From June 1, 2016, all employees or salaried taxpayers will have to submit Form 12BB to claim income tax deductions on leave travel allowance concession (LTA), house rent allowance (HRA) ,interest paid on home loans and Income tax . You will also need to submit proofs of your investments or expenditures. This article explains Form 12BB in detail.

Table of Contents

Income Tax Proof Submission by Employee to Employer

Employers ask Salaried Employees to furnish a declaration to their employer for the Income Tax Deduction they are eligible under various provisions of Income Tax along with proofs under section 192 of Income Tax Act. Employers consider these declaration and proofs while calculating tax and TDS on Salary of their employees. Although employer has been taking declarations from employees there was no standard format for the same. But now CBDT has prescribed Form No.12BB for the purpose of estimating employee’s income or computing the tax deduction at source from 1 Jun 2016, through notification No. 30/2016.

What is process of Investment declaration, proof submission to Employer?

- The employers asks employees for declaration of the their proposed investments for tax exemptions/deductions from employees in the beginning of the financial year (April itself)

- Based on your declaration and the investments that qualify for deductions and exemptions, your employer deducts tax on your salary every month.

- By December or January employer asks for submission of the proofs for all proposed tax saving investments.

- The deductions are shown in Form 16, which is given by employer. Employer also gives Form 12BA for prequisites.

Our article Income Tax Proof Submission to the Employer explains proof submissions to claim deductions by Employees in detail.

Section 192 of Income Tax Act : TDS on Salary

Section 192 of the I.T.Act, 1961 says that

- Employer(Organization/Person),responsible for paying income which is chargeable under the head Salary , shall deduct income tax on the estimated income of the employee under the head salaries.

- The tax is required to be calculated at the average rate of income tax as computed on the basis of the tax slabs.

- The deduction on tax or TDS is to be made at the time of the actual payment.

- No tax is required to be deducted at source, unless the estimated salary income exceeds the maximum amount not chargeable to tax applicable in case of an individual during the relevant financial year.

- The tax once deducted is required to be deposited in government account and a certificate of deduction of tax at source (also referred as Form No.16) is to be issued to the employee.

- The particulars of this certificate are to be furnished by the employee in his income tax return after which he gets the credit of the TDS in his personal income tax assessment.

- The employer/deductor is required to prepare and file statements of Tax Deducted at Source on prescribed format(s) to the Income-tax Department.

Form 12BB

What is Form 12BB?

The Central Board of Direct Taxes (CBDT) has recently released New Form No. 12BB, a new standard form for salaried tax payers to claim tax deduction for

- LTA (Leave Travel Allowance) / LTC (Leave Travel Concession)

- HRA (House Rent Allowance)

- Interest payable on Home Loan (Section 24) and

- All Tax Deductions under Chapter VI-A which relates to allowable deductions under various sections including Section 80C, Section 80CCC Section 80CCD, etc

- You can download Form 12BB in pdf or Form 12BB in word format.

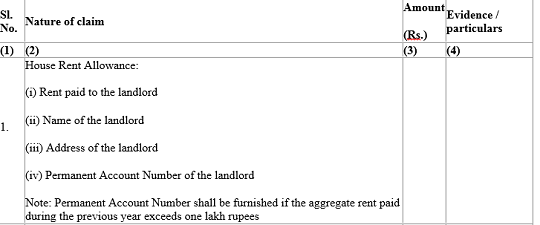

Form 12BB and HRA

House Rent Allowance or HRA is an Allowance given to employee. Our article HRA Exemption,Calculation,Tax and Income Tax Return covers HRA in detail Overview of HRA is as follows:

- HRA is given by the employer to the employee to meet the expenses of rent of the accommodation which the employee has taken for his residential purpose.

- House Rent Allowance so paid by the employer to his employee is taxable under head Income from Salaries , but an employee can save taxes under Section 10(13A) of the Income Tax Act.

- To claim HRA, employee has to provide Rent receipts.

- You also have to provide details of landlord (name & address) and the amount paid as rent. Permanent Account Number (PAN) of the landlord shall be furnished if the total rent paid during the year exceeds one lakh rupees.

- To claim HRA in Form 12BB one has to fill information in format shown in image below.

Form 12BB and LTA

Leave Travel allowance or LTA is an allowance you get from your employer when you are on leave from work and actually travel. At times it is also called as Leave Travel Concession or LTC. Overview of LTA is as follows. Our article What is Leave Travel Allowance or LTA explains it in detail.

- To avail the scheme, you have to be on leave and travel to any place in India. Overseas travel is not allowed.

- The entire cost of the holiday is NOT covered. Only the travel costs are covered so expenses on hotel rooms, sightseeing, food, etc, cannot be included.

- The tax exemption is limited to the fare component, which is economy class air fare of national carrier Air India, first class AC rail fare or first or deluxe class bus fare.

- You can get exemption only for the amount you are eligible for and the actual amount spent on travelling. So, if your LTA amount is Rs 15,000 but you’ve spent Rs 20,000, you will get an exemption only for Rs 15,000. Alternately, in case you spent only Rs 10,000, you will get an exemption for Rs 10,000 only. You will have to pay tax on the remaining Rs 5,000.

- You can claim exemption for up to two journeys in a block of four calendar years. These time-period of four calendar years are called as blocks and are predetermined i.e they are also notified by the income tax department.

- The new block started on January 1, 2014 and will end on December 31, 2017.

- Note that the applicable year is calendar year and not financial year

- From 1 June 2016, the CBDT has made it mandatory for all the salaried employees to submit travel related expenditure proofs to their employers in Form 12BB as shown in image below, where in column 3 you have to mention amount and in Column 4 the proofs/Evidence.

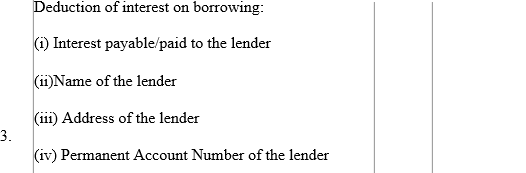

Form 12BB and Interest Payments on Home Loans

Taking Home Loan provides tax benefits. The EMI amount of Home Loan is divided into the principal and interest components Principal amount paid towards Housing loan for purchase or construction of House Property is allowed as tax deduction under Section 80C of the Income Tax Act. But the interest part of the EMI can be claimed as a deduction under Section 24 under the head Income from house property. Overview of Interest Payment on Home Loan is given below. Our article Income from House Property and Income Tax Return discusses it in detail.

- Interest can be claimed as a deduction under Section 24 under the head Income from house property.

- You can claim up to Rs 200,000 or the actual interest repaid whichever is lower. The limit before FY 2014-15 was 1.5 lakh

- If the house is given on rent, there is no restriction on the interest amount.

- There is no restriction of Self Occupied Property for claiming the tax break on interest paid under sec 24.

- Co-owners and Co Borrowers can claim deductions in the ratio of ownership.

- The certificate issued by the housing loan company, showing the split between principal and interest for the EMI paid, is required for claiming tax benefits.

- Before Jun 1 2016 you had to submit the certificate issued by housing loan company.

- From 1 June 2016 for claiming deduction of interest on home loan, in Form 12BB you would have to provide the name, address and PAN of the lender as shown in image below.

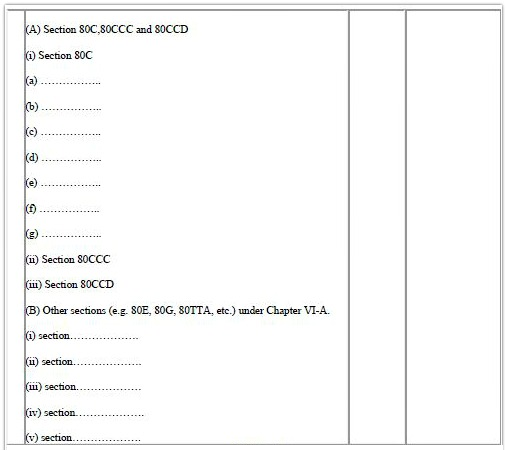

Form 12BB and Income Tax Deductions under Chapter VI -A

The Income Tax Act provides for various income tax deductions. Chapter VI-A pertains to allowable deductions under Section 80C , Section 80CCC, Section 80CCD as well as other sections like 80E, 80G and 80TTA. After reducing the income tax deductions that have been claimed, the total taxable income would be taxed as per the Income tax slab rates of the individual. Deductions Allowable under various sections of Chapter VIA of Income Tax Act are given below and are discussed in detail in our article Income Tax Overview

| • Section 80C (Various investments) | • Section 80CCC (Premium for annuity plans) |

| • Section 80CCD(1) (Assessee’s contribution to pension a/c) | • Section 80CCD(2) (Employer’s contribution to pension a/c) |

| • Section 80CCD (Additional contribution to NPS) | • Section 80CCG |

| • Section 80D (Medical/health ensurance) | • Section 80DD (Reh. of handicapped dependent relative) |

| • Section 80DDB (Medical exp. on self/dependent relative) | • Section 80E (Intt. on loan for higher studies) |

| • Section 80G (Donations) | • Section 80EE (Intt. on loan for residential house property) |

| • Section 80G (Donations) | • Section 80GG (House rent) |

| • Section 80GGA (Donations) | • Section 80GGC (Sci. Research/Rural Dev.) |

| • Section 80RRB (Royalty on patents) | • Section 80QQB (Royalty on books) |

| • Section 80TTA (Saving bank intt.) | • Section 80U (Physical disability) |

You have to provide the details & evidences of your investments or expenditures related to various sections like 80C, 80CCC, 80CCD, 80D (medical insurance premium), 80E (deduction of interest on education loan), 80G (donations), Section 80EE etc.. You were already providing the information about tax deduction to your employer but now it would be in Form 12BB as shown in image below. Evidence of investment or expenditure will have to be provided for claiming tax deduction under Chapter VI-A.

Download Form 12BB in pdf or Form 12BB in word format.

Related Posts:

- How to Claim Deductions Not Accounted by the Employer

- Form 16, Form 12BA

- Income Tax for AY 2016-17 or FY 2015-16

- Joint Home Loan and Tax

- E-filing : Excel File of Income Tax Return

- How to Calculate Income Tax

Form 12BB is just a standardization of the income tax deductions that an employee can take. It is to ensure that employer collects all required proof for income tax deductions claim. Do you think Form 12BB was required? Do you think that Form 12BB is just more of compliance burden and want to request Income-tax Dept please don’t hound salaried taxpayers with compliance burden whose taxes are deducted at source!