LIC launched it’s first online term plan, LIC’s e-Term policy which can be bought via LIC Direct . The trend of buying online insurance policies is slowly and steadily growing in India. In this article we shall look at what is online term insurance, why are online term insurance cheaper,what are disclosures in Term Insurance plans,compare premium of online term life insurance

What is Term Insurance?

Term insurance is a life insurance policy in which against payment of regular premium, the insurer agrees to pay one’s beneficiaries the sum assured in event of his premature death during policy term. Once the policy is issued, Premium will remain the same for the entire tenure of the policy. This is subject to service tax regulations as declared by the Government of India. However, if he survives till the end of the policy term, one gets nothing.

Why should one but Term Insurance ?

Insurance provides financial protection against unexpected events and Life insurance is meant to offer financial protection to dependants in the unfortunate event of one’s death. Its purpose is to enable one’s dependants to maintain their current life style and pursue their life goals.

People buy endowment or money back insurance plans because they get the money back but for this one needs to pay high premium, returns on such policies work out to be around 8%. Term insurance has the lowest possible premium among all the other insurance plans available and if one invests the difference in premium between premium paid for endowment/money back policy into say fixed amount Public Provident Fund (PPF) one ends up being better. Discussed in detail in our article Mixing Insurance with Investment

Why should one buy a Term Insurance Plan Online?

With the arrival of e-commerce the world has moved ahead fast, competitively. Just like other products one can now buy a term plan online. It is one of the cheapest ways to buy insurance, it saves you time and money.

- Cheaper : On an average, online term plans are around 30 to 40% of an offline term policy.

- Honest, More disclosures : Online policies have an edge. Since you fill the proposal form online, you can ensure it is filled completely and correctly.

How much cheaper are online Term Insurance Plan?

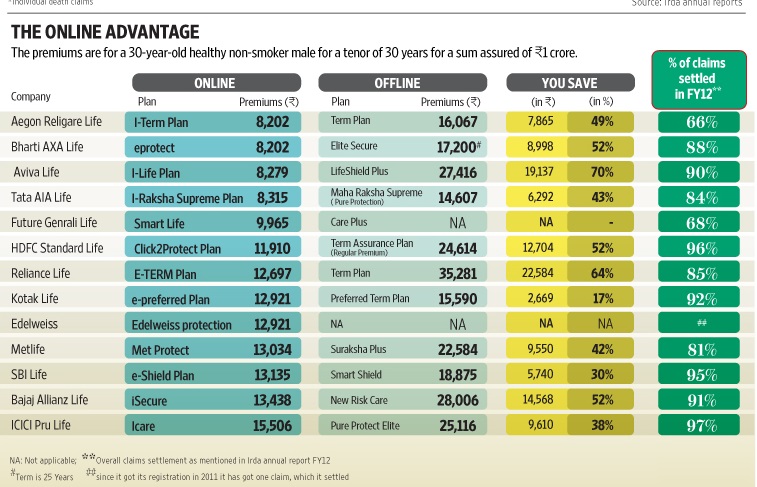

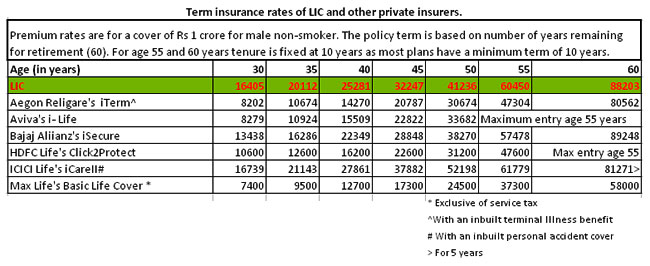

The image below from livemint’s Will your online plan pay the claim? shows premium for a 30 year old healthy non smoker male for a tenor of 30 years for a sum assured of 1 crore. Its from Apr 2013 but it gives an idea of how premiums of online insurance term plan compare with offline Insurance term plan

Why are online Term Insurance Plan Cheaper?

Reduction in premiums is largely due to the costs that insurers save by moving their plans online. On an average, a term plan pays about 20-25% as commissions to the agents. There are no agents involved while selling an online term plan, which means there are no agent commissions to be paid out. Online, that’s a straight saving and insurers are able to pass on savings to their customers. You also save on cost by moving the paperwork in electronic form.

What about Disclosures in the online Term Insurance Plan?

Life insurance is a contract between you and your insurer and is based on good faith. You need to disclose all material facts regarding yourself and your health. Suppression or lie of any sort means the insurer can refuse paying you the claim.

So what leads to more disclosures? Interestingly, the answer is the lack of agents. Insurance companies are finding that the risk assessment in online policies is better. That’s because there are no agents involved. Because the customers are filling up the proposal form themselves, it has been seen that the number of declarations is far higher in online plans than offline. Agents tend to misguide policyholders at the time of buying an insurance plan in order to escape time-consuming processes like medical examinations. Although this makes the buying process a lot easier, but results in claims rejection, especially if it’s an early claim.

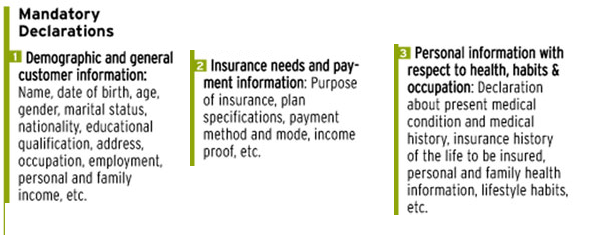

What kind of disclosures or information is required in buying online insurance policy?

Present and past medical conditions, insurance history, personal and family health, lifestyle habits, etc, have an important bearing on risk. The questions asked in a life insurance application form can be generic or very specific.The difficulty level may vary accordingly. The answers are mostly in yes or no. If the answer to each question is no, the process is hassle-free if the declarations are true. However, if the answers are yes, the company seeks further explanations and in some cases even documents so that it can decide the premium or whether to accept your application. Generally the questions asked in filling the form are as follows

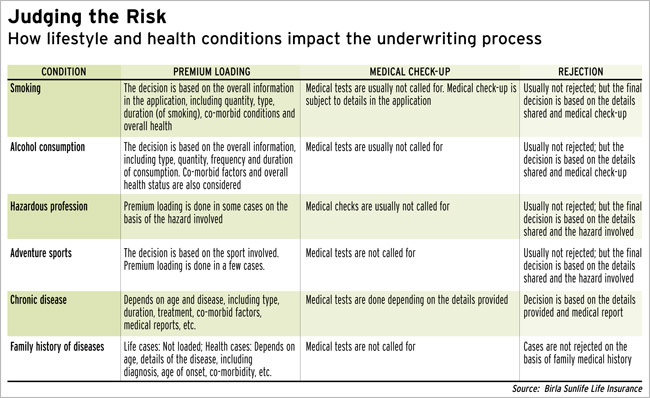

Say, if your answer to the question whether you are a smoker is yes, you may be asked what you smoke (cigarette, beedi or cigar), how many do you smoke in a day and for how many years have you been smoking. If you say you have stopped smoking, you will be asked when and why. Usually if you are a smoker, you will pay a higher premium than a non-smoker for a life or a health insurance policy. If you are in a hazardous occupation or love adventure sports, then also you fall in the higher risk category. The insurer may even reject your request for insurance in such a case.

Based on these declarations, the insurance company assesses the risk involved in insuring the applicant and accordingly fixes the premium.

- In some cases, it will ask the buyer to undergo medical tests before issuing him the policy.

- Based on the results of these tests, the policy can be rejected, passed or passed with restrictions or loading.

There is no set rule for such scenarios. It’s a subjective call taken by the insurance company but following image from Business Today Handling Detailed Interrogation captures how lifestyle and health condition affects insurance. Note this works for both online and offline. Click on image to enlarge

Though it is possible because of the full disclosure the insurance company may charge a higher premium, it is better to have a slightly more expensive policy than a paper policy at a lower premium, one that won’t pay when you need it the most.

You can, of course, disclose everything offline as well, but unfortunately, most consumers merely sign at places specified by an agent, leaving the rest of the form to be filled by him.

Will online policies get good service from Insurance companies?

Agents try to dissuade online buyers, saying such policies don’t get good service from companies . This is not true says the companies. When a claim is processed, there is no differentiation between a policy bought online and one purchased through an agent. The online customer can expect the same quality of service from the insurance company as any other customer. Besides, all insurance companies have to comply with the rules laid down by the insurance regulator, Insurance Regulatory and Development Authority, IRDA.

It is too early to say whether low online premiums will impact claims settlement and there are two reasons for that.

- First, lack of data. Insurers usually don’t segregate their claim settlement record across products and the (Irda) also publishes a consolidated figure in its annual report.

- The second, and the most important, reason is that most of these online policies have been sold only in the last few years

Typically Insurers have six months to investigate and settle an early claim that comes within the first two years of the policy. For policies older than that the claims need to be settled in 90 days. Hence, the chances of claims rejection are highest in claims that are made early in the policy when the insurer carries out thorough investigation. Our article What is Claim settlement ratio discusses and compare Claim Settlement ratio over years across Insurers in India.

Some are worried about buying 20-30-year policies from relatively unknown companies. They are worried if the insurance company will be around in case the insured dies in 10-15 years. In this case, the key is IRDA regulates all insurance companies and requires these to maintain what is called a solvency ratio. Solvency ratio is the ability of company to meet its debt and other obligations. It indicates whether a company’s has enough money to meet its short-term and long-term liabilities.Solvency ratio, with regard to an insurance company, means the money it has relative to the premiums written, and measures the risk an insurer faces of claims it cannot cover. In India, insurers are required to maintain a solvency ratio of 150% at all times. So, the chances of a problem occurring on this front aren’t so high but yes they are not Zero either.

As one of my reader said “In the event of death, you would not want your family members to be left at the mercy of a faceless organisation for claim settlement. If you have an agent, your family can always take help from him for claim settlement” But then there have been cases of agents not being around to help you. With an active redressal mechanism instituted by the regulator and the changing focus of the insurers, there is a good reason to believe that genuine claims will not be rejected.

What are downsides of buying Insurance plan?

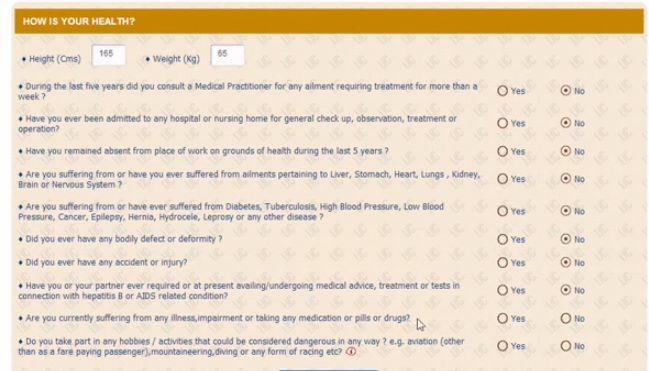

People find the form for filling details online a little scary. The toughest part for most customers is answering the medical-and lifestyle-related queries in the proposal form. Some questions are general, but some are specific and relate to medical condition, profession and hobbies of the buyer. For example Has your weight altered by more than five kg in the last two years? Have you been incapable of working for more than five days in a week in the past two years? How many cigarettes do you smoke in a day and/or how many pegs of alcohol do you consume in a week? Health questions from LIC eTerm policy are given below. Click on image to enlarge.

When you purchase online, there won’t be any agent running after you for the renewal premium. If you are the forgetful sorts and don’t pay when the premium is due, your policy can lapse. Companies offer a grace period of 15-30 days for late payment but don’t bank on it. Work around , Give an Electronic Clearing System (ECS) mandate to your bank so that the premium automatically gets paid when it is due.

Since when has been online Term plans available in India?

The first online term insurance plan called i-Term was introduced by Aegon Religare in October 2009. In 2012 they launched a new and improved protection plan .AEGON Religare iTerm Plan. It was for long that Life Insurance Corporation (LIC) stayed away from joining the bandwagon of online term plans. But after a long wait, the country’s largest insurer has finally joined the club in May 2014.

According to a report by Boston Consulting Group and Google India, it is estimated that three in every four insurance policies sold by 2020 would be influenced by digital channels. The report also states that insurance sales from online channels will grow 20 times by 2020, and overall Internet influenced sales would be Rs 300-400,000 crore.

What has been observed is that average sum assured for online term plans is Rs. 70 lakh. This means most of these policies anyway need medical examination to establish the health record of the policyholder. This is not so for a large number of offline policies where the sum assured is usually very low, The average sum assured of the industry is Rs.1.3 lakh. (Source livemint)

Are premiums of online Term plans are same across companies?

No just like the offline plans the premium of online Term plans differ. From BusinessToday Life Insurance Corporation launches online term plan premiums of online term plans are shown below. For a 35-year-old male, non-smoker, LIC offers a cover of Rs 1 crore for Rs 20,112 for a term of 25 years. The same cover by Max Life is offered for less than Rs 9500, a difference of more than 100 per cent.

Reason for different in premium is the varying mortality charge levied by insurers. Basically, insurers use mortality tables , data estimating the longevity of the population , to arrive at life insurance premiums for different categories of investors. While LIC uses mortality tables dating back to 1994-96, most private insurers use tables released in 2006-08. As life expectancy has shot up over the last two decades, using a more recent version sharply cuts the cost of a life insurance plan. Using the new mortality table could mean a 5-10 per cent difference in the premium cost.

How does one buy online Term Insurance Plan?

In the good old days, buying insurance meant calling up your agent and dictating your needs. Your agent suggested the product, completed the proposal form and collected the premium while all the while all you had to sign the document and give the cheque.

Buying Online means you give your details online,calculate your premium, fill in the questionnaire and then buy the policy by paying the premium. Incase you need to appear for medical examination, that will be done offline.

[poll id=”60″]

Related Articles :

- What is Claim settlement ratio

- How to Claim Life Insurance

- Checklist for buying Life Insurance Policy

- Insurance at every lifestage

- Discontinue Life Insurance Policy: Surrender,Paid Up,Loan

- Basics of Insurance

So do think Indians will take to buying insurance plans like Term plans online? With LIC offering the online term plans people will buy from LIC inspite of having to pay higher premium? Have you bought term plan online? How has the experience been?

It was really helpful. I found TataAIA as the good website for Life Insurance Online. Look for more blogs forward.Thanks for the information.

Thanks for the information on life insurance online it was really helpful. I found TataAIA as the good website for Life Insurance Online. Look for more blogs forward.

Being an expert in the industry, I would like to clarify the following

point with you :-

I have taken a term policy from Max Life recently for Rs.50 Lakhs.

My diabetic history was disclosed in the proposal. Though the

medical reports were normal, life insurance company charged me

50% extra premium based on my health declaration.

I have 4 personal accident policies and 2 mediclaim policies in my

name which I mentioned on my proposal form. How ever, I forgot

to give the details of 2 term polices which were lapsed in 2013.

Actually, those term polices were taken in 2012 but I discontinued

them due to the over charging of premium (on my health ground).

And I don’t have those policy details also. So I could not give the

details of those policies on proposal form.

Also I didn’t mentioned in the proposal form that I had been charged

with extra premium by other insurance companies earlier. However,

details of all current (existing) policies were given on the proposal.

In your expertise, should I ignore my new term policy and go for a

new term insurance plan to avoid any complications due to

concealment of fact and insurability.? Will my nominee face any

problem in case of a claim, since I didn’t mentioned the details of

expired policies.? Will this issue be treated as a very serious offense

even after paying the premium for 3 years.?

Please revert.

Regards,

Mathew K

Muscat

Online term plans are 60% cheaper than offline plan so always choose best plan which suits you…

Or compare term insurance before buy through insurance comparison site

Like PolicyX.com

Online term plans are 60% cheaper than offline plan so always choose best plan which suits you…

Or compare term insurance before buy through insurance comparison site

Like PolicyX.com