Income from Other sources such as interest of Saving Bank Account, Fixed Deposit, Recurring Deposit, Senior Citizen Saving Scheme(SCSS) needs to be shown in the Income Tax return. This article explains Income from Other sources, with picture, what kind of income comes under this head, whether TDS is deducted or not, how to show it Income Tax Return with specific cases of common income such as Saving Bank Account,Fixed Deposit, RD, SCSS, Infrastructure bonds in 80CCF.

Table of Contents

Overview of Income from Other Sources in ITR

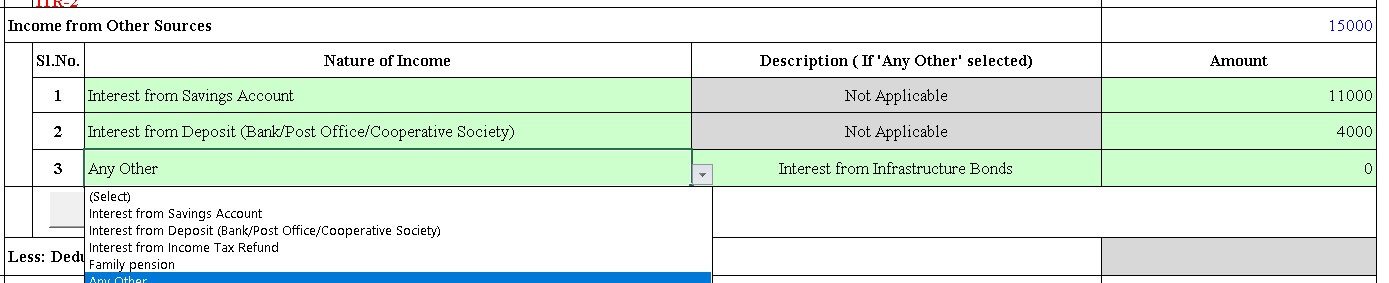

Earlier (FY 2017-18 or AY 2018-19) ITR-1 asked for only the total amount of ‘Income from other sources’, but from FY 2018-19 or AY 2019-20 year you will have give a detailed break-up. The image below shows the Income form Other Sources in ITR1.

- Any income which does not fall under the heads of Salary, House Property, Business & Profession and Capital Gain will fall under the head Income from Other Source.

- In ITR1 for FY 2018–19 or AY 2019–20 the Income from other sources is shown in the image below. it consists of Interest from Saving Bank account, Interest from Deposit(Fixed/Recurring of Bank/Post office/Cooperative Society), Interest from Income Tax Refund and Any other

Interest from Saving Account: Income from Other Sources in ITR

Saving Bank interest, however small the amount, is your income. Find interest on all your saving bank accounts by going through you bank statements. Show the total amount in your ITR in Income from Other sources. You can also get Interest certificate from the bank.

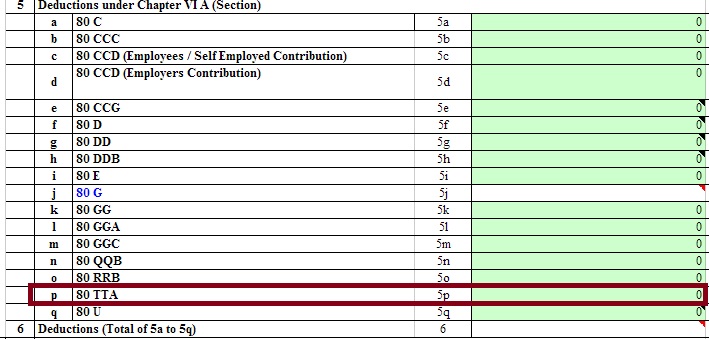

Claim 80TTA deduction for Interets on Saving Account

- No tax is deducted(TDS) on Interest of Saving Bank account.(yet)

- From FY 2012-13 (AY 2013-14) year section 80TTA has been introduced for which deduction up to an extent of Rs 10,00 in interest from all the bank accounts is allowed to an individual or Hindu undivided family,

- Interest over Rs 10,000 will be taxed at the tax rate of an individual. Section 80TTA is shown in Deductions under Chapter VI-A along with 80C, 80D

- Section 80TTA is shown in Deductions under Chapter VI-A along with 80C, 80D. Our article Interest on Saving Bank Account : Tax, 80TTA discusses it in detail.You need to add interest from all your saving accounts to Income from other sources and then claim deduction under section 80TTA. If your total interest income from ALL your saving bank accounts

- is less than or equal to Rs 10,000 For example if your interest from ALL saving bank accounts is Rs 7,000 you need to show 7000 in income from other sources and then show Rs 7000 for section 80TTA

- is more than Rs 10,000 say 15,000 then add 15,000 to Income from other sources and then show Rs 10,000 in Section 80TTA

Interest on Fixed Deposit and Income from Other Sources and ITR

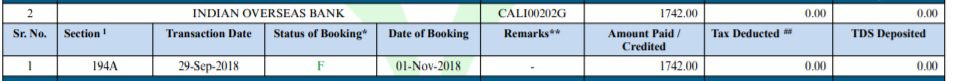

Interest on Fixed Deposit is taxable as Income from other sources on the entire amount whether TDS is deducted or not. When TDS is deducted you will be issued Form 16A to show the total interest and TDS. It would also be reflected in Form 26AS.(whether interest is deducted or not). Image below shows interest on FD where no TDS is deducted.

Show the entire interest earned in FD in the Financial year to income from other sources. Take the value from Form 26AS.

If you multiple FDs then get interest earned in all the FDs and then show the sum in ITR.

TDS & interest on Fixed Deposit

TDS is deducted on interest in Fixed Deposit if

- @10%: If the Interest income in a financial year is more than Rs 10,000 and PAN submitted: For example if interest is 20,000 , TDS deducted will be Rs 2,000(10% of 20,000)

- @20%: If the Interest income in a financial year is more than Rs 10,000 and PAN is not submitted: If you have not submitted PAN details, any interest beyond the limit, the TDS would be deducted @ 20% p.a

- If Form 15G or Form 15H submitted then No TDS would be deducted and your Form 26AS will show the Form H submitted details.

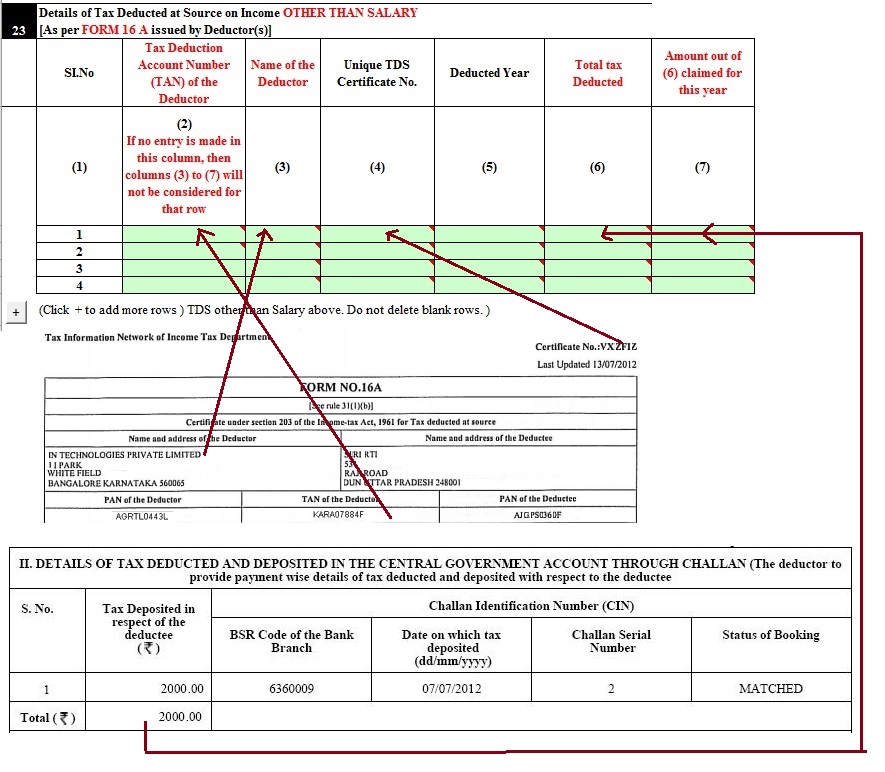

if TDS is deducted show it in TDS2 schedule as shown in the picture below for Mr S Khan from our article Income From Other Sources: Saving Bank Account, Fixed Deposit,RD and ITR which covers it.

Recurring Deposits, Post office Monthly Income Scheme, Term Deposits

In case of Recurring Deposits, Post office term deposits interest earned is taken as Income from Other Sources and is taxed. Our article Overview of Recurring Deposits covers Recurring Deposits in detail.

Senior Citizen Scheme

If the interest income in a year is more than Rs 10,000, then the TDS (tax deducted at source) is cut. So it is treated in the same way as Fixed Deposit.

Family Pension

Family Pension means a regular monthly amount payable to a person belonging to the family of a person in the event of his death. For example an employee died on job and his family is getting pension from EPS.

Family pension is taxable as income from other sources and a standard deduction of 1/3rd of pension or Rs 15,000 whichever is less is allowed. Steps to find Deduction amount from Pension.

- Find 1/3 of pension amount.

- Check if it is less than 15,000. If yes then deduction amount is 1/3 of pension amount else it is 15,000

- Deduct the pension amount from the pension.

- Show the amount in the earlier Step as Income from Other Sources.

Income from Infrastructure Bonds

In the FY 2010-11, FY 2011-12 additional income tax benefit of 20,000 was made available under section 80CCF of the Income Tax Act, 1961 for investments made in long-term infrastructure bonds (as notified by the Central Government). This deduction limit of 20,000 will be over and above 1,00,000 benefit available under section 80C, 80CCC and 80CCD. This move was intended to provide a fillip to the infrastructure finance and provide an opportunity to individual tax payers to reduce their tax liability. The interest received on these bonds shall be treated as income from any other source and shall form part of the total income of the assessee in that financial year in which they are received. If you had invested in infrastructure bonds then you can check whether interest was paid to you by checking Onemint Interest Payment Dates of Infrastructure Bonds Issued in 2011-12

What is Income from Other Sources ?

Income earned during the year can be classified into categories like :

- Income from Salary

- Income from House Property

- Income from Business & Profession

- Income from Capital Gain

- Income from Other Sources :Any income which does not fall under the heads of Salary, House Property, Business & Profession and Capital Gain will fall under the head Income from Other Source. Hence, this is the residuary head of income.

This income is NOT exempt i.e it is taxable under the Income Tax Act 1961. Section 56 deals with this residuary head of income and covers all such taxable income. You are required to enter data of all income earned by you during the year. Our article Exempt Income and Income Tax Return

What are examples of Income from Other Sources ?

Sub-section 2 to section 56 enumerates various types of income which would be chargeable to tax under Income from Other Sources. Some examples of certain incomes normally taxed under this head are given below:

- Dividend: Dividend is chargeable at a rate of 10% if aggregate amount of dividend during that year exceeds Rs. 10,00,000. This is applicable for individuals/HUFs. If the dividend is received from a domestic company and it is chargeable under dividend distribution tax, then it will be exempted.

- One-time income: Income from lotteries, crossword puzzles, horse races, games, gambling or betting.

- Interest on securities if it is not taxable under “Profits and Gains of Business or Profession”.

- Income from machinery, plant or furniture belonging to taxpayer and let on hire. This is applicable if income is not chargeable to tax under the head ‘Profits and Gains of Business or Profession’.

- Composite rental income from letting of plant, machinery or furniture with buildings, where such letting is inseparable. Again, this is applicable if this income is not taxable under the head ‘Profits and Gains of Business or Profession’.

- Interest received from IT Dept. on delayed refunds,

- Income from royalty,

Insurance commission,

Examiner-ship fees received by a teacher (not from employer), - Any sum exceeding Rs. 50,000 received without consideration shall be treated as income provided that the sum of money is not received from any relative or on the occasion of the marriage of the individual or under a will or inheritance etc.

- If an employee receives any compensation due to the termination of his employment or modification of terms and conditions relating to the job, then that amount will be taxable.

- Any sum of money received as an advance or otherwise in the course of negotiations for transfer of a capital asset shall be charged to tax under this head, if:

- a) Such sum is forfeited; and

- b) The negotiations do not result in transfer of such capital asset.

Income from Other Sources in ITR2

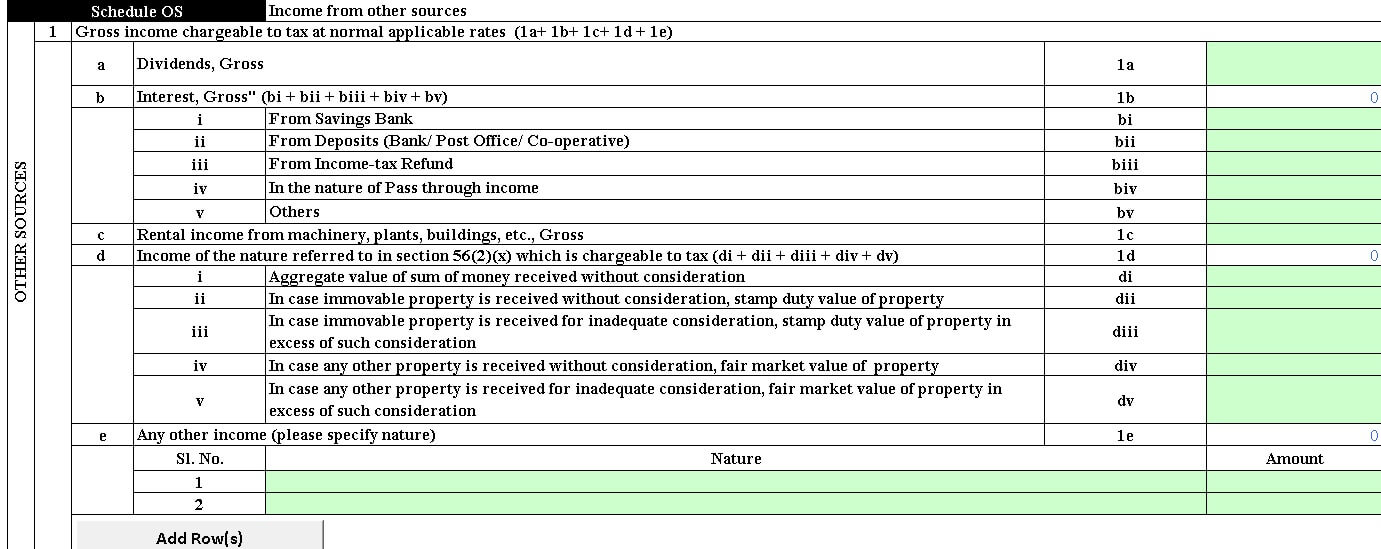

In ITR2 For Income from other sources one has to fill Schedule-OS, shown in picture below

- (i) Against item 1a and 1b, enter the details of gross income by way of dividend and interest which is not exempt.

- (ii) Against item 1c, indicate the gross income from machinery, plant or furniture let on hire and also such income from building where its letting is inseparable from the letting of the said machinery, plant or furniture, if it is not chargeable to income-tax under the head Profits and gains of business or profession.

- (iii) Income from owning and maintaining race horses is to be computed separately as loss from owning and maintaining race horses cannot be adjusted against income from any other source, and can only be carried forward for set off against similar income in subsequent years.

- (iv) Winnings from lotteries, crossword puzzles, races, games, gambling, betting etc., as per section 115BB are to be entered on gross basis and are subject to special rates of tax; hence a separate item is provided and the income from these cannot be adjusted against the losses arising under the head Income from other sources.

- (v) Item 5 of this Schedule computes the total income chargeable under the head “Income from other sources” (item 3 + item 4c). If balance in item 4c which shows income from owning and maintaining race horses is a loss, please enter 0 and enter the total of item 3.

Most of us would have interest on saving bank account, fixed deposits, recurring deposits ,company deposits which we need to add together and fill in Interest Gross 1(b). How to handle interest on saving bank account, fixed deposit etc are explained later in article. ITR2 with all the income is shown below

Related Articles:

- Fixed Deposits and Tax

- Exempt Income and Income Tax Return

- How to Calculate Income Tax

- Viewing Form 26AS on TRACES

Irrespective of whether income is taxable or exempt from tax, you should disclose it in your return. This article explains Income from Other sources, what it is how, how to show it Income Tax Return. In case of cumulative deposit scheme which span multiple financial year, Fixed Deposits, Recurring Deposits etc is is recommended that you show interest income earned every financial year.

I am a recently retired man of 62 years old. I have professional income as I am having consultancy. I also have monthly pension income (superannuation pension from LIC), income from other sources and capital gains from shares.

I feel I should file returns using ITR3 this year. But where is the pension to be mentioned in ITR3? In salary section there is mandatory entry of employer which I do not have. Is the pension to be filled after deducting standard deduction in Income from other sources?

Kindly help

Uncommuted pension received by a retiree from a superannuation fund is taxable under head ‘salary’, subject to standard deduction of Rs. 40,000/- (from AY 2019-20)

Is TDS deducted by the LIC? If yes you can check it in Form 26AS. Will it be possible for you to send the picture of the TDS deduction to out email id bemoneyaware@gmail.com

Capital Gain from shares please check the grandfathering clause.

A really great article you are too good! the way you explain about FD interest and section 80TTA.

my bank has issued interest certificate for SB account as well as 3 TDRs which have been opened by way of sweep facility, which shows interest accrued and interest paid separately for each account. should both be added to show in my income from other sources in ITR 1

Yes interest earned from FD(due to Sweep facility) and Saving bank account interest has to be shown as Income from other sources in ITR1.

Please check if interest from FD also appears in Form26AS.

You can send us the bank statements and the TDRS with Form 26AS at bemoneyaware@gmail.com

Dear Sir,

I had Fixed Deposits in bank for which the tax is deducted and the same is reflected in 26AS form

Do I still need to show the Total interest as Income from Other Sources in ITR-1 form?

If that case this will be added to the Salary and additional tax is shown.

I want to clarify as already the tax is being deducted by Banks on FD Interest, Should I again need to pay more tax after updating the details

Please reply

It depends on your income slab.

If you earn more than 5 lakh you have to pay Tax on the interest of FD at 20% but

TDS would be deducted at 10% if the amount is more than 10,000 Rs.

If you earn more than 10 lakh you are in 30% tax bracket.

You need to show interest earned on FD as income from other sources,

claim TDS deducted and pay balance tax as self assessment tax.

Our article Self Assessment Tax, Pay Tax using Challan 280, Updating ITR explains it in detail.

Savings bank account interest has to be filled in section- Income from other sources(Ensure to fill Sch TDS2). do we need to fill TDS2 tab in case of saving bank account interest?if yes then how?

No TDS is deducted for Saving Bank interest. So no TDS have to be shown.

Please check our article Interest on Saving Bank Account : Tax, 80TTA,ITR

my salary is 150000/-, income from other ” interest” is 39000/-. TDS deduct 3900/- by bank. Can i refund it ? how many refund it ? and how refund it ?

please reply sir.

thanks

Please go through the article Income Tax Refund: How to claim Refund,Check Status for more details.

You can file ITR1.

For this year please submit form 15G/15H to avoid TDS deduction

For sample filled form you can see here.

Dear Sir,

Recently I had FD’s at Indian Overseas Bank (in between 3-4 lacs) after maturity of which I transferred same to the my another account of HDFC bank to open FD at HDFC bank.

Do I have to show that amount (3-4 lacs) while filing ITR as it is transferred from my one bank account to another..

Dear Sir/Mam,

I had a house which I sell for Rs6500000, For which I paid 65000(1% of value) as a tax. At the same time I bought a property worth Rs 1cr for which I paid tax 100000(1% of value). How to fill ITR to showcase these entries.

Please help me to understand.

Thanks!

Aman

SIR, I AM A SALARY PAID EMPLOYEE IN A COMPANY. I RECEIVED NEARLY RS 40000 FROM PAYPAL IN

MY BANK A/C. PL. LET ME KNOW WHICH ITR SHOULD. I FILL & PAYPAL AMT IN WHICH HEAD. THANKS

Why did you receive money from paypal?

Did you do some freelancing?

Income from freelancing typically comes under Income from Business and for which ITR3-ITR4 has to be filed.

Hello sir,

Last financial year (2017-18) I have missed to show my FD interest while Filing Tax return. Also this year also I will get the Interest. So while filing the Tax for this year can I included last year interest. My case I have submitted pan card so 10% TDS deducted.

Last year FD closed already

Now again I have taken new FD from SEP-2017.

For example: 1 FD I have received the 1000RS interest and current existing FD interest 500RS. Then 2018-19 tax filing can I show 1500rs under Other income.

Don’t mix ITR for different years.

Please file ITR as per the details in Form 26AS.

Interest is shown in Form 26AS and your ITR is also processed according to details in Form 26AS.

Many people this year have got the outstanding demand notice for their FD interest.

If your ITR is processed then let it be

Our article Form 26AS explains Form 26AS in detail

Hello Sir,

I want to ask one thing, my employer had deducted the tax for financial year 2014-215, due to some negligence, I did not e-file of that year. I have form 16a and form 16b, Can I e-file of that now? If yes, what are the consequence of this? And, what things I should care? Please suggest.

Thank you

31st March 2018 is the last date to file last year tax returns for FY 2015-16 (or AY 2016-17)

and FY 2016-17(AY 2017-18)

You cannot file returns for other years

Sir,Please help me with your valuable suggestion. My father expired in 2013 Dec, and my mother (Nominee) got money from my father’s bank account . Recently we have received notice from IT Dept asking to file ITR for FY2014-15.And my doubt is whether money received by mother is taxable? and if it is not taxable where do we need to show this income under which section of ITR I?

Sad to hear about your father’s death.

Is the notice about your Father’s income or your mother?

Can you send copy of the notice to our email id bemoneyaware@gmail.com

income tax return for deceased person also needs to be filed in case where a person dies and had taxable income. His legal heir/representative needs to file the return on his behalf for the income earned till the date of death. Legal heir has to register himself at the income tax website for filing the return on behalf of deceased. Our article Income Tax Return of Deceased explains the process in detail.

The interest received on FD inherited by the successor will be taxable if he wishes to continue the FD. The interest will be taxable from the date of death of the previous holder up to the date of maturity. But if the successor discontinues the FD and withdraws it then he won’t be liable to pay any tax.

Sir, if TDS is deducted and shown in TDS 2 in tax details.should I also add that amt in income other than salary?

and can I show short term capital gain amt of 18000 in ITR-1 Colum income other than salary..

thanks

I need to know that, P.P.F Interest credited yearly is considered as “Income From Other Sources”

& what is ment by Interest of Previous year passed on to this F.Y only for accounting purpose..?

Can a P.P.F interest credited yearly if not mentioned in Balance sheet of previous F.Y but passed on this F.Y…. what will this suggest..?

will the previous year interest credited will be considered as present year income..?

My doubt are not related to Income Tax…just want to know about what are income from other sources…? & how it can be calculated..?

Hi,

I am a senior citizen of 68 yrs and have been submitting 15 H form to the bank for non deduction of tax. For FY 2015 – 2016 I.e A.Y 2016-2017, my total income is as follow.

Income from family pension – Rs 110000

Income from FD’s. – Rs 2,85,000 ( Form 15 H submitted no TDS has been cut)

Income from SB interest – 20000

LIC pension – 10000

Total income – 1,10,000+2,85,000+20000+10000=4,25,000/-

Investment

5 year senior citizen saving scheme in 2015 Oct – 4,00,000 ( Form 15 H submitted. No TDS)

Deductions under 80C (for 5 yr senior citizen scheme) – 1,50,000

80TTA deduction – 10000

Total deductions – 1,60,000

Net taxable income = 4,25,000 – 1,60,000 = 2,65,000

Senior citizEn exemption limit = 3,00,000

So, the net taxable income is less the exemption limit.

So tax to paid for A.Y 2016-2017 = zero

I have filed zero tax returns. But, the family pension , I showed in Income from salary or pension and the remaining under Income from other sources. Hope it is not a problem.

Also I didn’t claim the family pension deduction of 15000 which is allowed.

Can you please confirm that the above calculations and process is correct. Hope there won’t be any issues.

Also I have already submitted 15 H for 2016-17 also and the interest is getting credited monthly and quarterly and I don’t know exactly how much will be my total income in FY 2016-2017 ( as there could be increase or decrease in pension with the 7 the pay commission which is not yet finalized), can I calculate the total income for FY2016-2017 at the time of filing the return in June- July 2017 and pay the tax accordingly, as it is difficult to plan investment due to changing pension due to 7 the pay commission.

Request tax experts to please help and confirm on the above scenarios.

Thanks

Also, I filed ITR1 for the above. Showed the family pension in Income fro m salary or pension and other income under Income from other sources…Hope that is fine. Kindly please respond to above two posts. Thanks

Hi,

If you have any issue or query regarding Incometax/TDS/ITR filing you can mail me at mukeshjhaicai@gmail.com or call 9560318936. Will assist you asap.

I have not seen the 26AS at the time of paying tax in Mfebruary/But I have seen it on April while submitting the return/ Hence I have not included the 26AS amoount in my Income from other sources. No TDS is deducted . The total amount is Rs.2628/- My IT return is processed. What is the option for me?

Jagatheesan

Sir,

Am under the slab 2.5Lakh to 5 Lakh.

My total income after all tax exemptions is 2,60,000 rs.(So tha tax (10%) is 1000)

And also i have a another income from SBI in a fixed deposite mode: 6500 rs. (So tha tax (10%) is 650)

I didnt not submitted the above SBI Fixed deposite income in my company at the final declaration of income.

But i submitted the 15H/G form to SBI, that not to deduct the income tax from that fixed deposite.

So, i got the form16 from my company in which the other source income from SBI is not shown.(because i didnt not submitted).

Now i have to fill the tax returns. now am not understanding how to show that SBI intrest which is not shown in form 16 in the tax filling. please help me in this regard.

Contact no: 8121167066.

You have to fill bank interest amount in the column ” Income other than salary”

Fill the bank interest of 6500 as Income from other sources as shown in the image in the article.

Bank would not have deducted TDS as interest on FD in that year is less than 10000. So you had np need to submit Form 15H

I want to know the section description to be given in schedule OS for the income earned from senior citizen savings scheme, post office monthly income scheme and fixed deposit interests While filling it says it cannot exceed 50 characters.Is is sufficient if I give 56(1).I request your kind reply

Add up all interest from Senior Citizen Scheme, Post Office Monthly Income scheme and all Fixed Deposit interest.

You show it as Income from other sources 1 (b) as shown in image.

I am a senior citizen.My income is from Bank FDs and profit by way of trading in shares in stock exchange.which form should i use …?

Bank FD’s- Will go into Income from Other Sources.

Fr Trading in Shares- Income from Capital Gain

i want to file income tax 2014-15 but i want to know show my income from account writing. so which head is in show

Hi

I have withdrawn my PF before 5 yr which my previous organization deducted the tax and provided a Form 16. Now while filling return do I need to add the pf withdrawal amount under “income from other source” or it will be completely exempted from tax further.

Also they didn’t mention the breakup contribution from employee and interest part in the form 16.

I have query on Schedule OS in ITR-2A.

I started filling Form ITR-2A. But it seems filling details in Schedule OS 1d are mandatory even if income from the heads is 0. In fact none of the heads in 1d (5BB,115A(i,ii etc) are applicable to me but Calculate Tax does not allow to leave 1d(1,2,3,4,5) empty & I have to select heads forcibly & randomly with Income 0. This does not look proper to me. Kindly suggest.

Can you send me a link which provides detailed information about filling or leaving different Schedules & their sub sections.

Kindly reply ASAP.

Thanking you. Best regards. RAKESH

hi

I wont to know about outstanding Int. of FD of Society present in last year

and current year also new investment and few old investment was mature in current year and reinvestment.

how to effect made in tally esrp 9

suggest as soon as possible….

regard priya mishra

Sorry we don’t cater to Tally questions

Sir where should gift received by me amounting to more than 50000 be declared in the ITR-2

Sir i want information about my grandppa’s tax, last 2 years back he was sold property and he was invested that money in bank FD A/c type that amount was 500000

is it taxable or not?.

Why Bank Charges Deducted from Income Other sources

Sir, I was showing interest income from Kvps in Itr for the last 5 years,but I want to skip it this F.year2015-16 and take it next year F.year 2016-17.,just to lower taxable income below 5,00,000/- for taking advantage ofRs 2000/- under Sec.87A.

As per my knowledge KVP are not chargeable under income tax.

Hi,

My wife is a house wife still i had shown the income for her as “Income from other sources” also paid the requisite taxes. My Querry is, will she be eligible for the home loan.

Hi,

My wife is a house wife still i had shown the income on her name in this head ” Income from other sources” and also paid the requisite Taxes. DOES this income help in getting the home loan facility.

SIR

MY MOTHER HAS INCOME ON FIXED DEPOSIT RS 313896

AND FIELD FORM 5G or Form 15H submitted hence No TDS would be deducted

now if she save 50000 then no tax liberality

is income tax return filling is necessary

Terms and conditions

Cancel at any time

Thanks for the prompt reply. In other words TDS is applicable on RD if interest earned is greater than 10000.

Am I correct?

Last question, are you CA or tax consultant/lawyer?

Yes since June 2015 the TDS on RD will be deducted if interest exceeds Rs 10,000

No we are not CA or tax consultant/lawyer though we work with them. We are women trying to understand and share the financial information that we learn.

Please clarify my doubt. I am a costumer of Kotak Mahindra Bank.

I am having below mentioned retail products of the said bank

a) Saving A/c

b) Fixed deposit for 1 year

c) Recurring Deposit for 12 months.

a)Interest earned in Saving a/c is Rs. 6500 for f.y 2015-2016

b)Interest earned in Fixed Deposit Rs. 9000 for f.y. 2015-2016.

c)Interest earned in Recurring deposit Rs. 8000 for f.y 2015-2016

My question are as follows-

Will bank detuct TDS separately in each head(a,b,c) if in excess of 10000, separately.

(or )

in a combined/joint manner (a+b+c=6500+9000+8000=23500) if in excess of 10000 in a year?

Q.)Does bank deduct TDS for recurring deposit? If yes, then when?

No TDS is deducted for interest on Saving Bank account. Interest on all Saving Bank accounts upto 10,000 is tax free under 80TTA. So show interest on saving bank account as Income from Other sources and then claim for deduction under 80TTA.

TDS will be deducted if Interest on FD is more than 10,000 Rs.

Interest on RD from June 2015 will be deducted at the rate of 10% on 31 Mar 2015 like in FD.

Each of these are taken individually. For you no TDS would be deducted as each of these are below the tds limit.

But you would have to pay tax on interest on FD & RD as per your income slab

Hi

But in my case the sbi has deducted TDS after accumulating all interest from all FD and RD of all branch. They have issued TDS.

Now my question is that whether Rs 10000 in 80TTA includes the interest from FD and RD also. I have total around 17000 interest from FD and RD from all accounts. Thanks

sir i file the itr but i forgot to shown the fdr interest in itr then what i do

you can file revised return by showing the interest on fdr’s after paying the necessary taxes

Sir,

I am salary payable not cover in Income tax limit. But I get some extra income from tuition or other work. I want to know that can i show it in income from other sources under ITR-1. I want to know also the limit of Income from other sources under ITR-1.

Thanks

you have to showincome from tutuions under other sources of income and add to your salary income. There is no limit for showing other sources of income .

I have account where interest credited to my account is 15000 and have fd in same bank which generated interest of 2500. i have another account where fd interest is 13352 which is having a tax deduction of 1480. While filing itr i believe that the total income from all other sources will be 15000+2500+13352 and under section 80TT i need to write 15000. Is it correct ???please clarify

Sir,

I’m trying to file my returns online.

From 26AS form, Interest earned on FDs is 19353, Tax paid is 1935 (10% of 19353).

But if i add Interest Earned under ‘Income from Other Sources’ then the Tax Utility tells me that I still have to pay around 2000 more. Why is it so?

TDS is already deducted at the Bank for the interest earned.

Why does it still say that I have to pay more tax?

can i include my spouse’s saving bank interest in my tds 80tta

Hi,

I have withdrawal my EPF fund of my last company before 5 years in last year Aug 2014, the amount I have received in two installments i.e. 35350 and 12935. So I just want to know how much tax I have to pay in my ITR FY2015-16.

Because I don’t know the tax for the same is already deducted or not and I have checked in EPF account , no details of previous company account is showing there.

So please tell me how much amount I have to pay as a tax in other source of income.

Thanks in advance.

Akhil

Hi

I want to know that i have 3 bank accounts (1) First bank account credited interest more than 10000 and deducted tds. (2) second bank credited 6000 bank interest but not deducted tds (3) 3rd bank credited 1000 interest.

Now kindly tell how do i file income tax return, may i only file ITR for First bank or I have to combine the interest of all banks than file ITR.

I m waiting for your reply, kindly reply soon.

We assume you are talking about FD interest.

Combine interests from all the FDs as income from Other sources.

Claim TDS deducted by First bank.

Remember that interest on FD is taxable as per your income slab

Thanks for your valuable information.

Hi,

My form 26A shows interest at around 3200 and TDS deducted at around 10%. As per wherever i read it is mentioned that banks would deduct TDS only if interest goes above 10k, then why did bank deduct TDS? Do i need to show this amount in income from other sources? If not, how do i get 10% TDS back which is already deducted by bank.

Sir bank deducts TDS when interest on FD is more than 10,000 Rs . And interest deducted is 10%.

Can you mail your that part of TDS to our email bemoneyaware@gmail.com

In any case interest from FD is taxable as per your income slab. So add the entire interest in Income from Other Sources and claim TDS deducted in TDS section and if due tax pay it, else get refund

Our article Video on Fixed Deposit, TDS on FD and how to show Interest income from FD in ITR explains it in detail

I had FD for 3+ years and I closed my FD before yearly maturity in March 2015. The interest shown by bank in Form 26AS is Rs. 4061 and TDS as Rs. 1187. Since interest is less than 10000 do I still need to show this amount in “Income from Other Sources” section?

Hi,

I won 12,500 as price money in a competition.

And the company paid 5357 as TDS. I had no other income that year from salary or otherwise.

As per your article i have entered this Income of 17857 as Income from other sources.

Is this TDS refundable ?

Thanks

A good question but answer is Sadly No.

Income tax deducted on prize money is not refundable. Taxation of prize money is governed by the Chapter XII of Income Tax Act, 1961 which deals with determination of tax in certain special cases.

No, the amount of tax deducted will not be refunded to you because the tax on lottery or prize has to be paid by a person even if the taxable income of the person is below exemption limit.

Hi,

Thanks so much for the answer.

When I am filing my ITR online, in the Taxes Paid and Verification tab : it is automatically showing the status as tax refundable, and the amount equivalent to the TDS paid.

Also it automatically picks up this TDS from Form 26 AS.

Should i submit the form as it is ??

Thanks

you have to verify that details filled in are correct.

You would also have to add details about other income ex

-Income from Interest on Saving bank account

-Income from interest on FD

Hi Kriti,

Everything is correct. All I am saying is that as per the rules TDS is not refundable sinces its from money won in the competitions, but the form shows it as refundable, because i don’t have taxable income.

Regards,

Aashish

Sir,

Thanks for valuable information you are providing.

I am an ex-serviceman and not employed anywhere. I am getting pension.

I am filling ITR 1.

What should I fill as ‘Employer category’ in income details tab, and ‘Name of Employer in field 19 of TDS tab?

Sir,

Thanks for valuable information you are providing.

I am an ex-serviceman. I am not employed any where, and receiving pension only.

I am filling ITR 1.

What should I fill in ‘Employer Category’ on income detais page and ‘Name of Employer’ in field 19 of TDS section?

Hi,

I’m a salaried person working in a private co. My wife has joint bank accounts and demat accounts with her parents (E&S), and these accounts are existing before our marriage. She does not make any share transaction but her father may or may not. She has a single account and joint accounts with me as well. However, her total annual income from savings bank acc interest, divident payout etc. is well below the minimum income exemption limit and this is even less than 1% of my salary. Now I’m having follwing two doubts:

1.Whether she should file ITR return (she is having a PAN)?

2.Should my wife’s income from these accounts can affect my tax liability?

Regards,

Sir,

I have given my IT statement to my employer and based on my declaration my employer has given the form 16. At that time I have forgotten to mention the interest amount of Rs.15,000 received for FD. But the bank had deducted the TDS and it reflected in form 26AS. Now is it possible to add the interest income of Rs.15,000/- in the column of other income sources while filing the ITR 1 now. (i.e, August 2015). If i add the above income then the income slab crosses Rs.5.00 lakh and I have to pay 20% TAX. I am ready to pay the balance TAX. Please clarify whether the income from other sources which was neglected before march 2015 can be added while filing the ITR.

dear sir,

Iam filling ITR 1 every year as per salary from private job. Now i want to show income from property (i.e. property adviser) and tution coaching centre. please tell me what I can do for this income, where can i show it.

thanks

Give bifercation of interest gained per year from R.D.&KVP.

I am working for legal firm and getting salary ,on which TDS at 10% is deducted and form 16A is issued.Understand since it is 16A it will be considered as fee for professional work.

I also have interest income on FD. Kindly advise which ITR to be filled and can I claim any other deduction for expenses.

Under what head will I show my earnings Salary or other income

My question is I got 8000 rs interest from FD and 3000 rs from saving account. But no TDs is deducted.

1.Do I need to show it in iTR?

2. Do i need to pay tax over and above both Interest accrued from saving bank and FD account?

Yes Sir you need to show both Interest from FD and Saving bank account whether TDS is deducted or not.

If you are filing ITR1 add interest from FD and saving bank account i.e 11000 Rs Income from other sources.

Then show interest on Saving bank account in section 80TTA. Your 3000 Rs will get deducted as under section 80TTA you can avail deduction till Rs 10,000

You would have to pay tax on interest earned.

Our Video on Fixed Deposit, TDS on FD and how to show Interest income from FD in ITR explains about FD and tax on it in detail. You can go through it

Hi,

I received the interest on my Saving account Rs.5939/-.

Also I received the interest on my FD. Rs.11177/-.

But I had not updated my PAN with the bank. So bank deducted the TDS with 20%. My taxable income falls in the slab of 30%. Now I have updated the PAN. But the TDS deducted by the bank do not reflect in my Form 26AS. Shall I show the other income / TDS in ITR1? If yes, then what will be my other income 11177 or 17116 ? Whether I have to pay 10% remaining tax or shall I get 10% refund ?

Hi,

I want to know as to why do i need to pay interest under Section 234B,C for showing income from interest on Savings bank account. How would a working class person keep paying advance tax for income on savings account?

Sir if your tax due in a year is more than 10,000 Rs you need to pay advance tax.

For saving bank interest deduction of Rs 10,000 under section 80TTA is allowed.

So all we can say is that these are rules of the game, learn them else pay fine

My sister has only interest income from fixed deposit. what itr form has to be filed? what category is to be mentioned in the employer category , as she is a house-wife.

Employer category NA

Interest on FD to shown as income from other sources.

She can file ITR1.

To understand how interest on FD is taxed you can refer to our article Video on Fixed Deposit, TDS on FD and how to show Interest income from FD in ITR

Hi Pls. let me know if a salaried person getting more than 10000Rs from bank interest can ITR 1 be used or person needs to fill ITR 2 in this case.

A salaried person getting more than 10,000 Rs from bank can fill ITR1.

Show full Interest from saving bank account in Income from Other sources. Show it also in 80TTA and you would get 10000 deduction on interest on SB account.

please till me avout tthe interest calculation

bank fd + rd intrest= 8399

saving bank account = 5952 plese tell me both are examted upto 10000.00 limit

Saving bank account : Interest upto 10000 is exempted.

Show it in Income from Other sources and also in section 80tta

Bank FD + RD recurring interest : Entire amount is taxable as per your income slab.

You can see our video Video on Fixed Deposit, TDS on FD and how to show Interest income from FD in ITR for more details

sir my accountent also gives me form 16A as a proof of TDs deducted from my Seving Bank Accounts Fd Intrest

so sir is itr1 is suitable for me or I should file another itr form?

Sir Form 16A is usually for interest from FD.

Interest on FD is taxable as per your income slab. Comes under Income from other sources.

You can use ITR1 to file it if you have income from salary, income from 1 house property and income from other sources like FD

How do we show the interest paid on personal loan? Is it shown under Chapter VI-A or do we simply deduct it from Total Interest earned during the year?

For personal loans, deductions are applicable only for a declared business and its earning

or for the interest on loan repayments used for property construction.

Hello Team

You are doing a excellent job.

Actually I won a LED TV last year in the scratch card contest run by Automobile Company. They deposited 30% TDS amount to govt. It is also showing in my 26AS also.

So which ITR form is suitable for me regards to this case. I am a salaried person.

Deduction of Tax at Source on prize won

Prizes won in Cash.

As per section 194B of Income Tax Act, 1961, if the prize money is more than Rs. 10000/- (Ten Thousand Rupees) TDS shall be deducted. TDS rate prescribed is 30%. Thus if you win Rs. 1 lakhs in a game show, you will receive net Rs. 70 thousand after deducted of tax Rs. 30000/-

Prizes won in kind .

As per section 194B of Income Tax Act, 1961, if the prize money is not in cash but in kind (Say you won a car) or partly in cash or party in kind then the receiver of the prize is required to deposit the tax calculated @ 30% of the aggregate value of the prize.

Act, 1961 which deals with determination of tax in certain special cases.

As per section 115BB the total income tax payable by a person who is in receipt of a winning from lottery orgame etc. shall be the aggregate of the following:

(a) Income Tax @ 30% on the winnings from lottery/game etc.

(b) Income tax on his rest of income as if there were no such winnings

Example:

Mr. ABC won Rs. 500000/- in a TV Game Show but he received Rs.3,50,000/- after deduction of Tax at source. His other income from salaries and interest is Rs. 350000/- and he is entitled to a deduction of Rs. 100000/- under section 80C.

His income tax obligation for Assessment Year 2015-16 shall be as under:

Computation of Income and Tax

1 Income from Salaries+Interest 350000.00

2 Income from other sources 500000.00

3 Gross Total Income (1+2) 850000.00

4 Deduction under Section 80C 100000.00

5 Total Income (3-4) 750000.00

6 Income Tax:

6.1 Income Tax on TV winnings 150000.00

6.2 Income Tax on rest of Income (Rs. 7 lacs minus Rs. 5 lacs) 0.00 150000.00

7 Education and SHE Cess 4500.00

8 Gross Tax Liability 154500.00

9 Less: Tax Deducted at Source 150000.00

10 Amount Payable 4500.00

sir my accountent also gives me form 16A as a proof of TDs deducted from my salary…

so sir is itr1 is suitable for me or I should file another itr form?

Sir how many types of income do you have

-income from salary

-income form FD,Interest on Saving bank accounr

So you can use ITR1

I am working under Nrhm…n get a salary of 25000 p.m.I HV saving bank interest of 3000 n FD interest of 3000.I HV lic premium of 30000 n ppf of 10000 in this financial year…I HV no other source of of income except above mentioned salary n SB,FD.

our office accountant cuts TDs of 10% every month on our salary(I.e. 2500)

please tell me which itr form should I fill…

n plz also tell while giving details of saving bank account, do I have to give details of f.d n r.d accounts?

You will need to file ITR-1 denoting the salary income, interest on fixed deposit/ RD and saving bank interest, while claiming the deduction of amount of investments(LIC & PF) you made.

And also you need not to show FD/RD a/cs no. Just add the interest received on them to your total income.

I have Savings Bank Interest, Interest on PPF and Dividend.

In B3. Income from other sources(Ensure to fill Sch TDS2) do I show only Savings Bank Interest? OR

B3 = S.B Interest + PPF Interest + Dividend

The word exempt means free from an obligation from doing something. In the case of income tax, Exempt income refers to income which though is earned and received during the financial year is not taxable

How to show exempt income? as explained in our article Exempt Income

IN Schedule EI

Interest income : Income from PPF, Income From Tax Free Bonds comes here (Note: Interest from Fixed Deposit, Saving Bank Account are taxable and come under Income from Other Sources). Add all such income and show it here

Dividend Income : Any dividend received from Shares/Stocks or Mutual Funds etc needs to be added together and shown here.

Saving Bank Account comes under the category of Income from Other Sources as shown in picture below from ITR2 and ITR1.

Hello,

I’ve received some amount as a nominee to my father’s SCSS account, after his unfortunate demise. He used to pay tax on the interest received on this amount. Now, is this amount taxable in my hands? Do I’ve to show it under income from other sources?

Thanks,

-Vaibhav

Vaibhav, sad to hear about your father. Our best wishes with your family.

Coming to the question there are two parts to the ans

1. You would have to file income tax of your late father and inform Income tax department about closure of his file.

2.You will not be taxed on inheriting them.

However, the interest you earn on these deposits and bonds would henceforth be taxable in your hands.

You would need to verify from your parents’ tax records if they included the accrued interest on such instruments in their personal tax returns in the past.

If this has been done, you would be taxable only for that portion of accrued interest that has not been considered in their personal returns.

Suppose your parents make an investment of Rs 10,000 in a fixed deposit in financial year 2009-20. They earned a simple interest of 10% per annum for five years. The annual interest would work out to Rs 1,000.

The fixed deposit is scheduled to mature in the financial year 2014-15.

Let’s assume the inheritance took place in the financial year 2014-06.

Considering the above facts, if the yearly interest of Rs 1,000 has been included/ offered for tax in your parents’ personal return in the intermediate years (2009-2014), then the maturity proceeds of Rs 15,000 (Rs 10,000 plus Rs 5,000 interest) would not be taxed in your hands.

In case the same has not been done, then you will be taxed on the Rs 5,000 you receive as interest when the deposit matures.

The above interest income would be taxed at the slab rate in which your income is categories

I have received interest from MIS rs. 7200. and received FD interest Rs. 7554/- whether I need to show all this income under income from other source. if Bank need to deduct TDS on this amount?

Swati, bank will deduct TDS only when interest on FD is more than 10,000.

Yes you have to show all this income in Income from Other sources

if i get rs. 500000 from my relative what i should do?

Depends on kind of relative.

As per section 56 of the Income-tax Act, money received by an individual from any person during any financial year without consideration, the aggregate value of which exceeds Rs. 50,000, is taxable under the head Income from other sources. However, exemption is available if the money is received from a relative, which includes among others the spouse of an individual.

Relatives include spouse of the individual; brother or sister of the individual; brother or sister of the spouse of the individual; brother or sister of either of the parents of the individual; any lineal ascendant or descendant of the individual; any lineal ascendant or descendant of the spouse of the individual; and the spouse of the person referred to as aforesaid. Gifts received on marriage:-Any gift received by an individual on the occasion of his/her marriage would also not be taxable. It is customary to receive gifts of money and kind on the occasion of marriage. Therefore, this is an important exception to the general rule. Gift received under a will, etc :-Any gift received under a will or by way of inheritance, or in contemplation of death of the payer is also not taxable. Certain other events :-In case an individual receives any gift from any local authority as specified under the Act, the same would not be taxable. Similarly, any gift received from any fund or foundation or university or other educational institution or hospital or other medical institution or any trust/institution, as specified under the Act, would not be taxable. Documentary Evidence:-Gifts received are quite prone to litigation. Hence, it is prudent to maintain documentary evidence in respect of the gifts received, to avoid any dispute with tax authorities at a later stage. This is particularly relevant in case the gift amount is substantial and also where it is received from relatives. In case of gift of money received from a relative, it is advisable to have gift deed/letter of understanding exchanged and kept in records by the recipient of the gift for future reference.

I have earned interest of Rs.5300 on FD. Bank deducted TDS of Rs. 530 it is 10% of total intt. earned,whether 3% of cess is to be paid by me while filing of ITR?

Short ans Yes you have to pay education cess of 3%.

Long ans:

Sir we are surprised as Banks deduct TDS when interest is more than 10,000 Rs.

Sir you would have got form 16a from the bank.

Check form 26as

Whatever figures are mentioned in the forms wrt to tax and tax deducted has to be added in appropriate sections.

So income from interest on FD would be used as Income from other sources, all incomes are added together, surcharge applied and final some tax due if required needs to be paid

Hi

I am a Housewife and I just have income from Fixed Deposit Brokerage.

The Fixed Deposit company has deducted tax while giving me the brokerage amount.

The total income is around Rs. 20,000

I want to claim for refund of TDS

Can you please tell me whether I can fill ITR 1 for filing return?

income from Fixed Deposit Brokerage should come under Income from business and profession. So ITR1 cannot be used . You need to use ITR4

Dear Kirti Ji,

How we will reflect income from the interest from joint FD. I am having two FD one my self is primery and in others my wife is primary owner. Interest of FD also goes to our joint account. Where my wife is primary owner. The form 26A i got from bank it does not shows any TDS deducted from our joint account. It has detail for TDS deducted from my personal account.

Can you please explain me What would be the procedure for that.

Regards,

Sir,

I am 57 years of age and receiving a pension amount from LIC from the accumulated superannuation amount. Is this receivable taxable or exempt from income tax?

What is the penalty for paying late income tax?

I am showing interest for FD’s in my returns and paying IT to save tax on maturity of the FD’s. Is it OK and within the rule?

Kindly mail your reply to my e mail id.

Regards.

Vijay Halli

Sir,

section 80CCC provides that the pension received from such annuity plan under superannuation scheme of LIC or any other insurer will be taxable. The said amount shall be taxable under the head “income from other sources” being the residual head under the I T Act

Since when are you receiving this pension?

Yes Sir one needs to show interest on FD in return every year.

Hi, I have a query for a Housewife..based on above article what would be the implications of filing ITR if a housewife has following sources of income annually:

Rent from property (which is on the name of deceased husband)- Rs. 100000

Interest from FDs- Rs. 150000

Interest from Saving Bank A/c’s- Rs.10000

Is it mandatory for the individual to file ITR if done earlier?

ITR is for tracking the income tax paid. For FDs and Saving account PAN number would anyway be linked. So Income tax office know that she is involved in financial transactions.

Her total income is more than exemption limit so she should file ITR.

She can claim deductions on her rent income, TDS on FD so she can submit form 15G if age less than 60 years and 15H is age more than 60 years so that no TDS is deducted on her FD interest.

She can get refund if TDS was deducted for earlier year.

I renewed FD amt.218000 in FY 2015-16 on receipt of intt.@9%. Further I invested on FD Rs.2 Lakh for same FY. I have no other income.

Now what will be my Gross Income/Taxable income for FY 2015-16 that may be reflected in IT return. Pl. oblige me with correct reply. P.K.Dey

Your income is 18000 .As it is above 10,000 TDS will be deducted check our article Fixed Deposit , Interest , TDS, Tax,Income Tax Return, Refund for details

Sir, your gross total income will include only interest income from above Fixed Deposits, i.e (Rs,4,18,000*9% = 37620). This is below taxable income which is Rs 2,50,000, but interest being above Rs 10,000 bank will cut your TDS at 10%. But as you have mentioned that you don’t have any other income you may submit Form No 15G to bank declaring that your income will be below taxable limit, for preventing TDS.

Thank you for this useful article.

Thanks for taking time out to write encouraging words. We appreciate it a lot.

I and my wife have a joint savings account.My salary is getting deposited in that account.My home loan EMI is deducted from the joint account and after the deduction my wife transfers her share of EMI from her own account to this account every month. There is an interest of Rs 10,000 that is accumulated.Understand that As per 80 TTA deduction, interest cannot be considered as deduction for body of individuals.Does this joint account form a body of individuals? IF not, can I, as a primary account holder claim entire deduction under 80TTA for this joint account on the interest of Rs10,000 earned?

Yes you can claim entire deduction on interest on account earned.

A first holder/primary account holder is the person who is listed first on the account. This person is the main user of the account and is responsible for the account. The primary account holder can add secondary account holders who also are authorized to perform transactions according to some rules.

Usually its a practice to show tax in the name of the person who is the primary holder of the account

I and my wife have a joint savings account.My salary is getting deposited in that account.My home loan EMI is deducted from the joint account and after the deduction my wife transfers her share of EMI from her own account to this account every month. There is an interest of Rs 10,000 that is accumulated.Understand that As per 80 TTA deduction, interest cannot be considered as deduction for body of individuals.Does this joint account form a body of individuals? IF not, can I, as a primary account holder claim entire deduction under 80TTA for this joint account on the interest of Rs10,000 earned?

Yes you can claim entire deduction on interest on account earned.

A first holder/primary account holder is the person who is listed first on the account. This person is the main user of the account and is responsible for the account. The primary account holder can add secondary account holders who also are authorized to perform transactions according to some rules.

Usually its a practice to show tax in the name of the person who is the primary holder of the account

Nice article and easy to understand.

I have done some shares trading and would like to include in the ITR. But i am not clear on how to calculate the short term gains / long term gains . Could you provide an article on this?

Nice article and easy to understand.

I have done some shares trading and would like to include in the ITR. But i am not clear on how to calculate the short term gains / long term gains . Could you provide an article on this?

Hope, the payment of gratuity is not taxable income. Thanks for the info.

Gratuity is the form of gratitude provided to employees in monetary terms for services rendered to the company.An employee is eligible for gratuity, if he/she has completed 5 years of complete service with the company. Eligible employees would be paid gratuity in case of resignation, retirement or superannuation or death.

For the purpose of gratuity taxation, employees are divided into 3 categories. Govt employees, other employees who are covered under payment of gratuity act and other employees who are not covered under payment of gratuity act.

a) Govt employees:Gratuity is fully exempted from tax for all Government employees

b) Other employees who are covered under payment of gratuity act Least of the following is exempted from income tax

15 days of salary for every completed year of service (Including part there-of)

Rs 10 Lakhs

Actual gratuity received

So it depends on what kind of employee you are?

Nice article.Can you please help me understand when should we declare Gratuity in ITR-2 for exemption

Do we need to write it under Exempt Income Or Allowance Exempt under Section 10

Gratuity is a part of salary that is received by an employee from his/her employer in gratitude for the services offered by the employee in the company. As per Sec 10 (10) of Income Tax Act, gratuity is paid when an employee completes 5 or more years of full time service with the employer(minimum 240 days a year).For the purpose of calculation of exempt gratuity, employees may be divided into 3 categories –

In case of government employees – they are fully exempt from receipt of gratuity.

In case of non-government employees covered under the Payment of Gratuity Act, 1972 – Maximum exemption from tax is least of the 3 below:

(i) Actual gratuity received;

(ii) Rs 10,00,000;

(iii) 15 days’ salary for each completed year of service or part thereof

In case of non-government employees not covered under the Payment of Gratuity Act, 1972 – Maximum exemption from tax is least of the 3 below:

(i) Actual gratuity received;

(ii) Rs 10,00,000;

(iii) Half-month’s average salary for each completed year of service (no part thereof)

So calculate how much of your gratuity is taxable and how much is exempt

Taxable part of gratuity is has to be shown under the head ‘Income from salary’.

Exempt part – as you asked can be shown either as Allowance or Others in Exempt Income. There is a confusion with regard to this. Technically It is not an Allowance?

Caclub how to show gratuity in ITR2 says show as Others in exempt

while Wealth18 says it should be shown under Allowance.

I would go with Exempt income but please verify. You can call following numbers to verify (waiting time is a little long)

For Income tax related queries

ASK : 1800 180 1961

For Rectification and Refund

CPC : 1800 425 2229

e-Filing : 1800 4250 0025

Hope, the payment of gratuity is not taxable income. Thanks for the info.

Gratuity is the form of gratitude provided to employees in monetary terms for services rendered to the company.An employee is eligible for gratuity, if he/she has completed 5 years of complete service with the company. Eligible employees would be paid gratuity in case of resignation, retirement or superannuation or death.

For the purpose of gratuity taxation, employees are divided into 3 categories. Govt employees, other employees who are covered under payment of gratuity act and other employees who are not covered under payment of gratuity act.

a) Govt employees:Gratuity is fully exempted from tax for all Government employees

b) Other employees who are covered under payment of gratuity act Least of the following is exempted from income tax

15 days of salary for every completed year of service (Including part there-of)

Rs 10 Lakhs

Actual gratuity received

So it depends on what kind of employee you are?

Nice article.Can you please help me understand when should we declare Gratuity in ITR-2 for exemption

Do we need to write it under Exempt Income Or Allowance Exempt under Section 10

Gratuity is a part of salary that is received by an employee from his/her employer in gratitude for the services offered by the employee in the company. As per Sec 10 (10) of Income Tax Act, gratuity is paid when an employee completes 5 or more years of full time service with the employer(minimum 240 days a year).For the purpose of calculation of exempt gratuity, employees may be divided into 3 categories –

In case of government employees – they are fully exempt from receipt of gratuity.

In case of non-government employees covered under the Payment of Gratuity Act, 1972 – Maximum exemption from tax is least of the 3 below:

(i) Actual gratuity received;

(ii) Rs 10,00,000;

(iii) 15 days’ salary for each completed year of service or part thereof

In case of non-government employees not covered under the Payment of Gratuity Act, 1972 – Maximum exemption from tax is least of the 3 below:

(i) Actual gratuity received;

(ii) Rs 10,00,000;

(iii) Half-month’s average salary for each completed year of service (no part thereof)

So calculate how much of your gratuity is taxable and how much is exempt

Taxable part of gratuity is has to be shown under the head ‘Income from salary’.

Exempt part – as you asked can be shown either as Allowance or Others in Exempt Income. There is a confusion with regard to this. Technically It is not an Allowance?

Caclub how to show gratuity in ITR2 says show as Others in exempt

while Wealth18 says it should be shown under Allowance.

I would go with Exempt income but please verify. You can call following numbers to verify (waiting time is a little long)

For Income tax related queries

ASK : 1800 180 1961

For Rectification and Refund

CPC : 1800 425 2229

e-Filing : 1800 4250 0025

Nice article! I would love to see one article about step by step guide to how to file ITR online (e-filing) for people who have income from other sources like fixed deposits and mutual funds.

It is difficult to write article specific to income only for fixed deposits and mutual funds esp. for mutual fund as it depends on what kind of mutual fund you have, equity or debt, short or long term.

But yes we plan to cover wrt to mutual fund and income tax in near future.

Nice article! I would love to see one article about step by step guide to how to file ITR online (e-filing) for people who have income from other sources like fixed deposits and mutual funds.

It is difficult to write article specific to income only for fixed deposits and mutual funds esp. for mutual fund as it depends on what kind of mutual fund you have, equity or debt, short or long term.

But yes we plan to cover wrt to mutual fund and income tax in near future.