Credit score plays a critical part in the loan granting process these days. Based on your credit score, a bank will decide whether to give you a loan or how much interest to charge you on the loan. Credit score is a 3 digit numeric summary of your credit history assigned to you by credit information bureaus such as CIBIL. The Score is derived by using the details found in your Credit Information Report (CIR). Higher the Score more favorably your loan application will be viewed by a lender.

Your Credit Information Report is nothing but a factual statement of your credit payment history. This information is put together from different credit givers. Like your medical reports tell you how healthy you are, your credit report shows your financial health and creditworthiness. You can get your credit report from three agencies :

- Credit Information Bureau (India) Ltd, or Cibil,

- Equifax Credit Information Services Pvt. Ltd and

- Experian Credit Information Co. of India Pvt. Ltd.

While one bank may subscribe to Cibil, another to Experian and the third to Equifax. These reports are similar,with different names in some cases. They have information about your personal information, details of all your loan accounts, enquiries made on your account by various lenders . While all three reports are unique in their own way, each has elaborate information on your finances. In this article we shall focus on understanding the Credit Information Report (CIR) by CIBIL.

Credit Information Report is factual statement of your credit payment history. This information is put together from different credit givers. It has information about the :

- Loans, credit card you have called as Accounts, and

- The loans you applied for called as Enquiries. Enquiries are made on your credit history when you apply to a lender for a loan. The lender accesses your Credit Report to assess your repayment capability.

There are 2 versions of CIBIL Credit Information Report (CIR) :

- One with CIBIL credit score charges Rs 470

- The other one, without it. charges Rs. 154.

If you want to check your score, you have to go for the one which costs Rs. 470. No bank/ finance institution would be able to provide you this report. You need to buy it yourself.

Now you can get 1 Credit Report Free annually. How to get Free CIBIL Credit Report and CIBIL Credit Score discusses it in detail.

Table of Contents

Details of when CIR Report was generated

The report starts with details on when the report was generated, for whom, reference number called as Control number. The Control Number is a unique 9-digit number found on the top right hand side of your CIBIL Credit Information Report and is generated every time a credit report is generated. This number is unique for the credit report generated. In case you have any queries on your report in the future, you will need to provide this number to the bureau.

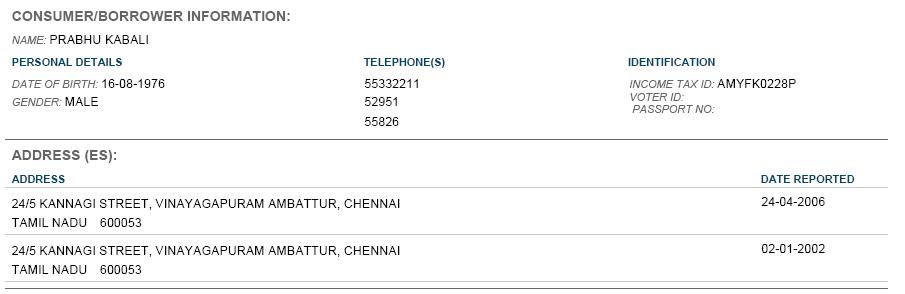

Consumer Information

This section of your report contains your personal information, such as name, date of birth, gender, telephone and mobile numbers, Permanent Account Number(PAN) and addresses.This section shows your latest address as well as past addresses. Ensure that the spellings and dates mentioned are correct and your address updated.

CIBIL Score

Credit score is a 3 digit numeric summary of your credit history. The CIBILScore ranges from 300 to 900 points for those with credit-history of more than 6 months. The closer your Score is to 900, the more favorably your loan application will be viewed by a lender. In Oct 2012, CIBIL came up with CIBIL TransUnion Score 2.0.

CIBIL TransUnion Score 2.0 is a new, updated version of the Credit score which has been designed keeping in mind the current trends and changes in the consumer profiles & credit data.The CIBIL TransUnion Score 2.0 also introduces a risk index score range for those individuals who have a credit history of less than 6 months. These individuals were categorized under the category of “No History- NH” in the earlier version. The score range is from 1-5, with 1 signifying “high risk” and 5 signifying “low risk”.

| Score & Index | Interpretation(i.e., for whom does this score reflect) | |

| NA or NH |

|

|

| 1-5 |

|

|

| 300-900 |

|

|

Summary

It is a summary of all your loan accounts and enquiries made. Accounts section has various parameters such as

- Total number of accounts,

- Number of overdue accounts

- Number of closed accounts

- Zero balance account: Zero balance accounts are those where you have paid off the dues. but haven’t closed them. Just paying off the last equated monthly instalment does not mean the loan is closed.

- Recent account :the date when the latest account was opened

- Oldest account : the date when the first account was opened

Check: If the number of zero balance accounts does not match the number of closed accounts, then it indicates that you have a few loose ends to tie by closing the paid off for accounts formally. Just paying off the last equated monthly installment does not mean the loan is closed.

Check: If you haven’t taken a loan recently and it shows you have a recent account on a date you don’t recognize, it means you could have been a victim of a fraudulent activity in your name. In such a case, get in touch with the credit bureau and/or the institution from the where loan was availed for further assistance.

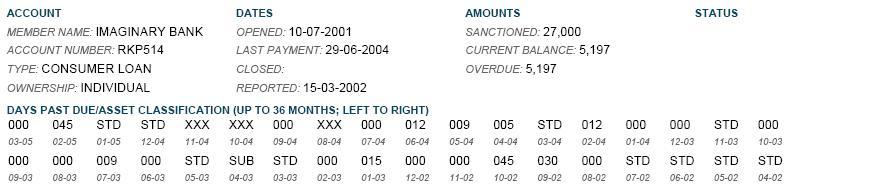

Accounts

The ‘Accounts’ section of your credit report contains existing and past credit facilities that you have availed from various loan providers. For example, if you have a home loan and a personal loan, your credit report will reflect both accounts on your credit report along with details such as the name of the lender, type of credit facility, dates of opening and closing (if applicable) of each account, current balances, status of the accounts and your payment history. Your credit report summarizes your credit behavior across these accounts for the last 36 months.If there is any discrepancy, get in touch with your bank. For every account it has information like:

- Name of lender, Type of loan account, whether it is a car or home loan or a credit card,the account numbers whether single or jointly held

- Dates:the day the account was opened, date of the last payment.

- Who has responsibility for paying loan: whether it’s a joint or individual account or whether you are a guarantor on a loan account.

- loan amount, current balance, amount overdue etc

- status of the account—it could be active, paid off or written off. If you have a dispute on an account, it will be mentioned as a disputed account

- Payment history: This section of the report shows your history of payments for a period of 36 months against the loan(s) taken or credit card dues. It shows the exact number of days, if any, past the due date or DPD (Days past due)

Sample Account Information is shown below. Account information is discussed in detail in our article CIBIL CIR : Account and Negative Factors.

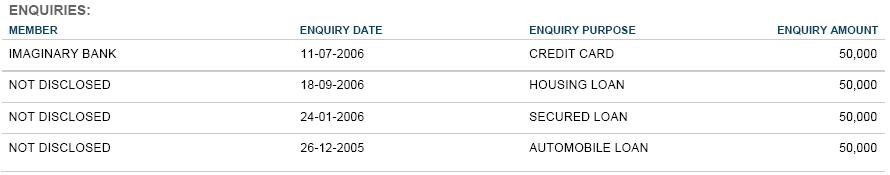

Enquiries

This section tells who’s been asking for your credit report i.e enquiries made on your account by various lenders. It shows the total number of enquiries as well as gives details of each enquiry. Name of the institution which enquired, the date of the enquiry, the purpose of the enquiry and the amount for which the enquiry was made, it has all related details.

Remember that no lender can request to see your credit report without your consent. Usually consent to check your credit report is part of your loan application form. If you haven’t applied for a loan and the report shows that a lender has made an enquiry, there is a good possibility that you may have been exposed to identity theft. Get in touch with the bank immediately.

Note:Enquiries are not added to your CIBIL credit report when you purchase one directly from a CIBIL.

Distinction between an Account and an Enquiry in that the Account denotes actual loan obligations that you currently are bearing while the Enquiry denotes that you had applied for a loan or other credit facility from various lenders.

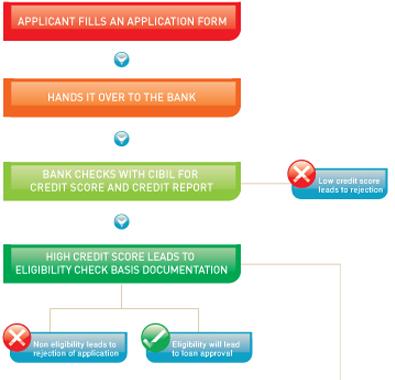

Loan Application Process

Banks or lending institutions need to find if particular loan applicant can repay the loan,so they need to know applicant’s borrowing and repaying history. Say you apply for home loan from Lender D. Before Lender D gives you a home loan, it must check multiple things, such as your salary, your age, your past EMI repayment history. It gets your past EMI repayment history information from Credit Information Report and Score. It provides lending institution with an indication of the “probability of default” of the individual based on their credit history. Higher score means that the credit institution will have more confidence in your ability to repay the loan and hence, the better the chances of your application getting approved. Loan application process is shown below.

Please note that your credit score is credit score is one of the important factors, but not the only deciding factor for the banks to sanction you a loan. There are other factors also like your income, the income-expense ratio,your residence stability, your personal debts such as the loan to value ratio, the tenure of the loan, against assets are also taken into consideration.etc. All the banks have their own parameters and policies to sanction a loan. It’s important that you understand your Credit Information Report and what it takes to maintain a good credit history, so that is viewed favourably by Loan providers.

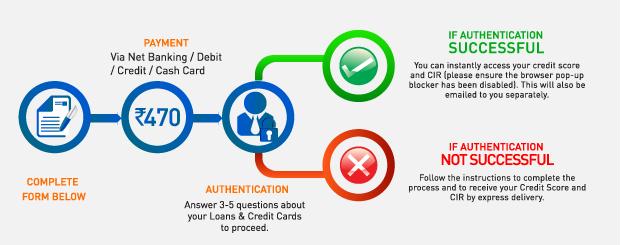

How to get Cibil CIR /Score

It is recommended to get Credit Information Report to know your credit history and whether it accurately reflects your credit usage and activity. It reports loan accounts that belong to you and correctly. To get CIBIL’s CIR Report and Score offline (downloading form and posting it) and online (submitting information on internet) are available.

Now you can get 1 Credit Report Free annually. How to get Free CIBIL Credit Report and CIBIL Credit Score discusses it in detail.

The process is defined below.

Offline: Can get both versions without score(154) and with score(470)

- Step 1: Download the form (pdf)

- Step 2: Collect all the required documents, including address and identity proofs.

- Option 1: Online Payment: Fill the request form online and pay via net banking, debit, credit or cash card. On making a payment, you will get a registration ID. You will receive an email with details about your “on-line payment confirmation” along with the Cibil registration ID and transaction ID.

- Option 2: Demand Draft: Download the form from their website. Make a demand draft of the required amount.

- Step 3: Take a printout of the “online payment confirmation” details and mail it along with your identity and address proofs to any of their addresses. If you’ve made the demand draft, attach the demand draft to the form and documents.

- By post: Credit Information Bureau (India) Ltd, P.O. Box 421, Wagle Industrial Estate P.O. Thane- 400 604.

- By courier: Consumer Relations – Disclosure Request,Credit Information Bureau (India) Ltd,Hoechst House, 6th Floor, 193, Backbay Reclamation, Nariman Point, Mumbai- 400 021.

Online: Only with score is possible (470 Rs)

Go to CIBIL webpage of online form and follow the process as shown below. It is also explained in Jagoinvestor CIBIL Report Online – Get your credit score in your email

Refrences: CIBIL’s Understand your Credit report (pdf), Livemint’s Things to look in CIR.

Thanks to Shiv Kukreja’s article on onemint CIBIL Credit Information Report which was of great help in understanding the report.

Related Articles :

- List of Articles About Loans, Debt, Credit Cards, CIBIL Report

- CIBIL CIR : Account and Negative Factors.

- FAQ regarding CIR report

- Understanding Loans

- Life of Debt – Responsibly

[poll id=”31″]

In this article we tried to explain CIBIL’s Credit Information report. Like your medical reports tell you how healthy you are, your credit report shows your financial health and creditworthiness.

5 responses to “Understanding CIBIL CIR report”

Hi, very informative article. Good work!

Unfortunately I have a bad credit score and I want to borrow some funds. What are some good borrowing options where my scores would be ignored? Is peer to peer lending a good option?

Popular Peer to Peer Lending platforms are

Faircent, Lendbox, Vote4cash, Loanmeet, i-lend, Rupaiyaexchange, i2iLending, lendenclub, etc.

The P2P agency in true sense is an intermediary – or in today’s modern e-commerce parlance “marketplace” where lenders and borrowers meet (e-commerce equivalent of buyers and sellers meeting). In the global P2P model the player gives a platform for the lenders and borrowers to meet. They (lenders and borrowers) are able to negotiate the terms between themselves and the player (P2P portal) gets a fee for this. A borrower can decide from whom to borrow; and likewise a lender can decide who gets his/her money.

If you are a person with good credit background (good CIBIL record) and you have all the documents ready then definitely you are going to approach a bank where you can easily get a personal loan at interest rate of approx. 12-15% depending on the risk profile. If an individual is having problem for getting loan from a bank due to any minor issue then the person can approach these P2P sites where he can get a loan at a rate of around 15-30%.

Now Since there is a greater probability that borrowers with not a good CIBIL record are coming to the P2P sites, the toughest task for these companies is to filter the sub-prime borrowers so as to minimise the risk of the investors. Investors have to be very cautious while determining the risk and return in their lending.

The reason some of these are not getting a loan are serious like recent delinquency, low salary, cibil issues etc. Some others because of debt burden or some sins of the past. It is for these that peer to peer lending is of immense help where they have the ability and willingness to pay but no alternatives to obtain credit. Now p2p marketplaces will need to attract such borrowers thorough their marketing activities. Sites which already attract such loan seekers will obviously be in a position of strength. Next they check the basic details and profile of the loan seeker to establish whether the person prima facie is eligible for a loan. The next step is to undertake a credit as well as other checks which is done by different sites in different ways. Next the eligible borrowers are conveyed the interest and upon acceptance listed on the site for lenders to check. Once enough lenders agree to fund a loan request (there is usually a cap on how much a single lender can invest), the marketplace gets agreements signed and the loan disbursed. EMI payments are checked regularly and delinquencies dealt with as per the terms of the contract.

I researched on the web and found out some more p2p lending platforms like http://www.loankuber.com/. I am thinking of investing a small amount to start with.

Dear Sir,

DEBT DOCTOR MANAGEMENT SERVICES is India’s first and only Retail Debt

Management Company, with NOC from RBI and ISO 9001:2008 Certification for

Debt Management and Debt Counseling. We are 5 years old with more than

20,000 Account Acquisitions.

Further to our conversation, find attached PIF (Personal Information Form),

please fill this form and send it back to us along with a copy of your Pan

card/ address proof to initiate process.

Any of the following:

Id proof: Pan card

Address proof: Passport/bank statement/ Passbook/ telephone bill/Mobile

bill/ electricity bill/ Voter’s id.

As mentioned, there is an Enrollment process to Debt Doctor as it would

require documentation to be completed by you, this would enable Debt doctor

to communicate with the Banks & Credit Bureau initially and further to

arrive at a resolution for your issue.

We can do following for you:

1.We will purchase a detailed CIBIL report (CIR) on your behalf.

2.We will be analyze your Credit History & Credit Score.

3.A detailed plan will be drafted to resolve any discrepancies first i.e.,

(you might have paid all the dues to the financial institutions and

information in CIBIL is wrongly updated. We will fix the errors on your

credit report) Then we will check about the defaults / overdue amount to be

paid by you to the financial institutions.

4.We will first check with you (since when you have defaulted or not paid

the amount to the financial institutions) Then we will check with the bank

about the closure amount.

After paying the closure amount to the creditors.

5.We will get you the closure letter/ No due certificate letter from the

bank.

6.We take the complete responsibility of the documentation for closure.

7.We also ensure the CIBIL update is done by the bank. And whichever

information’s are not updated in the report we will get it updated in the

report.

For the score to improve there must be running loan or credit card so we

will get you a pre paid card for the score improvement and monitor for the

score.

8.After updating all the records in CIBIL, your CIBIL will be cleared & then

loans should not get declined.

Once you enroll with us we will provide you a registration number valid for

lifetime.

As per our conversation over the phone regarding the issues related to your

cibil report, We at debt doctor do” CIBIL MASKING”, clearing the old credit

histories by paying past dues to your various outstanding loans. Here first

need to talk to your bank, pay the old dues. Get NOC & No dues from the bank

& ask there for update your record into CIBIL & at the same time, and need

to contact CIBIL to correct the status for past mistakes. CIBIL will check

with the lenders & after getting the confirmation, they will remove the

settled or written off status from your report & then will update your

credit score also.

After you register with us, our Service team will get in touch with the

banks/ financial institutions related to your credit report, and initiate

this cibil masking procedure and negotiate and close the status, post which

our cibil team will work with you towards improving your track record and

ways to rebuild your credit score.

We can help you clearing these issues with our services and improve your

credit report and make you credit worthy.

Details of Fees:

For, Settlement, CIBIL Repair & to improve the score (Credit Report & Repair

Service) Enrolment Fees: Joining Fee:7999 /- (to be paid to start process)

This will be the life time member ship fee, and we will continue to service

with the same if any other assistance you need with respect to any loan or

credit card issues

You can deposit the amount in bank; these are the bank account details.

Account Name: Debt Doctor Management Services Pvt Ltd.

Account Number: 00762020001772

Bank: HDFC Bank Ltd

Branch: Post Box 5106, Shankarnarayana Bldg,

25/1, MG Road, Bangalore 560001.

IFSC Code: HDFC0000076

Thanks & Regard

vanitha

Debt Doctor Management Services Private Ltd.

ISO 9001;2008 Certified Company

Level 5,Leo Complex

44/45 Residency Cross Road

Bangalore-560025, INDIA

Direct # +91 80 30732225

Contact no:9964360188

[…] not able to get loan? For details about CIBIL CIR report you can go through our earlier articles Understanding CIBIL CIR report, CIBIL CIR : Account and Negative […]