Wearing a helmet while driving is inconvenient but covers one from damage in an accident. Reaching an hour or two early before the scheduled departure of flight prevents one from missing the flight though time is wasted just sitting at the airport. Similarly Insurance provides financial protection against unexpected events and Life insurance is meant to offer financial protection to dependents in the unfortunate event of one’s death. Its purpose is to enable one’s dependents to maintain their current life style and pursue their life goals. But selecting life insurance products can be confusing. There are plans that promise to return a fixed sum, endowment and money back plans, there are whole-life plans, plain vanilla term plans. There are also products like unit-linked insurance plan (Ulip) where the policyholder can choose to invest in different securities and get market-related returns. In this article we shall cover how to calculate return on insurance policy called Internal rate of return (IRR), find return of endowment, moneyback policies, compare insurance cover and investment if one buys term plan with ppf , difference between insurance and investment.

Table of Contents

Overview of Life Insurance Policies

Life Insurance Plans offered by insurers can be classified into following categories:

- Pure Insurance Products :Term Plans

- Investment cum Insurance: Endowment, Money Back, Whole Life, Unit Linked Plan.

Our article Life Insurance covers different insurance policies in detail. An overview of few of polices is given below:

Term Insurance : is for a specific period of time, one can select the length of the term for which one wants the coverage right from one year up to 35 years. Premiums of this policy are fixed and does not increase during the term period of one’s policy. In case of sudden death, dependents receive the Sum Assured, cover amount one got oneself insured for .In case the individual assured survives the term of policy, no claim is paid to the assured.

Endowment Plan: An endowment plans if policy holder dies during the policy term, nominee gets the sum assured plus some returns; if he survives the policy term, he gets back the sum assured and returns.

Money Back Plans: Similar to Endowment plan with basic difference that unlike endowment plans where benefits are disbursed at end of policy term, money back policies payout a fixed percentage at various interval. A portion of the sum assured is paid out at regular intervals. If the policy holder survives the term, he gets the balance sum assured.guaranteeing a regular flow of income at fixed stages in our lives

Tax benefits on Insurance policies is available.

- Premiums paid towards a life insurance policy qualify for tax deductions under Section 80C with a limit of 1 lakh in a financial year.

- Section 10 (10D) exempts maturity proceeds from tax.

All regular-premium life insurance policies issued after April 1 2012, except pension plans, will have to offer a protection cover of at least 10 times the annual premium. Otherwise, they will not be eligible for tax benefits under section 80C and 10 (10D). Before 1st April 2012, the mandated cover was five times the annual premium.

Calculating Returns of an Insurance Policy

People buy endowment or money back insurance plans because they get the money back. But how much do they get back? Let’s see.

Let’s take LIC’s – New Janaraksha Plan An endowment plan (we chose it randomly from the list of LIC plans from LIC’s webpage Individual Plans) It’s features are :

- This is an Endowment Assurance plan that provides financial protection against death throughout the term of plan.

- It pays the maturity amount on survival to the end of the term

- This is a with-profit plan and participates in the profits of the Corporation’s life insurance business. It gets a share of the profits in the form of bonuses. Simple Reversionary Bonuses are declared per thousand Sum Assured annually at the end of each financial year. Once declared, they form part of the guaranteed benefits of the plan. Final (Additional) Bonus may also be payable provided a policy has run for certain minimum period.

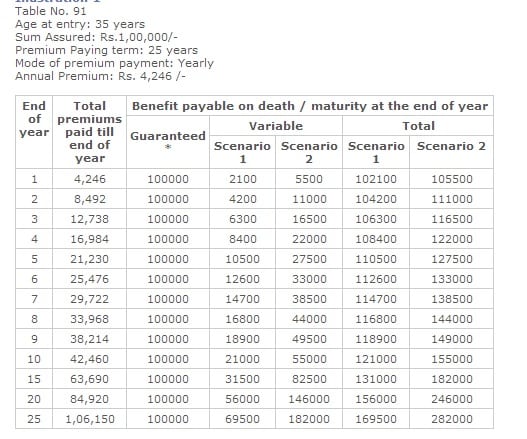

Let’s see the benefit illustration from LIC’s webpage for a 35 years old for sum assured of 1,00,000 paying premium of Rs 4,246 for 25 years.

The non-guaranteed benefits (1) and (2) in illustration are calculated so that they are consistent with the Projected Investment Rate of Return assumption of 6% p.a.(Scenario 1) and 10% p.a. (Scenario 2) respectively. In other words, in preparing this benefit illustration, it is assumed that the Projected Investment Rate of Return that LIC will be able to earn throughout the term of the policy will be 6% p.a. or 10% p.a., as the case may be. The Projected Investment Rate of Return is not guaranteed.

Future bonus will depend on future profits and as such is not guaranteed. However, once bonus is declared in any year and added to the policy, the bonus so added is guaranteed.

Internal Rate of Return or IRR

Returns on insurance policy is calculated using IRR or Internal Rate of Return. IRR is simply the percentage return over a specific period of an investment. It is used to calculate the returns if given some amount at a fixed interval, for example after every 3 months or after every 1 yr . The only thing which matters is that there should be equal distance between two installments. When you invest or pay premium you need to -ve as in example every year we are paying premium of Rs 4,246 which is written as – 4,246. While when we get something out of investment like maturity value/ or percentage of money as in money back policy, we need to show it as positive quantity. Our article Understanding Returns explains different kind of returns(Absolute, CAGR etc) in detail.

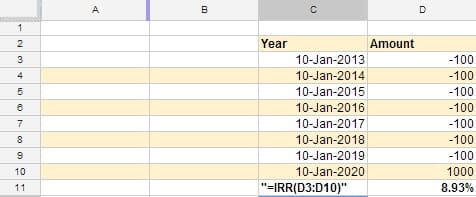

Let’s see an example of IRR calculation in excel. Suppose you invested 100(shown as -100)every year from Jan 2013 and got back 1000 (+1000) in Jan 2020. What is the return on investment (ignoring taxes, etc)? It is easily calculated in excel using IRR function as shown in picture below:

Calculating Returns of an Insurance Policy

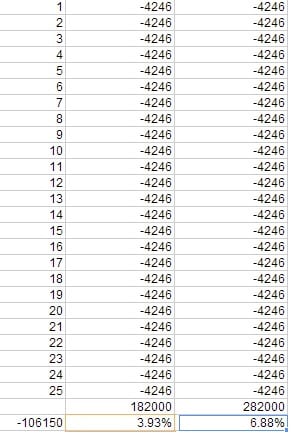

IRR for buying above mentioned endowment policy comes out to be 6.88% if maturity value is Rs 2,82,000 and 3.93% if maturity value is Rs 1,82,000 as shown in picture below.

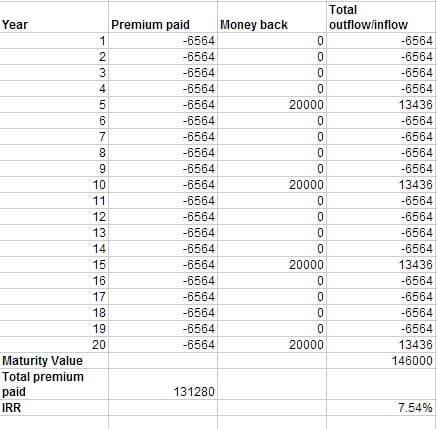

LIC’s Money Back Policy 20 years provides financial protection against death throughout the term of plan along with the periodic payments on survival at specified duration during the term.For a LIC Money-Back Policy of 20 years ,20% of the sum assured becomes payable each after 5, 10, 15 years, and the balance of 40% plus the accrued bonus become payable at the 20th year.

IRR for a policy taken at 35 years for 20 years for Sum Assured : Rs. 1,00,000 and annual premium paid yearly Rs 6,564 is as shown in picture below.

If one claims tax deduction under 80C the returns would be higher. JagoInvestor explains the calculation of returns on insurance policies using IRR with video on youtube.

Keeping Insurance and Investment Separate

Term insurance, as the name itself explains, and has the lowest possible premium among all the other insurance plans available. PPF is government backed fixed income investment. If a person buys a term plan, and invests the rest of the amount in a public provident fund (PPF), he can make more money than what the insurance companies offer. PPF will also give him tax advantage. One gets the same amount of life cover as term plan and a better corpus by splitting the two. If somebody can live with volatility and instead of putting in PPF,put in an equity fund and assume a return of 10-12% , then your corpus would be even more.

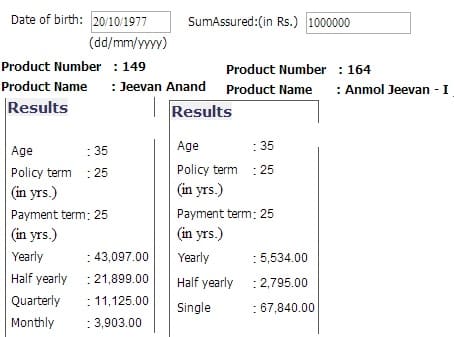

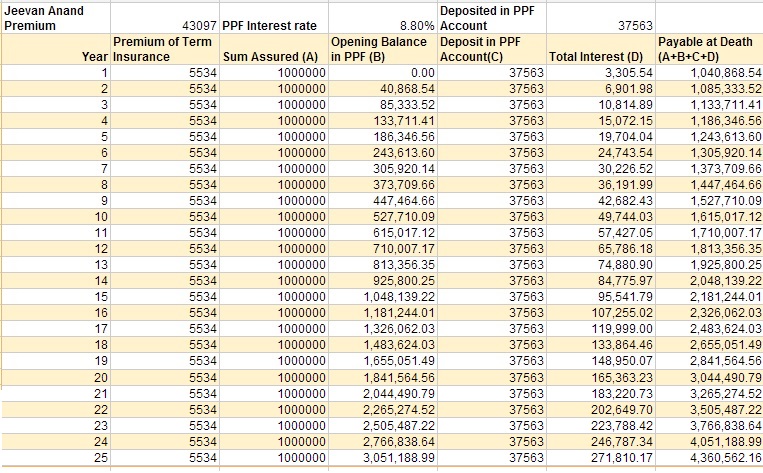

The picture given below shows if Insurance Premium from Jeevan Anand is used for Term plan and PPF.

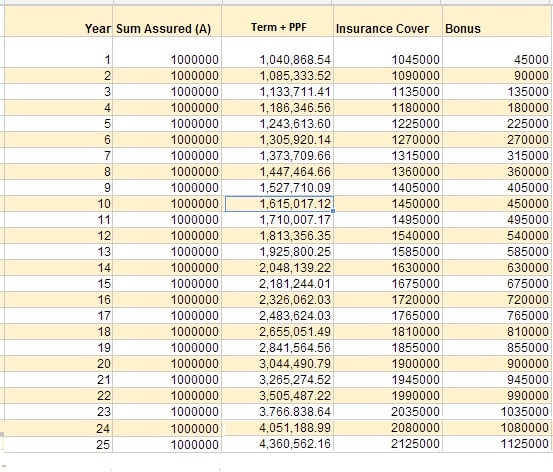

But what about the insurance cover? If one invests in Jeevan Anand one gets bonus.In LIC Jeevan Anand plan one gets bonus which is announced as 45 Rs per 1,000 of sum assured. It was 45 in year 2008,2009,2010 and was increased to 47 in 2011,2012. Assuming a bonus of 45 per 1,000 of Sum Assured if one had invested in Jeevan Anand for 10 lakh(10,00,000 or 1000 * 1000) then insurance cover would include Sum Assured + bonus on Sum Assured. After Year 1 the bonus would be 45*10,000,000/1000 = 45,000. So Insurance cover in Year 1 would be 10,00,000 + 45,000 = 10,45,000. After two years the bonus would be 45*2*10,00,000/1000 = 9000 So Insurance cover in Year 1 would be 10,00,000 + 90,000 = 10,90,000. Comparing the insurance cover with PPF and Term plan the results are as shown in picture

From the picture it is clear that coverage is more than Term+PPF in initial years but later difference widens.

Difference between investment and insurance

| Description | Investment | Insurance |

| Objective | It is used to grow money. | It is used to meet financial requirement for Loved ones if something happens to you. |

| Options | Different options like PPF,Fixed Deposit,Equity.Every investment has different duration and risk grade associate with investment product | Different policies like Term,Endowment, Whole Life etcTerm Insurance : You pay less premium and get maximum sum assured life coverage as death benefitsFor other policies premium is high as you try to get some returns. |

| Focus | Investment return and safety of invested amount. | Insurance amount (Sum assured) and premium to pay. |

| Tax Planning | Can invest in PPF,ELSS etc to get 80C benefit with a limit of 1 lakh in a financial year | Premiums paid towards a life insurance policy qualify for tax deductions under Section 80C with a limit of 1 lakh in a financial year. Section 10 (10D) exempts maturity proceeds from tax. |

Related Posts:

- Life Insurance

- Understanding Returns

- Understanding Public Provident Fund, PPF

- Beginner to Investing – Approaches, Plan, Psychology

Before buying insurance or any product, think what you are getting and an what cost? Try not complicate your life by combining investment and insurance in one. Keep it simple! Do you have endowment or money back policy? Why did you buy it? Was it bought to save tax or some relative , neighbour made you buy it? Do you have a term plan?

0 responses to “Mixing Insurance with Investment”

Good one. Needed this data for a while to calculate the losses on my current endowment plan. Thanks.

Thanks Nandini. So how much loss are you making on your endowment plan?