RBI had extended the moratorium for all the EMIs falling due in June, July and August 2020. Earlier It was for EMIs between 1 March and 31 May 2020. This has been done to ease the lack of liquidity that borrowers might face due to COVID-19 pandemic. During this period, borrowers can opt to not pay their equated monthly instalments (EMIs) or credit card dues. Note this is only a grace period, not a waiver of the loan. Let us look at What is a moratorium, How much does one have to pay if one defers paying EMI or credit card in detail? Should one take this moratorium?

We advise our readers to opt for a moratorium only if your income has been severely impacted and you are unable to pay your EMIs.

Table of Contents

Overview of RBI Moratorium

- You can opt to not pay their equated monthly instalments (EMIs) or credit card dues. Note this is only a grace period, not a waiver of the loan.

- It is applicable to all standard term loans under Housing Loan, Loan against Property, Auto Loan, Education Loan & Personal Loan as on March 1, 2020.

- If you do not pay the EMIs of your loan for any months between 1 Mar to Aug 2020, you will not be blacklisted i.e credit report will not be affected.

- However, the bank will charge interest for the unpaid amount. It gets added to your Principal. Missing two instalments could extend your loan by 6-10 months or increase EMI amount by 1.5%. And not paying credit card dues will result in bigger credit amount.

- You have three options to pay your dues:

- 1. One-time interest payment after the moratorium period is over

- 2. You can increase your EMI keeping the loan tenure as same

- 3. You can increase your Loan tenure keeping the EMI same

- You can Download the EMI Moratorium calculator to know the best option here.

- If you do not want the EMI moratorium, no further action is required from your side.

- Most banks have decided to go for the opt-in option, wherein a loan account holder requires to inform the bank about his decision to opt for the three-month moratorium scheme. (either by calling or via mail or SMS) that they want to go for the three-month breather. If one has multiple loans, One can opt for the moratorium for each loan that they have availed.

- IDBI Bank has chosen opt-out route. Loan account holders of this bank, who DO NOT wish for the loan moratorium would require to send an email.

What is Moratorium?

A moratorium is a temporary suspension of an activity or a law until future events warrant lifting the suspension or related issues have been resolved. A moratorium may be imposed by a government or by a business. Moratoriums are often enacted in response to temporary financial hardships

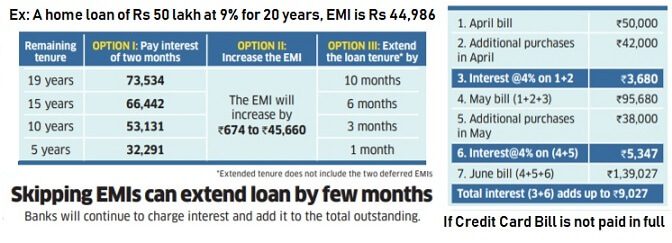

Don’t defer paying your credit card bill

Think carefully before taking a moratorium on your credit card bill. Non-payment will increase up your credit card bill as 3-4% a month will be charged for rolling over the balance. One will have to pay interest on the unpaid amount and also the amount spent going further. That is where compounding works against you. As shown in the example below. If Apr bill was 50,000 and one did not pay then one would have to pay interest on Unpaid April bill and also additional purchases made in Apr, till you pay. The total interest works out a substantial amount.

If you have a fat credit card bill and don’t have enough liquidity, get the amount converted into easy EMIs of 6-24 months. You will pay 12-18% on this, but that will still be lower than the 36-48% annualised cost of rolling over the credit card balance. You can also take personal loan to settle the bill. At 18-24%, personal loans are not cheap but not as costly as rolling over the credit card bill.

Should you defer Paying EMI’s on loans

If you do not pay the next two EMIs of your loan, you will not be blacklisted, i.e bank would not consider that you have defaulted your loan and credit score will not be affected.

- Skipping EMIs can extend the loan by a few months

- Banks will continue to charge interest and add it to the total outstanding.

- Missing two instalments could extend your loan by 6-10 months or increase EMI amount by 1.5%.

Though the specifics will vary across banks, borrowers are likely to be given three options by lenders.

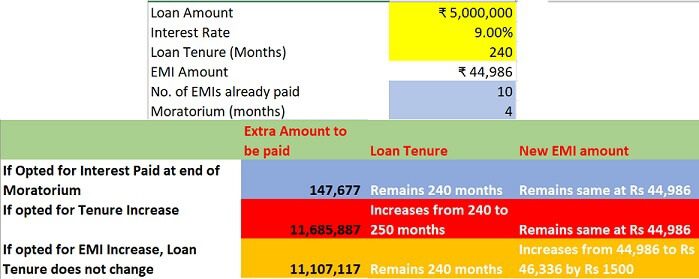

- Option I: The borrower can make a one-time payment for the interest that you had to pay for months you have got EMI waived.

- Option II: The interest is added to the outstanding loan which will increase the EMI for the remaining months.

- Option III: The EMI is kept unchanged but the loan tenure is extended. The number of additional EMIs will depend on the age of the loan.

- You can Download the EMI Moratorium calculator to know the best option here.

Let us assume a borrower took a home loan of Rs 50 lakh at 9% for 20 years. The EMI comes to Rs 44,986. How will going for a moratorium of 4 months affects amount to be paid.

Clearly, the longer the remaining tenure, the bigger is the impact. This is because the interest accounts for a larger portion of the EMI in the early years and progressively comes down. Even after the first year, the interest accounts for almost 80% of the EMI. But in the 19th year, the interest portion is less than 10% in the EMI.

So, people with older loans taken 10-15 years ago will not feel the burden as much as someone with a new loan taken 2-3 years ago.

Go for the deferment plan only if there is a dire need. Otherwise, if you have sufficient resources and can pay the EMI, don’t opt for the moratorium.

Video about Moratorium Option

This 13-minute video explains about Moratorium option with examples.

How to avail EMI moratorium from SBI Bank

SBI has simplified the process of stopping the EMIs by initiating an SMS communication to nearly 85 lakh eligible borrowers asking about their consent to stop EMIs. Those who are willing to defer their EMIs need to reply with a “YES” to a designated virtual mobile number (VMN) mentioned in the SMS sent by the Bank within five days of receiving the SMS if they wish to defer the EMIs.

How to avail EMI moratorium from HDFC bank

Customers must keep their loan account number ready before they begin the process. The HDFC bank customer will have to provide their consent to the bank through any of the following ways:

Either, by calling on 022-50042333, 022-50042211 and following the instructions or

by submitting their request online by visiting https://apply.hdfcbank.com/vivid/afp?product=mo

How to avail moratorium facility from ICICI Bank

To apply for the moratorium facility from ICICI Bank, follow the steps below – Go to ICICI Bank’s website.

- Now, in the announcement window, click on ‘Choose Your Option’.

- Now, you will be asked to enter either your ‘Registered Mobile Number’ or ‘Registered Email ID’.

- Enter either your phone number or Email ID and click on ‘Next’.

- Enter either your PAN or your date of birth and click on ‘Next’.

- If you have a retail loan such as a personal loan, two-wheeler loan, car loan, home loan, business installment loan or any other retail loan mentioned in this first list ‘Retail loans’, select the loan on which you want to avail the moratorium. Once you have selected the loan, scroll down and click on ‘Submit’.

- If you have availed cash credit, overdraft, term loan, demand loan, crop loan or any other loan mentioned in the second list of ‘Working capital / Business / Agri Banking facility’, select the loan on which you want to avail the moratorium. Once you have selected the loan, scroll down and click on ‘Submit’.

- If you have outstanding credit card bill or EMI on debit card, you can avail moratorium in the third list ‘Credit Facilities’ Click on ‘Submit’.

- Your response will be recorded and the bank will contact you for confirmation after some time.

FAQ on RBI EMI Moratorium

QUESTION 1: When/what was the RBI announcement?

ANSWER: Last week, the Reserve Bank of India announced a three-month moratorium on all term loans outstanding as on March 1, 2020, as well as on working capital facilities.

QUESTION 2: Why has RBI announced the relief package?

ANSWER: Reserve Bank of India has announced certain regulatory measures to mitigate the burden of debt servicing brought about by disruptions on account of COVID-19 pandemic and to ensure the continuity of viable businesses. It was felt that there may be a temporary disruption in the cash flows, and in some cases loss of income, for the businesses/ individuals and the present measures work to bring relief to those businesses / individuals.

QUESTION 3: Which are the facilities eligible for availing the benefits under the RBI COVID-19 regulatory package and whether the facility is extended across the board to all borrowers?

ANSWER: All term loans (including agricultural term loans, retail, crop loans and loans under Pool Purchases) and cash credit/overdraft are eligible to avail the benefits under the package. This is available to all such accounts, which are standard assets as on 1st March 2020. Further, to avoid unnecessary paperwork the facility has been extended across the board to all the borrowers by extending repayment of term loan installments (includes interest) by 90 days. The original repayment period for term loans will get extended by 90 days e.g. a loan repayable in 60 installments maturing on 1st March 2025 will mature on 1st June 2025.

QUESTION 4: Is rescheduling of payments applicable for all kinds of term loans?

ANSWER: It is applicable for all term loans in all the segments, irrespective of the segment and the tenor of the term loans.

QUESTION 5: Is rescheduling of term loans only for principal amount or it also includes interest?

ANSWER: Rescheduling of principal can be done for a period of three months falling due between March 1, 2020 and May 31, 2020. For example, where the last installment of a term loan falls due for payment of on say 1st March 2020, it will become payable on 1st June 2020.

For EMI based term loans, it will be three EMIs falling due between 1st March 2020 and May 31st, 2020 and the tenor will be extended by three months and have to be repaid during the extended period, as per the example under (2) above.

For other term loans, it will be all the installments and Interest falling due during the same period, irrespective of the tenor of payment i.e. monthly, quarterly, half yearly, annually, bullet payment etc. For term loans, where the repayment has not commenced, the interest portion for three months alone needs to be reckoned.

QUESTION 6: What happens if the extended tenor of term loan goes beyond the maximum period stipulated for a product or as stipulated in the loan policy?

ANSWER: This can be extended for all such term loans without the need for seeking deviations or approvals.

QUESTION 7: What will be the treatment of interest on the working capital facilities?

ANSWER: The recovery of Interest applied to cash credit/overdraft on 31st March, 30th April and 31st May 2020 is being ‘deferred’. However, the entire interest must be recovered along with the interest being applied on 30th June 2020 and in cases, where monthly interest is not being applied, along with the next interest date.

QUESTION 8: What will be the impact of this relief by RBI on borrowers as far as reporting of default is concerned?

ANSWER: Any delay in payment leads to default and gets reported to Credit Bureaus. For business loans of Rs. 5 Crores and above, the banks report the overdue position to RBI also through CRILC. As a result of this relief package, the overdue payments post 1st March 2020 will not be reported to Credit Bureaus/ CRILC for three months. No penal interest or charges will be payable to the banks. Similarly, SEBI has allowed that Credit Rating Agencies (CRAs) may not consider the delay as default by listed companies if the same is owing to lockdown conditions arising due to COVID-19.

QUESTION 9: That means businesses/ Individuals should necessarily take the benefit?

ANSWER: You may take the benefits under this package if there is a disruption in your cash flows or there is loss of income. However, you must take into account that the interest on the loans, though not mandatorily payable immediately and gets postponed by 3 months, continues to accrue on your account and results in higher cost.

To give you a perspective, suppose your loan outstanding is Rs 100,000 and you are charged 12 percent rate of interest on your loans, then every month you are liable to pay Rs. 1,000 as interest. In case you opt not to service the interest every month, you are liable to pay interest at 12 percent p.a. and accordingly you will pay Rs. 3,030.10 at the end of 3rd month.

Similarly, in case the interest rate is 10 percent, you are required to pay Rs. 833 p.m. or Rs. 2,521 after three months.

QUESTION 10: Should I get upset if any bank staff or its collection agent approach me for repayment?

ANSWER: You should not get upset and tell bank staff/ collection agent that you want to avail the benefit being extended under regulatory package.

QUESTION 11: What about my credit card dues?

ANSWER: The relief is available for credit card payments also.

In case of credit card dues, there is a requirement to pay minimum amount and if it is not paid the same gets reported to Credit Bureaus. In view of the RBI circular, the overdues in the credit card account do not get reported to the credit bureaus for a period of three months.

However, interest will be charged by the credit card issuer on unpaid amount. You should check from your card provider to arrive at interest payable. Although no penal interest will be charged during this period, but you must remember that the interest rate on credit card dues are normally much higher compared to normal bank credit and you should take a decision accordingly.

QUESTION 12: What about interchangeability being permitted from non-fund based to fund based or FB to NFB for businesses?

ANSWER: The interest applied on the fund based portion of interchangeability availed during the said period of 1st March to 31st May 2020 will be eligible for moratorium. In respect of new sanctions accorded from 1st March and availed during the period, the interest applied on the Fund based portion would be eligible.

QUESTION 13: In what other ways, businesses have been given relief?

ANSWER: The businesses may request the bank to re-assess their working capital requirements on account of disruption of their cash flows or elongation of working capital cycle. They may also request for reduction in margin on NFB facilities (LCs/ BGs etc) or also relief in Security. Decision will be taken by the bank branches on case-to-case basis based on the genuineness of the request.

QUESTION 14: Are NBFCs/MFIs/HFCs eligible under the “easing of working capital financing”?

ANSWER: At present, they are not being considered under the scheme. However, RBI has made provision for sufficient liquidity support to these financial intermediaries under recently introduced Targeted Longer-term Refinancing Operations i.e. TLTRO. Liquidity availed under the scheme by Banks has to be deployed in investment grade corporate bonds, commercial paper, and non-convertible debentures over and above the outstanding level of their investments in these bonds as on March 27, 2020.

Banks shall be required to acquire up to fifty per cent of their incremental holdings of eligible instruments from primary market issuances and the remaining fifty per cent from the secondary market, including from mutual funds and non-banking finance companies. Investments made by banks under this facility will be classified as held to maturity (HTM) even in excess of 25 per cent of total investment permitted to be included in the HTM portfolio. Exposures under this facility will also not be reckoned under the large exposure framework. Banks will be able to support NBFCs/ MFIs/ HFCs etc. under this window and we do not foresee liquidity squeeze for these Financial Intermediaries.

QUESTION 14: Will all these measures of RBI be treated as “restructuring”? What about the provisions applicable?

ANSWER: The measures stipulated by RBI under the March 27, 2020 circular on COVID-19 Regulatory Package will not be treated as “restructuring” and hence will not result in asset classification downgrade. Accordingly, the enhanced provisions for Restructured Accounts will not apply.

QUESTION 15: What about installments/EMIs being recovered through SI/ECS/NACH? What will be the procedure for refund of the installment/EMIs, if demanded by the borrower?

ANSWER: Please get in touch with your bank for the revised mandate