2012 was an eventful year, from big events like the London Summer Olympics and the U.S. presidential race, to regional conflicts in the Middle East and Africa, to issues closer to home. India was the worst performing global equity market in 2011 and 2012 didn’t hold much promise. But the market and the economy have their own ways. Despite very little going India’s way, periodic bursts of foreign fund flows, and reform measures announced by the government changed sentiment. Till September, the rally was mainly on account of benign liquidity but post Chidambarama’s return to the finance ministry in August, the markets were buoyed by the government’s reform drive. From being the worst performing market globally in 2011, Indian equities turned the corner registering a 25 percent return year to date. Let’s take stock of how Indian economy( inflation, fiscal deficit, gold, CAD, RBI movements, rupee ,challenge by euro crisis) fared, in 2012 and what challenges lay ahead in 2o13.

Table of Contents

Taking Stock

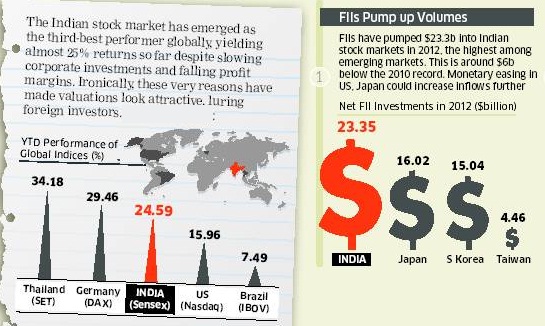

Indian markets climbed the wall of worry both the global and the domestic, to rank the 3rd best-performing market globally and the best performing market in Asia in 2012.

FII flows into Indian shares: The popular belief was that the problems in the Eurozone and US would have repercussions for the global economy, and prompt investors to shun risk assets like emerging market equities. On the contrary, net FII flows of over USD 22 billion into Indian equities was the second highest in a single year.

Stock market beats Gold :The stock market in India is up about 25% in 2012 and has beaten gold, where money has grown by about 12%

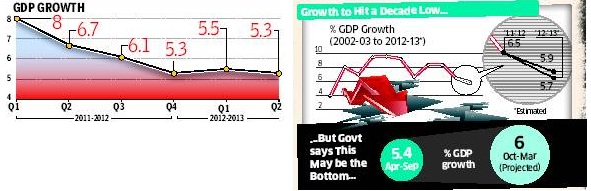

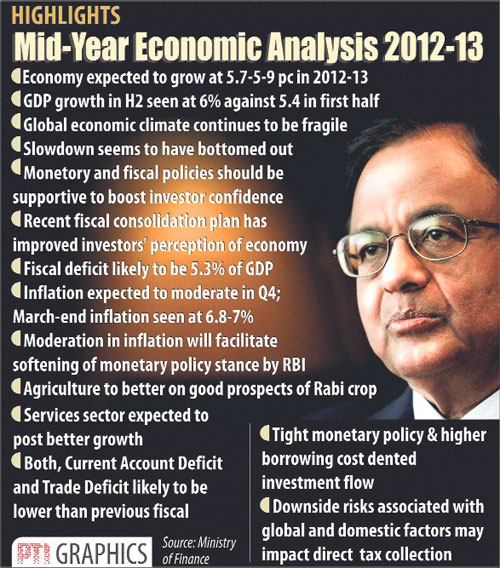

GDP growth :GDP growth for the first and second quarters of FY13 averaged 5.4%. After projecting a growth target of 7.6% for the fiscal, the government has now toned down its estimate to 5.7-5.9%, the lowest in a decade.

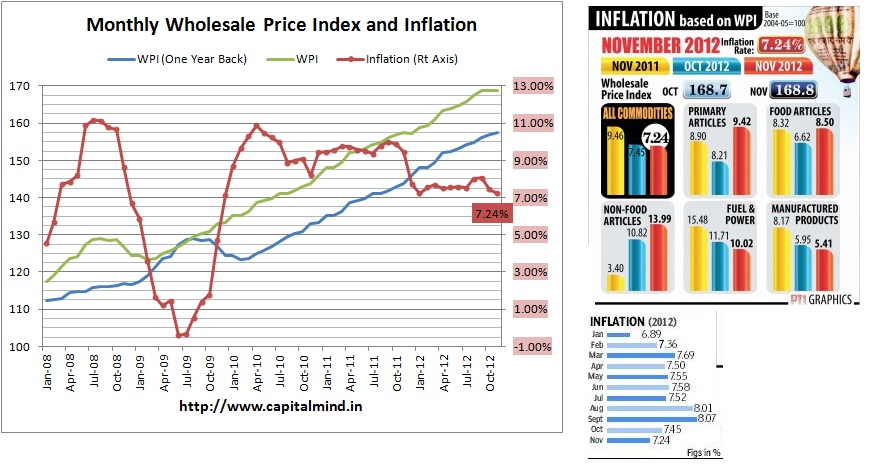

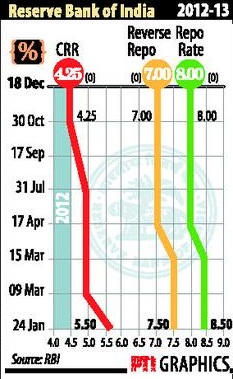

Inflation: Inflation showed no signs of easing, despite the slowing economy, as supply side problem and loose fiscal policies hampered RBI’s efforts to check price rise. The central did cut rates by 50 basis points once during the year, but that was about it. Inflation, rather than growth, was RBI’s priority and continuous easing of rates did not happen.

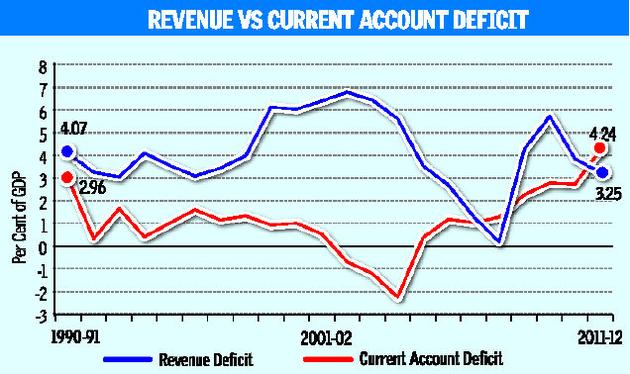

Current Account Deficit: The current account measures the value of goods, services, investment incomes and transfers . A deficit implies the country is importing more goods and services than exporting. More details at: Economic’s help Global Current Account Deficits, Pinterest What India imports and exports, HindiBusinessLine Twin Deficits Myth

Downgrade of India’s sovereign rating:The crisis has not been fully averted, but one of the oft-repeated predictions was that India would be downgraded by rating agencies this calendar itself. The Finance Minister has managed to keep the wolves from the door for now, but it is still an uphill task ahead.

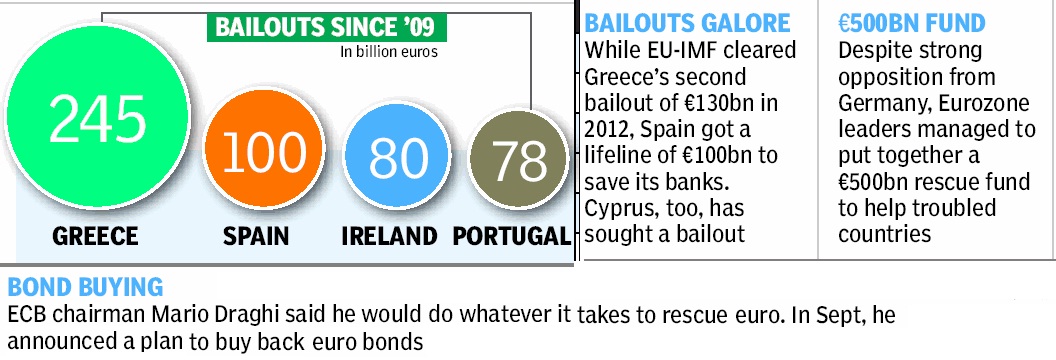

The Euro-crisis remained a serious threat to the world economy and while adjustment of deep-rooted imbalances across the euro area has begun, much more is needed to ensure long-term sustainability, including structural reform in both deficit and surplus countries

Challenges facing Indian Economy

In May 2012 HDFC Fund Manager, Prashant Jain, wrote letter to investors:It’s tomorrow that matters (pdf file) about key challenges facing the Indian economy with the message Bull markets are born on pessimism, grow on skepticism, mature on optimism and die on euphoria.

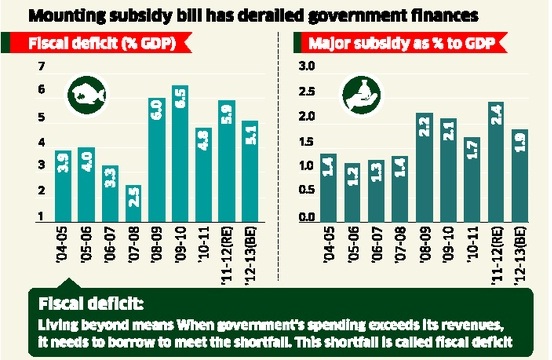

High Fiscal deficit: This has been the key concern in India over the last few years. Fortunately at one level and unfortunately at another, this is an issue that is of our own making and therefore the solution is in our reach too. Though some steps have been taken in the last budget, the real solution lies in eliminating / sharply reducing the diesel subsidies. Despite several disappointments on this front over last several years, there is hope that this will be tackled on a priority basis as the dangers of not tackling this are hidden from none.

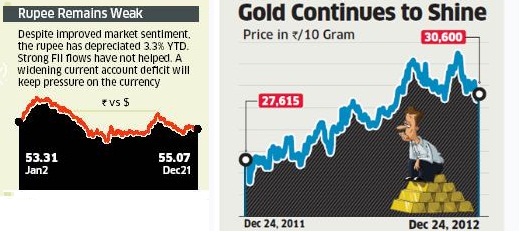

High Current account deficit (CAD): The worsening of current account deficit over last few years from 1.3% of GDP in FY08 to nearly 3.8% in FY12 (market estimates) is almost entirely on account of increase in gold imports from 0.4% of GDP in FY08 to 2.3% (E) of GDP in FY12. Looking at the sharp rally in gold prices over last several years, investor behaviour that is so typical of such situations, significant moderation in USD gold prices over last year and sharp moderation in recent gold import volumes, it appears that the highest gold imports are behind us. If this is indeed the case, then as and when gold imports revert closer to longer-term average of 0.5% of GDP, the CAD should get addressed progressively in the current and over the next few years. The sharp INR depreciation should also moderate CAD in FY13 and beyond by making exports more competitive and imports costlier.

Depreciating INR: This is a result of high CAD and of poor investment sentiment leading to weak capital flows. Though forecasting currencies is harder than stock markets, it has been experienced that when there is a consensus in one direction, that is where the turning point often is. A nearly 25% depreciation in less than one year of the currency of a large economy like India is not a small movement and it appears to be excessive. What could also come to the help of the INR is the expected improvement in CAD in FY13, any policy steps that improve investment sentiment, notably reducing fuel subsidies and / or any moderation in global crude oil prices.

European Crisis: Though the way forward of European crisis is hard to figure out, most would agree that the impact of the European crisis on the Indian economy and therefore on the equity markets over long periods should be much less than on other countries. This is so because India’s exports / investments in the stressed economies of Europe are miniscule.

The road ahead : Year 2013

The outlook for equity has definitely improved in the later part of 2012. As a result, the stock market in India is up about 25% in 2012 and has beaten gold, where money has grown by about 12%, by a wide margin. But it is also important to note that the stock market lost about 25% in 2011 even as gold went up 31% in the same year. The domestic market, apart from the positive vibes from the global development, has also gathered momentum because of some reforms measures by the government and expectations around cut in interest rates in 2013. It is also expected that one of the biggest driver of our market—foreign institutional investors—will keep pumping money into the market. In this scenario, it would be interesting to see which asset class will outperform the other in 2013. Livemint’s Will 2013 see gold shine or equity outperform?

Eurozone debt crisis remains the biggest threat to the global recovery, followed by the US “fiscal cliff”, geopolitical risk to oil prices, high unemployment undermining confidence and emerging markets’ transition to domestic sources of growth.US fiscal cliff, if it materializes, could push the world economy into recession, while if the eurozone debt crisis is not sorted this could lead to “a major financial shock and global downturn.

All eyes are now on liquidity, interest rates, earnings, and a continuation of the reform drive in 2013. Politics could be a wild card with the possibility of an early election not being ruled out. In the near term, all eyes will be on budget 2013, the last full budget ahead of the next general elections. With a high fiscal deficit and Chidamabrama’s penchant for new taxes, investors are cautious on how far the finance minister will push to keep voters happy. Challenges before India are as shown in image below:

Other Reviews of 2012

Twitter‘s review for 2012, 2012.twitter.com is divided into 6 categories – Golden Tweets, Pulse of the planet, Only on Twitter, Trends, New Voices and Your year on Twitter.

Google‘s review titled Google Zeitgeist 2012 takes a look at all that happened this year right from Arab Spring to Hurricane Sandy. The report shows that there were close to 1.2 trillion searches made on Google this year in 146 languages. The report also takes into account the searches made in individual countries.The number one search term which was trending in India was that for the IBPS clerk exam. This was followed by ‘GATE Exams’. Sunny Leone was the third most trending search term in the country. Other top search terms were for the movies Rowdy Rathore and Ek Tha Tiger.

Facebook has looked back at the events of the year and organised them as stories on its Facebook Stories page.

Related Articles:

Inspired by Onemint’s The one big learning of 2012

Slowing economy, global financial turmoil, corruption scandals. No one knows what the future holds. Taking a call on which asset class will outperform in 2013 is a difficult one. What have you learnt from Year 2012?Did you anticipate equity will run up?Did your investment pattern change in 2012? How will be 2013? Where are you planning to invest in 2013? What are key challenges that India faces and you face?