The Union Budget 2021-22 was presented by Finance Minister Nirmala Sitharaman on 1st February 2021. There are no changes in the tax slabs, no Covid Cess was introduced. The Union Budget 2021 cheered Stock Markets as the Sensex jumped over 2,300 points while the Nifty reclaimed 14,250 on 1 Feb 2021. Highlights of the Budget are given below. No negative was positive for the budget.

Table of Contents

Highlights of Budget 2021

Highlights of Budget 2021 are given below. Details are later in the article.

- Income Tax Returns will be Pre-filled with details of capital gains, dividend income in addition to salary, tax payments, TDS, etc.

- Senior citizens above 75 years are exempted from filing income tax returns if their only annual income is pension income and interest income. Section 194P has been inserted to enforce the banks to deduct tax on senior citizens more than 75 years of age who have a pension and interest income from the bank.

- Reduced deadline for filing belated, revised ITR by three months from March 31 of the relevant assessment year to December 31 of the assessment year. So the last date for voluntarily filing the ITR for the current financial year, i.e., FY 2020-21 will be Dec 31, 2021

- Reduction in time for IT Proceedings from 6 years to 3 years: Except in cases of serious tax evasion, assessment proceedings in the rest of the cases shall be reopened only up to three years, against the earlier time limit of six years.

- Affordable housing additional deduction under Section 80EEA deduction has been extended till 31st March 2022.

- Gains from ULIPS are taxable if the premium on ULIP taken on or after 1 Feb 2021 is more than Rs. 2.5 lakh per year. This removes the disparity relative to mutual funds. Death benefits continue to remain tax-free regardless of the premium amount.

- The interest on any contribution above Rs. 2.5 lakh by an employee to a recognized provident fund is taxable effective from 1st April 2021. This means that a person contributing up to Rs 20,833 a month to PF i.e has a basic salary of up to Rs 1.73 lakh a month will not have to pay the tax. But whether the interest will only be taxed in the year of contribution, not after it is still not clear. This only applies to EPF and not PPF.

- Non-filers of the income tax return will have to pay higher TDS rates under the new section 206AB in the Income Tax Act. The proposed TDS rate in this section is higher of the followings rates:

- 2 times the rate specified in the relevant provision of the Act; or

- 2 times the rate or rates in force; or

- the rate of 5 per cent

- In case of Bank failure, Rs.5 lakh Deposit Insurance will be available in a time-bound manner. In the Madhavpura Mercantile Co-operative bank (Gujarat-based) fiasco involving the infamous stockbroker Ketan Parekh during 2012 still, many depositors have not received anything from the DICGC.

- Agriculture Infrastructure And Development Cess (AIDC) has been imposed on petrol and diesel at Rs 2.5 and Rs.4 per litre respectively. But there would be no additional burden on the consumer as the Basic Excise Duty (BED) and Special Additional Excise Duty (SAED) rates have been reduced on them.

- AIDC cess has also been introduced on import of gold and silver(2.5 per cent), alcoholic beverages (100 per cent), crude palm oil (17.5 per cent), apples (35 per cent), coal, lignite and peat (1.5 per cent), fertilizers, including urea (5 per cent), and cotton (5 per cent).

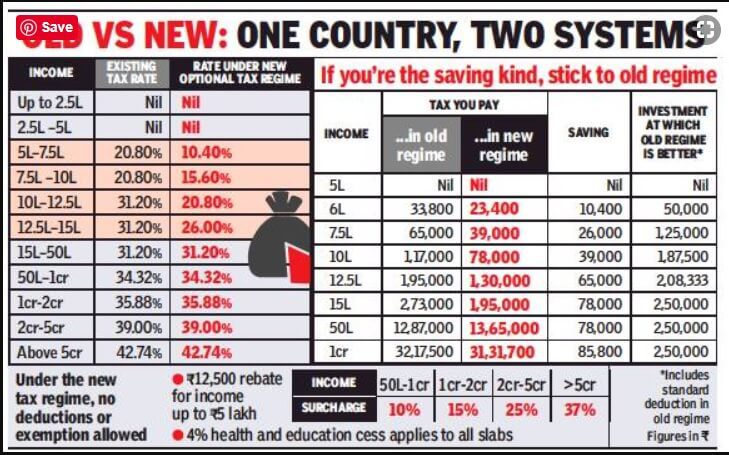

Tax Slabs for FY 2021-2022

Budget 2021 did not make any changes to the income tax regime with no change in standard deduction or Section 80C limit.

There will be two types of tax slabs.

- For those who wish to claim IT Deductions and Exemptions.

- For those who DO NOT wish to claim IT Deductions and Exemptions.

if you wish to choose the new tax regime, then you have to forget the deductions or exemptions such as Standard Deduction, HRA, LTA, under chapter VIA (like section 80C, 80E, etc)

Our article Old or New Tax Regime to choose with Calculator for Income Tax for FY 2020-21 discusses it in detail.

Tax on EPF, VPF Contribution above 2.5 lakhs

The interest on any contribution above Rs. 2.5 lakh by an employee to a recognized provident fund is taxable effective from 1st April 2021. This means that a person contributing up to Rs 20,833 a month to PF i.e has a basic salary of up to Rs 1.73 lakh a month will not have to pay the tax.

The number of people who actually contribute more than Rs 2.5 lakh is less than 1 percent of the total number of contributors in the EPF,” reported DNA quoting Expenditure Secretary T V Somanathan. Therefore, the common man does get affected by this move.

But will the interest be only be taxed in the year of contribution, not after it, is not clear?

From the finance bill 2021 (page 34)

But provisions of these clauses shall not apply to the interest income accrued during the previous year in the account of the person to the extent it relates to the amount or the aggregate of amounts of the contribution made by the person exceeding two lakh and fifty thousand rupees in a previous year in that fund, on or after 1 st April 2021, computed in such manner as may be prescribed

For all contributions made by employees (not employer) in EPF or VPF, which exceed Rs. 2.5 lakhs in a year, any interest earned on this excess amount will be subject to regular taxation. any balances in EPF that you will have till 31 March 2021 or interest earned on them in the future are exempt from tax.

The contribution limit of 2.5 lakhs a year is combined on the Statutory contribution of 12% of the basic + any VPF contributions. It does not include the Employer contribution.

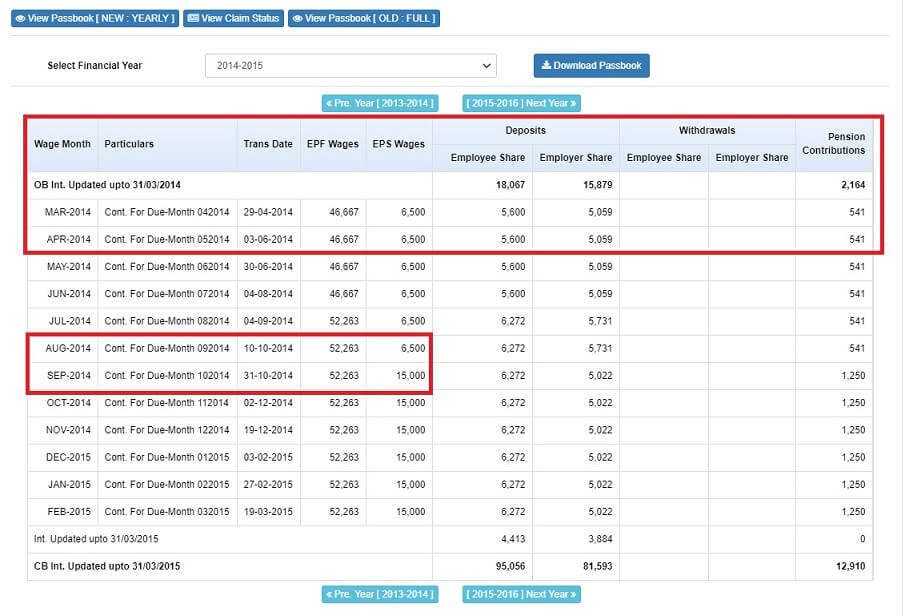

VPF: In EPF, an employee has to contribute 12% of his basic pay towards his provident fund account. An equal amount is contributed to by his employer. An employee may voluntarily choose to contribute more than 12% he can do so up to 100% of basic and D.A. This is called Voluntary Provident Fund or VPF. But the employer will contribute an amount matching only the 12%. In the EPF passbook, VPF contribution does not appear differently. More details about VPF in our article Voluntary Provident Fund, Difference between VPF, EPF and PPF

Will the EPF passbook be updated to show different contributions portfolios, 1. Employer’s contribution, 2. Employee’s contribution below 2.5L each year, 3. Employee’s contribution above 2.5 lakh each year. The current passbook(as of Feb 2021), from our article, How to view EPF Passbook, is shown in the image below

Is Investing more than Rs 2.5 Lakh in EPF is still a good strategy?

Should one contribute to EPF above 2.5 lakhs?

The number of people who actually contribute more than Rs 2.5 lakh is less than 1 percent of the total number of contributors in the EPF,” reported DNA quoting Expenditure Secretary T V Somanathan. So common man does not get affected by this move of the Finance Minister.

This marks the second time the NDA government has sought to tax employees’ provident fund savings. A 2016 Budget announcement to tax 60% of EPF account balances at the time of withdrawal, was later rolled back.

- If you are under the 30% tax slab, then your post-tax returns will be 5.95%

- If you are under a 20% tax slab, then your post-tax returns will be 6.8%

- Finally, if your tax slab is 10%, then your post-tax returns will be 7.65%

Assuming you are under the highest tax bracket of 30%, who will give you the 5.95% tax-free returns in the current scenario?? Bank FDs, Debt Funds, Tax-Free Bonds, RBI Floating Rate Bonds, or NCDs.

There may be few instruments like PPF which may be offering higher tax-free returns than the EPF post-tax returns on the amount which is taxable as per the new tax rule.

Deposit Insurance on Bank Failure

If the bank fails financially and has to go in for liquidation then a depositor can get up to Rs 5 lakh(before 4 Feb 2020 it was 1 lakh) under the Deposit Insurance Scheme of the Bank. The debacle of Yes Bank, PMC(Punjab and Maharashtra Co-operative) Bank has brought back the focus on depositors’ money protection and deposit insurance.

The insurance cover offered by the DICGC covers all different accounts of one depositor held with different branches of the same bank for a maximum of Rs 5 lakh. Therefore, if you have more than one account with the same bank (even if in different branches), then, too, you will be insured for Rs 5 lakh only

If Shyam has Rs 75,000 in the failed bank he will get only 75,000 Rs. While if Meena has 6.6 lakhs in a failed bank she will get only 5 lakhs and will lose 1.6 lakh.

Please note, that DICGC will be paid but when is a question. In the Madhavpura Mercantile Co-operative bank (Gujarat-based) fiasco involving the infamous stockbroker Ketan Parekh during 2012 still, many depositors have not received anything from the DICGC

You can check the DICGC Claim Submission Pending page to understand different circumstances under which payment could be delayed. A simple appeal by the bank can drag on for months to years.

Finance Minister Nirmala Sitharaman in her Budget speech of 2021 announced that depositors will have easy and time-bound access to deposits if a bank gets liquidated

More details in the article Deposit insurance on bank failure, Amount, Limit

ULIP

The Budget 2021 attempts to make the taxation of ULIPs and Mutual Funds the same.

If you take a new ULIP on or after Feb 1, 2021 and the annual premium is Rs. 2.5 lakhs or more, then you are liable to pay capital gains tax on the maturity of such a ULIP.

Note, payout in case of death continues to be tax exempt.

Video on the budget 2021

This year’s Budget focuses on the seven pillars for reviving the economy

Health and Wellbeing, Physical and Financial Capital and Infrastructure, Inclusive Development for Aspirational India, Reinvigorating Human Capital, Innovation and R&D, and Minimum Government Maximum Governance.

Several regulations around the securities market are proposed to be merged as a single code.

Several direct taxes and indirect taxes amendments were also proposed.

Related Articles:

Understand Income Tax: What is Income Tax, TDS, Form 16, Challan 280

- Old or New Tax Regime to choose with Calculator for Income Tax for FY 2020-21

- Deposit insurance on bank failure, Amount, Limit

- Voluntary Provident Fund, Difference between VPF, EPF and PPF

Experts and analysts hailed the Budget as growth-oriented and a pragmatic one as the government raised CAPEX target without increasing tax rate

FM had earlier promised to present a “budget like no other”. Is this a budget like no other?

Trackbacks/Pingbacks