Though filing Income Tax Return or ITR is not difficult every year, we may still make mistakes. Incorrect filing of income tax returns may result in delay in getting refund and further trouble. In fact, there are some mistakes that are commonly made by most individuals. Based on the queries received Here are some of the common mistakes that can be avoided while filing ITR and Checklist before Submitting your ITR. Hope this article helps you while filing your Income Tax Return error-free.

Table of Contents

Overview of Checklist before submitting ITR

- Quoting Aadhaar made mandatory for filing income tax. If you don’t have Aadhaar provide the enrollment ID of Aadhaar application.

- It is also mandatory to link PAN with Aadhaar but the deadline has been extended to September 30, 2019.

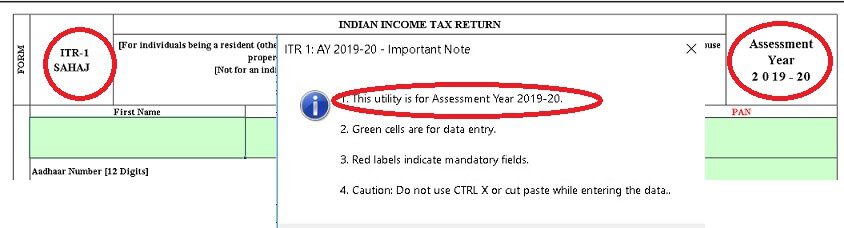

- Select the Correct Assessment Year. For filing an Income Tax return for Income earned between 1 Apr 2021 to 31 Mar 2022 AY is 2022-23.

- Select the correct ITR or Income Tax Return Form. ITR depends on the Type of Income that you have. ITR1 is just for those with Salary Income and Income from one House property. Others check the Type of ITRs

- Match Income and TDS with AIS, Form 26AS. Our article Income Tax Annual Information Statement (AIS), TIS, and How to use it to File ITR What to Verify in Form 26AS? explains what information to look for in AIS and Form 26AS.

- Report Interest from Saving Bank Accounts under Income From Other sources and claim the deduction of Rs 10,000 under section 80TTA.

- Report Interest from Fixed Deposit and Recurring Deposit in Income from Other sources. Now even though TDS is not deducted Interest Income shows up in Form 26AS.

- Mention Correct Details, Personal Details, Bank Details

- Fill Salary Details properly. Give proper breakup. Else you might get Compliance Notice.

- If you work in MNC and you have stocks(RSU, ESPP, ESOP) of foreign companies then please report it as Foreign Assets.

- Claim Deductions 80C, 80D deductions etc

- If Salaried, claim your exempt allowances. LTA & Medical Reimbursement cannot be directly claimed in your return.

- Report Exempt Income: Income from PPF, Tax free bonds, etc

- Please club income of your wife or children. If you have opened a bank account of your child then show interest from that bank account.

- Fill correct TDS details.

- Calculate Tax Liability. You should have 0 tax due before filing ITR. Pay Self-assessment Tax if due using Challan 280 and update ITR. You should owe Zero or Nil tax to Government while filing your ITR

- After submitting ITR do E verification or send ITR-V

Filing ITR

To file an Income Tax Return is an obligation placed on every citizen of India by the Government. It is proof of your financial life. Our article If You don’t file the Income Tax Return on time talks about it in detail.

Not filing returns at all

Every individual has to file returns if the income exceeds the exemption limit before allowing any deduction (Rs.2.5 lakh for every individual other than senior citizens). So a taxpayer having an annual income above Rs.2.5 lakh should file returns even if he can claim the entire Rs 2.5 lakh in deductions such as life insurance premium, Public Provident Fund, education loan interest and so on. Tax return papers are required while applying for a loan or visa application.

No Tax Dues, No Income Tax Return

Many think that as the employer has deducted TDS therefore all taxes are paid on time and there is no income tax due from his or her end so one need not file Income Tax Return. Please note, Income Tax Return should be filed even if all the taxes are paid on time through TDS. why you should file your Income Tax Return for your own benefit. Amounts paid as advance tax and withheld in the form of TDS(Tax Deducted at Source) or collected in the form of TCS (Tax Collected as Source)will take the character of your tax due only on completion of self-assessment of your income. This self-assessment is intimated to the department by way of filing of return. Only then does the government acquire rights over the prepaid taxes as its own revenue. Filing of return is critical for this process and hence has been made mandatory.

Mandatory E-filing for Income more than Rs 5 Lakh

If one is earning more than 5 lakh during FY one should e-file Income Tax Return. In such cases, the Physical return will be rejected by the Income Tax Department. E-filing is convenient and processing of ITR is also fast.

Mistakes while filing ITR to Avoid

Select Correct Assessment Year and ITR

Select the Correct Assessment Year

Assessment year is always one year ahead of the financial year. For income earned between 1st Apr 2018 to 31 Mar 2019, Financial Year is FY 2018-19 and you have to file ITR for AY 2019-20 If you incorrectly select Assessment Year for ex AY 2017-18 for this year, you would get an income tax return notice. Our article Difference between Assessment Year and Financial Year, Previous Year, Fiscal Year in World explains it in detail.

- When your Income Tax Return is processed you are likely to get a notice since the tax details do not match up with his records

- You have to respond to AO with the error in tax payment details.

- You may have to submit a rectification of a return under section 154 . (Efiling portal -> My Account -> Rectification Request).

- Once your rectification request has been looked at by the AO, he/she has the powers to make a correction in your return.

- The AO will adjust your previous year tax payments against this year’s notice and tax dues (if any).

| Income Earned Between | FY | AY | Due Date for filing ITR | Last date for filing ITR | Notes |

| 1 Apr 2019 to 31 Mar 2020 | FY 2019-20 | AY 2020-21 | 31 Jul 2020 | 31 Mar 2021 | Current Financial Year. Advance Tax to be paid |

| 1 Apr 2018 to 31 Mar 2019 | FY 2018-19 | AY 2019-20 | 31 Jul 2019 | 31 Mar 2020 | ITR to be filed |

| 1 Apr 2017 to 31 Mar 2018 | FY 2017-28 | AY 2018-29 | 31 Aug 2018 | 31 Mar 2019 | Cannot file ITR.File Condonation request and pay Tax Liability |

Select the correct ITR or Income Tax return Form

There are seven forms, out of which only four are applicable to individual taxpayers. Filling of an incorrect ITR form leads to a defective return notice and the return is deemed to be not filed.

For most individual taxpayers, the applicable form is ITR 1 (Sahaj). In case you need to be sure, confirm the form details with your chartered account. For Individuals and HUFs for AY 2019-20 the table below shows the various ITRs. Filing ITR : Video on which ITR to fill

| ITR Form | ITR 1 (Sahaj) | ITR 2 | ITR 3 | ITR 4 (Sugam) |

| Applicable to | Resident Individuals | Individual, HUF, Partner in a Firm | Individual, HUF, Partner in a Firm | Individual, HUF |

| Income/Turnover Limit | Income Less than Rs 50 Lakhs | No Limit | No Limit | Income Less than Rs 50 Lakhs / Turnover less than Rs 2 crore |

| Income from Salary | Yes | Yes | Yes | Yes |

| Income from House Property

Home Loan, Rental Income (Residential & Commercial) |

Only One House/Property | One or More House/Property | One or More House/Property | Only One House/Property |

| Income from Business & Profession

|

No | No | Yes | Only Presumptive Business Income |

| Income from Capital Gains

(Selling of Property, Mutual Funds, Stocks, Gold) |

No | Yes | Yes | No |

| Income from Other Sources

(Interest on Fixed Deposit, Interest on Saving Bank account) |

All except Income from Lottery/Race Horse | Yes | Yes | All except Income from Lottery/Race Horse |

| Exempt Income

(Income from PPF, Tax free bonds, Long term capital Gains on Equity, EPF withdrawal after 5 years) |

Yes if Agriculture Income less than Rs 5,000 | Yes | Yes | Yes if Agriculture Income less than Rs 5,000 |

| Foreign Assets/Foreign Income | No | Yes | Yes | No |

| Carry Forward of Loss | No | Yes | Yes | No |

Further, in a case where the income of another person like spouse, minor child, etc. is to be clubbed with the income of the assessee, this Return Form can be used only if the income being clubbed falls into the above income categories.

| ITR | Income from | Who cannot use |

| ITR-1 OR SAHAJ |

|

having any asset (including financial interest in any entity) located outside India or signing authority in any account located outside India.

If you have foreign assets, you cannot use ITR-1. If you have exempt income which is more than Rs. 5,000, you cannot use ITR-1. |

| ITR-2 |

|

|

| ITR-3 | who are partners in a partnership firm and do not have any proprietary business or profession | |

| ITR-4S(Sugam) |

|

|

| ITR-4 | income from a proprietary business or profession. |

Care to be taken While Filling Personal and Details in ITR

Mention Correct Personal Details

It’s important that you mention basic details such as Permanent Account Number (PAN), name, date of birth and address correctly. Your name and date of birth should match with that mentioned on your PAN card. Since all communication by the income tax department is now done via email, one should make sure that a valid and functional email ID is provided in the tax return form.

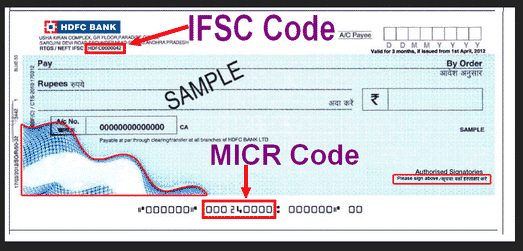

Mention Correct Bank Details in ITR

It is mandatory to provide correct Bank Details in ITR especially if you are expecting Refund. Even if there is No Refund still provide correct information on bank account.

In Indian Banking Systems, the IFSC or Indian Financial System Code is an 11 digit unique number which helps to identify each bank branch. The 11 alphanumeric combination of character are given below, Let us consider the IFSC code for State Bank of India (SBI) located in Nariman point in Mumbai. The IFSC code for the bank is SBIN0004425.

- Starting 4 digits in alphabets show the bank name, First 4 characters are SBIN representing the name of the bank i.e. State Bank of India.

- Fifth digit is Zero. It is reserved for future used by RBI.

- Last 6 digits are alphanumeric and identify the branch, Ex: 004425

You can find IFSC code in your chequebook, as shown in the image below. Our article IFSC Code, How it is used in NEFT, RTGS, Different from MICR, SWIFT covers it in detail.

Care to be taken while Filling Income Details in ITR

Claim Deductions properly while Filing ITR

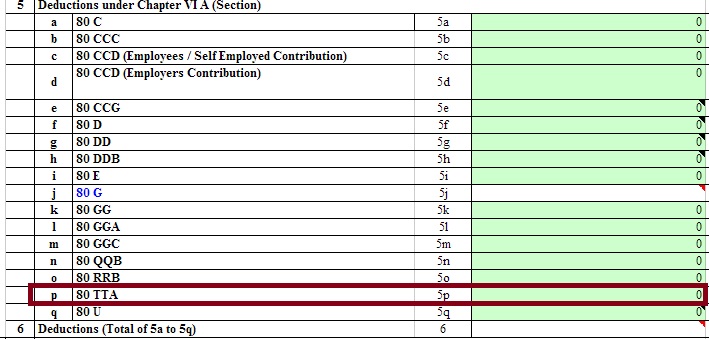

You can save tax by investing for the long term as in EPF, PPF or buying Life insurance or Health Insurance policies. These tax saving options are categorized under different sections, which if you inform your employer are available in your Form 16. Just enter the same information in the corresponding cells. You may need to consolidate contributions under particular sections such as 80C which has a limit of 1.5 lakh, as shown below.

If you did not declare your tax saving options or did not submit proof within due time(usually by mid Feb) and still made some tax saving investments then you can still claim it while filing returns. Our article How to Claim Deductions Not Accounted by the Employer discusses it in detail.

- LTA & Medical Reimbursement cannot be claimed in your return.

- You should have claimed HRA through your employer. If not done then you Claim House Rent Allowance exemption in your income tax return. HRA exemption can be claimed in your income tax return. First, find out how much exemption you can avail on HRA. Now, re-calculate your total taxable income after adjusting this exemption. Finally, calculate your tax dues. You can then claim a refund of excess tax deducted by your employer in Income Tax Return.

- Claim deductions under section 80(80C, 80D)

- Bills for preventive health check-ups. If you have not yet exhausted your deduction limit under section 80D and you have a bill for a preventive health check-up, you can claim this bill and get a maximum of Rs 5,000 as a deduction

Report Exempt Income

All types of incomes—taxable or exempt—are to be reported while filing tax return. Several incomes such as dividends, Interest from PPF, and long-term capital gains on listed securities are exempt from tax. However, you must report these in your tax return since their details are provided to the IT department by companies and brokerage firms. Our article Exempt Income and Income Tax Return talks about in detail. Image below shows how to Show Exempt Income in ITR1 and ITR2.

Report Interest from Saving Bank Accounts

Interest earned on all your savings bank accounts is essential, even though earnings up to Rs.10,000 per annum are tax exempt. Add interest from all your Saving Bank Account. Show it under 80TAA as shown in image below

Interest from Fixed Deposit and Recurring Deposit.

Interest earned on a fixed deposit/Recurring t is fully taxable. It is a common misconception that either the interest income fixed deposit accounts is not taxable or that tax has already been deducted on interest income by bank. In fact, banks only deduct 10% TDS on interest income, whereas you may be in the 30% tax slab. The IT department has recently started reconciliation of TDS data received from banks and the interest income reported by individuals in their returns. Non-reporting of interest income is a sure shot reason to receive a notice from the department. Our article Fixed Deposit , Interest , TDS, Tax,Income Tax Return, Refund talks about in detail.

Income from House Property

Do remember that if you own two or more houses, you can show only one as self-occupied. If the other properties are rented out, file that income under the head Income from house property. In case any house property is not let out during the year, even then the taxpayer should determine its fair rent value and offer it for taxation as income from house property. Our article Income from House Property and Income Tax Return talks about in detail.

Tax, TDS and ITR

Please Match TDS with Form AIS and 26AS

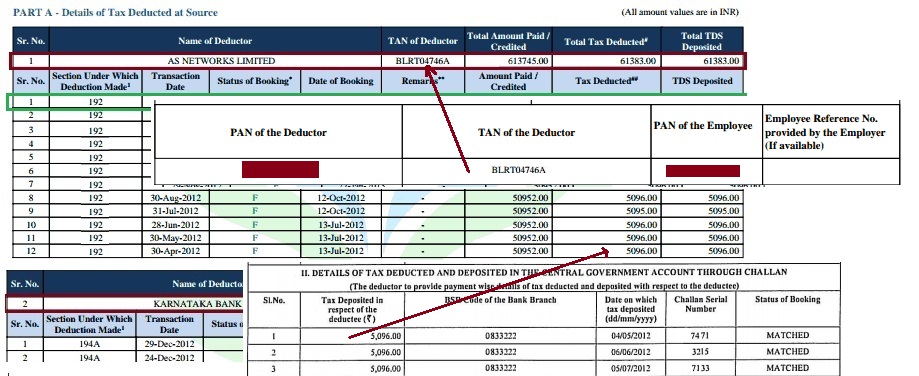

From FY 2020-21, Income Tax Department has rolled out the Annual Information Statement or AIS which provides one’s comprehensive view of information such as interest, dividend, stocks transactions, mutual fund transactions, foreign remittance information, etc. It has also provided a facility to capture feedback on discrepancies online. So if the income is in AIS, Income Tax Department knows, one cannot ignore it.

A simplified Taxpayer Information Summary (TIS) has also been generated which shows the total value for the taxpayer for ease of filing return. Form 26AS on the TRACES portal will also continue in parallel till the new AIS is completely operational.

Our article Income Tax Annual Information Statement (AIS), TIS in detail, 50 kinds of income that are reported in AIS

Any mismatch in the details provided in Income Tax Return and Form 26AS may invite notice from income tax department.

- Fixed Deposit and TDS : Most common example is TDS on Bank FD’s. Banks deduct TDS @ 10% but if the Tax Payer is in higher income tax bracket i.e. 20% or 30% then balance tax should be deposited as self assessment tax. Most of the taxpayer don’t pay balance tax on income from Bank FD’s. In such a scenario, you can get a notice from Income Tax Department.

- Change of Jobs: if you have changed jobs during the year, both employers will give the tax benefit of basic exemption and deductions to the employee and hence less TDS would be deducted from the salary. This leads to additional tax liability at the time of filing returns. In case you do not report the previous employer’s income in your tax return, you are liable to get a notice.

Our article What to Verify in Form 26AS? explains what information to look for in Form 26AS.

Fill correct TDS details

Make sure you put correct PAN and Tax Deducted Account Number of the employer or other deductors in the tax deducted at source (TDS) information sheet. A mistake here means that the income tax (I-T) department may not allow tax credit for TDS from the deductor concerned. Image below shows matching Form 16 with Form 26AS.

Self Assessment Tax and Updation of ITR

You should owe Zero or Nil tax to Government while filing your ITR. Self Assessment tax means any balance tax paid by on the income after taking TDS and Advance tax into account before filing the Return of income.The Tax liability of a person is computed after taking the various deductions & exemptions into account. If the Total Tax Paid (total of TDS & Advance Tax) is less than the Total Tax Liability, it means one owes the balance tax to the government. This has to be paid as Self Assessment Tax. One has to pay this balance tax or Self Assessment Tax before filing the tax return. For example, You have a fixed deposit from which you earned Rs.9,000 as interest, and made short-term capital gains of Rs.15,000 from bonds. If you fall in the 20% tax bracket, you tax liability on these two incomes would be Rs.4,944. You didn’t disclose these incomes to the employer and, thus, this money was not taken into consideration for taxation.

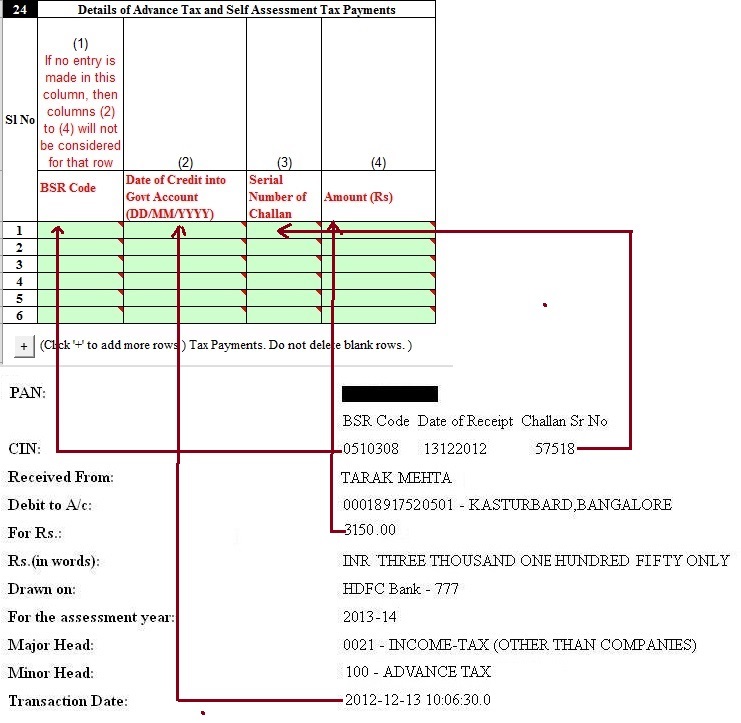

Our article Paying Income Tax : Challan 280 explains how to pay Advance Tax, Self Assessment tax in detail. Image shows updating of ITR after paying Self Assessment Tax. While Paying Self Assessment Tax please be careful of following things else you would have to run around to get Challan corrected . Our article talks about How to Correct Challan 280

- Assessment year : ex For filing Income Tax return for Income earned between 1 Apr 2017 to 31 Mar 2018 AY is 2018-19.

- Tax applicable : For individual Select 0021 : INCOME-TAX (OTHER THAN COMPANIES)

- Type of Payment : Type of payment depends on why you are paying income tax.

- 100 for Advance Tax

- 300 for SELF ASSESSMENT TAX,

- 400 for Tax on Regular Assessment for making any payment only when demand has been raised by Income Tax Department.

After filing ITR : ITR-V or E verification

We often consider filing of the tax return is the end of the whole story. But picture abhi baki hai mere dost. . One can

- Send 1-page verification document, ITR-V, to the CPC Bangalore OR

- Income tax return from AY2015-16 can now be verified electronically. Persons using this facility will not be required to submit a signed paper copy of ITR-Verification form (ITR-V) to CPC Bengaluru. Article E-verification of Income Tax Returns and Generating EVC through Aadhaar, Net Banking talks how to eVerify ITR in detail

Please do also read Income Tax Department’s Official Check Points to e-File

Infographic of Checklist for Filing ITR

Related articles:

- Articles to Understand Income Tax, How to Fill ITR,Income Tax Notice…

- E-verification of Income Tax Returns and Generating EVC through Aadhaar, Net Banking

- If You don’t file the Income Tax Return on time

- Understanding Form 16 – Part 3

- Income Tax for Beginner

- Basics of Tax Deducted at Source or TDS

- Filing Income Tax Returns after deadline

- Income Tax for FY 2015-16 AY 2016-17

Incorrect filing may result in delay in getting refund and more trouble. If you are not confident about filing yourself, take the help of professionals such as chartered accountants, tax filing websites, or tax return preparers. But even after they have filled in the details please verify. Happy Income Tax Filing

Excellent, what a website it is! This weblog gives helpful information to us, keep it

up.

Hi,

I prepared my ITR2 returns through auto-populate of pre-filled xml downloaded from ITR efiling website. After update I found that on ITR2 – TDS page the TDS credit was not matching as seen in Form26AS for some entries. It was showing lesser TDS value as compared to TDS in 26AS. So I manually corrected it. Later I uploaded my returns and e-verified it. Now when I run the tax credit mismatch utility from efiling website it is showing tax credit mismatch.

Sno. TAN/PAN Deductor Name TDS/TCS CLAIM Amount Amount Available in 26AS

1 MUMSXXXXX STATE BANK OF … 1056 932

However when I check in my form26AS there is TDS of Rs 1056 instead of Rs932 as being reported in tax credit mismatch. How should I get this mismatch corrected and why it is being reported when in 26AS it is showing correct values

There seems to be a bug in Income tax software.

You can bring it to the notice of income tax department.

In the meanwhile you can revise the return with proper values and reverify.

How to bring this in notice of income tax and get it corrected . I called their helpline but they are not able to understand the issue. As said I have already uploaded my returns after verifying details in 26as and tax credit mismatch is coming post upload

Important post. July 31 is the deadline

Thanks for comment Anita

useful informative post thanks to sharing

helpful informative post thanks to sharing

Dear sir While making a Self Assessment Tax challan for assessment year 2018-19, I wrongly wrote the assessment year as 2017-18 and the challan has been processed by the bank and also I get the BSR Code and challan number. I have following queries

1. Can i file the revise return of previous year i.e. assessmnet year 2017-18 and claim the refund of the extra amount deposited ?

2. As the time frame to get the assessment year rectified by the bank has already expired , how much time the AO will take to rectify the assessmnet year keeping in view the last date to file the returns for the current assessment year is very near ?

dear sir i am defence person drawing pension,till last AE i was filling return in paper form as my income was bellow 5l.this AE i have to file electronically ,the problem is that i was showing employer as NAVY .this time when i got FORM16 the bank has given their address in place of employer.bank is neither correcting nor explaining same.they say that all pensioner particular are same i.e employer address.what difficulties i am going to face if i show bank as employer,may be PCDA i.e pension disbursing authority may be regarded as employer of defence pensioner.have you got any idea in this subject

regards

Q: If I receive my pension through a bank who will issue Form-16 or pension statement to me- the bank or my former employer?

The bank.

Ref:Income Tax FAQ

Although I had not sold any property but, while filing my ITR-2, the JAVA utility is giving me

validation error in TDS tab in TDS3 field as ‘Enter the PAN of the buyer’ and ‘Name of the buyer’. Please let me know if I had done any mistake while filing or any one else had also got this kind of error.

Hi,

I am a NRI and need to fill ITR2.

I have a house which was let out for 7 months @20k/m to a tenant who left and a new tenant came in from whom I received the rent of 21k/m for 3 months till 31st march 2017. The house was let out totally for 10 months to 2 separate tenants at 2 different rents as above. my query is

1) how do I show this in ITR2? Should I show it as total of 20×7+21×3=203K and mention the 2 tenant names ?

2) or I need to fill both tenancies as separate entries?

3) If it needs to be shown as separate entries do I need to fill the same property entry twice with respective tenants info?

Looking forward to your advice on same.

Thanks,

Jivan

Dear Sir,

I have the following income other than salary.

Short-term Capital gain: Rs. 2342

F&O trading loss Rs. -4057

F&O trading turnover: Rs. 11354.61

Interest from Savings Bank accounts: Rs. 6998

Dividend from equity shares: Rs. 353

I would like to carry forward F&O trading loss or set off. Could you please let me know which ITR form should I fill? Do I require audit on F&O trading turnover?

Thank you very much in advance.

Thanks,

Ramesh

If you are a salaried person who trades in stocks, filing income tax returns can be a tricky job. Depending on the instrument, frequency of trade and volume, you can either fill the ITR-2 form meant for the salaried with no business income or ITR-4 is for income from business and profession.

Take, the case of Ajitesh Pathak, a bank employee who also trades in stocks. He has no fixed period of trading – makes investment as and when he finds a stock at an attractive price. Experts say if he has taken delivery of all the stocks, he can fill ITR-2. In this form, he can show the gains and losses he made, and in case of the latter, they can be carried forward to the next seven years to set them off against future capital gains. If the portfolio is purely delivery-based, the taxpayer has better chances of convincing the assessing officer it was for investment purpose and it’s not assessee’s business.

However, if Pathak went long or short on stocks, wherein he didn’t take the delivery, this would be classified as income from speculative business, and he will need to fill up ITR-4. This form will also allow him to claim expenses related to this business. For example, if he has a car and a computer that he has used for this, he can claim depreciation on them. All this sounds good as long as he has not made losses. If he did and want to claim them, then he will need to maintain books of accounts and get them audited by a chartered accountant. “Those who trade in futures and options (F&O), mandatorily need to file ITR-4. Income tax laws define this as income/loss from business. If the income is more than Rs 1 crore, he will also need to maintain book of accounts and get them audited.,” says Amol Mishra, head of tax at myITreturn.com.

It gets complicated if the salaried is doing both delivery and speculative trading. In such a case, the person will need to bifurcate the portfolio into ‘investments’ and ‘stock-in-trade’ (non-delivery based). The rules to carry forward the losses will, however, vary. In case of intraday, they will be treated as income from speculative trade. The losses can be carried forward only for four years and cannot be set off against non-speculative gains. Trades in derivatives are considered to be non-speculative.

Tax experts say if a salaried person does not trade regularly in F&O or intraday, and has losses below Rs 30,000, it’s best not to claim losses and fill ITR-2. The compliance cost can be high since the chartered accountant who audits the books will change at least Rs 20,000-30,000, wiping out any gains you have made. In case of small gains, the person can declare them under income from other sources

Thank you very much for you detailed explanation.

In may case, if I don’t show this f&o trading loss, I will not get any compliance issue from IT department.

Am I correct?

Thanks,

Ramesh

Dear Sir,

There is a new section called “Assets and Liability” in the ITR this year. If we have our own independent/apartment which is used for living, does that have to be declared in this section, or is it only applicable for house/plot that is bought for investment purpose?

Thanks!

AM

Sir,

Its good to have correct jurisdiction. Updation of PAN will not change the Jurisdictional officer directly. You need to send letter for change in Jurisdiction.

But please go ahead and submit your ITR. Jurisdiction is something that would be needed if returns are not OK, or Assessing officer needs more info.

Our article Change of Assessing Officer and Jurisdiction for Income Tax discusses it in detail

Dear Sir/Madam,

If I e-file my ITR, do I have to still mention Income Tax Ward/Circle? My problem is that I moved from Delhi to Bangalore & made address change in PAN but IT website still shows Jurisdictional A.O. as my ward in Delhi though I will be filing return (e-file) from Bangalore.

Kindly reply ASAP. Thanking you. Best regards, RAKESH