Banking through USSD does not require a visit to a branch, or even a digital wallet, to carry out monetary transactions. Bank without the Internet even on a basic mobile using USSD. The services of Mobile Banking via USSD can be enjoyed by any individual with any mobile phone, with or without a GPRS connection. This article gives an overview of USSD, how to send money using USSD banking, banking operations you can do with USSD and drawbacks of using USSD banking.

Table of Contents

USSD overview

Mobile Banking over USSD is based on the real-time interaction between a customer and the bank, unlike SMS service. All account holders can enjoy Mobile Banking via USSD services. Though the service is free of charge from the bank, other charges by the mobile network provider may be applicable.

- You need not download any application on the phone.

- The service works 24 hours a day and 7 days a week.

- You are required to dial a pre-fixed code(*99*) on your mobile phone and hit the ‘Call’ button.

- An instant menu pops up on the screen and you can choose the next step. With Mobile Banking via USSD, you can enjoy the many services like Balance, Send Money etc.

- Once the USSD popup notification arrives, you have to respond within 10 seconds, or the process will get canceled.

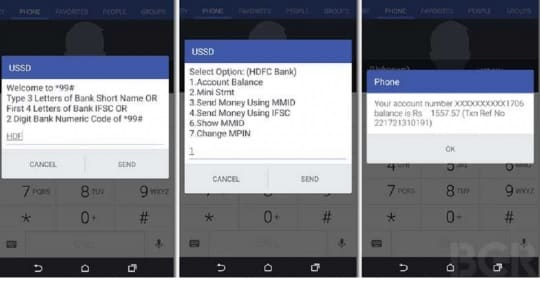

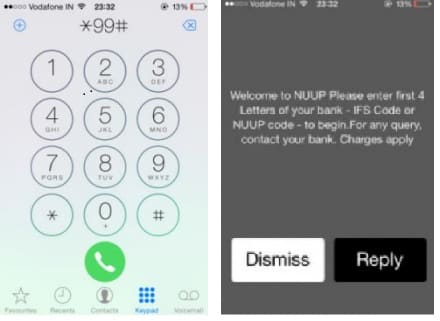

- The following image shows Mobile screens while using USSD.

What is USSD?

USSD stands for Unstructured Supplementary Service Data and this interface was built by National Unified USSD Platform (NUUP) for envisioning financial deepening and the inclusion of under banked society especially the rural areas into mainstream banking services. This technology uses GSM network channels to transmit information where the communication takes place between the bank and telecom operator. USSD is currently the best available technology to deliver financial services to low-income customers. USSD works on smartphones but also on basic phones such as black and Nokia phones.

Why is there a need for USSD banking?

With the impeccable bold step of demonetization and efforts towards a cashless economy, common man is keeping their mobile wallets full and internet pack at its highest. What if you are enjoying in the laps of mountains on the north-east with barely some network and no internet connection but you need to make an urgent transfer to mom? Lesser known yet crucial USSD based mobile banking can be a savior in such case.

Considering that a majority of mobile users in rural India do not have the same access to banking facilities as their counterparts in urbanized pockets, a convenient form of Mobile Banking based on unstructured supplementary service data (USSD) was introduced targeting the rural areas. The services of Mobile Banking via USSD can be enjoyed by any individual with any mobile phone, with or without a GPRS connection.

Charges for using USSD Banking

Your telecom operator will charge a minimal fee on each transaction in your bill cycle or as balance deduction. The prices of USSD banking were revised from Rs. 1.50 to Rs. 0.50 per transaction whether it goes through or not. This means if you enter the USSD code but your transaction is not processed due to the number of reasons, you will still be charged for same. But, there are no additional roaming charges for availing USSD outside your place of residence.

Limitation of USSD Banking

- Maximum Rs. 5000 can be sent with USSD banking which sometimes is not suffice.

- A person has to respond within 10 seconds otherwise the session expires and you have to repeat the entire process right from entering the USSD codes once again.

- Sometimes the external application is down due to network or any other issue leading to persistent repetition of the procedure.

- Using USSD one has to pay minimal charges of 50 paise per transaction, even for failed transactions.

*99# in the USSD banking

*99# is the USSD launched to revolutionize the banking sector so that every man is able to avail and benefit from the services. *99# is a common number for all telecom service users that is supposed to be dialed from their phones to avail the services. *99# is extended by 51 leading banks and all GSM providers across the country and can be accessed in 12 different regional languages including Hindi and English.

Languages supported by USSD banking

As intention to cater to needs of the people not well versed with English, USSD can be accessed in 12 different regional languages including Hindi and English.

The following USSD codes can be dialed instead of *99# to access the desired language for USSD banking:

| Language | USSD Code |

| English | *99# |

| Hindi | *99*22# |

| Marathi | *99*28# |

| Bengali | *99*29# |

| Punjabi | *99*30# |

| Kannada | *99*26# |

| Gujarati | *99*27# |

| Tamil | *99*23# |

| Telugu | *99*24# |

| Malayalam | *99*25# |

| Oriya | *99*32# |

| Assamese | *99*31 |

Getting started with USSD banking

Getting MMID

First and foremost, you need a phone, a bank account and your mobile number registered for mobile banking. In case your phone number isn’t registered with your bank, you’ll have to visit the branch and fill up a form to register and link it with your bank account.

Once that is done, you’ll have to generate MMID. MMID is an abbreviation for Mobile Money Identifier which is a 7 digit code issued by banks for customers to have access to Immediate Payment Service (IMPS). MMID is usually sent by the bank once you register your mobile number for availing mobile banking services.

Along with the MMID, you’ll also need the MPIN (a four-digit code to authorize transitions). Once you get the default MPIN, you’ll have to change it to any four digits of your choice (more on that below).

How to Start using USSD Banking, What Banking Operations can do with USSD

- Unlock your phone and open the dialer.

- Press Star (*) the required numbers as per your language selection followed by hash (#). For example, to choose English, dial *99#.

- You will see a welcome screen on which you have to enter the first 3 letters of the bank’s name ( ICI for ICICI, HDF for HDFC, SBI for State bank of India, AXI for Axis and so on) or first 4 letters of IFSC code( IFSC is a unique alphanumeric code to identify the bank and branch can be found on cheque book) or two digit bank code followed by pressing send on the screen.

- Once you click send, your registered mobile number will be verified along with your bank details and the following screen will be displayed.

- A person can perform elementary bank functions like send money using MMID or IFSC, view his own MMID, change mPin(used in IMPS transactions), view account balance or mini statement.

- Depending on what function you want to perform enter number 1-7 from the keypad and click on send. It is advisable to change mPin if you are logging in for the first time.

How to find Balance using USSD

- Select balance enquiry menu option “1” from the services.

- After validation of mobile number by the system available balance of the registered account will be displayed

How to Send money using MMID on USSD Banking

- Press Star (*) the required numbers as per your language selection followed by hash (#). For example, to choose English, dial *99#.

- Depending on what information of the beneficiary available with you, select option 3 or 4 and click on send.

- Now enter 10 digit beneficiary mobile number carefully and click on Send.

- Enter beneficiary MMID number and click on send.

- Enter an amount up to Rs. 5000 and add an optional remark for your reference and click on send.

- Authenticate your transaction with your secured mPin.

How to Send money using IFC on USSD Banking

- Select Fund transfer-Account menu option “4” from the services.

- Reply with Beneficiary IFSC and Account Number. e.g. UBIN0556688, 566802070000058

- Reply With Amount and Remarks (if required) e.g. 100

- Reply with mPin and last 4 digits of a/c no: e.g. 4321 0058

- Success/failure message will be shown on screen and received in the SMS.

Know MMID using USSD Banking

- Select Know MMID menu option “6” from the services.

- After validation of mobile number MMID will be displayed.

Change mPin using USSD Banking

- Select Change mPin menu option “7” from the services.

- Reply with your Old mPin. e.g. 1234

- Reply with new mPin. e.g. 2345

- Re-enter new mPin. e.g. 2345

- After validation successful/failure message will be displayed

Related Articles:

- Go Cashless:Digital Wallets, NEFT,IMPS,UPI, Debit Cards,Credit Cards

- What are Mobile Wallets or Digital Wallets

- Paytm: How to Use Paytm,Open Paytm account,Pay using Paytm

- Pockets Facebook App by ICICI Bank, Social Banking

- What happens when credit card is swiped?

- What is Unified Payment Interface or UPI?

- Third Party Fund Transfer NEFT RTGS

- IMPS or Immediate Payment Service : Send Money Instantly

- What is Mobile Banking

Banking through USSD does not require a visit to a branch, the internet or even a digital wallet, to carry out monetary transactions. Have you done USSD Banking? Do you think USSD Banking will be used?

TO GET FREE STOCK FUTURE TIPS VISIT BEST STOCK FUTURE TIPS

…

VERY VERY INFORMATIVE ..