Have you failed to report some tax saving investment to your employer or did you make the investment after submitting your investment declaration to the employer. You can claim all the deductions/ exemptions under section 80C,80D while filing of Income Tax Return for the relevant financial year. This article will explain how to claim tax saving deductions not accounted by employer in ITR under section 80 with examples and images.

Table of Contents

Deductions That an Employee Missed and can Claimed while Filing ITR

Missing the income tax proof submission deadline or tax saving investments as declared in the beginning of the financial year, April. Or missing submitting bills for your reimbursements results in higher tax being deducted from Salary in month of Feb and Mar. But many tax deductions and exemptions can be directly claimed while filing your income tax return, even though proofs for these were not submitted to the employer timely. So you can get a refund from the Income Tax Department if more has been deducted then due. Even though these do not show up on your Form 16, since you could not inform your employer about them, you can claim these in your tax return. Have the requisite details at the time of filing your return and claim them in the relevant sections. The deductions that an employee missed and can claim while filing ITR is as follows:

- House Rent Allowance exemption under section 10.

- Claim deductions under section 80C: If you made deposits to PPF or purchased NSC certificates, or made payments for any deductions covered under section 80C, you can claim all of these at the time of return filing.

- Bills for preventive health check-ups:If you have not yet exhausted your deduction limit under section 80D and you have a bill for a preventive health check-up, you can claim this bill and get a maximum of Rs 5,000 as a deduction. This can be filled in ITR under section 80D.

- House Loan Details: If you have missed submitting your loan certificate details to your employer. You can save on Interest on Home Loan while filing ITR.

- Deduction on home loan interest cannot be claimed when the house is under construction. It can be claimed only after the construction is finished.

- To claim Home Loan Interest , The home loan must also be in your name. A co-borrower can claim these deductions too.

- An individual can claim deduction of up to Rs.2 lakhs (Rs. 1,50,000 till AY 2014-15) on his home loan interest if the owner or his family reside in the house property or the house is vacant

Do note that you don’t have to submit any deduction or investment proofs to the Income Tax Department whiling filing ITR. Returns are submitted without attaching any files or physical documents. But you must keep them safely these proofs with you for 6 years, lest you receive an Income Tax Notice and the Assessing Officer calls for them.

Deductions missed by Employee which cannot be claimed while filing ITR

Please note that the following cannot be directly claimed while filing your return. You can only claim it through your employer.

LTA: Expenses on a trip during the year against your LTA can only be claimed via your employer. LTA is allowed to be claimed twice in a block of four years. The current block is 2014 to 2018. There is some relief available as you are allowed to carry forward your unclaimed LTA to the next year, so you can request your employer to not deduct tax on it and allow you to claim it next year. But if you have not made that declaration for FY 2015-16 and TDS has already been deducted on LTA, you cannot get a refund of that TDS.

Medical Reimbursement : if you didn’t submit your medical bills your employer will deduct tax and pay you the remaining amount.

Claiming HRA not accounted by employer

But if for some reason you could not submit Rent Receipts or employer did not consider it , you can claim it while filing ITR. When HRA is not accounted by employer, more TDS is deducted from salary. It may happen that may be eligible for refund if net tax paid is more due from you. So claiming HRA not given by employer in ITR involves changing following steps. Our article How to show HRA not accounted by the employer in ITR discusses it in detail.

- Calculation of HRA

- Filling the Salary Details in ITR with modifications for HRA

- Checking if Refund is due or not.

Note there is no change in Filling in the TDS details as per Form 16 and verified in Form 26AS or other schedules.

In ITR1 To claim the HRA not accounted by the employer in ITR1 you can deduct the amount of HRA exemption calculated from the Gross Salary and enter it as Income from Salary.

In ITR2 : To claim the HRA not accounted by the employer in ITR2 once you calculate the HRA exemption subtract that from 1(a) ie Salary as per provision contained in sec 17(1) and fill the detail.

So for Example your Gross Salary from Form 16 is 5,30,000 and you have HRA exemption. So instead of shoing 5,30,000 in ITR1 fill in 4,90,000.

Process of Claiming Deductions under section 80 from Employer

Declaration of Investments for Tax Exemption/Deduction by Employee

The income tax act puts the responsibility on the employer to deduct tax at the time of payment of salary to the employees every month. The employer has to deposit the tax with the government before the seventh day of the following month. The TDS rules are very strict and the employer faces stringent penal provisions for non-deduction or non-deposition of tax. Employers also have to file the TDS returns at the end of every quarter of a financial year. So the employers asks employees for declaration of the their proposed investments for tax exemptions/deductions from employees in the beginning of the financial (April itself) . This helps them to calculate the taxable income according to the investments proposed and deduct the tax accordingly. Some common exemptions/deductions are:

- House rent and leave travel allowances are the common exemptions that can be claimed,

- Investments in PPF, NSC, ELSS, life insurance premiums, home loan principal repayment etc are some under common deductions under 80C.

- Interest on housing loan is deduction under Section 24.

- Other deductions include medical insurance premium (section 80D), interest on education loan (section 80E), maintenance of disabled dependent (section 80DD), etc.

Thus, after you submit your tax saving investment proposals, the employer starts deducting taxes from your monthly salary.

Submission of Proof for Proposed Investments before due date

By December or January employer asks for submission of the proofs for all proposed tax saving investments. Some employees fail to make the declaration, while some may give the details but fail to provide the relevant documentary proof within the time frame prescribed by the employer. What if employee fails to invest the amounts (s)he had proposed in the declaration made in the beginning. Ex: employee declared he will invest 20,000 in PPF but does not invest by January or does not buy medical insurance proposed. Then employer needs to recalculate the tax liability and recover the shortfall in tax deducted from the salaries in the remaining months of the financial year. This results in the increased tax liability and employee’s salary getting substantially reduced after paying it. As one month’s salary may not be sufficient for the employer to make up for the TDS shortfall, employer prefers to have two-three months in hand.

Employer issues Form 16 to his employees for each of the financial year (April to March of next year). Form 16 provides details of the salary income of the employee along with the Tax deducted at Source (TDS). What if the employee invests after the deadline for submission. Their might also be cases when employee invests more than proposed, in that case also recalculation of tax liability needs to be done which might not be sufficient to get adjusted in remaining months. This may result in extra deduction of taxes by employer. Then the employees can claim tax exemptions /deductions only while filing tax returns.Employee should then calculate the final tax liability, taking care of tax exemptions/deductions in accordance with the tax laws for that year. And If the total tax liability is less than the taxes paid or deducted during the year, they might even be eligible for a tax refund. In any case deduction of TDS and obtaining Form 16 does not sufficient. One is required to file his/her return of income before the due date i.e., 31st July, incorporating other income in addition to salary income, and pay taxes or claim refunds, whatever the case may be. It is important to keep records of tax investments, in case if the employer does not deduct taxes or deducts extra taxes, and then these certificates can be use for claiming refunds.

Claim tax saving deductions under section 80 in ITR

We shall modify our example taken in Filling ITR 1-Form of Mr T Mehta. Let’s assume that Mr. Mehta did not submit any proof of tax saving investments to his employer. To recap details of Mr Mehta income, investments and TDS are as follows:

- Income from salary : Document proof is Form 16. TDS for salary is updated in the Form 26AS.

- Income from other sources: Interest on saving bank account (Rs 5000) and Interest from Fixed Deposit(Rs 20,000). Documents for:

- Interest on saving bank account document is bank account statement. No TDS is deducted for interest on saving bank account.

- Interest on Fixed Deposit: Document is Form 16A which shows TDS cut by bank at the rate of 10% if interest on the Fixed Deposit in the financial year is more than Rs 10,000 . As Mr. Mehta has earned interest of Rs 20,000 bank would deduct 10% of 20,000 i.e 2000. This is updated in the Form 26AS.

- He earned dividend from stocks and equity mutual funds for amount Rs 2,200. Interest from PPF was Rs 672. This income is tax free or exempted income

- Chapter VI-A Deductions: He has made investments which allow him to save income tax.

- Section 80C: He invested Rs 30,000 in Public Provident Fund (PPF), paid Rs 7,000 as premium for LIC policy. These investments allow him to save tax under section 80C.

- Section 80D : He paid Rs 10,000 for premium of health insurance policy for his family.

- Tax Deducted at Source(TDS) is Interest on Fixed Deposit Rs 2,000 shown in Form 16A given by bank.(Note bank gives TDS only when interest on FD is more than 10,000 in an year)

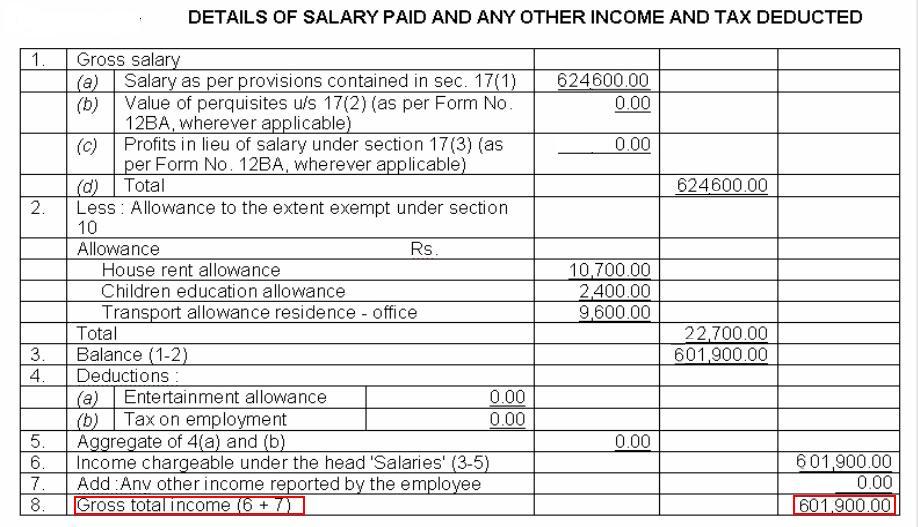

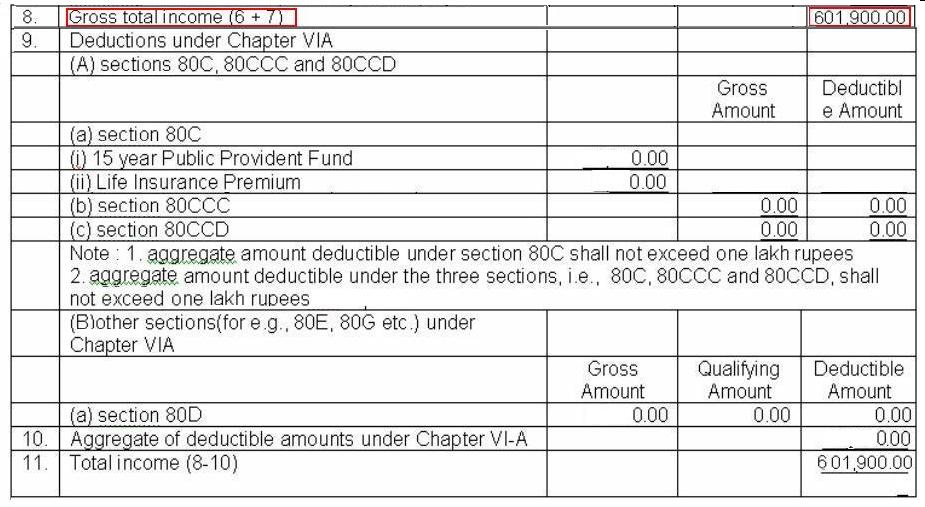

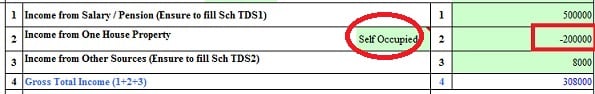

As he has not submitted the declaration/proof to his employer , employer has deducted more tax. Now Employer has deducted tax(including Education Cess and Surcharge) of Rs 53,951. Earlier TDS deducted was Rs 44,269 . Form 16 of Mr. T Mehta has no change in Gross Total income, as shown in image below.

But the total income after deductions of Chapter VI-A is different. Now it 6,01,900 instead of Rs 5,54,900.

So total tax that the employer will deduct will be calculated as follows:

| Description | Income | Tax |

| Exempt Income | 1,80,000 | 0 |

| Income chargeable at 10% | 3,20,000 | 32,000 |

| Income chargeable at 20% | 1,01,900 | 20,380 |

| Total | 6,01,900 | 52,380 |

| Education Cess @ 3% of Income Tax Payable | 1,571 | |

| Total Tax liability | 53,951 |

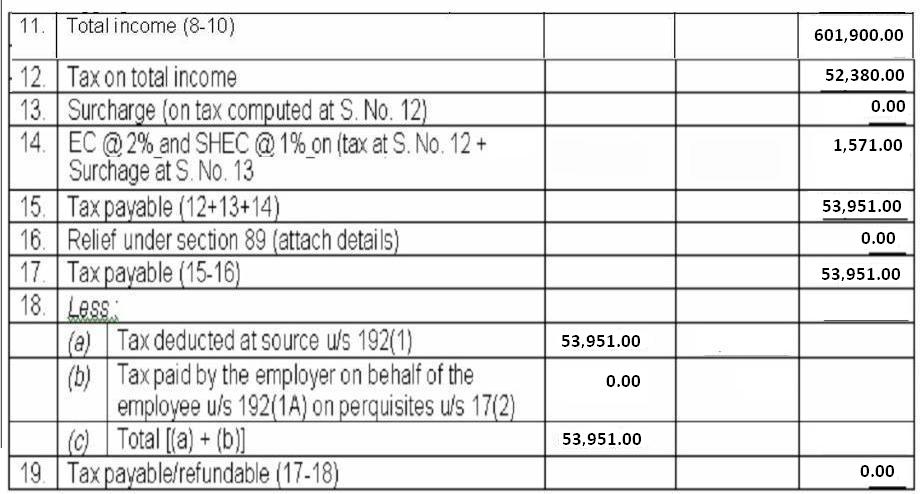

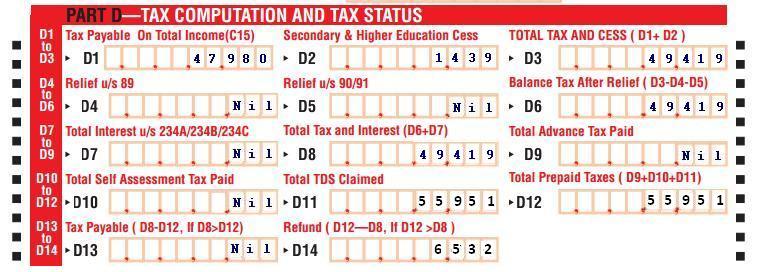

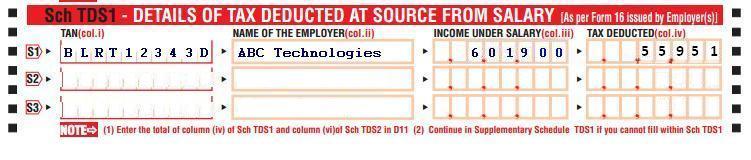

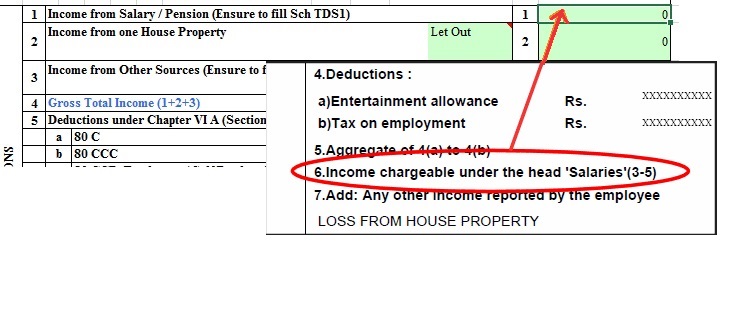

Details of TDS by Employer as shown in Form 16 will be as shown in picture below:

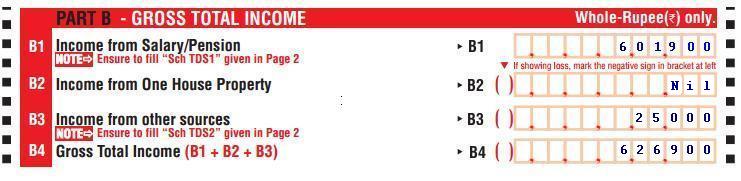

Part B of ITR-1 remains the same

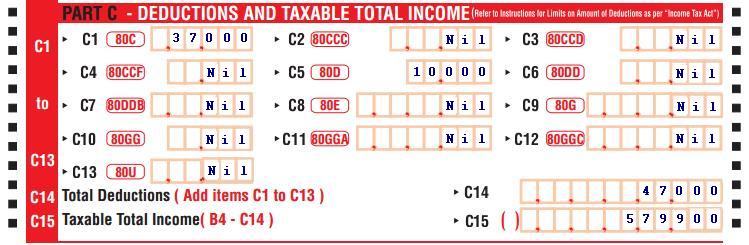

Part C for claiming deductions remains the same, it does not matter whether you submitted the proof to employer or not, as shown in picture below:

We need to now compute tax for Mr. Mehta. Mr. Mehta total taxable income is:

= Salary Income – Deductions + Income from other sources

= Rs 601,900 – 47,000 + 25,000 = 5,79,900 There is no change in computation of tax as Mr. Mehta is man below 60 years of age so his exemption limit as per Assessment Year 2012-13 is 1,80,000. So the computation of his income is given below

| Description | Income | Tax |

| Exempt Income | 1,80,000 | 0 |

| Income chargeable at 10% | 3,20,000 | 32,000 |

| Income chargeable at 20% | 79,900 | 15,980 |

| Total | 5,79,900 | 47,980 |

| Education Cess @ 3% of Income Tax Payable | 1,439 | |

| Total Tax liability | 49,419 |

So though the total tax liability of Mr. Mehta, including income from interest on saving bank and fixed deposit, is only 49,419 Rs his employer has deducted Rs 53,951. Bank also deducted TDS of Rs 2,000 on his fixed deposit. Mr Mehta has paid tax of 6,532 more as shown in calculations

-

-

-

- TDS paid: Rs 53,951 + 20000 = 55,951

- Tax liability is = Rs 49,419

- Tax paid more = Rs 6,532

-

-

He can claim that as refund. So Part D of ITR1 will change as follows:

- Bank Details and information about exempt income would not change.

- As he has paid more tax he would not have to pay Advance Tax and Self Assessment Tax, so Sch IT: Details of Advance and Self Assessment Tax would be empty.

- ITR1 Sch TDS2 will not change for TDS deducted by bank.

- What would change are the details of TDS as shown in picture below.

After filling the form in paper or e-filing he needs to submit it.

Please note that inspite of employer deducting more TDS, employee may have to pay tax if his tax liability is more. So employee may not always claim refund.

For example if Mr. Mehta had earned Rs Rs 60,000 as income from other sources. His net tax liability would have been Rs 56,629 (including surcharge and education cess) which is more than TDS deducted 55,951. So he would have to pay the remaining tax Rs 678 (56,629 – 55,951)

Claiming Home loan while filing ITR

If you own a home, an office, a shop, a building or some land attached to the building say a parking lot then you have Income from House property. The Income Tax Act does not differentiate between a commercial and a residential property. All types of properties are taxed under the head income from house property in the income tax return. Our article How to fill ITR1 for Income from Salary,House Property,TDS discusses it in detail.

A self-occupied house property is used for one’s own residential purposes. This may be occupied by the you or your family, parents and/or spouse and children. A vacant house property is considered as self occupied for the purpose of Income Tax. There is no income from your house property. The gross annual value of this property is zero.

A let out house property is one which is rented for the whole or a part of the year. When a property is let out, its gross annual value is the rental value of the property. The rental value must be higher than or equal to the reasonable rent of the property determined by the municipality.

If you own more than one house property, the I-T Department only counts one property as a self-occupied house. It treats all other houses as rented properties even if they are not rented at all. Rental income calculation is based on what rent a similar property in the area would earn.

Income from House property for 1 Self Occupied House = 0 (Gross value of the house) – Payment of Home loan Interest) – 1/5 of preconstruction loan.

Maximum Income form House property for 1 Self Occupied House that you claim is = Maximum of(2,00,000 and Income form House property for 1 Self Occupied House calculated above)

For example Mukund have taken home loan of Rs 40,00,000 (40 lakh) for 20 years @10.5% then his loan EMI is Rs 39,935 For the financial year 2016-17, he paid 4,79,222 which includes a payment of Rs. 65,493 towards principal and Rs 4,13,730 towards interest.

So Total income form House property is= 0 (Gross value of the house) -4,13,730 (Payment of Home loan Interest)=–4,13,730(please note the negative or minus sign)

When you enter this amount in ITR1 as income from house property you will get the error. Loss cannot exceed 2,00,0000 for income from House property. You have to fill in maximum of 2,00,000 irrespective of how much your home loan interest is if it’s self occupied.

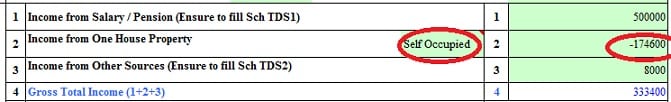

If Total Income from House property for 1 Self Occupied House is less than 2,00,000 then you enter that amount as Income from House Property as shown in image below

Record Keeping

Please keep all the papers related to income tax (Form 16, bank account statements, proof of investments for tax saving etc) safely whether submitted to the employer or not. Quoting from our article Paper Work A Necessary Headache

Since legal proceedings under the income tax act can be initiated up to six years prior to the current financial year, you must maintain such documents at least for this period.

Please plan your tax saving, if possible in the beginning of financial year, and submit proof of investments on time.

Disclaimer: Please do not construe this as professional financial advice. While efforts have been made to provide correct information, this is our understanding of the Income tax law. Apologies upfront for any mistakes. Please let us know and we will correct.Please don’t send us emails asking us to check your income tax detail. But if you have any doubt on the article or some clarification is required or you feel some information is wrong. Please leave it in comment section so that all readers can benefit. For details check our Disclaimer.

Related Articles:

- Basics of Income Tax Return

- Filling ITR 1-Form

- Filling Individual ITR Form: Fields A1 to A22

- Filling ITR-1 : Bank Details, Exempt Income, TDS Details

- After filing Income Tax Return

- Paper Work A Necessary Headache

175 responses to “How to Claim Deductions Not Accounted by the Employer in ITR under section 80”

Great article!

My previous employer had provided House rent allowance under section 10(13A) for almost the same salary, but my current employer is providing Rs.0 under that section in my Form 16.

What is the technical reason behind that? (I understand that different employers have different policies)

Hi

I failed to submit education loan interest certificate (under 80E)during investment proof submission. Can I do it when filing of FORM 16 and how can I do it. please provide steps.

hi can i calm CAR vehicle fuel & maintenance , because some issue we dont claim form company . means Fuel & maintenance part not shoe in form 16A , but i have car in my name

kindly suggest ,can i claim this exp. at the time of IT return filling .

Hi,

Did you get the answer for your question, Actually i am also looking for the same information.

Conveyance allowance, also called Transport Allowance is a type of allowance offered to employees of a company to compensate for their travel from residence to and from respective workplace location. Allowances are generally offered to employees on top of their basic salary component and may or may not be taxable as per the Income Tax Act.

There is no limit on the amount of conveyance allowance a company can offer to its employees. However, there is a limit on the amount of exemption under the Income Tax Act as detailed below.

Conveyance allowance is given an exemption of up to Rs.19,200 per annum or Rs.1,600 per month. The sections under which this exemption is applicable are Section 10(14)(ii) of Income Tax Act and Rule 2BB of Income Tax Rules.

Please do remember that you can not claim the same at the time of filing your return of income if your employer has not provided you the same.

I missed providing my House loan certificate .. Can I add while e-filing?

Yes you claim Home Loan interest while Filing ITR.

Find the type of property you own ex Self Occupied, Rental etc and find rules corresponding to it. For ex for Self Occupied Property Annual Value is Nil, Standard deduction of 30% not allowed.

If taken on Home loan : Have the certificate from the bank which shows interest and principal paid for the financial year (For FY 2012-13 )AY 2013-14) 1 Apr 2012-31 Mar 2013).

If the house and/or loan is joint , divide income,loan in ratio or ownership. Our article Joint Home Loan and Tax discuss it in detail

If you have reported income from House Property to your employer, it will be shown in Form 16 but you still need to show it in ITR.

Our article How to fill ITR1 for Income from Salary,House Property,TDS discusses it in detail.

Hi,

I missed to submit medical insurance of my parents under 80D to the employer. While filing ITR, I mentioned that amount also under 80D, so its showed me the refund tax amount which I will get. Finally after submitting it showed me dialog telling no need to submit any documents regarding your IT returns. But now I got a mail from It Department for proposed adjustment u/s 143(1)(a) from the Income Tax Departmen as that extra amount I showed is not there in my Form 16. What should I do, can you please some one help me on this.

There have been bulk of such emails sent in last few days . our article Notice 143(1) and Proposed Adjustments talks about it.

Wait for few days. You should get revised email

You can take 80D deductions while filing ITR.

Hi,

In the beginning of financial year , i declare the savings of Rs 20000 in PPF to my employer but at the end of year i am not able to make that on time . My employer didnt ask for a document till 31st march and later he asked me for document of PPF that i dont have. Now they are not giving my Form 16.

So is it possible that i can fill my ITR without Form 16 and also without declaring the PPF saving during filling ? Also will it effect my employer contribution as they said they already filled the TDS return of the company and asking for Rs 5000 plus tax so that they can revised their TDS return along with the correction of my Form 16 ?

That’s a tricky situation.

Handle it with care. Though the company is equally to blame you need to find a solution that suits both parties.

Hi ,

In the beginning of the financial year , I had declare the PPF of Rs 20000 but in the end of financial year , my employer created the form 16 for it without asking for the proof from me but now I dont have any document for PPF of Rs 20000 because i was not able to make that saving on time. My employer is not giving my Form 16 because of this reason.

So is it possible that during the filling of ITR without Form 16 , i will not show that saving under 80 C ? also it will not affect any employer TDS return which they had done already as they are asking for Rs 5000 to revise my Form 16 along with the employer TDS return ?

If you invested in PPF before 31 Mar 2017 then you can claim it while filing ITR.

If you haven’t done then you won’t claim it under 80C, no issues.

Get the Form 16 from employer as it is. They have to provide it whether you did saving or not. No need to revise TDS or pay 5000 Rs.

Did they deduct TDS without considering PPF?

You can check Form 26AS which shows TDS deducted through your income tax notice website or netbanking

Hi,

they deducted TDS with consideration of PPF of Rs 20000.

Thanks

Hi , My employer deducted Tax for the Jan and Feb, I understood they have not consider my Housing Loan Interest and accordingly they deducted tax for Jan/Feb, I have raised concern and realized that they have done mistake and they have considered the Housing Loan and did taxing only in March Salary, I did asked what will happen to the tax amount that is deducted in Jan and Feb, They are saying it can not be refunded. I also asked them how can I get this extra tax deducted against my housing load in Jan/Feb. They said I have to do it personally while filing IT.

Is that true. Please let me know

Hi,

My employer deducted medical exp Rs.1250/per month since April 16 to Jan 17 total Rs.12500/- is deducted from my salary and i left the job from feb 17. Now i am asking them to release deducted amount and they asking me to submit medical bills but i don’t have any bills to submit.

Hence, HR were saying without submit the bills will not release amount like and they are not ready to pay TDS also.

Kindly help me in this regard.

Hello There, I forgot to put in the documents when I declared the Income Tax. I did not put my Home Loan interest document while declaring the Income Tax at my office. And unfortunately Rs.3000 was deducted as Income tax in the march payslip. Please help me how to recover the lost amount and also can I get it back when I declared while doing ITR. Please advise.

Hi Team,

I have received the form-16 from old company and i need to update the Income from the previous employer during the current year new comapny and what amount i need to enter for the below mentioned concerns . also i have copied the company form-16 , kindly check and let me know the status

1 Income received from previous employer salary

2 Professional Tax recovered by previous employer

3 Provident Fund contributed with Previous employer

4 Tax paid outside salary / Tax recovered by previous employer

Details of Salary paid and any other income and tax deducted

———————————————————————————————————————————————————————————————————————————————————————————————

1 Gross Salary

a. Salary as per provisions contained in sec 17(1)

Rs.

313647.00

b. Value of perquisites u/s 17(2) (as per

Rs.

0.00

Form No. 12BA, wherever applicable)

c. Profits in lieu of salary u/s 17(3) (as

Rs.

0.00

per Form No. 12BA, wherever applicable)

—————————————

d. Total

Rs.

313647.00

2 Less:Allowance to the extent exempt under section 10

Conveyance

Rs.

16800.00

HRA Rebate

Rs.

39771.00

Rs. 56571.00

Rs. 257076.00

5 Aggregate of 4 (a) and (b) Rs. 2400.00

6 Income chargeable under the head ‘salaries’ (3—5) Rs. 254676.00

7 Add: Any other income reported by the employee

Housing Loan Interest Rs. 0.00

8 Gross Total Income (6+7) Rs. 254676.00

3 Balance (1—2)

4 Deductions :

a) Entertainment allowance Rs.

b) Tax on employment

Rs.

0.00

2400.00

9 Deduction under Chapter VIA

(A) Sections 80C,80CCC and 80CCD

(a) section 80C

(i)

Life Insurance Premium

(ii) Provident Fund

(b) Section 80CCC

Gross

Amount

Deductible

Amount

(c) Section 80CCD

8727.00

11934.00

0.00

0.00

20661.00

(B) Other sections (for e.g. 80E,80G,80TTA etc.) under Chapter VIA

Gross

Qualifying

amount

amount

20661.00

Deductible

amount

10 Aggregate of deductible amount under Chapter VI—A Rs. 20661.00

11 Total Income (8—10) Rs. 234015.00

12 Tax on total income Rs. 0.00

13 Less Section 87a Rs. 0.00

14 Surcharge Rs. 0.00

15 Education Cess @ 3% (on tax computed at S.No.12—13+14) Rs. 0.00

16 Tax payable (12—13+14+15) Rs. 0.00

17 Less: Relief under section 89 ( attach details ) Rs. 0.00

18 Tax payable (16—17) Rs. 0.00

———————————————————————————————————————————————————————————————————————————————————————————————

Verification

———————————————————————————————————————————————————————————————————————————————————————————————

I, ASHISH RAVI KAKKAR, Son of RAVI KUMAR KAKKAR working in the capacity of GLOBAL HEAD HR do

hereby certify that the information given above is true, complete and correct and is based on

the books of account, documents, TDS statement and other available records.

——————————————————————————————————————————————————————————————————————

This certificate is signed using digital signature

For 3I INFOTECH CONSULTANCY SERVICES LTD.

Signed By

: ASHISH RAVI KAKKAR

Place : NAVI MUMBAI

Designation

: GLOBAL HEAD HR

Date : 21/05/2016

Certificate Issuer: e—Mudhra CA Serial Number

: Y

———————————————————————————————————————————————————————————————————————————————————————————————

Emp. No. : 62928 PAN: BCBPS0029KFORM NO. 12BA

[See Rule 26A(2)(b)]

Statement showing particulars of perquisites, other fringe benefits or amenities and profits in

lieu of salary with value thereof

———————————————————————————————————————————————————————————————————————————————————————————————

1. Name & address of employer

: 3I INFOTECH CONSULTANCY SERVICES LTD.

: 3RD TO 6TH FLOORS, TOWER 5,

: INTERNATIONAL INFOTECH PARK,VASHI

: NAVI MUMBAI — 400703

2.TAN

: MUMI08028G

3.TDS Assessment Range of the employer

: TDS CIRCLE

4.Name,designation and PAN of employee

: SANJAY KUMAR WADAPPI/ TEAM LEADER/ BCBPS0029K

5.Is the employee a director or a person : NO

with substantial interest in the company:

(where the employer is a company)

:

6.Income under the head “Salaries” of the : 313647

employee (other than from perquisites) :

7.Financial year

: 2015—2016

8.Valuation of Perquisites

You can contact us support@taxache.com.

We will assist you in filing advance taxes. Joint tax computation. and ITR filing.

Sir I have submitted part payment against my house loan. Can i submit IT certificate as a investment proof ?

No investment proof has to be submitted while filing ITR. Just keep it with you for 7 years.

Hi,

I filed online income tax return for year 2015-16.Due to some reasons,I was not able to get form 16 from my employer and filed return with help of payslips and tax and salary information provided by employer through mail.

The issue is that employer has deducted TDS amount of Rs.70,000,But yesterday I received a intimation mail from income tax department which is showing mismatch of TDS.As per this mail,As Computed Under Section 143(1), TDS deducted amount is only Rs. 31000.

Total income tax is Rs. 63691.

I have all the payslips showing TDS amount deducted Rs. 70,000. However don’t have form 16.Please suggest can i reject this intimation by providing my payslips and can demand for return amount as i paid more than tax calculated?

Please suggest.

Dear Neha,

You could file a grivience in the e-filing portal that the demand is not right. Submit the required documents.

For help contact us on support@taxache.com

I have been paying my son and daughter fees of 10.5L. Till last year I have given my son’s fee for ITR and the daughter fee was not given for ITR. Now I have only my daughter’s fee for my ITR.

Now can I give my daughters fee for ITR.

Yes you can

Deduction under section 80C can be claimed towards school fees or tuition fees paid for the education of your children. A maximum deduction of Rs 1,50,000 is available within the overall limit of Section 80C. The educational institution must be situated in India for the deduction to be allowed.

This deduction can be claimed by an Individual. The deduction can be claimed for maximum 2 children. It is allowed on the amount which is actually paid in the year.

Eligible Payments – Here are all the school fees that can be claimed as deduction –

Play school fees

Pre-nursery fees

Nursery class and higher classes fees

University, college or other educational institution fees

Payments that are not allowed – The following payments towards the child’s education are not allowed to be claimed as a deduction –

Part time courses

Coaching classes or private tuitions

Distance learning courses

Donation to an educational institution

Development fees

Hostel fees

Late fees are also not eligible.

Hello ,

I’ve forgotten to declare my HRA,insurance and tax saving fixed deposits for the financial year 16-17. as a results my salary has been taxed for 3 months from july.i’ve declared the investments now and it should be fine from october. but i’ve lost quite some cash during these 3 months.

is it possible to file for returns at the end of the year?and get the money back ?

Dear Friend,

Once HRA has not been availed, it cannot be claimed. Hence it is beyond the scope right now. After submission of the investment proofs, the taxes would be calculated accordingly. You can contact us support@taxache.com

I missed to gave my medical expenses bills to my employer for last year. Due to same employer cuts the tax, I hv all original bills for that period. I also already filed itr1. Can I still claim medical expenses, by revision of itr1 & sent all original bills & dr. prescription to CPC Bangalore or any other means. No problem for save tax by 17(2) upto 15000.

Pls guide. I hv total 70000 rs. Bills for my dependent mother’s heart surgery.

Regards.

Medical bills cannot be claimed as employer would have given the money instead of the reimbursement.

You can claim medical insurance charges

Hi,

I left my employer in May 2016. New employer says they will not accept my proof for the period 1st April 2016 to May 2016.

LTA : 85000 was given in May 2016 by my previous employer.

Previous employer is not cooperating and is not accepting the LTA documents even though it is for the duration when I was working with them. Even the House rent receipts are not being accepted. My current employer has lower LTA component. How can I claim the overall LTA component. Is my previous employer allowed to refuse to accept the documents ?

They say that they have filed the taxes for first quarter. Does that stop them from accepting my documents ? In normal practise we give documents for the whole year in the final quarter. Kindly guide.

Hi

My company does pay HRA and I left my company on 1st week of march. They deducted HRA till Feb and mentioned the same amount in the Form 16.

Can I mention the March month HRA in Tax Exempt Allowances in ITR file.

As I shifted from my place my Rent has increased from March, will it be ok if the amount is different.

Hi,

My company does not have an HRA component allocated at the time of joining. We have a Fixed allowance component which can be bifurcated into HRA/LTA etc. Though I had submitted the rent receipts at the time of IPSF, I did not allocate any amount to HRA and hence tax was deducted on the entire Fixed Allowance. Now, without having given HRA allocation in my Fixed allowance, can I still claim for refund on the rent paid based at the time of IT return?

Sir

I m working in Underground mine.

I get 14000rs (170000rs annually) per month as a underground allowance which is paid by company for working in tough environment condition and this allowance is a part of salary.can I claim for tax refund on this allowance.

I am eligible for ITR 1 and my employer didn’t give HRA exemption benefit as I missed submitting my rent receipts. Form 16 is also not showing the same. Now if I ask for refund in my ITR filing, will I get a notice from Income tax? Does my employer needs to revise my Form 16?

No you will not get a notice.

Your employer does not need to revise Form 16.

Please follow the steps explained in our article How to show HRA not accounted by the employer in ITR

I failed to submit HRA and LIC receipts to my employer in January 2016 for AY 15-16 and huge tax was deducted in the month of March 2016. As you mentioned we can still claim the exemption, should we file it as original return or revised return? My returns status shows as ITR processed for AY 15-16 in income tax website. Please suggest!

Sir for Jan 2016 you need to file return for AY 2016-17 by 31 Jul 2016. You can claim the full deduction as explained in the article.

AY 15-16 is for income earned between 1 Apr 2014- 31 Mar 2015. You don’t need to touch that ITR

Dear sir,

Please guide in detail. I missed to submit my LIC slip to employer so now what and how, I can show in ITR portal and get refund? should I fill the LIC amount in 80CCC block. Please help me.

Just add LIC amount to other amount claimed in 80C like EPF Interest(in Form 16), PPF investment.

The Section 80CCC deals with tax deductions on annuity plans from the Life Insurance Corporation of India (LIC) and other insurers. Annuity plans means pension plans.

Total you can claim under 80C + 80CCC is 1.5 lakh.

How will I submit documents proof to IT department.

You don’t need to submit document proof to IT department. Keep it safe with you for 6 years

Hello Sir,

I have a query regarding ITR. My form 16 provided by my employer did not have Rs 11,000 ELSS investment, and deductible amount was coming to 1,40.000. I talked to my finance team and they suggested to fill the ITR with all amount i.e. 1,50,000. I filled the same and got the acknowledgement. It says DO NOT SEND THIS ACKNOWLEDGEMENT TO CDC. But, I am not sure, how will they get to know the total investment if I do not send the investment proofs along with the form.

Income tax department expects you to be honest.

So no documents have to be uploaded

My grand mother was admitted in hospital due to a kidney issue and diabetics. The bill came upto 4.48 lakh. Inssurance company issued only 40000 of the amount. Out of which her pharmacy expense was 98000.

I did not file any of these or even the medical bill to my employer. I would like to know how if i can claim any of these. If Yes, what are the sections i can!

Appreciate your help, Good day

Wish your grandmother a speedy recovery.

Typically grandparents are not dependants so you cannot submit medical bills for her to your employer.

I provided the employee the TDS certificate in may and then he transferred from my school,now he asked me to give the TDS certificate through email,I replied him to came to office and I will reissue your TDS certificate. Then he refused that you never issued me the TDS certificate and I have no records that I had issued him certificate. He asked me to mail the scan copy of TDS certificate. Is it safe to provide the TDS through mail (due to data protection act).please guide me.

Thanks in advance

Yes it is safe to provide TDS details through mail.

I have paid 2400 rs of profetional tax in a year.where i mention this tax in itr1.I m gov employe.which article under deducted the tax in itr1.pls help

It should be in your Form 16. Are you filing ITR1 or ITR2? If ITR1 just show Income in Form 16 at point 6

Hi Team,

A very informative blog I must say..I have a query.Infact two. First one- I was employed with my employer A from last 3 years. I left the company and joined company B in Jan’16. I have the previous form 16(15-16)from my Employer A from April’15-March-16.In that, there is a refund of 18k. In the form 16 of my new employer B (from Jan’16-March’16)- I don’t have any tax due as they did not do any TDS. It was left to me.As per my calculation, it should come near to 20K.I was suppose to pay this while filing the ITR. When I uploaded both the Form 16 from 2 employers, the total tax due showing is 38K! I think is is including the refund amount of 18K. How to cliam the refund? Is that I can pay now 38K and side by side apply for a refund to IT dept?

The next question is that if I do any investment of 38K now, will I be able to claim it for my previous year tax exemption under 80C? Or will it be counted for FY 16-17 80C

Need a quick saviour

For Calculation of taxes, one needs to be aware of the total income of the year. The refund of 18k is based on the fact you did not work for 3 months with employer A. There were no taxes deducted because it was not taxable for 3 months. But when you club both the income, suddenly you see that you had to pay taxes. I Think it is right. You cant make investments after 31 March 2016. Unfortunately you need to pay taxes. For help contact us on support@taxache.com

my employer not considered the home loan interest and principal paid amount while calculating income tax and accordingly sent form 16. to claim refund which ITR to be used and where to be filled the amount. Also, I have paid Rs. 15000/- as pension fund to ICICI pru which is not considered. kindly help me

ITR depends on the type of income. So you can read our article Which ITR to fill .

Home loan interest comes under Income from House property. Our article How to fill ITR1 for Income from Salary,House Property,TDS explains it in detail.

Principal on home loan under 80C in Chapter VIA

Pension fund of ICICI pru under 80CCC

A maximum of Rs 1,50,000 can be claimed under 80C+80CCC together

If I pay 9500 per month as rent and my HRA deduction from the salary from gross income is 94848 which component should I deduct from my salary to calculate my tax?Should I deduct 1,14,000 or 94848 from it.

Hi Sir,

My current employer has not been considered the correct value of HRA , in form 16 instead of showing 90000 its showing as 7700 value. How I can claim the rest of the amount.

Hi,

In my salary slip i get HRA component . But the form 16 issued by employer has not deducted HRA under Section 10 . i.e. 0.0 . Where should i claim the actual HRA claimed for rent paid ? Is it under 80GG or should i deduct the same amount from income chargeable under head of salaries given in Form 16 ? I am going to fill ITR1 .

Thanks

Please go through our article How to show HRA not accounted by the employer in ITR for details. If you have any questions then please don’t hesitate to ask.

hi,

you shd actually go for hra exemption as 80GG would be limit for 24000 only.

Greetings,

Very nice blog.I have following query :

My employer pays conveyance/travelling exp and Driver’s salary as part of salary

What exemptions can I claim for petrol expenses and driver’s salary.I own a 1100 CC car and is used ONLY and ONLY for coming to and fro office.

Best regards,

Pranav

And yes I also pay salary to my driver

Any comment on my query would ve very very helpful…thanks

Hello,

My HRA exemption for 5 months is not considered in my Form 16, because of wrong date of housing loan commencement got provided by me by mistake. My housing loan started in Oct 2015, and before that from April to Sept I had been staying in a rented apartment. Now, my employer didn’t consider this HRA exemption and hence I am liable for tax payment of ~10K.

Is there any way to show this HRA while filing the ITR? Please help ASAP.

Yes you can claim it by deducting HRA due for 5 months from your salary while filing ITR.

Please calculate your HRA based on basic salary , place of living. Multiply it by 5/12.

Subtract it from your salary and show it as Salary.

Which ITR are you filing? ITR1 or ITR2

Hi,

In my salary slip i get HRA component . But the form 16 issued by employer has not deducted HRA under Section 10 . i.e. 0.0 . Where should i claim the actual HRA claimed for rent paid ? Is it under 80GG or should i deduct the same amount from income chargeable under head of salaries given in Form 16 ? I am going to fill ITR1 .

Thanks

Deduct the same amount from income chargeable under head of salaries given in Form 16.

Thank You sir .

I have a doubt , if i deduct HRA to be claimed from income chargeable under head of salaries . then it would mis match the actual income in TDS sheet of ITR1 excel sheet ( given by income tax dept ) . Let us say i have 3.75 lac total income under head of salaries given in Form 16. HRA claimed 15 k so total taxable income = 3.50 lacs .But same 3.75 lacs i have to show in TDS sheet with Employer TAN and TDS deducted. Like this ITR1 form is validated , but later on Can IT dept inquire me about mismatch of income chargeable under head of salaries with what is given in TDS sheet ? Can’t i show 15K under 80GG same as what ppl filing ITR2 form do ? So that it will be clear every thing where the 15k has been claimed .

I hope i made you clear my question .

Thanks much .

Yes if you claim that you might have paid more tax than due and might get refund.

You cannot claim under section 80GG. If you claim both HRA and under 80GG then that is not allowed. And Income tax department would have more question.

I have personally claimed HRA while filing ITR and so far have not been questioned by Govt. Our article How to show HRA not accounted by the employer in ITR explains it in detail.

Section 80GG provides for Deductions for House Rent paid, provided that a deduction for payment of House Rent has not been claimed under any other section of the income tax act. In other words, if a salaried employee is being given house rent allowance by his employer and he is claiming a deduction from the same, he won’t be eligible to claim deduction under Section 80GG for payment of Rent. All other taxpayers who are neither getting benefit of House Rent Allowance and nor have they claimed the expense for rent paid under any other section of the income tax act, can claim deduction under Section 80GG. HRA limit under section 80GG has been proposed to be increased from 24,000 to 60,000 Rs.

Hi,

I had done the PPF investment in month of march (22 nd march 2016, but i had not able to claim it, so employer has deducted my tax and same was reflected in my form -16. now i want to reembressed my deducted tax against PPF investment while ITR filling. how to show the investment details while doing the return filling.

please comment on it at earliest.

Show PPF inv as 80C max 1.5L

I did a LIC investment which was discontinued. Therefore, I did not declarer to my employer. this year I activated that investment after depositing two premium amount with some penalty. So, How much I can claim in ITR, full amount (two premium + penalty) or only partial (two premimum amount/ one premium amount).

Only that amount that is for this FY

Hi Team…In the last Financial Year 2015-16, I had worked in ABC company for seven months (01/04/2015 – 21/10/2015) and they were deducting TDS for these months. I had left the organization in the same month and started my own business..Now, my previous employer sent me Form-16 via email which I have reconciled with 26AS form downloaded from TRACES. The TDS amount showing correctly in the Form-16 issued to me.

But,my previous employer didn’t show any deduction of HRA and U/S 80-C rebate in my Form-16. So, my question is here how can I show the deduction of HRA and can claim rebate U/S 80-C…Please help me in this regard.

Yes you can claim HRA for 7 months and all 80C deductions that you have made before 31 Mar 2016 as explained in article.

If you have some confusion please do ask.

Please help, under which section of ITR-1, I need to maintain unclaimed HRA for the previous company. Also please help where I can claim medical receipts bill if it was not submitted.

Hello..

I need your expertise..

I pay my LIC on a quarterly basis. But my deduction under 80C was mentioned for 1 quarter only in the Form-16.

My Form-16 has been generated for the FY:2015-2016.

How can I claim the deductions for rest of the 3 quarters as these deductions will help me in reducing the Taxable income and get a refund..?

Do I need to upload any LIC proofs of the remaining quarters to Income Tax or submit any proofs..?

Or I can simply file an ITR mentioning the deductions of rest of the quarters and ask for a refund…

Please Help…

So your employer has not taken 80C investment for 3 quarters and it is not showing up in Form 16.

If LIC instalment has been paid between 1 Apr 2015 to 31 Mar 2016, you can show it in ITR.

No you don’t need to upload any documents but keep them safe with you for atleast 7 years.

You mention the entire investment under 80C, if it reduces your taxable income then you can get refund.

sir i forgot to fill 3000O under 80C. my Form16 has been generated already . its ITR1 . I need to get return for that amount. Can you tell me how to file return for the same.

Let me understand.

You have got your Form 16. It does not have 80C deductions.

Its ok you can claim amount under 80C while filing ITR1.

Just enter the amount under 80C under chapter VI-A. Please note if you have EPF, paid any LIC premium then you can add it to 30,000 and then claim it.

Please refer to image claiming 80C deductions

But where do i upload the proof for ppf?

You don’t need to submit any proof while filing ITR.

Investment in PPF comes under section 80C with maximum limit of 1.5 lakh including EPF,Insurance premium etc.

You can submit the proof to your employer so that he considers it for tax calculation.

If you haven’t submitted proof to your employer or you are self employed, just mention it in 80C while filing ITR.

If your case is picked up for more questions or scrutiny then you need to provide proof to assessing officer.

HI,

I forgot to submit the HRA receipts to my employer for the financial year 2015-2016. Now the HRA is not mentioned in F-16 given by my previous employer. Now how can i claim that HRA during filling ITR-2016-2017.

please reply ASAP as my tax deduction is much higher

Please deduct the HRA deductions as explained in the article while filing your salary in ITR.

Then you can get extra tax paid as refund

Hi Sir,

I forgot to show my housing loan details to my employer. So, i got Form 16 withouthousing loan details. Now, I want to add those details in IT return filling. My housing loan is joint ownership with my dependents and they were living in the house. I’m living and working in different city and submitted rent receipt of living home to my employer.Now, what should i do for including housing loan details in ITR

That is no problem.

Are you filling ITR1 or ITR2?

Our article Income from House Property and Income Tax Return shows with images of how to fill Housing loan details in ITR

Source of income is Family pension & FD interest.Treasury office not issuing Form-16 and also not entering family pension amount & TDS in 26AS.Bank already deducted TDS.Actaual tax will be nil or less if i produce my tax savings documents. Whom to verify tax savings documents (under 80C) ?

Hi sir,

I worked for a company and was paid INR 2lakhs as joining bonus in financial year 2015-2016. I left my company in may 2016 and paid back a part of my joining bonus to the company.Also,since I am going for higher studies i wont be having any source of income in the next financial year.How can I file a income tax return for the amount that I paid back to my previous company. the form 16 provided by the company for financial year 2015-2016 does not mention this amount returned as I paid it back in may 2016. Should I be asking my employer for any other document other than form 16?

The Income-tax Appellate Tribunal (Chennai bench) has recently held that a sign-on bonus which has been repaid by an employee cannot be deducted from his income. This is because tax provisions relating to salary income do not allow for such a deduction. For more details please read the article. Sign-on bonus returned to ex-employer cannot be deducted from salary income

If you still want to try, if your employer can show the money returned in Form 16 for FY 2016-17 or in full and final statement then you can try asking for refund while filing ITR next year.

Hi,

I have forgot to submit 50k non taxable amount to my employer and its not there in my recent Form16. Can I Add those amount in 80C part in IT Return form ?

Shall I need to submit any document to IT Dept. ?

You don’t need to submit any documents to IT dept. Keep it with you for next 7 years.

What kind of submission you forgot . Was it related to 80C/80D?

Hi,

My employer had considered only Rs.75,0000/- under my Home loan interest deductions instead of Rs.110,000/- for income tax calculation. Accordingly the employer has deducted more TDS. Now while asking for refund during income tax returns filing, do I need to upload documentary evidence on the IT dept website or do I need to send documents by post to them or no need to attach any document proof for the claimed deduction of Rs.110,000/- Kindly suggest.

You don’t need to attach any document while filing ITR.

But please keep it in your records if required, just in case you have Income tax query

Thank you sir

sir, i need to make tax saving of 1.5 lakhs for last financial yr (2015-16), but due to some inadvertant reasons i could make investments of 65000 only. is there any clause for late submission of investments beyond march 31st 2015? can i do anything about it?

Sorry to claim Investments under 80C made before 31 Mar 2016.

Hi,

I didn’t submit the HRA proof to my previous employer.only one month April

Joined the new firm in May 2016. My new firm say they wont accept the HRA exemption for the period spent in previous job ?

How to get the tax exemption for HRA for April? I dont have proof, Can i submit the returns for the minimum amount of Rs 8000 without proofs.

Thanks

SIR, IN MY FORM 16, THE BM OF SBI HAS REPEATED HIS NAME AS FATHERS NAME IN THE CERTIFICATE AND HAS NOT MENTIONED ANY RELIEF UNDER SEC 89 OF IT ACT ON MY ARREARS PAID IN 2011-12. IAVE REPEATEDLY SUBMITTED APPLICATIONS FOR REVISION OF THE ERRONEOUS FORM 16 BUT TO NO AVAIL TILL DATE..WHAT TO DO…

Hi Sir,

i am an individual tax payer have only income from salary,

my concern is, to get the tax refund….

while filing on line tax return (ITR-V) do i need to submit/upload the investment proofs those have not been submitted to my employer in time and not reflecting in TDS from?

Hi,

I didn’t submit the HRA proof to my previous employer (monthly rent Rs 20000 per month for the period of April to October 2016).

Joined the new firm in November 2016. My new firm say they wont accept the HRA exemption for the period spent in previous job ?

How to get the tax exemption for HRA for April to October? I have pan details of my owner.

Thanks

Shiv

Assuming your new company has accepted your HRA exemption from period Apr-Oct 2016.

You can claim the HRA deduction for period Apr-Oct 2016 while filing ITR as explained in the article. Keep the rent receipts as proof.

As you have changed Jobs, you would have two Form 16s so be careful while filing ITR

Hi,

I have submitted the following proofs to my employer-

HRA – 96,000

Interest on Housing Loan- 1,42,000

In the summary submission form, under the “Interest on Home Loan” category, I have given –

Declaration – 1,42,000

Proof – 0 (This is the mistake I have done)

This is my first time submission under this category..

I have submitted the housing loan proof documents but gave the value 0 for “Proof” (Big mistake).

Eventually my salary got deducted 🙁

Is there a way I can submit again and claim the amount?

Kindly give your inputs on this!

Hello,

Can i claim for refund if my employer has not considered my documents for income tax deductions? Wanted to know, how much processing time it takes to have the refund claimed after the returns are filed?

There was a mistake from my end, I had not provided the proofs of investments in the specified deadline by my employer, as a result more tax was deducted from my salary and the employer has assumed i have no investments.

These are the documents which i have

> Home Loan Interest : 195000/-

> Home Loan Principle : 98000/-

> Public Provident Fund : 30000/-

> Insurance Premium : 25000/-

> Children Education Exp: 100000/-

All these expenses can be claimed while filing ITR. There is no accurate number as to how much time will refund take, for some it has taken less than 15 days for many few months. Assume 3-6 months to be pleasantly surprised.

So, let’s learn what measures one can take in order to receive Income Tax refund quickly.

1. File your Income Tax Return on time:

2. File your Income Tax Return Online: From June, 2015, Income Tax Department (ITD) has made it mandatory for people seeking Income Tax Refund to file their Income Tax Return online.

3. Crosscheck the TDS/Self assessment tax paid mentioned in Form 16 with Form 26AS: It is very important that you crosscheck the details of TDS (as mentioned in Form 16 or Form 16A) or Self Assessment tax or Advance Tax with Form 26AS. Actually the income tax authorities take the figures of Form 26AS as final for giving tax credits to tax payers during the processing of income tax return. Crosschecking of Form 26AS is done to assure thatassure that the figures of Form 16 corresponds with the figures mentioned in form 26AS which26AS that finally results in claiming tax credits smoothly.

4. Choose the right ITR form to file Income Tax Return

5. Provide correct TAN no. of TDS deductor: Mentioning of Correct TAN No. of Deductor in Income Tax Return assumes prime importance. You can locate the TAN no. from Form 16 or Form 16A (as the case may be) received from the TDS deductor. If the TAN no. of deductor mentioned in ITR does not match with Form 16 then you may end up losing your tax credits and will deprive you of any income tax refund. You may even get a notice from Income Tax Department for shortfall in taxes. So be very cautious while filling TAN No. of Deductor in Income Tax Return.

6. Provide correct Bank Account details: From June, 2015, Income Tax Department will release the refund directly into the bank account of the tax payer (also called ECS). The earlier option of refund via cheque at the taxpayer’s address has been abolished. So, it becomes very important that one provides correct bank details such as bank account no. , IFSC code of the bank branch, MICR code, etc. in his tax return. This enables smooth issuance of refund by Income Tax Department.

7. Send the ITR-V to CPC Bangalore within 120 days of e-filing: If you have e-filed your tax return without digital signature or without Aadhar card EVC (Electronic verification) mechanism then you are required to send the completely filled ITR-V form duly signed to CPC (Central Processing Center), Bangalore within 120 days of e-filing your Income Tax Return. If you fail to do so then your Income Tax return will become void and thus you will be deprived of tax refund.

8. Keep Tracking the Status of Intimation U/s 143(1)

sir, my employer had included medical reimbursement of treatment done at government hospital as taxable , i had submitted all my original bills of treatment already. please help me how to claim this amount approx 72000 rs as non taxable in my it return to be filed this year

thanks

Please talk to your finance department and understand why they have made it taxable.

Income Tax treatment in case of salaried person who are provided with medical benefit:

This is dealt in section 17(2) of the Income Tax Act as perquisite.

The whole amount of expenses incurred by the employer will be allowable expenditure to such employer under Income Tax Act.

In case of salaried person who is provided with medical allowance the whole amount will be taxable.

Medical Expenses: Reimbursement

Where an employee is allowed to get reimbursement for the medical expenses incurred by him at a hospital maintained by the employer or a Government approved hospital, the entire amount of reimbursement is tax-free and is not treated as a taxable perquisite.

Sir,

I have purchased flat which was under construction since last 2 years.due that I was unable to show my home loan in investment. How can I take back the excces tax which has been deducted.?

Dear sir,

I have switched my job in January. While my new employer is done investment proofs submission date in December itself.

They requested for income and investment from previous employer which I gave.

Also, I have given projected income amount in previous income mistakenly.

Now new employer only have considered income from previous employer (+projected) but NOT considered my investment proofs.

So I have huge deduction in Jan salary.

Please suggest way out. I haven’t got my FNF from previous employer.

You can talk to your current employer and understand why there are more deductions.

When you change job in a financial year you need to make sure that the deductions and exemptions regarding tax liability are made only once. Our article Changing Jobs and Tax, Form 12B talks about how basic exemption is accounted by two employers, correct way to calculate tax when one switches jobs, how Form 26AS will have multiple entries. It is better to give a copy of your full and final settlement from previous employer to new employer so that new employer can take care of tax liability and you have to refer to just one Form 16 while filing ITR. Else you will have to take care of it while filing ITR. If somehow more tax is deducted you can ask for refund while filing ITR

Sir,

If HRA exemption is not included in Form 16, you say that we can claim exemption in the ITR. Is there any coloumn for entering landlord’s PAN number in the online IT return?

Pattabiraman

Dear Sir,

1) I want to claim Tax extemption under 80DD for my father who is having paralysis. What forms ( Apart from form 10-IA ) I need to upload in Form C Filling Process in my Company . Is a certificate describing disability required from Neuro Surgon or Neuro Physician.

2) Can Brain Stroke which Result in Paralysis be claimed under 80 DDB for Medical Expense Exteption ????

Please Reply to 3rd Point also

3) Out of many disabilities

(i) blindness;

(ii) low vision;

(iii) leprosy-cured;

(iv) hearing impairment;

(v) locomotor disability;

(vi) mental retardation;

(viii) mental illness;

If only one ( suppose its Locomotive Diability ) is there . Then Also Claim Deduction can be claimed for 1,25,000 rupess( Hands& Legs not working on Left side , so I AM considering it as disability more than 80%, Hope its right ??? )

I have forgotten to claim some savings which are comes under section 80c during the assessment year 2015-16(F.Y 2014-15). I have also not mentioned during returns of incometax.

is there any possibility to claim that amount now.

Is your return for FY 2015-16 processed.

As per section 139(5) of the Income-tax Act, 1961, the revised return can be filed before the expiry of one year from the end of the relevant assessment year or before the completion of assessment by the income tax department, whichever is earlier. So, for instance, if you have already filed your return for financial year 2014-15 (FY15) before the due date, 7 sep 2015, but want to make modifications, you can file a revised return till 31 March 2017. However, if the income tax department has already completed the assessment of your return, then you cannot file a revised return.

I was hospitalized due to which didnt submitted the income tax proff to my company, now the dates are gone..

I can file ITR but how will i show my house rent now in ITR.

Please help

You can try asking your company if they can accept as its only Jan.

In case they don’t. Do not worry.

If you live on rent and have made rent payments you can claim deduction on House Rent Allowance at the time of filing your return. All you need is your rent receipts and PAN of your landlord (where rent payments are more than Rs 1,00,000 per annum).

You need to calculate the amount of HRA exemption which is minimum of

Actual HRA Received or

40% (50% for metros) of (Basic + Dearness Allowance) or

Rent paid (-) 10% of (Basic + Dearness Allowance)

you can use HRA Calculator to find out how much HRA will be exempt from tax.

While filing ITR subtract the above HRA exemption from the total taxable salary. This is the new “total taxable salary” to be used for filing your tax returns.

You can claim a refund of excess tax deducted by your employer in your Income Tax Return.

sir,

I have forgotten to claim some savings which are comes under section 80c during the assessment year 2016-17(F.Y 2015-16). I have also not mentioned during returns of incometax.

is there any possibility to claim that amount now.

FY 2015-16 or AY 2016-17 is still running. You can submit the claim to your employers.

Else 80C deduction you can claim while filing ITR.

Hi,

My question is a little stupid…. I pay a premium of 80k towards an insurance scheme which is paid in two installments. Now I switched jobs in the middle of the year. I had shown the first installment of 40k in my first company and that was accounted for in the tax computation sheet i received post resigning as well. Now in my new organization’s proof submission process, by mistake i showed the entire 80k again and submitted the documents. What will be the consequences of this mistake?

No questions are stupid. And this has happened to many.

If possible get it corrected in the new employer. You can actually submit the full and final settlement of your earlier company to your current employer so that he can take care of all income tax deductions and give you Form 16 with details of your earlier employer too.

If somehow the mistake is not corrected now, no harm done..you would have to correct it while filing ITR. Then you would have to pay additional tax.

Hi,

I have one doubt.I have changes my middle of this financial year Aug.But During tax submission to new employer, By mistake i have submitted house rent amount only from aug to march, not submitted entire house rent amount.Is it make any problem.

Hi,

My question is slightly unconventional.

What if I don’t want to claim HRA deduction, which has already been approved by my employer.

e.g. I submitted all the required proofs to my employer like rent receipts, rent agreement, etc. and the employer approves them all, adjusts my TDS accordingly, includes this info in form 16 also. But, just in case, because of any reason, I discover later that I dont want to take this deduction, can I ignore this deduction while filing return? I will have to pay self-assessment tax for the difference, thats true. But, is it valid?

Hi, i have worked in one company for 40 days and then changed to my present company in may 2015.Now the question is i don’t have form 16 or any other supporting for that one month(except my pay slip) my present employer taken care for rest of the year.My salary in my previous company is about 3,50,000.How should i go forward for this financial year(Income tax proof submission) for that one month???

Your income tax proof submission should be to current company so that it can adjust the tax it deducts on your behalf.

As you had worked only for 40 days in earlier company tax pertaining to that would have been submitted by your earlier company.

Making a job switch in the middle of the year involves making sure that the deductions and exemptions regarding tax liability are made only once. Our article Changing Jobs and Tax, Form 12B explains it in detail

Hi Sir,

I have done with my review.. I work for private company.. as my manager stated I will get 58000 bonus.. But today I got is 52000, there is 6000 tax deduction..could you please reply me back that there is any way tat I can get this deduction amount.. Please let me know asap.. I am very frustrated. Why this govt need our hard earned money.

I am a State Govt employee. Income tax from my salary was deducted by my DDO as TDS for assessment year 2009-2010. I don’t know whether My DDO file TDS or not . Huge amount of tax deducted from my salary is not figuring in 26AS certificate downloaded from the site. I have no control over my DDO. I have received a demand notice for short payment of about 5200 after assessment of my return by CPC, Bangalore. If e-TDS is filed, this demand will not stand.And for the assessment year 2015-2016 I paid excess tax.It was stated by the IT WEBsite that the refund willbe adjusted for the Outstanding amount for the Assessment year 2009-2010. But I have already paid Income tax via the DDO. whether I have to pay tax to IT DEPT the second time. Is it punishment to me for not proper filing of TDS by My DDO. What should I do?

We can understand your problem. You should not pay tax twice.

Do you have proof that TDS was deducted, TDS certificate or Form 16.

Can you contact your finance department and get the DDO to update the details regarding missing TDS.

You can approach your Assessing Officer with proof that TDS was deducted.

I Have Updated Monthly HRA As Annual HRA By Mistake In Flexi Benfits Plan Section , After That I Have Realized And Tried To Correct My Mistake.But As Part Of The Company Policy they Are Not Allowing To Change The Values Once They Have Submitted It And Also In The Form 16 For This Year Will Contain The Wrong HRA Value ( I.E. Monthly HRA Amount As Yearly HRA).

Is There Any Possibility To Claim The Rest Of The HRA Value While Filling The Income Tax Returns For This Financial Year?.

Hi,

My employer has shown less saving then i have made. I have also filed ITR with the figures provided by the employer in Form 16. Is there any way to show the actual savings after filing the ITR to Income Tax Department and get the refund. If, yes, please let me know the way.

Thanks and regards

By less savings you mean less deductions under section 80C?

Yes you can claim it by revising your return if your return has not been processed till now.

Revising return is similar to filing original return with difference being in the section you file.

For Whether original or revised return select R-Revised.

For Return filed under section select Revised 139(5).

Enter the E-filing acknowledgement receipt number from the ITR-V Which you would have got after filing the original return.

Our article How to Revise Income Tax Return (ITR)

sir

my employer has not deducted underground allowance and uniform washing allowance while calculating my taxable income. how i can claim them

Hi,

I file my ITR online and got response that it’s Defective because of Tax liability show as Taxable and i come to know that my EMployer didn’t conside my Loan interest and Principal amount in Form 16.

Did need to mail that document to the IT dept.

Did i have to just file th Update XML file without any documents attached to it

No documents have to mailed to Govt. Just upload XML file.

Taxable means that you need to pay tax to govt.

You can check why your return is defective.

You can revise your return and show Loan interest as -ve in Income from House Property and Principal in section 80C.

I have filed my return online on 31st Aug. But I don’t have submitted any deductions eg HRA,insurance premium. Also I don’t have submitted it to my employer. In this situation can I claim any refund after filing my return.

That’s the advantage of filling return before due date, you can revise the return.

Yes you can revise your return and fill appropriate deductions. If it results in refund you can should get it.

I changed jobs in year 14-15 now issue is : From previous employer they did not exclude short notice period amount(Rs 88962) which they got from me while leaving org from income ( in form 16) part. And new employer did not include that income while calculating tax. Now my income tax has increased even i did not get money and i am bound to pay income tax

Please give me suggestion what should i do to pay correct amt of tax.

Thanks

Bharat

Tricky situation. We can only pass reference to two links

Tax treatment of notice pay in Income Tax

Another one is Treatment of notice pay & joining bonus recovery in your income tax return

Hi

I have form 10 1 80ddbfor the expenses incurred for my mother not submitted to my employer and this amount doesn’t reflect in the form 16 . can I claim this while filing the tax returns by including the amount in ITR1 for under the deductions section 80DDB and calculate the tax. how do I send the copy of form 10 1 or upload the same while doing tax returns in the e-filing online.

Your help is much appreciated.

Yes you can. Deductions under 80DDB can be claimed while filing income tax returns (as mentioned by @ca-karan-batra also). There is no need to submit proof along with ITR. If needed, IT department can ask for proof later while ITR processing.

Does it needs to be submitted every year?? Like i have already submitted in my last year, Now this year they have again asked for the same

Hi, I would like to know about Home Loan exemption process as I had taken two Home Loan one from LIC Housing as Construction Loan at my native place, and another Home Loan taken from HDFC LTD for buying a Flat in DELHI & it is under construction and expected to got possession in Dec’15.

My query is that my employer consider LIC Housing home loan in FORM-16 but not consider HDFC Home Loan while it has deducted from Sept’2014 to till date as well and no clue why they had not considered.

Can I get exemption of HDFC Loan from Income Tax while submitting ITR ? If yes, then how ? If not then, why it can not be consider as I am paying hard money monthly ?

I am very greatful to you if I got guidance, thank you in advance.

A home loan borrower can claim Income Tax exemption on interest payments of up to Rs 2 lakh and another Rs 1.5 lakh under Section 80 C towards the principal repayment for a Self-occupied property.

However, you cannot seek these tax benefits in the pre-construction phase (i.e. no tax deductions available for an under construction house), even if you have started repaying the housing loan through EMIs.

The Section 24 of the Income Tax Act states that if a property is still to be constructed, there will not be any tax deduction on the interest payment for all of those years.

However, the interest for the pre-construction period can be availed for deduction in five equal installments from the year the construction is complete.

Thanks a lot for clarification.

Hi, I have worked in a company till Oct’15 and didn’t claimed my HRA. So could you please tell the section in ITR where i can furnish my HRA details to get the claim. Thanks in advance.

Typically HRA is covered in Form 16 and hence there is no separate section in ITR. if not claimed then you have to deduct it from the salary and fill as explained in the article above.

Please note that HRA exemption is allowed for the period you have worked.

My form 16 shows my saving details as Rs 1,50,000, which was submitted to account department as undertaking as me earlier in the Fy 2014-2015.

But due to some reasons i could save only Rs.1,31,000. So what is the procedure to file correct tax returns. Kindly suggest.

Sir it is unusual for companies do give deduction of 1.5 lakh without proof. Your EPF contribution is also included in 80C. So verify with your finance or payroll dept as to why deductions were given as 1.5 lakh.

If what you said is correct

While filling ITR under tax deductions under 80C mention 1,31,000 instead of Rs 1,50,000 and pay the tax due as self assessment tax.

Thanks. In case of self assessment tax same challan 280 needs to be filled. Right??

Hi Sir,

i have a very confusing question one of my friends father is government employee his annually salary is 326000/- but he had not filling any return yet (not any single return) 16 year service every year around 6000 to 8000 rs TDS deduted by employer from him salary he has a different investment like lic ,housing loan payment .ppf payment but he was not declare to employer my question is can he take examption for above mention investment for refund.and for past how much year return he can file.

If you have missed filing IT returns on time, you can file it within 1 year from the end of relevant assessment year

These returns which are filed after due date is called – BELATED tax returns (Section 139(4) of Income Tax Act 1961)

For FY 2013-14 or AY 2014-15 for which due date was 31 Jul 2014, you can file the return till 31-Mar-2016

Yes, if you file return after due date, you loose certain rights:

1) Interest on Outstanding Taxes – If you have any taxes due and you have not filed return by due date, then you need to pay penal interest @ 1 % per month from the due date of filing the return to the actual date of filing (As per Section 234A of the Act) .

For e.g if your tax due is Rs 10000 and you filed the return on 2-Aug-2015, you need to pay 1% interest on Rs 10000 i.e Rs 100

2) Penalty for ITR filing after 31-Mar-2016 (hardly exercised): As per Section 271F of Income Tax Act, the assessing officer may impose a penalty of Rs 5000, if an individual fails to submit ITR before the end of the relevant assessment year. However, this penalty is rarely exercised by Assessing Officer, if taxes have been paid.

The HRA component chosen by me was lesser than the actual rent paid. Suppose in my salary component I have chosen 10,000 as my HRA and accordingly I have got the exemption in my form 16 but I have paid 15,000. So please suggest whether I can change my exemption amount by decreasing the Gross Salary Income ?

And we have an Rent agreement shared by four people whether that is eligible for HRA exemption for 1/4th amount of total Rent Paid?

My company paid me Rs 1250/- per month as medical reimbursement. But while calculating tax they considered medical bills till 15th Jan. I have some more medical bills dated after 15th Jan and I have some income from interest.

Can I claim tax benefit on the medical bills which my company haven’t considered?

While calculating self assessment tax can I subtract the amount of remaining medical bills from the income from interest?

If I calculate self assessment tax by subtracting the amount of medical bills, how to show it in ITR1 form?

No Amit you cannot claim medical bills from income tax. You can claim these only through your employer.

I don’t want to claim medical bills, I just want to claim tax exemption on the amount of medical bills.

Is it possible?

If someone claim for refund in ITR form for any investment that is not considered by employer, then the person doesn’t need to share the documents along with ITR submission form, then how the income tax department validate the genuine refund cases ?