The depository is an organization that holds financial securities with it in Demat form i.e electronic form. The depository is similar to a bank, but while a bank holds your money, they hold stocks, shares, bonds etc. It is responsible for the maintenance of ownership records and facilitation of trading in dematerialized securities. There are only two depositories in India – NSDL, and CDSL. This article is about Why should you know about depository? What is a depository? What are NSDL and CDSL? How do they differ?

Table of Contents

Why should you know about depository?

It is good to know but in most cases, one just opens a Demat account and uses it.

One when one has to transfer the Demat account from one broker to another, then one has to answer the question of whether the transfer is inter depository or intra depository.

It is like admin department in the school, it does background work. One only deals with admin department during school exit when one needs transfer certificate.

What is a depository? What is NSDL or CDSL?

When you open a Demat account and buy any shares and take delivery, your shares are held by a depository.

So when a company needs to know its shareholder details to send dividends, rights, bonuses, or any other notification, it asks for the information from these depositories in India.

A Depository facilitates holding and transacting in securities in the electronic form and facilitates settlement of trades on stock exchanges. These securities include stocks, ETFs(Exchange-traded Funds), debentures, bonds, units of mutual funds, units of Alternate Investment Funds (AIFs), Certificates of deposit (CDs), commercial papers (CPs), Government Securities (GSecs), and Treasury Bills (T-bills).

It does away with all the risks and hassles normally associated with paperwork

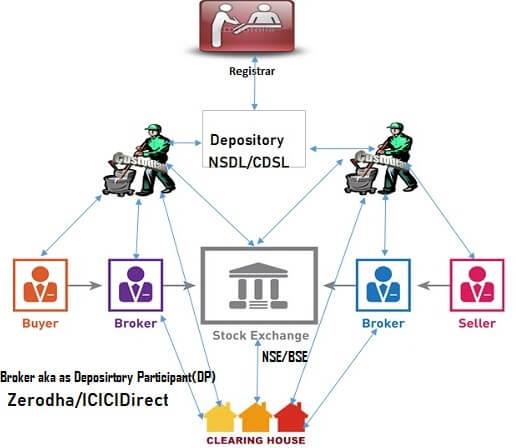

Depository interacts with its clients or investors through its agents, called Depository Participants popularly called DPs or broker. For any investor to avail, the services provided by the Depository have to open a Depository account, known as Demat Account, with any of the DPs.

A DP can be a bank, financial institution, brokerage house, or similar entity. To be eligible, it must be registered with the Securities and Exchange Board of India (SEBI) and comply with its norms and guidelines. The image below shows the interaction between investors(buying/selling stocks), Exchange, Depository and Depository Participant(DP)

You can’t directly choose which depository to open an account. It is the broker or the Depository Participant (DP) who decides which depository to use for example Zerodha is on CDSL while ICICIDirect is on NSDL.

Even you can open an account with two DP’s and you can transfer the share from NSDL to CSDL and vice versa

- National Securities Depository Limited (NSDL) is promoted by the National Stock Exchange(NSE), Industrial Development Bank of India and Unit Trust of India etc. Its website is https://nsdl.co.in/

- Central Depository Services Limited (CDSL) is promoted by the Bombay Stock Exchange(BSE), State Bank of India, Bank of India among others. Its website is https://www.cdslindia.com/ CDSL was listed on 30 June 2017 on the National Stock Exchange (NSE)

List of services provided by CDSL and NSDL

- Account opening

- Account statement

- Maintenance of Demat accounts

- Trade settlement

- Share transfers

- Rematerialisation and dematerialisation

- Distribution of non-cash corporate actions like Stocks bonus, splits

- Nomination/transmission

- Changing account details

CDSL, NSDL, and Demat Number

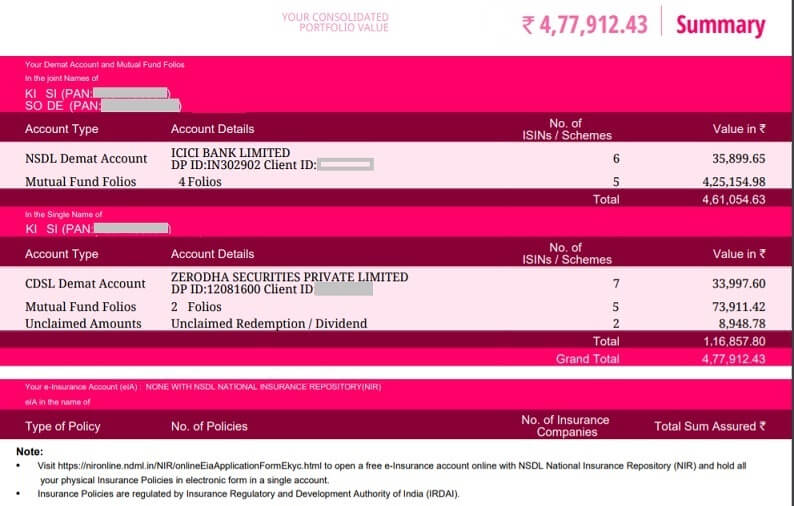

A Demat account number is a combination of the DP ID and the customer ID of the Demat account holder. Usually, the first 8-digits of your Demat account number is your DP ID where the last 8-digits of your Demat account number is the Customer ID of the account holder.

For NSDL, the Demat account number starts with “IN” followed by a 14-digit numeric code.

So one can find whether’s one depository is CDSL or NSDL from the Demat number as shown in the NSDL CAS Statement in the image from the article NSDL CAS, CDSL CAS

For example,

- For CDSL, if your Demat account number is 0101010102020202, in such a case 01010101 is the DP ID and 0202020202 is the Demat account holder’s customer ID. The Demat account number is also known as Beneficiary Owner ID or BO ID in the case of the CDSL

- For NSDL, if a Demat account number is IN12345698765432, in that case, IN123456 is the DP ID and 98765432 is the customer ID of the Demat account holder.

Differences between NSDL and CDSL

There is not much difference between the NSDL and CDSL. Both NSDL and CDSL are regularized by the Indian Government and offer the same facilities to customers. One can transfer shares from the Demat account between two depositories. The table below highlights the difference between NSDL and CDSL

| NSDL | CDSL | |

| Abbreviation | National Securities Depository Limited | Central Depository Securities Limited |

| Website | https://nsdl.co.in/ | https://www.cdslindia.com/ |

| Operating Market | National Stock Exchange (NSE) | Bombay Stock Exchange (BSE) |

| Founded | 1996 | 1999 |

| Promoters | IDBI Bank, UTI, etc. | HDFC, SBI, BOI, BOB etc. |

| Demat account number format | 16-digit alpha numeric number.

Account number begins with ‘IN’ followed by 14 numeric digits |

16-digit demat account number |

| Number of depository participants registered

(As on February 29, 2020) |

278 | 588 |

| Investor Accounts

(As on 31 Jan 2021) |

1.95 crore | 3,04,09,585 |

List of DPs on CDSL

You can check the CDSL website for a list of DPs, the important ones are given below

- ZERODHA BROKING LIMITED

- Upstox

- 5PAISA CAPITAL LIMITED

- Anand Rathi Share & Stock Brokers

- Geojit BNP Paribas Financial Services

- IL&FS Securities Services

- India Infoline

- J M Financial Services

- Karvy Stock Broking

- Motilal Oswal Securities

- Reliance Securities

- SBICap Securities

- Sharekhan

- SMC Global Securities

- Stock Holding Corporation India

- The Hongkong & Shanghai Banking Corporation

List of DPs on NSDL

- ICICIDirect

- HDFC Securities Limited

- IIFL Securities

- Kotak Securities Limited

Related Articles:

- Market Prediction using INDIA VIX – All You Need To Know

- Buy or Sell Stock at your Price: GTT of Zerodha, ICICIDirect VTC, HDFC Securities GTD

- How to buy Stock: Delivery or Intraday, Market or Limit, T+2

- Difference Between NSE and BSE, Listing of company on Stock Exchange

- Indians Invest in US Stock Market: Why, DOW, NASDAQ, How to invest

- Investing in Stock Market: Open Demat account and Trading account

- Top Websites for Indian Stocks Market Investors, Stock selection

- Technical Analysis and Fundamental Analysis of Stocks

So what is your depository?