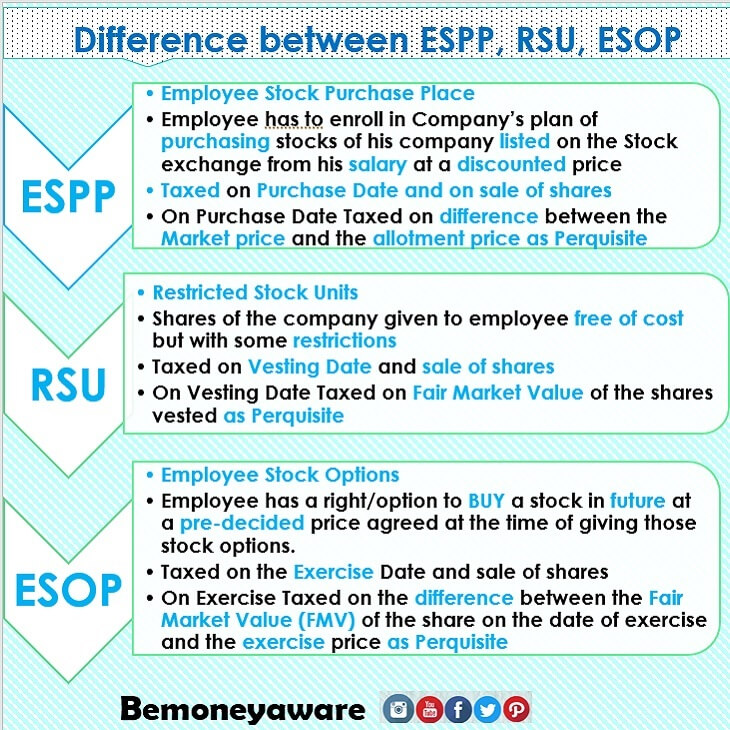

Companies reward employees through various stock-based compensation programs including Employee Stock Option Plans (ESOP), Restricted Stock Units (RSU), and Employee Stock Purchase Plans (ESPP). This comprehensive guide focuses on ESPP – how it works, tax implications, and strategies to maximize your benefits.

Table of Contents

What is ESPP?

An Employee Stock Purchase Plan (ESPP) allows employees to purchase their company’s stock at a discounted price using payroll deductions. Unlike ESOPs or RSUs, ESPPs give you the choice to participate and determine your contribution level.

How ESPP Works

1. Enrollment Process

- You elect to participate during specific enrollment periods (typically twice yearly)

- Choose your contribution percentage (usually 1-15% of gross salary)

- Money is deducted from each paycheck during the offering period

2. Stock Purchase

- At the end of the offering period, accumulated funds purchase company shares

- Shares are bought at a discounted price (typically 10-15% off market price)

- Shares are deposited directly into your brokerage account

Real-World Example:

- Enrollment Period: January (for Jan-June offering period)

- Monthly Contribution: ₹10,000 (10% of salary)

- Total Accumulation: ₹60,000 over 6 months

- Stock Purchase: July, using the full ₹60,000 at discounted price

Key ESPP Terms Explained

Essential Terminology

Enrollment Period: Window when you can join or modify your ESPP participation. Missing this means waiting for the next enrollment cycle.

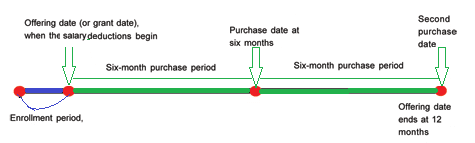

Offering Period: Duration during which payroll deductions accumulate (typically 6-24 months). Your money is held until the purchase date.

Purchase Period: Interval after which stocks are actually bought. May occur multiple times during a long offering period.

Grant Date: First day of the offering period, important for tax calculations and lookback pricing.

Purchase Date: Predetermined date when accumulated funds are used to buy shares for all participants.

Purchase Price: Final price per share after applying discounts and lookback provisions.

Advanced Features

Lookback Provision: Your purchase price is based on the lower of:

- Stock price at the beginning of the offering period

- Stock price at the end of the offering period

Example of Lookback Benefit:

- Stock price at start: ₹1,000

- Stock price at purchase date: ₹1,500

- With 15% discount: You pay ₹850 (15% off the lower ₹1,000)

- Immediate profit potential: ₹650 per share (76% return!)

Discount: Additional percentage reduction (typically 10-15%) applied to the base price determined by lookback provision.

Tax Implications of ESPP

Indian Tax Treatment

1. Perquisite Tax (At Purchase)

- Discount received is treated as taxable perquisite

- Added to your salary income for the year

- Taxed at your marginal tax rate (up to 30% + cess)

Calculation Example:

- 100 shares purchased at ₹850 (discounted price)

- Market price at purchase: ₹1,200

- Perquisite value: 100 × (₹1,200 – ₹850) = ₹35,000

- Tax liability: ₹35,000 × your tax rate

2. Capital Gains Tax (At Sale)

For Indian Listed Companies:

- Short-term (≤1 year): 15% tax on gains

- Long-term (>1 year): No tax up to ₹1 lakh annually, 10% beyond that

For Foreign Listed Companies:

- Short-term (≤24 months): Gains taxed as per your income slab

- Long-term (>24 months): 20% tax with indexation benefit

Cost Basis Calculation

Your cost basis for capital gains = Purchase price + Perquisite tax paid

Example:

- Purchase price: ₹850 per share

- Perquisite tax paid: ₹105 per share (30% of ₹350 benefit)

- Cost basis for capital gains: ₹955 per share

Strategic Considerations

Should You Participate in ESPP?

Benefits: ✅ Guaranteed discount (10-15% minimum return) ✅ Potential for higher returns with lookback provision ✅ No investment risk during accumulation period ✅ Flexibility to sell immediately after purchase

Risks: ❌ Concentration risk in single company stock ❌ Market volatility after purchase ❌ Immediate tax liability on perquisite ❌ Opportunity cost of locked-up salary

Hold vs. Sell Strategy

Immediate Sale Strategy:

- Pros: Lock in guaranteed discount profit, eliminate market risk

- Cons: Higher tax rate on short-term gains, miss potential upside

- Best for: Risk-averse investors, concerns about company outlook

Long-term Hold Strategy:

- Pros: Potential for additional gains, better tax treatment

- Cons: Market risk, concentration in single stock

- Best for: Confident about company prospects, diversified portfolio

Hybrid Approach (Recommended):

- Sell 50% immediately to lock in guaranteed profit

- Hold 50% for potential long-term gains and better tax treatment

ITR Filing Requirements

For Foreign Stocks (US/International Companies)

Foreign Asset Declaration:

- Report in Schedule FA if holdings exceed ₹50,000

- Required even if you haven’t sold the shares

- Include current market value as of March 31

Income Reporting:

- Perquisite income in salary section

- Capital gains in Schedule CG

- Use SBI TT buying rate for currency conversion

Documentation Required:

- Form 12BA from employer (shows perquisite income)

- Brokerage statements from foreign broker

- Tax documents (1099-DIV for US dividends)

Common ITR Mistakes to Avoid

❌ Not reporting perquisite income from ESPP discount ❌ Using wrong currency conversion rates ❌ Missing foreign asset declaration ❌ Incorrect capital gains calculation ❌ Not claiming foreign tax credit for overseas withholding

Maximizing ESPP Benefits

Best Practices

1. Enrollment Strategy:

- Participate if your company offers lookback provision

- Consider maximum allowed contribution (15%) if financially feasible

- Ensure you have emergency fund before participating

2. Tax Planning:

- Set aside funds for perquisite tax liability

- Consider timing of sale for optimal tax treatment

- Plan around annual capital gains exemption limits

3. Portfolio Management:

- Don’t let ESPP shares exceed 5-10% of total portfolio

- Regularly rebalance to maintain diversification

- Consider company outlook and industry prospects

Advanced Strategies

Dollar-Cost Averaging: If holding long-term, consider selling portions at different times to average out market volatility.

Tax Loss Harvesting: If stock declines, consider selling for tax loss benefits while maintaining long-term positions in other shares.

Roth IRA Contributions (for US residents): Use ESPP profits to maximize retirement contributions.

Frequently Asked Questions

Q: Can I stop ESPP participation mid-period? A: Most plans allow stopping during enrollment periods. Some permit suspension during offering periods, but accumulated funds still purchase shares.

Q: What happens if I leave the company? A: Shares already purchased remain yours. Accumulated contributions may be returned or used to purchase shares, depending on plan terms.

Q: Can I transfer ESPP shares to Indian brokers? A: Yes, but involves complex procedures and costs. Most prefer keeping shares with original foreign broker.

Q: How is currency fluctuation handled? A: You benefit/lose from currency movements between purchase and sale. Use actual exchange rates on transaction dates for tax calculations.

Comparison: ESPP vs. Other Stock Programs

| Feature | ESPP | ESOP | RSU |

|---|---|---|---|

| Employee Choice | Yes (opt-in) | No (granted by company) | No (granted by company) |

| Purchase Price | Discounted market price | Fixed exercise price | Zero (free shares) |

| Immediate Ownership | Yes, after purchase | After exercise | After vesting |

| Upfront Cost | Salary deductions | Exercise price payment | None |

| Tax on Grant/Vest | Perquisite on discount | No tax until exercise | Perquisite on vesting |

| Flexibility | High (can stop anytime) | Medium (can choose not to exercise) | Low (automatic vesting) |

2025 Updates and Trends

Recent Changes

- Increased scrutiny on foreign asset reporting

- Enhanced ITR validation for international transactions

- New compliance requirements for large foreign holdings

Planning Considerations

- Consider impact of changing tax treaties

- Monitor RBI regulations for foreign investments

- Plan for potential changes in capital gains taxation

Conclusion

ESPP can be an excellent wealth-building tool when used strategically. The guaranteed discount provides immediate returns, while lookback provisions can amplify gains significantly. However, success requires understanding tax implications, maintaining portfolio diversification, and having clear entry/exit strategies.

Key Takeaways:

- Participate if offered – especially with lookback provision

- Plan for taxes – set aside funds for perquisite tax

- Don’t over-concentrate – limit to 5-10% of portfolio

- Consider hybrid strategy – sell some, hold some

- Stay compliant – properly report in ITR filings

Remember, while ESPP offers attractive benefits, it should complement, not replace, a diversified investment strategy. Always consider your overall financial goals, risk tolerance, and tax situation when making ESPP decisions.

What is difference between ESPP, RSU and ESOP?Related Articles :

- RSU of MNC, perquisite, tax , Capital gains, ITR, eTrade

- Salary, Net Salary, Gross Salary, Cost to Company: What is the difference

- Variable Pay

- It’s not what you earn that makes your financial position!

- Understanding Form 16: Part I

- Basics of Employee Provident Fund: EPF, EPS, EDLIS

- How to Calculate Income Tax

This article is for educational purposes only and should not be considered as tax or investment advice. Consult with qualified professionals for personalized guidance.Hope this article helped you in understanding what is ESPP? How different it is from ESOPs and RSUs? Have you availed of ESPP? Would you suggest going for ESPP?

32 responses to “Employee Stock Purchase Plan or ESPP: Complete Guide”

Hi,

I wanted to know what would be the initial value of investment in A3 incase of ESPP where stocks are bought on discount and difference between FMV and purchase price is added to Perquisite in salary and TDS is deducted.

Also what would be the initial investment incase of RSUs.

Adding to this what is peak value of investment during the Period. Is it calculated from everyday closing value of the share or the peak it achieved during trading sessions.

Adding these points would be superb to your wonderful article. Thanks a lot.

For listed LTCG is there no tax or is there 10% tax in excess of 1 L profit? Can you confirm please?

For listed LTCG is there no tax or is there 10% tax in excess of 1 L profit?

only for the stocks listed on Indian Stock exchanges

For international tax different rules apply!

I have stocks acquired through ESPP from a US MNC. I am leaving the firm and want to keep these stocks. Can I transfer these stocks to my India DMAT account? This MNC is not listed in India.

Sadly no.

You cannot transfer your US MNC stocks to Indian Demat Account.

Hi,

I have invested in ESPP in my company. But I am not sure how to declare that in FA for in ITR2. The scenario is as such:

1. I purchased 20 stocks in a period of 1 year at price of $40 each(Grant price).

2. The purchase price was $90.

3. The taxation which my organization is calculating, is on the difference in grant and purchase price like ($90-$40)*20 = $100

4. With conversion rate of INR 70 my taxable amount becomes = 100 * 70 = 7000

5. Now what amount must be declared in following fields in the FA form:

Total Investment, Income Derived from asset, Income taxable amount,

Schedule where offered, Item number of schedule

Request you to please help me in this.

P.S. – I have not sold even a single share till this time.

Total investment is $1800

Hi,

I have invested in ESPP in my company. But I am not sure how to declare that in FA for in ITR2. The scenario is as such:

1. I purchased 20 stocks in a period of 1 year at price of $40 each(Grant price).

2. The purchase price was $90.

3. The taxation which my organization is calculating, is on the difference in grant and purchase price like ($90-$40)*20 = $100

4. With conversion rate of INR 70 my taxable amount becomes = 100 * 70 = 7000

5. Now what amount must be declared in following fields in the FA form:

Total Investment, Income Derived from asset, Income taxable amount,

Schedule where offered, Item number of schedule

P.S. – I have not sold even a single share till this time.

Hi,

What happens if i sell the shares in losses?

You show it as a capital loss.

You have a chance to offset it in the next 8 years if you file ITR in time.

Income comes under five heads – salary, income from house property, income from business and profession, capital gain and income from other sources. The law allows you to set off losses in one against gains in another, depending upon the various criteria.

However, tax laws allow setting off of losses against gains in the same category, based on different criteria. If an income is tax-exempt, it however cannot be adjusted against any loss from an income that is taxable. For tax computation, profit or losses in shares are clubbed under the head of capital gains.

If an investor has held shares for less than 12 months from the date of buying, then the resulting loss on its transaction on stock exchanges, if any, is termed as short-term capital loss (STCL).

This loss can be adjusted against the short-term capital gain (STCG) or long-term capital gain (LTCG) from shares, if any, thus lowering the tax outgo. Short-term capital gains from equities are taxed at 15 per cent. (If an investor has held shares for more than 12 months, then the resulting gain/loss is termed long-term capital gain/loss.)

If the short-term loss cannot be set off in the same fiscal, then the balance can be carried forward to subsequent eight years. In each of these, the said short-term losses can be set-off against short-term capital gain (STCG) or long-term capital gain, if any.

To reduce outgo, many investors set off gains made from equities in the fiscal against losses occurred in same year or previous year. They book losses, if any, on existing holdings and then later repurchase the stock to keep their holdings intact.

For example, an investor has already booked short-term profit (by selling within 12 months) of Rs. 10,000 in some stocks. At the same time, the investor is sitting on un-realized loss of Rs. 4,000 in some other stocks.

In that case, the investor has to pay short-term capital gains tax at 15 per cent on Rs. 10,000 profit. To reduce short-term capital gains tax liability, the investor can sell the stock on which he is incurring Rs. 4,000 of losses. In that case, the investor’s has to pay tax on Rs. 6,000 (Rs. 10,000 – Rs. 4,000), not Rs. 10,000. To keep his holding intact, the investor can later repurchase the stock.

However, long-term capital losses on shares can only be set off against long-term capital gains, if any. Further, any long-term capital losses that cannot be set off against long-term capital gains arising in the same fiscal can be carried forward to subsequent eight years.

Awesome article. Thanks for publishing it. It will be great if you can publish with revised tax rules introduced in 2018 budget.

Hi,

I bought all my vested stocks on April 8 2015 and my company listed on Nasdaq on April 24, 2015. I sold my all shares on Nov 2016. Is it long term or short term in Indian taxation system.

Very nice article… Thanks for sharing…

For LTCG on foreign stocks, is it not true that minimum holding period of the stocks should be 3 years?

In “Example of LTCG”, how is the value $223.5 derived for calculating “Indexed cost of acquisition”?

that seems a typo, 264.14*711/939 gives 200, so 223.5 should have been a 200. Either a typo, or on purpose to confuse readers.

It is 223.5 * 939/711 not the other way round

Hello,

I file my returns online. I could not find a section under ITR where I could fill in the details of the ESPP and RSus granted to me. Please help me understand where these details should be filled in case an individual files the returns online.

Which value should be considered as purchase price for calculating STCG. Should it be actual purchase value post company discount(e.g. $8.5) or should it be FMV on date of purchase/allotment (e.g. this could be either $12 or $10 based on situation) or should it be base value on which discount is offered (e.g. $10 in this case) ?

Would this be a beneficial option if one opts for QuickSale,where in most cases it’s sold for around same price as that on date of purchase.

Hi Anil,

Can you please let me know what is the process of TAX deduction on ESPP in india?

Lovely article. Hope it is up to date with the current taxation policies and norms.

Thanks for your kind words. They are very encouraging to us.

Did you find anything missing?

Hi Kirti,

Section 2(42) of IT Act says duration as 36 months to be qualified LTCG for stocks not listed in india. Has anything changed in between? can you please clarify the source of info.

https://indiankanoon.org/doc/1595434/

that’s correct. foreign stocks are considered unlisted securities.

Thanks for the wonderful article, very informative, Can you please help me understand in the example of “Example of LTCG” for the calculation of “Indexed cost of acquisition” how is value of “$223.5” is arrived? Also in calculation of “Expenditure on transfer” is it constant as 10% of the 1 share at buy price?

Thanks a lot. It clarifies many things. I have been calculating my gains differently for my NYSE listed RSU and ESPP. I was calculating the gain/loss in USD and applying the currency conversion rate on the day of sale for changing it to INR. Can you give which section in the IT act gives the information of foreign capital gains, if possible?

1. My broker maintains the ESPP and RSU stocks related statements separately. So some times I sell the shares allotted later before the earlier alloted shares. Should I still follow First in First out for the computation. Broker maintains each grant related purchase and sale separately in the statement.

2. Can I add currency conversion losses to the sale proceeding calculation?

Thanks a lot again.

I have the following two questions regarding LTCG computation in the above article …

1.Is it right only 10% of brokerage can be claimed as expenditure on transfer ?

2.For RSU LTCG, is it right one will still go by the FMV on the date of grant as its purchase price, assuming perquisite tax was paid for it ?

For STCG, shouldn’t it be (selling price) – (purchase price).

purchase price = $8.5 * 100 = Rs 59.93 * 8.5 * 100 = Rs 50,940.5

selling price = $12 * 100 = Rs 61.63 * 12 * 100 = Rs 73,956

STCG = RS 73,956 – 50,940 = 23,016

Thanks for input Rahul. We appreciate it.

We looked at it and corrected it.

Please note that purchase price is 12 $ and not 8.5$ the price at which you got shares. This is because the difference between the price you got and Fair Market Value, was perquisite for you and your company paid tax on it. Tax on the shares should be mentioned in your Form 12BA and Perquisite in Form 16.

Very informative website. keep up the good work.

Thanks for the encouraging words.

Very informative website. keep up the good work.

Thanks for the encouraging words.