Modern banking in India originated in the last decade of the 18th century. Now India has many types of banks such as public and private sector banks, small finance banks, cooperative banks. Banks are classified as Scheduled and Non-scheduled banks. Let us look at the types of banks in India in detail.

Table of Contents

What is Bank?

A Bank is an institutional body that accepts deposits from the investors and grants credit to the entities who are needing the funds. Banks play a vital role in maintaining the economic status of a country. They provide financial services like wealth management, safe deposits, currency exchange, locker system, etc.

Banks make money by accepting deposits and lending money out at interest. They also charge for services provided.

Among the first banks were the Bank of Hindustan, which was established in 1770 and liquidated in 1829–32; and the General Bank of India, established in 1786 but failed in 1791.

The largest and the oldest bank which is still in existence is the State Bank of India (S.B.I).

Types of Bank in India

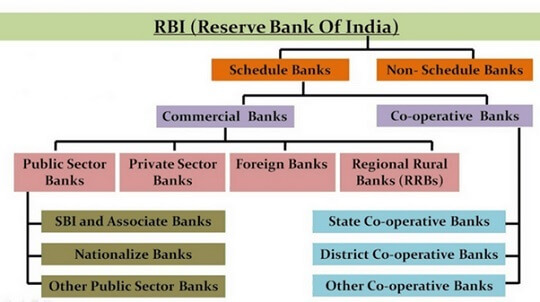

In the Indian banking system, RBI is the apex body who acts as the leader of the banking system in the country. RBI regulates the money supply in the country and supervises and controls the banking and non-banking financial companies in India. Our article Reserve Bank of India talks about RBI in detail

Banks can be classified into 2 categories namely, Scheduled Banks and Non-Scheduled Banks under Banking Regulation Act, 1949.

Scheduled Banks are the Banks that are included in the second schedule of the Reserve Bank of India (RBI) act, 1934. Non-Scheduled Banks, on the other hand, are the ones that are not included in the second schedule of the Reserve Bank of India (RBI) act, 1934.

Scheduled Banks can further be categorized into 2 categories i.e. Commercial Banks And Co-Operative Banks.

Commercial Banks are further divided into Public Sector Banks, Private Sector Banks, Foreign Banks, and Regional Rural Banks (RRBs).

The Co-Operative Banks are divided into State Co-Operative Banks, District Co-operative Banks, and other Co-Operative Banks.

You can check out Wikipedia article List of Banks in India for names of banks.

Types of Banks in India

Difference between Scheduled Banks v/s Non-Scheduled Banks

The major differences that exist between the scheduled and non-scheduled banks can be understood from the table given below:

| Scheduled Banks | Non-Scheduled Banks | |

| Definition | Listed in the second schedule of the RBI act, 1934 | Not Listed in the second schedule of the RBI act, 1934 |

| RBI Rules and Guidelines | Follow the rules made by RBI | Do not follow the rules made by RBI |

| Minimum Paid-up Capital and Reserve amount | 25 lakhs | Don’t comply with the rules of RBI |

| Clearing House Membership | Scheduled Banks can become a member of the clearinghouse | Non-Scheduled Banks cannot become a member of the clearinghouse |

| Cash Reserve Ratio | Need to maintain CRR and deposit the amount to RBI | Need to maintain CRR but they can keep the amount with themselves |

| Borrowing | Ability to borrow money from RBI | Not allowed to borrow money from RBI |

Commercial Bank

A commercial bank is a financial institution that accepts deposits from the public, gives loans, and offers financial products and services to individuals and businesses.

Types of Commercial Banks

Commercial Banks can further be classified into the following categories:

Public Sector Banks: Public Sector Banks are the banks where a major stake (i.e. more than 50%) is held with the government. There are over 21 Public Sector Banks in India. These include 19 nationalized banks, State Bank of India & Associate Banks, and IDBI.

Private Sector Banks: Private Sector Banks are the ones where a major stake is held with private individuals. These banks have limited liability. These include HDFC Bank, ICICI Bank, Axis Bank, IDFC (estd. 2015), and Bandhan Bank (estd. 2015).

Public Sector Banks in India

Public Sector Banks (PSBs) are a major type of bank in India, where a majority stake (i.e. more than 50%) is held by a government. These banks are listed on stock exchanges. There are a total of 12 Public Sector Banks alongside 1 state-owned Payments Bank(India Post) in India.

In terms of volume, SBI is the largest public sector bank in India and after its merger with its 5 associate banks (as on 1st April 2017) it has got a position among the top 50 banks of the world.

Subsequently, the number of public sector bank has been reduced to 12 from 27

| Anchor Bank | Merger Banks | Established | Headquarter | Branches | |

|---|---|---|---|---|---|

| 1 | Bank of Baroda |

|

1908 | Vadodara, Gujarat | 9,583 |

| 2 | Bank of India | 1906 | Mumbai, Maharashtra | 5,000 | |

| 3 | Bank of Maharashtra | 1935 | Pune, Maharashtra | 1,897 | |

| 4 | Canara Bank |

|

1906 | Bengaluru, Karnataka | 10,342 |

| 5 | Central Bank of India | 1911 | Mumbai, Maharashtra | 4,666 | |

| 6 | Indian Bank |

|

1907 | Chennai, Tamil Nadu | 6,104 |

| 7 | Indian Overseas Bank | 1937 | Chennai, Tamil Nadu | 3,400 | |

| 8 | Punjab and Sind Bank | 1908 | New Delhi, Delhi | 1,554 | |

| 9 | Punjab National Bank |

|

1894 | New Delhi, Delhi | 11,437 |

| 10 | State Bank of India |

|

1955 | Mumbai, Maharashtra | 24,000 |

| 11 | UCO Bank | 1943 | Kolkata, West Bengal | 4,000 | |

| 12 | Union Bank of India |

|

1919 | Mumbai, Maharashtra | 9,609 |

Mergers in Public Sector Banks

The Central Government entered the banking business with the nationalization of the Imperial Bank of India in 1955. A 60% stake was taken by the Reserve Bank of India and the new bank was named as the State Bank of India. The seven other state banks became the subsidiaries of the new bank in 1959 when the State Bank of India (Subsidiary Banks) Act, 1959 was passed

The next major government intervention in banking took place on 19 July 1969 when the Indira Gandhi government nationalised an additional 14 major banks. The total deposits in the banks nationalised in 1969 amounted to 50 crores.

In 1980, 6 more private banks were nationalised.

- State Bank of Saurashtra was merged with SBI on 13 August 2008.

- State Bank of Indore was acquired by State Bank of India on August 27, 2010.

- The State Bank of Bikaner & Jaipur, State Bank of Hyderabad, State Bank of Mysore, State Bank of Patiala and State Bank of Travancore, and Bharatiya Mahila Bank were merged with State Bank of India with effect from 1 April 2017.

- Vijaya Bank and Dena Bank were merged into Bank of Baroda in 2018.

- IDBI Bank was categorised as a private bank with effect from January 2019.

- In April 2019, Vijaya Bank and Dena Bank were merged with Bank of Baroda

- On 30 August 2019, Union Finance Minister Nirmala Sitaraman announced a merger of six public sector banks (PSBs) with four better performing anchor banks. This merger will be effective from 1 April 2020. The banks are being merged in order to streamline their operation and size, two banks were merged to strengthen the national presence and four were amalgamated to strengthen regional focuses.

- Indian Bank is to be merged with Allahabad Bank (anchor bank – Indian Bank)

- PNB, OBC and United Bank are to be merged (anchor bank – PNB)

- Union Bank of India, Andhra Bank and Corporation Bank are to be merged (anchor bank – Union Bank of India)

- Canara Bank and Syndicate Bank are to be merged (anchor bank – Canara Bank)

Private Banks in India

A private bank has a bank capital requirement of 500 crores and the total assets that a private bank must possess should be worth of 5000 crores.

Private Sector Banks can further be classified into Old Private Sector Banks and New Private Sector Banks. Old Private Sector Banks are the ones that are established before 1993 while the New Private Sector Banks are the ones that are established after 1993.

There are over 12 Old Private Sector Banks in India. These can be found in the table given below:

| Bank Name | Established | Headquarter | Branches |

|---|---|---|---|

| City Union Bank | 1904 | Thanjavur, Tamil Nadu | 600 |

| Karur Vysya Bank | 1916 | Karur, Tamil Nadu | 668 |

| Catholic Syrian Bank | 1920 | Thrissur, Kerala | 426 |

| Tamilnad Mercantile Bank Limited | 1921 | Thoothukudi, Tamil Nadu | 509 |

| Nainital Bank | 1922 | Nainital, Uttarakhand | 135 |

| Karnataka Bank | 1924 | Mangaluru, Karnataka | 835 |

| Lakshmi Vilas Bank | 1926 | Chennai, Tamil Nadu | 570 |

| Dhanlaxmi Bank | 1927 | Thrissur, Kerala | 269 |

| South Indian Bank | 1929 | Thrissur, Kerala | 852 |

| DCB Bank | 1930 | Mumbai, Maharashtra | 323 |

| Federal Bank | 1931 | Aluva, Kerala | 1,252 |

| Jammu & Kashmir Bank | 1938 | Srinagar, Jammu and Kashmir | 958 |

| RBL Bank | 1943 | Mumbai, Maharashtra | 342 |

| IDBI Bank | 1964 | Mumbai, Maharashtra | 1892 |

| Axis Bank | 1993 | Mumbai, Maharashtra | 4094 |

| HDFC Bank | 1994 | Mumbai, Maharashtra | 4,787 |

| ICICI Bank | 1994 | Mumbai, Maharashtra | 4,882 |

| IndusInd Bank | 1994 | Mumbai, Maharashtra | 1,004 |

| Kotak Mahindra Bank | 2003 | Mumbai, Maharashtra | 1,369 |

| Yes Bank | 2004 | Mumbai, Maharashtra | 1,050 |

| Bandhan Bank | 2015 | Kolkata, West Bengal | 1000 |

| IDFC First Bank | 2015 | Mumbai, Maharashtra | 301 |

Foreign Banks

These are the banks that have their headquarter located in a foreign country while they are operating in our country. Examples of Foreign banks are HSBC, Bank of America, American Express, Royal Bank of Scotland, etc.

They should have a foreign direct investment of 74% from the foreign country.

To comply with the local rules and regulations, foreign banks must have a minimum capital of 5 billion (i.e. 500 crores).

The banks must maintain priority sector lending of 40% (including lending to agriculture, MSME, weaker sections, renewable energy, education, and housing).

Regional Rural Banks (RRBs)

Regional Rural Banks (RRBs) were set up in 1975 on the recommendation of the Narshimham Committee to primarily serve the rural areas of India by providing them the basic banking and financial services.

RRBs are regulated by NABARD (National Bank for Agriculture and Rural Bank) and they operate at regional levels in different states of India. RRBs have their branches set up for the urban areas.

A typical RRB has a 50% stake of the central government, 15% of state government, and 35% of the sponsor banks.

Prathama Bank is the first RRB set up in India. This was established on 2nd October 1975 and was sponsored by Syndicate Bank with its headquarters at Moradabad.

Co-Operative Bank

What is a Co-Operative Bank?

A Co-Operative Bank is a non-profit, self-help/mutual-help institution that holds deposits, makes loans, and provides financial services to co-operatives and member-owned organizations. Co-Operative Banks are registered under the co-operative societies act, 1912 and are regulated by the RBI under the Banking Regulation Act, 1949 and Banking Laws act, 1965.

These banks function on the principle of one member, one vote. Their functions include deposit mobilization, the supply of credit, and provision for remittance.

Types of Co-Operative Bank

The co-operative banks can be categorized into the following categories:

State Co-operative Banks: State co-operative banks work at the state level. They can operate in 2-3 states due to which they are often known as multi-state co-operative banks.

District Central Co-Operative Banks: District Central co-operative banks as the name suggests, they work at the district level. These banks act as a link between the societies present at the village level to the state co-operative banks.

Difference between Commercial Banks and Co-Operative Banks

The major differences between the commercial banks and co-operative banks can be understood from the table given below:

| Commercial Banks | Co-Operative Banks | |

| Definition | Offer banking services to individual and businesses | Offer banking services to a limited extent (to agriculturists, rural industries, etc.) |

| Governed by | Banking Regulation Act, 1949 | Co-Operative Societies act, 1912 |

| Type of Organization | Profit Based | Non-Profit Based |

| Areas of Operation | Large | Small |

| Borrowers | Account Holders | Member shareholder |

| Categorized into | Public Sector Banks, Private Sector Banks, Foreign Banks, and Regional Rural Banks (RRBs) | State Co-operative Banks, District Co-Operative Banks |

Small Finance Banks

These banks help with financial inclusion of sections which are not taken care of by other leading banks. They look after micro industries, unorganized sector, small farmers etc. RBI and FEMA are the governing bodies of these banks.

These are:

1. AU SMALL FINANCE BANK

2. CAPITAL SMALL FINANCE BANK

3. FINCARE SMALL FINANCE BANK

4. EQUITAS SMALL FINANCE BANK

5. ESAF SMALL FINANCE BANK

6. SURYODAY SMALL FINANCE BANK

7. UJJIVAN SMALL FINANCE BANK

8. UTKARSH SMALL FINANCE BANK

9. NORTHEAST SMALL FINANCE BANK

10. JANA SMALL FINANCE BANK

Payments Banks

This is a new model of banking in India. A payment bank is categorised as a scheduled bank, conceptualised by Reserve Bank of India formed committee headed by Dr Nachiket Mor on 23 September 2013. On 19 August 2015, the Reserve Bank of India gave in-principle licences to eleven entities to launch payments banks. The minimum capital requirement to set up a payment bank is 100 Crore.

The main objective of payments bank is to broaden the reach of payment and financial services to small businesses, low-income households, migrant labourers in a very secured technology-enabled environment. They have restricted operations, can take maximum of Rs. One Lakh is acceptable per customer by these banks. Like other banks, they also offer para-banking services like ATM cards, Debit- Credit cards, net-banking, mobile banking etc.

The RBI had given licences to 11 payments bank of which following are currently operational.

- Airtel Payments Bank,

- Fino Payments Bank,

- Jio Payments Bank and

- Paytm Payments Bank

Those who have backed out from the payments bank space include Tech Mahindra, Cholamandalam Finance and a consortium of IDFC Bank, Telenor and Sun Pharma. In July 2019, Aditya Birla Payments Bank said it would close operations by October 2019 due to unanticipated developments that rendered the economic model unviable

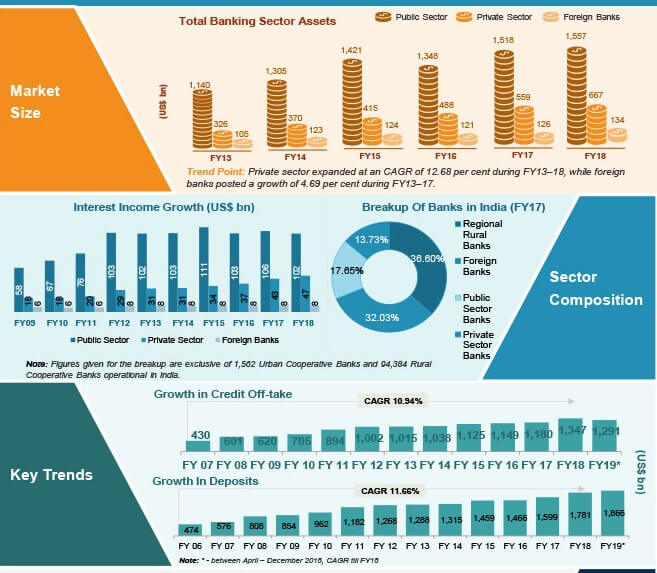

Banking Sector in India – Overview

The image below from IBEF Growth of Banking Sector shows the composition of banking sector in India, growth of deposits etc

Banking sector in India

Please check out Wikipedia article List of Banks in India for names of banks.

Related Articles:

- Nationalisation of banks: When, Why and Impact

- Banks Failure: Can Banks in India Fail? Too Big to Fail Banks

- Reserve Bank of India

- What is Bank

Thank you very much for sharing detailed information about banks. This is really valuable information. On this matter, I want to suggest to you that if you want to find the details of these banks then you can see it capital one routing number.