As mentioned in our article Basics of Income Tax Return Different forms are prescribed for filing of returns for different tax-paypers(Individual, Hindu Undivided Family, Firm ) and nature of income (income from salary, business etc). Income Tax Return is to be filed only when Gross Total Income ( Income from all sources ex: Salary, House, Interest from saving bank account ) before deductions is more than the exemption limit specified by the government as explained in Basics of Income Tax Return. In this article we shall see how to fill Income Tax Return ITR1 so let’s learn more about ITR-1 for the Assessment Year 2012-13(financial year 2011-12). Income Tax Dept Instructions for filling ITR-1(pdf) also explains how to fill ITR-1.

Table of Contents

ITR-1 Form

Income Tax Return Form 1 (ITR-1) also called as Sahaj (which means easy in Hindi) applies to Individual with income only from:

1. Income from salary/pension: or

2. Income from one house property(excluding where loss brought forward from previous year): or

3. Income from other sources( excluding winnings from lottery and income from races horses)

So if you have income from business or profession or have Income from Capital Gains you cannot use ITR-1 Form, you have to use other ITR forms. It is the simplest of Income Tax Return Form. ITR-1 Form can be downloaded from here(pdf)

Example

To fill Form 16 we shall take example of Mr. T. Mehta who has

- Income from salary : Document proof is Form 16. TDS for salary is updated in the Form 26AS.

- Income from other sources: Interest on saving bank account (Rs 5000) and Interest from Fixed Deposit(Rs 20,000). Documents for:

- Interest on saving bank account document is bank account statement. No TDS is deducted for interest on saving bank account.

- Interest on Fixed Deposit: Document is Form 16A which shows TDS cut by bank at the rate of 10% if interest on the Fixed Deposit in the financial year is more than Rs 10,000 . As Mr. Mehta has earned interest of Rs 20,000 bank would deduct 10% of 20,000 i.e 2000. This is updated in the Form 26AS.

- He earned dividend from stocks and equity mutual funds for amount Rs 2,200. Interest from PPF was Rs 672. This income is tax free or exempted income

- Chapter VI-A Deductions: He has made investments which allow him to save income tax. The proof of these investments were submitted to his employer so these are reflected in his Form16.

- Section 80C: He invested Rs 30,000 in Public Provident Fund (PPF), paid Rs 7,000 as premium for LIC policy. These investments allow him to save tax under section 80C.

- Section 80D : He paid Rs 10,000 for premium of health insurance policy for his family.

- Tax Deducted at Source(TDS) is Rs 46,269.

- Salary income, Rs 44,269 shown in Form 16, including Education Cess and Surcharge.

- Interest on Fixed Deposit Rs 2,000 shown in Form 16A given by bank.(Note bank gives TDS only when interest on FD is more than 10,000 in an year)

Mr. Mehta has to fill ITR-1. Let’s see how the above mentioned details get reflected in ITR-1.

Form Structure

ITR1 form is divided into various parts such as:

- Part A: Personal Details : Filling Individual ITR Form: Fields A1 to A22 covers it.

- Part B: Gross Total Income

- Part C : Deductions and Taxable Total Income

- Part D : Tax Computation and Tax Status

- Bank Account Details ( Mandatory in all cases irrespective of refund due or not)

- VERIFICATION

- Sch IT – DETAILS OF ADVANCE TAX AND SELF ASSESSMENT TAX PAYMENTS

- Sch TDS1: Details of Tax Deducted at Source From Salary.(As per Form 16 issued by Employer(s))

- Sch TDS2-DETAILS OF TAX DEDUCTED AT SOURCE FROM INCOME OTHER THAN SALARY (As per Form 16A issued by Deductor(s))

- SUPPLEMENTARY SCHEDULE TDS 1

- SUPPLEMENTARY SCHEDULE TDS 2

Every field in the form has a tag for example:Tag for FIRST NAME is A1, while Income From Salary/Pension is A13. These tags help to find the appropriate field fast. We shall be referring to these tag names along with field names.

General Instructions for filling the Form

Quoting from Official Instructions for filing ITR2(pdf)

- All items must be filled in the manner indicated therein; otherwise the return maybe liable to be held defective or even invalid.

- If any schedule is not applicable score across as “—NA—“.

- If any item is inapplicable, write “NA” against that item.

- Write “Nil” to denote nil figures.

- Except as provided in the form, for a negative figure/ figure of loss, write “-” before such figure.

- All figures should be rounded off to the nearest one rupee. However, the figures for total income/ loss and tax payable be finally rounded off to the nearest multiple of ten rupees.

Part B:Gross Total Income

As we know ITR-1 applies to people earning Income from Salary. Income can be charged under this head/category of Income From Salary only if there is an employer-employee relationship between the payer and payee. Salary includes basic salary or wages, any annuity, gratuity, advance of salary, leave encashment, commission, perquisites in lieu of or in addition to salary and retirement benefits. Income from Salary explains it in detail.

Document which proves the salary earned is Form 16 and Form 12BA.

- Form 16: After the financial year ends, employer gives employee Form 16 which will contain all the earnings, deductions and exemptions available. Understanding Form 16: Tax on income explains Form 16 in detail.

- Form 12BA: give details of Perquisites given by the employer to employee. Understanding Perquisites, Understanding Form 12BA talks about Perquisites in detail.

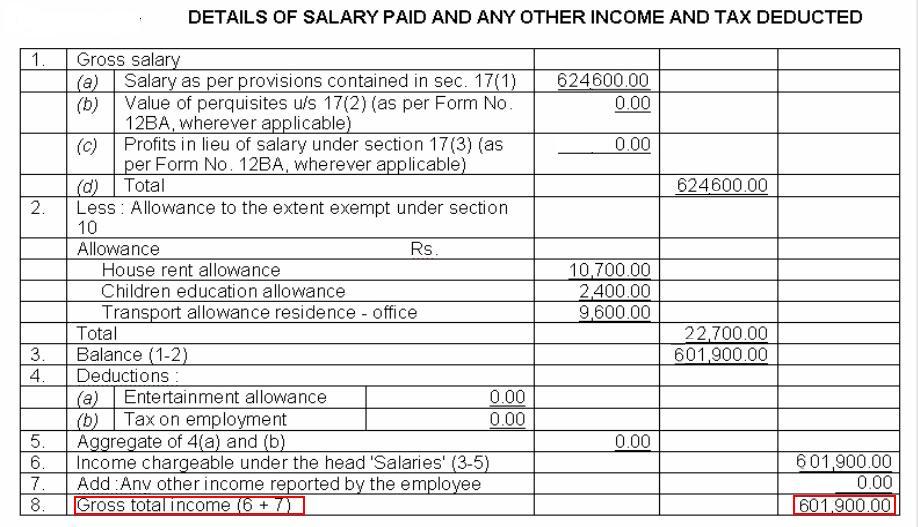

Form 16 of Mr. Mehta is shown in picture below. While Total salary is 6,24,600 because of exemptions under Section 10 ex: HRA, Transport the Gross Total income comes out to be 6,01,900. This is what needs to be filled in field B1 of ITR-1, Income From Salary

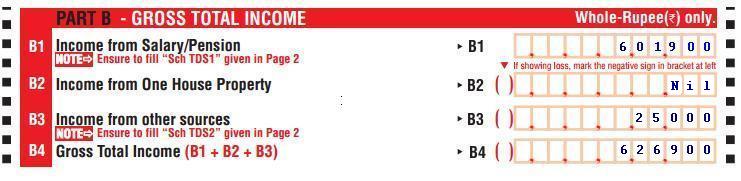

So Part B if ITR 1 for Mr. Mehta will be as follows:

Part C : Deductions and Taxable Total Income

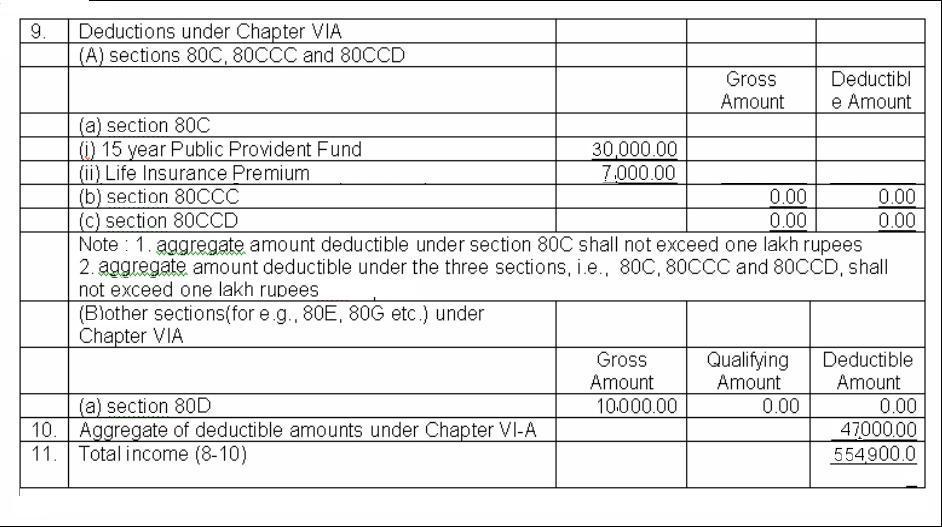

As mentioned earlier Mr. Mehta had invested Rs 30,000 in Public Provident Fund (PPF), paid Rs 7,000 as premium for LIC policy. These investments allow him to save tax under section 80C. He paid Rs 10,000 for premium of health insurance policy for his family which allowed him to save tax under Section 80D. He had submitted proof of these investments were to his employer so these are reflected in his Form16 as shown in picture below.

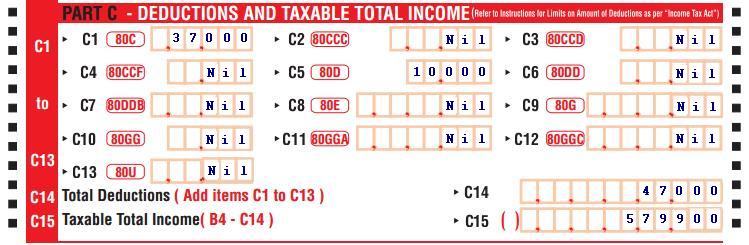

This is reflected in ITR1 Part C as shown in picture below:

Proof for Deductions not submitted to employer

If you have not submitted the proof of tax saving instruments to your employer. Then it will not be reflected in Form 16. But you can still show it in the ITR as shown in image ITR1:Part C.

What would be the difference then: Suppose Mr. Mehta had not submitted the proof then entries in Form 16 for deductions would be 0 hence Total income in Form 16(Point 11 in the image of Form 16:Deductions) would be Rs 6,01,900 and not 5,54,900. This would result in his employer deducting more tax for him.

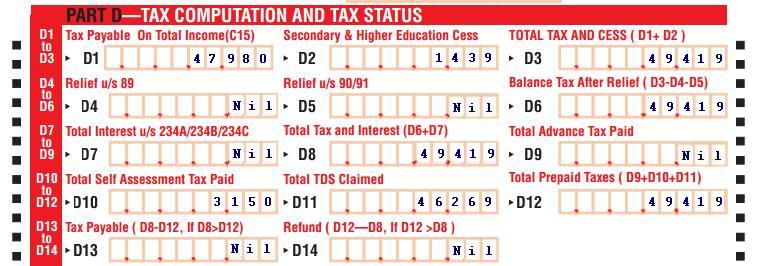

Part D: Tax Computation and Tax Status

We need to now compute tax for Mr. Mehta. Mr. Mehta total taxable income is: Rs 5,79,900 breakup as follows:

- Income from salary after deductions ( 5,54,900) and

- Income from Other Sources (Interest on Saving Bank account Rs 5,000 and Rs 20,000 Interest from FD)

Calculation of Tax

Mr. Mehta is man below 60 years of age so his exemption limit as per Assessment Year 2012-13 is 1,80,000. So the computation of his income is given below

| Description | Income | Tax |

| Exempt Income | 1,80,000 | 0 |

| Income chargeable at 10% | 3,20,000 | 32,000 |

| Income chargeable at 20% | 79,900 | 15,980 |

| Total | 5,79,900 | 47,980 |

| Education Cess @ 3% of Income Tax Payable | 1,439 | |

| Total Tax liability | 49,419 | |

| TDS / Advance Tax deposited | 46,269 | |

| Net Tax Due | 3,150 |

Mr Mehta has some Net Tax Due. This is because of interest on Saving bank account and TDS for Interest on FD was to be at 20% because of Mr. Mehta income slab but bank cut at 10%. So Mr. Mehta has to pay Self Assessment Tax of Rs 3,150 using Challan Challan No. ITNS 280 is used for payment of Income tax.

- Select (0021) INCOME-TAX (OTHER THAN COMPANIES) in tax applicable field

- Select (300) SELF ASSESSMENT TAX in type of payment.

After paying the tax liability, Part D , Tax Computation and Tax Status of ITR-1 would be as shown in image

Note:

- While efforts have been made to provide correct information, this is our understanding of the Income tax law. Apologies upfront for any mistakes. Please let us know and we will correct.

- Please do not construe this as professional financial advice. You should consult a qualified income tax expert(CA/income tax lawyer) prior to making any income tax decision. We accept no liability for any interpretation of articles or comments on this blog being used for actual taxation purposes.

- Please don’t send us emails asking us to check your income tax detail. But if you have any doubt on the article or some clarification is required or you feel some information is wrong. Please leave it in comment section so that all readers can benefit.

Related Articles:

- Calculators : Finotax:Calculator , InvestmentYogi:Income Tax Calculator

- Basics of Income Tax Return

- Filling Individual ITR Form: Fields A1 to A22

- Filling ITR-1 : Bank Details, Exempt Income, TDS Details

- Understanding Form 16: Tax on income, Understanding Perquisites, Understanding Form 12BA

- After filing Income Tax Return

- Income Tax Overview

Picture abhi baki hai mere dost. (Movie is not over yet). In next part we will fill remaining of the ITR-1 Form which has important details like Bank Account, Exempt Income, Filing details of Tax Deducted at Source. Looking forward for your feedback.

Income Tax Dept Instructions for filling ITR-1(pdf)

Hey, thank you so much sir… for sharing greate and peacefull information in this blog. here i would like to share with you some more information on how to e-filing ITR 1 for AY 201-920?

I am Working under private company and earning salary and commission on sale of policies.which ITR should be fill (ITR-1 OR ITR4)

I have discovered a site that has the most affordable rates on name brand flashlights. This site states it has quickly delivering in a protected online order atmosphere. If you are looking for flashlights for outdoor camping or emergency situation situations this is a web site you need to look into.

Initially I was getting around Rs 8000 for a year but my actual salary is around Rs28000 now I got the remaining sum which is upto 3lakh in FY 2015-16 in addition to the salary this adds upto 7-8 lakh in FY 2015-16. As per me taxable income is may be upto 3 lakh… But taxable income shown is 7 lakh…what to do in this scenario???

I have income from Indian govt income 14899

From saving bank account TDS 54

And income from a private company TDS 12

But company and bank not provide me Form 16

Which iTR suitable for me

i am filling the online ITR for Assessment Year 2016-2017 – ITR 1

i can’t find section 80EE for tax deduction against interest paid on housing loan.

Should it be included in section 80E only??

Sir, it is only available from FY 2016-17 or AY 2017-18

FM while announcing the Budget 2016 re-introduced Section 80EE which provides for additional Deduction of Rs. 50,000 for Interest on Home Loan. This incentive would be over and above the tax deduction of Rs. 2,00,000 under Section 24 and Rs. 1,50,000 under Section 80C.

This Deduction of Section 80EE would be applicable only in the following cases:-

This deduction would be allowed only if the value of the property purchased is less than Rs. 50 Lakhs and the value of loan taken is less than Rs. 35 Lakhs.

The loan should be sanctioned between 1st April 2016 and 31st March 2017.

The benefit of this deduction would be available till the time the repayment of the loan continues.

This Deduction would be available from Financial Year 2016-17 onwards.

Thanks a lot for your clarification.

can you please let me know how am i supposed to apply for deduction against interest paid for House loan on the online ITR website.

Interest paid for home loan is included in Calculation of Income from House Property.

If you are using ITR2 then the calculation are in detail.

If you are using ITR1 you need to calculate it yourself and fill in details.

I hope you are NOT going to claim Interest paid for Under constructed house.

If you need more details you can check this Youtube video. How to show home loan interest for self occupied house in ITR 1 tax return

Dear Bemoneyaware team,

Thanks for such a detailed post.

I need to pay tax on interest on fixed deposit for AY13-14. I am not sure of the amount I should pay, so what I did was –

– logged into the govt site http://incometaxindiaefiling.gov.in/

– open ITR1 for AY13-14

– put my interest income in the head “Income from other sources”

– go to the bottom most head “Total tax and interest payable” and note the amount shown there

I think this is the amount I need to pay as tax on fixed deposit, but I am not too sure of this. Can you please suggest if this is indeed the amount to be paid as income tax on fixed deposit interest?

Why suddenly do you want to pay interest for AY 2013-14?

Isn’t your return for AY 2013-14 processed.

Actually this is not my return, its my mother’s. She provided 15H for FY 2012-13 to bank, listening to someone’s advice, but then neither did she pay the taxes by herself nor did she file ITR for AY2013-14.

Now I am clearing up that. Could you please help me on this ?

Hi…Can you please let me know this ?

Sir if I got a salary in cash so is in it important to make a salary slip…nd if I make my salary slip so should i deducted HRA???

Sir I am a govt.sarvant and I want e filling on line by form 16 ,please help me sir fill up form step wise

Sir you can either go through the articles on our website or you can go through the Videos on Youtube such as https://www.youtube.com/watch?v=H1sNl8H6wWQ

I have 2 form 16.

I received a gratuity amount of around 2 lakhs from my previous employer.

Do I need to file ITR 1 or ITR 2?

If ITR 1, where do I need to mention the exempt gratuity amount in ITR 1?

please advise how to reflect the disability pension in the IT return as the entire pension for a soldier with disability, is income tax exempted for the Armed Forces retiree? Regards.

please advise how to reflect the disability pension in the new IT return online— HOW-UNDER WHAT SECTION ? —- as the entire pension for a soldier with disability ATTRIBUTABLE TO MIL SERVICE, IS FULLY TAX EXEMPT, for the Armed Forces retiree? Regards

Should I File ITR2, to show the Gratuity income. then the total income will be as per 26AS..Please Advise

Gratuity income is exempt upto 10 lakhs for private employee.

You need to see how much of your gratuity income is exempt.

Is it mentioned in Form 16.

Show the exempt part of Gratuity income

Hi,

Wanted to know where to show the Gratuity income in ITR Form as the 26AS shows the clubbed income though tax is not deducted for the gratuity. I have included the same under Exempt income. But it shows a net sal diff between Total income(where it actually calculates taxes) and the Salary in TDS1.

PLease advise

Hi, I am filling my E-filling ITR-1 but no any option in form for NSC kindly suggest me how can filling my ITR-1

Interest from NSC is taxable under Income from Other Sources

Deduction under 80C

Sir, how many amount is applicable for saving individual. LIC premium which section mention in ITR 1.

LIC Premium comes under section 80C.

See Part C : Deductions and Taxable Total Income, described in above article

I mean how to rectify saved ITR1 draft, before submission.

Hi, I have filled in ITR1 and saved the draft for submission to IT dept, I forgot to include my SB a/c details and amt of l

penalty I paid. Please advise me how rectify saved from and submit thereafter. Thanks

How are you filing- excel, Java on online.

Just open the form again and add details.

I’m drawing a salary of around 15000 pm.in a private sector. For that i’m not having pay slip and other proof of salary drawn. If asked, they ‘ll give a statement of salary given yearly once in their letter head duly stamped and signed by management representative. Also no deductions was made here. in this case how can i file ITR. Pl. clarify me.

Your income is below the exemption limit ie 2.5 lakh so you are not required to file Income tax return.

during filing e filling ITR 1, if my interest income is 43500, If I am claiming income under other sources income as 33500 and 10000 under D19 column for exemption of income, is it correct computation ? please reply

Add the entire interest to income from others sources, if TDS is deducted show it in TDS2 schedule.

We have explained it in our article Fixed Deposit , Interest , TDS, Tax,Income Tax Return, Refund

Hello,

Thanks for your blog. It really meant a lot.

I have the following query: I have not claimed my medical bills (around 10,000/-),

and has not been included in the income.

My question is, under which section can I include those bills amount and do I need to share those original bills to IT department?

Thanks in advance,

Sham

Unfortunately reimbursements of medical bills can only be done through employer – if you fail to submit bills the employer will deduct tax and pay you the amount of reimbursement in your March salary.

preventive health check up those bills can be claimed under section 80D. If you have not exhausted your limit under section 80D for health insurance, you claim deduction up to Rs 5,000 in your Income Tax Return.

I WISH TO CLAIM TAX-REFUND IN THE ASSESSMENT YEAR 2015-16.I.E.PRESENT A.Y.CAN I FILE ITR-1 ONLINE USING JAVA UTILITY OR JUST BECAUSE I HAVE TO CLAIM TAX REFUND IS IT MANDATORY FOR ME TO USE RETURN FORM ITR-2 ONLY? I SATISFY ALL OTHER RESTRICTIONS STIPULATED FOR FILING ITR-1.KINDLY REPLY BY E-MAIL AS EARLY AS POSSIBLE.

SUDHEER AGASHE

How to file for Refund??

How to file for Return??

Dear Sir,

If I have income from salary, dividends, Long Term Capital Gain and FD interest do I have to fill the Sahaj form or some other form. Please clarify.

Thank you.

As you have Long term capital gains you would have to fill ITR2. For more details check out

our article Income tax Overview

Hi,

Thanks for nice and clear explanation.

Could you please also add a note about the documents/proofs to be send across to IT dept.

– example: if some one has not deposited the savings proofs to his company and wants to avail deductions later while filing tax (part C)

– is proof required that the payment of self accessment tax is done?

– any other required documents.

Thanks,

Cheers,

Sunny

Thanks Sunny.

No documents/proof are needed to be sent to IT dept.

-If someone has not deposited saving proofs to his company he can still claim it to avail deductions. In such a case TDS cut by employer will be higher than if saving proof considered.

-Yes proof of self-assessment is the challan number and tax amount that one has to fill. It is explained in Filling ITR-1 : Bank Details, Exempt Income, TDS Details

Great post. Thanks for sharing. It is so clear and relevant.

Thanks Srinivas for your kind words. Glad to know that you found it relevant

Great post. I love it, it will be definitely useful for salary professional novices about what forms to use and what details to be filled in it during ITR filling.

Thanks for your efforts 🙂

Thanks for encouraging words. Great to be of help. We are sharing efforts of our struggle in filling the ITR.

thans,for great information

Thanks Parveen for appreciating it. It makes our hard work worth it.