Your credit score is an extremely important part of your financial future. There are going to be some purchases that you will want to make in your life that you will have to borrow money for. For instance, you probably can’t afford to buy a home or a car outright, so you will have to go to a lender to get a loan. Lenders use your credit score to assess your risk. If you seem like a high risk it will appear as if you won’t be able to pay the loan back, so you might get denied. This is just one of the many reasons that your credit score is so very important. This article covers the other reasons.

Table of Contents

About Credit Score

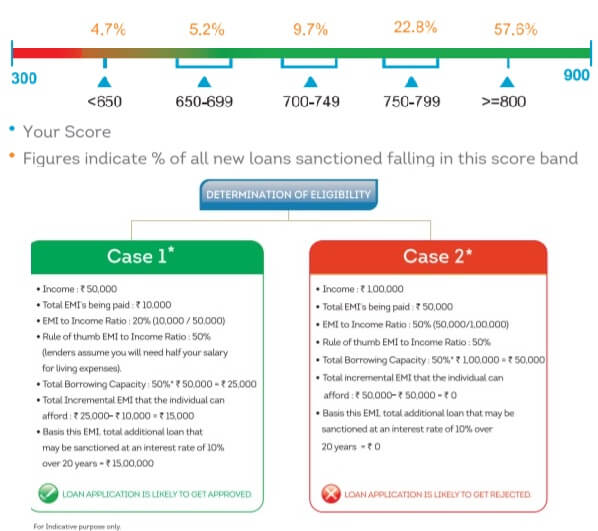

A Credit Score is a three digit numeric summary of your credit history which ranges between 300-900. It is derived by using details found in the Accounts and Enquiries section on your Credit Information Report (CIR). It indicates the probability of default of a borrower based on their credit history.

Your Credit Score is one of the first checks that a lender does when they are evaluating your loan application. It is important to know that nearly 90% of the loans are granted for individuals with a score greater than 750. The higher your Credit Score, the higher are the chances of your loan application getting approved.

Loan eligibility is determined using information such as Income. Current EMIs, and Credit Score. Once a Credit Score meets the lender’s internal credit policy criteria. they then analyse the documents to understand some key points before approving loan application as mentioned below.

Your Credit Score Can Save You Money

If you want to buy a home at some point, you are going to have to take out a mortgage. Homes are not cheap and this will be a loan that you will be paying on for many years to come. This is where a good credit score could literally save you thousands of dollars. When you take out this mortgage you will also be charged an interest rate for the loan. With a higher credit score, you are going to get a lower interest rate. If your credit score is lower, you are going to be charged higher interest rates. Over a thirty-year period, the savings on this lean really could be substantial. The same principle applies when you buy a car.

Insurance Premiums

It is true that some states don’t allow insurance providers to use your credit score to set the premium that you will pay for insurance. However, there are some states that do allow this. If you live in a state that does allow these principals, you are going to pay much less each month for your insurance coverage with a better credit score. This might not seem like a substantial amount but think about all the insurance that you are going to need. You will need home insurance, all your cars will need to be insured, you need life insurance and you might even need business insurance. If you aren’t even sure what your credit score is you can check your free credit score here.

Cable And Internet

Cable and Internet are not essential for the home, but you probably won’t’ find many homes in today’s time that does not have these two commodities. Well, you might be surprised to learn that many Internet, TV and cell phone providers are now checking customers’ credit scores before setting them up with service. If your score is low enough it is possible that you might be denied an account. Some providers may not deny you service, but they may require you to pay a security deposit. This would be extremely frustrating.

More Employment Options

Without a job, you won’t be able to maintain your credit score. And, there are some employers these days that are running credit score checks before hiring employees. If you have a lower credit score it might look like you are irresponsible. This would not be a good sign for an employer.

Related Articles: