You would have often seen people using cards in shops. They buy things, at the counter they give a card to the shopkeeper who swipes the card on a machine, gives a receipt and people walk off with their things without paying any money seemingly. These cards can be a debit card or credit card and are made of plastic so are called plastic cards or plastic Money. Both debit and credit card look similar but behave differently.

- Debit Card: On using a debit card, the money is immediately deducted directly from the user’s account. The user can buy things as long as there is money in his account. A debit card is a way to “pay now.”

- Credit Card: Here, the person uses the card to buy and then pays back later. There is a limit to which one can buy on credit card. It is easy to fall into the trap of money

Credit cards can make life easier, but they also make overspending easier. With a credit card, you’re spending money you don’t necessarily have yet. If you’re not careful, this can quickly lead to unexpected debt.

Do you understand the Pros and Cons of Credit Card

The Questions below would help you understand the Pros and Cons of Credit Cards

Related Articles

- How Credit Card Number is Verified Online Using CVV2

- Rupay card: Difference from Visa, Master, One Nation One Card

- How India pays: Cash, Cheque,NEFT,Cards etc

- What is the difference between Debit and Credit Card?

- What happens when Credit/Debit card is Swiped?

- How one gets into Credit Card Debt

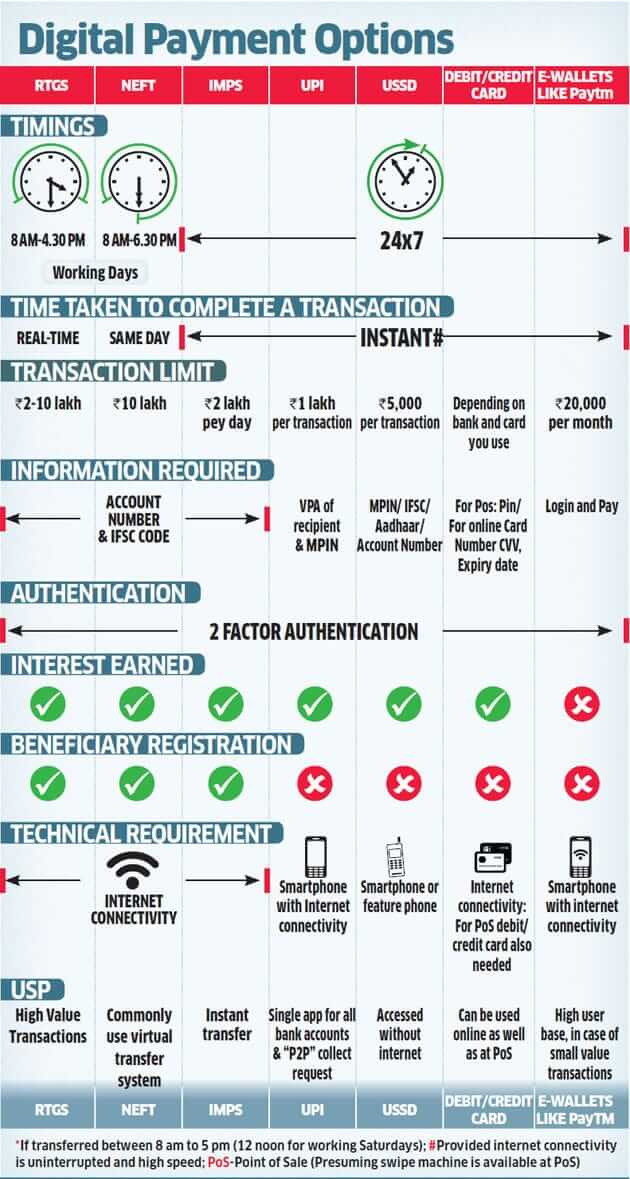

Various Payment Options

The image below shows various Payment options and their advantages and disadvantages, from our article How India pays: Cash, Cheque,NEFT,Cards etc