We often hear of people being (mis)sold ULIP or insurance policies or inappropriate mutual funds by his Relationship Manager. The advice of a relationship manager or personal banker is totally biased and is based on the following considerations (a) Commission/Earning potential (b) Targets assigned to him (c) Portfolio Rotation. Who are Relationship managers? Why do they sell toxic products? Why does a customer buy them? We shall talk about Examples of misselling of financial products.

if you’re not paying for the product, you are the product

Sir, we have a very good product which can give you a much better return than FD. The product has given 16% returns for the last few years. You just need to invest for 3 years. Savant a retiree had gone to the bank to open FDs and he ended up buying 2 ULIP policies with a premium of 3 Lakhs/annum/per policy for 10 years. The relationship manager attention and coffee and biscuits cost Savant a big 6 Lakhs rupees per annum. Who is to be blamed, Savant or Relationship manager?

We are not saying that all Relationship Managers are bad. But all we are asking you is just be aware that such things happen.

Table of Contents

How Customers were sold Unsuitable products by Relationship Managers

Sir, we have a very good product which can give you a much better return than FD. The product has given 16% returns for the last few years. You just need to invest for 3 years. Savant a retiree had gone to the bank to open FDs and he ended up buying 2 ULIP policies with a premium of 3 Lakhs/annum/per policy for 10 years. The relationship manager attention and coffee and biscuits cost Savant a big 6 Lakhs rupees per annum. Who is to be blamed, Savant or Relationship manager?

Sarita was sold 2 endowment policies with an annual premium of 10 Lakhs each by her relationship manager. She was told that she will get an interest rate of 8% like an FD. In the fourth year, she was unable to pay a premium. She needed money and she tried to contact the Relationship Manager. But the Relationship Manager(RM) had already left the bank and had joined another bank now. She met another RM at the bank. She was shocked to see the surrender value of the policies were less than 20 Lakhs. Though she had already paid the premium of 60 Lakhs! The new RM saw the opportunity and asked Sarita to surrender the endowment policies and take the amount of 15 Lakhs. The remaining 5 Lakhs can be invested in a ULIP which will “give her returns of 20% and she can recover her losses within a span of 10 years”. Also, if she does not want to pay the premium, she can stop paying the premium after 5 years. And Sarita bought it. Who is to be blamed Sarita or Relationship Manager?

Chetan Bhagat is his book 2 States, talks about how Krish working in a bank, sells stocks of Internet companies to a seventy-year-old woman. The Excerpt is given later in the article.

Yes, for every mis-seller there is a mis-buyer who deserves it.

Who are Relationship Managers?

Relationship Managers(RM) are usually assigned to customers who have lots of money in the bank account, who have been with Bank for some time. Customer is told that relationship manager will take special care, he can directly talk to the relationship manager for any banking needs, he will help to complete all the banking formalities and that too for free. You get personal attention, someone who will come to your house to collect documents all for free. Sounds too good to be true right!

But when you meet the relationship manager, after the basic formalities will suggest a product. You feel self-important and flattered by their attention. You feel obliged. And many end up buying the product thinking that Relationship Manager knows best. And RM is from a reputed institute and works for reputed banks!

Relationship managers are generally MBA Marketing guys, who are hired for selling financial products. The service team is different from the Relationship Manager. Relationship Manager just forwards the customer requests.

The Relationship manager changes job frequently, the attrition rate is high. Many times when you figure out that you were mis-sold a financial product, the relationship manager is no longer working in the same bank. He has moved to another job.

Why does Relationship Manager sell you products which are not good for you?

Banks sell third-party products like insurance, mutual funds, credit cards etc. Note, Bank get a commission from it, not the Relationship Manager.

A relationship manager knows how much money do you have in your bank account, when the money came, how long it is lying there. He knows when your FD matures.

A relationship manager has immense pressure to sell products and meet targets. If they do not achieve these targets then they might be fired. Commission on different products vary. But is more for ULIPS and Traditional life insurance policies. Now to do these revenue targets, he needs to sell mutual funds worth 5 Crores or only 36 Lakhs of ULIP. And there is huge pressure from top management, to sell insurance policies. The images below show the commissions earned. Our article, Commission on Post office schemes,Insurance, Stocks and Mutual Funds, talks about commissions that different products offer.

To make Relationship managers more competitive banks and financial institution organize contests such as Big Mutual Funds Day, Maha Insurance Day, Credit Card ki Lalkaar GOA is baar. (reminds of Big billion dollar sale!)

Relationship Managers do not earn any commission as it goes to the bank but they get to party big at places like Goa, Udaipur, Jaipur, or International places.

Target number pressure and keeping job fuels relationship managers to keep on doing the same. The last thing on “your” bank RMs mind is “your” interest!

Story of a Relationship Manager who quit his job

Given below is the story of a banker who was a Relationship manager and quit his job.

Before buying from a Relationship Manager

We want to purchase a smartphone or a car. We research about it, go to google, check the features, check the price, ask our friends for feedback.

But we do not do it for financial products, why? Do we not understand the product or we don’t want to understand the product. Someone said, “(most) investors are idiots”. That is true, but not because of a lack of intelligence but because most investors are lazy.

Do not feel obliged to buy as Relationship manager came to the house to get some signature, it is their work. Say No though this may look a bit awkward.

The relationship manager pushes us to the sign documents & cheques immediately. Relationship managers are trained on products only, you dig a bit deeper and they are clueless. So next time, before buying any product, buy the time to study the product. Given below are the reasons what customer wants and what they are sold.

| Product: Customer’s request | RM’s suggestion | Why it is mis-selling | Impact of mis-selling |

| Fixed deposit: Wants to invest in an FD with monthly interest option | Invest in balanced funds instead as they’ll earn you higher income | The returns from balanced finds may be higher, but the risk they carry is also higher and the bank does not highlight this fact. Also, monthly dividends cannot be guaranteed | As dividends are not guaranteed, you may be in for a shock if you pick balanced funds for monthly income. Also, dividends come from the fund’s NAV and if the fund continues with dividends in a falling NAV scenario, you may end up with a capital loss |

| Senior Citizens’ Savings Scheme: Wants to invest Rs 15 lakh in the Senior Citizens’ Savings Scheme. |

PSU Bank: Invest in an FD because only people above 60 can invest in SCSS.

Private bank: Invest in a Ulip with us as only PSU banks can offer SCSS |

People above 55 can also invest if they are retired or have taken VRS. Private banks can also offer SCSS. | You will lose the interest rate differential between normal FD and SCSS. And as Ulip carry higher risk, they are not suitable for retired people |

| Term insurance: Wants to purchase term insurance. | Private, foreign bank and PSU banks: Invest in a Ulip as it offers better returns. | Insurance is meant to cover risk, and not generate returns. This fact cannot be sidelined by banks to push Ulips or endowment plans | The premium for the Ulip insurance cover will be very high compared to that of term insurance premium, and the cover offered will be inadequate & much less compared to a term plan |

| Gold bonds: Wants to invest in gold bonds | Private, foreign, and PSU banks: Buy gold coins instead as gold bonds come with a lock-in period | Gold bonds do not have a lock-in. Though they are not very liquid, the bonds are listed and traded in the secondary market | You will lose interest during the maturity tenure that comes from gold bonds. Also, when you sell the gold coins, jewelers are likely to pay 5-10% less compared to their market price |

| Bank lockers: Wants to take a bank locker. | PSU Bank: We have limited number of lockers, but you may get one if you start an FD with us.

Private Bank: We have limited number of lockers, but you can get one if you buy a Ulip from us. |

Forcing customers to buy other products to get a locker is not allowed | Investors will lose out by investing the money in FD & low yield, tax-inefficient or

Ulips that deduct mortality charges as they can invest the same amount in mutual funds. Besides likely higher returns, mutual funds also offer better liquidity. |

Video on Beware of Relationship Manager or Personal Banker

This 8 minute video by Nitin Bhatia talks about why one should be Beware of Relationship Manager or Personal Banker. Are you following the advice of your relationship manager or personal banker blindly? Before making any investment decision, you should understand the financial product. The advice of relationship manager or personal banker is totally biased and is based on following considerations (a) Commission/Earning potential (b) Targets assigned to him (c) Portfolio Rotation

How many Misselling complaints are made?

The Reserve Bank of India (RBI), in its analysis of complaints handled by Banking Ombudsman offices during 2018-19, stated that mis-selling complaints shot up by over 92.57 per cent in 2018-19, compared to the levels reported last year. The category, which was introduced in July 2017, had a mere 579 complaints being reported in 2017-18, evoking disbelief. In 2018-19, this number has risen sharply to 1,115. Unscrupulous bank officials are often accused of selling unsuitable investment-cum-insurance policies to gullible customers.

What to do if you bought unsuitable product?

If you have bought an insurance policy then see if it within free look period. The law allows the policyholder 15 days as free-look period from the date of receipt of the policy document. Policyholder is allowed to cancel the policy during this period and get a refund. Note that the insurance company pays back the premium after deducting certain expenses such as the medical examination expenses if any, tax, and any other charges. Inform the insurance company in writing, it should not be communicated orally.

If not within free look period. Register your grievance with your bank.

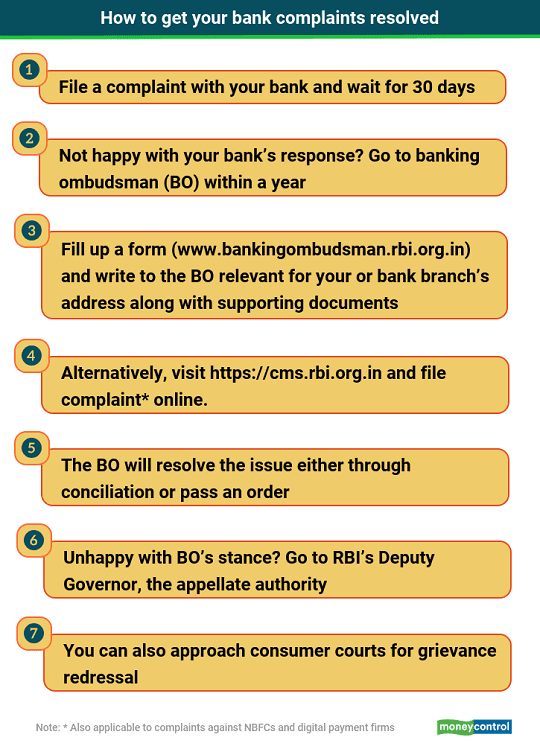

If your bank does not respond within 30 days from the date of filing the complaint or the response is not to your satisfaction escalate the matter. Approach the banking ombudsman’s. RBI also has complaint management portal for registering grievances against banks, non-banking financial companies (NBFCs) and digital payment firms, explained below. The image below shows the steps (ref: MoneyControl know your rights and protect yourself )

Using RBI complaint management portal

In June 2019, Reserve Bank of India (RBI) launched Complaint Management System (CMS), a software application to facilitate RBI’s grievance redressal processes. Through this portal you can file complaints against all financial service providers such as banks and non-banking financial companies (NBFCs), which are regulated by the central bank.

Although the aim of this move is to resolve customer complaints faster, the complaint filing process itself is tedious and one that requires a lot of information to be filled in. For instance, you have to give complete details of the bank or the person you are lodging a complaint against like name, address, mobile number and so on. Also, all through the process, most of the time, you will see a predefined drop-down list from where you will have to select the required option.

Visit RBI complaint management portal https://cms.rbi.org.in. After that, click on file a complaint link.

You will need to furnish details including your personal information, bank branch details, account number, and nature of complaint along with relevant documents to support your claim. The banking ombudsman concerned could either reject your complaint or settle it through conciliation or award in your favour. You can also approach consumer courts – either directly or in case you are unhappy with the ombudsman’s verdict.

Chetan Bhagat book 2 states and Misselling

This Excerpt is from the book, 2 States: The Story of My Marriage. It is how Krish working in a bank, sells stocks of Internet companies to a seventy-year-old woman.

2 States: The Story of My Marriage ( commonly known as 2 States), was written by Chetan Bhagat was published in 2009. It is the story about a couple coming from two different states in India, Punjab and Tamil Nadu, who fall in love in IIM and face hardships in convincing their parents to approve of their marriage. A Movie starring Arjun Kapoor and Alia Bhatt was made in 2014 based on the book.

He read reports for the next two hours. Each one had financial models done my overenthusiastic MBAs who were more keen to solve equations than to question what they were doing. One table compared value of Internet companies with the number of visitors to the site. The recommended company had the lowest value to eyeball ratio, a trendy term invented by the analyst. Hence, BUY! screamed the report. Of course, the analyst never questioned that none of the site visitors ever paid any money to the Internet company. ‘It is trading cheap on every multiple conceivable!’ the report said, complete with the exclamation mark.

‘Sir, this is Ms Sreenivas,’ Sri said. A fifty-year-old lady with gold bangles thicker than handcuffs came to my cubicle. We moved to the sofa area, to give a more personal, living room feel as we robbed the customer.

‘You are from IIT?’ she peered at me.

‘Yes,’ I said even as I readied my pitch about which loss-making company to buy.

‘Even my grandson is preparing for it,’ she said. She had dark hair, with oil that made it shine more.

‘You don’t look old enough to have a grandson preparing for IIT,’ I said. Ms Sreenivas smiled. Sri smiled back at her. Yes, we had laid the mousetrap and the cheese. Walk in, baby.

‘Oh no, I am an old lady. He is only in class six though.’

‘How much is madam’s balance?’ I asked.

‘One crore and twenty lakh, sir,’ Sri supplied.

I imagined the number in my head; I’d need to work in this job for thirty years to get there. It almost felt right to part her from her money. ‘Madam, have you invested in any stocks? Internet stocks are cheap these days,’ I said.

Ms Sreenivas gave me a worried look. ‘Stocks? Never. And my son works in an Internet company abroad. He said they might close down.’

‘That’s USA madam. This is India, we have one billion population or two billion eyeballs. Imagine the potential of the Internet. And we have a mutual fund,

so you don’t have to invest in any one company.’

We cajoled Ms Sreenivas for five minutes. I threw in a lot of MBA terms like strategic advantage, bottom-line vs. top line, top down vs. bottom up and it made

me sound very intelligent. Ms Sreenivas and Sri nodded at whatever I said.

Ultimately, Ms Sreenivas agreed to nibble at toxic waste.

‘Let’s start with ten lakh,’ I said to close the case. ‘Five. Please, five,’ Ms Sreenivas pleaded with us on how to use her own money.

Part 2: When Ms Sreenivas stocks are down

‘Yes, I have. But the tricky part is she is down ten lakh. And that is because she believed these reports. So no matter how well I read these reports, she won’t

trust them. Can I sit on my chair?’ I asked.

‘You, you said this will double. It’s down seventy percent-aa,’ Ms Sreenivas said.

‘Actually madam, the market went into self-correction mode,’ I said. I now understood the purpose of complex research terms. They deflect uncomfortable questions that have no answer.

‘But, I’ve lost ten lakh!’ she screamed.

‘Madam, stock market goes up and down. We do have some other products that are less risky,’ I said, capitalizing on her misery to sell more.

‘Forget it. I am done with Citibank. I told you to do a fixed deposit. You didn’t. Now I move my account to Vysya Bank.’

My sales rep brought several snacks and cold drinks for her. Ms Sreenivas didn’t budge.

‘Madam, but Citibank is a much better name than Vysya,’ I said.

‘Give me the account closing documents,’ Ms Sreenivas said. We had no choice.

Related Articles

- Online Fraud : UPI Scam, AnyDesk, Matrimonial Site, Lottery, Fake Job Offer etc

- Phishing, Email Scam: What is Phishing? How to spot Phishing email? What to do after Phishing attack?

- Cyber Crime : Credit Card Fraud,Bank Account Hacked

- Financial Advisor : What do they do? Fee based or commission based

- Commission on Post office schemes,Insurance, Stocks and Mutual Funds

Bank Managers mis-sell expensive and unsuitable products to customers who feel self-important and flattered by their attention. Do you agree with the statement? Have you been missold any product by bank relationship manager? What happened?

RM of IDFC.bank really has mis sell insurance policies by breaking our FDs. now we are upset that how to reverse that amount.