Reserve Bank of India (RBI) placed Yes Bank under a moratorium on 5 Mar 2020. PMC or Punjab and Maharashtra Cooperative Bank was put under RBI watchlist in Sep 2019. The PMC bank crisis claimed many lives. Angry depositors have been gathering to protests to get their money out. From 1969 onwards, 36 private banks have been put under moratorium in the public interest, due to mismanagement and have gone out of existence. This article covers, What is a moratorium? What happens when a bank is placed in moratorium? What kind of restrictions one can face? Can banks fail? Which banks in India have failed? Which are too big to fail banks? How many bank accounts you should have and how to choose

Table of Contents

What is moratorium

A moratorium is a temporary suspension of an activity or a law until future events warrant lifting the suspension or related issues have been resolved. A moratorium may be imposed by a government or by a business. Moratoriums are often enacted in response to temporary financial hardships. Some examples of the moratorium:

On 27 Mar 2020, RBI announced 3 month EMI moratorium due to Coronavirus offered for EMI’s and Credit card dues which fall between 1 March and 31 May 2020. EMI is for term loans like home loans, personal loans, credit card dues etc. To pay or not pay EMI, Credit Card dues for 3 months, RBI moratorium due to Covid 19

On 5 Mar 2020, the RBI imposed a moratorium on Yes Bank restricting withdrawals at Rs 50,000. It was lifted on 18 Mar 2020.

In Sep 2019 PMC Bank or Punjab and Maharashtra Cooperative Bank was put under RBI watchlist. Withdrawals from PMC bank are still capped at Rs 50,000 (as on 21 March 2020).

What happens when your bank comes under moratorium?

In the case of PMC Bank and Yes Bank, once RBI placed the bank in the moratorium, several restrictions were placed. What kind of restrictions that one can face?

Q If my bank deposits are insured, should I worry?

Your deposits up to ₹5 lakh in each bank are insured by the Deposit Insurance and Credit Guarantee Corporation. However, this cover is triggered only when the bank is put under liquidation or its license is cancelled. It is not applicable if the bank is temporarily placed under moratorium or suspended. However, all deposits will continue to fetch interest as per prevailing interest rates. Deposit insurance on bank failure, Amount, Limit

Q Can I withdraw money from ATM if the bank is placed under moratorium?

Withdrawals at ATMs are permitted up to the prescribed limit. Yes Bank saving/current bank account holders could only withdraw up to Rs 50,000. PMC bank saving/current bank account were allowed to withdraw only 1000 Rs(subsequently raised to 40,000 and then to 50,000) in six months

Q What happens to my bank debit/ credit card?

Debit cards will permit withdrawals at ATMs up to the prescribed limit. However, debit and credit cards may not be usable at merchant outlets as Point of Sale terminals may be disabled temporarily.

Q What happens to cheques issued or deposited if bank is placed under moratorium?

All clearing activities are typically suspended during the moratorium. Your cheques already issued will not be honoured till the clearing activities are restarted. Similarly, cheques you have deposited will not be presented in clearing till reinstatement of clearing activities.

Q What happens to payments towards the bank’s credit card EMIs and loans?

If the bank allows, customers can transfer funds into the bank from third party accounts. In case of Yes Bank, inward IMPS and NEFT services were enabled to ensure that customers can make payments towards credit card dues and loan obligations from other bank accounts.

Q What happens to the bank’s forex card if bank is placed under moratorium?

Forex cards may remain unusable for an indefinite period of time.

Q Will I be allowed to operate or access locker facilities?

You will be allowed to access your locker even if your bank is placed under moratorium.

Q What happens to my loans if bank fails?

A The bank will not be able to grant or renew any loan for the period it is placed under moratorium. Your ongoing loans will, however, have to continue to be serviced.

Q If my bank is merged with another, what happens to the deposit rates and loan conditions?

In case a bank is merged with another, the existing terms and conditions for deposits and loans in your name may change. Even when there is no merger or only a partial takeover, existing terms and conditions may be changed at the discretion of the management or as directed by the RBI. Any change in interest rates or terms won’t be liable for compensation.

Can Banks fail?

Between 1947 and 1969, 559 private banks in India failed, with numerous people losing their life’s savings. A total of 736 private banks failed, amalgamated, ceased to function or transferred their liabilities and assets, or went into liquidation between 1948 and 1968

14 largest commercial banks that accounted for 85% of bank deposits in the country then were nationalised in the midnight of July 19, 1969. Later in 1980, six more banks were nationalised. Our article Nationalisation of banks: When, Why and Impact explains it in detail

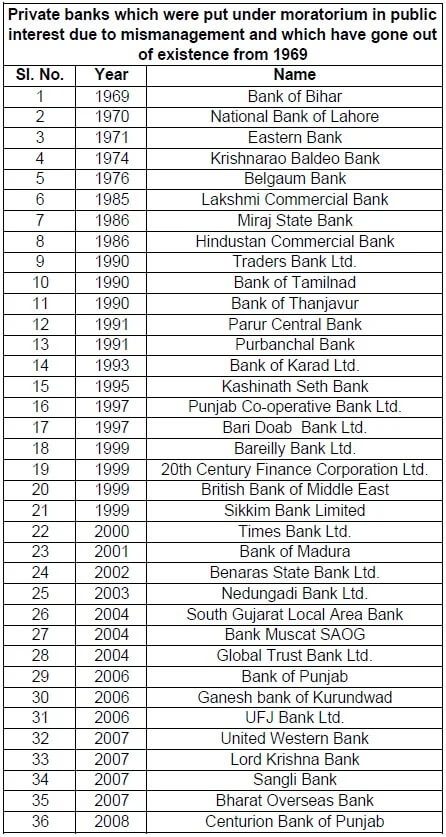

From 1969. 36 private banks have been put under moratorium in the public interest, due to mismanagement and have gone out of existence as shown in the image below. Several of them were merged with healthy Public Sector Banks (PSBs), such as the high-profile case of the Global Trust Bank which was merged with the Oriental Bank of Commerce in 2004.

Too Big to Fail banks in India

In India State Bank of India, HDFC Bank and ICICI bank are classified as too big to fail banks. The too-big-to-fail tag also indicates that in case of distress, the government is expected to support these banks. Due to this perception, these banks enjoy certain advantages in funding. It also means that these banks have a different set of policy measures regarding systemic risks and moral hazard issues.

Domestic systemically important bank or D-SIB means that the bank is too big to fail. Banks whose assets exceed 2% of GDP are considered part of this group. If a domestic systemically important bank or DSIB fails, there would be significant disruption to the banking system and the overall economy. The concept of D-SIB emerged after the global financial crisis.

As per the framework, from 2015, every August, the central bank has to disclose names of banks designated as D-SIB. It classifies the banks under five buckets depending on the order of importance, bucket five is more important than bucket one. ICICI Bank and HDFC Bank are in bucket one while SBI falls in bucket three.

Our article Banks Failure: Can Banks in India Fail? Too Big to Fail Banks discusses it in detail.

How to choose your bank accounts, Number of bank accounts?

Banking serves as the core of our financial activities. We should take a safety-first approach to this aspect. Yes, a customer’s deposits are insured up to ₹5 lakh per bank (raised from 1 lakh in Budget 2020). Let’s start with some precautionary measures that can help avoid a liquidity crunch or loss of savings if your bank fails.

- Don’t run after higher interest rate on Saving bank account/ Fixed deposit.

- Don’t keep all savings tied up in one bank Maintain savings accounts in at least 2-3 different banks and spread the money across these accounts. This should be regardless of whether the bank is public or private. This way, you have multiple options to fall back on in case one account gets frozen.

- Have different family members bank with different banks. Even if one member’s savings get stuck, others can chip in to cover expenses

- Consider spreading the ECS mandates for loans, SIPs and other bill payments across different accounts. Have one primary and a secondary bank account, letting ECS mandates run from the primary bank account while linking investments to a separate bank account.

What to look for when choosing a Savings Account: Bank, Interest rate, Balance covers it in detail.

We would recommend having account in 1 nationalised bank and 1 public sector bank.

Related Articles:

- Deposit insurance on bank failure, Amount, Limit

- Nationalisation of banks: When, Why and Impact

- Punjab and Maharashtra Co-operative (PMC) Bank

- What are Central Banks,What is RBI? What do they do?

- What to look for when choosing a Savings Account: Bank, Interest rate, Balance

How many bank accounts do you have? How did you choose these bank accounts? What do you look for while choosing bank account?

3 responses to “What happens when a bank is placed in Moratorium : ATM, NEFT, Can banks fail”

Thanks for taking time and writing this article.. this much historical data collection is a worthy and great effort… Thank you so much.

मैंने काफी बार pf withdraw के लिए apply किया पर हर बार आधार otp मिलता तो है परन्तु apply नहीं होता । कृपया मुझे बताएं कि pf विभाग के अधिकारियों ने काम न करने की क्या कसम ले रखी है। मेरे पैसे मुझे जरूरत के समय नहीं मिल रहे। निकम्मे कर्मचारी, कामचोर विभाग शर्म करो । Uan-101105550509

How are you trying?