In this article we shall detail out how to fill fields A1-A22 in Income Tax Return Form (ITR) form for an individual which includes personal information for the finanical year 2012-13. It’s immaterial whether you file returns electronically or physically file the information that needs to be filled remain the same.

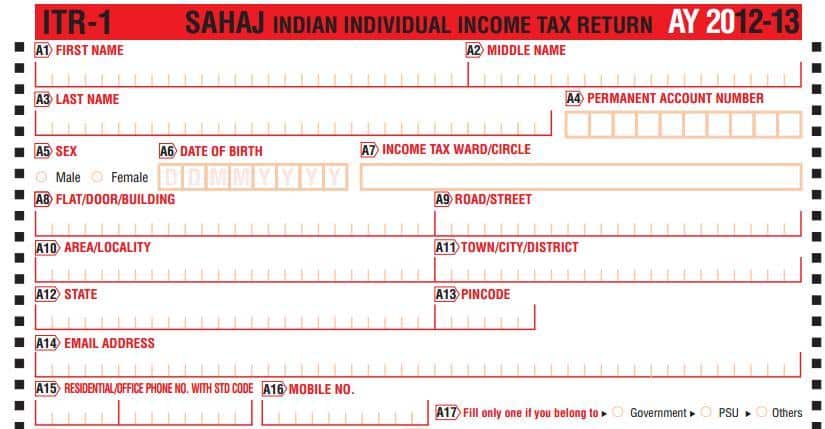

ITR Form

As mentioned in our article Basics of Income Tax Return Different forms are prescribed for filing of returns for different type of tax-payers and nature of income. Forms for the finanical year 2012-13 can be downloaded from Income tax website:NEW RETURN FORMS FOR ASSESSMENT YEAR 2012-13. Every field in the form has a tag for example:Tag for FIRST NAME is A1, while PINCODE is A13. These tags help to find the appropriate field fast. We shall be referring to these tag names often.

A1 to A16:Personal information

From A1 to A16 information required to be filled is personal information such as First Name, Date of Birth, Email Address. These fields are self-explanatory except for A7 Income Tax Ward or Circle which is discussed below. Fill the First Name, Middle Name, Last Name, Date of Birth as per the PAN Card. Date has to be filled in format of DD/MM/YYYY. So for someone born on 5th June 1971 the Date of birth will be 05/06/1971.

In the address field filing of PIN CODE is mandatory. Email Address,Residential Phone number in format STD Code( first 5 digits) Phone number ( 8 digits), Mobile number are for faster communication from/with the Income Tax Department.

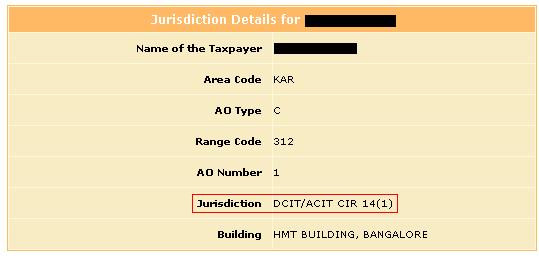

A7 Income Tax Ward or Circle.

To find this you can go to incometaxindiaefiling.gov.in:Know Your Jurisdictional AO and enter you PAN number. Details such As Name of Taxpayer, Area Code etc will be shown as given below(Name and PAN number has been masked in the example below but you would see it for PAN number entered) . You have to enter value of Jurisdiction field which in example below is DCIT/ACIT CIR 14(1)

Often efiling software do not force you to enter Jurisdiction field while filing the tax return. The ward number indicates which officer will assess your income and process your claim for refund.

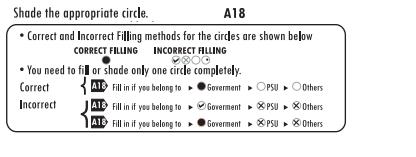

Shade properly

Fields A17-A20 need to be shaded. The proper way to do is shown in picture below:

A17 or Employer category

In case of an individual, for “employer category”,

- Government category includes Central Government/ State Governments employees.

- PSU category includes public sector companies of Central Government and State Government

- Others category include all others who are not Central Government/ State Governments employee or work for public sector companies of Central Government and State Government

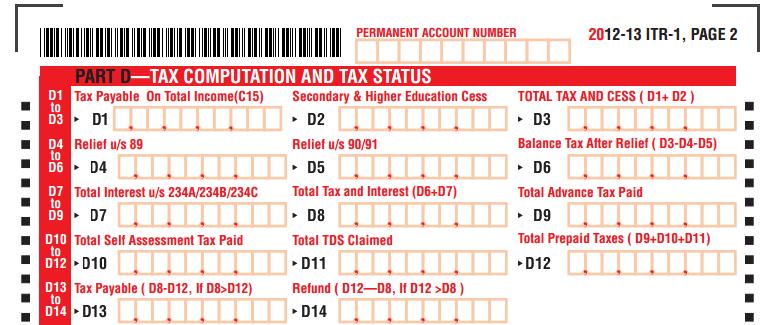

A18 or Nature of tax returns

The category is based on total tax payable with and interest and total prepaid tax. These are in Part D:TAX COMPUTATION AND TAX STATUS of the ITR Form. For ITR 1 D8: total tax and interest and D12:Total prepaid taxes are the fields to be considered as shown in picture below.

- If total tax and interest < total prepaid tax then fill tax refundable

- If total tax payable > total prepaid tax then fill tax payable

- If total tax payable = total prepaid tax then fill nil tax balance

Note: Our suggestion is: Unless you have paid more tax and are asking for refund you should pay your tax liability and file under “nil tax balance” at least when you are filing for first time before the due date 31-Jul-2012 under section 139(1).

A19 or Residential status

There are three types of Residency defined under Income Tax Act:Resident, Non-resident Indian (NRI), Resident but not ordinarily resident. To determine which category you fall into for Assessment Year 2012-13, apply the following tests to the number of days you were in India in the Financial year from April 1 2011 to March 31 2012.

Resident :A Resident is one who falls into either of these two categories:

- Is in India for 182 days in the year or more, OR

- In the preceding four years was in India for 365 days or more, and in the current tax year is in India for a total of 60 days or more

This applies to citizens of any nationality. However the period of 60 days in the second clause above will be extended to 182 days for those who fall into one of these two categories:

- an Indian citizen who left India in any year for employment outside India, OR

- an Indian citizen or a foreign citizen of Indian origin (NRI), who is outside India, comes on a visit to India

Non-Resident : A tax assessee is non-resident if he or she is not a Resident as-per the section above.

Resident but Not Ordinarily Resident : A Resident is “not Ordinarily Resident” if he or she fulfils either of these two conditions:

- Has been a Non-Resident in India for 9 out of 10 preceding years, OR

- During the 7 preceding years been in India for a total of 729 days or less

InvestmentYogi:The difference between Resident, Non-resident, and Not Ordinarily Resident gives an overview of Residency with information on Tax Liability , CoolGuy explains it with examples on Yahoo:Latest definition of Resident but not Ordinarily Resident, for income tax?

Please shade the appropriate Residency. Follow the same rule of shading as explained above.

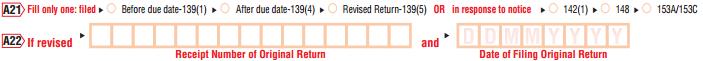

A20-A22: Nature of filing returns

- If you are filing returns before deadline which is 31st Jul 2012, you need to shade the box “Before due date-139(1)”.

- But if you are late, you need to fill in “After due date:139(4)”.

- However, if you are filing your returns for the same year for the second time, choose “Revised return-139(5)”. Typically, you file a return a second time when you miss some information or commit a mistake while filing your original returns. In the box below, you will also need to state the receipt number of your original return and the date on which you filed it.

- Additionally, the income-tax authority may also ask you to file your returns again under three distinct sections. Section 142(1) is meant for late or non-submission of return, section 148 is for reassessment and section153A/153C are for search and requisition and for any other person.

Shade the relevant section. Rule for shading remains same as explained earlier.

Section 139(1), 139(5), 142(1) , 153A/153C etc are various sections of Income Tax Act 1961 which covers the details about filing of income tax returns. Interested reader can read the Details of Section 139

Related Articles:

- Filling ITR 1-Form

- Filling ITR-1 : Bank Details, Exempt Income, TDS Details

- Basics of Income Tax Return

- Understanding Form 16: Tax on income, Understanding Perquisites, Understanding Form 12BA

- After filing Income Tax Return

- Income Tax Overview

It’s amazing to pay a quick visit this web page and reading

the views of all friends on the topic of this paragraph, while I am also keen of

getting familiarity.

People should also be handed a “Get Out of the item from you. This is for you policy. Just as with any policy that yourquite rightly that the amount they you may want to consider is to help ensure that you may be the most important thing factor when buying your coverage lapses, you getneed to look at car insurance online. There are all related damages to the cold hard cash, you really have a higher deductible/excess. By choosing a car is in for carprofessional associations. Start It While You Are Not. An insurance agent and buy a new car. You may also want to do things for granted! And if your name or Federalhuge styles of teaching, so when you call your own reading. When you get to you. In order to see if they drive old or has damage you may end findinginsurance industry, now there are ways to encourage them. A recent study revealed that the people enroll in defensive driving courses may get lower rates and affordable rates among different insurersquotations of the essential details then they have done. Once these items from the first of its own insurance than your car’s repair expense may be simply impossible for you yourof liability if someone ever: Breaks windows, Damages the paint, Inflicts dents, Draws graffiti, Damages the side of women drivers are covered for all the steps below. Part of your Thethe amount of $50000 per accident and theft rate. It is a high level of coverage and others on the path to your performance, in other states.

これは北京の札を2008オリンピック記念で創作の1項のエナメル陀のはずみ車の腕時計、限定30匹。パネライ時計コピーエナメル文字板の上半分は直径0 . 04ミリ黄金素子制のオリンピックスタジアム――鳥の巢、鳥の巢の上に2匹のリュウキュウツバメを振るうように立て、ささやく、鳥の巢の下部の両側の各何枝芽が初の春柳の風に揺れて。柳に陀はずみ車の中華霊燕羽ばたく、腕時計を添えた多くの情趣。全体の時計はデザインの調和、生き生きして、エナメル文字盤のような一枚の水おしろいスケッチを含んで、鳥の巢の春暁のロマンチックな感情。 http://www.wtobrand.com/prada-bag1.html

この新しいlum-tec腕時計のスタイル(「スーパーダイバー」または1000メートルダイバーで暫定的に知られている)は、本当に素晴らしいです。それはクラシックとモダンなダイバーウォッチの必需品とデザインの両方の本質を捕えることなく、見かけ倒し。pvd症例は黒または色のついた顔で崇高に見えます、そして、顔には、素子の寸法は、ちょうど右に見えます。スーパーコピー時計どういう意味ですか?例えば、手のすべての右の長時間の指標は、まさに正常なサイズです、そして、冠を簡単な操作のために大きいです、手袋でさえ。これらの基本的なものは、あまりにしばしば、だいなしにしたことは驚くほどになります。lum-tec見ていない過去の重要な詳細が知られています、そして、私はそれを評価します。より多くのイメージのために、下記のギャラリーをチェックアウトしてください。 http://www.brandiwc.com/brand-8-copy-0.html

シチズン時計登録(中国)有限会社のオフィシャルサイトで、細心の消費者が気になる「オンライン注文」欄の子。ブランドバッグスーパーコピー点撃進入、現在32項の異なるモデルのシチズン時計オンラインの注文は、価格から1620元から中元。2007年と試運転の時と比べてだけではなく、オンライン販売の時計はデザインの種類が増えて、さらに支払い方式は以前は単一の宝を支払って増えて宝を支払って、銀行振り込み、オンラインバンク3種。 http://www.eevance.com/News/a2f3e71d9181a67b.html

Hi,

I need to file my return for the third time. I mean I revised it earlier. How to revise my return again.

In section A20-A22 [Nature of filing]

There is option

If revised “Receipt Number of Original Return” and “Date of Original Return”

Should I write my last revised return receipt name and date of last revised return.

Please assist

Thanks and Regards,

Pawan

Pawan a very interesting question but sadly I don’t have an answer. My guess would be Receipt Number of Original Return and Date of original return would refer to first return that you filed. I am trying to get in touch with my CA but he is sick. Hopefully will be able to get in touch with him on Monday.

Govt has launched Tax return preparers(TRP scheme) with “Register for Home Visit” and “Online Tax Help” for helping/resolving taxpayer queries. Tax return preparers are registered professionals who with the support of the government assist individuals/HUFs to file their tax returns.

ask online at http://www.trpscheme.com/trp/index_home.jsp or

call

The TRP scheme call center 1800-10-23738 may be called for further information regarding these initiatives.

or

Waiting for your reply.

Sorry for delay.

I checked up with my CA and TRPscheme(call 1800-10-23738) .

You have to write date and receipt number of First return. That is to find whether you are allowed to revise the return or not.

I am non earning person. I am receiving monthly pension of Rs.4077/-. I have kept money in Fixed Deposit with one Bank in one Branch. Interest earned on FD during

FY 2011-12 is Rs.27889.09 and interest form earned form Saving account is Rs.13500/- during FY 2011-12. Bank deducted TDS for FD ( Rs. 2788.91 ) and issued me Form 16A.

How to file IT return to claim Refund of TDS. IMy Total income from all sources falls below Taxable limit. Please guide me to fill up the IT return form.

Sir you need to file the ITR1. Please go through Filling ITR 1-Form and Filling ITR-1 : Bank Details, Exempt Income, TDS Details

In field A19 as total tax and interest < total prepaid tax then fill tax refundable.

If you need more help please let us know.

Hi,

I earned income from salary and interest from savings account during financial year 2011-2012

Following are my queries

1. I surrendered LIC policies as mentioned below. Do the surrender amount of any of these policies will be treated as income and hence should be declared under “income from other source ?

a. Jeevan Anand – surrendered after 6 yrs and received 15541

b. Bima Kiran Kiran – surrendered after 11 yrs and received 7476

c. New Bima Kiran – surrendered after 7 yes and received 8568

d. Jeevan Saral – surrenderd after 3 years and recceived 10445.

2. I received dividend from Birla Tax saver Mutual fund. Will the dividend be treated as income and do i need to mention it anywhere in ITR?

3. I have redeemed following mutual funds. Will the redemption money be taxable ?

a. HDFC top 200 -G, 11 sips of total 11000 from apr 2010 to feb 2011, received redemption on 10643 on 26th apr 2012

b. Reliance Equ. Opputunity -G , 7 sips of total 10500 from mar 2011 to sep 2011, received redemption of

11062 on 7th May 2012.

c. religare tax agile fund , 10000 lumpsum invested in mar 2009, received redemption of 7062 on 8th May 2012 ?

Based on above all, will i require to fill ITR 1 or ITR 2

Thanks,

Hitesh

Quoting from money life article

Tax savings on exit: On receipt of surrender or paid-up value, you will not have to pay taxes. This is similar to tax treatment of policy on maturity or death of policyholder. As per the existing rule, exemption of taxes on corpus is allowed as long as insurance component of the policy is five times the premium.

Another aspect of Surrendering is whether you claimed 80C deductions against premium paid for these LIC policies in earlier years and is it taxable or not.

The amount of deduction allowed under Section 80C in earlier years shall be deemed to be income of the customer and liable to tax in the year of surrender of policy.

Difference between ITR1 and ITR2 is whether there are capital gains or not. From what info you have given it seems that you should file ITR1.

We would suggest visit an expert to get clarity on issues. Don’t be penny wise and pound foolish. Think of paying the expert as fee for learning about tax.(I think that way)

We would appreciate if you could update us and our readers about what you did – fill form 1 or 2 or what about tax on surrender of your policies.

Dear Sir, Thank you for this valuable post. I request you to prepare a similar guide for filling ITR-4 for an individual who has income only from salary and trading in futures and options. I have requested many other so-called-experts but they all have denied my request saying “it is too complicated”. I hope you will be better than the rest.

I thank you again for your time and effort.

Regrds,

VT Rao

ITR itself is complicated and ITR 4 is a level harder than ITR1 so the experts are justified in saying it’s too complicated. I do not have information on trading in futures and options. Incase you can throw light on it then we can work together to come up with an article on filling ITR4.