We know how the right advice can make all the difference. Indian Cricket team has many coaches to help our team perform better. Many hire a fitness coach to achieve their fitness goals. So don’t we need a Financial coach or a Financial advisor? What does a Financial advisor do? Types of Financial Advisors? Fee-based or Commission based?

Table of Contents

Who is a Financial Advisor?

A lot of people think a financial advisor is an expert who gives you advice related to investing. But the picture is incomplete. A financial advisor helps to create a plan for eliminating financial risk and building wealth over the long term. They do much more than explaining confusing jargon but help you with everything from budgeting, finding your insurance needs, saving for your children’s education to saving for retirement.

But Financial advisors don’t come in a one-size-fits-all package. They have different degrees and certifications. They offer a wide range of services. But financial advisors can come generally in two distinct forms: broker and advisor but they have significantly different motivations because of the way they get paid.

- Fee-only advisor, you pay for the advisor’s services which can be fixed amount or percentage of assets managed.

- Commission based advisor, you buy the insurance products and mutual funds through the advisor and advisor earns through commissions.

The problem with a commission based advisor is the possibility of a conflict of interest between the welfare of the client and the advisor. The advisor can suggest a product which might get him a good commission(e.g. loaded mutual funds, variable annuities, whole life insurance) but would not suit the client. This is the best thing about selecting a fee only financial planner is the fact that you expect the advisor to suggest the best product suited for you. The commissions provide an incentive to sell products with the highest payout to the advisor. The fee-based planning principles are the same as in fee only financial planner atlanta or in India.

In India, not everyone can offer investment advice. They have to be registered as an investment adviser (RIA) with SEBI. SEBI Regulation does not fix any minimum or maximum fee to be charged by the Investment Adviser from clients. It is as per the agreement between the client and the investment adviser.

How does Financial Advisor help?

A financial advisor can help you understand your risk profile, your wishes and goals. What you’ll need to do to achieve your goals. what actions you need to take to reach your goals short and long-term goals such as buy a vehicle, travel, sending kids off to college, buy a new house. He should educate and guide you about finance, insurance and investing.

Manage your Debt: While you don’t need a financial advisor’s help to get yourself out of debt, your advisor can show you the benefits of being debt-free.

Insurance: An advisor can explain types of insurance needed,(life, health) and your options for insurance.

Tax Planning: A financial advisor can explain how taxes impact your finances and help you save taxes.

Investments: They can help you determine what investments( fixed income, mutual funds) are right for you and show you how to manage(asset-allocation) your investments.

They review and if needed rebalance your portfolio since plans often go off track due to changing market conditions

How much commission does an Insurance agent or Mutual Fund agent earn?

Our article Commission on Post office schemes, Insurance, Stocks and Mutual Funds talksabout the commission in detail.

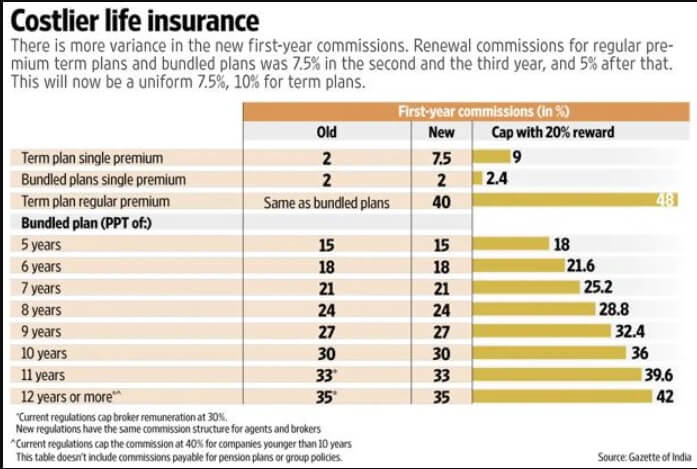

For insurance, the commission is calculated as a percentage of the premium and is included in the premium. The image below shows the commission of life insurance policies before and after 2017. Life plans are divided into two segments: pure risk products (term plans) and bundled plans(insurance and investments). The maximum first-year commission for a regular premium term plan is 40%, and renewal commission at 10% each year through the premium payment term.

Commission of a Mutual Fund agent

- Trail commission: This is the figure that is earned by the distributor when the investor remains with the fund for a specified period of time on a continuous basis.

- One time transaction charge: It is Rs 150 for new investors of mutual fund and Rs 100 for existing investors. This is the cost which will be deducted from your invested amount.

- Upfront commission which is the amount that is received for the purpose of getting the initial investment into the fund. The upfront commission is the commission paid by mutual funds company (AMC) to the agent in the first year.

The Comission earned by Mutual Fund agent in investment of a lakh each year for 15 years is 1,10,972

| No. of years | Investment | Total Asset Under Managment@12% | Upfront Commission | Trial Commission | Total Commission |

|---|---|---|---|---|---|

| 1 | Rs.1,00,000 | NIL | Rs.500 | NIL | Rs.500 |

| 2 | Rs.1,00,000 | Rs.1,12,000 | Rs.500 | Rs.560 | Rs.1,060 |

| 3 | Rs.1,00,000 | Rs.2,37,440 | Rs.500 | Rs.1,187 | Rs.1,687 |

| 4 | Rs.1,00,000 | Rs.3,77,932 | Rs.500 | Rs.1,889 | Rs.2,389 |

| 5 | Rs.1,00,000 | Rs.5,35,284 | Rs.500 | Rs.2,676 | Rs.3,176 |

| 6 | Rs.1,00,000 | Rs.7,11,518 | Rs.500 | Rs.3,557 | Rs.4,057 |

| 7 | Rs.1,00,000 | Rs.9,08,901 | Rs.500 | Rs.4,544 | Rs.5,044 |

| 8 | Rs.1,00,000 | Rs.11,29,969 | Rs.500 | Rs.5,649 | Rs.6,149 |

| 9 | Rs.1,00,000 | Rs.13,77,565 | Rs.500 | Rs.6,887 | Rs.7,387 |

| 10 | Rs.1,00,000 | Rs.16,54,873 | Rs.500 | Rs.8,274 | Rs.8,774 |

| 11 | Rs.1,00,000 | Rs.19,65,548 | Rs.500 | Rs.9,827 | Rs.10,327 |

| 12 | Rs.1,00,000 | Rs.23,13,313 | Rs.500 | Rs.11,566 | Rs.12,066 |

| 13 | Rs.1,00,000 | Rs.27,02,910 | Rs.500 | Rs.13,514 | Rs.14,014 |

| 14 | Rs.1,00,000 | Rs.31,39,260 | Rs.500 | Rs.15,696 | Rs.16,196 |

| 15 | Rs.1,00,000 | Rs.36,27,971 | Rs.500 | Rs.18,139 | Rs.18,639 |

Fee based Advisor

How your adviser is compensated is an important factor in determining what kind of advice you’ll receive. Building relationships means building trust and being up front and transparent is critical. As a fee-only registered investment advisor (RIA) they are held legally to a Fiduciary Standard, which means by law we have to hold your interests above our own.

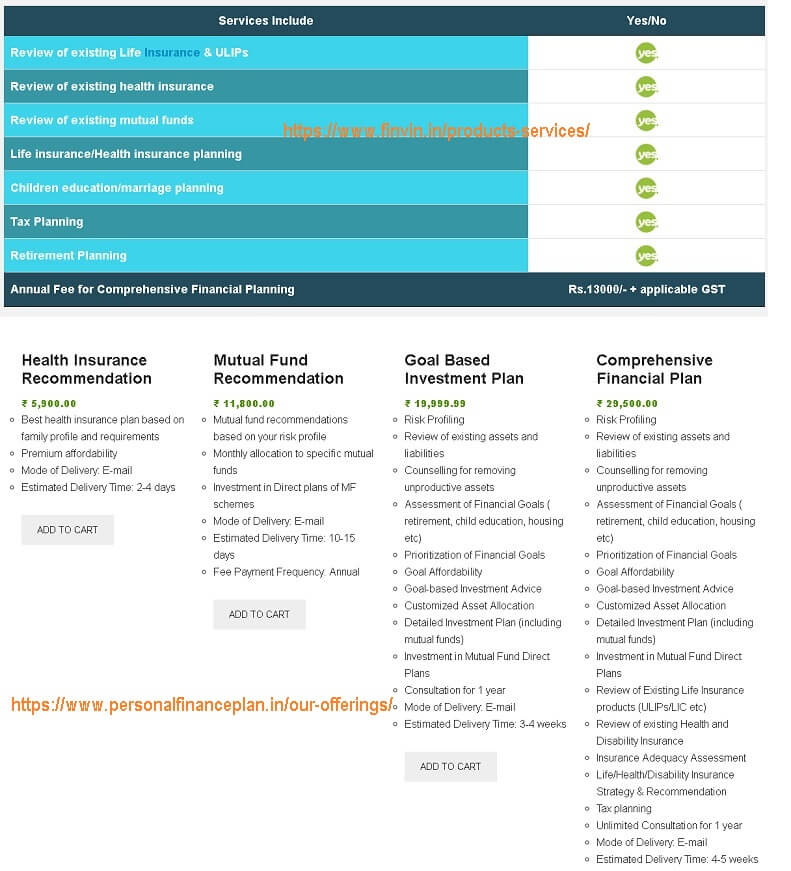

A fee-based advisor can charge a flat fee or a percentage of the investment done on his recommendation. In India mostly financial advisor charge flat fees and vary depends on services offered. The fees of the Fee varies from Rs 5000 to 25,000 Rs. Many charge more fees in the first year that in the second year. The image below shows the fees of registered SEBI IA.

How does one become a Fee-based Advisor

No person can act as an Investment Adviser unless he has obtained a certificate of registration from SEBI. SEBI came out with Investment Advisers Regulations (2013) in the interest of the investors.

- The application fee is Rs. 5000 (for an Individual or Partnership Firm) for others it is 25,000.

- Registration fee of 10,000 (for anIndividual or partnership firm). For others, the registration fee is 5 Lakhs.

- Compliance: Yearly audit by a Chartered Accountant is required to ensure compliance.

- SEBI has a web-based grievance redressal system called SEBI Complaint Redress System (SCORES). Investors can lodge their complaints at https://scores.gov.in. On receipt of complaints, SEBI takes up the matter with the concerned investment adviser and follows up with them for redressal.

Distribution activities by RIA or Fee based investor

A SEBI registered Investment adviser, cannot sell any financial products to his clients and earn a commission.

But RIAs other than Individuals can have a separate division for distribution! The investment advisory has to be provided by a separate department or a subsidiary. But the client shall not be under any obligation to avail the distribution services offered by the investment adviser or its affiliates

Qualification to apply for registration as an Investment adviser in India

To apply for registration as an Investment Adviser in India, minimum qualifications required are

(1) A professional qualification or post-graduate degree or postgraduate diploma in finance, accountancy, business management, commerce, economics, capital market, banking, insurance or actuarial science or

One should be a graduate(in any discipline) but with an experience of at least five years in activities relating to advice in financial products or securities or fund or asset or portfolio management.

(2) A certification on financial planning or fund or asset or portfolio management or investment advisory services from (a) NISM or (b) from any other organization or institution including Financial Planning Standards Board India (FPSB) or any recognized stock exchange in India provided that such certification is accredited by NISM.

What should you look for in a financial advisor?

Expect to develop a long term relationship with your advisor. Do proper due diligence on the advisor before zeroing in on one.

- Meet the person, check out his level of competence, experience, processes he follows for investing, reviewing and rebalancing

- Ask for references of his clients

- Ask relevant questions about advising, investment planning, track record and fees

- Try to find out if your way of thinking about finance and investing matches with that of the advisor

- Decide whether you want fee-based or commission based financial advisor.

Related Articles:

Commission on Post office schemes, Insurance, Stocks and Mutual Funds

May extcated date not for hr dipartment cleer.3 time mail sent me.