Advantages of Mutual Funds are Diversification, More choice, Affordability, Tax benefits and Professional management. When you invest in a mutual fund scheme, you are buying a portfolio of securities. If it is actively managed mutual fund, a fund manager picks the constituents of the portfolio. Fund managers are critical to the performance of active mutual funds. This article talks about Who is Fund Manager, difference in Active vs Passive Investing in Mutual Funds, Responsibilities of Fund Manager,How to find Mutual Fund’s Fund Manager,Top Fund Managers in India,How much does a Mutual Fund Manager earn in India, Popular Fund Managers in India, Do Mutual Fund Manager Invest in their own schemes?

Table of Contents

Who is Fund Manager?

Mutual fund investments are managed by experienced and skilled professionals, who with the help of an investment research team, analyzes the performance & prospects of investments such as companies or bonds and selects suitable investments to achieve the objective of the scheme. The investments are chosen to build the portfolio in a way that it meets the collective goals of the fund and the investors. The efficiency of a fund manager is tested in performance related to their target benchmark. If the target benchmark is beaten frequently, both the fund and the manager are good.

Active Vs Passive Investing in Mutual Funds

Active investing involves fund manager and his team who actively searches out investments to generate the maximum returns and to beat the market. Active investing attracts higher fund management charges because of intentive fund management efforts and activity. Most mutual funds in India are active mutual funds.

Passive investing on the other hand, is largely rule and data driven. For instance money may be invested in securities proportional to their representation in a an index (based on some pre-defined rules – usually weighted by market capitalisation) and almost always executed by an algorithm rather than a fund manager. They are usually cheaper as in they have lower fund management charges since they do not require active management. The most popular form of passive mutual funds are Exchange Traded Funds or ETFs.

Passive investing in mutual fund schemes is not popular in India, unlike USA. Investors have preferred schemes managed by fund managers because of their ability to beat returns of the underlying benchmarks.

Responsibilities of Fund Manager

Decision Maker Choosing the investments to build a portfolio that can consistently outperform its benchmark and standout in a peer set. This is the primary responsibility of a fund manager. The investment objective of the scheme defines the universe in which securities can be picked. Every fund has a defined investment objective, which decides not only the asset type, but also the general theme within which a fund manager can select. However, the investment in assets is defined within a range. For example, many hybrid funds that have a mix of equity and debt, such as monthly income plans, specify that 0-20% of the assets under management can be in equity and the rest in debt securities. The fund manager can decide whether to invest 5% or 20% in equities.

Most fund houses have teams of analysts that help the manager with research in areas like securities, sectors and macroeconomic factors. But the fund manager has to take the final decision on stock selection, which is taken after weighing all the research findings. This is known as portfolio construction, and is heavily dependent on the fund manager’s skill.

The open-ended mutual funds see inflows and outflows on a daily basis, it is the fund manager who will decide how much gets invested and what remains in cash.

Communication : Fund managers are answerable to investors as well as the trustees of the asset management company, who are appointed to ensure that investor interest remains a priority. Hence, they need to have a good rationale for their investment decisions and should be able to communicate these verbally and formally across various forums.

Ethical conduct: They also have the statutory responsibilities of maintaining ethical conduct while handling investor money.

Promotion: Responsibilities of a fund manager are also to meet investors and distributors to promote their funds.

How to find Mutual Fund’s Fund Manager?

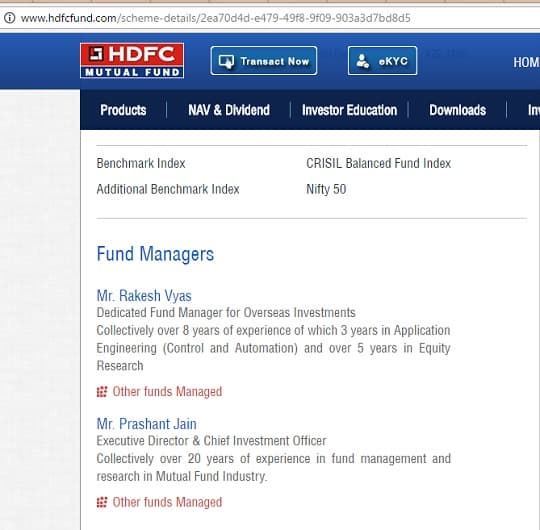

You can gets details of various fund managers on. For example lets take HDFC Prudence Mutual Fund.

Individual mutual fund house website

How to find Fund Manager on Valueresearchonline.com

- Find the fund on valueresearchonline.com using Search Box or Mutual Fund Company or rankings or..

- Select Analysis Tab as shown in image below

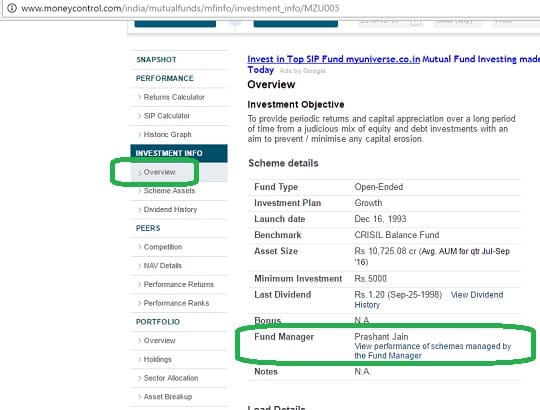

How to find Fund Manager on Money Control

- Find the fund on moneycontrol.com using Search Box or Mutual Fund Company or rankings..

- Click on Overview on the fund’s page.

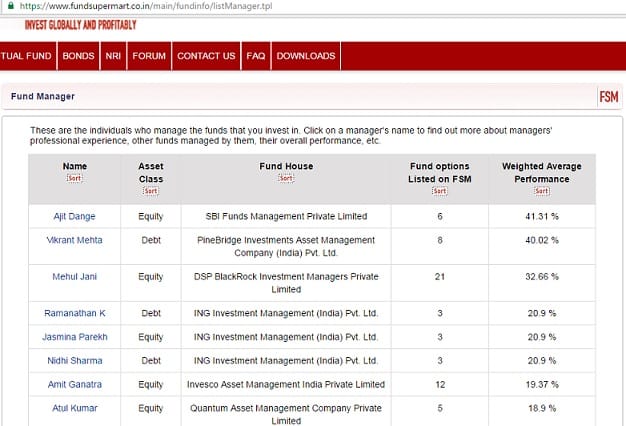

How to find Fund Manager on Fund SuperMarket

FundSuperMarket.com maintains a list of the fund managers of the mutual funds which you can sort based on Fund House,Asset Class, Weighted Average Performance

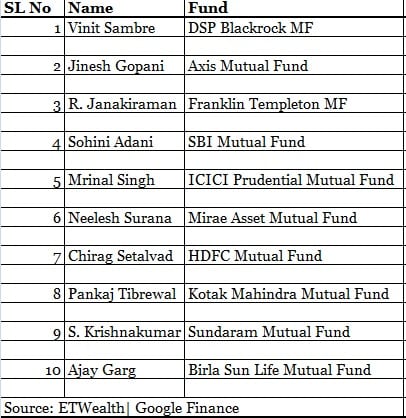

Top Fund Managers in India

Making money in the stock market is not everybody’s business, but several fund managers on Dalal Street have made a name as astute stock pickers by delivering handsome returns.

ET Wealth in association with mutual fund research firm Morningstar brought out the ranking of the best equity fund managers of 2016. The study was based on the performance of equity funds over a five-year period from July 1, 2011 till June 30, 2016.

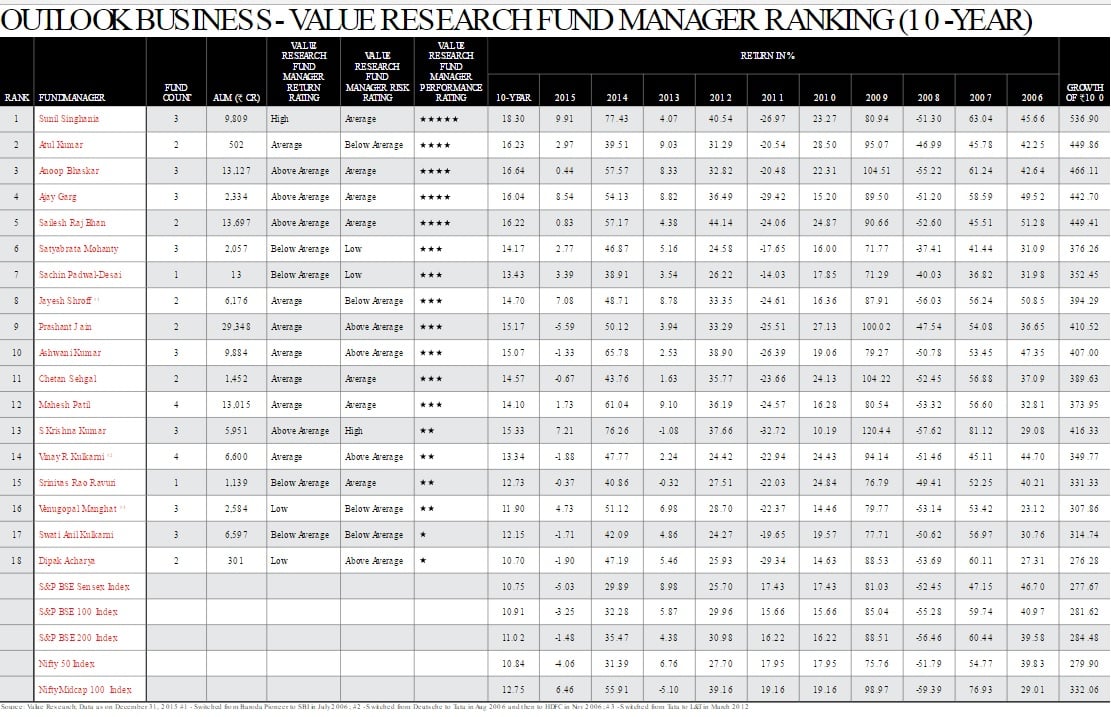

Outlook Business-Value Research Fund Manager Ranking is based on the average risk-adjusted performance of all fund schemes managed by a manager and across fund house in case s/he has switched the fund house. They have presented rankings based on both 10-year and five-year, and profiled the top 10 managers based on the five year track record and the top two based on 10-year track record.

How much does a Mutual Fund Manager earn in India?

In May 2016, around 20 mutual fund houses have revealed the pay packets of their top executives on Monday to comply with the Securities and Exchange Board of India’s (Sebi) diktat to disclose salaries of key executives. The regulator had asked AMCs to disclose salaries of all top employees’ as well as of those whose annual remuneration is equal to or above Rs 60 lakh per annum, within a month of the end of the financial year. As per the revised rules, AMCs can differentiate between long term remuneration which includes exceptional amounts computed on exercise of options granted under Esops.

Sebi’s 18 March 2016 directive was aimed at improving the disclosure norms of funds, especially in terms of costs.The same directive asked the funds to disclose the amount they paid to distributors as commission and also expense ratios. An analysis of the 10 largest and the 10 smallest funds by assets under management shows that, in general, the smaller funds have followed the regulator’s directive. Ref: Mint

Popular Fund Managers in India

When you talk about Fund managers in India some names that crop up are:

- Prashant Jain: Prashant Jain is the Chief Investment Officer, Executive Director, and Fund Manager at HDFC Asset Management Company Ltd.

- Nimesh Shah– Managing Director & CEO

- Mr. S. Naren – Executive Director & Chief Investment Officer: Naren joined ICICI Prudential AMC in October 2004. At ICICI Prudential AMC, Naren oversees the entire investment function across the Mutual Fund and the International Advisory Business. He is instrumental in overall investment strategy development and execution. He also directly manages the ICICI Prudential Dynamic Plan and the ICICI Prudential Top 100 Fund.

Do Mutual Fund Manager Invest in their own schemes?

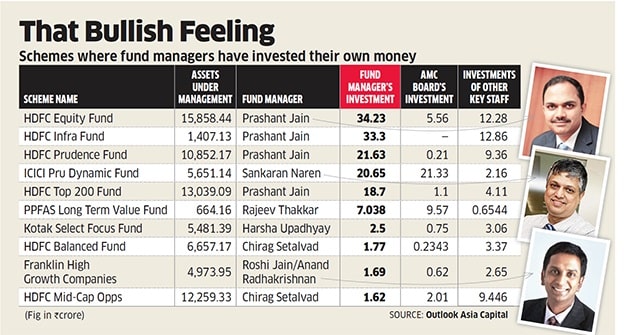

Do Fund managers bet on their own scheme? How much ‘skin in the game’ does the fund manager have It would seem strange that fund managers or key employees not investing in some large schemes even though the same individuals talk about why the fund is a great investment idea. There are funds with very little or no investments by their fund managers or members of the AMC board. Some fund houses are also actively encouraging employees to invest in their schemes. At ICICI Pru MF, the bonuses of senior management are invested in mutual fund schemes and redemptions are allowed in a staggered manner over 3-4 years. At Kotak Mutual Fund, employees have taken a voluntary pledge to invest in funds from the AMC. “We want to tell our distributors and investors that we practice what we preach. Just like some restaurants put up a sign saying The owner eats here”, this is a confidence boosting measure to create trust among distribution partners and investors ” says Nilesh Shah, managing director of Kotak Mutual Fund. Ref: Economic Times

Investors who desire personalised investment solutions and portfolio construction, with easy access to the fund manager, and with a focus on long term wealth creation opt for portfolio management services. Thanks for sharing.

Portfolio Management Service is a customised solution for wealth creation for individuals with a high net-worth to invest in equities, debt and other securities through a designated fund manager, according to the investment objectives of the investor. Thanks for sharing.

I have been looking for something like this, finally got the information which I needed. thank you so much for sharing.