LIC completed 60 years of its incorporation in August 2016. LIC’s celebrated this by announcing bonus and granting a onetime special bonus. It also launched LIC’s Bima Diamond Policy(Plan No. 841) on 1st September 2016 which is available for sale for up to 31st August 2017. This Bima Diamond Policy is the 4th policy launched by LIC in 2016 and is a non-linked traditional money back policy. This article reviews New LIC Bima Diamond Policy, its features, benefits and for whom this policy is ideal.

Table of Contents

Highlights of LIC Bima Diamond Policy

LIC Bima Diamond Policy is non-linked plan i.e it is NOT Unit linked Insurance Plan or ULIP which are a combination of life insurance and investment plans. In 2016 LIC lanuched 3 plans LIC Jeevan Labh Plan, LIC Jeevan Shikhar Plan and LIC Jeevan Pragati Plan. Key features of LIC’s new money back policy, Bima Diamond Plan are

- Money-Back: Money back at an interval of every 4th year. From the first premium paid, for every 4 years of subsistence, a percentage of the sum assured will be paid as survival benefit to the policy holder.

- On survival, the policy holder will receive the balance sum assured + loyalty additions.

- Extended Life Cover : Extended cover period for half of the policy term after end of the policy term.

- Auto cover feature : On a policy of at least 5 full years on which subsequent premium is not duly paid, auto cover period of 2 years is available.

- Premium Paying Term : Under this plan, you pay premium only for less years than the time for which policy is active. i.e The premium paying tenure is less than the life cover tenure. There are 3 fixed options.

- Policy Term of 16 years with Premium Paying Term of 10 years. Example : If you buy LIC Bima Diamond policy with Rs 5 lakh sum assured for 16 years then you need to pay the premiums for up to 10 years. Your life cover shall be for 24 years (16 Years policy term + 8 years extended coverage). You will get money back 3 times i.e 4th, 8th, 12th during policy tenure and rest on maturity.

- Policy Term of 20 years with Premium Paying Term of 12 years: If you buy LIC Bima Diamond policy with Rs 5 lakh sum assured for 20 years then you need to pay the premiums for up to 12 years. Your life cover shall be for 30 years (20 Years policy term + 10 years extended coverage). You will get money back 4 times(4th, 8th, 12th ,16th ) during policy tenure and rest on maturity.

- Policy Term of 24 years with Premium Paying Term of 15 years: If you buy LIC Bima Diamond policy with Rs 5 lakh sum assured for 24 years then you need to pay the premiums for up to 15 years. Your life cover shall be for 36 years (24 Years policy term + 12 years extended coverage). You will get money back 5 times(4th, 8th, 12th ,16th , 20th) during policy tenure and rest on maturity.

Existing LIC Money Back Plans

Money Back plans offered by LIC and overview of LIC Moneyback plans are given below.

- » LIC’s Bima Diamond Policy

- » LIC’s NEW MONEY BACK PLAN – 20 YEARS

- As part of the policy, 20% of Sum Assured is paid as survival benefit at the end of 5, 10 and 15 years.

- Also, a simple reversionary bonus is payable on maturity

- Minimum Basic Sum Assured: Rs. 100,000. Maximum Basic Sum Assured: No Set Limit

- Minimum Age: 13 years Maximum Age: 50 years

- Maximum Maturity Age for Life Assured: 70 years

- Term: 20 years

- Premium paying term: 15 years

- » LIC’s NEW MONEY BACK PLAN – 25 YEARS

- In case of Life Assured surviving to the end of the specified duration 15% of the Basic Sum Assured at the end of each of 5th, 10th, 15th & 20th policy year.

- Maturity Benefit: In case of Life assured surviving the stipulated date of maturity, 40% of the Basic Sum Assured along with vested Simple Reversionary Bonuses and Final Additional bonus, if any, shall be payable.

- » LIC’s NEW BIMA BACHAT :

- You need to pay premium only one time.

- Minimum entry age required to buy this policy is 18 years. Maximum entry age is 65 years.

- The policy will mature when the person is 75 years old.

- The minimum sum assured needs to be Rs. 20,000.

- The policy offers three terms to choose from based on your age and requirement. The terms include 9, 12 and 15 years.

-

- The policyholder will receive 15% of the sum assured for a term of year 9 years at the end of 3rd and 6th policy year.

- The policyholder will receive 15% of the sum assured for a term of 12 years at the end of 3rd, 6th, and 9th policy year.

- The policyholder will receive 15% of the sum assured for a term of 15 years at the end of 3rd, 6th, 9th, and 12th policy year.

- » LIC’s NEW CHILDREN’S MONEY BACK PLAN

- The plan can be purchased by any of the parent or grand parent for a child aged 0 to 12 years.

- On the Life Assured surviving the policy anniversary coinciding with or immediately following the completion of ages 18 years, 20 years and 22 years, 20% of the Basic Sum Assured on each occasion shall be payable, provided the policy is in full force

- LIC’s Premium Waiver Benefit Rider is available as an optional rider on the life of proposer aged between ages 18 to 55 years by payment of additional premium. In case of death of the proposer, the premiums under the basic plan falling due after the date of death shall be waived

- » LIC’s Jeevan Tarun

- Premium needs to be paid till the child is 20 years old while the policy continues till the child completes 25 years of age

- The plan can be purchased by any of the parent or grand parent for a child aged 0 to 12 years.

- The risk cover on the child starts after he completes 8 years of age or 2 years from date of policy commencement, whichever is earlier

- There are 4 options for choosing maturity benefit:

- Option 1: No Survival Benefit on Matuirty 100% of Sum Assured + vested Bonuses

- Option 2: 5% of Sum Assured paid every year for the last 5 policy years on Maturity The remaining 75% of the Sum Assured is paid + vested Bonuses

- Option 3: 10% of Sum Assured paid every year for the last 5 policy years on Maturity The remaining 50% of the Sum Assured is paid + vested Bonuses

- Option 4: 15% of Sum Assured paid every year for the last 5 policy years on Maturity The remaining 25% of the Sum Assured is paid + vested Bonuses

LIC Bima Diamond Policy is Money back plan

Money back means that a certain percentage of sum assured is paid back to the policy holder at regular intervals and rest is paid on Maturity. In simple words, the money comes back to the holder in between the policy term rather lump sum in the end. LIC Bima diamond policy ensures money back every 4 years. The following table states the policy tenure and the years money will be returned. Our article discusses in detail about Mixing Insurance with Investment

| Policy Tenure | Money back received in | % of sum assured received every 4 years | Total % of sum assured received | On Maturity |

| 16 years

|

4th, 8th and 12th policy year | 15 | 45% in 16 years | 55% of sum assured + Loyalty additions |

| 20 years | 4th, 8th, 12th and 16th policy year

|

15 | 60% in 20 years | 40% of sum assured + Loyalty additions |

| 24 years | 4th, 8th, 12th, 16th and 20th policy year

|

12 | 60% in 24 years | 40% of sum assured + Loyalty additions |

Death Benefit of LIC Bima Diamond Policy

- If the mishap occurs within 5 years of the policy tenure the nominee will receive the entire sum assured as death benefit.

- Once it crosses the 5 year line sum assured along with loyalty addition will be received by the nominee.

- In case of death after maturity i.e during the extended cover period, 50% of the basic sum assured will be granted as death benefit.

Let us see the benefits with the help of an example: Mr. Rohan, age, 30 buys the New Bima Diamond policy for a policy term of 24 years and sum assured Rs. 500000 with premium of Rs.29835.

- If he passes away with the first 5 years of policy purchase, his family/nominee will get Rs. 500000

- If he passes away between 5 years to 23 years on taking the policy: then the family/ nominee will get back Rs. 5 Lakhs + Loyalty addition as applicable.

- The extended cover for Mr. Rohan will be for 12 years. So total policy cover = 36 years. If Rohan passes away when he is 56 i.e during the extended cover period, his family will receive Rs. 2.5 Lakhs as death benefit.

- If he is alive when the policy matures in the 24th policy year or when he is 54, he will get back Rs. 200000+ loyalty additions. Also in the 4th, 8th, 12th, 16th and 20th year of survival he will receive Rs. 60000 each time as survival benefit.

Extended life cover in LIC Bima Diamond Policy

The LIC Bima diamond policy an extended risk tenure that begins once the actual policy tenure expires. It means you would keep getting life cover even after the policy tenure ends. The period of extended cover would the half of the policy tenure. This extension in tenure is available without any additional cost.

For example Mr. Saini has opted for a 20 year LIC Diamond Policy. Mr, Saini dies in the 21st year. As the original policy tenure is 20 years, the extended risk cover is of ½ * 20 years = 10 years. So the life cover will for a period of 30 years and without spending an extra penny!

Auto Life cover in case of lapse of LIC Bima Diamond Policy

A unique feature of this policy is the automatic life cover wherein you continue to enjoy the benefits even after policy lapse. If you fail to pay premiums on time and within the grace period, the policy lapses and enters the auto cover stage. The period for auto cover depends upon the number of premiums previously paid.

- If the premiums are paid for less than 3 years, there will not be any auto cover.

- If premium is paid for 3 years but less than 5 years attract auto cover for 6 months.

- If premium is paid for more than 5 years auto cover will be for 2 years.

Bonus and Loyalty additions in the LIC Bima Diamond Policy

This policy is not eligible for any bonus. But it qualifies for loyalty additions after payment of all premiums or on death after 5 years. LIC declares loyalty addition time to time. It depends upon the surplus of the LIC. Loyalty addition is also factored in while calculating the surrender value of the LIC Bima Diamond Plan.

Tax Benefit of the LIC Bima Diamond Policy

Premiums paid are exempted from tax under Section 80 C and maturity proceeds are exempted from tax under Section 10 (10D) . Our article Before Buying Insurance Policy to Save Income Tax covers in detail all aspects of claiming tax benefit in buying insurance policy.

Option to avail term riders

Optional riders for an additional cost can be availed while buying this policy. Accidental death and disability benefit riders are available to pair with the policy. The rider sum assured cannot exceed the basic sum assured.

Loan can be taken against the LIC Bima Diamond Policy

Loan can be taken against this policy.The maximum loan that can be availed is 80% of the paid up policy or 90% is all premiums are paid.The loan interest rate keeps changing with time but is presently 10% p.a.

Should one Buy LIC Bima Diamond Policy

Endowment and Money Back plans are traditional insurance cum savings products that have been very popular in India (especially from LIC). The endowment plans pays the money, which includes the sum assured (or cover) and bonus, on the maturity of the policy. Money back policy, on the other hand, returns money usually as a fixed percentage of the sum assured to the insured during the term of the policy at some regular frequency (e.g. 5 years). The balance sum assured and bonuses are paid on the maturity of the money back policy. In the event of a death claim, both endowment and money back plans pay the sum assured to the insured.

Who should buy LIC Bima Diamond Policy?

- As endowments are money back policies that literally pay back the money in installments, it is ideal for people who require money at regular intervals such as for child education. It is also suitable for people who look at insurance as an investment cum saving option. This investment cum saving policy can be bought to fulfill your short or long term financial needs

- You have an option to pay less and get life cover for a longer period of time.

- Also people who do not have a fixed source of income to pay premiums and generally tend to default have an option to delay the premium payment by maximum 2 years.

Negatives of LIC Bima Diamond Policy

- Premium rates are very high.

- Maximum Sum assured is only Rs. 500000. After 20 years value of 5 lakhs will not be much.

- No guaranteed or simple reversionary bonus.

How much return would you get from LIC’s New Bima Diamond Policy?

LIC’s New Bima Diamond policy is a money-back policy so returns will not be higher than 4-5%.Benefit illustration is shown below.

| Particulars | |

| Age at entry | 30 |

| Mode of premium payment | Yearly |

| Basic Sum Assured | 100000 |

| Policy Term | 16 |

| Premium Paying Term | 10 |

| Amount of annualised premium * | 8712.00 |

Variable scenario 2: Gross Investment return 8% p.a.

Variable scenario 1: Gross Investment return ©4% p.a.

| End of year | Total premiums paid till end of year |

Amount payable on Death during the Year** | Amount payable on Surrender during the Year*** | ||||

| Guaranteed Surrender Value |

|||||||

| Guaranteed | Variable | Total | |||||

| Scenario 1 | Scenario 2 | Scenario 1 | Scenario 2 | 0 | |||

| 1 | 8712 | 100000 | 0 | 0 | 100000 | 100000 | |

| 2 | 17424 | 100000 | 0 | 0 | 100000 | 100000 | 0 |

| 3 | 26136 | 100000 | 0 | 0 | 100000 | 100000 | 7841 |

| 4 | 34848 | 100000 | 0 | 0 | 100000 | 100000 | 17424 |

| 5 | 43560 | 100000 | 0 | 0 | 100000 | 100000 | 6780 |

| 6 | 52272 | 100000 | 0 | 1500 | 100000 | 101500 | 11136 |

| 7 | 60984 | 100000 | 0 | 2000 | 100000 | 102000 | 15492 |

| 8 | 69696 | 100000 | 0 | 3000 | 100000 | 103000 | 22462 |

| 9 | 78408 | 100000 | 0 | 4000 | 100000 | 104000 | 15085 |

| 10 | 87120 | 100000 | 0 | 5000 | 100000 | 105000 | 23361 |

| 11 | 87120 | 100000 | 0 | 6000 | 100000 | 106000 | 26628 |

| 12 | 87120 | 100000 | 0 | 7500 | 100000 | 107500 | 29895 |

| 13 | 87120 | 100000 | 0 | 9000 | 100000 | 109000 | 18162 |

| 14 | 87120 | 100000 | 0 | 10500 | 100000 | 110500 | 21429 |

| 15 | 87120 | 100000 | 0 | 12000 | 100000 | 112000 | 24696 |

| 16 | 87120 | 100000 | 0 | 14000 | 100000 | 114000 | 24696 |

| 17 | 87120 | 50000 | 0 | 0 | 50000 | 50000 | |

| 18 | 87120 | 50000 | 0 | 0 | 50000 | 50000 | |

| 19 | 87120 | 50000 | 0 | 0 | 50000 | 50000 | |

| 20 | 87120 | 50000 | 0 | 0 | 50000 | 50000 | |

| 21 | 87120 | 50000 | 0 | 0 | 50000 | 50000 | |

| 22 | 87120 | 50000 | 0 | 0 | 50000 | 50000 | |

| 23 | 87120 | 50000 | 0 | 0 | 50000 | 50000 | |

| 24 | 87120 | 50000 | 0 | 0 | 50000 | 50000 | |

| Policy Anniversary | Total premiums paid till end of year |

Amount payable as Survival Benefit on the specific Policy Anniversary / Maturity Benefit |

||||

| Guaranteed | Variable | Total | ||||

| Scenario 1 | Scenario 2 | Scenario 1 | Scenario 2 | |||

| 4 | 34848 | 15000 | 0 | 0 | 15000 | 15000 |

| 8 | 69696 | 15000 | 0 | 0 | 15000 | 15000 |

| 12 | 87120 | 15000 | 0 | 0 | 15000 | 15000 |

| 16 | 87120 | 55000 | 0 | 14000 | 55000 | |

Buying LIC Bima Diamond Policy

LIC does not provide option of buying many of its policy online. As on 15 Oct 2016, you can purchase LIC e Term(Term Insurance) and LIC Jeevan Akshay ( an immediate annuity (Pension) Policy) online. To buy Visit http://www.licindia.in & click on buy policies online. For other policies you need to find an agent or visit branch of LIC.

Eligibility of LIC Bima Diamond Policy

Premium in life insurance policy depends on age, To calculate age and hence premium Life insurance companies use actual date or nearest birthday. Nearest Birthday Age calculates your life insurance age based on your nearest birthday, which could be either your last birthday or your next.

If your date of birth is Apr 15,1960 and you are enrolling on Apr 16 2015 then as per your nearest birthday , your age is 2015-1960 = 55 years . This is similar to actual age.

But nearest birthday on Nov 21,2015 would be 56 years i.e 2015-1960+1 as you would nearer to your 56th birthday than 55th birthday. So after 6 months from your birthdate you have to take your add 1 more to your current age.

| Minimum | Maximum | |

| Entry Age | 14 years ( Completed) | Policy Term 16 years: 50

Policy Term 20 years: 45 Policy Term 24 years: 40 |

| Maturity Age | – | 75 years |

| Sum assured | Rs. 100000 | Rs. 500000 |

Premium of LIC’s New Bima Diamond Policy

Under this plan, the premium paying tenure is less than the life cover tenure.

- For a policy of 16 years, you pay premium only for 10 years.

- For a policy of 20 years, you pay premium only for 12 years.

- For a policy of 24 years, you pay premium only for 15 years.

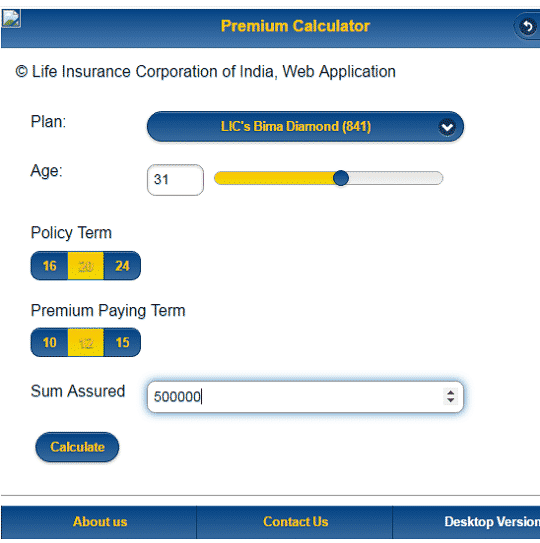

To find premium from LicIndia website follow the steps mentioned below

- Go to licindia.in, select Premium Calculator

- Selecting New Bima Diamond policy(841) under products.

- Entering details and sum assured.

Premium rates for some of the ages for sum assured Rs. 500000 is given below:

| Age at entry | Policy term | Annual premium rates | Half yearly premium rates | Quarterly Premium rates | Monthly premium rates |

| 14 | 16 years | 42901 | 21678 | 10952 | 3651 |

| 20 years | 42901 | 21678 | 10952 | 3651 | |

| 24 years | 42901 | 21678 | 10952 | 3651 | |

| 30 | 16 years | 29835 | 15078 | 7619 | 2540 |

| 20 years | 29835 | 15078 | 7619 | 2540 | |

| 24 years | 29835 | 15078 | 7619 | 2540 | |

| 45 | 16 years | 46943 | 23719 | 11983 | 3994 |

| 20 years | 46943 | 23719 | 11983 | 3994 | |

| 24 years | Not eligible | Not eligible | Not eligible | Not eligible | |

| 50 | 16 years | 49255 | 24888 | 12573 | 4192 |

| 20 years | Not eligible | Not eligible | Not eligible | Not eligible | |

| 24 years | Not eligible | Not eligible | Not eligible | Not eligible |

Rebate of LIC’s New Bima Diamond Policy

Rebate is a portion returned to an insured as an incentive to buy. It is like discount. In case of LIC Bima Diamond policy there is some discount or rebate on the premium which is calculated on the frequency of premium payment or because of higher sum assured.Rebate based on Frequency of Payment and Sum Assured is given in table below

So, if Mr. Singh, 30 years opts for sum assured Rs. 500000 and policy tenure of 16 years, the premium payable is Rs. 29835 approximately.

- He decides to settle the premium annually, so he will be eligible to receive an instant rebate of 2% of Rs. 29835 = 597. Therefore the premium payable will be Rs. 29238.

- Also as the sum assured is Rs. 500000 Mr. Singh qualifies for another rebate of 3%. So total rebate or benefit for Mr. Singh is 5% (2+3%) of Rs. 29835 = Rs. 1492.

- Net premium payable after applicable rebates = Rs. 28340.

| Frequency of Payment | Rebate |

| Yearly | 2% |

| Half yearly | 1% |

| Quarterly/monthly | Nil |

Rebate based on Sum Assured

| Sum assured | Rebate |

| Below 2 lakhs | Nil |

| 2-4.8 Lakhs | 2.5 % of sum assured |

| 5 Lakhs | 3% of sum assured |

Cancelling LIC Bima Diamond Policy

If he is not satisfied with the ‘Terms and Conditions” of the policy, he may return the policy within 15 days from the date of receipt of the policy. This is known as the cooling off period.

Surrender LIC Bima Diamond Policy

This policy comes with guaranteed surrender value. But failure to pay premiums for 3 years attracts no surrender value.

- How to Register Online at LIC e-Services

- LIC Bonus Rates, Special Bonus,Calculation,Returns from Bonus

- What is Electronic Insurance Account or eIA

- LIC Jeevan Shikhar Insurance Policy

- Mixing Insurance with Investment

- Checklist for buying Life Insurance Policy

- Insurance : Surrender or Make policy paid up or Continue

Remember buying insurance at a later age is always expensive. What do you think of this LIC Bima Diamond policy? Worth a buy? Have you bought Money back plans or endowment plan?