A mutual fund is a professionally managed investment scheme that pools money from many investors and invests it in stocks, bonds, short-term money market instruments and other securities in accordance with objectives as disclosed in offer document. This article covers all the articles that have covered in depth by us at bemoneyaware which talks about basics of Mutual funds, Comparing Stocks vs Mutual Funds, How to Directly Invest in Mutual Funds, How to Choose Mutual Funds, What are returns of Mutual Funds, How to Nominate and Claim MF Units.

| What are Mutual funds | Types of MF | Stocks Vs Mutual Funds |

| Direct Investing in MF | Tax and MF | Choosing MF |

| Exiting from MF | Returns | Nominate and Claim |

Table of Contents

What are Mutual funds

Mutual funds have a fund manager and a team who invests the money on behalf of the investors. With mutual funds, one can invest minimum amount (at times as little as Rs 100) which are spread across a wide cross-section of securities giving one advantage of diversification. Buying a mutual fund is like buying a small slice of a big pizza. The buyer of mutual fund gets a proportional share of the fund’s gains, losses, income and expenses. The advantages of Investing in Mutual Funds:

- Affordability,

- Professional Management,

- Diversification,

- Variety of Investment ex: Equity, Debt, Return potential, Flexibility, Transparency,

- Tax Benefits,

- Liquidity,

- Clear – Cut regulations [SEBI]

Stocks vs Mutual Funds

Invest in Equities screams the personal finance literature(newspapers, magazines, blogs). If one wants to invest in equities there are two ways, Stocks and Mutual Funds. In this article, we shall explore why is it recommended that one invests in Equities?What are the pros and cons of investing in Stocks, in Mutual Funds?

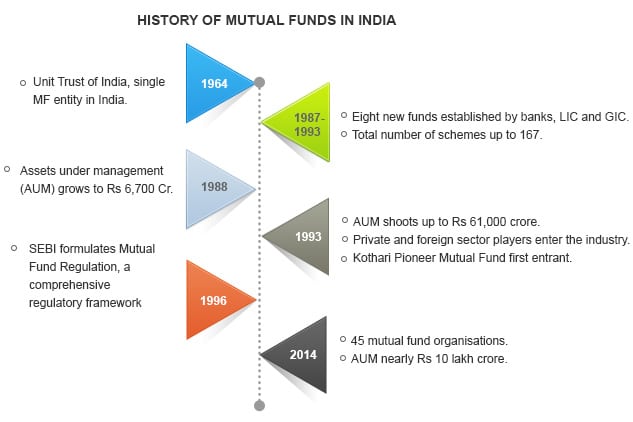

History of Mutual Funds in India

Mutual funds in India have come a long way since 1964 when the Unit Trust of India was the only player.

By the end of 1988, UTI had total assets worth Rs 6,700 crore. Soon after, eight funds were established by banks, LIC and GIC between 1987 and 1993. The total number of schemes went up to 167 and total money invested – measured by Assets under Management (AUM) – shot up to over Rs 61,000 crore.

In 1993, private and foreign players entered the industry, marking the third phase. The first entrant was Kothari Pioneer Mutual fund, which launched in association with a foreign fund.

The Securities and Exchange Board of India (SEBI) formulated the Mutual Fund Regulation in 1996, which, for the first time, established a comprehensive regulatory framework for the mutual fund industry. Since then, several mutual funds have been set up by the private and joint sectors.

Types of Mutual Funds

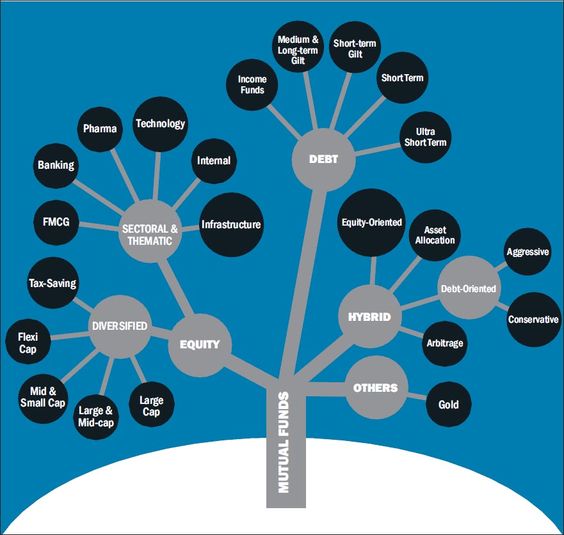

There are various types of mutual funds, those that invest in stocks i.e equity and in bonds etc i.e debt mutual funds. Even among Equity Mutual Funds are Large-cap, mid-cap, small-cap funds. Difference between small-cap, mid-cap, and large-cap mutual funds in India is in the type of companies they invest and hence the risk and returns expected from these mutual funds. We need to understand Types of Mutual Funds, risk and return associated with these mutual funds and what type of companies different mutual fund invests in.

Mutual funds invest in different asset classes including equity, debt and gold. Following image shows the different types of Mutual Funds. Comparing types of Mutual funds to Cricket players is shown here.

Types of mutual funds: Are You Making Right Choice

- What are Balanced Mutual Funds

- Understanding ELSS Funds or Equity Linked Saving Schemes

- Understanding Equity Saving Funds, Arbitrage, Taxation

- International Mutual Funds: What are these, Pros and Cons, Tax

- Best ELSS Funds to Invest for Tax Savings

- Alternatives to Fixed Deposits: PPF,FMP,Debt MF,RD,CD

- What are Fixed Maturity Plans (FMP)

Types of Mutual Funds in India (Ref: Valueresearchonline.com)

Types of Mutual Funds and Cricket Players

Comparison of Types of Mutual Funds with Types of players in Cricket Team is given later in the article. A large-cap equity fund is like Rohit Sharma, Virat Kohli who would give steady returns in long innings. While Small-cap fund is like a pinch hitter, may give good returns or get out fast! Just like good cricket team need all kind of players so your Mutual Fund should be spread across multiple types of mutual funds.

Comparison of Types of Mutual Funds with Types of players in Cricket Team

Choosing Mutual Funds

Mutual funds are one of the best investment options available today, as said by media, financial planners. But there are various types of mutual funds, equity funds, debt funds, balanced funds, income funds, index funds etc. with several schemes equity has large cap,small cap, debt funds have short term, gilt. Availability of so many mutual fund categories and schemes in the current volatile markets can put the investor in a fix of how to choose a mutual fund to suit his/her needs Before you make an investment in mutual fund, first you need do some homework. These articles help you.

- How to Choose Mutual Fund

- How to Choose Mutual Fund : Ratings, Fund House,Size

- Dividends Options of Mutual Funds :Tax, Switch

- Growth and Dividend Option in Mutual Funds

- Mutual Fund Managers in India

- Mutual Fund Manager’s Limitations

- Rantings of a Mutual Fund Investor

- Number of Mutual Funds

- Many Mutual Funds: Diversification or Diworsification

- Finding Info on NFOs of FMP,MFs,FD and Saving Interest Rates

How to Start Investing in Mutual Funds

- Know Your Customer or KYC

- How to fill FATCA and additional KYC for Mutual Funds Online or Offline through CAMS or Karvy or directly

- Central KYC or cKYC, One KYC for your Banks, Mutual Funds, Insurance

- Get started with Mutual Fund investing: KYC, Platform

Direct Investing in Mutual Funds

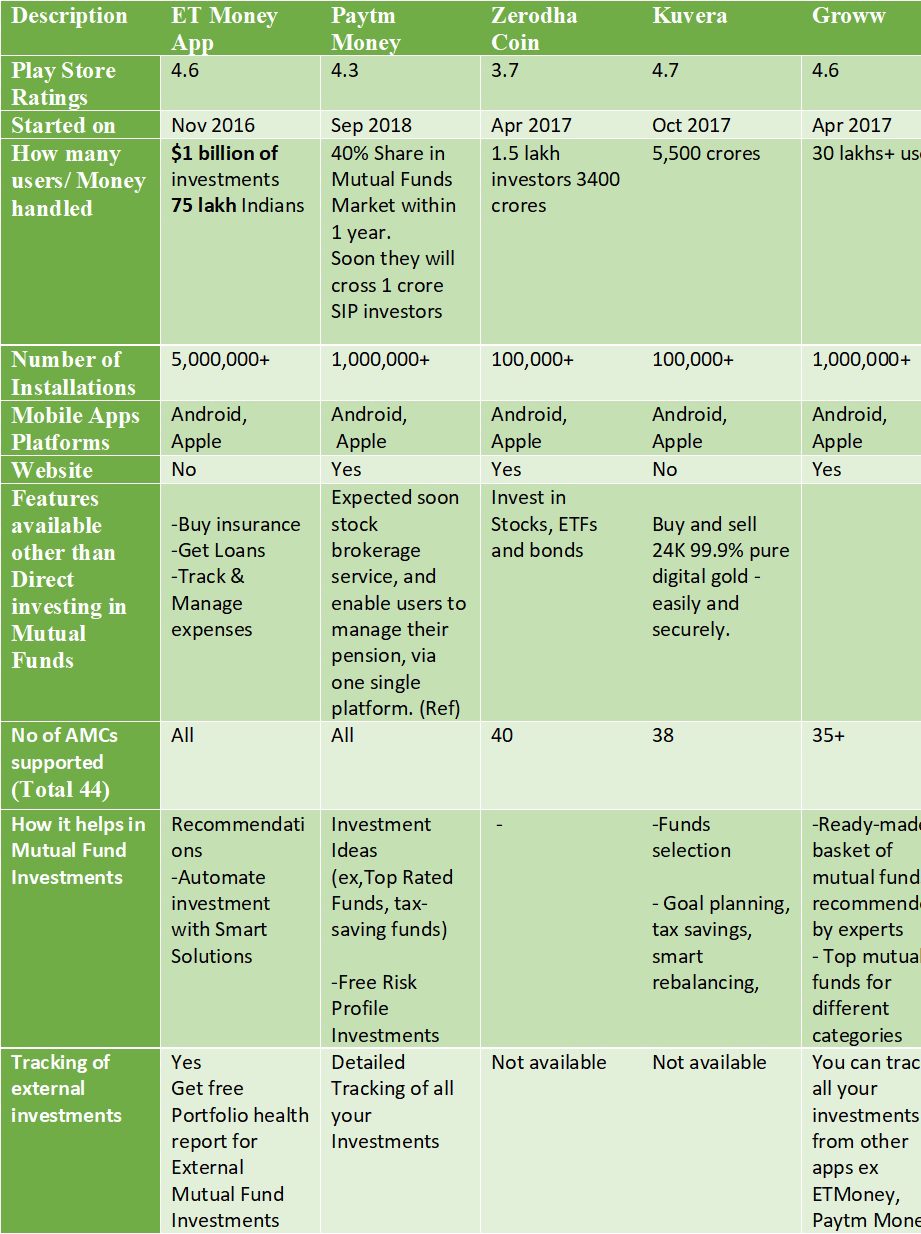

Regular and Direct Mutual Fund plans are options to buy the same mutual fund scheme, run by the same fund managers who invest in the same stocks and bonds. The major difference between direct plan and a regular plan is that in the case of a regular plan your mutual fund(also known as AMC) pays a commission to your broker whereas in case of a direct plan, no such commission is paid.

- Direct Investing in Mutual Funds

- Compare Direct Mutual Funds Investing Platforms,

- PayTM Money

- ETMoney

- MF Utility : Investing in Mutual Fund Direct Plans online

- MF Utility: How to buy and Sell Mutual Funds Directly

| Description | Regular Plan | Direct Plan |

| What | Investing through distributors | Investing directly |

| Expense Ratio | High | Low |

| NAV | Low | High |

| Returns | Low | High |

| Investment Advice | Available | Not Available |

| Market Research | Done by distributor/agent | Done by self |

| Portfolio Tracking | Done by distributor/agent | Done by Self |

Returns of Mutual Funds

- Best and Worst Mutual Funds : Difference in returns

- Mutual Fund SIP returns over time

- Not All Mutual Funds Do Well -the Laggards

Selling Mutual Funds

- Switching of Mutual Funds

- Redeeming Mutual Funds : Check Exit Load,Taxes

- How to sell or redeem Mutual Fund Units: Online, Exit Load, Cut off,SIP

- Systematic Transfer Plan or STP in MF: What is STP,How to invest

- Basics of Capital Gain

Mutual Funds and Tax

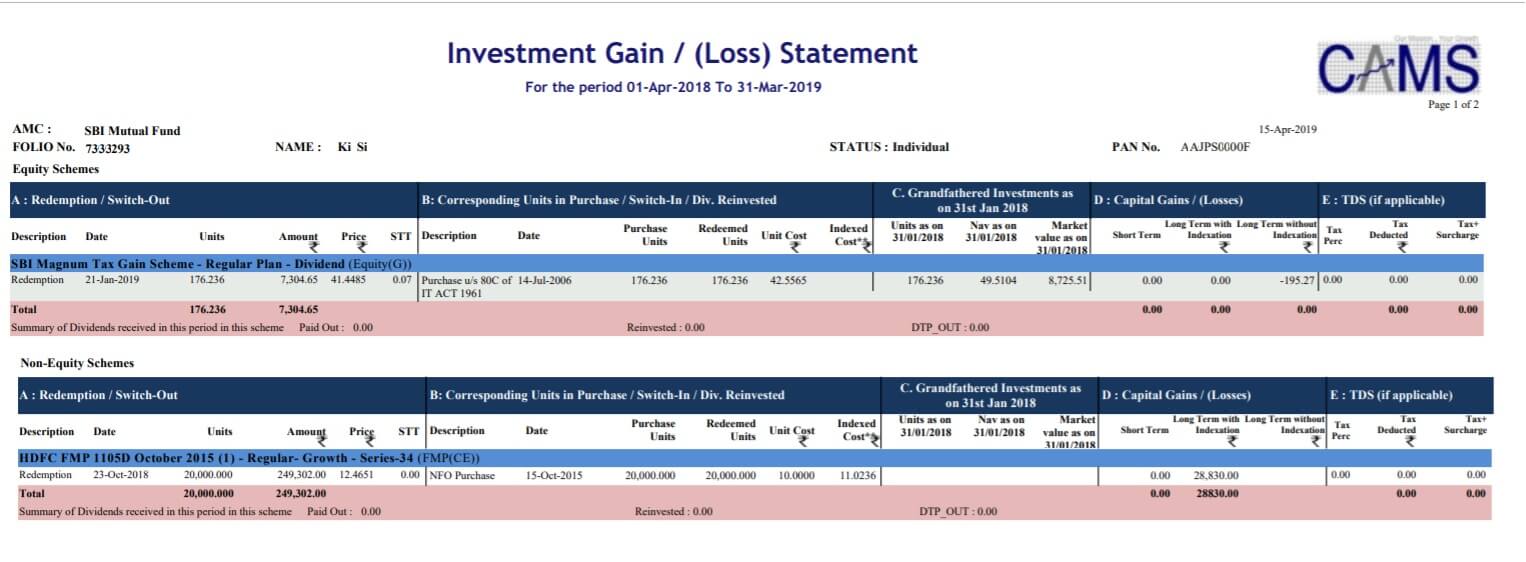

When you buy and hold Mutual Funds, if you get dividends, then what are the taxes associated with Dividend from Mutual Funds. When you sell Mutual Funds, whether Equity or Debt you need to consider if you have to pay taxes on profit earned or loss.

When you sell a mutual fund, the fund house does not deduct the tax from your gain(except for NRI). You have to calculate capital gain tax and pay tax on mutual fund income when you sell the mutual fund either as Advance Tax(if the amount of gains is more than 10,000) or as Self Assessment Tax while filing ITR. The taxability of capital gains depends on the type of Mutual Fund(Equity or Non-Equity) and how long did one hold the MF(Long term capital gain LTCG or Short Term Capital Gain STCG). The taxation of SIP is to be calculated for each SIP instalment.

- Tax and Mutual Funds

- How to get Capital Gain Statements for Mutual Funds CAMS, Karvy etc Capital Gain Statements for Mutual Funds CAMS, Karvy etc

- Short Term Capital Gains of Debt Mutual Funds,Tax, ITR

- Long term Capital Gains of Debt Mutual Funds, Tax and ITR

- Long Term Capital Gain on Stocks & Equity Mutual Funds with Calculator

- NAV of Equity Mutual Funds on 31 Jan 2018: Needed if you have bought equity funds/stocks before 31 Jan 2018.

- BSE Stock Price on 31 Jan 2018 for LTCG on Shares

- Cost of Inflation Index from FY 2017-18 or AY 2018-19 for Long Term Capital Gains

Paper Work and Mutual Fund

- Know Your Customer or KYC

- How to link Aadhaar to Mutual Funds Investments

- How to fill FATCA and additional KYC for Mutual Funds Online or Offline through CAMS or Karvy or directly

- Get started with Mutual Fund investing: KYC, Platform

After You Invest in Mutual Funds

- What is Folio Number in Mutual Funds?

- NSDL CAS, CDSL CAS: Statement of holdings in all Demat Accounts, Mutual Funds

- How to Nominate:Bank Account, Mutual Funds

- How to get Capital Gain Statements for Mutual Funds CAMS, Karvy etc

choose mutual funds for the investment is such an important thing to think..because through in mutual funds you can invest your funds with diversification which will help the small investors to invest in the proper way with the risk element.

DirectMF – Intelligent Automated Direct Fund Investing Platform with Robo Advisory Visit https://www.directmf.in

Wonderful knowledge in one place.

Please tell me if a parent can buy MF in the name of his dependant but adult children?

I would also highly appreciate it you could send a pdf having the text of this article along with text of all the associated articles relevant to “all about MF” – tall demand, I know, but hoping……

Thank you.

Falconer

Yes you can buy in name of Adult children with Adult children as first holder and you being second holder.

The process remains the same – do KYC done In person or eKYC if amount invested is less than 50,000 per AMC.

Thanks for the suggestion, we can collect all articles in a book format. Will let you know when we are done with it.

Dear Ladies,

Thanks for the reply.

I have created a docx file with all the articles related to ” All About Mutual Funds”, that I would like to share with you, so that you can decide to make it available for others as you feel appropriate, since this is your original work. I am sending this to you on bemoneyaware@gmail.com.

In this docx file, I have tried to retail all bookmarks and appropriate links to help in browsing this particular topic.

Thank you

Falconer

Thanks a lot for the document.

We are zapped. Really appreciate it.

Thanks for this wonderful article! All the insights are really very helpful.

It’s a very good article and shares a beneficial information about mutual funds.

Thanks. Glad you liked it.

If there is something you would like to see please let us know.