You would have often seen people using cards in shops. They buy things, at the counter they give a card to the shopkeeper who swipes the card on a machine, gives a receipt and people walk off with their things without paying any money seemingly. These cards can be a debit card or credit card and are made of plastic so are called plastic cards or plastic Money. Both debit and credit card look similar. Other than Debit/Credit word on the card there is no difference in the appearance of the card which at times also might be missing. But they differ functionally. What is the difference between Debit and Credit Card?

Debit Card and Credit Card

Table of Contents

What is Debit Card?

A debit card is linked to the account of the cardholder i.e one who owns the cards. They are usually issued by Banks and financial institutions. When ones use a debit card the money is immediately deducted directly from one’s account associated with the card. One can buy things as long as there is money in the account. A debit card is a way to “pay now” Say you have Rs 10,000 in your account. The amount you can spend, or withdraw, through your card cannot exceed this limit.

In India, most of the debit cards that are issued are Debit-Cum-ATM card. You can use the Debit Card to withdraw money from the ATM.

What is Credit Card

Credit Card is a plastic card that is issued by financial institutions such as banks. As the name Credit suggests when one buys using a credit card, one is buying by taking a loan. One needs to pay back later(there are no free lunches in life!).

There is a limit to which one can buy on a credit card. So, even if you have only Rs 10,000 in your account but your credit limit is Rs 50,000, you are free to spend up to Rs 50,000.

Can you swipe the credit card as much as you want? If wishes were horses! You need to repay the amount bought on credit by the due date.

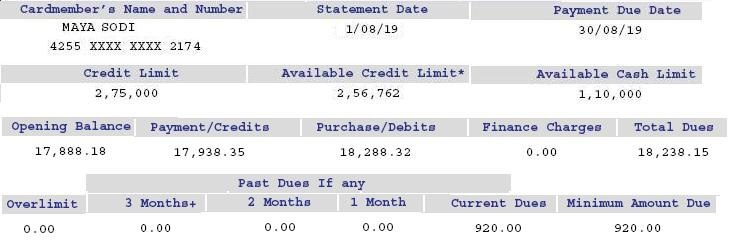

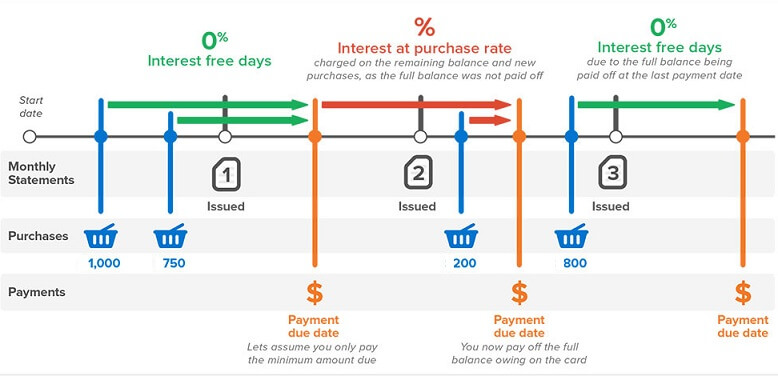

At the end of predefined time, called monthly billing cycle, the credit card company which issued the card would send the bill to the person who swiped the card. The due amount has to be paid by the due date. One can pay the full amount by the due date(which is recommended) or pay at least the minimum amount.

Credit Card Bill Statement

If you don’t pay on time, you have to pay a penalty. if you pay the minimum then you would have to pay interest on the transaction done through credit card. If you keep paying the minimum soon you would land in credit card debt.

Our article Credit Card Debt

Credit Card Interest and Billing Cycle

What is the difference between Debit and Credit Card?

Credit means buying money, goods, and services at any given time but paying for it at a future date. Based on whether you are paying on credit or not there are two kinds of Plastic cards, which are used by the cardholder to buy goods and services.

- Debit Card: On using a debit card, the money is immediately deducted directly from the user’s account. The user can buy things as long as there is money in his account. A debit card is a way to “pay now.”

- Credit Card: Here, the person uses the card to buy and then pays back later. There is a limit to which one can buy on credit card. It is easy to fall into the trap of money

Why should one have a credit card?

Credit cards can make life easier, but they also make overspending easier. With a credit card, you’re spending money you don’t necessarily have yet. If you’re not careful, this can quickly lead to unexpected debt.

More flexibility – Some hotels, airlines will insist on credit cards for any reservations or bookings that you make. You won’t pay with a credit card, but they will want it as security.

To have a Credit history: getting a credit card and using it responsibly i.e sticking within limits and paying the balance off each month, will increase your credit card rating. This will improve your chances of better credit terms, such as low-interest rates, low fees etc, for any future loans, such as car loan, the home loan you may need.

Earn Cashback, Reward Points: Many cards offer rewards programs that will accrue points, discounts, or other benefits like frequent flyer miles.

Use Credit Card responsibly

Video on the Difference between Credit Cards and Debit Cards

This 6-minute video explains what is Credit Card & what are the differences between Debit Card & Credit Card in HINDI. How to use Credit Card Smartly & How does these Credit Card works. What are the advantages & Disadvantages of a Credit card over Debit Card?

Related Articles:

- How Credit/Debit card is Verified when it is Swiped?

- Choosing the best credit card: Annual Fee, Reward points,Cashback, APR

- Rupay card: Difference from Visa, Master, One Nation One Card

- How India pays: Cash, Cheque,NEFT,Cards etc

- Compound interest: How it can be your friend or your enemy

- HOW TO WRITE A CHEQUE

- Contactless Card: Pay Without Pin on using Credit and Debit Card