What Should you consider before buying the house? As Soon as one gets the job and gets married one is under pressure to buy the house. This article talks about how a father asks his son to think before buying the house.

Things to consider before Buying the house

- Don’t buy if you aren’t absolutely sure that you want to be there long term

- House costs money more than just buying the house

- Renting the house if you don’t use it

- Tax Benefits and Home Loan : Owning a home offers tax advantages by way of interest payment, principal repayment as well as capital gains.

- House for now or for future

- House always appreciates

- House is Illiquid

Don’t buy a house

Nikhil’s Bhaiya’s father is not a good father. My son said after we watched the Ad of SBI Insurance Great Dad. “He didn’t let him buy the house..Don’t you remember” said my son . I was taken by surprise (shock actually) and I remembered how an year earlier Mr Gupta (our neighbour Nikhil’s father) had come to our house as he had disagreement with Nikhil.

Nikhil was a smart guy with engineering degree under his belt and was working in IT company. As he was now well settled in job he wanted to take a loan to buy the house just like his other friends. Mr Gupta was against the idea. “At 26-27 when you are undecided about your future why do you want to take a big liability like home loan ? And too just because your friends are doing it..Talk of peer pressure” Next day Gupta family came to our house(a neutral territory Mrs Gupta said and this time she was not supporting her husband) for a discussion between Nikhil and his father . The discussion is given below and after that my respect for Mr Gupta went up It made me realise that being a father means not only providing for the basic needs of Roti Kapda Makaan Education but also guiding them. Quoting Danille Steele from the book Daddy .

It’s a responsibility you can never shirk, never forget, never avoid. You can’t take a day off from being a father. You can’t drop out, or change your mind, or decide not to be there. For the next eighteen years, if not longer, that baby would be your responsibility solely.

The Video that we saw, it pulls the heart strings.

And now to what Mr Gupta said on what should one consider before buying the house,

Don’t buy if you aren’t absolutely sure that you want to be there long term: You need to be careful about making this choice when you’re young and not sure where your life is headed. One day you want to go for higher study, other day you wanted to join Start up. The other day you wanted to move to other place, even talked about moving to other country. Now may be a time for you to explore to travel or take on a new hobby. Owning a home would limit your flexibility. You can’t get out on a moment’s notice; selling or even renting out a house takes time. Buying a house on loan will not only cost drain on finances but time too.

House costs money more than just buying the house :One cannot compare the cost of buying to renting by looking at rent vs EMI.

- Apart from the basic rate the cost of a property includes other amounts payable to the builder such as parking, water charges, Club house charges, legal charges, floor premium charges, etc., as well as amounts payable to the government towards taxes such as stamp duty, registration, service tax and VAT. These amounts together increase the cost of the property by around 15%.

- Then there is cost for interiors.

- Once bought house involves additional costs like property taxes, insurance, maintenance and repair costs.

All these can add significantly to the expense of owning. Many of these charges are not recoverable when the property is sold, hence should be regarded as expenses on which there are no returns, rather than as an investment. Then if you take out a loan to buy a home, you will have to pay interest expense to the individual or institution that lent you the money. And you are locking your future earnings (becoming an EMI slave. Costs of owning a home should not be a financial burden. You are servicing a car loan and if you guy for higher studies you need an education loan?We know that if we miss payments, our credit score takes a dive and we have trouble borrowing in the future. Don’t let you house cost your freedom.

Renting the house if you don’t use it : People who encourage buying a home instead of renting typically make the case that if you rent, you are throwing a significant amount of money down the drain. They say if you don’t want to live in house you can rent it. When people talk of rent they talk of rental yield. The rental yields is the annual rate of return through rental income from a residential property at the current price. If you earn an annual rent of Rs. 2 lakh on a property which is priced at Rs. 50 lakh, then the rental yield is 4%. It essentially measures the return you make on the asset without considering the expected capital gain or loss. Gross rentals from renting out residential house property on an average, are typically around 2 to 5 % of the prevailing property value . However, many expenses such as property tax, monthly maintenance charges, repairs, etc are typically borne by the owner, which reduces the net returns from rentals of the prevailing property value.

It also depends on what kind of people you rent to .Do they pay rent on time? Do they take care of the house. Remember how Mr Sharma was complaining the other day of the tenant who left the house in a shambles when he vacated and she had to fix up the house and find a new tenant. How long do they stay – if you end up looking for tenants every year then you end up paying broker charges..

Tax Benefits and Home Loan : Owning a home offers tax advantages by way of interest payment, principal repayment as well as capital gains. Most investments in house property are funded through home loans. The interest and principal are tax-deductible. You often hear “I fall in the 30 per cent tax bracket, my return is higher compared with investing in a fixed deposit and paying tax on the interest earned” . Our article Income from House Property and Income Tax Return explains income on house property and how to show it in ITR in detail.

- The tax advantage under Section 80C has been increased to ₹1.50 lakh for the assessment year 2014-15 and 2015-16.

- Irrespective of the number of houses owned, you can claim repayment of principal on housing loan.

- You can also claim stamp duty and registration fees as deduction.

- Interest paid on housing loan is also deductible.

- If your second home is rented out and the rent received is less than the interest paid. Then, the income from the property will be a loss and this can be deducted. The second home is exempted from wealth tax provided rental income is offered for taxation — as actual rent or deemed rent. If the second house is purchased out of capital gains within the stipulated time, capital gain tax is also saved.

- When a property is sold, Capital Gains tax is payable thereon. Such tax can be avoided in some cases, but to save tax, the sale proceeds have to be invested in another property or in low return bonds,

But, Interest burden is a huge cost and adds manifold to the cost of the property. A loan taken at an average rate of 10.5 % per annum for 15 years will double the loan amount repayable i.e. interest paid over the period will be equal to the loan amount! So a loan of Rs 50 lakhs repaid over 15 years @ 10.5 % per annum interest results in a total repayment of around Rs 1 crore over 15 years, which includes Rs 50 lakhs as interest. Home loan rates of interest tend to be around 1.5 to 2.5 % more than the prevailing rate of inflation. Thus, if the prevailing average rate of inflation is 9% p.a, the home loan rates would be somewhere between 10.5 & 11.5% per annum, which in many cases is more than the rate of return from property over the long term.

Interest on home mortgages is deductible, which sounds good but is frequently overrated. Yes, it’s deductible. But the deductibility doesn’tho offset the fact that you are paying someone interest. It’s an expense that makes you an EMI slave.

House for now or for future:You don’t buy house every day. So you have to think for whom are you buying the house? Is it good enough to meet your future needs. Space needs grow as the family size increases. Will you buy a 2 BHK house or a 3 BHK house? (Now a days there are 3 BHK house with 2Toilets) . If you can’t afford to buy a home that will accommodate your significant other, or new baby and any of these is a possibility in the next few years don’t buy yet. Individuals may have specific likes and dislikes What if your wife wants to live in an apartment with amenities or prefers a different location or doesn’t like the layout of the house or the interiors.

House always appreciates : But houses always appreciates in value. Sure it does and what usually happens is that people sell their home and buy another home with it(After all they need a place to live in and Usually it’s the bigger one) . By then price of other homes would also have appreciated. Unless you buy a lesser value home or move to other location where prices are low. So how much return can we expect from it. Mr Gupta showed us the post tax return of Asset classes – equities,gold,real estate,Fixed Deposits. our article Returns of Stock Market, Gold, Real Estate,Fixed Deposit discusses topic in detail

House is Illiquid : Property is a very illiquid asset. A sizeable fund gets locked up, not earning any return. It may require months or even years to dispose of and cannot be sold piece meal, hence has to be sold entirely even if a part of the value is required in cash. In case of emergency large scale fund requirements, it may not be possible to raise the cash quickly.

Your decision to purchase a home will be one of the biggest financial transactions of your life. Therefore, it should be thought out well in advance, should not be based on emotion and should not be taken lightly. What should a young person do (Mrs Gupta’s reply was get married):

- Enjoy life. Kaam Karoo, Ghoomo Phiro Aish Karo (for Zindagi na mile dubaraa)

- Learn about investing and different asset classes. You learnt about earning money now learn about how to save and invest.

- Find your risk profile.

- Learn about Insurance especially Term Insurance . As they say precaution is better than cure.

Wondering what happened to Nikhil. He did not buy the house. Soon he went out on a company’s assignment to a different city. Talks are ongoing about a foreign assignment. His parents are looking for a bride for him. Some of his friends who bought the house were laid off. They are struggling to pay EMI.

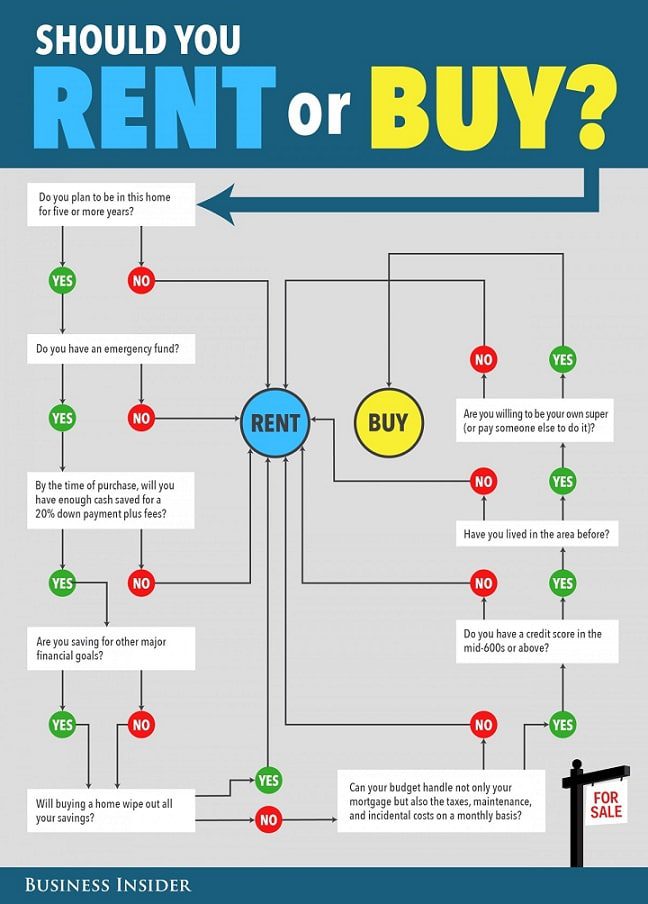

Should you rent or Buy a house

The following image from Grabhouse shows the decision points of renting or buying a house

Related Articles:

- How to Calculate Capital gain on Sale of House?

- Young 20s -30s: Loans, Debt and Credit Cards

- An Interview: 20s and Money

- What I learnt about Money from my Parents

- Credit Card Debt

- EMI Calculator

The responsibility we as parents have is tremendous because our children become our echoes. So the question for the father is “Are you a Good Dad or #GreatDad?”“What kind of role model are you?” What are you teaching your child? How do you say No to your child? How do you talk to your adult children about money and what you do to resolve the differences. What do you think is right age to buy a house and what should one consider before buying the house?

23 responses to “Buying the house: Right time to buy,what should one consider before buying”

Thanks for sharing such a nice piece of article

This is very nice post for anyone looking for buying house.

Can you also explain the hidden charges we should be aware of while buying house.

This is very nice post for anyone looking for buying house.

Can you also explain the hidden charges we should be aware of while buying house.

Thorough and well presented.

Totally satisfied…

Thanks!

Thanks for comment. We appreciate. Look forward to more feedback

Thorough and well presented.

Totally satisfied…

Thanks!

Thanks for comment. We appreciate. Look forward to more feedback

The explanation was very practical approach to the dilemma that every young person faces during his decision making. The situation does change though when you plan to get married and settle down since a property does come into question a lot whether the guy has his own property or not would you not agree?

Well said Siddhesh. I remember seeing an ad in this regard..mother of girl asking whether prospective guy has house or not.

Few decades/years ago before girl parents used to check whether prospective in-laws have house or not.

25-30 is too young for a guy to have a property and I see many freshers soon planning to buy a house…hence the post

The explanation was very practical approach to the dilemma that every young person faces during his decision making. The situation does change though when you plan to get married and settle down since a property does come into question a lot whether the guy has his own property or not would you not agree?

Well said Siddhesh. I remember seeing an ad in this regard..mother of girl asking whether prospective guy has house or not.

Few decades/years ago before girl parents used to check whether prospective in-laws have house or not.

25-30 is too young for a guy to have a property and I see many freshers soon planning to buy a house…hence the post

The ad really moved me.. and the way you have also added your own advice..This is such a valuable post! Thank you so much for the useful tips.

Thanks Pratyusha

The ad really moved me.. and the way you have also added your own advice..This is such a valuable post! Thank you so much for the useful tips.

Thanks Pratyusha

I think people have one perception that Property is the best investment for long term. Even I had the same till I buy my first flat. But gradually realized that in the long run there is no alternative to Equity. Very well said.

I would not agree with that Santanu. One needs a mix of Equity,Property,Debt,Gold which experts call Diversification or Asset Allocation. The problem with Property is it’s a huge investment and is illiquid so one has to think 101 times before proceeding.

I think people have one perception that Property is the best investment for long term. Even I had the same till I buy my first flat. But gradually realized that in the long run there is no alternative to Equity. Very well said.

I would not agree with that Santanu. One needs a mix of Equity,Property,Debt,Gold which experts call Diversification or Asset Allocation. The problem with Property is it’s a huge investment and is illiquid so one has to think 101 times before proceeding.

Agreed to this article. Thanks

Thanks Laksmipathy for kind words

Agreed to this article. Thanks

Thanks Laksmipathy for kind words