I have stocks in French MNC, which I got through ESPP. Do I need to declare the stocks in Foreign Asset? This article covers Undisclosed Foreign Income and Assets, What are ESPP, ESOP, and RSU. Who is the resident Indian? What are foreign assets? The Foreign Asset schedule in ITR2.

We received the query sometime back. We also came across the Business Standard article Declare foreign assets and income to avoid penalty which mentioned that a multinational information technology company organised a workshop on tax filing for its employees. Nothing unusual, except that the workshop focused on how to account for shares received under the company’s equity compensation scheme. Since these shares are listed abroad, they are foreign assets in the hands of the employees. Is the company being too cautious? Maybe not, considering the provisions of the Undisclosed Foreign Income and Assets Bill, 2015. We decided to dig deeper into the issue.

Disclaimer: This is for educational purposes only. Please consult your CA/Tax lawyer. Though we have tried to give the information to the best of our ability We accept no liability.

Please note: from CBDT FAQ

Question. 4: I have held shares of a company during the previous year, which are listed in a recognized stock exchange outside India. Whether I am required to report the requisite details against the column “Whether you have held unlisted equity shares at any time during the previous year?”

Answer: No.

Table of Contents

How to show ESPP, ESOP, RSU as Foreign Assets

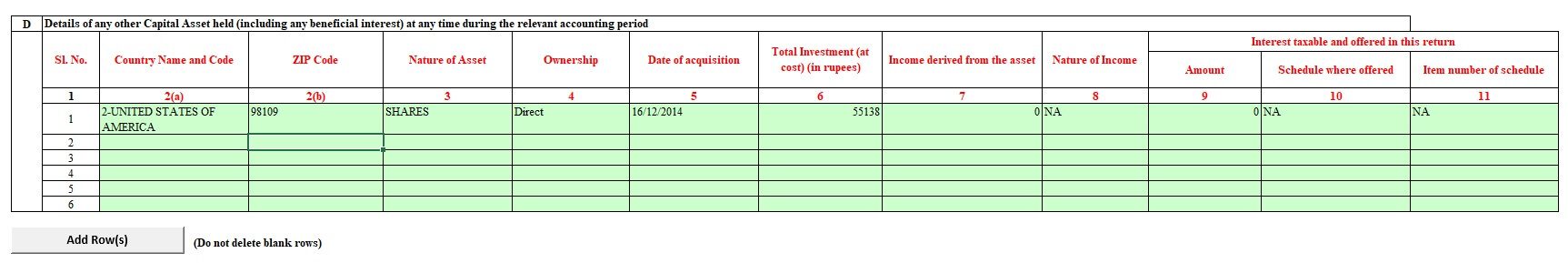

One needs to show shares received as ESPP/RSU/ESOP of MNC as Capital Asset in Schedule FA(Foreign Assets) of ITR2 as shown in the image below. ITR1 does NOT have the schedule for Foreign Assets.

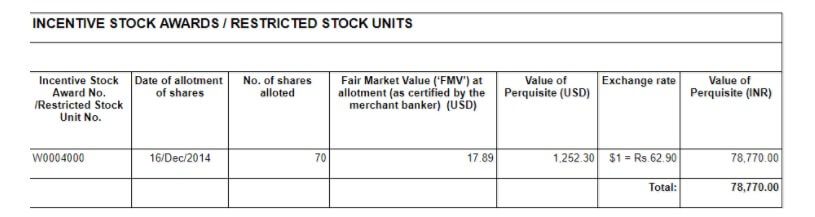

In this example we shall take the case of only when shares of a company in the US were allotted to the employee and the employee has not sold them till filing of the income tax return. To fill this please go through Prerequisite on the Stock Options report or the break-up provided by your employer on stocks allotted to you, similar to the one shown below. Our article RSU of MNC, perquisite, tax , Capital gains, ITR, eTrade covers RSU in detail.

You need to get the Date of Allotment of shares, Fair Market Value of the Share on the date of Allotment.

Details of any other Capital Asset (including any beneficial interest) at any time during the previous year

- Country Name and code :

- Nature of asset: Shares

- Nature of Interest-Direct/Beneficial/owner/Beneficiary: Direct

- Date of acquisition: Date on which stocks were allotted

- Total Investment (at cost) (in rupees): Price at which RSU/ESPP was allotted. (Please deduct the number of shares that were credited to your account after tax deduction. Say you were allotted 70 shares but because of tax only 49 stocks were credited into your broking account). In example 49*17.89(FMV)*62.90(USD Exchange rate)

- Income accrued from such :

- 0, if you haven’t sold the shares.

- If you have earned a dividend then declare the dividend received.

- If you have sold the shares then you have to show the profit/loss received from the sale of the shares.

- Nature of Income :

- Not Applicable or NA if you haven’t sold any shares

- If you have earned a dividend then declare the dividend received. You need to declare divided as Income from other sources

- If you have sold the shares then you have to show them in the Long Term Capital Gains/Short Term Capital Gains section

- Income taxable and offered in this return: if you haven’t sold any shares

-

- Amount Schedule were offered: Not Applicable or NA if you haven’t sold any shares

- Item number of schedule: Not Applicable or NA if you haven’t sold any shares

If shares were allotted at different times, say 25% of RSU in the first year and 25% in the second year, then you have to fill in multiple rows.

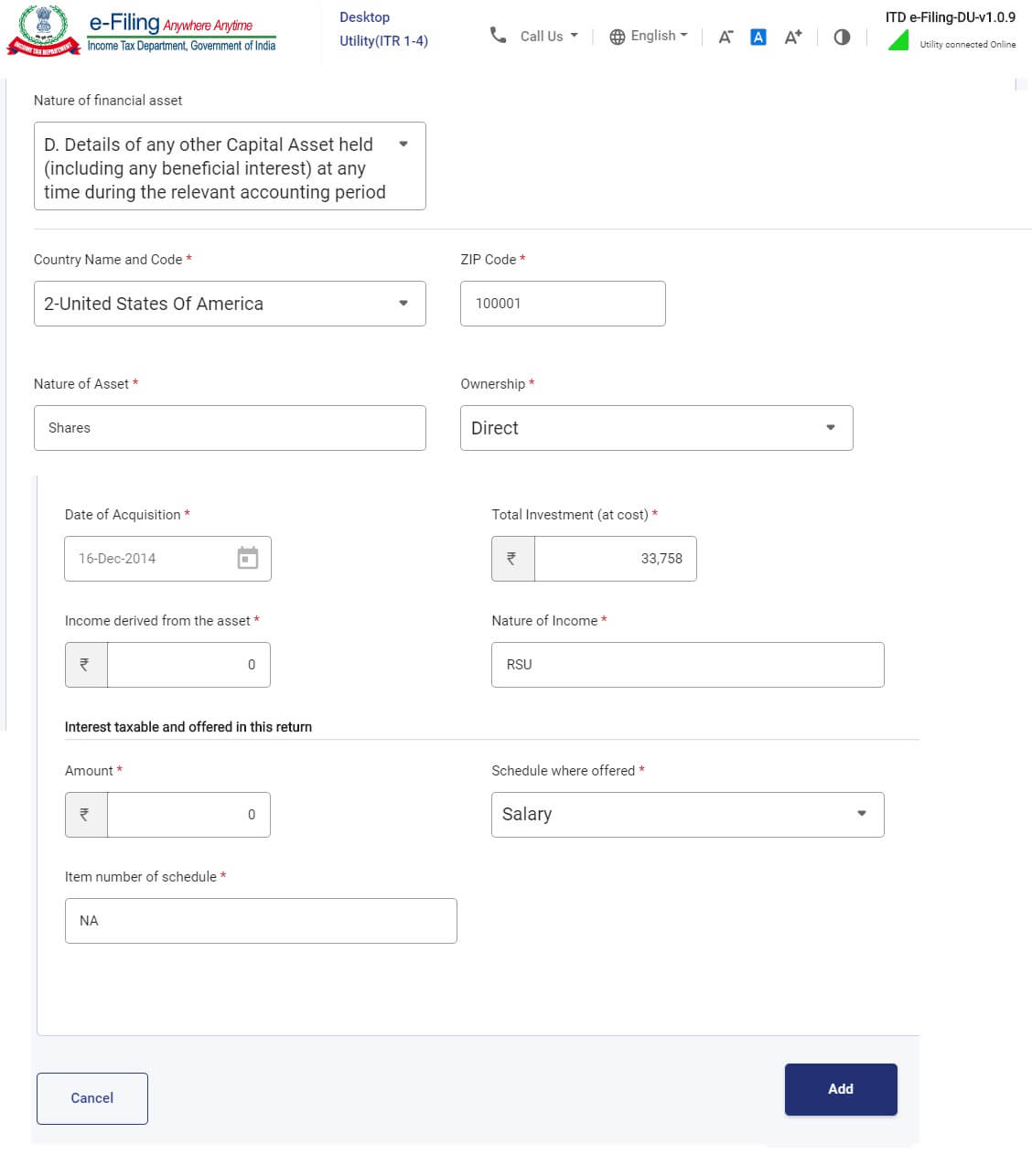

In the new ITR utility, the Foreign Assets are shown below, details in the article RSU of MNC, perquisite, tax, Capital gains, ITR

The Undisclosed Foreign Income and Assets (Imposition of Tax) Bill, 2015

The Bill provides for separate taxation of any undisclosed income in relation to foreign income and assets. Such income will henceforth not be taxed under the Income Tax Act but under the provisions of the proposed new legislation on unaccounted money. Its overview is given below.

The Undisclosed Foreign Income and Assets (Imposition of Tax) Bill, 2015 was introduced in Lok Sabha on March 20, 2015 by the Minister of Finance, Mr. Arun Jaitley.

The Bill will apply to Indian residents and seeks to replace the Income Tax (IT) Act, 1961 for the taxation of foreign income. It penalizes the concealment of foreign income and provides for criminal liability for attempting to evade tax in relation to foreign income.

Tax rate: A flat rate of 30 per cent tax would apply to undisclosed foreign income or assets of the previous assessment year. No exemption, deduction or set off of any carried forward losses (as provided under the IT Act) would apply. This would apply from April 1, 2016 onwards.

Scope of income to be taxed: The total undisclosed foreign income and asset of an individual would include:

- income, from a source located outside India, which has not been disclosed in the tax returns filed;

- income, from a source outside India, for which no tax returns have been filed; and

- value of an undisclosed asset, located outside India.

One – time compliance opportunity: A one-time compliance opportunity for persons who have any undisclosed foreign assets (for all previous assessment years) will be provided for a limited period. Such persons would be permitted to file a declaration before a tax authority and pay a penalty at the rate of 100%.

Tax Authorities: The relevant tax authorities and their jurisdiction would be as specified under the IT Act. They would have powers of inspection of documents and evidence. The proceedings are to be judicial.

Penalty for offences:

- Undisclosed foreign income/assets: The penalty for nondisclosure of foreign income or assets would be equal to three times the amount of tax payable, in addition to tax payable at 30%.

- Failure to furnish returns: The penalty for not furnishing income tax returns in relation to foreign income or assets is a fine of Rs 10 lakh. This would not apply to an asset, with a value of five lakh rupees or less.

- Undisclosed or inaccurate details of foreign assets: If a person who has filed tax returns does not disclose his foreign income, or submits inaccurate details of the same, he has to pay a fine of Rs 10 lakh. This would not apply to an asset, with a value of five lakh rupees or less.

- Second-time defaulter: Any person, who continues to default in paying tax that is due, would be liable to pay an amount equal to the amount of tax arrears.

- Other defaults: If a person fails to abide by the tax authority in (i) answering questions, (ii) signing off on a statement, (iii) attending or producing relevant documents, he is to pay a fine between Rs 50,000 to two lakh rupees.

Prosecution for certain offences:

- Wilful attempt to evade tax: The punishment would be rigorous imprisonment from three to 10 years, and a fine.

- Wilful attempt to evade payment of tax: The punishment would be rigorous imprisonment from three months to three years, and a fine.

- Failure to furnish returns: or non-disclosure of foreign assets in returns: The punishment is rigorous imprisonment of six months to seven years, and fine.

- Punishment for abetment: The punishment is rigorous imprisonment of six months to seven years, and fine.

- Liability of company: For any offence under this Act, every person responsible for the company is to be liable for punishment. His liability is absolved if he proves that the offence was committed without his knowledge.

ESOP, RSU ,ESPP

Let’s just get an overview of ESOP, RSU and ESPP which can be given to employee of company, listed or not listed on Indian stock exchange or foreign stock exchange

- Employee Stock Options or ESOP is a employee benefit plan offered by a company to its employees. ESOPs provide an opportunity to employees to acquire a stake in the company. ESOPs confer a right and not an obligation on the employees to buy shares of the company at a future date at a pre-determined price. Our article What are Employee Stock Options (ESOP) covers it in detail.

- Restricted Stock Units (RSUs) : Restricted Stock Units represent an unsecured promise,i.e no strings attached, by the employer to grant an employee a set number of shares (at zero strike price) on completion of the vesting schedule or other conditions.

- In Employee Stock Purchase Plan or ESPP: the employee is allowed to directly buy the company’s stock on a monthly basis at a certain discount to the market price. For example, if the market price is Rs 150, the company will offer this to their employees at Rs 135, a 10 per cent discount. our article Employee Stock Purchase Plan or ESPP covers it in detail.

These benefits form a part of the employee’s salary income and are taxable as a prerequisite. The perquisite value is computed as the excess of the fair-market value (FMV) of the share. There are specific valuation rules prescribed for listed and unlisted companies to determine the FMV. The employer is required to withhold tax at source or deduct TDS in respect of such a perquisite. It would also be reflected on your Form 12BA. Our article Understanding Form 12BA explains perquisite and salary in detail.

In the event of employee disposing of the shares, the difference between the sale consideration of the shares and the FMV on the date of exercise is chargeable to tax under the head, capital gains, in the hands of the employee. The nature and rate of capital gains would depend upon the period of holding of shares from the allotment date. Further, the fact that whether security transaction tax (STT) has been paid on sale of such shares, is also a factor.. Most of us sell the shares immediately upon receipt to enjoy the gains and regard this money as a bonus. But the tax implications need to be factored in before utilisation of such proceeds. As a planning tool, to optimise returns from Esops,ESPPs,RSUs hold them for a longer duration to characterise such gains as long-term gains.

What is the foreign income of a Resident taxpayer

Who is resident taxpayer?

An Indian citizen who lives abroad will qualify as an ordinarily resident in India if she spends 182 days or more in India during the financial year and 729 days or more in the seven years immediately preceding the current financial year.

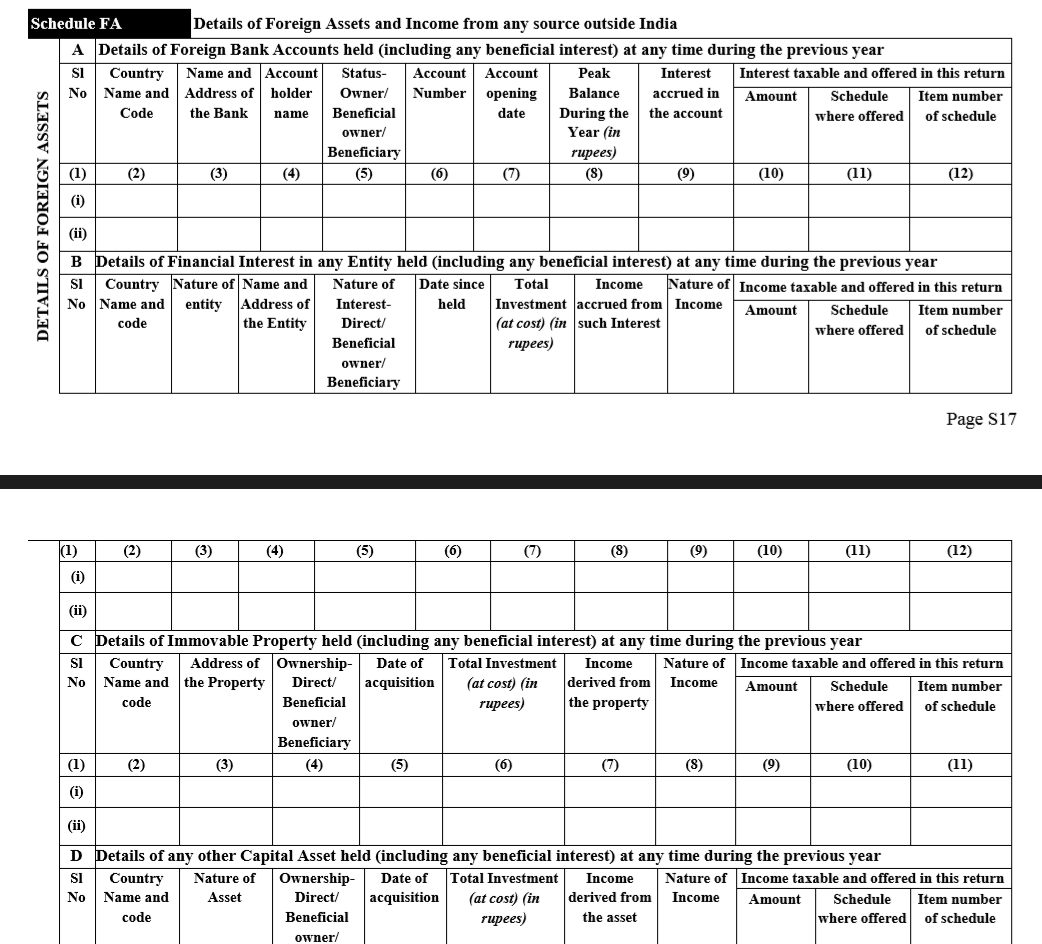

Schedule FA requires a resident assessees to disclose the following particulars relating to overseas assets

- Bank accounts Did you work outside India for some period of time and opened a bank account at such place? One has to indicate the location of the country, name and address of the bank, the account holder’s name and the peak balance maintained in the account during the year.

- Financial interests in an entity Hold stocks or stock options, ESOPs, ownership rights, shares, or debentures (by whatever name called) or have investments in a mutual fund, pension fund or even a financial interest in an intellectual property right. You have to mention the country name and code, name and address, and nature of the entity where the interest is held and the total investment.

- Immovable property :other asset You to give information about the country name and code, location of property/asset and total investment;

- Details of accounts with signing authority that have not been included in the above together with the name and address of the institution where the account is held. Have income from foreign royalties, or earn rent from a property owned outside India, earned capital gains from assets outside India

Please note that many countries across the globe have reporting requirements with respect to overseas assets. The US, in fact, recently introduced the mandatory reporting of foreign assets in Form 8938. Other countries which mandate such reporting include countries such as Ireland, Italy, Korea, Brazil and Canada.

The declaration of foreign assets has been since FY 2011-12. The CBDT had introduced Schedule FA in all the tax return forms other than ITR1.

In the following situations, FA does not have to fill.

- If someone has earned some google adsense income which was transferred directly to his savings bank account. All Incomes from Blogging and other online incomes (incl. Adsense, Affiliate, Services etc) are required to be disclosed under head “Profits or Gains of Business or Profession” and you can submit this information in either ITR 4 or ITR 4S.

- You worked in the foreign country for a few months and earned some salary and later returned to India and is now a resident. Income earned during the stay in foreign is not considered foreign income

Disclaimer: This is for educational purposes only. Please consult your CA/Tax lawyer. Though we have tried to give the information to the best of our ability We accept no liability.

Related articles:

- RSU of MNC, perquisite, tax , Capital gains, ITR, eTrade

- Employee Stock Purchase Plan or ESPP

- What are Employee Stock Options (ESOP)

- Salary, Net Salary, Gross Salary, Cost to Company: What is the difference

- Variable Pay

- It’s not what you earn that makes your financial position!

- Understanding Form 16: Part I

When we talked to a few people who work in MNC and have stocks in the foreign country, they were not aware of it. Many of them haven’t filed or are not filing their stocks as Foreign assets. The intention of the article is not to scare but to make aware.

171 responses to “Declare ESPP,ESOP,RSU of MNC in ITR as Foreign Assets”

A big thank you for sharing details regarding filling RSU and ESOP in Income Tax returns form. I have a small suggestion. I hope in future revision of the eBook/pdf you add RSU topic (I possible little bit in more detail).

Thanks a lot for your feedback, Kiran.

What would you like us to add about RSU.

Thank you for the reply.

It would have helped if you had quoted an example of RSU and ESOP and explained how to refer the fields and add values in the ITR form for cases wherein RSU / ESOP have been sold (Gains) vs unsold RSU and ESOP.

Also, how to consider the Dividends which may been received in response to RSU / ESOP.

Dividend from MNC is considered as Income from Other Sources.

Next you have to consider if tax is deducted or not on Dividend income

Assume a scenario where a taxpayer is a tax resident of Country A (Residence State) and he is in receipt of income from Country B (Source State). The Source State withholds a portion of taxes on the income received by the taxpayer in that country. Further, the Residence State, according to its tax laws, would tax the taxpayer on his worldwide income which would include income from the Source State too.The concept of claiming deduction or credit of taxes paid in Source State against tax liability in Residence State is called Foreign Tax Credit.

Section 90 discusses claiming of FTC in a case where India has entered into a Double Taxation Avoidance Agreement (DTAA) with another country and such DTAA provides for claiming of such FTC

Section 91 deals with claiming of FTC in scenarios where India has not entered into a DTAA with the country where the income arises for a taxpayer. Under these sections, if the taxpayer is a resident of India, and he has paid taxes outside India, he can claim a credit of such foreign taxes paid against his tax payable in India.

Good idea.

We shall work on it.

On shares of foreign company dividend was received on which federal tax was levied now which DTAA details which i need to mention in ITR2 for getting releif on the the above mentioned tax levied (Country – USA)

i have got shares of foreign company through ESOP, now in ITR2 whether i have to declare this in Foreign Assets only or i have to disclose in this table “Whether you have held unlisted shares at any time during the previous year? in Part-A General also ?

Hello Team,

Thanks for sharing information in details. I really appreciate your enthusiasm on comment section.

I have a question regarding FA schedule. I am ordinary resident of India. I own RSU from a MNC company. Shares are allocated by Indian subsidiary which is registered in India. Shares are trading on the name of Parent company which is registered in Bermuda, it has headquarter is in the other country i.e London UK. However stock is listed in NYSE(USA). In order to fill the details under A3 of the FA schedule, I asked the company to provide details such as Country Name , name of the entity and the address of the entity. My company said that country will be India as shares were allocated in India only and address will remain as address of the Indian subsidiary.

I was in doubt with the reply of company so I asked a CA, he said that Country will be USA and you can put the address of any USA office of the company.

I had also raised an email with Income tax helpdesk, they said “in their opinion the country and address should be of the parent company ( which is registered in Bermuda as stock is trading on the parent company name)”.

One of the professor said that FA is applicable only if gross income exceed is above Rs 50 Lakh. I got confused with all this. It would be great if you can provide your valuable thoughts on this.

I really appreciate your help on this.

Regards,

Vicky

Hi,

Through an ESPP program my company deducted amount for buying shares

I left the company and before leaving sold the shares.

The date of starting the ESPP is Feb 2016 and Date of selling is Sept 2018. So some shares come under long term and some come under my regular tax cap

But ultimately, the cost and selling difference was a negative 6000 INR

Should i declare the amount ? If yes, how do i put it in my ITR

Regards

Eswar

We would recommend you to declare them.

As explained in the article you have sold the shares then you have to show them in Long Term Capital Gains/Short Term Capital Gains section

I am getting RSUs and ESPPs and I know I have to fill schedule FA and fill sections A1 for showing my foreign depository account details and A3 for showing the foreign equity. How my question is what to show in initial value of investment and peak value and closing value? Is it going to be the total amount i have received or the Fair Market Value of one share? What will be the peak value and closing amount?

We are trying to get answers to it from some CAs.

Will update as soon as we get the info.

But many are filling just A3 and not A1.

Infact many have filled Table D which requires lesser details.

Your company should provide a report which shows the Fair Market Value of share,

Peak value is the peak value of the stock price between 1 Apr 2018 to 31 Mar 2019.

Closing amount is value of the stocks as on 31 Mar 2019.

Hi Any update from CA’s ? We are closing in on the date .. Also could you check where we really need SBI TT rates for conversion or can we use the RBI reference rates. SBI TT is not available anywhere on website especially the historical ones.

You can contact your employer to get the Exchange rate.

If you are short of time use the RBI reference site.

Don’t let it delay your filing ITR

If the shares are sold in FY 2018-19 before 31st march 2019, will the closing balance be 0?

Yes. You have to declare it in Foreign Assets and show capital gains/loss in appropriate section

Yes

Hello,

Fill in Table D which does not require peak value.

Please check our article http://bemoneyaware.com/rsu-tax-perquisite-capital-gains/ for details.

Use Fair Market Value

Hi , I have declared FA from long time, however missed to report the dividend income. Dividends were getting reinvested from 2014 . Dividends gets credited twice in a year. This is listed on US stock Exchange . How do I declare this on ITR. Second question comes to capital gains. If 2 years from now If I am selling this shares wont I be paying the capital tax gains twice on these reinvested dividends .

Hi,

How to fill the dividend received from foreign company and what are sections need to be filling

for example:

Dividend received is: ₹9,048.88

Tax paid at 25% is : ₹2,262.22

Expected to pay % is 30.9% : ₹2,796.10

Difference to pay is: ₹533.88

I have shares accrued from past 8 years or so, which I haven’t made it to FA but I have mentioned them in AL (assets/liabilities) in the past (lack of knowledge/good CA). This time I am trying to file myself and going through all this info. I believe I can declare the RSUs/ESPP vested/purchased this year in FA-A3/D which is okay. What do I do with the shares accrued in past 8 years? Should they somehow go into FA or continue declaring their value in AL?

Since both RSUs/ESPP show up as perquisite in my F-16 in all past years, so its not like I have tried to hide them.

Any suggestions on what to do with shares accrued in past 8 years?

Any suggestion for this question?

Looking for response to this query ?

Best to declare RSUs/ESPPS that you held as of 31 Mar 2021 in Foreign Assets in ITR.

How to show has been discussed in our article http://bemoneyaware.com/rsu-tax-perquisite-capital-gains/

This is a great article and very helpful.

Could you please guide me how to fill FA of ITR2 when I buy shares every month as ESPP.

As you said for ESOP, we need to provide the vesting date, but what to do in case we buy share every month as part of ESPP. Do i need to fill 12 rows for each month as the dates and purchase values are different.

Typically for ESPP part of your salary is deducted every month but one gets shares only twice a year.

So you have to fill in rows when shares come to your account and enter details related to it.

Hi

Thanks for the informative post. I bought some US listed shares through ESPP in FY18-19. I haven’t sold them yet, but I’d earned dividend on the shares in the same FY (tax was also withheld on the dividends by US govt). Should the dividend be declared as foreign income and tax paid for the same? If so, under what schedule?

Thanks

Yes, Dividend has to be declared.

Please check if TAx has been deducted from the dividend.

For example, US companies do deduct tax and issues form 1042-S, Foreign Person’s U.S. Source Income Subject to Withholding, which has income and tax deducted details.

You have to fill in Foreign Assets Table A3

Details of Foreign Equity and Debt Interest held (including any beneficial interest) in any entity at any time during the relevant accounting period

Hi,

How to fill the details in Foreign Assets Table A3? for RSU/ESPP shares dividend received?

8)Initial value of the investment

9)Peak value of investment During the Period

10)Closing balance

11)Total gross amount paid/credited with respect to the holding during the period

(12) (₹) Total gross proceeds from sale or redemption of investment during the period.

to disclose the shares ESPP/RSU which is not sold which section need to fill

B. “Details of any other Capital Assets held”

OR

D. “Details of Financial interest in Foreign Entity”

Regards,

Shyam

I am also looking for the answer especially when I have to just report the income what will be the value in column 11 and and column 10

Closing balance

(10)

Total gross amount paid/credited with respect to the holding during the period

(11) (₹)

Hi,

Thanks for the great article. Very informative. I have a query

I have been receiving RSUs from the past 4 years. But lack of ignorance, I have never filed them.

Now should i just show the RSU which are alloted in the previous financial year?

Also I have capital gain from the sale of RSUs of previous years, should that be shown in capital gain even though if we do not show in FA?

Please file this year this RSUs you held this year.

Please file capital gains for this year.

Hi,

I was trying to fill this information in the latest excel format for ITR2 and realized that the table is not enabled for entering the data. Is there any step that I am missing here?

Check your Sheet PartB-TI-TTI.

Row 20 (which is given below) should be Yes for Foreign Assets sheet to be active.

“Do you at any time during the previous year,-

(i) hold, as beneficial owner, beneficiary or otherwise, any asset (including financial interest in any entity) located outside India; or

(ii) have signing authority in any account located outside India; or

(iii) have income from any source outside India?

[applicable only in case of a resident] [Ensure Schedule FA is filled up if the answer is Yes ]

“

Great article!

Nice post and information.

Great information is posted by you.

I was allotted ESOPs in 2012. I have two questions 1) I have got the dividends against these options but my cost of acquisition was nil can i go ahead and show the same in FA schedule in section D as zero cost of acquisition and with the dividend income details? 2) As part of exercising these options my company is insisting on taking this income as part of my salary deduct TDS on slab rates instead of “20% with indexation” tax as applicable for long term gains on unlisted securities, are they right in their view?

For RSU sale, in addition to reporting STCG/LTCG on Schedule CG of ITR2, which schedule should we disclose this sale on? FSI or TR-FA?

I got 100 shares (30% withheld and credit to account 70) from my MNC employer in FY14-15 so while filing ITR, I declared them in ForeignAssets schedule as 100 * share’s value on the day of transaction. Later on I realized that I should have only declared 70 of them,but i didn’t not revise my return.

FY15-16 also I got another 100 (30% withheld and credit to account 70) Now I have a total of 140 shares. This year I thought I’ll correct the last year’s declaration to 70 and this year’s i’ll put as 70 shares value in Foreign Assets.

Will there be a problem, since I am changing last year’s declared foreign asset Should I first revise my last year’s return? Can one revise FY14-15’s return now?

I had RSU’s from my US based MNC in eTrade which got vested in FY15-16. I sold all in FY15-16 and I do not hold any vested stock as on 31-Mar-2015. I had gain which I am declaring in capital gains schedule. Do I still need to fill “Schedule FA” in ITR-2, even though I do not hold assets at the end of FY15-16? I ask this as the form mentions “Details of Financial … held at any time during the previous financial year”.

If I have to fill details of sold units what is to be filled in schedule where offered and item number of schedule. I inference the following from the form

Country code: 2 United States of America

Nature of entity: Shares

Name of entity: XYZ Inc

Address of the entity: abcde…

Nature of Interest: Direct

Date since held: Vesting date

Total investment (at cost) (in rupees): derived perquisite value of stocks remaining after TDS at the time of vesting

Income accrued from such Interest: Value of gain from selling the stocks

Nature of income: Short term capital gain

Under Income taxable and offered in this return, Amount: same as capital gain

Schedule where offered: Capital Gains

Item number of schedule: A5 (referring to the Other Short Term Capital Gains section on CG Schedule)

Thanks for your comments!

Hi, If a person have incorporated a company in Singapore, then Singapore company incorporates another company in USA. Also he would have singing authority on Singapore and USA company’s foreign bank accounts.

1. Does this person have to disclose only share in Singapore company, or will have to disclose interest in both Singapore and USA company?

2. Does this person also need to disclose bank accounts?

Friends,

What if i buy an ETF/shares from a foreign exchange and sell them after 2 years, but DO NOT convert the gains into rupees and DO NOT transfer back into my indian bank account or any bank account and rather reinvest the entire earnings back by buying shares of another foreign company. Am i liable to pay taxes on my profits/income? As factually i didnt have any income actually transferred to my accounts.

It diesn’t matter whether you have income in your Indian accounts. You have a brokerage account in a foreign state and you are accruing income there. You do have to pay income tax in India (unless you are non-resident and not ordinarily resident in India).

It is to avoid evasion of such income that the govt. is asking people to declare assets in foreign accounts (bank/brokerage/whatever type of accounts).

As per following instructions of ITR2, I would fill ESPP ( And RSU/ESOP) in section “B” i.e. “financial interest” rather than “capital asset” as given in the example of the article:

(B) Financial interest would include, but would not be limited to, any of the following:-

(2) if the owner of record or holder of title is one of the following:-

(ii) a corporation in which the resident owns, directly or indirectly, any share or voting

power.

As per following instructions of ITR2, I would fill ESPP ( And RSU/ESOP) in section “B” i.e. “financial interest” rather than “capital asset” as given in the example of the article:

(B) Financial interest would include, but would not be limited to, any of the following:-

(2) if the owner of record or holder of title is one of the following:-

(ii) a corporation in which the resident owns, directly or indirectly, any share or voting

power.

Thanks bemoneyaware and AM. Couple more clarifications, please help with:

1. AM picking from one of your examples in another post:

Suppose that I have 100 RSUs that vested in last financial year at 25 USD per share, at 55 rupees per dollar. My company withholds 30% (approximate) of the vested shares for tax withholding, and releases the balance 70% (70 shares) to me.

Question is: In the “Investment” Column of Schedule FA, should the investment be based on 100 shares or on the actual credited 70 shares? That is, should investment be shown as :

100 x 25 x 55 OR as

70 x 25 x 55

2. Also, since all these shares were acquired (vested between 2008-2011) and not in the FY2014-15, there is NO mention of these as Perquisites in my Form-16 for FY 2014-15. Hence, nothing is mentioned in Item 4 (Value of Perquisites) in Schedule-S (Salary). Does’nt the “Investment” column in FA add up and match with the perquisites item 4 in Salary Schedule? Are these two fields not expected to match?

1. In my returns, I mentioned whatever was given in the perquisite value as the “investment amount” (which would be 100*25*55). But I guess theoretically speaking, the investment amount has to be 70*25*55, as the STCG/loss is computed with reference to this amount. But I am not too sure about this.. I hope it doesn’t matter much as long as the tax is computed correctly.

2. I guess that should be okay since in your old salary documents, the perq value would be mentioned for those shares.

4. I don’t think so, as you can continue to hold shares that were vested in previous financial years, the perq value of which is not accounted in this year.

Btw, I am no CA and just commenting my thought process on this. I tried checking some of these things with different people but no one seems to know the correct answers but just opinions 🙂

Thanks AM. Have filed with whatever was the best understanding based on you inputs and whatever I could get to lay my hands on. 🙂

By the way, I was wondering, is there no formal /official explanation of the IT rules. Where do CA and tax consultant get confirmed and real information from?

Thanks bemoneyaware and AM. Couple more clarifications, please help with:

1. AM picking from one of your examples in another post:

Suppose that I have 100 RSUs that vested in last financial year at 25 USD per share, at 55 rupees per dollar. My company withholds 30% (approximate) of the vested shares for tax withholding, and releases the balance 70% (70 shares) to me.

Question is: In the “Investment” Column of Schedule FA, should the investment be based on 100 shares or on the actual credited 70 shares? That is, should investment be shown as :

100 x 25 x 55 OR as

70 x 25 x 55

2. Also, since all these shares were acquired (vested between 2008-2011) and not in the FY2014-15, there is NO mention of these as Perquisites in my Form-16 for FY 2014-15. Hence, nothing is mentioned in Item 4 (Value of Perquisites) in Schedule-S (Salary). Does’nt the “Investment” column in FA add up and match with the perquisites item 4 in Salary Schedule? Are these two fields not expected to match?

1. In my returns, I mentioned whatever was given in the perquisite value as the “investment amount” (which would be 100*25*55). But I guess theoretically speaking, the investment amount has to be 70*25*55, as the STCG/loss is computed with reference to this amount. But I am not too sure about this.. I hope it doesn’t matter much as long as the tax is computed correctly.

2. I guess that should be okay since in your old salary documents, the perq value would be mentioned for those shares.

4. I don’t think so, as you can continue to hold shares that were vested in previous financial years, the perq value of which is not accounted in this year.

Btw, I am no CA and just commenting my thought process on this. I tried checking some of these things with different people but no one seems to know the correct answers but just opinions 🙂

Thanks AM. Have filed with whatever was the best understanding based on you inputs and whatever I could get to lay my hands on. 🙂

By the way, I was wondering, is there no formal /official explanation of the IT rules. Where do CA and tax consultant get confirmed and real information from?

I have sold some of the RSU’s alotted across different years in last FY 2014-2015. I still have some RSU’s with me.

Some one told me that sold ones should be entered in item “G” (i see this newly in this ITR2) and unsold shares (should be considered as asset and enter in item D of schedule FA).

1) Is this correct?

2) If correct how to fill up item G in the FA schedule of the ITR2?

3) one more question. I sold some the RSU vested in FY 2014-2015 after april 2015. I have them with me during FY 2014-2015 but, do not hve them now while filing the returns. Do I need to show them in capital assets (item D)?

Thanks,

Raju

I have sold some of the RSU’s alotted across different years in last FY 2014-2015. I still have some RSU’s with me.

Some one told me that sold ones should be entered in item “G” (i see this newly in this ITR2) and unsold shares (should be considered as asset and enter in item D of schedule FA).

1) Is this correct?

2) If correct how to fill up item G in the FA schedule of the ITR2?

3) one more question. I sold some the RSU vested in FY 2014-2015 after april 2015. I have them with me during FY 2014-2015 but, do not hve them now while filing the returns. Do I need to show them in capital assets (item D)?

Thanks,

Raju

In my view Zerodha is the best brokerage house in India, have been using their services for year now……..I referred Zerodha to one of my friend last month and a few days back he came to me saying, ‘Abhishek, Zerodha is the best broker I have ever traded with, you should know I just loved it”….he was so impressed by Zerodha pi, back office support and trading platforms that since then he has been referring Zerodha to all……………… the best thing about Zerodha is their industry leading brokerage of 0.01% for intraday and 0.1% for delivery for options its just Rs. 20 per trade means you can trade even 10 lots or 100 or more for just flat fee of Rs. 20…………..ti comes out to be 70-80% less compared to traditional brokers……………… and if you open your account through this website you can also get training material and services worth Rs. 6000 for free. Click here to visit the website now

In my view Zerodha is the best brokerage house in India, have been using their services for year now……..I referred Zerodha to one of my friend last month and a few days back he came to me saying, ‘Abhishek, Zerodha is the best broker I have ever traded with, you should know I just loved it”….he was so impressed by Zerodha pi, back office support and trading platforms that since then he has been referring Zerodha to all……………… the best thing about Zerodha is their industry leading brokerage of 0.01% for intraday and 0.1% for delivery for options its just Rs. 20 per trade means you can trade even 10 lots or 100 or more for just flat fee of Rs. 20…………..ti comes out to be 70-80% less compared to traditional brokers……………… and if you open your account through this website you can also get training material and services worth Rs. 6000 for free. Click here to visit the website now

Hello,

I have some RSUs which were granted to me by my organisation (a US MNC) from 2009-2011. The RSUs vested quarterly and were granted at NO cost (0 value). I have’nt sold a single RSU yet (and have NO capital gain, either in the previous financial year or even in years before that).

1. Do I need to declare those as Foreign Assets in this FY 2014-15 ITR-2?

2. When I fill this information in Schedule FA, it looks so empty. It almost seems useless, as there is NO relevant information here. But please confirm, if this is the correct way to file and relevant to file.

D Details of any other Capital Asset held (including any beneficial interest) at any time during the previous year

Sr No Country Code Nature of Asset “Ownership

” Date of acquisition Total Investment (at cost) (in rupees) Income derived from the asset Nature of Income Income taxable and offered in this return

Amount Schedule where offered Item number of schedule

(1) (2) (3) (4) (5) (6) (7) (8) (9) (10) (11)

1 2-UNITED STATES OF AMERICA RSU Direct 05/02/2009 0 0 NOT APPLICABLE 0 NA NA

2 2-UNITED STATES OF AMERICA RSU Direct 05/05/2009 0 0 NOT APPLICABLE 0 NA NA

Thanks,

Ritg

I believe “total investment amount” in your case has to be the perquisite value provided by your company, and it cannot be 0.

The accrued income has to be 0 since you haven’t sold the RSU yet. If you have sold the RSUs, then the accrued income should be the capital gain/loss on the sale.

Thanks for your reply AG. REgarding your below comment:

>> I believe “total investment amount” in your case has to be the perquisite value provided by your company, and it cannot be 0.

But I (as an individual) have’nt paid out or made any investment in procuring the RSUs. They were granted at ZERO cost to me. How can that be my “Investment”?

And yes, I have’nt sold any RSUs yet. So, “Income derived from asset” will be 0, right?

Thanks.

Yes total investment amount is the cost of shares on the day it was vested.

Income derived from assets will be 0 as you haven’t sold it

You haven’t directly made any investment, but indirectly you have made an investment as the stocks were bought from the perquisites that is part of your salary income which should be already taxed and part of your form Form 16. So, they are not at 0 cost. Suppose that you sold the RSUs at a later point of time for lesser price, you would actually be losing money, as you might have paid tax for the entire perq amount.

Yes, if you haven’t sold any RSU, the “income derived” should be 0. If you have sold, then you need to compute the short term gain or loss (negative number) for the difference between sale price and the FMV at which the perqs were calculated.

Thanks bemoneyaware and AM. Couple more clarifications, please help with:

1. AM picking from one of your examples in another post:

Suppose that I have 100 RSUs that vested in last financial year at 25 USD per share, at 55 rupees per dollar. My company withholds 30% (approximate) of the vested shares for tax withholding, and releases the balance 70% (70 shares) to me.

Question is: In the “Investment” Column of Schedule FA, should the investment be based on 100 shares or on the actual credited 70 shares? That is, should investment be shown as :

100 x 25 x 55 OR as

70 x 25 x 55

2. Also, since all these shares were acquired (vested between 2008-2011) and not in the FY2014-15, there is NO mention of these as Perquisites in my Form-16 for FY 2014-15. Hence, nothing is mentioned in Item 4 (Value of Perquisites) in Schedule-S (Salary). Does’nt the “Investment” column in FA add up and match with the perquisites item 4 in Salary Schedule? Are these two fields not expected to match?

There is confusion as to whether one should report RSUs,ESPPs as foreign assets etc.

From what we have understood,

RSUs cost of acquisition is the cost of stocks on the day RSUs were vested. It was not actually 0 as the company considered it as perquisite and deducted tax on it.

Reason of showing now here is in case you sell then govt would be able to match the foreign assets dates etc.

Bemoneyaware, Thanks for all your help. Will file the cost of RSUs on the day of vesting as Investment and ZERO income derived.

What should “Ownership” be defined as – Direct or Beneficial Owner.

I read somewhere that RSUs owned by an individual of a US company for RSUs held in a demat account in US fall under “Beneficial Owner”.

Thanks to our readers we also learn. Few of us have RSUs and we were in same boat as you.

You can put what you think right..this is a minor thing. Actually there is a school of thought which says don’t put ESPP, RSUs in foreign assets. Major confusion.

Our article is just one school of thought, we are searching for more information and update it.

I have RSUs and have declared like the one that have been described above

Many thanks for your reply again. Will look forward to your update on the same. I am following your blog closely 🙂

I have also heard that the FA can be declared upto 30th Sept 2015 (31st August is last date to file IT return).

1. If so, is it worth to wait until 30th Sept to declare FA (assuming that some air regarding RSUs may get cleared until then).

2. If I submit ITR now, how can FA be declared later? ITR filed as “Revised” return?

The ONLY Reason I am filing ITR-2 is ONLY to declare RSUs as FA. Else I have no other reason to file ITR-2. Filing ITR-1 was sufficient as I only have income from salary + FD interest.

Don’t wait just for RSU especially when you have not sold it.

Either go with ITR2 and fill FA. Or ignore RSU and fill ITR1.

Hello,

I have some RSUs which were granted to me by my organisation (a US MNC) from 2009-2011. The RSUs vested quarterly and were granted at NO cost (0 value). I have’nt sold a single RSU yet (and have NO capital gain, either in the previous financial year or even in years before that).

1. Do I need to declare those as Foreign Assets in this FY 2014-15 ITR-2?

2. When I fill this information in Schedule FA, it looks so empty. It almost seems useless, as there is NO relevant information here. But please confirm, if this is the correct way to file and relevant to file.

D Details of any other Capital Asset held (including any beneficial interest) at any time during the previous year

Sr No Country Code Nature of Asset “Ownership

” Date of acquisition Total Investment (at cost) (in rupees) Income derived from the asset Nature of Income Income taxable and offered in this return

Amount Schedule where offered Item number of schedule

(1) (2) (3) (4) (5) (6) (7) (8) (9) (10) (11)

1 2-UNITED STATES OF AMERICA RSU Direct 05/02/2009 0 0 NOT APPLICABLE 0 NA NA

2 2-UNITED STATES OF AMERICA RSU Direct 05/05/2009 0 0 NOT APPLICABLE 0 NA NA

Thanks,

Ritg

I believe “total investment amount” in your case has to be the perquisite value provided by your company, and it cannot be 0.

The accrued income has to be 0 since you haven’t sold the RSU yet. If you have sold the RSUs, then the accrued income should be the capital gain/loss on the sale.

Thanks for your reply AG. REgarding your below comment:

>> I believe “total investment amount” in your case has to be the perquisite value provided by your company, and it cannot be 0.

But I (as an individual) have’nt paid out or made any investment in procuring the RSUs. They were granted at ZERO cost to me. How can that be my “Investment”?

And yes, I have’nt sold any RSUs yet. So, “Income derived from asset” will be 0, right?

Thanks.

Yes total investment amount is the cost of shares on the day it was vested.

Income derived from assets will be 0 as you haven’t sold it

You haven’t directly made any investment, but indirectly you have made an investment as the stocks were bought from the perquisites that is part of your salary income which should be already taxed and part of your form Form 16. So, they are not at 0 cost. Suppose that you sold the RSUs at a later point of time for lesser price, you would actually be losing money, as you might have paid tax for the entire perq amount.

Yes, if you haven’t sold any RSU, the “income derived” should be 0. If you have sold, then you need to compute the short term gain or loss (negative number) for the difference between sale price and the FMV at which the perqs were calculated.

Thanks bemoneyaware and AM. Couple more clarifications, please help with:

1. AM picking from one of your examples in another post:

Suppose that I have 100 RSUs that vested in last financial year at 25 USD per share, at 55 rupees per dollar. My company withholds 30% (approximate) of the vested shares for tax withholding, and releases the balance 70% (70 shares) to me.

Question is: In the “Investment” Column of Schedule FA, should the investment be based on 100 shares or on the actual credited 70 shares? That is, should investment be shown as :

100 x 25 x 55 OR as

70 x 25 x 55

2. Also, since all these shares were acquired (vested between 2008-2011) and not in the FY2014-15, there is NO mention of these as Perquisites in my Form-16 for FY 2014-15. Hence, nothing is mentioned in Item 4 (Value of Perquisites) in Schedule-S (Salary). Does’nt the “Investment” column in FA add up and match with the perquisites item 4 in Salary Schedule? Are these two fields not expected to match?

There is confusion as to whether one should report RSUs,ESPPs as foreign assets etc.

From what we have understood,

RSUs cost of acquisition is the cost of stocks on the day RSUs were vested. It was not actually 0 as the company considered it as perquisite and deducted tax on it.

Reason of showing now here is in case you sell then govt would be able to match the foreign assets dates etc.

Bemoneyaware, Thanks for all your help. Will file the cost of RSUs on the day of vesting as Investment and ZERO income derived.

What should “Ownership” be defined as – Direct or Beneficial Owner.

I read somewhere that RSUs owned by an individual of a US company for RSUs held in a demat account in US fall under “Beneficial Owner”.

Thanks to our readers we also learn. Few of us have RSUs and we were in same boat as you.

You can put what you think right..this is a minor thing. Actually there is a school of thought which says don’t put ESPP, RSUs in foreign assets. Major confusion.

Our article is just one school of thought, we are searching for more information and update it.

I have RSUs and have declared like the one that have been described above

Many thanks for your reply again. Will look forward to your update on the same. I am following your blog closely 🙂

I have also heard that the FA can be declared upto 30th Sept 2015 (31st August is last date to file IT return).

1. If so, is it worth to wait until 30th Sept to declare FA (assuming that some air regarding RSUs may get cleared until then).

2. If I submit ITR now, how can FA be declared later? ITR filed as “Revised” return?

The ONLY Reason I am filing ITR-2 is ONLY to declare RSUs as FA. Else I have no other reason to file ITR-2. Filing ITR-1 was sufficient as I only have income from salary + FD interest.

Don’t wait just for RSU especially when you have not sold it.

Either go with ITR2 and fill FA. Or ignore RSU and fill ITR1.

HI,

I work for an MNC in India. Company is gving me RSUs and ESPP , out of which I have sold some of these making capital gains.

In this case do I need to fill schedule FSI in addition to schedule TR-FA. Currently I am filling this gain as CG without STT and paying tax in accordance to long/short term.

If yes can you please elaborate the information on how to fill it.

Thanks and Regards

Ashutosh Ojha

HI,

I work for an MNC in India. Company is gving me RSUs and ESPP , out of which I have sold some of these making capital gains.

In this case do I need to fill schedule FSI in addition to schedule TR-FA. Currently I am filling this gain as CG without STT and paying tax in accordance to long/short term.

If yes can you please elaborate the information on how to fill it.

Thanks and Regards

Ashutosh Ojha

Please note that “Nature of income” for shares could also include dividends.

What to do if there are capital gains as well as dividends from some RSUs? Need to fill two rows? Then the asset would get counted twice, right?

Also, for U.S. shares unless owning shares in physical form, the ownership is never direct but only as ‘beneficial owner.’ https://en.wikipedia.org/wiki/Street_name_securities

Please note that “Nature of income” for shares could also include dividends.

What to do if there are capital gains as well as dividends from some RSUs? Need to fill two rows? Then the asset would get counted twice, right?

Also, for U.S. shares unless owning shares in physical form, the ownership is never direct but only as ‘beneficial owner.’ https://en.wikipedia.org/wiki/Street_name_securities

How can one declare vested and unsold ESOPs in FA? As far as I read through various blogs, FMV is calculated on sale of ESOPs. So, how will one find and declare total investment?

Thanks for the nice article and useful details.

Thanks Vikram.

There are two thoughts to it, some say declare ESOPs , RSUs,ESPPs in MNC listed on outside stock exchange as Foreign assets, some don’t. There is no clarity.

But FMV of vested and unsold stock is on the day the stock became vested in your name. There is some perquisite tax which company pays on your behalf.

The example in the article talks about RSU allotted and how to show them in ITR.

How can one declare vested and unsold ESOPs in FA? As far as I read through various blogs, FMV is calculated on sale of ESOPs. So, how will one find and declare total investment?

Thanks for the nice article and useful details.

Thanks Vikram.

There are two thoughts to it, some say declare ESOPs , RSUs,ESPPs in MNC listed on outside stock exchange as Foreign assets, some don’t. There is no clarity.

But FMV of vested and unsold stock is on the day the stock became vested in your name. There is some perquisite tax which company pays on your behalf.

The example in the article talks about RSU allotted and how to show them in ITR.

>> There are two thoughts to it, some say declare ESOPs , RSUs,ESPPs in MNC listed on outside stock exchange as Foreign assets, some don’t.

What is the argument for not declaring RSUs in MNC listed on outside stock exchange in Schedule FA? I would like to know what the defense is.

I too have a few RSUs that have vested over the years. Unfortunately, it never crossed my mind that these are to be declared, since I had not sold a single stock; I assumed the tax complications start only once these are sold. (Part of my reason for not selling).

Recently in a meeting in our company, the finance head made a statement that RSUs might need to be reported in our ITR forms.

This has thrown me in a panic, especially after reading about the penalties for being in violation of this vague law.

To add to the complications, my IT return for a previous year is under limited scrutiny. So I am torn, if I declare the RSUs in this year’s return, I would possibly be handing a weapon to the assessing officer to attack me with (for not reporting in previous years). If I don’t, I might be extending a honest mistake.

The argument for not declaring RSUs in FA is that it already appears as Perquisites in Form 16.

If you have not done any selling then there is no capital gain.

Hence you are not hiding any income.

Many who earn above 50 lakhs show the cost of Stocks as their Capitals Assets.

Hi,

I wa working for a US MNC (named, say A) from 2008-2013, and the organization A had granted me Restricted Stock Units (RSUs with 0 buying value) of the company during that period, which vested yearly. For every 100 shares vested, only 70 shares were granted to my brokerage account (after dedection of tax on the shares vested). So, currently I have around 70*5 = 350 shares of the company in my brokerage account, which is maintained in the US as the company is headquatered in the US.I have NOT sold any RUS yet, so there is NO Capital gain. I also have not other income form any other source such as House etc., Only Salary + RSUs (unsold).

Few questions in that regard?

1. Do I have still have to fill ITR-2 for this year’s return?

2. How can I disclose these assests in this years’s IT return . Will this have to be done under Schedule FA of ITR-2?

3. If yes, how can I show these in this FY, as the RSUs have been accumulated over the previous 5 years and not in this FY 2014-15.

4. Under Scehdule FA, Table-D, What should I fill under the column “Income Taxable and Offered under this return”? What should I fill in “Amount” and “Schdeule where offered” and “Item number of Schedule”, as my current employer does NOT show it in the Form16 of current FY 2014-15, as it is nor perquisite from the current employer but is the perquisite of the pervious employer over 5 years before the current FY.

5. Will this need to be shown as Perquisite (Item 4 in Schedule S). But this is not in the current FY? These had been mentioned in all the FORM-16 for each year provided by my previous employer. But how do I show it in my current IT return for ITR-2?

Please help me understand how should I go about this.

Also, on the incometax efiling site, I see a separate form called Form-6 in the downloads section. What is this Form for?

Thanks,

Ritg

Sir there are two opinions on it. Some say declare some don’t.

You have to take call.

1&2. If you want to declare then you have to declare as FA in ITR2.

3&4. For every allotment one row as shown in image above. If you look at FA it says Capital assets held during the previous year not acquired during previous year.

5. No Perquisite is for this year’s income so you don’t have to show it.

ITR-6

Companies other than companies claiming exemption under section 11 must furnish their income tax must in ITR-6 Form. These are those whose income from property is held for charitable or religious purposes.

Many thanks for your reply. I am considering to fill it in the FA schedule.

If i t for previous years, what is required to be filled under the last column of Table-D in Schedule FA, mentioned under the head “Income Taxable and Offered under this return”? This head has 3 required fields – “Amount” and “Schedule where offered” and “Item number of Schedule”

What should be filled in these 3 columns. Which is the amount value and under which schedule should i refer it to, as taxable income?

Thanks,

Ritg

Hi,

I wa working for a US MNC (named, say A) from 2008-2013, and the organization A had granted me Restricted Stock Units (RSUs with 0 buying value) of the company during that period, which vested yearly. For every 100 shares vested, only 70 shares were granted to my brokerage account (after dedection of tax on the shares vested). So, currently I have around 70*5 = 350 shares of the company in my brokerage account, which is maintained in the US as the company is headquatered in the US.I have NOT sold any RUS yet, so there is NO Capital gain. I also have not other income form any other source such as House etc., Only Salary + RSUs (unsold).

Few questions in that regard?

1. Do I have still have to fill ITR-2 for this year’s return?

2. How can I disclose these assests in this years’s IT return . Will this have to be done under Schedule FA of ITR-2?

3. If yes, how can I show these in this FY, as the RSUs have been accumulated over the previous 5 years and not in this FY 2014-15.

4. Under Scehdule FA, Table-D, What should I fill under the column “Income Taxable and Offered under this return”? What should I fill in “Amount” and “Schdeule where offered” and “Item number of Schedule”, as my current employer does NOT show it in the Form16 of current FY 2014-15, as it is nor perquisite from the current employer but is the perquisite of the pervious employer over 5 years before the current FY.

5. Will this need to be shown as Perquisite (Item 4 in Schedule S). But this is not in the current FY? These had been mentioned in all the FORM-16 for each year provided by my previous employer. But how do I show it in my current IT return for ITR-2?

Please help me understand how should I go about this.

Also, on the incometax efiling site, I see a separate form called Form-6 in the downloads section. What is this Form for?

Thanks,

Ritg

Sir there are two opinions on it. Some say declare some don’t.

You have to take call.

1&2. If you want to declare then you have to declare as FA in ITR2.

3&4. For every allotment one row as shown in image above. If you look at FA it says Capital assets held during the previous year not acquired during previous year.

5. No Perquisite is for this year’s income so you don’t have to show it.

ITR-6

Companies other than companies claiming exemption under section 11 must furnish their income tax must in ITR-6 Form. These are those whose income from property is held for charitable or religious purposes.

Many thanks for your reply. I am considering to fill it in the FA schedule.

If i t for previous years, what is required to be filled under the last column of Table-D in Schedule FA, mentioned under the head “Income Taxable and Offered under this return”? This head has 3 required fields – “Amount” and “Schedule where offered” and “Item number of Schedule”

What should be filled in these 3 columns. Which is the amount value and under which schedule should i refer it to, as taxable income?

Thanks,

Ritg

Hi,

Thank you so much for the details.

How can we declare the ESPP stocks purchased over the previous Financial year – 2013-14? Please give more details on this.

Regards.

Sravya

Just adding on to my question,

If the ESPP stocks have been purchased between the period 1st April,2013 to 31st March, 2014, How can I declare them?

Can I declare it in the current year’s (AY:2015-16) ITR?

Q2. Also, I see that, in the ITR-2, there is a section in schedule FA: Financial Interest in any Entity – FA-B. Does the Income Tax Department provide any guidelines on which section do ESPP stocks come under?

Any help would be great. thanks a lot.

yes for every allotment one row as shown in image above. If you look at FA it says Capital assets held during the previous year not acquired during previous year

Instructions are in Instruction ITR2 (2015) on Page 9

) Schedule FA,-

(i) This schedule is to be filled up by a resident assessee. It need not be filled up by a ‘not ordinarily

resident’ or a ‘non-resident’. Mention the details of foreign bank accounts, financial interest in any

entity, details of immovable property or other assets located outside India. This also includes details

of any account located outside India in which the assessee has signing authority, details of trusts

Instructions to Form ITR-2 (AY 2015-16)

Page 9 of 11

created outside India in which you are settlor, beneficiary or trustee. Under all the heads mention

income generated/derived from the asset. The amount of income taxable in your hands and offered

in the return is to be filled out under respective columns. Item G includes any other income which

has been derived from any source outside India and which has not been included in the items A to F

and under the head business of profession in the return.

(ii) This schedule is to be filled in all cases where the resident assessee is a beneficial owner,

beneficiary or legal owner. For this purpose,-

Beneficial owner in respect of an asset means an individual who has provided, directly or

indirectly, consideration for the asset and where such asset is held for the immediate or future

benefit, direct or indirect, of himself or any other person.

Beneficiary in respect of an asset means an individual who derives benefit from the asset

during the previous year and where the consideration for such asset has been provided by any

person other than such beneficiary.

Where the assessee is both a legal owner and a beneficial owner, mention legal owner in the

column of ownership.

(iii) (A) The peak balance in the bank account during the year is to be filled up after converting the

same into Indian currency.

(B) Financial interest would include, but would not be limited to, any of the following:-

(1) if the resident assessee is the owner of record or holder of legal title of any financial

account, irrespective of whether he is the beneficiary or not.

(2) if the owner of record or holder of title is one of the following:-

(i) an agent, nominee, attorney or a person acting in some other capacity on behalf of the

resident assessee with respect to the entity.

(ii) a corporation in which the resident owns, directly or indirectly, any share or voting

power.

(iii) a partnership in which the resident assessee owns, directly or indirectly, an interest in

partnership profits or an interest in partnership capital.

(iv) a trust of which the resident has beneficial or ownership interest.

(v) any other entity in which the resident owns, directly or indirectly, any voting power

or equity interest or assets or interest in profits.

(3) the total investment in col(5) of part (B) has to be filled up as investment at cost held

during the year after converting it into Indian currency.

(C) The total investment in col(5) of part (C) has to be filled up as investment at cost in immovable

property held during the year after converting it into Indian currency.

(D) The total investment in col(5) of part (D) has to be filled up as peak investment (at cost) held

during the year after converting it into Indian currency. Capital Assets include financial assets

which are not included in part (B) but shall not include stock-in-trade and business assets

which are included in the Balance Sheet.

(E) The details of peak balance/investment in the accounts in which you have signing authority

and which has not been included in Part (A) to Part (D) mentioned above has to be filled up as

peak investment/balance held during the year after converting it into Indian currency.

(F) the details of trusts under the laws of a country outside India in which you are a trustee has to

be filled up.

(iv) For the purpose of this Schedule, the rate of exchange for the calculation of the value in rupees of

such asset situated outside India shall be the telegraphic transfer buying rate of such currency as on

the date of peak balance in the bank account or on the date of investment.

Explanation: For the purposes of this Schedule, “telegraphic transfer buying rate”, in relation to a

foreign currency, means the rate or rates of exchange adopted by the State Bank of India constituted

under the State Bank of India Act, 1955 (23 of 1955), for buying such currency, having regard to

the guidelines specified from time to time by the Reserve Bank of India for buying such currency,

where such currency is made available to that bank through a telegraphic

Hi,

Thank you so much for the details.

How can we declare the ESPP stocks purchased over the previous Financial year – 2013-14? Please give more details on this.

Regards.

Sravya

Just adding on to my question,

If the ESPP stocks have been purchased between the period 1st April,2013 to 31st March, 2014, How can I declare them?

Can I declare it in the current year’s (AY:2015-16) ITR?

Q2. Also, I see that, in the ITR-2, there is a section in schedule FA: Financial Interest in any Entity – FA-B. Does the Income Tax Department provide any guidelines on which section do ESPP stocks come under?

Any help would be great. thanks a lot.

yes for every allotment one row as shown in image above. If you look at FA it says Capital assets held during the previous year not acquired during previous year

Instructions are in Instruction ITR2 (2015) on Page 9

) Schedule FA,-

(i) This schedule is to be filled up by a resident assessee. It need not be filled up by a ‘not ordinarily

resident’ or a ‘non-resident’. Mention the details of foreign bank accounts, financial interest in any

entity, details of immovable property or other assets located outside India. This also includes details

of any account located outside India in which the assessee has signing authority, details of trusts

Instructions to Form ITR-2 (AY 2015-16)

Page 9 of 11

created outside India in which you are settlor, beneficiary or trustee. Under all the heads mention

income generated/derived from the asset. The amount of income taxable in your hands and offered

in the return is to be filled out under respective columns. Item G includes any other income which

has been derived from any source outside India and which has not been included in the items A to F

and under the head business of profession in the return.

(ii) This schedule is to be filled in all cases where the resident assessee is a beneficial owner,

beneficiary or legal owner. For this purpose,-

Beneficial owner in respect of an asset means an individual who has provided, directly or

indirectly, consideration for the asset and where such asset is held for the immediate or future

benefit, direct or indirect, of himself or any other person.

Beneficiary in respect of an asset means an individual who derives benefit from the asset

during the previous year and where the consideration for such asset has been provided by any

person other than such beneficiary.

Where the assessee is both a legal owner and a beneficial owner, mention legal owner in the

column of ownership.

(iii) (A) The peak balance in the bank account during the year is to be filled up after converting the

same into Indian currency.

(B) Financial interest would include, but would not be limited to, any of the following:-

(1) if the resident assessee is the owner of record or holder of legal title of any financial

account, irrespective of whether he is the beneficiary or not.

(2) if the owner of record or holder of title is one of the following:-

(i) an agent, nominee, attorney or a person acting in some other capacity on behalf of the

resident assessee with respect to the entity.

(ii) a corporation in which the resident owns, directly or indirectly, any share or voting

power.

(iii) a partnership in which the resident assessee owns, directly or indirectly, an interest in

partnership profits or an interest in partnership capital.

(iv) a trust of which the resident has beneficial or ownership interest.

(v) any other entity in which the resident owns, directly or indirectly, any voting power

or equity interest or assets or interest in profits.

(3) the total investment in col(5) of part (B) has to be filled up as investment at cost held

during the year after converting it into Indian currency.

(C) The total investment in col(5) of part (C) has to be filled up as investment at cost in immovable

property held during the year after converting it into Indian currency.

(D) The total investment in col(5) of part (D) has to be filled up as peak investment (at cost) held

during the year after converting it into Indian currency. Capital Assets include financial assets

which are not included in part (B) but shall not include stock-in-trade and business assets

which are included in the Balance Sheet.

(E) The details of peak balance/investment in the accounts in which you have signing authority

and which has not been included in Part (A) to Part (D) mentioned above has to be filled up as

peak investment/balance held during the year after converting it into Indian currency.

(F) the details of trusts under the laws of a country outside India in which you are a trustee has to

be filled up.

(iv) For the purpose of this Schedule, the rate of exchange for the calculation of the value in rupees of

such asset situated outside India shall be the telegraphic transfer buying rate of such currency as on

the date of peak balance in the bank account or on the date of investment.

Explanation: For the purposes of this Schedule, “telegraphic transfer buying rate”, in relation to a

foreign currency, means the rate or rates of exchange adopted by the State Bank of India constituted

under the State Bank of India Act, 1955 (23 of 1955), for buying such currency, having regard to

the guidelines specified from time to time by the Reserve Bank of India for buying such currency,

where such currency is made available to that bank through a telegraphic

Hi, Can I declare RSU/ESPP from previous financial years with this year return

yes for every allotment one row as shown in image above. If you look at FA it says Capital assets held during the previous year not just acquired during previous year

But Does it mean that we will be in trouble (even if no share was sold) as per your article?

Hi, Can I declare RSU/ESPP from previous financial years with this year return

yes for every allotment one row as shown in image above. If you look at FA it says Capital assets held during the previous year not just acquired during previous year

Suppose that I have 100 RSUs that vested in last financial year at 25 USD per share, at 55 rupees per dollar. My company withholds 30% (approximate) of the vested shares for tax withholding, and releases the balance 70% to me. My company will add the total vested shares under perquisite section (that is, 100*25*55 INR) and 30% tax is deducted on the same. Now suppose that I sold the RSU that I got in my hand (70 shares) at 27 USD. I will have capital gain for 70*(27-25)*55 INR. I pay the same and show this under section CG, under “short term capital gains from other sources”. Now my question is:

In the section FA, do I need to have two entries, one for the initially allocated 70 shares, linking it against the perquisite tax section, and the other entry for the STCG, linking the short term gain arising from this against the relevant section CG? If I have to do this, I suppose for the first entry the investment amount has to be “0” and the accrued income has to be 70*25*55 but for the second entry, the investment amount has to be 70*25*55 and accrued income has to be the STCG amount. Is this right?

Or is it sufficient to just specify one entry for the STCG amount alone?

One more question – What if I have a short term loss as a result of sale of RSU? Do I need to provide this information in section FA, with a negative entry as “income accrued” from the asset?

Suppose that I have 100 RSUs that vested in last financial year at 25 USD per share, at 55 rupees per dollar. My company withholds 30% (approximate) of the vested shares for tax withholding, and releases the balance 70% to me. My company will add the total vested shares under perquisite section (that is, 100*25*55 INR) and 30% tax is deducted on the same. Now suppose that I sold the RSU that I got in my hand (70 shares) at 27 USD. I will have capital gain for 70*(27-25)*55 INR. I pay the same and show this under section CG, under “short term capital gains from other sources”. Now my question is:

In the section FA, do I need to have two entries, one for the initially allocated 70 shares, linking it against the perquisite tax section, and the other entry for the STCG, linking the short term gain arising from this against the relevant section CG? If I have to do this, I suppose for the first entry the investment amount has to be “0” and the accrued income has to be 70*25*55 but for the second entry, the investment amount has to be 70*25*55 and accrued income has to be the STCG amount. Is this right?

Or is it sufficient to just specify one entry for the STCG amount alone?

One more question – What if I have a short term loss as a result of sale of RSU? Do I need to provide this information in section FA, with a negative entry as “income accrued” from the asset?

The RSUs vested are already included in income chargable under head ‘Salaries’ which means tax has already been dedcuted. If we have not sold these RSUs, do we still need to declare this ?

Also what about the older shares if it has not been sold ? Do we need to declare that also if they have not been sold ?

Yes Sir you are right, Because RSU are perquisite, company deducts tax on it, so they are actually not at 0 cost.

RSU are shares or capital assets which you have in foreign country. You can sell them anytime.

Theoretically speaking you need to declare all the RSU, ESPP received in different rows . Practically not many are doing it. So call is your Sir. Our recommendation just do it.

Thanks for your reply. Since tax has been deducted by the company do we need to show any values in “Income taxable and offered in this return” . The reason i am asking is because there is some tax which has been paid on these RSUs even though i have not sold them. If yes What should be the values of Ampunt(9), Schedule where offered(10) and Item number of schedule(11).

I checked another link – http://blog.cleartax.in/taxation-of-rsus-and-how-to-report-them-in-your-income-tax-return/ which says after vesting it should be under financial interest section of FA and not other assets section. Which one should we use ?

The RSUs vested are already included in income chargable under head ‘Salaries’ which means tax has already been dedcuted. If we have not sold these RSUs, do we still need to declare this ?

Also what about the older shares if it has not been sold ? Do we need to declare that also if they have not been sold ?

Yes Sir you are right, Because RSU are perquisite, company deducts tax on it, so they are actually not at 0 cost.

RSU are shares or capital assets which you have in foreign country. You can sell them anytime.

Theoretically speaking you need to declare all the RSU, ESPP received in different rows . Practically not many are doing it. So call is your Sir. Our recommendation just do it.

Thanks for your reply. Since tax has been deducted by the company do we need to show any values in “Income taxable and offered in this return” . The reason i am asking is because there is some tax which has been paid on these RSUs even though i have not sold them. If yes What should be the values of Ampunt(9), Schedule where offered(10) and Item number of schedule(11).

I checked another link – http://blog.cleartax.in/taxation-of-rsus-and-how-to-report-them-in-your-income-tax-return/ which says after vesting it should be under financial interest section of FA and not other assets section. Which one should we use ?

Really useful information.

How to calculate capital gain on RSU?

Should we calculate it first in Dollar and then convert into RS.

What exchange rate to use?

Your finance department should give you stock report which should mention the dollar conversion rate on date of allotment and sale.

You have to use the dollar conversion rate on date of allotment and sale.

Somewhere I read that capital gain has to be calculated first in Dollar. They give reference to “Rule 115 of the Income-tax Rules, 1962”

Then it is converted to Rupees using TT buying rate on the last day of the month preceding the month in which the shares are sold.

Is this true?

You would have got some information from your finance/payroll department as to what were the dollar rate at which it was transferred. You can use it. Verify with your finance department also.

We checked the rule that you have mentioned

Rule 115 : Rate of exchange for conversion into rupees of income expressed in foreign currency

explained here Rate of exchange for conversion into rupees of income expressed in foreign currency

(f) in respect of income chargeable under the head “Capital gains”, the last day of the month immediately preceding the month in which the capital asset is transferred :]

We checked with few people and this is what they follow:

At the time of the allotment of shares, employees shall be liable to pay tax on the amount of difference between the fair market value on the date of exercise and the exercise price and such amount shall be liable to be taxed as a perquisite paid by the employer to the employee under section 17 of the Income Tax Act, 1961.