If you pay Income tax and file ITR then you should know the difference between the financial year and the assessment year. To download right ITR, pay Advance Tax/Self Assessment Tax and for Income Tax Notice. In India mostly we follow English Calendar from 1 Jan to 31 Dec. But for accounting, we use Financial Year, denoted by FY, which is from 1 April and 31 March. The income in one Financial earned gets assessed(checked) in the next Financial year which is called Assessment year denoted by AY. Previous Year is used in Income Tax related issues. What is the difference between the Financial Year and Assessment Year? What is Fiscal Year? New Years in India, Fiscal Year of the countries of the World. Should we change the Financial Year to Calendar Year?

The Table shows the various Financial and Assessment Year. Ex: The income earned between 1 Apr 2018 to 31 Mar 2019 will be assessed after 1 Apr 2019. So FY becomes 2018–19 while Assessment Year(AY) is 2019–20. The due date for filing ITR for FY 2018-19 or AY 2019-20 is 31 Jul 2019 and one can file belated returns for FY 2018-19 or AY 2019-20 with penalty till 31 Mar 2020.

| Income Earned Between | FY | AY | Due Date for filing ITR | Last date for filing ITR | Notes |

| 1 Apr 2022 to 31 Mar 2023 | FY 2022-23 | AY 2023-24 | 31 Jul 2022 | 31 Mar 2025 | Current Financial Year. Advance Tax to be paid |

| 1 Apr 2021 to 31 Mar 2022 | FY 2021-22 | AY 2022-23 | 31 Dec 2021 | 31 Mar 2022 | File Updated ITR |

| 1 Apr 2020 to 31 Mar 2021 | FY 2020-21 | AY 2021-22 | 31 Dec 2021 | 31 Mar 2022 | File Updated ITR |

| 1 Apr 2019 to 31 Mar 2020 | FY 2019-20 | AY 2020-21 | 30 Nov 2020 | 31 Mar 2021 | File Updated ITR |

| 1 Apr 2018 to 31 Mar 2019 | FY 2018-19 | AY 2019-20 | 31 Aug 2019 | 30 Jun 2020 | Cannot file ITR.

|

| 1 Apr 2017 to 31 Mar 2018

|

FY 2017-28 | AY 2018-29 | 31 Aug 2018 | 31 Mar 2019 | Cannot file ITR. |

| Earlier Years | Cannot file ITR.

File Condonation request and pay Tax Liability

|

Table of Contents

What is the Financial Year and Assessment Year?

The calendar year starts on January 1 and ends on December 31 but a Financial year is from April 1 to March 31. As per the Income Tax Act, income earned by the individual/company in a financial year (FY) is assessed(checked/verified) in the next Financial Year. FY to which the income belongs is called the Previous year (PY) and the FY in which the income is assessed is called the Assessment year (AY). Financial Year is denoted as FY and Assessment Year as AY.

Ex: The income earned between 1 Apr 2018 to 31 Mar 2019 will be assessed after 1 Apr 2019. So FY becomes 2018–19 while Assessment Year(AY) is 2019–20. The due date for filing ITR for FY 2018-19/AY 2019-20 is 31 Jul 2019 and one can file belated returns with penalty till 31 Mar 2020.

In India, it is mandatory for individuals, companies to follow April – March year ending. For all Taxpayer, Business persons, Business Entity, Bank and for Professional like CA, CWA, CS the 31st March year-end plays a vital role as the Accounting or Financial year comes to an end.

Previous Year or PY. “Previous Year” is defined in Section 3 of the Income-tax Act, 1961 to mean the financial year immediately preceding the assessment year. Previous Year is same as Financial Year.

Difference between Financial Year and Assessment Year

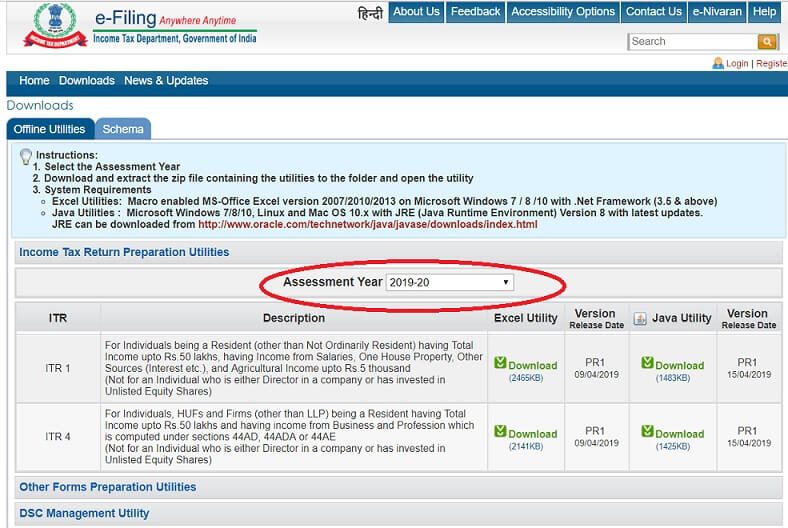

So though both FY and AY work from 1 Apr to 31 Mar time period, Assessment Year is one year later than Financial Year. Assessment Year is what is used in Income Tax Utilities, ITR and Challan 280. The Excerpt from Excel Utility ITR1 with assessment year is shown in the image below. Other images are later in the article

Financial Year and Assessment Year in Hindi?

In Hindi, a Financial Year is known as वित्तीय वर्ष and an Assessment Year is known as निर्धारण वर्ष.

Where all are Assessment Year used?

For Income tax Purposes one uses Assessment Year

- In ITR Assessment Year is used.

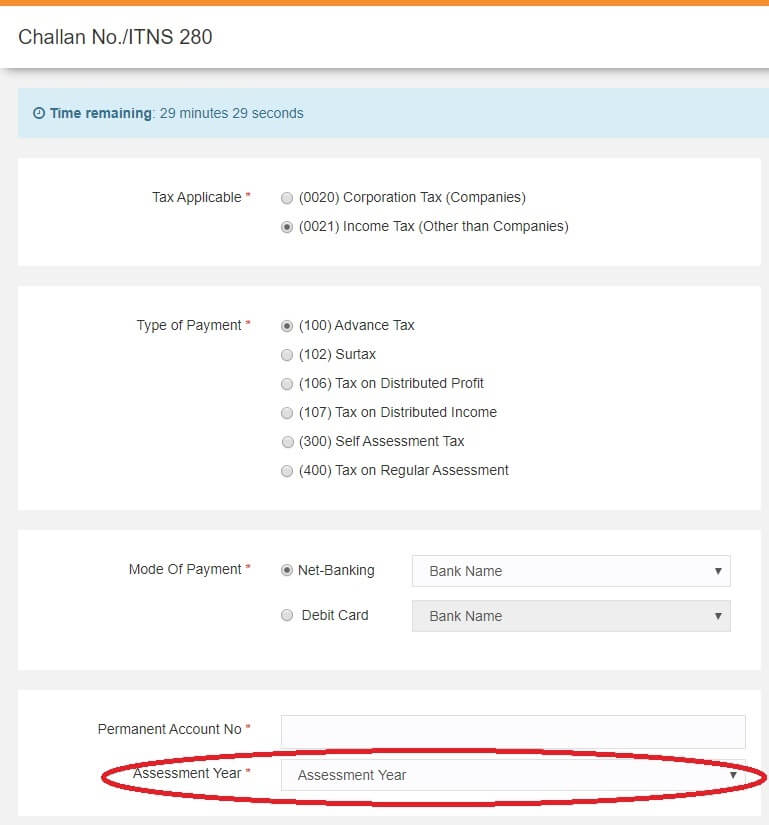

- To pay Self Assessment or Advance Tax Assessment Year is used.

- Income Tax Notice also mentions AY or Assessment Year

Download Income Tax Utilities based on Assessment Year

Check Assessment Year in ITR

Advance Tax/Self Assessment Tax in ITR

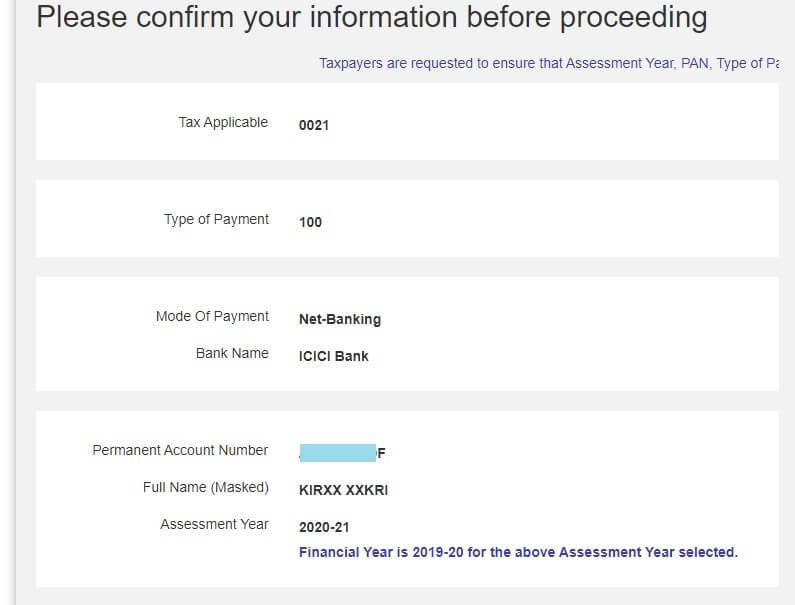

After filing the Assessment Year you can see the financial year

Income Tax Notice and Assessment Year

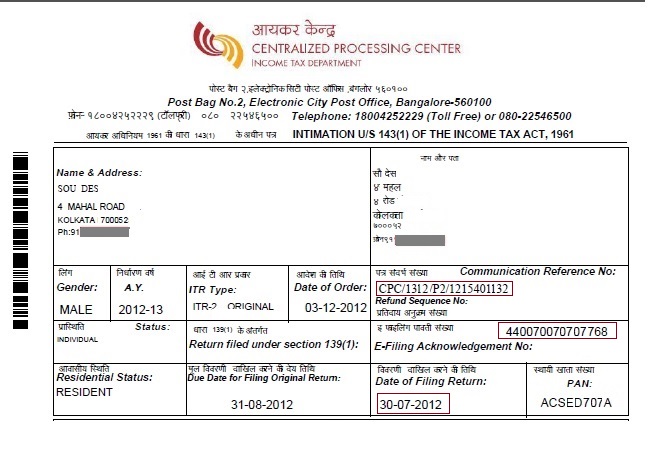

Income Tax Notice also mentions AY or Assessment Year as shown in the image below where AY is 2012-13 which is for Income between 1 Apr 2011 to 31 Mar 2012.

Assessment Year in the Income Tax Notice

What is Previous Year?

Previous Year or PY. “Previous Year” is defined in Section 3 of the Income-tax Act, 1961 to mean the financial year immediately preceding the assessment year. Previous Year is same as Financial Year.

The previous year is used in tax terminology whereas a financial year is used in other economic matters.

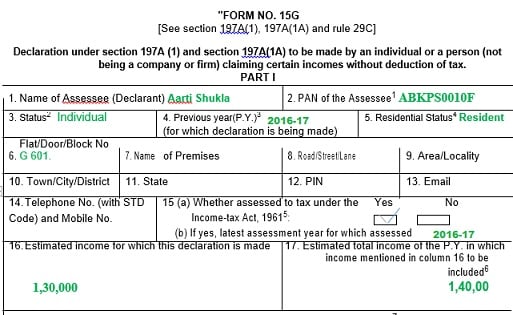

One comes across Previous Year in Form 15G/15H. See point 4 in the image below.

Difference between Fiscal Year and Financial Year

There is no technical difference between Fiscal Year and Financial Year. Government and Companies/business use Fiscal year for accounting and budget purposes. It is also used for financial reporting by business and other organizations.

Taxation laws generally require accounting records to be maintained and taxes calculated on an annual basis, which usually corresponds to the fiscal year used for government purposes. The calculation of tax on an annual basis is especially relevant for direct taxation, such as income tax.

A quarter is a three-month period on a company’s financial calendar that acts as a basis for periodic financial reports and the paying of dividends. Businesses, especially publicly listed companies i.e ones listed on the stock exchange often report their earnings quarterly where they also report their forward-looking “guidance” for what management expects from the next few quarters or through the end of the year.

- A quarter refers to one-fourth of a year and is typically expressed as “Q1” for the first quarter, “Q2” for the second quarter, and so forth.

- Quarterly reports are a crucial piece of information for investors and analysts.

Why does Financial Year in India start from 1 Apr?

This financial year is a legacy left behind by the British. India has been following the April-March financial year since 1867, mainly to align the Indian financial year with that of the British government.

- India being an agricultural economy, revenue generally depends on the outcome of the main crop being ripe in February / March.

- April 1st coincided with the Hindi festival of Vaisakha / Ugadi / Bihu i.e. Hindi new year

- English government formulated its annual budget on the basis of anticipated revenue receipts which would determine the planned expenditure and levy of new taxes and duties during the year

Interestingly the UK financial year begins on 6 April and ends on 5 April of next year.

Many feel that The main festivals in India like Navratri and Diwali fall in the month of October/November. During this period shop keeper is busy hence doesn’t have time for books and accounting. So March was preferred as the month of closure of the financial year and not December.

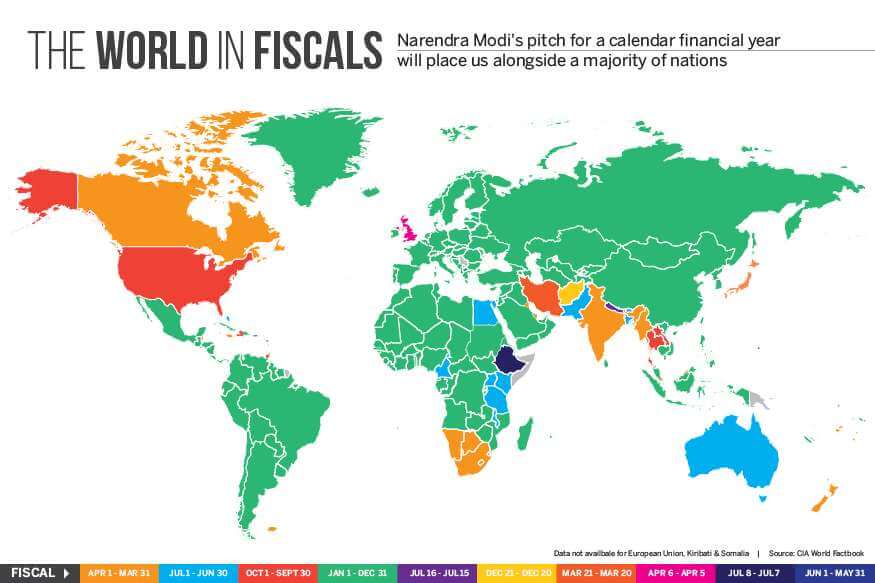

Fiscal Year in countries of the world

IMF and even the World Bank follows the January-December cycle. As a matter of fact, 156 nations follow the calendar year as compared to the financial year. The image below shows the fiscal years of the countries of the world.

- In Australia, a fiscal year is commonly called a “financial year” (FY) and starts on 1 July and ends on the next 30 June.

- The United States federal government’s fiscal year is the 12-month period beginning 1 October and ending 30 September the following year. The identification of a fiscal year is the calendar year in which it ends; thus, the fiscal year, which began on 1 October 2018 and will end on 30 September 2019, is 2019. It is often written as “FY2019” or “FY19”. Before 1976, the fiscal year began on 1 July and ended on 30 June.

- In the Republic of China (Taiwan), the fiscal year is the calendar year, 1 January to 31 December

Some people have the opinion that India needs to change the financial year same as Calendar Year from the existing 1st April to 31st March. A change in the financial year would require amendments in various statutes and changes in tax laws during the transitional period. Ref

Change of India’s Financial Year to January-December

Prime Minister Narendra Modi had pitched for changing the financial year to Jan-Dec during a NITI Aayog Governing Council meeting in April 2017, while addressing chief ministers at the Governing Council of NITI Aayog in April 2017. Saying that the Budget should be aligned to the agricultural season, which in turn may help in better allocation of resources to the sector.

The government had set up a committee headed by former chief economic adviser Shankar Acharya to examine the desirability, merits and demerits of shifting to a new financial year.

Any change in the financial year would have to be agreed upon by all states, and a number of them were still not in its favour. However, a shift in the financial year will mean a lot of dislocations initially, including changing the dates for Budget presentation and other administrative tweaks.

Modi had directed the states to take the lead on shifting the financial year from Apr-Mar. Madhya Pradesh, the first state to announce the switch to Jan-Dec financial year from 2018, later put its plan on hold.

Many New Years in India

In India mostly we follow English Calendar Year and Accounting year or Financial Year.

There are numerous days throughout the year celebrated as New Year’s Day in the different regions of India. The observance is determined by whether the lunar calendar is being following or the solar calendar.

| Solar or Lunar calendar | Date | Festival name | Religion / Regions (Hindu) |

|---|---|---|---|

| Lunar | varies, Mar/Apr | Ugadi | Andhra Pradesh, Telangana, Karnataka |

| Lunar | varies, Mar/Apr | Bighu | Jharkhand |

| Lunar | varies, Mar/Apr | Pratipada | Uttar Pradesh |

| Lunar | varies, Mar/Apr | Bikhu | Uttarakhand |

| Lunar | varies, Mar/Apr | Gudhi Padwa / Samsaar Padwo | Maharashtra, Goa, Konkan |

| Lunar | varies, Mar/Apr | Cheiraoba | Manipur |

| Lunar | varies, Mar/Apr | Navreh | Kashmir |

| Lunar | varies, Mar/Apr | Navratra | Jammu |

| – | – | Navratra | Rajasthan |

| Lunar | varies, Mar/Apr | Cheti Chand | Sindh |

| Solar | fixed, April 13/14/15 | Vaisakhi | Punjab |

| Solar | fixed, April 13/14/15 | Rongali Bihu | Assam |

| Solar | fixed, April 13/14/15 | Tamil puthandu | Tamil Nadu |

| Solar | fixed, April 13/14/15 | Vishu | Kerala |

| Solar | fixed, August 15/16/17 | First day of Chingam in Malayalam Calendar (Kollam Era) | Kerala |

| Solar | fixed, April 13/14/15 | Bishuva Sankranti | Odisha |

| Solar | fixed, April 14/15 | Poila Boishakh | Bengal |

| Solar | fixed, April 13/14/15 | Jud Sheetal | Mithila, part of Bihar |

| Lunar | varies, Oct/Nov | Nav Varas | Gujarat |

| Solar | varies, Aug 17,18,19 | Nowruz | Parsis |

| Solar | Fixed, March 21 | Nowruz | Zoroastrians |

Related Articles:

All about Income Tax has all our income tax-related posts in 1 place.

- Income Tax for FY 2019-20 or AY 2020-21

- Income Tax for FY 2017-18 or AY 2018-19 covers the Income Tax for FY 2017-18 in detail.

- ITR for FY 2018-19 or AY 2019-20: Changes, How to file

- Which ITR Form to Fill?

Please use the correct Assessment Year while filing ITR.