Over the past few years, globally and in India, there has been a shift from Actively managed mutual funds to passive investing i.e investing in Index funds or ETF (Exchange-traded funds). In Dec 2017, Warren Buffett won the bet of a million dollars placed in 2007 that an index fund would outperform a collection of hedge funds over the course of 10 years. Which are good ETFs and Index Funds to invest in is given in the image below. This article explains What are Index Funds and ETFs, How to choose the Index Fund/ETF, comparison of the Index Funds, ETFs, Mutual funds of Large Cap, International, Gold etc.

“A low-cost index fund is the most sensible equity investment for the great majority of investors,” Warren Buffett told Bogle in his book “The Little Book of Common Sense Investing.” “By periodically investing in an index fund, the know-nothing investor can actually out-perform most investment professionals,” Buffett said.

| Type of funds | Index Fund | ETF |

| Large Cap | UTI Nifty Index Fund | SBI ETF Nifty 50 |

| HDFC Index Fund – Sensex Plan | SBI ETF Sensex | |

| International | Motilal Oswal NASDAQ 100 FOF | Motilal Oswal Nasdaq 100 ETF |

| Gold | HDFC Gold Fund | SBI Gold ETF |

| Mid-cap | ICICI Prudential Nifty Next 50 Index Fund | |

| Small-Cap | Motilal Oswal Nifty Smallcap 250 Reg |

Table of Contents

What are Index Funds and ETF?

Index Fund: The primary aim of an index fund is to replicate the performance of its index like Sensex, Nifty 50, Nasdaq 100. In Index Mutual Funds instead of researching and selecting just those stocks that the fund manager thinks will outperform, an index fund buys all the stocks that make up a particular index. For example, an Index fund based on the Sensex would invest in all of the 30 stocks that form the Index in the same weight as that of the index.

So an investor who buys an index fund doesn’t have to pay a fee to the fund manager, hence the Expense Ratio of the Index Funds is low.

One buys and sells Index Fund just like any other Mutual Fund. So you can buy index funds on any mutual fund platform like MF Utility, ET money, Zerodha, Groww etc like you buy any mutual fund. Compare Direct Mutual Funds Investing Platforms: ETMoney, PayTM Money, Zerodha Coin,Kuvera, Groww

ETF or exchange-traded fund is a basket of stocks that tracks a particular index, just like an Index fund. But one has to buy and sell it just like a stock. So one needs to have a Demat Account to buy and sell ETFs.

So one can use brokers like Zerodha, Groww, ICICIDirect, HDFC Securities, Upstox etc. Our article How to choose a stockbroker? Where to open a Demat Account? discusses it in detail.

Our articles What are Index funds? What are ETFs? Do Index Funds Work? , What is ETF, Difference between ETF and Mutual Fund, ETF vs Index Fund, How to buy or sell ETF explains the difference in detail.

If you have a Demat account and you find that an ETF has fewer charges compared to an equivalent Mutual Fund then you should.

Buying ETF or Index Funds comes under Passive Investing.

- Active investing means a hands-on approach, typically by a fund manager.

- Passive investing involves following an index which means less buying and selling and often results in investors buying index funds or other mutual funds.

- Active Equity funds have an expense ratio of 1-2.5 percent, whereas the ETFs have an expense ratio of less than 1%

Passive Investing looks better in the relatively-large-cap space and active looks better in the mid-caps, smaller-cap space where there is a wider canvas for the fund manager.

The reason being Actively managed funds are not giving better returns than Indices like Senex/Nifty.

As of November 2020, the AUM of passive was Rs 2.4 lakh crore against active equity of Rs 8.3 lakh crore. That is, 28.9%.

How to choose the Index Fund/ETF

Expense ratio: Choose the Index Fund/ETF which has a less expense ratio. Lesser the expense ratio more the savings just like we see in the case of Direct and Regular Plans of Mutual Funds.

AUM: Choose the Index Fund/ETF which manages a lot of money that has good AUM(Asset Under Management) especially for ETFs to have sufficient buyers and sellers

Tracking Error: Choose the Index Fund/ETF which has less Tracking Error. Tracking error is the difference between the fund/ETF’s return and the index it is meant to copy. This information is not easily available on the Mutual Fund websites like Value Research Online, Money Control. One needs to get it from Mutual Fund documents. It is calculated by deducting the returns of Nifty Index Funds with that of Nifty 50 for each of the

Comparing Large Cap Index Funds, ETF and Mutual Funds

Large-cap Mutual Funds invests a significant amount (80%) of its corpus in top companies (Reliance Industries, Asian Paints, TCS, Infosys, HDFC Bank, ITC, etc.). These companies are market leaders in their sector with an impressive track record.

Large-cap Mutual Funds should be a part of every portfolio to give it a strong foundation. It is recommended to have 30-50% of one’s portfolio in Large-cap Mutual Funds/stocks.

Look at the image given below for top large-cap mutual funds, index funds, and ETFs. What do you notice?

Returns of the ETF and index funds are comparable

The expense ratio of ETFs is less than that of the Index funds which is less than that of Active Large-cap funds.

SBI Nifty 50 is the biggest fund in terms of size because EPFO contributes to that fund.

One can invest in SBI Nifty 50/SBI Sensex ETF which have expense ratio of just 0.07 or UTI Index Fund with expense ratio of 0.1 for Direct and 0.14 for Regular.

Comparing International Index Funds, ETFs, Mutual Funds

Investing in International markets offers investors a number of advantages especially in terms of Diversification such as Geographic, Portfolio. One can now buy stocks in US markets or invest in international markets like US, China through ETFs, Mutual Funds. It is recommended to have 5-15% of one’s portfolio in International Funds.

Our article International Mutual Funds: What are these, Pros and Cons, Tax discusses International Funds in detail. And Difference between Dow Jones, S&P 500, Nasdaq explains difference between US Indices.

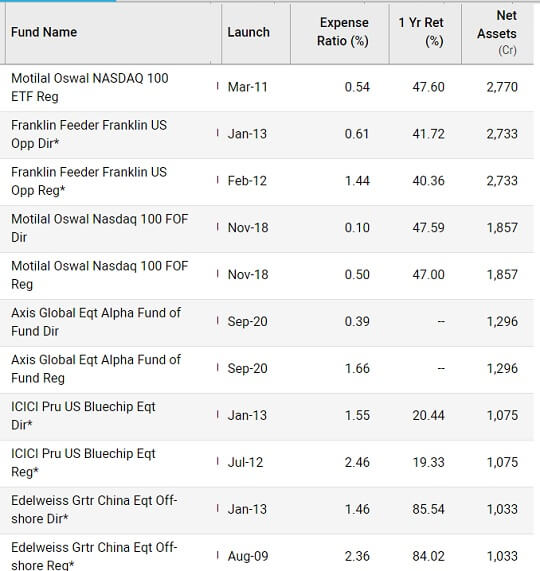

Look at the image given below for international mutual funds, index funds, and ETFs. What do you notice?

The expense ratio of Motilal Oswal NASDAQ 100 ETF(0.54) is more than that of the Motilal Oswal NASDAQ 100 Fund of funds(0.1) but is less than that of Active International funds(ex Franklin Feeder 0.61 for direct and 1.44 for Regular).

So one can invest in Motilal Oswal Nasdaq 100 Index Fund

Comparing Gold Funds, ETFs, Mutual Funds

One Asset class does not perform well in every year. One should invest in different types of investment products based on one’s financial goals. In the short term, gold prices can be volatile, but it given good returns over the long term. It is recommended to have 5-10% of one’s portfolio in Gold.

There are many ways to invest in Gold such as Gold Jewellery, Bars- Coins and Biscuits, Sovereign Gold Bonds, Gold ETFs, Gold Saving Funds, Gold Mining Funds, Gold Futures. Look at the image given below for Gold mutual funds, index funds, and ETFs. What do you notice?

Nippon India Gold ETF is the biggest fund in Gold.

The expense ratio of Direct Gold Funds are less compared to ETFs. For example Expense ratio of HDFC Gold ETF is 0.62 while that HDFC Gold Mutual Fund Direct plan is 0.10 and that of regular plan is 0.59.

So one should invest in Gold Mutual Fund rather than a ETF.

The winning formula for success in investing is owning the entire stock market through an index fund, and then doing nothing. Just stay the course.”

– John C. Bogle, The Little Book of Common Sense Investing

Best Index Mutual Funds and ETF for 2022

Best Index Mutual Funds and ETF for 2021 are given below. Do you agree with the selection?

| Type of funds | Index Fund | ETF |

| Large Cap | UTI Nifty Index Fund | SBI ETF Nifty 50 |

| HDFC Index Fund – Sensex Plan | SBI ETF Sensex | |

| International | Motilal Oswal NASDAQ 100 FOF | Motilal Oswal Nasdaq 100 ETF |

| Gold | HDFC Gold Fund | SBI Gold ETF |

| Mid-cap | ICICI Prudential Nifty Next 50 Index Fund | |

| Small-Cap | Motilal Oswal Nifty Smallcap 250 Reg |

Related Articles:

- What is ETF, Difference between ETF and Mutual Fund, ETF vs Index Fund, How to buy or sell ETF

- How to choose a stockbroker? Where to open a Demat Account?

- Does Index Fund or ETF Work? Will it work in India

- International Mutual Funds: What are these, Pros and Cons, Tax

Do you invest in Index Funds and ETF? Which ones? How do you choose the Index Fund/ETF?Do you agree with the selection?