A portion of employees’, working for MNC,compensation packages often includes stocks of their parent companies listed abroad. While this can be a lucrative perk, it also entails a set of compliance obligations in India. In this blog post, we delve into the documentation, taxation, and disclosure requirements associated with foreign employee stocks in India.

Table of Contents

Q.What are the types of foreign stocks that IT employees can get?

RSU (Restricted Stock Unit): The shares are allotted at a future date on fulfilment of certain conditions, usually at zero cost.

ESPP (Employee Stock Purchase Plan): The shares are allotted at a future date on fulfilment of certain conditions, at a predetermined discount to the prevailing market price. The employee has the choice of purchasing stocks of his company listed on the Stock exchange from his salary usually at a discounted price. If an employee enrolls in ESPP then he will contribute a fixed part of his salary, usually between 1 percent and 15 percent, for a fixed period of time say 6 months. At the end of the fixed period, the company will use this money to purchase the company’s stock at a discount to the price of the share.

ESOP (Employee Stock Option Plan): ESOPs provide an opportunity to employees to acquire a stake in the company. ESOPs confer a right and not an obligation on the employees to buy shares of the company at a future date at a pre-determined price.

Q.What are taxable events and rates for Employee Stock Options?

The employee stocks and derived income are taxed at three levels.

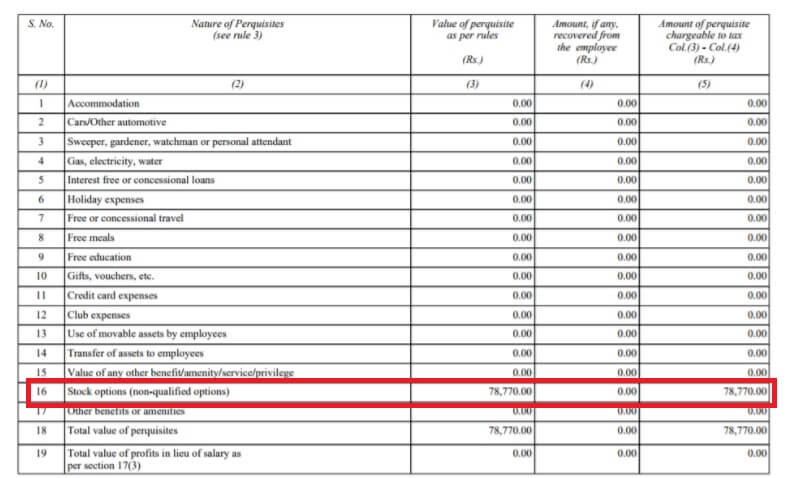

At the time of exercise: The difference between fair market value on date of exercise and amount paid by employee, if any, is taxed at slab rate as a value of perquisite.

At the time of dividend : Gross dividend is taxed at slab rate as income from other sources.

At the time of sale: The difference between fair market value on the date of exercise and selling price is taxed as capital gain. The holding period is counted from the date of exercise.

- If it’s more than 24 months, it is long-term capital gain, taxable at 20% with post-indexation benefit.

- If the period is lesser, it is short-term gain taxable at slab rate.

Q What is taxed as value of perquisites in Form 16?

In case of RSUs, the difference between the fair market value on the date of exercise, and the value it was allotted at (usually zero) is the value of perquisites.

For ESPPs, the discount offered on fair market value is the value of perquisites. This benefit is taxed at slab rate.

This is available in Form 12BA as part of Form 16.

Q.How does the employer handle the TDS?

Suppose an employee receives 30 stocks as RSUs on vesting date. As soon as vesting occurs, 10 stocks are sold to cover the tax liability at slab rate, and the balance 20 stocks are held in demat account. This is done to offset the cash impact of taxes in the year of vesting. Vesting does not result in any cash gains as stocks are unsold, but tax outflow in cash is still due at this event. This approach by employers takes care of the TDS outflow without impacting the in-hand salary.

The TDS by an employer is deducted only on value of perquisites in the year of vesting.

Q. Is Tax deducted by foreign countries for stocks owned?

The amount of tax withheld on foreign income will vary depending on the laws of the country in which the income is generated.

For example, in the United States,

- There is no capital gains tax in the US for non-resident aliens,

- Dividends are considered income and are subject to a 25% withholding tax, as per the India-US Double Taxation Avoidance Agreement (DTAA).

- To claim credit for taxes paid in India on foreign income, a statement of foreign income offered to tax, and foreign tax deducted or paid on such income must be submitted in Form 67. The details of tax relief claimed for taxes paid outside India must also be reported in Schedule TR of the ITR to avoid double taxation.

For more information you can refer to the Article How are Dividends of International or Foreign Stocks taxed? How to show in ITR

Q. Foreign Stocks are in Foreign currency. How to report it in Indian rupees?

To find dividend income and determine capital gain income You need to convert foreign currency into Indian rupee, and for this the SBI TTBR is used. You will need to check the rate on the last day of the month immediately preceding the month in which the dividend is declared, distributed, or paid by the company. The same concept applies to capital gains.

For vested stocks, the employer converts it at the required rates and shows the gross value in Form 16 as value of perquisites.

Q. Any special Tax requirements for Foreign stocks?

Any tax liability for dividend received and capital gains at the time of sale has to be dealt by employee. The employer only takes care of the tax liability via TDS at the time of vesting of RSU, ESPP or ESOPs.

Dividends and capital gains are taxable in the year of accrual and not necessarily dependent on their remittance to India. They have to be declared as Income from Other Sources and Capital Gains respectively.

For taxpayers with foreign stocks in India, the ITR form requires resident Indian to disclose the foreign stocks held at any time during the calendar year if it is followed in the foreign jurisdiction, under schedule Foreign Assets (FA).

For instance, while filing for assessment year 2023-24, individuals must declare all foreign assets held from 1 January 2022 to 31 December 2022. This is because most countries follow calendar year for assessment, unlike India, where financial year runs from 1 April to 31 March. Hence, even if one bought foreign stocks in March 2022, these would need to be declared in Schedule Foreign Assets, despite falling in the previous fiscal

year as per India’s fiscal calendar.

For more details you can refer to the article RSU of MNC, perquisite, tax, Capital gains, ITR, How are Dividends of International or Foreign Stocks taxed? How to show in ITR

Q. What documents does one need to maintain for Foreign stocks?

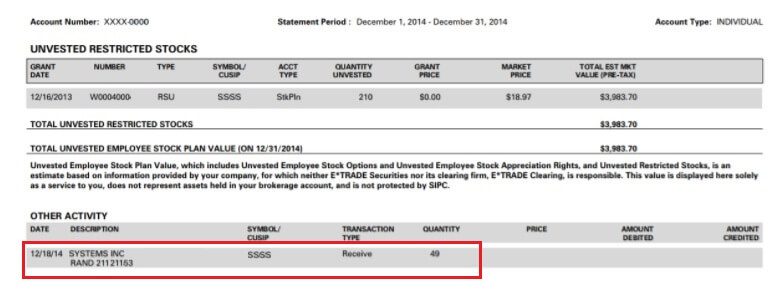

Broker demat account statements: These are available with the foreign broker’s login. These give a clear view of stocks exercised and sold, dividend income, taxes withheld on dividend income, and closing balance of stocks at the end ofthe period.

Employer’s stock option management portal: You can extract reports by ‘type’ and ‘status’ of employee stocks. These give a clear split of stocks vested in the relevant financial year, their fair market value on vesting date, amount paid by employee (if any) to exercise, sales made during the period, and exchange rate conversion in Indian rupee.

Form 12BA: This is an annexure of Form 16. It depicts the gross value of exercised stocks as per their fair market value,reduced by the amount paid by employee, if any. It is shown as value of perquisites.

Related Articles

Foreign employee stock options: Documentation, taxation and disclosure requirements in India

- What are Employee Stock Options (ESOP), how are ESOPs taxed

- ESPP

- RSU of MNC, perquisite, tax, Capital gains, ITR

- Salary, Net Salary, Gross Salary, Cost to Company: What is the difference

- Variable Pay

- It’s not what you earn that makes your financial position!

- Understanding Form 16: Part I

- Basics of Employee Provident Fund: EPF, EPS, EDLIS

In this blog post, we explored the documentation, taxation, and disclosure requirements associated with foreign employee stocks in India.