If the bank fails financially and has to go in for liquidation then a depositor can get up to Rs 5 lakh(before 4 Feb 2020 it was 1 lakh) under the Deposit Insurance Scheme of the Bank. The debacle of Yes Bank, Punjab and Maharashtra Co-operative (PMC) Bank has brought back the focus on depositors’ money protection and deposit insurance. Let’s look at the deposit insurance scheme in detail.

Finance Minister Nirmala Sitharaman in her Budget speech of 2021 announced that depositors will have easy and time-bound access to deposits if a bank gets liquidated

Table of Contents

What is Deposit Insurance?

In India, deposits like savings deposits, term deposits, and Recurring Deposits (RD) in most of the banks are covered by Deposit Insurance. i.e their deposits in the bank are insured up to Rs 5 lakh raised from 1 lakh on 4 Feb 2020. So if the bank fails and is liquidated then the depositor will get upto Rs 5 lakh. If Shyam has Rs 75,000 in the failed bank he will get only 75,000 Rs. While if Meena has 6.6 lakhs in a failed bank she will get only 5 lakhs and will lose 1.6 lakh.

Banks have the right to set off their dues from the amount of deposits. The deposit insurance is available after netting of such dues.

Deposit insurance is a measure implemented in many countries including India to protect bank depositors, in full or in part, from losses caused by a bank’s inability to pay its debts when due. Some 100+ countries have instituted some form of deposit insurance. Wikipedia article Deposit Insurance gives more information about how different banks in countries provide deposit insurance.

Please note, that DICGC will be paid but when is a question. In the Madhavpura Mercantile Co-operative bank (Gujarat-based) fiasco involving the infamous stockbroker Ketan Parekh during 2012 still, many depositors have not received even Rs 1 lakh from the DICGC

You can check the DICGC Claim Submission Pending page to understand different circumstances under which payment could be delayed. A simple appeal by the bank can drag on for months to years.

Deposit insurance is only symptomatic treatment. It does not address the cause. It is not a cure.

Which banks are covered under Deposit Insurance?

In India, all commercial banks including branches of foreign banks functioning in India, local area banks and regional rural banks and cooperative banks are insured by the DICGC.

All co-operative banks other than those from the States of Meghalaya, and the Union Territories of Chandigarh, Lakshadweep and Dadra and Nagar Haveli are covered under the deposit insurance system of DICGC.

However, government and inter-bank deposits are not covered. Also, deposits of the state land development banks with the state co-operative bank are not covered.

As on March 31, 2019, the number of registered insured banks stood at 2,098, comprising 157 commercial banks and 1,941 cooperative banks. With the current limit of deposit insurance in India at Rs 1 lakh, the number of fully protected accounts at end-March 2019 constituted 92 per cent of the total number of accounts, as against the international benchmark of 80 per cent.

The total insured deposits of Rs 33,700 billion as at end-March 2019 constituted 28.1 per cent of assessable deposits of Rs 120,051 billion, as against the international benchmark of 20 to 30 per cent.

The size of the Deposit Insurance Fund (DIF) of DICGC stood at Rs 937.5 billion as on March 31, 2019. During 2018-19, the Corporation sanctioned total claims of Rs 0.37 billion as against claims aggregating Rs 0.43 billion during the preceding year. As per the 2018-19 annual report of RBI, four cooperative banks were liquidated during the year, for which the claim list of depositors is yet to be received by RBI.

Who provides the Deposit Insurance in India?

Deposit Insurance in India is provided by DICGC or Deposit Insurance and Credit Guarantee Corporation. DICGC is a subsidiary of the RBI was set up under an Act of the Parliament for the purpose of insurance of deposits and guaranteeing of credit facilities. The Deposit Insurance and Credit Guarantee Corporation Act, 1961, provides deposit insurance of up to Rs 1 lakh and the rest of the amount is forfeited in the event of a bank failure.

DICGC does not directly charge any premium from bank depositors but banks pay a nominal premium for the cover. DICGC collects a premium of 0.05% on the entire outstanding deposit. This means that a bank whose deposits are largely high value ends up paying a premium on even that portion of deposits that are not covered.

DICGC is a mere pay box. It plays no role in thinking about when to intervene in a bank, and in running a smooth bankruptcy process.

When is Deposit Insurance to be paid?

The DICGC is liable to pay to each depositor through the liquidator, the amount of his deposit upto Rupees one lakh within two months from the date of receipt of claim list from the liquidator.

If a bank is reconstructed or amalgamated/merged with another bank: The DICGC pays the bank concerned, the difference between the full amount of deposit or the limit of insurance cover in force at the time, whichever is less and the amount received by him under the reconstruction / amalgamation scheme within two months from the date of receipt of claim list from the transferee bank / Chief Executive Officer of the insured bank/transferee bank as the case may be.

Has Deposit Insurance ever been paid?

According to the DICGC annual report it has paid Rs 4,822 crore in claims in respect of 351 co-operative banks since inception.

No scheduled commercial bank has been allowed to fail since liberalisation, with RBI and government ensuring that failed banks are acquired. Bank failures have been restricted to the cooperative sector.

Between 1947 and 1969, 559 private banks in India failed, with numerous people losing their life’s savings. One of the reasons for the Indian government’s decision to nationalise the biggest banks in India in 1969 was the huge number of instances of private banks going bust.

Our article Nationalisation of banks: When, Why and Impact discusses about why the banks were nationalized

From 1969 onwards, 36 private banks have been put under moratorium in public interest, due to mismanagement and have gone out of existence.

Is Deposit Insurance per account? Or per branch?

As per official Deposit Insurance

Each depositor in a bank is insured up to a maximum of 5,00,000 (Rupees Five Lakh) for both principal and interest amount held by him in the same right and same capacity as on the date of liquidation/cancellation of bank’s licence or the date on which the scheme of amalgamation/merger/reconstruction comes into force.

So if more than one deposit accounts (Savings, Current, Recurring or FD(Fixed Deposits)) is held by an individual in one branch, all the amount, interest is summed up to determine the insured limit of Rs 5 lakh. So if Satish has 20,000 Rs in Saving Bank account and FD with a maturity value of Rs 6 lakhs. Then Satish will only get 5 lakhs.

In fact, deposits across all the branches of the bank are totalled. So if Mehak has FD of maturity value 5.10 lakh in Bandra branch of a bank and FD of maturity value Rs 70,000 in another branch, then also she will be covered till Rs 5 lakh.

If you have deposits with more than one bank, the deposit insurance coverage limit is applied separately to the deposits in each bank.

How does Deposit Insurance work for Joint accounts?

In case of joint accounts, the order of account holders is taken into account to find the total insured limit. For example, If Shri S.K. Pandit also opens other deposit accounts in his capacity as a partner of a firm or guardian of a minor or director of a company or trustee of a trust or a joint account, say with his wife Smt. K. A. Pandit, in one or more branches of the bank then such accounts are considered as held in a different capacity and different right. Accordingly, such deposits accounts will also enjoy the insurance cover up-to rupees one lakh separately.

The following table shows the maximum insurance account based on different accounts held by the individual in a bank.

| Account Holder(type)

|

Savings A/C | Current A/C | FD A/C | Total Deposits | Deposits Insured upto | |

| Shri S. K. Pandit (Individual) | 17,200 | 22,000 | 80,000 | 1,19,200 | 1,00,000 | |

| Shri S. K. Pandit (Partner of ABC & Co.) | 75,000 | 50,000 | 1,25,000 | 1,00,000 | ||

| Shri S. K. Pandit (Guardian for Master Ajit) | 7,800 | 80,000 | 87,800 | 87,800 | ||

| Shri S. K. Pandit (Director, J.K. Udyog Ltd.) | 2,30,000 | 45,000 | 2,75,000 | 1,00,000 | ||

| Shri S. K. Pandit jointly with Smt. K. A. Pandit | 7500 | 1,50,000 | 50000 | 2,07,500 | 1,00,000 |

Can Limit for Deposit Insurance changed?

The limit of Deposit Insurance is capped at ₹1 lakh for both principal and interest held in a bank since 1993.

The limit has been revised periodically. From ₹5,000 per depositor in 1968, it was revised to ₹1 lakh in 1993.

Is the Deposit Insurance of ₹1 lakh per depositor adequate?

The current upper limit of ₹1 lakh per depositor needs to be revisited, experts say. Over the years, the composition of the bank deposits has undergone massive changes in India.

The DICGC coverage should be revised and bifurcated into 2 categories, said a State Bank of India report. There should be 1) coverage of at least ₹1 lakh for savings bank or SB deposits (around 90 per cent of the total SB accounts) and 2) coverage of at least ₹2 lakh for term deposits (around 70 per cent of the total TD accounts).

How does Deposit Insurance limit in India compare to other countries?

Deposit Insurance is lowest in India. It was revised to Rs 1 lakh in 1993 to Rs 1 lakh. It was raised to 5 lakh on 4 Feb 2020.

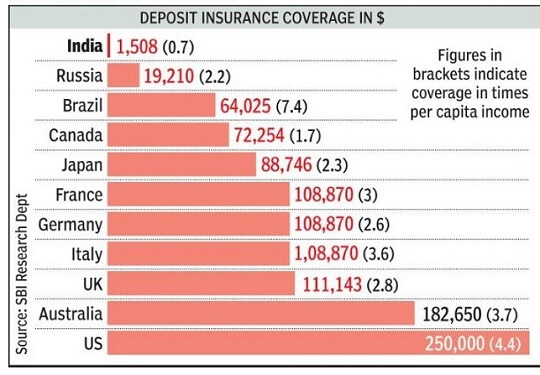

If we compare India with BRICS group of countries like Brazil, Russia, the comparative insurance figure rises to Rs 42 lakh & Rs 12 lakh respectively!

The coverage is very low even when the insurance amount is seen as a percentage of per capita income — 0.7% for India compared with 3.7% in Australia, 4.4% in the US and 7.4% in Brazil.

The image below shows the deposit insurance limit in various countries

Comparison of Deposit insurance limit comparison in India and other countries

the Indian economy has changed drastically since 1993, with the average per capita income of Indians and financial savings improving.

In FY17, bank deposits formed roughly 66% of the net financial assets of households, according to data from the Reserve Bank of India (RBI).

As of March 2018, about 62% of individual deposit accounts had less than ₹1 lakh. Deposits of ₹1 lakh were at 90% of the total bank deposits in 1993 when the insurance limit of ₹1 lakh was set under the Deposit Insurance and Credit Guarantee Corporation Act, 1961. The size of deposits has gone up sharply and given that the insurance limit has remained unchanged, coverage has dropped.

What about FRDI Bill?

The issue of depositor protection, which last came to the fore when in 2017, has once again gained importance in the wake of the PMC Bank failure and reports of other private banks coming under RBI’s scanner.

In 2017 late finance minister Arun Jaitley introduced the Financial Resolution and Deposit Insurance (FRDI) Bill.

The Financial Resolution and Deposit Insurance Bill (FRDRI) bill aims to set up a resolution corporation or RC which will monitor financial companies, such as banks, insurance companies, stock exchanges, and payment systems, so that the ill health of such a firm can be caught early on, rather than allowing it to get sicker and then suddenly come to the brink and fail.

But Section 52 of FRDI bill about bail-in which is depositors and creditors money would be used to rescue a failing financial institution was not liked.

Our article How Does FRDI bill affects Saving Deposits, Fixed Deposits? What is Bail-in? discusses it in detail.

Related Articles:

- official A Guide to Deposit Insurance

- Nationalisation of banks: When, Why and Impact

- Punjab and Maharashtra Co-operative (PMC) Bank

Deposit insurance is a necessary comfort given to people who trust their savings with the banking system. Deposit insurance is only symptomatic treatment. It does not address the cause. It is not a cure. Investors would do well not to consider bank deposits as “safe” and diversify risks

Trackbacks/Pingbacks