Transaction cost is the amount borne by the buyer or seller to avail a particular service or product. For example for buying a house, brokerage or commission paid to house brokers, stamp duty and registration charges paid to the government is transaction cost for buyer/seller. Making profits out of the market is back-linked to complex trading cost. So lets first understand the transaction costs involved in buying or selling shares such as Brokerage, Securities Transaction Tax(STT), Stamp duty, service tax,Other charges. And then see what is STT and how it impacts profits? How does Brokerage cost impact Transaction cost? How can you bring your transaction costs down while buying or selling shares?

Table of Contents

What are the Transaction costs involved in Buying or Selling shares or stocks?

You want to invest Rs 60,000 in the stock market. Hence you deposit Rs 60,000 in your trading account so that you can buy shares. You analyze the market & you decide to buy shares of Company ABC. Let’s assume, Stock of ABC is Rs 500 per share & you buy 100 of shares. So, you bought 100 shares of ABC at the rate of Rs 500 per share. Your total investment becomes Rs 50,000.

Then is Rs 10,000 left in your account “NO”. There are some costs you’ll have to bear when you purchase shares as well as sell-off your holdings or shares & this cost structure is called TRANSACTION COST

Trading cost= Brokerage+ STT+ Stamp duty+ service tax+ Other charges.

STT: Securities Transaction Tax

There are other trading costs that add up to your transaction costs. Before that you should know two terms:

When you buy and sell a stock within the same day, it is called Intraday Trading. When you purchase shares and hold them overnight, then you take delivery of the shares and hence, this is called Delivery Trading

Brokerage: This is charged by the broker as his commissions. Let see examples, When you had a transaction of Rs 50,000 broker charges you a commission of 0.3% on the transaction amount which is Rs 150.

Let’s assume, after a week the stock shot up around Rs 550 per share & you decide to sell share about taking the profits of Rs 50 per share. So you sell off your 100 shares that you bought for rs 500 per share. Now while selling off, you’ll again have a transaction of Rs 55,000 & the broker will again charge you a commission of 0.3% on that which is Rs 165

So in this entire trade, you made a total profit of Rs 5000 by buying & selling shares & your cost of broker commission is Rs 315( rs 150 while buying & rs 165 while selling ). But your net profit gained after brokerage is Rs 4685 ( Rs 5000 of total profit – Rs 315 brokerage cost).

Overall , you can assume around 0.2% will be charged on your transaction combining all different charges by govt. Let’s see an example of the cost of transaction on buying shares in NSE.

Now let’s assume that you purchased 100 XYZ share at Rs 500 through NSE you’re brokerage is 0.3% for a delivery trade, the total cost of buying shares with all transactions costs would be calculated as follows:

| Particulars | Amount (Rs.) |

| Total turnover | 50,000 |

| Brokerage ( 0.3%) | 150 |

| Stamped duty/charges on delivery: 0.01% | 5 |

| Securities transaction tax on delivery: 0.1% on turnover | 50 |

| Turnover tax/transaction charges: 0.0035% on turnover | 1.75 |

| Service tax: 14% on brokerage | 21 |

| Service tax: 14% on turn over/transaction charges | 0.25 |

| Swachh Bharat Cess: 0.50 % on brokerage and turn over/transaction charges | 0.86 |

| Krishi Kalyan Cess: 0.50 % on brokerage and turn over/transaction charges | 0.86 |

| Total charges (including brokerage) | 229.71 |

| Total payable (in case of purchases) | 50,229.71 |

| Total receivable (in case of sale) | 49,770.30 |

Explanation of various Transaction costs while buying or selling shares

Lets look at the various transaction costs while buying or selling shares in detail .

SEBI Turnover fees

Sebi’s turnover fees is part of the fee that investors pay to the exchanges through their brokers for trading on their platforms and the exchanges in turn pass it on to the regulator. SEBI also charges a Rs 50,000 annual fee from the brokers. In fiscal 2016, the aggregate collection of fees under these two heads was Rs 34.2 crore, as per the SEBI annual report. For example in Jan 2017 Sebi reduced its turnover fees by 25% to Rs 15 per Rs 1 crore worth of turnover from Rs 20 earlier

| Sr. No. | Nature of securities | Rate of Fee |

| 1. | All sale and purchase transactions in securities other than debt securities | 0.0015 per cent of the price at which the securities are purchased or sold (Rs.20 per crore) |

| 2 | All sale and purchase transactions in debt securities | 0.000005 per cent of the price at which the securities are purchased or sold (Rs.5 per crore) |

Stamp Duty

Stamp duty is levied on the value of shares transferred. In India, stamp duty is levied by various states and hence rate of stamp duty varies from state to state. In Maharashtra, the stamp duty rate for Cash Market (other than Government Securities) and Derivatives Market Turnover (non-delivery) is :

| Type of Trade | Stamp Duty Rate |

| Non-delivery trade | 0.002% |

| Delivery trade | 0.01% |

Service Tax

Service tax is a tax levied by the government on service providers on certain service transactions but is actually borne by the customers. It is categorised under indirect tax and came into existence under the Finance Act, 1994. For consumers like us, service tax is omnipresent, well quite literally. From eating-out to travelling to entertainment, almost every expense that one makes has an element of service tax in it.

| Category | Tax Rate | Payable By |

| Stock brokers Services | 15.00% (14.00% service tax, 0.50% swachh Bharat cess, 0.50% krishi kalyan cess) | Brokers and collected from their clients. However if the services are partly performed outside India and payment is received in convertible foreign exchange within 6 months, then the services will be treated as Export of Services and will be exempt from levy of Service Tax |

Securities Transaction Tax (STT)

Securities transaction tax is payable in India on gains from securities traded in except commodities and currency. STT is a direct tax that is collected by the Central Government of India

| Sr. No. | Taxable securities transaction | Tax rate from June 1, 2013 upto May 31, 2016 | Tax Rate w.e.f. June 1, 2016 | Payable by |

| 1. | Purchase of an equity share in a company, where such contract is settled by the actual delivery or transfer of such share or unit. | 0.100 per cent | 0.100 per cent | Purchaser- on the value of taxable securities transaction based on the volume weighted average price. |

| 2. | Sale of a equity share in a company, where such contract is settled by the actual delivery or transfer of such share or unit | 0.100 per cent | 0.100 per cent | Seller – on the value of taxable securities transaction based on the volume weighted average price. |

| 3 | Sale of a unit of an equity oriented fund, where such contract is settled by the actual delivery or transfer of such share or unit | 0.001 per cent | 0.001 per cent | Seller – on the value of taxable securities transaction based on the volume weighted average price. |

| 4a | Sale of an option in securities | 0.017 per cent | 0.05 per cent | Seller – on the option premium.. |

| 4b | Sale of an option in securities, where option is exercised | 0.125 per cent | 0.125 per cent | Purchaser – on the settlement price. |

| 4c | Sale of a futures in securities | 0.010 per cent | 0.010 per cent | Seller – on the price at which such futures is traded. |

What is STT and how does it impact profits while buying or selling shares?

Securities transaction tax is payable in India on gains from securities traded in except commodities and currency. STT is a direct tax that is collected by the Central Government of India. The rate of taxation is different for equity and futures and options.

Suppose a trader buys 1000 shares worth Rs.20000 at Rs.20 each and sells it at Rs.30 each. If the trader sells the shares the same day then intraday STT rate will apply which is 0.025%.So, STT = 0.025*30*1000 = Rs.750

While introducing the Securities Transaction Tax (STT) in 2004-05 on stock market trades, the then finance minister P Chidambaran seems to have been inspired by one of the basic rules of the stock broking business, whether the client gains or loses, the broker still gets his commission

Similarly, irrespective of the day-trader/investor making money or not, the government would still get the STT owed to it. STT nets the government around Rs 7000-7500 crore annually, and it is next to impossible to evade this tax as stock exchanges have the record of every single trade. So the government does not have to spend much to ensure compliance.

The only problem being that higher the STT, higher will be the cost of transaction and thus lesser will is the profit earned. As STT is decided by the government and not individual brokerage firms, an individual investor cannot do much to save STT. Therefore, it is wise for the investor to save these trading costs via other sources like opting for lesser brokerage firms. Read more about STT.

How does Brokerage cost impact Transaction cost?

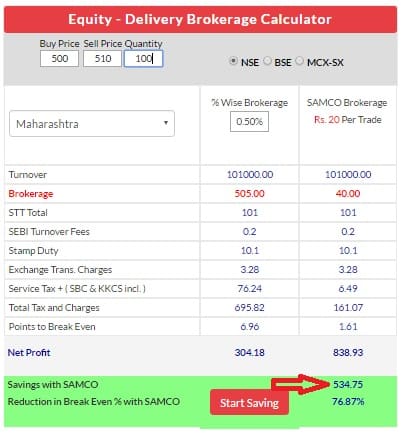

Using a Brokerage calculator like the one Samco Securities has created , one can see, how lower brokerage can increase your profits in equity- intra-day and delivery, futures and options commodities. For example Discount broker Samco charges flat Rs. 20 per Executed Order or 0.2% of intro-day equity futures or delivery equity or delivery equity whichever is LOWER, thus saving a fortune especially on higher volume trade. The image below shows on turnover of 1,01,000 one can save 500Rs per transaction. So even if you can’t save on STT save on brokerage!

How brokerage and Annual Maintenance Charges (AMC) can impact your profit?

Brokers also charge an amount called Annual Maintenance Charges (AMC) that is deducted monthly from your account. It is a better option to enroll for lump-sum payment of AMC to save on your cost thus lowering your overall transaction cost and shooting better returns. Though some brokerage firms claim lowest brokerage but have hidden costs that are charged during the course of time. These include:

- Inactivity fees.

- Fees for not maintaining minimum balance

- Interest on margin loans

- Account opening charges

What cost has to be considered while calculating Capital Gains

In the case of sale of shares, you may be allowed to deduct these expenses:

a. Broker’s commission related to the shares sold

b. STT or securities transaction tax is not allowed as a deductible expense

For example:

Swati bought 250 shares of a listed company in October 2018 at a cost of Rs. 155 per share, paying a total of Rs. 38,750. She sold them for Rs. 192 per share in March 2019, after 5 months, at Rs. 48,000. Let us see how much her short-term capital gains will be.

- Full sales value – Rs. 48,000

- Brokerage at 0.5% – Rs. 240

- Purchase price – Rs. 38,750

- Therefore short-term capital gain made by Swati will be Rs. 48,000 – (Rs. 38,750+ Rs. 240) = Rs. 9,010

Long-term capital gains can be computed by subtracting the following 3 items from the total value of sale:

- Brokerage or expenditure incurred in connection with the sale of the asset

- The indexed purchase price of the asset

- Indexed cost is arrived at when the price is adjusted against the rise in inflation in the asset’s value. The Government of India releases the Cost Inflation Index, through which the indexed cost can be estimated.

Sandeep bought 250 shares of a listed company in October 2014 at a cost of Rs. 145 per share, paying a total of Rs. 36,250. He sold them for Rs. 192 per share in March 2016, after 17 months, at Rs. 48,000. In this case, to calculate long-term capital gains, we first need to check what the Indexed purchase price of the asset is.

Indexed purchase price of the shares = 36250 x 1081 / 1024 = 38268 approximately

So Sandeep’s long-term capital gains are based on the following numbers:

- Full sales value – Rs. 48,000

- Brokerage at 0.5% – Rs. 240

- Indexed purchase price – Rs. 38,268

- Indexed improvement cost – Rs. 0

- The long-term capital gains made by Sandeep will be Rs. 48,000 – (Rs. 38,268+ Rs. 240) = Rs. 9,492

Note: Samco is just chosen as an example.

Related Articles:

- Investing in Stock Market: Open Demat account and Trading account

- Stock exchange: What is it, Who owns, controls

- Stock Market Index: The Basics

- Why people Lose Money in Stock Market

- News that affect the Stock Market

- Ups and Downs of Sensex

Before selecting your stock broker keep the transaction cost in mind, as recommended by Warren Buffet. Hence Trading with a discount broker like SAMCO gives helps increase your profits by keeping your transaction cost at a bare minimum.

9 responses to “Transaction costs while buying or selling shares or stocks”

Can I add dmart charges to cost of acquisition?

In share trading there are various charges like brokerage, stt, gst, stamp duty, exchange fee, sebi turnover fee etc. So while calculating long/ short term capital gain from shares what are the charges from above can claimed as a expenses when share trading is not done as business. I will be very much grateful if somebody will guide me on this.

and what is income tax law for this

Very interesting question.

In the case of sale of shares, you may be allowed to deduct these expenses:

a. Broker’s commission related to the shares sold

b. STT or securities transaction tax is not allowed as a deductible expense

For example:

Swati bought 250 shares of a listed company in October 2018 at a cost of Rs. 155 per share, paying a total of Rs. 38,750. She sold them for Rs. 192 per share in March 2019, after 5 months, at Rs. 48,000. Let us see how much her short-term capital gains will be.

Full sales value – Rs. 48,000

Brokerage at 0.5% – Rs. 240

Purchase price – Rs. 38,750

Therefore short-term capital gain made by Swati will be: Rs. 48,000 – (Rs. 38,750+ Rs. 240) = Rs. 9,010

Long-term capital gains can be computed by subtracting the following 3 items from the total value of sale:

Brokerage or expenditure incurred in connection with the sale of the asset

Indexed purchase price of the asset

Indexed cost is arrived at when the price is adjusted against the rise in inflation in the asset’s value. The Government of India releases Cost Inflation Index, through which the indexed cost can be estimated.

Sandeep bought 250 shares of a listed company in October 2014 at a cost of Rs. 145 per share, paying a total of Rs. 36,250. He sold them for Rs. 192 per share in March 2016, after 17 months, at Rs. 48,000. In this case, to calculate long-term capital gains, we first need to check what the Indexed purchase price of the asset is.

Indexed purchase price of the shares = 36250 x 1081 / 1024 = 38268 approximately

So Sandeep’s long-term capital gains are based on the following numbers:

Full sales value – Rs. 48,000

Brokerage at 0.5% – Rs. 240

Indexed purchase price – Rs. 38,268

Indexed improvement cost – Rs. 0

The long-term capital gains made by Sandeep will be: Rs. 48,000 – (Rs. 38,268+ Rs. 240) = Rs. 9,492

but what about the brokerages & expenses while purchasing shares. Nothing mentioned about gst ,stamp duty etc.

sir i have sold niftee bees ,broker has not deducted stt .is there going to be problem later.it is like share

thanks & regards

ETFs are attractive investments because of their low costs, diversified holdings, tax efficiency and stock-like features. ETFs are the most popular type of exchange-traded products in the USA and Europe. In India to promote investment activity in ETF and to attract retail investors who can use ETF’s as an easy entry vehicle into the capital markets government has kept very lower security transaction tax (STT).

Currently, most ETF’s are exempt from STT upon purchase

The STT is applicable only the sell side of ETF @ of 0.001%.

No STT for GOLD ETF’s and Liquid ETF’s.

thanks for prompt reply,but my doubt is not deducting STT by broker while selling unit

2, as per IT return gain in equity is tax free if same is held for more than one year and STT is deducted and same is to be reflected in ITR2 in column tax free income where STT is paid

3, gold and liquid etf are debt scheme so no question of STT

4,i have put this view to broker they are not giving satisfactorily reply,where my complain will be addressed. warm regards

Did you sell on BSE/NSE?

Who is your broker?

Simple and Effective ! a great info-taining article 🙂