Tax saving Fixed deposit is a type of fixed deposit by investing in which you can get tax deduction under section 80C of the Indian Income Tax Act, 1961. Interest Rates of Tax Saving FD (Fixed Deposits) is between 6% to 7.70% for General and 6.5% to 8.2% for Senior Citizens. This article talks about key features of Tax Saving Fixed Deposits, Gives Best Tax Saving Fixed Deposit Interest rate and Tax Saving Interest Rate of popular banks.

Table of Contents

Overview of Tax Saving Fixed Deposit

Key highlights of Tax Saving Fixed Deposits are given below. Our article Tax Saving Fixed Deposits discusses the topic in detail.

- The Maturity period of a Tax Saving Fixed Deposit is 5 years.

- Get tax deduction up to Rs.1, 50,000 under section 80C. This tax deduction is only for the year you make the investment. The Tax you save is as per your income slab.

- Minimum investment must be Rs.100. Further investments can be made in multiples of Rs.100 only.

- The deduction is available to individuals, members of Hindu undivided family (HUF), senior citizens and NRIs.

- Tax saving deposits can be opened both singly and jointly. In case of a joint account, tax benefit will be availed by the first holder of the deposit as per the section 80C of the Income Tax Act, 1961

- The interest earned from tax saver fixed deposits is taxable like FD.

- Interests paid out on monthly or quarterly basis based on the option one selects.

- TDS or Tax will be deducted at source

- TDS of 10% of the interest paid if the interest paid exceeds Rs 10,000 in a financial year if PAN is provided. You can see the same in Form 26AS.

- TDS will be charged at 20% p.a if no PAN is provided.

- In case your income does not exceed taxable slab and so want to avoid TDS, you can submit Form 15G or 15H when making the deposit. You would also need to submit the form at the start of every financial year to the concerned bank branch. Our article How to Fill Form 15G? How to Fill Form 15H? discusses the topic in detail.

- Premature withdrawal is not available.

- You cannot get a loan against tax saving fixed deposits.

- One can open a Tax Saving Fixed Deposit by visiting the Bank Branch or through net banking.

Best Tax Saving Fixed Deposit Interest rate

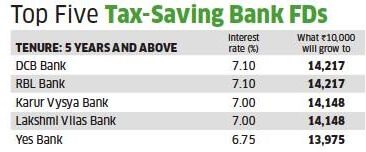

Interest Rates of Tax Saving FD is between 6% to 7.70% for General and 6.5% to 8.2% for Senior Citizens as on Jan 28 2018. Given below is a table of interest rates of the top 5 Tax Saver Fixed Deposit schemes in India as on 28 Jan 2018.

Interest and Tax Saving Fixed Deposit

- The interest earned from tax saver fixed deposits is taxable like FD as per the income slab. It should be shown as Income from Other sources while Filing ITR.

- Interests paid out on monthly or quarterly basis based on the option one selects.

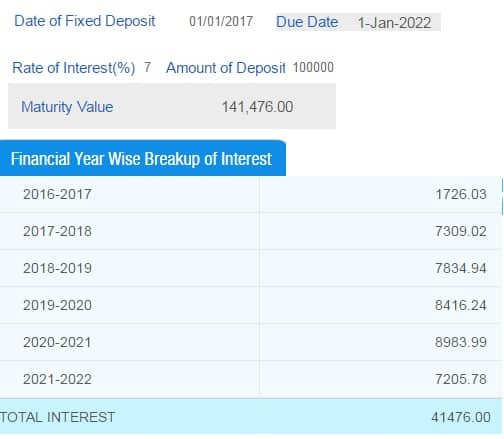

The image below shows the tax in various financial years for a Tax Saving Fixed Deposit opened on 1 Jan 2017

Table below shows how much amount you saved by investing 1 lakh in Tax Saving Fixed Deposit at 7% for different income tax slabs.

| Amount Invested | Tax Slab | Tax Saved | Interest earned | Tax on FD Interest | Actual Tax Saved

(Tax Saved-Tax on Interest) |

| 100000 | 30% | 30,900 | 41476 | 12442 | 18458 |

| 100000 | 20% | 20,600 | 41476 | 8295 | 12305 |

| 100000 | 10% | 10,300 | 41476 | 4147.6 | 6152.4 |

Comparing Tax Saving Fixed Deposit with other Tax Saving options

Table below shows the Features of Tax Saving Fixed Deposits

| Category | Product Features | Score |

| Flexibility of Investment | Money can be invested once in an FD.However, multiple FDs can be opened in a financial year.

No option to switch to equity or other security before maturity. |

2 |

| Liquidity | FDs can’t be broken before 5 years. | 1 |

| Volatility | Returns are fixed at the interest rate decided in the beginning. | 5 |

| Maturity Period | Tenure for these Fixed Deposits is five years. | 2 |

| Taxability | Investment is tax-free, but interest and maturity values are taxable. | 1 |

| Total | 11 |

The table below shows the comparison of various Tax Saving options in the different categories and overall. Our article Five Best Tax Saving Options In Financial Year 2016-17 compares various tax saving options. Our article Choosing Tax Saving options : 80C and Others discusses which Tax Saving Option to choose.

| Rank | Investment | Flexibility of Investment | Liquidity | Volatility | Maturity Period | Taxability | Total Score |

| 1 | ELSS | 3 | 3 | 1 | 5 | 5 | 17 |

| 2 | ULIP | 3 | 2 | 3 | 4 | 5 | 17 |

| 3 | Life Insurance | 2 | 2 | 5 | 2 | 5 | 16 |

| 4 | PPF | 3 | 2 | 4 | 1 | 5 | 15 |

| 5 | NSC | 4 | 3 | 5 | 2 | 1 | 15 |

| 6 | NPS | 4 | 1 | 2 | 2 | 4 | 13 |

| 7 | Tax Saving FDs | 2 | 1 | 5 | 2 | 1 | 11 |

Related Articles:

- Tax Saving Fixed Deposits

- Choosing Tax Saving options : 80C and Others

- How to Fill Form 15G? How to Fill Form 15H?

- Five Best Tax Saving Options In Financial Year 2016-17

- Income Tax for AY 2017-18 or FY 2016-17

Tax-saving fixed deposits can turn out to be a good solution for investors looking for safe and convenient tax saving schemes because it is an easy and secure tax saving method that will help you in your tax planning. You can try https://goo.gl/RyOQwM for more on tax saving fd