I logged into income tax website to check my ITR status and I saw notice of Communication of proposed adjustment u/s 143(1)(a). I didn’t submit any response as 30days time limit is over. What am I supposed to do now?

Update on 7 Sep: Many readers have said that for them after limit of 30 days the eProceedings link got opened again. Please follow steps in our article Communication of proposed adjustment u/s 143(1)(a) and e-Assessment/proceeding

Table of Contents

Overview of if you did not respond to Communication of proposed adjustment under 143(1)(a)

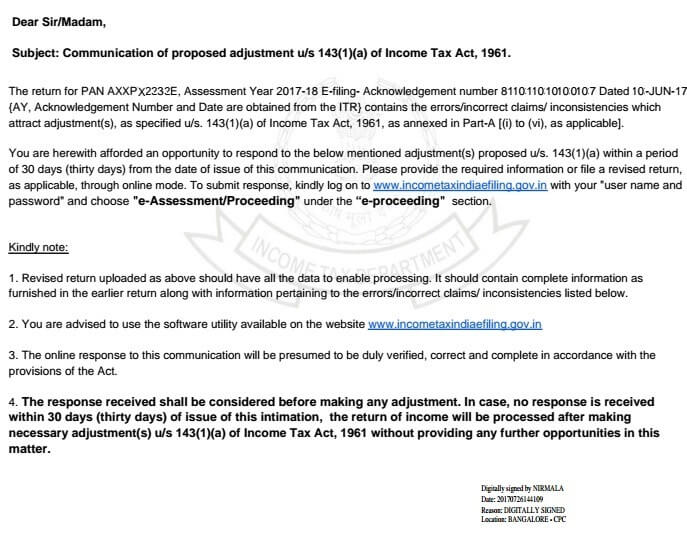

Please note that as per the notice, shown in the image below,

The response received shall be considered before making any adjustment. In case, no response is received within 30 days (thirty days) of the issue of this intimation, the return of income will be processed after making necessary adjustment(s) u/s 143(1)(a) of Income Tax Act, 1961 without providing any further opportunities in this matter.

- Sadly there is no way to reply after 30 days. The link for e-proceedings gets closed.

- We expect that You should get another email/notice from Income Tax Department asking you to pay extra tax for which demand was raised. You can expect Notice under Section 143(1) /Section 139(9). If you get Demand Notice earlier Income Tax Department allowed one to pay the outstanding tax if you agree or you can reject the Outstanding demand. We are not sure if this option would be available.

- If you have missed the communications because your Mobile or Email Id was not set up then either check the status regularly by logging to Income Tax website, going to My Account >> e-Filed Returns/Form . Or setup Mobile and Email id for receiving SMS and emails from Income Tax.

What happens next if you did not reply to Communication of proposed adjustment u/s 143(1)(a)?

Sadly there is no way to reply after 30 days. The link for e-proceedings gets closed.

We expect that You should get another email/notice from Income Tax Department asking you to pay extra tax for which demand was raised. You can expect

- Notice under Section 143(1) which would be a demand notice. If the tax is due, you will have to pay it within 30 days. Earlier If you get Demand Notice Income Tax Department allowed one to pay the outstanding tax if you agree or you can reject the Outstanding demand. We are not sure if this option would be available. Our article How to Pay or Reject Outstanding Income Tax Demand under Section 143(1) explains in detail.

-

Notice under Section 139(9) if your return is defective.The errors can include if you have used the wrong ITR form; if you haven’t paid the entire tax due; if you have claimed a refund for deducted tax but have not mentioned the relevant income; if there is a mismatch in the name on the form and PAN card, or if you have paid taxes but not listed income. You will need to correct your return and e-File your response under Section 139(9).

Update Mobile and Email id for receiving Income Tax Communication

If you have missed the communications because your Mobile or Email Id was not set up then either check the status regularly by logging to Income Tax website, going to My Account >> e-Filed Returns/Form . Or setup Mobile and Email id for receiving SMS and emails from Income Tax.

Income-Tax Department uses the registered contact details (Mobile number & E-mail ID) for all communications related to e-Filing. It is mandatory that all tax payers must have valid

contact details registered in e-Filing portal.

Details are Primary or Secondary. Primary or Secondary Contact Details can be used for sending the Alert, SMS, Email, and Notifications. But OTP Pin will be sent to Primary Contact Detail only. Typically a member of the family usually the father files return for himself, his parents, his wife and his adult children. When you are filing for some else, one needs to use Primary and Secondary details. Primary contact should be the one who is managing the efiling account say husband if he is managing e-filing account of wife

- One should provide his own email id and Mobile number as Primary Contact.

- One can enter any other person’s email or mobile number as a Secondary Contact.

- Same Primary contact details can be used for a maximum of 10 taxpayers or assessees.

To update Mobile and Email Id at income tax website

Overview of steps is given below. You can read our article How to update contact details on Income Tax e-Filing website for more details.

- Go to incometaxindiaefiling.gov.in.

- Now login with your account details with your user id, password, and date of incorporation/birth.

- Go to Profile Settings->My Profile in the Menu

- You would see 3 tabs PAN Details, Address and Contact Details

- Click on Contact Details. You would see the current Primary and Secondary Email Ids that are set currently.

- Click on Edit to make changes.

- Update the correct Contact Number and Mail Id

- Click Save after making Changes

- Related Articles:

- All articles on Understand Income Tax, Fill ITR,Income Tax Notice

- Communication of proposed adjustment u/s 143(1)(a) and e-Assessment/proceeding

- After e-filing ITR: ITR-V,Receipt Status,Intimation u/s 143(1)

- Understanding Income Tax Notice under section 143(1)

- Income Tax Notice :Sections,What to check,How to reply

- How to Revise Income Tax Return (ITR)

- Defective return notice under section 139(9)

- Filing Income Tax Returns after deadline

11 responses to “If you did not respond to Communication of proposed adjustment u/s 143(1)(a)”

I did not responded as as i have made a mistake in 80GG rent.

Now it shows add authorised representative. What should i do.. It is already 9 months. i have not received tax refund and ITR is also processed. How to rectify it, can anyone help me.

I did not responded as it said necessary adjustment will be made and ITR will be processed.

Now it shows add authorised representative. What should i do.. Its been 3 months. i have not received tax refund

Hi Ankur, Did you ITR processed? Can you tell me how to do now

I have received communication for proposed adjustment u/s 143(1)(a) but I couldn’t respond to it within the given period of 30 days and the link got expired. What can I do now? Please guide me.

Dear Sir/madam

I have receive income tax notice u/s 143(1) a income mismatch with 26AS .But stipulated time is over(30 day).

Now what i have to do for this.

If the notice is not responded well in time, tax department may send you a notice of demand under section 156 and may also initiate recovery proceeding after 30 days if any additional taxes is payable by the assessee.

Why was the notice sent?

Do you agree to the conditions raised in the notice or not?

Do you owe income tax department some tax?

Hi,

I filed my ITR for the first time last year and i filed my ITR in ITR 3 instead of ITR 4 by mistake. because of this i got a defective return notice.

i was asked to reply within 15 days but due to some unavoidable circumstances i could not reply to that notice.

now what should i do? can i revise my return and re-file under ITR-4?

Can we revise the return again in this case.

Did you agree and then submitted the return?

Can you explain the steps you took after getting the Income Tax notice?

Now the cpc extended I mean for those who couldn’t give reply with in 30 days can give reply now they made it open

Thanks a lot for the information.