International Mutual Funds are the funds that allow investors to invest in the stock market beyond their country in their own currency. For example, a person living in India can invest in the stock market of the USA which is beyond their domestic boundaries, in Rupees. It enables Indian investors to enjoy the benefits of geographical diversification by reducing their risks and improving returns. What are International Mutual Funds? What are the pros and cons of investing in International Mutual Funds? What are the tax rules related to International Mutual Funds? Alternative to International Mutual Funds, PPFAS Long term Equity Fund.

Table of Contents

International Mutual Funds

An individual who does not have exposure in international stocks has three ways of doing it. One is by using the liberalised remittance scheme to directly invest in equities abroad. The second is to buy a pure international fund and the third is to invest in a multi-cap fund which also invests in international stocks such as Parag Parikh long term equity fund.

International Mutual funds are of different types

- Country-specific: US, Brazil, Europe, Japan or China.

- Region-specific: Europe, Asia

- Thematic funds: For example, investing in consumption, energy, commodities real estate etc available.

International Mutual Funds invest in international markets either directly or invest in other funds in those markets. Investing in other funds called a feeder route and is typically in the form of a fund-of-funds. The image below shows the top International Mutual Funds sorted on Net Assets as on Apr 2019.

Why should one invest in International Funds?

Investing in International funds offer investors a number of advantages especially in terms of Diversification. These include:

- Geographic Diversification

By investing across different asset classes – equities, debt and gold – investors can mitigate the risk of depending on any one asset. Different countries have different growth rates due to their distinct economic cycle. Another way to diversify is to invest across geographies.

There could be phases when the Indian economy goes through a rough patch, at such a time some international markets may do well and give a higher return. Table 1 shows that different markets performed differently at different points of time, thereby allowing investors to benefit from Geographic diversification. At any given point, you will have one geography doing well and other geographies may not do well.

Portfolio diversification

Participation through international funds gives you a chance to own companies like Apple, Amazon, Mastercard, Alphabet, Microsoft and Facebook. International funds offer an advantage of portfolio diversification. Also, many large companies in areas like automobiles, technology, internet are based in markets like the US and Europe. The image below shows the strength of different companies.

If you look at Nestle domestic, which is an emerging market company, it is only exposed to Nestle India and the revenue is generated in the Indian continent, and if you look at Nestle Global, it will be exposed to all emerging geographies as well as international developed geographies and they will also get royalty benefits from existing players.

Companies like Suzuki Motor Comp, the majority of its consolidated business come from the Indian business only. But if you look at the comparison of valuations, the holding company has a lower valuation than the Indian company. So, one gets to participate in the same opportunity but by going into different geography and participating in a cheaper valuation.

Tata Motors, which is listed in India, most of its profits comes from a global subsidiary which is Jaguar Land Rover. So, if you look at it even that is an international company to think about. So, companies no longer are restricted by geographies in terms of how they want to operate then why should you restrict your portfolio

Changing Needs

Indians are planning or sending children abroad for higher education, international holidays. Given this, it makes sense to diversify geographically.

Risks of International Mutual Funds

International Mutual Funds have a number of disadvantages too.

- Currency risks

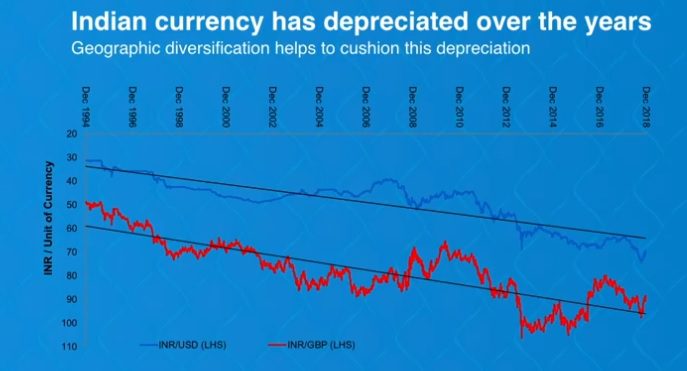

While investors will invest with rupee, the fund house will have to take exposure to international stocks in different currencies. Due to this, investors have to be prepared for currency risk, due to fluctuations. For example, in Oct 2018, the value of the dollar versus rupees was $1 = Rs. 72.5 and in Apr 2019 it has reached $1 = Rs. 69.0. This, in turn, could impact the net asset value (NAV) of the fund. For example, if the rupee depreciates against the dollar, you will get more rupees for every dollar invested in that region and your NAV could be higher. On the contrary, if the rupee appreciates against the dollar then you get fewer rupees for every dollar invested there and your NAV will take a hit to that extent.

- Political Risk

Political Risk involves government instability or political unrest. This situation makes the market less attractive for investment opportunities as there are a lot of uncertainties about the political environment. This may lead to a decreased value of currency and fall in the market. For example, the trade war between the US and China had imposed a lot of trade barriers and the markets are therefore exposed to various risks.

- Economic Risk

Economic Risk involves the changing demand and supply factors in the foreign country. A negative shift in the demand would cause the prices to drop, thereby, putting the businesses at a risk quickly. This would lead to low-profit margins, decreased income, and impacts the ability of the companies to pay their debt. The after-effects may also have an adverse impact on your investment.

Investors, therefore, need to be cautious before making an investment in the foreign market. They must account all the possible risk factors to ensure that their funds are safe and are invested in the right market to get maximum returns.

How to invest in International Mutual Funds?

The process to invest in International Mutual Funds is similar to buying a regular fund. You can purchase them through Distributors, IFAs, AMC, Online Portals etc. You can also do SIP in an International Mutual Funds

Tax on International Mutual Funds

Let’s understand the taxation rules involved in the International Mutual Funds. These funds are treated as debt funds. Hence tax is as follows:

- Long-term Capital Gains

These are applicable in the cases where the funds are held for more than 36 months. The tax has to be paid @20% (plus surcharge, if applicable and cess) with indexation.

- Short-term Capital Gains

In short-term capital gains, afunds are held for a short period of time i.e. less than 36 months. In this case, the tax is required to be paid at the income tax slab rate.

- For Domestic Customers

Investor does not pay any tax on dividends but a Dividend Distribution Tax (DDT) is deducted at source @29.12% (25% + 12% surcharge + 4% Health & education cess) for Individuals and @ 34.944% (30% + 12% surcharge + 4% Health & education cess) for any other person.

- For NRI Customers

The NRI customers are charged @ 10% (plus surcharge, if applicable and cess) without indexation relating to units redeemed from unlisted schemes. This is applicable to the case of long-term capital gains.

Alternative to International Mutual Funds: PPFAS Long Term Equity Fund

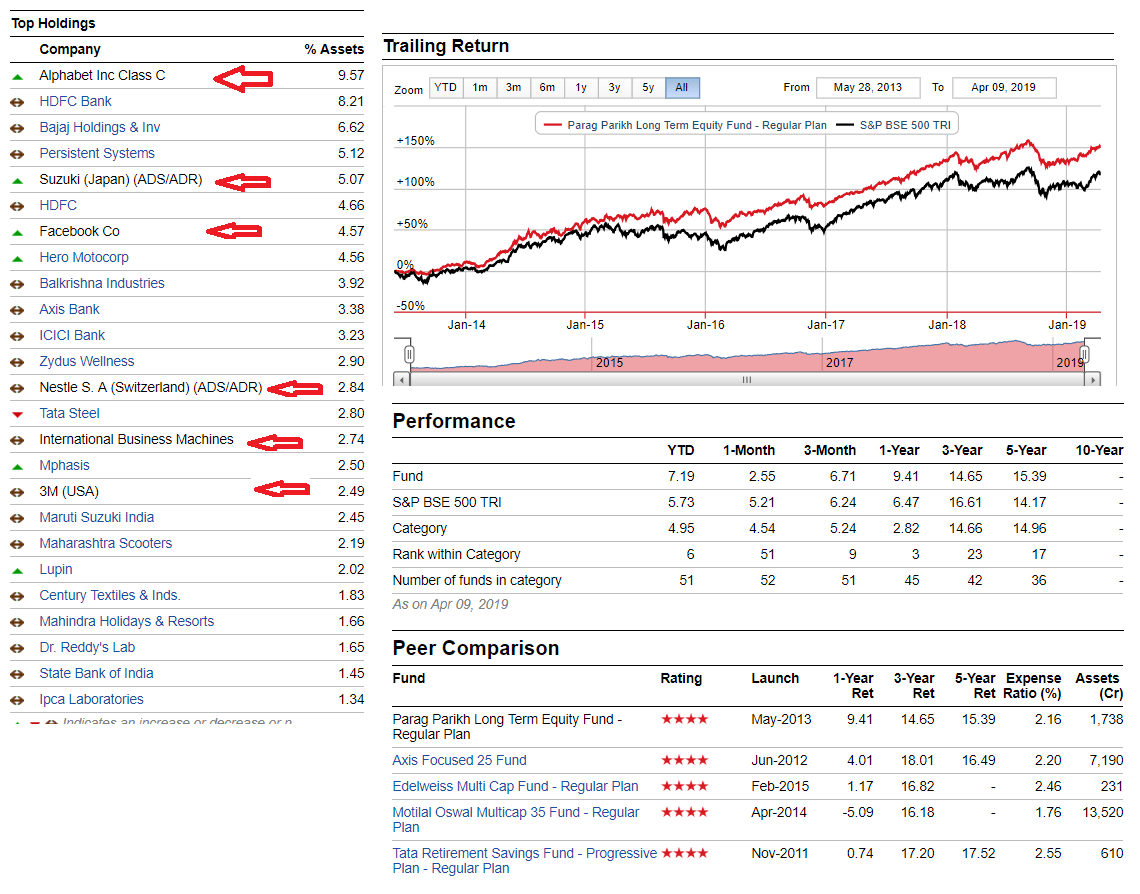

Parag Parikh Long Term Equity Fund is different from other equity oriented mutual fund in India, as this fund is one of only a handful of Indian mutual fund schemes to invest in a basket of Indian and foreign stocks.

PPFAS Long Term Equity fund concentrate on stock-picking rather than forecast currency movements. However, this fund reduce the risk of their investors losing due to sharp currency appreciation of the Indian rupee, by hedging approximately 80% of our foreign exposure through Currency Contracts.

For investing in foreign stocks, this fund prefers countries where stock markets are well-developed, good governance is in place, financial statements are prepared in English and stock markets are liquid. Within these countries, they seek companies which are large, have operations in multiple countries and are reasonably valued.

PPFAS Long Term Equity Fund has around 27 per cent of its total portfolio invested in overseas equities with investments in Alphabet(Google), Facebook etc. As per the Sebi guidelines, AMC can only invest up to 35 per cent of their AUM in international stocks. At the same time, as the fund grows, over a long time, there is a limit of about 300 million dollars per AMC set by the RBI in terms of using foreign exchange by investments abroad.

Details about PPFAS Long Term Equity Funds can be found on Valueresearch website here. A snapshot of its portfolio and returns is given below.

Video on International Mutual Funds

This 9-minute video by Franklin Templeton talks about International Mutual Funds.

Related articles:

- Understanding Equity Saving Funds, Arbitrage, Taxation

- What are Balanced Mutual Funds

- Understanding ELSS Funds or Equity Linked Saving Schemes

- MF Utility: How to buy and Sell Mutual Funds Directly

- Investing in Equities: Stocks vs Mutual Funds

- Get started with Mutual Fund investing: KYC, Platform

On one hand, International mutual funds offer multiple advantages over the domestic investment. At the other end, it possesses disadvantages of the market risks and taxation schemes. The world is an oyster, but be wise when you venture abroad. Your decision must be calculated after accounting the risk involved, tax schemes, and all the expenses incurred during the investment. Do you think it makes sense to invest in International Mutual Funds?

Investing in International Mutual Funds, investors must be aware of certain things as well. When an investor is investing in an International mutual funds he is exposed to a country-specific risk for all the countries in which the fund is having investments. This type of Mutual Funds may also pose currency risk. It influences the performance of the fund with any movement in the same. The returns are affected negatively by the appreciation of INR and positively with the depreciation of INR.

Informative post.