People change jobs these days, unlike days of our parents when people joined companies and worked there till retirement. Changing jobs often leads to a situation where an individual gets tax exemptions twice from his earlier employer as well as from his new employer. Exemptions and Tax Liability form an important consideration while switching jobs. Making a job switch in the middle of the year involves making sure that the deductions and exemptions regarding tax liability are made only once. We shall explain how basic exemption is accounted by two employers, correct way to calculate tax when one switches jobs, how Form 26AS will have multiple entries, how Form 12B may be used to declare income from previous employer.

Calculation of Tax Liability by both the employers on Switching Job

Suppose Anshuman worked in a company where his annual income was 6 lakh. He told the company that he will be investing 50,000 to save taxes. But he worked till Oct 2013. So His first employer will calculate his tax liability by deducting basic exemption limit and his tax saving from his taxable income.

|

Income from first job (full year) |

6,00,000 |

|

Investments under section 80 C |

50,000 |

|

Taxable income |

5,50,000 |

|

Less tax free exemption |

2,00,000 |

|

Tax to be calculated on income |

3,50,000 |

|

Tax (for full year) |

41,200 |

|

Monthly Tax |

3433.33(41,200/12) |

|

TDS paid by company(till Oct) |

21,100(41,200/12 *6) |

Tax calculated by second employer on annual salary of 8 lakh for 6 months only. He does include his income from the first year. He again takes care of investments under section 80C and basic exemptions

|

Income from second job (half year) |

4,00,000 |

|

Investments under section 80 C

|

50,000 |

|

Taxable income |

3,50,000 |

|

Less tax free exemption |

2,00,000 |

|

Tax to be calculated on income |

1,50,000 |

|

Tax (for full year) |

15,000 |

|

Monthly Tax |

1250(15,000/12) |

|

TDS paid by company(from Nov) |

7,500(15,000/12 *6) |

So Anshuman has paid tax of 28,600 (21,100 + 7,500) on his income of 7 lakh (3 lakh + 4 lakh)

Correct way to calculate his tax liability is as follows, which uses Basic Exemption only once

|

Income from first job |

3,00,000 |

|

Income from second job |

4,00,000 |

|

Investments under section 80C |

50,000 |

|

Tax free exemption |

2,00,000 |

|

Taxable income |

6,50,000 |

|

Tax liability |

60000 |

|

Total (before cess, surcharge) |

10,000 |

- So instead of Rs 60,000 of tax to be paid ,as TDS, on salary of Ansuhuman only 28,600 was paid.

- The other thing that made Anshuman happy on switching jobs was that his tax-home pay shot up. But it was short-lived happiness. In May his salary for month of Apr was less than in March. Because his tax was calculated based on income from full year and hence TDS increased and so his take home decreased.

- When he files his income tax return for the FY 2013-14 he would have to pay TDS he owes also interest on the tax due as he is liable to pay advance tax. Our article Advance Tax covers when is Advance tax due and how to calculate it in detail.

How would the Government know that I have switched job?

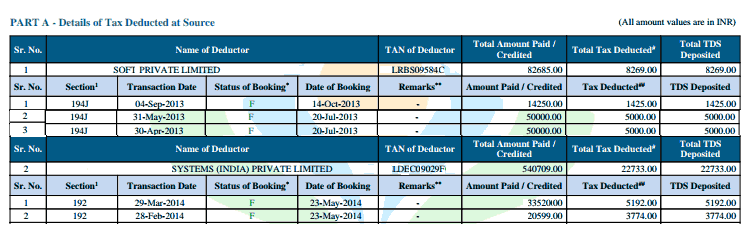

All tax deducted against your PAN number is recorded. The employer submits(or is supposed to submit) TDS to Government So when you change jobs the partA of Form 26AS has multiple entries as shown in excerpt from image below. There are 2 deductors with their TAN and information on tax deducted. To know more about structure of Form 26AS you can read our article Understanding Form 26AS and What to Verify in Form 26AS? Click on image to enlarge

Form 12B

When a new employee joins the company, he may give the particulars of income from his earlier employment by filling Form 12B which has following details

- Details of your previous employer like his PAN No., TAN Number, Period of employment

- Break up of Salary like Basic Salary + DA, Perquisites, House Rent Allowance, Leave Encashment, Leave Travel Allowance etc.

- Deduction with respect to Provident Fund and Particulars of value of perquisites such as Rent free accommodation(if any)

- Deductions if any under Section 80C, Section 80G, Section 80E, Section 80D, Section 24

- TDS on Salary deducted by the previous employer (enclose certificate issued under section 203)

- Professional Tax (if any) paid by the employer

These details in Form 12B are required to be furnished based on the Salary Slip and the Form 16 issued to you by your previous employer. Form 12B is required to be furnished even if no TDS was deducted by your previous employer because the salary was less than the basic exemption limit as per the Income Tax Slabs. It is quite possible that after combining your current and previous salary, your total salary is chargeable to tax. An extract of the specimen copy of Form 12B is enclosed herewith and the full copy can be viewed at http://law.incometaxindia.gov.in/DITTaxmann/IncomeTaxRules/pdf/itr62Form12B.pdf

Form 12B shall be verified and signed by the employee and based on these details furnished by the new employee, the employer issued a Consolidated Form 16 at the end of the year.

Image of Form 12B(pdf) from incometaxindia.gov.in website is given below.(Click to enlarge)

For an employee joining in the middle of a FY, is it the responsibility of employer to ask for salary details of previous employment?

According to section 192(2), where an assessee is employed under more than one employer or has held successive employment under more than one employer, he MAY furnish to the person responsible for making the payment , which may be any one of the employers as the assessee may choose – such details of his income under the head salaries received from the other employer or employers.it is the option / discretion of the employee whether or not to file Form No 12B. The current employer can’t insist on filing of Form No 12B. If the employee chooses not to file, then employers’ obligation is limited to compute TDS on salary payable by him.

If Form 12B is filed, then current employer can deduct the TDS on salary paid by previous employer (incase no TDS was deducted by previous employer). And if the TDS was deducted by previous employer, any excess or shortfall can also be adjusted.

If the details are so furnished in the prescribed form, the person responsible for making the payment SHALL take it into account for deducting tax at source.

The usage of MAY and SHALL shows that the employee has the option of furnishing the said particulars. It is, therefore, not mandatory to provide the details of the previous employment to the new employer in Form 12B.

It is always in the interest of an employee to furnish such details because otherwise there can be duplication of exemptions and deductions and there can be a shortfall in tax deduction and as a result the employee would become liable to deposit advance tax.

Who’s responsible for filling up the Form 12B: My previous employer or me?

It is the responsibility of the employee to fill the declaration in Form No 12B and also attach Form 16, if any, issued by your previous employer. It is required to be filled up even if there was no TDS deducted by your previous employer due to the salary being less than the basic exemption limit. It is quite possible that after combining your current and previous salary, your total salary income exceeds the maximum amount not chargeable to tax.

How to fill Form No. 12B for giving it to my current employer so that income (and tax already deducted thereon, if any) from my previous employment can be considered for the purpose of TDS from my current salary income?

Fill up Form 12B based on the Form 16 (if you have) or on the basis of salary certificate (if you don’t have Form16) issued by your previous employer. You can also take the help of your salary slips. In case of any difficulty, you can take guidance from your previous or current employer.

Can my current employer still refuse to deduct TDS on my previous salary once I submit Form 12B?

Ans: No, once you submit Form 12B, it becomes the obligation of the employer to deduct TDS on your consolidated salary after accounting for TDS deducted (if any) by your previous employer.

Is Form 12B the same as Form 12BA?

Not at all. Form 12BA is a statement showing particulars of perquisites and fringe benefits, if any. It is issued every year by your employer along with Form16. Our article Understanding Form 12BA covers Form 12BA in detail.

What if I have submitted all my investment proofs and rent receipts to the earlier organisation?

You need to fill Form 12B, verify it and submit to your new employer. Your ex-employer does not have to enter the picture.You can use the salary slips from your ex-employer. So you have the option either of obtaining Form 16 from your ex-employer or submitting Form 12B.

If you cannot produce Form 16 or Form 12B, you have to re-submit the proofs of the investment if your new employer insists on it.

This will be valid only if your previous employer did not take the investments into consideration. That is, he has not already calculated your tax consideration.

What if I don’t fill Form 12B?

Then the new employer will not take account of tax liability of previous employer. You then would have two Form 16. It becomes your responsibility to take both the forms and compute taxes as shown in Right way to calculate. This may result in some tax payable, which can be deposited as self-assessment tax, along with interest as applicable. Our article Paying Income Tax : Challan 280 talks of how to pay the tax using Challan 280. Our article How to Fill ITR when you have multiple Form 16 explains how to fill Income Tax return when you hav multiple Form 16.

Related articles:,

- Economic times Feb 2012’s Are you evading tax

- Fill Excel ITR form : Personal Information,Filing Status, Fill Excel ITR1 Form : Income, TDS, Advance Tax

- Understanding Form 16: Tax on income

- Salary, Net Salary, Gross Salary, Cost to Company: What is the difference

- Changing Jobs:Take Care Of Bank Account

When you change the jobs, be aware of tax liability that may arise. Make sure that basic exemption, deductions etc are not taken into account more than once. If possible fill Form 12B. If not then you might end up with multiple Form 16. You can take both the forms and compute the taxes by applying the slab benefits to the total income. This may result in some tax payable, which can be deposited as self-assessment tax, along with interest as applicable. Did you fill Form 12B when you changed your job? How did you take care of tax liability when you changed your jobs

I hv resigned and last working of previous company is 14th may 2021 and joining new company on 17th may 2021, i need to submit form 12B. My previous company payslip components of 1month is like this. Basic 25500, HRA 10200, conveyance allowance 1600, edu allowance 4000, medical allowance 1250, special allowance 4450, professional development 4000 and deduction professional tax 200, medical insurance 612, pf 3060. Can you provide me the values in column 6 to 12 based on above values

Hi All,

I am confused on the new Annexure-2 (salary details)

the total amount of salary received from other employers (s) [336]

I want to know that, what amount we should put in this column when we go to the TDS return 24Q-Q4 <Annexure-2 (salary details) total amount of salary received from other employers (s) [336])?

In case we are second employer of the employee.

Total amount of Rs.500,000 Lakh received from previous employer and HRA of 80,000 has been exempted, then we should fill in this column the amount of taxable amount of Rs.50,0000 or the amount after exemption (50,0000-80,000 = 4,20,000)?

Thank you to share insightfull article on Tax. Kindly help me, What is my income tax liability inFY 2019-20 if i have worked/ private job only three and half months from 1st april 2019 to 13th july 2019 and earn Rs 45000 salary per month in financial year 2019-20. After that i have not any attend job because to take care of family member who have cancer.Total annual income from all sources around Rs 170000.

As your total income (45,000 X3 + 1,70,000) is 3,05,000.

If you claim Rebate while filing ITR your tax liability will be 0.

Check out our article Rebate and Income Tax in FY 2019-20 to understand rebate.

I joined current company on May 27th, 2019. So apparently, only April and May salary from previous employer is accountable. Can I avoid filling Form 12B for current employer?

Check that old salary details are reflected in Form 26AS.

It is better that you fill the form. Now Form 16 format has info about salary from the previous employer

But we are still in 1st Qtr it is OK if you don’t fill the form

Hello Team, I would say this the best article about filling FORM 12B that I could on the internet or any person in that case! However, I would be glad if the below questions get answered too

I worked in my previous organisation till July 1st week 2018 and Joined the new in 2nd week. Now that I have already filled Income Tax for FY 2017-18, with the help of Form 16 provided by my previous employer in June. With this scenario, I have below questions :

1. Do I need to include details of my Salary from April to July 2018 in Form 12B including my Full and Final Settlement from previous organisation?

2. My Salary components include – Basic, HRA, Allowances like Shift , Food & Special Allowance, Leave encashment, Telephone and Internet Reimbursement and Under Deductions- PF, Professional Tax and Income Tax.

3. With above components, What Should I fill in Columns – 6,7, 8, 10 and 11?

Thank You in advance.

Thanks for kind words.

The details that you need to provide you are the one pertaining to this financial year, from the 1 Apr 2018 to last working day

Not of the earlier financial year.

Your new employer is not worried about last year details.

How much PF/employer tax/HRA/Tax was deducted

You need to provide details as per the full and final payment.

You can give the details of your form 26as which tells how much income you earned and how much TDS was deducted.

Without seeing your payslip and your full and final payment this is help that we can provide.

Sir, as i know in IT return form “Salary(excluding all allowances, perquisites and profit in lieu of salary)” must sum of all basic from apr, 2018 to mar, 2018. I switched my company in nov, 2017.

Should i calculation basic of previous company plus current company. I also given my form-16 to current company at time of joining.

Yes you should calculate basic salary from earlier employer too.

Please check whether your new company has taken care of your earlier company for tax details.

You can send both the Form 16 and and Form 26AS to our email id bemoneyaware@gmail.com

Hi all,

I joined new organization but I don’t have form no 16 as well as they didn’t provide me form no 12 b, as per hr discussion he saying that I am not eligible for the incom tax because Please provide me some information.

is it mandatory to submit the form 12 b in new organization?

if yes, then what is the solution for it, because earlier employer refuse the provide it?

and this issue I already mentioned to the hr of new organization.

In my previous organization I’m eligible for tax. In my new organization they asking the form 12B, is it mandatory to submit the form 12B? If I didn’t provide what they will do?

Hi,

I have wrongly provided income of previous emplyment due to which i getting deductibg with more tax amount. can you tell me is there way to correct the form..?

Where have you wrongly provided income of previous employer? To your new employer?

So it’s not reflecting in Form 16.

Don’t worry. Check your Form 26AS.

Check your previous employer Form 16.

Use these details while filing ITR.

Hey,

I switched my job within the financial year.

My previous employer says that form 12B will be available in the month of May.

Also where do I submit my rent receipts etc.

In May one gets Form 16 along with Form 12BA not Form 12B.

When an employee receives ‘perquisites’ from his job, Form 12BA is provided by his employer to the employee. Perquisites are the benefits derived from a job or a position and these are in addition to salary already being paid to the employee. Our article Understanding Form 12BA explains it in detail

Form 12B is when you change your job and submit tax deductions done by earlier company as full and final settlement to new company which then deducts tax accordingly. Else both companies will give you maximum deduction as explained in the article. This is done when you join the new company.

If form 12B is submitted you need to consult just one Form 16 while filing ITR else you will have to take care of both Form 16.

You need to submit your rent receipts along with your landlord PAN number(if monthly rent is above 8333) to your finance department so that they can give your HRA exemption

I have a lot of confusion in filling up column 7 of form 12-b.

i.e. Total amount of house rent allowance, conveyance allowance and

other allowances to the extent chargeable to tax (See section

10(13A) read with rule 2A and section 10(14)]

I have HRA, conveyance allowance, food coupon allowance, leave allowance, city allowance. All these components are taxable. I have never claimed these allowances. So should I fill the total of these components in column 7.

Also, in my full n final settlement I have leave encashment. Where should I enter this amount?

HR dept in my company is not aware of this form & hence they are unable to help me.

Kindly help.

Thanks.

Correcting my query above

I joined a new company in October 2021 and instead of providing the previous employer income from April 2021 to September 2021 i have wrongly updated income from October 2020 to September 2021 income.Because of this more tax is deducted.If I edit the previous employer income now will they deduct less tax from upcoming months?

And how to get the extra tax paid?

Get in touch with your payroll department.

Tell them the situation.

Once you upload the correct details they can adjust the tax payment.

hi sir,

suddenly I joined new organization but I don’t have form no 16 as well as they didn’t provide me form no 12 b, as per hr discussion he saying that I am not eligible for the incom tax because I am not in slap of incom tax. Please provide me some information.

is it mandatory to submit the form no 16 and 12 b in new organization?

if yes, then what is the solution for it, because earlier employer refuse the provide it?

and this issue I already mentioned to the hr of new organization.

Strictly speaking an employer is obliged to issue Form 16 which is a certificate of tax deducted at source only when he has deducted any tax from the employee’s salary. If no tax has been deducted owing to the fact that the employee’s salary is below the tax-free threshold, then there is no need to issue Form 16.

all,

I joined new organization but I don’t have form no 16 as well as they didn’t provide me form no 12 b, as per hr discussion he saying that I am not eligible for the incom tax because Please provide me some information.

is it mandatory to submit the form 12 b in new organization?

if yes, then what is the solution for it, because earlier employer refuse the provide it?

and this issue I already mentioned to the hr of new organization.

In my previous organization I’m eligible for tax. In my new organization they asking the form 12B, is it mandatory to submit the form 12B? If I didn’t provide what they will do?