.

In my case, my previous employer has shown leave encashment under the name “Value of any other benefit/amenity/service/privilege” as a Perquisites in Form no. 12BA,which is taxable by being a part of gross salary.

Now is there a way to claim or to avoid paying tax?

Nice post Kirti!

I’ve a question: Is Leave encashment from previous employer[after resigning] is taxable?

My understanding is “Exemption from Tax with limitation”.

In my case, my previous employer has shown leave encashment under the name “Value of any other benefit/amenity/service/privilege” as a Perquisites in Form no. 12BA,which is taxable by being a part of gross salary.

Now is there a way to claim or to avoid paying tax?