The Bharat Interface for Money (BHIM) was rolled out by Prime Minister Narendra Modi on 30 Dec 2016, in an initiative to enable fast, secure and reliable cashless payments through mobile phones. This article talks about what is BHIM app? What are Features Of BHIM App, List of banks supported by BHIM App, Details of how to start with BHIM app,

Table of Contents

What is BHIM App?

BHIM App is an App to make India go Digital and Cashless. It is named after Bhimrao Ambedkar and the acronym BHIM also expands to Bharat Interface for Money. It has been developed by the National Payments Corporation of India (NPCI). These are early days for the app and more features and improvements are expected soon. BHIM’s big advantage is that it is government backed and the money is transferred directly from bank account to bank account without an intermediary. The USP of the app is its simplicity. The new BHIM app will soon work with just your thumbprint.

The Android app is already available on the Google Play Store. An iOS version will be launched soon.

- Check Balance: You can check your bank balance and transactions details on the go.

- Custom Payment Address: You can create a custom payment address in addition to your phone number.

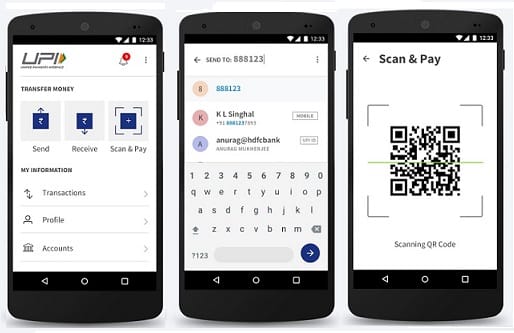

- QR Code: You can scan a QR code for faster entry of payment addresses. Merchants can easily print their QR Code for display.

- Transaction Limits(BHIM): Maximum of Rs. 10,000 per transaction and Rs. 20,000 within 24 hours

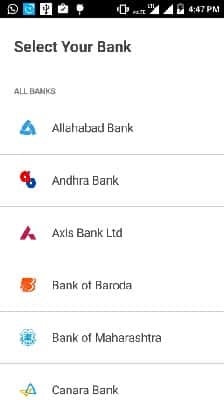

Banks one can use with BHIM app

Allahabad Bank, Andhra Bank, Axis Bank, Bank of Baroda, Bank of India, Bank of Maharashtra, Canara Bank, Catholic Syrian Bank, Central Bank of India, DCB Bank, Dena Bank, Federal Bank, HDFC Bank, ICICI Bank, IDBI Bank, IDFC Bank, Indian Bank, Indian Overseas Bank, IndusInd Bank, Karnataka Bank, Karur Vysya Bank, Kotak Mahindra Bank, Oriental Bank of Commerce, Punjab National Bank, RBL Bank, South Indian Bank, Standard Chartered Bank, State Bank of India, Syndicate Bank, Union Bank of India, United Bank of India, Vijaya Bank.

How to start with BHIM App?

The process is simple. All one has to do download the Bhim app, register your bank account with BHIM and set a UPI PIN for the bank account. The phone number you use for the app needs to be associated with your bank account. To make use of BHIM app you will need to have an account with any of the 32 banks that currently support the app. Overview of steps is given below.

- Download the App from Google Playstore. iOS version will be launched soon.

- Click On Open

- Choose your language. BHIM App currently supports English And Hindi Language. We assume there will soon be provision for regional languages as well.

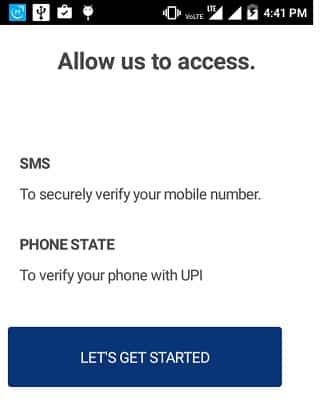

- Verify Mobile Number Which is associated with the bank. It sends SMS to Verify Mobile Number and Phone State to verify UPI address. Click On Let’s Get Started. You will be charged for SMS.

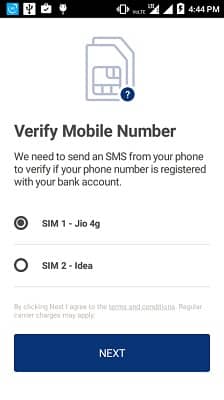

- BHIM App automatically detects Your Sim Cards. Choose The Sim Card or Phone Number which is associated with your bank account.

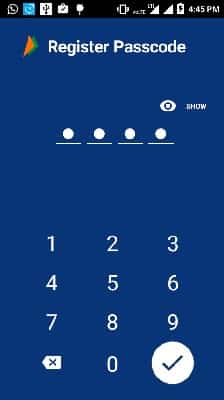

- After verification Register your passcode which is 4 digit password or PIN for BHIM app. It will be used you every time you use your App.

- Associate Bank:

- If you’ve already created a UPI account, it will fetch the data for you.

- If not, you need to feed in the last six digits of your debit card and the expiry date.

- if you have UPI on two banks, you can only link one, for now. So if you want to switch, you have to disable the selected one and go back to the bank selection option.

For people who don’t have a smartphone or don’t want to use the app just yet, the solution is USSD i.e *99#. The USSD code detects your account and gives you 4 options to confirm your bank account. And there on you can’t transact easily, including fetching your account balance and seeing the mini statement.

Once done, you can begin sending/receiving money through the app by using the beneficiary’s mobile number/UPI handle or QR code. The benefit here is that you no longer need the persons IFSC code, bank account number, etc. You just need their mobile number or alternatively, their UPI payment address which reads something like xyz@ybl.com. The person you are sending or receiving money from also needs to have a UPI account.

Details of how to start with BHIM app

Download the App from Google Playstore. iOS version will be launched soon.Click On Open

Choose your language. BHIM App currently supports English And Hindi Language. We assume there will soon be provision for regional languages as well.

Verify Mobile Number which is associated with the bank. It asks for permission to access SMS and Phone State to verify UPI address. Click On Let’s Get Started. To verify your mobile number you’ll be charged 1-2 Rs balance based on the operator.

It sends SMS to Verify Mobile Number and Phone State to verify UPI address. Choose the Mobile number which is associated with Bank account. To verify your mobile number you’ll be charged 1-2 Rs balance based on the operator.

After verification Register your passcode which is 4 digit password or PIN for BHIM app. It will be used you every time you use your App, do transactions.

Associate Bank with Bhim App.

- If you’ve already created a UPI account, it will fetch the data for you.

- If you have not created UPI account, you need to feed in the last six digits of your debit card and the expiry date.

- if you have UPI on two banks, you can only link one, for now. So if you want to switch, you have to disable the selected one and go back to the bank selection option.

How to Use BHIM App?

BHIM app main windows shows Transactions, Profile and Bank Account. You can Transfer Money: Send, Request, Scan and Pay.

BHIM App to Send Money

- Select Send,

- Enter Mobile Number or UPI address to send Money,

- Verify

- Enter Amount

- Select Pin

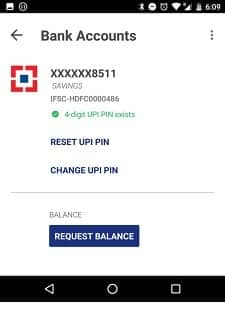

BHIM app to Request Balance. Go to Bank Account and selecting Request Balance. However, this feature started may show error and is most likely to be fixed in the future builds.

Change UPI Pin

UPI PIN is a four digit number that is needed to authenticate the transactions, similar to the four-digit ATM PIN. Changing UPI is easy. Go to Bank accounts and select “Reset UPI PIN.” You will be prompted to enter the last 6 digits of your debit/ATM card and then will receive an OTP. Please note that the UPI PIN will be common for all the UPI apps.

How to Change UPI Username in BHIM App

What if you don’t want your number in the UPI address and instead prefer a name or any alpha numeric character. Well, the app comes with an option that lets you change your UPI username. Firstly open the My Profile section, click on Add Payment address It is here that you can mention your UPI address and add the same. At any instance, one can have multiple UPI address and can also choose any one of the addresses as the primary address.

Related Posts:

- Go Cashless:Digital Wallets, NEFT,IMPS,UPI, Debit Cards,Credit Cards

- What are Mobile Wallets or Digital Wallets

- Paytm: How to Use Paytm,Open Paytm account,Pay using Paytm

- Pockets Facebook App by ICICI Bank, Social Banking

- What happens when credit card is swiped?

- What is Unified Payment Interface or UPI?

- Third Party Fund Transfer NEFT RTGS

- IMPS or Immediate Payment Service : Send Money Instantly

- What is Mobile Banking

This no-frills payments app could pose a challenge to other payment services such as Paytm. BHIM promises to be cross platform allowing users to pay to other who are not on UPI. The Paytms, the MobiKwiks, the FreeCharges give benefits such as cash back which BHIM doesn’t.

It is really a great and helpful piece of information. I’m satisfied that you simply shared this helpful info with us. Please stay us informed like this. Thank you for sharing.

Thanks for sharing such a great blog. I find this on google thats is very informative for me.

Thanks for sharing…very helpful article

How I can unsubscribe from bhim. Pls give me a suitable tips. Thanks

i am unable to generate upi pin

No matter how many times I tried to set the UPI pin, it goes back to login page. I then discover that the UPI pin had not been generated. This problem needs to be rectified

App is expecting same mobile number in bank account number to be used in the phone as well, so am not able to use it as in smart phone there is different mobile number

Please let us know if you have encountered this issue.

I cannot use the app as my mobile number cannot be verified. What to do? Tried for 2 days. Cannot verified. Sms sending failed.