On 25 Jul 2016, Finance Ministry notified the salary hike based on Seventh Pay Commission recommendations. About 1 crore employees and pensioners will benefit from the pay hike from Aug 2016, effective from January 1, 2016. The government has decided to pay them seven months’ arrears at one go with their August salary. This article explains with example how to calculate pay and Arrears as per 7th Pay Commission. It also provides 7th Pay Commission Calculator for Pay and Arrears.

Table of Contents

Overview of 7th Pay Commission

- According to the pay new structure, the existing basic pay as on December 31, 2015, shall be multiplied by a factor of 2.57.

- The new pay is effective from 1 Jan 2016.

- The 7 month arrears shall be paid in one go with August salary. In the past, the employees had to wait for 19 months for the implementation of the Commission’s recommendations at the time of 5th CPC, and for 32 months at the time of implementation of 6th CPC. However, this time, 7th CPC recommendations are being implemented within 6 months from the due date.

- After taking into account the DA at prevailing rate (125 percent of basic pay), the salary/pension of all government employees/pensioners will be raised by at least 14.29 percent as on 01.01.2016

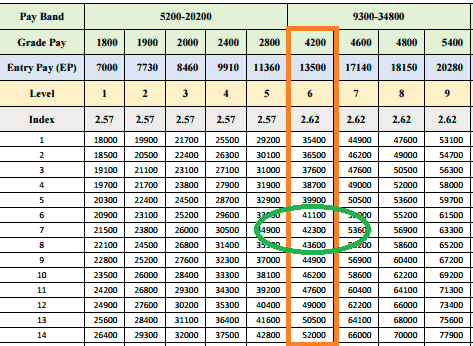

- The present system of Pay Bands and Grade Pay has been dispensed with and a new Pay Matrix as recommended by the Commission has been approved. The status of the employee, hitherto determined by grade pay, will now be determined by the level in the Pay Matrix. Separate Pay Matrices have been drawn up for Civilians, Defence Personnel and for Military Nursing Service. The principle and rationale behind these matrices are the same.

- The financial impact of accepting Seventh Pay commission’s recommendations in 2016-17 will amount to Rs.1.02 trillion. There will be an additional implication of Rs. 12,133 crore on account of payments of arrears of pay and pension for 2015-16. Out of the total financial impact of Rs 1,02,100 crore, Rs 73,650 crore will be borne by the General Budget and Rs 28,450 crore by the Railway Budget

How to Calculate Pay under 7th CPC Commission

- Step-I Calculate your sixth CPC basic Pay

- Ex: ( Grade Pay + Band Pay) = 4200+12110= 16310

- Step-II Multiply the answer in Step-I with 7th CPC Fitment Formula 2.57. ( Paisa to be rounded off to the nearest Rupee)

- Ex: 16310 x 2.57 = 41916.70 = Rs 41917

- Step-III Match this Answer with Matrix Table ( Given Below). if there is no matching figure in the Pay matrix, choose the closest higher figure assigned in the Grade Pay column

- Figures assigned in Grade Pay column Rs.4200. There is no matching figure we arrived above in this matrix, so the closest higher figure assigned in the Grade Pay column can be chosen ie is Rs. 42300. So , Rs 42300 is your New 7th CPC Basic Pay.

- Step-IV : Find your HRA . HRA has been revised as 24%, 16% and 8% for 30% , 20% and 10% respectively So if you are in 30% HRA Bracket, your HRA in 7th CPC is 24% .

- Ex: HRA= Find the 24% of the Basic Pay = 42300 x 24/100 = 10152

- Step-V: Find your TPTA (Transport Allowance). 7th CPC Recommends Transport Allowance for three Category of Employees for Two Types of Places. If you are living in A1 and A classified cities (See the List of 19 cities classified as A1 and A cities) you will be entitled to get higher TPTA rates

- Ex: Since your Grade Pay is 4200 you fall in Second category. ie Grade Pay 2000 to 4800 i.e Rs 3600+DA. As DA is Nil as on 1.1.2016 Your TPTA is Rs. 3600.

- Step-VI : Add all the figures. As DA will be Zero from 1.1.2016 So no need to calculate the DA to calculate 7th Pay and Allowances from 1.1.2016. New Basic Pay + HRA+TPTA = 42300+10152+3600 = 56052. Your revised 7th CPC Grass pay as on 1.1.2016 = Rs.56052

How much Arrears will one get under 7th Pay Commission

The arrears shall be paid during the Financial Year 2016-2017 along with Aug 2016 salary. Questions is How to calculate Arrears. Arrears of pay means the difference between:

- (i) the sum of the pay and dearness allowance to which he is entitled on account of the revision of his pay under these rules for the period effective from the 1st day of January, 2016

- (ii)the sum of the pay and dearness allowance to which he would have been entitled (whether such pay and dearness allowance had been received or not) for that period had his pay and allowances not been so revised.

7th Pay Commission Calculator for Pay and Arrears

| Basic Pay as on 1.1.2016 | |

| Grade Pay as on 1.1.2016 | |

| Select Your Pay Band and Grade Pay |

|

| Select Your Transport Allowance |

|

| Select Your House Rent Allowance |

|

| Select Your City Details given below* |

|

| Non Practicing Allowance | |

| Note*: 7th CPC refers 19 Cities as Higher TPTA Cities: Delhi, Hyderabad, Bengaluru, Greater Mumbai, Chennai, Kolkata, Ahmedabad, Surat, Nagpur, Pune, Jaipur, Lucknow, Kanpur, Patna, Kochi, Kozhikode, Indore, Coimbatore and Ghaziabad | |

| As Per 7th CPC :Your Pay Matrix Level and Pay Matrix Index | |

| Your Total Arrears for 6 Months |

Exclude HRA |

| 6th CPC Basic Pay | Initial Basic | Revised Basic Pay | 7th Basic Pay |

| House Rent Allowance | House Rent Allowance | 7th CPC House Rent Allowance | 7th CPC House Rent Allowance |

| 6th CPC Transport Allowance | 6th CPC Transport Allowance | 7th CPC Transport Allowance | 7th CPC Transport Allowance |

| Dearness Allowance | Dearness Allowance | Dearness Allowance | 0 |

| Non Practicing Allowance | NPA | Your 7th CPC NPA | NPA |

| Your 6th CPC Total Pay | Total Pay | Your 7th CPC Total Pay | Total Pay |

Pay Matrix of 7th Pay Commission for Civilians

The six pay commission introduced the concept of pay grades and did away with the concept of a pay scale. The seventh pay commission got rid of the pay grade and use a simply pay matrix to fix pay. “Pay Matrix” means Matrix with Levels of pay arranged in vertical cells as assigned to corresponding existing Pay Band and Grade Pay or scale. This pay band ensures that there no disproportionate jumps in salaries when one gets promoted, as was the case with the six CPC pay scales. For instance, if you are a level 10 employee at index 13 earning Rs 80,000 per month, upon being promoted to level 11 you will earn Rs 96,600 and not the entry pay of level 11.

- There are 18 levels of promotions that an entry-level employee can go through.(Horizontal row)

- “Level” in the Pay Matrix means the Level corresponding to the existing Pay Band and Grade Pay

- Within these levels there is an index for the amount of years one has served in the government.(Vertical Row)

- These indexes decrease as one moves up the hierarchy. A cabinet secretary is at level 18, the highest possible,with a salary of Rs 2,50,000 a month. They will not get the 3% annual increment

HRA and 7th Pay Commission

As per 6th CPC the percentages on HRA were prescribed on basic pay according to the cities in India. The cities are classified as X, Y and Z and the rates of percentage respect of the cities are 30%, 20% and 10% on basic pay (Grade pay including). The 7th Central Pay Commission has recommended

- to reduce the percentage of House Rent Allowance for all categories of Central Government employees rationalized to 24 percent, 16 percent and 8 percent of the Basic Pay for Class X, Y and Z cities respectively.

- rate of HRA will be revised to 27 percent, 18 percent and 9 percent when DA crosses 50 percent,

- and further revised to 30 percent, 20 percent and 10 percent when DA crosses 100 percent.

- For Classification of cities as X,Y and Z please check our article 7th Pay Commission : Understanding Seventh Pay Commission or the image Classification of cities as X,Y and Z

| Population of City | DA above | |||

| Present | 7th Pay | 50% | 100% | |

| Above 50 lakh (Class X) | 30% | 24% | 27% | 30% |

| 5 lakh to 50 lakh (Class Y) | 20% | 16% | 18% | 20% |

| Below 5 lakh (Class Z) | 10% | 8% | 9% | 10% |

Transport Allowance and 7th Pay Commission

| A1+A Cities | For Other Cities | |

| Grade Pay 1800 to 1900 | Rs 1350+DA | Rs 900+DA |

| Grade Pay 2000 to 4800 | Rs 3600+DA | Rs 1800+DA |

| Grade Pay 5400 and above | Rs 7200+DA | Rs 3600+DA |

Classification of A1/A has been abolished for other purposes (like HRA, CCA) but retained for Transport Allowance. There are total 19 cities classified as A1/A

- 6 in A1, which are Hyderabad, Delhi, Bengaluru, Greater Mumbai, Chennai, Kolkata and

- 7 in A, which are, Ahmedabad, Surat, Nagpur, Pune, Jaipur, Lucknow and Kanpur.

- Recently, 6 more cities, viz., Patna, Kochi, Kozhikode, Indore, Coimbatore and Ghaziabad have been added to A1/A categories, making it nineteen in all.

Nonpracticing Allowance (NPA) and 7th Pay Commission

In the case of medical officers in respect of whom Non Practicing Allowance (NPA) is admissible, the pay in the revised pay structure shall be fixed in the following manner : (i) the existing basic pay shall be multiplied by a factor of 2.57 and the figure so arrived at shall be added to by an amount equivalent to Dearness Allowance on the pre-revised Non-Practicing Allowance admissible as on 1st day of January, 2006.

The figure so arrived at will be located in that Level in the Pay Matrix and if such an identical figure corresponds to any Cell in the applicable Level of the Pay Matrix, the same shall be the pay, and if no such Cell is available in the applicable Level, the pay shall be fixed at the immediate next higher Cell in that applicable Level of the Pay Matrix. (ii) The pay so fixed under sub-clause (i) shall be added by the pre-revised Non Practicing Allowance admissible on the existing basic pay until further decision on the revised rates of Non Practicing Allowance

Are Government Employees Happy with 7th Pay Commission

There has been a spate of commentaries about how beneficial the 7th Pay Commission mandated pay hikes, and now approved by the Union Government with retrospective effect will benefit the economy. Others have cheered this with comments like “you pay peanuts you get monkeys!” But No government employee is really celebrating the 7th pay commission hike. There were threats of going on strike in Jul but that never materialised. Finance Minister Arun Jaitley claimed that the recent implementation on 7th CPC made by the government will match the salaries of government employees that to the private sector. Quoting from an IIM-Ahmedabad study he said it “found that pay in the government sector is distinctly greater than that in the private sector so there can’t be protests from employees.” He was basically comparing the salaries of class IV and III employees in government and private sector.

- Unlike the private sector, where the compensation is revised annually depending on the performance and skills, government employees have to typically wait for a decade for any substantial revision in their wages, if one sets aside the 3 percent routine annual pay increase.

- The cost of living and prices of food items have gone up so much since the sixth pay commission.

- Often, even the well performing bureaucrats feel that there is no value for their work, beyond the element of mental satisfaction, since the reward is same for the performers, laggards, sleepy heads and those who take a detour during their morning walks to office only to punch in their attendance and later return post lunch.

- Central and state government employees are the ones who get pension and each time pay of serving employees is hiked, a pensioner’s pension is also hiked. They also have other post-retirement facilities like health care. The number of pensioners (53 lakh) is higher than number of serving employees (47 lakh). A middle ranking government employee on his retirement said, “Sarkari naukar jinda toh lakh ka mara to sava lakh ka”(A retired man worth more than a serving one).”

The Government knew that after a pay and pension hike would be announced, unionists will cry hoarse of injustice committed on them, some others would want anomalies to be rectified and parity be restored. To remedy that, the Union Cabinet has set up four committees:

- first to look into the implementation issues anticipated;

- second will go into the likely anomalies;

- third committee to examine the recommendations on allowances, which have largely been kept on hold and

- fourth to suggest measures for streamlining the National Pension System.

IIM-Ahmedabad study on Salary Comparison

Commissioned by the Seventh Pay Commission, IIM-Ahmedabad conducted the ‘Salary Comparison Study’ in October 2015 examinining 40 professions, including nurses, teachers, scientists, electricians, drivers and clerks. It found the salaries of gardeners, clerks, receptionists and drivers lower in the private sector. Experts are broadly in agreement with the findings of the IIM-Ahmedabad study. But it’s not all black and white.

For example, a driver in the private sector typically earns around Rs. 12,000 a month, while an entry-level driver in government service earns around Rs. 25,000, including additional benefits and allowances. Even qualified professionals working with the government at the entry level are paid more.Government doctors with an MBBS degree get Rs. 80,500 a month while their counterparts in the private sector are paid only Rs. 50,000.

The study also found wide variations in salaries within the private sector, primarily because of the size of organisations, location, and profitability status. For example, in private schools where the recommendations of the Sixth Central Pay Commission are followed, the salaries are comparable to government sector, but in other schools the payments are lower.

| Central Government | Private Sector | SEBI Listed | |

| C- Grade employee | Rs 18,000 | Rs 20,000-25,000 | Rs 30,000-35,000 |

| B- Grade employee | Rs 25,000 | Rs 50,000-65,000 | Rs 75,000-1.25 lakh |

| A- Grade employee | Rs 40,000 to Rs 45,000 | Rs 1.5 lakh-2.54 lakh | Rs 3.5 lakh-5 lakh |

| Class 1 employee | Rs 56,100 | Rs 3 lakh-5 lakh | Rs 8 lakh-10 lakh |

| Cabinet Secretary or CEO | Rs 2.5 lakh | Rs 15 lakh-25 lakh | Rs 1 crore to Rs 3 crore |

| MBBS Doctor(entry level) | 80,500 | 50,000 | |

| MBBS Doctor(15 years) | 1,30,000 | 1,05,000 | |

| MD Doctor (Entry Level) | 95,000 | 1,05,000 | |

| MD Doctor(15 years) | 1,60,000 | 3,70,000 |

Yes, if compared with a private sector CEO’s salary which ranges between Rs 12.5 lakh and Rs 2.5 crore per month — according to data available with HR consulting firm Omam Consultants — the salary of the cabinet secretary seems paltry; the topmost bureaucrat in the country takes home Rs 2.5 lakh per month. But then, you can’t ignore the embellishments — the tangible and non-tangible perks doled out to a government officer.

For example A Central government officer gets accommodation in Lutyens’ Delhi — the market value of the rent of the cabinet secretary’s bungalow on 32 Prithviraj Road, for example, is several times more than his salary. An officer also gets a car, a driver, phone bill reimbursements, unlimited medical benefits for self and dependents, pension and a whole range of allowances, including one-time book allowance for Indian Foreign Service officers, and then a secret allowance -an undisclosed amount paid to officers working in the cabinet secretariat for dealing with top secret papers and performing sensitive duties.

In fact, many of the 196 allowances that exist in the government were not known publicly till Justice (retired) AK Mathur-headed pay panel placed each one of those in public domain and recommended the abolition of 52 such allowances,

Demand for Govt. jobs?

The Uttar Pradesh government secretariat recently received applications from postgraduates and Ph.D holders in response to a notification of vacancies of peon. Many people choose Government Job due to factors such as job security, work-life balance, a five-day week, post-retirement benefits. In government jobs, the ratio of the top pay to the lowest pay must be within a certain band (12-13:1). No such consideration applies in the private sector. But government jobs are not easy to come by and reservations for SC, ST and OBCs make it seem like a prize that is kept out of the reach of people from general categories.

[poll id=”76″]

Related Articles

- Salary,Allowances,Dearness Allowance,Government Salary, Pay Commission

- 7th Pay Commission : Understanding Seventh Pay Commission

- Pay and perks of Indian MP, MLA and Prime Minister

- What is Leave Travel Allowance or LTA

- Understanding Variable Pay

- Understanding Form 16: Part I

- How To Fill Salary Details in ITR2, ITR1

Ariyar10-08-2013

Ariyar1-1-2013

When arrel will be Credit