We often consider filing of the tax return is the end of the whole story. But picture abhi baki hai mere dost. There is misconception that once the tax return has been filed electronically, work is over until the next tax return filing deadline. One has to e Verify the ITR or send ITR-V if income tax returns are filed online without digitial signature, get acknowledgement of Receipt of ITR-V from Central Processing Centre (CPC) Bangalore, then wait for intimation from Income Tax Department under section 143(1). This article covers what to do after e-filing ITR.

Table of Contents

Checklist after e-filing ITR

1. Verify the ITR or dispatch ITR-V

The primary thing that one should do just after e-filing is that either

- E-verify or

- Dispatch ITR-V to CPC Bangalore.

After e-filing of ITR E Verification

To facilitate taxpayers the income tax return from assessment year (AY) 2015-16 can now be verified electronically. Persons using this facility will not be required to submit a signed paper copy of ITR-Verification form (ITR-V) to CPC Bengaluru. It works in same way as the One Time Password that one uses to do shopping on internet through credit-card. Our article E-verification of Income Tax Returns and Generating EVC through Aadhaar, Net Banking covers it in detail.

After you have uploaded your return to income tax e-filing website you can Verify the ITR electronically. Electronic Verification or E Verification of Income Tax return consists of two parts:

- Generation of Electronic Verification Code.

- EVC is a unique 10 digit alpha numeric code and can be used only with the PAN of the person furnishing the income tax return.

- EVC can be used to verify any ITR such as ITR 1 (Sahaj) / ITR 2A / ITR 2 / ITR 3 / ITR 4 /ITR 4S (Sugam).

- One EVC can be used to validate only one ITR whether it is original or revised return.

- EVC remains valid for 72 hours but can be generated various times through various modes.

- Electronics Verification of Income Tax Return can be done while uploading Income Tax Return . Electronics Verification can also be done of an already uploaded Income Tax Return in last 120 days which are not e-Verified.

What are the ways in which one can generate Electronic Verification Code?

- By linking Aadhaar to PAN Number and verifying it with one time password. The Aadhaar Number and PAN card can be linked if Name, Date of Birth and Gender are same on both the records

- Using Generate EVC at the income tax return filing website, incometaxindiaefiling.gov.in . You can use this method only if Total income as per ITR is less than Rs 5 Lakh and there is no Refund claim

- Through bank ATMs of all major banks

- Through Net banking of all major banks

After e-filing Sending ITR-V

- ITR-V is generated when you file your I-T return online—without using a digital signature.It is a one page document, pdf file.

- You also receive it as an acknowledgement email from the Income Tax Department in your inbox, after you file your return electronically.

- They can also download the ITR-V from the https://incometaxindiaefiling.gov.in website from My account ->My Return after login into it

- This ITR-V also contains the acknowledgement number of electronic transmission and the date of the transmission as an evidence of filing for the benefit of the assessee.

- The password of ITR V is your PAN number in lower case, followed by your date of birth in DDMMYYYY format , for example for Mr Sharma with PAN number AJSPD8693E and date of birth as 20-Mar-1976 the password would be ajspd9693ed20031976

- ITR-V should be printed in dark black ink and clear to read.

- You have to sign the copy of the ITR-V in blue ink .Your signature should not be on bar code of the Form. Bar code and numbers below the bar code should be clearly seen.

- In case the return was prepared by a Tax Return Preparer (TRP), the particulars of TRP be also filled and this verification form be countersigned by the TRP.

- You do not need to send any supporting documents along with the ITR-V. Just the one page signed ITR-V.

- Do not use stapler on the Form ITR-V. Do not fold this signed ITR-V.

- Enclose the same in an A-4 size white envelope. Send the envelope to the CPC through speed post or ordinary post within 120 days from the date of filing. You cannot courier the ITR-V.

- Inside a single envelope, you can send several ITR-V forms.

- The envelope should be send to Income Tax Department CPC Post Box No.1, Electronic City Post Office, Bangalore-560100, Karnataka. You cannot submit ITR-V anywhere else in India

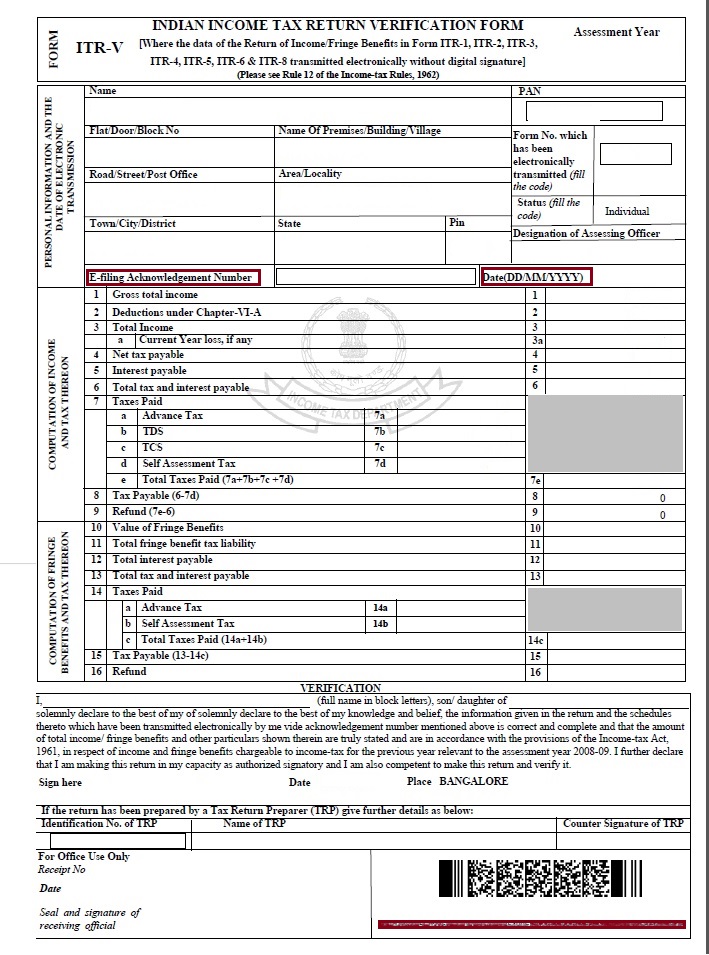

Picture below shows empty ITR-V form. (Click on image to enlarge)

Remember, if you miss submitting your ITR-V within 120 days, your e-filing will be considered invalid. It will be considered that you have not yet filed your return. You then have to file a revised return, get a new ITR-V and submit the same within 120 days. So far Income Tax Department has been extending the last date for submission of ITRV but don’t procrastinate or postpone sending your return.

Acknowledgement from CPC

- The e-mail from CPC is sent to the email ID mentioned in the ITR. If you don’t get the acknowledgement, check you SPAM folder.

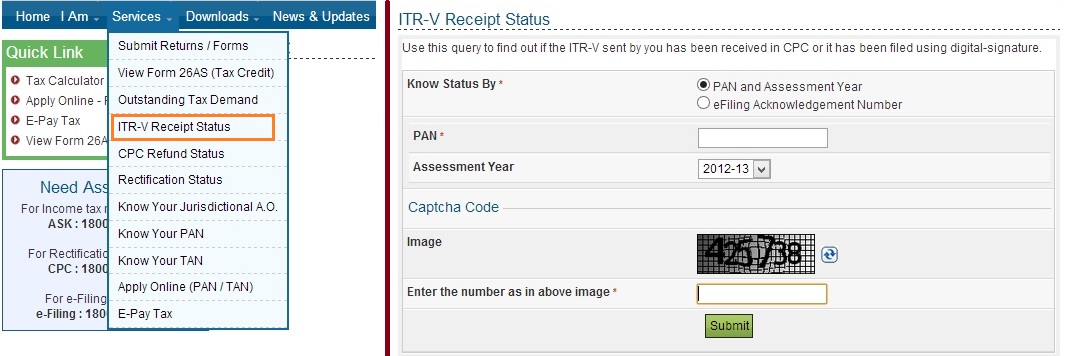

- By filling details of your PAN and assessment year or by filling the e-filing acknowledgement number on the ITR-V Receipt Status tab under Services section on the e-fling website as shown in picture below.

- It is also available on the income-tax web site, https://incometaxindiaefiling.gov.in, you can login in your account and check Views and Forms under the tab My Account.

- You can also call the CPC call centre number 1800-4250-0025 (from 9am to 8pm) to enquire about the status of e-filing.

Processing of Income Tax Return

After e-verification of ITR, wait for around one month to get the intimation from IT department under section 143(1). You will receive another email from IT department once your income tax return gets processed. This email is called Intimation under section u/s 143(1). The intimation as the name suggests intimates the tax payer about, any tax and interest payable or if the assessee is eligible for refunds after providing all the necessary adjustments relating to tax deducted at source, advance tax paid, any tax paid on self – assessment or any other amount in the nature of tax or interest.

- These intimations will be received through email to the Email address provided in filing income tax returns online and would also be sent by Post

- The intimation shall be sent before the expiry of one year from the end of the assessment year in which the income was assessable. So Intimation for FY 2012-13 or AY 2013-14 will be sent by

- Intimation letter is protected with password. To open document, enter your PAN No (In small letters) and Date of Birth/ Date of Incorporation in ddmmyyyy format.

It states any difference between the amount of Income, Deductions and Income Tax Payable, and TDS or Income Tax paid as stated by you in your return with respect to that computed by your Income Tax Officer u/s 143(1).If you look at the notice you will see that there are two columns:

a) As provided by taxpayer in return of Income and

b) As computed under section 143(1).

If there is no difference in both columns i.e details provided by the taxpayer and as verified by the Income Tax department match, then this notice will serve as final assessment of the return with nothing to be done on part of the taxpayer.

If tax paid is less than what is computed by Income tax department then this intimation becomes Notice of Demand u/s 156. For example, if Income as disclosed by taxpayer is Rs 6,00,000 but the department computes his income as Rs. 6,50,000, then there will be shortfall of tax paid. If he feel that computations by Income Tax Department are correct then he will have to pay such tax If he thinks that the demand is wrong then he must prove his case with necessary procedures.

If the tax paid is more than the income computed by the department then such intimation will have a refund and such refund will be granted to the taxpayer. Refund will either be sent by cheque or credited into the bank account mentioned in Income Tax Return.

This Intimation u/s 143(1) should be treated as completion of assessment income tax returns for the year unless there is tax due from the tax payer.

Check Income Tax Return /Refund Status

Income-tax Department has provided access to check Income-tax Return / Refund Status in user login.

- Step 1: Login/Register on Income-tax website click here.

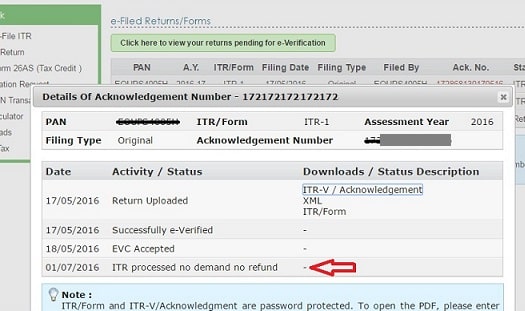

- Step 2: After Login click on My Account >> e-Filed Returns/Forms.

- Step 3: Click on Ack. No. of concerned Assessment Year.

- Step 4: View the Return Status.

Below are the different ITR statuses that you may see.

| S. No | Status as per Income Tax | Meaning | Action to be taken |

| 1 | Not determined | This means that your Income-tax Return is still not processed. In such cases you should confirm if your return is filed and duly verified. You may check your Return verification status here. Below are different status of ITR-V Receipt Status :

a. ITR-V Received – ITR-V is received at CPC-Bangalore and successfully verified b. ITR-V e-verified – Income-tax return is e-verified. c. E-return for this Assessment Year has been Digitally signed – Return is filed with Digital Signature. It is verified with Digital Signature. d. ITR-V not received – ITR-V is not received by CPC or e-verified. You should try e-verification process or send signed ITR-V to CPC Bangalore. (Please note that return filed in paper form are not shown online, so if you have filed manually at Income Tax Office, then you need to wait) |

In such cases, one should confirm if Income-tax return is filed and duly verified. |

| 2 | Refund paid | The Income-tax Department has sent the refund to you by Cheque or by direct debit to the Bank Account Number you provided while filing your return.

|

In case you have received your refund, that’s a good news. If not received and you had opted for “Direct debit to your bank account”, then contact your bank to check for any errors.

If you had opted for refund by cheque , but haven’t received the cheque then check out the Speed Post tracking reference number for your cheque on the Refund Banker’s website. |

| 3 | Assessment Year not displayed in Refund / Demand Status | No e-return has been filed for this PAN – You have missed to file the return.

|

You should file your Income-tax Return immediately. |

| 4 | No Demand no refund | You may have claimed a refund in your income tax return but according to the income tax department, you may not be liable for any refund as per their calculation. This may happen in case there is mismatch in their and your calculation of income or TDS details. In such cases, it may issue an intimation u/s 143(1) showing comparison between details submitted and details considered by Income Tax Department. If there is any mistake in the return, same can be corrected by filing rectification return.

|

In case, there is any error or you have missed to enter any Income or Claim any deductions, then you can revise your return.

If you have received an intimation from the department, then firstly, understand the reason of difference in your computation and that by the department. If you agree with department’s calculation, then file a rectification return after correcting your errors. |

| 5 | Refund Unpaid | It means that income tax department has sent refund to you but either your address is wrong or bank details provided are incorrect, due to which refund was not processed.

|

Visit this link of the Refund Banker’s website and enter your PAN and Assessment year for which you want to know the reason for refund failure and correct the same by updating the details on income tax department’s website and raising a refund re-issue request. |

| 6 | ITR processed refund determined and sent out to Refund Banker | It means that the income tax department has processed your return and Refund request is generated. The details are forwarded to the refund banker for processing the same. Check this status again after a few days for knowing the updation in status by the refund banker.

|

The Refund Banker service will give you the latest details of your refund that may include speed post tracking, error messages in case of incorrect bank details etc. So, after a few days, check this status again. |

| 7 | Demand determined | It means that the income tax department has rejected your refund claim and instead raised an outstanding demand for unpaid taxes. You shall receive a notice from the department with exact amount of demand outstanding and reason for the same. Also this may be seen in Intimation u/s 143(1). If there is difference between amount calculated by Income Tax Department with details submitted in return, same can be corrected by filing Rectification Return.

|

Check the intimation and understand the reason of difference. On a safer side, cross check with your e-Filing records to verify the information you provided was accurate.

If you find that your own refund request was erroneous, pay the tax demanded by the I-T department within the time limit mentioned in the intimation. If you think the I-T department made a mistake, you can change/ update your information if necessary and file a rectification supporting your refund claim. |

| 8 | Contact Jurisdictional Assessing Officer | It means that the I-T department needs some clarification / Information regarding your Income Tax Return. When you receive such a message, contact the AO (Jurisdictional Assessing Officer) for your region.

Click here to find out details about your AO .

|

After you have found out your Assessing Officer, then contact him via telephone, post or email. |

Keeping Income Tax Records

Even if your income tax returns are processed successfully you need to keep all the paper work. Since legal proceedings under the income tax act can be initiated up to six years prior to the current financial year, you must maintain Income tax related documents at least seven years. Our article Paper Work A Necessary Headache discuses it in detail. The records that you need to keep are

- Form 16, Form 12 B

- Filed returns

- Tax paid

- Tax deducted at Source (TDS),Form 16A,

- Tax exemption documents,

- Bank account statements

- Gift deed

- Intimations from Income Tax Department (Soft copy email etc) and hardcopy.

Be watchful of emails, letters and notices received from the Income tax Department and respond to them within the requisite time. Mails from Income Tax Department comes from email id intimations@cpc.gov.in

Related Articles:

- After filing Income Tax Return

- How to Calculate Income Tax

- E-verification of Income Tax Returns and Generating EVC through Aadhaar, Net Banking

- Income Tax for Beginner ,Income Tax For Beginner – Part II

- Interest on Saving Bank Account : Tax, 80TTA

- Challan 280: Payment of Income Tax

349 responses to “After e-filing ITR: ITR-V,Receipt Status,Intimation u/s 143(1)”

after revived of intimation 143 for tax refund, what is time period to credit refund amount or revive cheque?

Sir,

I have filed my ITR-1 On 10Th July 2018 For A-Y 2018-2019 & FY 17-18 . After successfully E-Verified still not processed and not any intimation from income tax dept till 6th January 2019. My refund is exceeding more than Rs 50000/=. What can I do for that.

sir after ITR verification how long does it take to receive Intimation Order u/s 143(1)

I have filed itr for ay 2018-19 evc accepted on 1 july 2018. But it is not processed till now. Should I wait for some more time?

Yes Sir you need to wait.

Generally, it takes 20-45 days from the date of e-verification of your Income Tax Return to get your ITR processed

Processing of income-tax returns by the Income-tax department (whether CPC or by jurisdictional officers) is done under section 143(1) of the Income-tax Act. As per this section, the time limit is one year from the end of the financial year in which the return of income is filed.

Therefore, for example, if you have filed the return of income for Assessment Year 2018-19 (Financial Year 2017-18) sometime in July 2018 then the last date for processing that return is 31st March, 2020 (i.e. one year from the end of F.Y. 2018-19 (which is the financial year in which the return has been filed).

Hi,

I tried raising the grievances since my income tax refund is pending for assessment year 2017-18. Its already e-verified on 24 July 2017. But since then no processing is done. Every time I called them on help line they says we can not tell you the time lines in which the refund will be processed. Also order under section 143(1) is also not processed.

Request you to guide me in this regard.

Thanks

Shreyas Gadre

Hi, I tried reaching out to my AO officer via email, since my refund is pending with him for processing.

But it’s been 3 months since I heard from him. As directed by Helpline numbers, I had raised a rectification & also a grievance to Assessing officer but to little help, as the e-nivaran status is pending for long. Could you please guide me further on this? Whom should be approached in cases when you haven’t had a chance to see any communication from the AO or ITR dept after repetitive efforts?

You can raise it on social media.

You can file RTI.

An RTI application can in most cases, solve this issue in a very simple manner. The procedure to file an RTI application for a refund is very simple:

Please refer the sample of RTI application at the end . The following points must be taken care of while drafting of an RTI application for obtaining Income Tax Refund:

Ø The question posed before the PIO (as termed in the RTI Act i.e. your assessing officer. PIO is acronym of public information officer) must not be “Why is my Income Tax Refund not being processed/released?” No direct allegations of any kind whatsoever must be made. The purpose of the RTI is to receive relevant information held and on record and not accuse the functioning of the system.

Ø The question must be, “Please provide the status of my Income Tax Refund” or “As per the schedule of issuing Income Tax refunds, when I can expect to get my refund?”

Ø Further, the PAN of the assessee, the assessment year for which refund is pending, amount of refund are details that must be mentioned in the application with all details.

Ø Any prior correspondences with the Department, Rectification Applications or any other documents filed must also be duly enclosed.

However, in some cases, these RTI applications are rejected or incomplete/incorrect information is provided to the assessee.

A CA cannot apply on behalf of the assessee. The RTI application must be signed by the assessee himself. However, an assessee may authorize a CA or an Advocate or any other person to represent the assessee in the course of hearing before the PIO or the Appellate Authorities by way of a Power of Attorney that specifically provides for delegation of power with respect to RTI matters.

Sample RTI application

To

The CPIO under the RTI Act 2005

Name of Assessing Officer (ITO/AC)

Income Tax Ward/Circle No………….

(Address)

From

Mr. xxxxxxxxxxxxxxxxxxx

(Full Name and address as in PAN/IT Return)

Telphone –

Mob –

Email –

Dated:xxxxxxxxxxxxxxxxx

Dear Sir,

Application for information under Sec 6(1) of the RTI Act 2005

I, Mr. ______________, a Citizen of India hereby apply for the following information under the RTI

Act 2005

Background

Enclosed is a photocopy of my Income Tax Return for the Financial Year XXXX-XX (AY: XXXX-XX)

submitted on ……………… to your Ward/Circle No………… My PAN Nr. is…………………………

In the mentioned Income Tax Return, I had claimed a refund of Rs. …………………….

As on date, I have not received the said refund order along with the detailed calculation of the

refund and the interest payable thereon and nor has it been credited to my Bank A/C Nr……………with

………… ……………………… (Name and Address of Bank/Branch).

In this connection, please provide me the following information under the RTI Act 2005:

Information Sought:

1. A certified copy, of the “Citizens Charter” issued by your Department

2. As per the Citizens Charter, in how many days is the Income Tax Department supposed to

refund the excess income tax paid by the assessee and claimed in his IT return ?

3. Names, Designations, Office Address, Office Telephone Number, Mobile Numbers (in case

mobile provided and paid for by the office), of ALL the officers of the Income Tax department

who have seen my Income Tax returns and are supposed to process the refund claimed there

in.

4. Name, Designation, Office Address, Office Telephone Number, Mobile Number (in case mobile

provided and paid for by the office) of the Officer with whom my Income Tax refund matter is

presently pending ?

5. The date since which the file/matter is pending with the Officer as identified in Item 4 above.

6. Please inform me the reasons under Sec 4(1)(d) of the RTI Act for the following, since I am

an “affected” person

a) The file/matter to be pending with the officer as mentioned in item no. 4 above.

b) The delay in refunding the amount as claimed in my Income Tax return under

reference

7. Please provide me certified copies of any instructions received from any higher authority of

the Income Tax department or any other “Competent” Authority which has instructed the

assessing officer or any other officer to delay the refund of excess income tax paid by me in

my IT return under reference

8. Inspection of all files and records, including all file notes, concerning the processing of my

refund claim as mentioned above

9. The Name, Office Address, Office telephone number and Mobile Number of the Higher Officer

to whom a First appeal will lie under Sec 19(1) of the RTI act 2005

The CPIO is requested to note, that the information requested above, has not been submitted by me

to the Public Authority but has been generated by the department and/or is available on their

records. Therefore it does not fall under Sec 8(1)(e) – information submitted in a “fiduciary

capacity”.

Further, the information requested in this application is pertaining to me (the applicant) and is

therefore not covered under Sec 8(1)(j) or Sec 11 – personal or private information or third party

information.

The CPIO is also requested to note that there is no sub clause in Sec 8 or Sec 9 of the RTI Act,

under which, a CPIO has the option, of denying information, unless it serves a larger “public

interest”.

I am willing to pay any additional charges as determined by the CPIO under Sec 7(3), and

communicated to me with a reasoned order which includes detailed calculations which have been

used for demanding the extra amount to be charged.

In case the CPIO has any doubts on the information requested above or needs any further

clarification, he is free to call me on any of the numbers mentioned above, at any time of the day or

night.

Please find enclosed IPO Nr………………., for Rs. 10.00, dated…………….payable to “Accounts Officer”

towards payment of Application Fees for this RTI Application. The payees name on the IPO is as per

DoPT Circulars F. No. 1/2/2007-IR dated 23 March 2007 and F. No. 10/9/2008-IR dated 05

December 2008.

Thanking You,

(XXXXXXXXXXXX)

Encl:

1. Copy of IT Return for the FY XXXX-XX (AY: XXXX-XX)

2. IPO Nr……………….for Rs. 10.00 dated………………..

really a step by step explained article.jeep it up.i am learning about income tax a lot from your website. THANKS.

My family very time ssay that I am killing my time here at web, except I know I am getting know-how everyday by reading thes good content.

Sir, I had filed return for the year 2017-18 and fwd to income tax department and ack for the same has been fwd to number. You are requested to intimate the present position of the case.

Please call CPC at 1800-425- 2229(Toll free) 8 am to 8 pm from Monday to Friday

Hello Sir,

Pls. discard my previous request. After seraching in my mails i got the IT depts. u/s 143(1) copy. It shows my advance tax and self assessment tax as nil and only showing TDS.

Now pls. guide me, how to tell dept.

Thanx

Please check your Form 26AS. If you have paid Advance Tax and Self Assessment Tax it should show up. Our article What to Verify in Form 26AS? explains it in detail.

Sir,

In this regard, TDS means Tax deducted by employer where as advance tax means tax credited in advance by the tax payer himself before end of that F.Y. and self assessment tax credited at the time of the actual filing of the returns for the relevant A.Y in due course of time. But in the instant case, in notice if it is shown as TDS discarding advance tax and self assessment it is an error you have to file returns in rectification option.

Hello Sir,

I have self assessed and as per the calulations, it was showing me refund and when i efiled my itr on it dept website, its saying “No Demand no refund”. I mailed my details still they are telling me “Dear Taxpayer, CPC could not allow the t ax credits since no collections availabl e or credits allowed to the extent as it is available in 26AS for AT/SAT. We request you to verify the tax payments deta ils in 26AS and confirm the status of th e entire payments and file for online re ctification, with the updated tax payment details by logging on to http://www.in cometaxindiaefiling.gov.in.”

Pls. help me what i should do.

sir i want empty online from ITR-V acknowledgement 2014-2015

Thanks for your several informative posts.

I have a query.

For the AY 2015-16, I E-filed the return, it was processed and I got the refund also some time in Feb 2016. Now I got an SMSS form IT (e-Sahayog) that there is a mismatch between 26AS and the income shown under schedule OS (interest income) and has asked for clarification. When I checked I found that there was an error in the entry which resulted in lesser income reported because of which I got excess refund and now I need to pay more tax. I have not received any IT notice.

Having noticed that I made an error, can I now pay additional tax for AY 2015-16 and file a revised return?

Having got excess refund, how the refund amount can be entered in the revised return of AY 2015-16 (if I am allowed to file revised return). Do I need to pay interest on the refund amount while I pay additional Tax? at what interest rate?

Expecting a response from you

Thanks

Johnny

Please use the steps mentioned in e Sahayog user guide.

Sir i filled my ITR for F/Y 14-15 & 15-16 & upload it but i found big mistake in my f/y 14-15 return ,so i want to verify only return for f/y 15-16.is it possible ?

You cannot rectify the belated returns.

Hi Sir,

I filed ITR V but I missed the 120 days deadline for verifying the return.

I am trying to e-verify the form but while I am doing so I get the message that there is no return pending for e-verification.

Do I need to file the return again or is there any workaround to this issue?

Thanks,

Tarun

Login https://incometaxindiaefiling.gov.in – > Goto My Account -> Goto View efiled returns/forms -> Click on acknowledgement number of the ITR of the year you want to verify -> find under activity/status : Succesfully everified/ ITRV received.

If you can’t find that , it might be the case that your ITR filed online has been rejected. Therefore you need to file return again.

PS: Kindly consult a Tax expert and not to take any decision based on this reply only. This is just for help.

I SUBMIT MY ITR V FOR ASSESSMENT YEAR 2015-15 0N 12-08-2015,BUT TODAY I GOT AN EMAIL FROM IT DEPTT THAT I AM NOT FILED MY ITR FOR ASSESSMENT YEAR 2015-16,I AM A NON FILER MONITAIRING SYSTEM,THAN WHAT I DO ?

return submitted on 28th July 2016 but missed the 120 days deadline for ITR-V submission , status is “return uploaded” .I’ve not claimed any refund .can I send it to CPC Bengaluru now ? please advice .. Thanks in advance …

Mostly Income Tax Department extends deadline for submitting ITR-V, though so far they have not mentioned in for AY 2016-17.

Please either everify your ITR or send ITR-V to CPC fast.

You can call CPC Bangalore at 080-22546500 and on toll Free no. 1800-425- 2229 between 8:00 AM to 8

PM. The service is available in English, Hindi and Kannada.

Sir

Itrv assessment year2014-15 On recived on 14-09-2016 my Refund Has not come, If any, mistakes by me what Can i do for refund

Hello,

I have filed my returns in June. However, I received an online notice that there was a defect in my returns. I have rectified the defect under 139/9 and uploaded. I have also e-verified and currently the status is in “submitted” status. There is a refund claimed and it has been more than a month. Can you please let me know when I can expect mmy returns.

return is successfully e-varified and till now i have not receive any e-mail confirmation. but received intimation u/s143(1). what can i do

Please check the document received in email. It is status of your ITR processing

Go through our article Understanding Income Tax Notice under section 143(1) for more details.

Document shows computation of income, with income reported under various categories, deductions claimed, taxable income, tax due, tax paid ex advance tax, self assessment tax, TDS, etc in two columns

a) As provided by taxpayer in his Income tax return is from the ITR filed by the tax-payer.

b) As computed under section 143(1) are computations by CPC .

Scroll down and at the end of all calculations you would see two headings Net Amount Refundable and Net Amount Payable

HELLO SIR,

I HAVE FILED MY RETURN OF INCOME FOR THE A/Y 2014-15, AS PER RECORDS BUT ONE ALPHABETICAL MISTAKE APPEAR ON NAME SO I.T.D INTIMATE ,YOUR RETURN HAD BEEN INVALID U/S 139(9). COMPLy the NAME(CHANGE) WITH IN 15 DAYS FROM INTIMATION DATE of RECEIVED. BUT I HAVE SEARCH FOR COMPLY WITH THAT PROBLEM, BUT THERE IS NO OPTION AVAILABLE(SHOW NO 139(9)RETURN)

I have filed ITR on 19/7/2016.

The status now is ITR received.

Have nt received the refund amount yet.

Should I contact someone .

Please assist

My friend filed ITR5 for AY 2015-16 on 04/02/2016. He didn’t e verify the return and not sent ITR 5 form to CPC Bengluru. The status shown return uploaded and what to do now please guide us. Thanks

Hi,

My revised return is processed but original is showing as Successfully e-verfied. IS it normal or should I contact CPC?

This is normal. It just maintains history.

You e-verified your return which it shows.

Your revised return is processed.

hi before one month i receive intimation

but the status show no demand no refund

any one help me out what is the next step.

It means your return is processed and CPC agrees with your income and tax details.

You don’t have to do anything.

Happy Diwali!

I’ve filed my income tax return for the assessment 2016-2017 on 23rd July 2016. The current status on the website shows as EVC accepted. Also, the refund status is shown as “Not Determined”. It’s now close to 3 months that I’m waiting for the refund.

If the status shown is of Not Determined then it means your ITR has not yet been processed. All you need to do is, wait for your ITR to get processed.

Seeing everyone’s ITR being processed fast one is in doubt.If things are fine you should get your refund. there is no time limit for processing of return. It can be from 15 days to 6 months

Sir I submitted my ITR1 on 18.7.2016 and on the next day I revised it as I have to pay some more tax which paid online and E verified on 19.7.2016. My return is not still processed. If our return is revised then is it take more days to process? Please advise.

I HAVE FELLED MY RETURN 16/06/2016 EVC ACCEPTED ON 17/06/2016

E VERIFIED ON 01/07/2016

BUT STILL STATUS SHOWN NOT DETERMINED

ITS NEAR ABOUT 4 MONTHS

NOW WHAT SHOULD I DO?

Hi Asif,

I’m facing the same issue. Have to got any answer?

Iam also same problem

sir i have forgot to send itr v to bengalaru for assesment year 2012-13….so what will happen ? I haven sent it on 10 sept but the due date was up to 30th august.

HI,

I have filed my TDS on 27/07/2016, got Successfully e-verified on 01/08/2016.

EVC was accepted on 04/08/2016. i got confirmation stating that ITR processed refund determind and sent out to refund banker.

how long it takes to credit my TDS amount in my account.

Regards,

Kubendar Reddy

Hi, I have the same question. Any update on your refund status?

It takes 3-4 days usually ,

3 days

very nice article.

I have a question

I uploaded my return on 04/08/16 and e verified it a day later.

However, still it is showing as successfully everified and nothing else. I filled ITR4S. Almost everyone I have asked have had their ITR processed.

What should I do?

Wait for some more time. ITRs are usually processed between 7 days to 6 months. Did others file ITR4S?

Return was e-verified on 30.07.2016.

Status showing evc accepted on 04.08.2016.

Still the status is same till 23.09.2016.

Any one has idea, how long it normally takes to process ITR.

returns take Within a week to 6 months to be processed. So don’t worry.

What’s your surname ? I think they are considering it alphabetically by surname. I observed few of my friends whose surname starting with A,B and C got processed ITR in just last week. So if your surname starts accordingly, expect a delay. Mine starts with “S” and I am still awaiting the status change.

I don’t think so..as my surname starts with S and my return got processed before my husband whose surname starts with D.

But maybe they go by first name ?

uploaded 29.07.2016.

e verified 04.08.2016.

But still, to date 20.09.2016. status is not updated, it is successfully e-verified only.

pl./ help

I am also facing same problem.

Uploaded on 23/07/16

E Verified on 30/08/16

But still it is not processed. Still status is showing as just verified.

Any one have idea on this.

Hi Sandeep,

Got any status change ?

I filed my return before the due date. I had yet not submitted my ITRV FORM. now i want to revise my return. shall i revise after or before submitting my ITRV. and under what section.

can somebody guide me.

Thanks in advance

My ITR has been processed (PAN- ALWPD9901E), refund has been determined & sent to banker but not credited due to wrong Bank Account. But sorry to inform you that not get any intimation mail regarding this from IT department. Email id entered is correct and also got the ITR submission mail Please help & oblige.

apply for re-issue of refund online

I filed ITR the message of refund process has came but my account no is incorrect how should I correct it. On itdnl website it shows contact to advisory officer to whom should I contact or what procedure I follow please tell.

2016-17

Returned uploaded on 25/06/2016.

ITRV Received on 22/07/2016.

ITR Processed refund determined sent out to refund banker on 01/08/2016.

Till today i am not received any refund.

Spoke to CPC , they told me they already processed to Refund banker.

Spoke to SBI- they not received any instruction regarding the same.

Why its taking so long? when i am expected to get the refund? Very poor service from CPC team , their tel caller just tell everyone to check their NSDL website.

Same issue here. Have you got refund? If yes, how many days it took in your case? Thanks

I filed my returns on 20/7/2016. I also got the verification of my Aadhaar card pin approved and was told there was no need to send a hard copy to the respective address. When I checked for the status on the ITR site, the status says successfully e-verified. Its been a month now and have no updates on the same. How many days will the IT office take to refund the amount. I remember last year I got a refund in 20 days.

ditto same here

same with me , e varified on 30 July but till date 16 Sep its not processed. no mail received yet

Hi Surendra,

Any update on ITR status ?

My initials are as same as yours “SS” and status not changed for 3 months now.

Are the returns processed in the order they are received or there is priority for demand and / or refund cases, as compared to No demand no refund cases.

My and wife’s returns verified on 28th July, still the status “successfully e-verified”. Till 21st Aug.

I HAD FILED MY RETURN THROUGH E-VERIFICATION ON 3/8/16.THE STATUS IS ALSO SHOWING SUCCESSFULLY E-VERIFIED.BUT TILL DATE(19/8/16) THE STATUS HAS NOT CHANGED.HOW MUCH DAYS WILL IT TAKE TO PROCESS THE ITR

Hi,

Thanks for a great article.

I have submitted e-filing on 29-07-16 for year 16-17 and completed E-verification and status changed to EVC accepted by 02-08-16 but then still(17/08/16) status remains same as EVC accepted. it is not moving to next step. Do i need to wait for more days for it to get processed or i can raise a trouble ticket for this issue?

Please guide.

Thanks,

Leo

same for me also. I did it on 17-July-2016 For AY 16-17.

same for me also. I did it on 17-July-2016 For AY 16-17.

Thanks,

Cnu

It takes a week to 6-9 months to process the return.

Returns filed earlier, say in June, are dealt fast because number is less.

Yes, But one of my friend filed on 30-July-16. It is processed on

16th Aug.

It happens. For many of my friends they filed returns in Jun got processed only in Oct

I have filed in the month of june that is 05/06/2016 still it is pending at ITR processed refund determined and sent out to Refund Banker

sometimes they will issue refund cheque to the address mentioned in ITR

Hi,

I am a senior citizen of 68 yrs and have been submitting 15 H form to the bank for non deduction of tax. For FY 2015 – 2016 I.e A.Y 2016-2017, my total income is as follow.

Income from pension – Rs 110000

Income from FD’s. – Rs 2,85,000 ( Form 15 H submitted no TDS has been cut)

Income from SB interest – 20000

LIC pension – 10000

Total income – 1,10,000+2,85,000+20000+10000=4,25,000/-

Investment

5 year senior citizen saving scheme in 2015 Oct – 4,00,000

Deductions under 80C (for 5 yr senior citizen scheme) – 1,50,000

80TTA deduction – 10000

Total deductions – 1,60,000

Net taxable income = 4,25,000 – 1,60,000 = 2,65,000

Senior citizEn exemption limit = 3,00,000

So, the net taxable income is less the exemption limit.

So tax to paid for A.Y 2016-2017 = zero

I have filed zero tax returns.

Can you please confirm that the above calculations and process is correct.

Also I have already submitted 15 H for 2016-17 also and the interest is getting credited monthly and quarterly and I don’t know exactly how much will be my total income in FY 2016-2017 ( as there could be increase or decrease in pension with the 7 the pay commission which is not yet finalized), can I calculate the total income for FY2016-2017 at the time of filing the return in June- July 2017 and pay the tax accordingly, as it is difficult to plan investment due to changing pension due to 7 the pay commission.

Request experts to please help and confirm on the above scenarios.

Thanks

It looks like ur calculations are right. As long as you have not missed anything like rental income etc. For next year you can just calculate based on this years income & maybe add a 5-10% increase. But since as per my knowledge senior citizens are exempt from paying advance tax, you can always just calculate tax payable at the time of filing returns next year as you have done this year. ..

Just out of curiosity, this 10K from LIC, was it an annuity plan you bought directly from LIC? & if so why did you buy it? I just want to get your take on such schemes.

Thanks CYBOY for your reply. Just out of curiosity are you a practicing CA or tax planner? The LIC one is pension bima yojana. Also, request other experts also provide your inputs

I am neither. I do tax planning & help in filing for family & friends so don’t mind commenting where absolutely required.

One pointer for you, under Sec80D there is benefit upto 20K for medical insurance. Being a central govt retiree you don’t need this, but an amount upto 5K deduction can be claimed under preventive health checkup for you & spouse within this 20K limit. Pls note, preventive helth checkup is checkup done not part of treatment & not to diagnose any illness. ie if you have regular sugar, cholesterol, BP checks then this can be claimed here. Just keep bills filled for 6years.

Thank you for inputs. I have undergone many medical tests, a few surgeries etc, but to avoid unnecessary nuisance of saving all the paper work, haven’t sought any 80D exemption, unless I go for any extra Medical insurance in future, as now days CGHS creates more hurdles than making life easy for senior citizens. It becomes difficult to maintain too many unnecessary paper work. I feel that govt should raise the exemption limit to 5 lakhs for senior citizens above 70 yrs as it would make lives of old pensioners easy as most of the pensioners/ family pensioners income fall between 1 lakh and 5 lakh. It would help them lead tension free life to that extent instead of running around pillar to post at the time of tax filling.

abe buddhe itna paisa aya kaha se tere paas?

sir mera 2013-14ka it refund nahi huwa pan no BDNPS0927D sir plz muje es no par msg kar dejiyega 8057491769

Contact us for a solution to your problem. we are experienced in dealing refund cases. Contact: 9948487284 / arknco@outlook.com

Mr Singh, never ever share your PAN details online. Same with any other ID like Licence, passport, Aadhaar, PF no’s etc.

I have filed ITR V for assessment year 2013-14 but the same not yet refunded to my accounts till date. my pan no is BGFPS9880L. MY CONTRACT NO 9756768836.

Hi,

Thanks for a great article.

I have submitted e-filing on 29-07-16 for year 16-17 and completed E-verification and status changed to EVC accepted by 02-08-16 but then still(10/08/16) status remains same as EVC accepted. it is not moving to next step. Do i need to wait for more days for it to get processed or i can raise a trouble ticket for this issue?

Please guide.

Thanks,

Leo

WAIT FOR SOME MORE DAYS IT WILL PROCESS

Dear Sir,

I was uploaded my Income tax return on 30.07.16 for the assessment year 206-17. After submitting I opt for Adhaar link but the message received that your mobile no. not linked with adhaar. Then i opt the last opt. I will sign and submit the ITR-V by post. The uploading is accepted. But till date I have not received the auto generated confirmation with ITR-V form. What can I do, please suggest.

Regards,

Dear Sir,

I was uploaded my Income tax return on 30.08.16 for the assessment year 206-17. After submitting I opt for Adhaar link but the message received that your mobile no. not linked with adhaar. Then i opt the last opt. I will sign and submit the ITR-V by post. The uploading is accepted. But till date I have not received the auto generated confirmation with ITR-V form. What can I do, please suggest.

Regards,

Hi,

I have filed ITR and also e verified the form. But the problem is that there is some due amount which I have to pay.

What should I have to do now ?

Please help. Thanks in Advance.

ITR status for AY 2015-16 is “ITR PROCESSED”. Can i revise it?? Thanks in advance

No once the ITR is processed you cannot revise the ITR

I NEED URGENT HELP I HAVE BY MISTAKE FILLED IN THE WRONG FIGURES AND UPLOADED MY IT FORM. ITR1.

I NEED TO RECTIFY THAT HOW DO I DO IT?

First don’t panic.

Have you e-verified your return?

If not please make changes, carefully this time.

Submit ITR

E-verify it or send ITR-V to CPC.

If you have then revise the ITR. Our article How to revise Income Tax return discusses it in detail

Contact us for a solution to your problem. we are experienced in dealing refund cases. Contact: 9948487284 / arknco@outlook.com

Hi,

I filed an e-file return (ITR-V) on 10/7/2016 for the FY 2016-17. It has been processed also by CPC, Bangaluru and when i log in to my account and enter the acknowledgement segment it states that itr processed on 16/7/2016 and refund determined and sent out to refund banker, but i have not recieved any intimation order and when i am requesting them to resend the intimation u/s 143 order, the site say no intimation order exists for the assessment year… whereas i have recieved intimation letters for my previous years and even the refund amount…So what should i do?

Tell me please.

Thanks.

Hi ,

I have filed my ITR by 5th july.There is some mistake in entries.I got CPC intimation that I have to apy 44000.Then I checked and got my mistake.Now I need to do revise filing or rectification.Now calcualtion shows 190 Rs. payable so I have paid it as well.

Hi,

I have intimation under 143(1)for the assessment year 2009-2010. I am not able to find details as the download button is not working as it was a manual filing(I guess). I am pretty sure that there will be no discrepancy but anyways I want to check and close this. I know I am late in this matter but can somebody please help me of how should I go ahead and find what was the discrepancy. secondly I find that jurisdictional office still remains the earlier one. And not the place where I reside. how should I change that.

Please give your views!

i never get any intimation from CPC even after getting refunds from CPC. what may be the reasons.

Who files your returen?

Do you file it online ?

What is the email id given for efiling?

Hey,

Have received a message that my return has been transferred to jurisdictional officer for further review . .what do need to do

You will get more information and notice. You would have to meet the Assessing officer.

when the amount will be refunded?I have received message on 14th stating that ITR V has been received on14-06-2016

Now CPC will process your return. Will see if your income and tax details match with what you have filled in ITR.

If things are fine you should get your refund. there is no time limit for processing of return. It can be from 15 days to 6 months

Hi

My brother filed revised income tax returns through some person for 2015-16 in august 2015, but still when i check the status in income tax india efiling website , i see status always as “ITRV received” and we should get a refund amount , till now it is not processed , when does the revised return gets processed by the income tax department.

Please suggest.

Hi,

I filed an e-file return (ITR-V) for the FY 2016-17. It has been processed also by CPC, Bangaluru and I have received an Intimation u/s143(1) (stating No demand No refund) e-mail from CPC. After realise, I seem there was some mistake on “Deduction under chapter VI” in my ITR form. May I know what should I have to do? May I file a Revised Return in this case?

Tell me please.

Thanks.

Hi,

I filed an e-file return (ITR-V) for the FY 2016-17. It has been processed also by CPC, Bangaluru and I have received an Intimation u/s143(1) (stating No demand No refund) e-mail from CPC. After realise, I seem there was some mistake made by me on “Deduction under chapter VI” in my ITR form. May I know what should I have to do? May I file a Revised Return in this case?

Tell me please.

Thanks.

Hi

When I was filling the ITR-1 then I found some amount need to pay as Income Tax after all calculation. But I filled the ITR-1 and submitted as well.

After that I paid my balance income tax amount through online NSDL portal. So please let me know is anything wrong in filling the ITR-1 and if yes then what is the solution?

There are a few points to consider, 1. You have assessed that additional tax needs to be paid. 2. You fill ITR-1 & upload it. 3. You then pay tax that was due. If this is the sequence you have followed, then your ITR is defective.

You should do step 3 first & then step2. Reason- The details of tax paid needs to be filled in ITR before upload/ e-verification.

If you have paid the taxes AFTER uploading ITR & if this is for this year ie AY16-17, then you can revise your return with correct details.

Kirti,

Hi i got message as ITR-V was received successfully on 07-06-2016.

May I know when am got the refunded amount. (i.e. Exception)

I received message ITR V Received, What can I Do for getting refund of excess amount paid,When will I Receive

Are you talking about AY 2016-17 for which deadline is 31 Jul.

Now CPC will process your return. Will see if your income and tax details match with what you have filled in ITR.

If things are fine you should get your refund. there is no time limit for processing of return. It can be from 15 days to 6 months.

CPC has target of settling refund within 7-10 days. CPC has to process your return and verify that your details are ok. Then it will issue the refund if it agrees with your numbers.

Wait for month atleast.

i got refund .but no change in status of itr on efilling wbsite .is there any problem?

sir can i do that tax filing please send me a number to my mail

Hi,

As per the ITR-V sheet, i see a refund of Rs. 5000. Is this amount that I will be refunded or i would have to pay the same?

Your early reply will be highly appreciated.

regards,

Samuel

Refund would be paid back. Refund comes when you have paid more tax than was due from you. So please verify your Income and TDS and if Refund is due, check that you have given correct IFSC code and bank details.

Hi,

I filed my income tax return for the assesment year 2015-16 in June 2015 itself through some person and he told that this time we need not post the signed ITRV hard copy to CPC. Because of that I dint send the signed ITRV to CPC before due date. When I checked the status recently it was mentioned that my ITRV is not recieved by CPC and hence I posted the duly signed ITRV to CPC in June 2016 and I got the acknowledgment message that my ITRV has been recieved on 3rd JUne 2016. when I checked my status today it is coming as delayed ITRV submission.

So I request the concerned person to answer my query whether I will get 2015-16 refund or not due to delayed submission of ITRV? I should get 1Rs. 10,000.

This time, we are filing for AY – 2016-2017. We have many free websites which give service for free. One such site is Cleartax. Please visit cleartax or Incometax website by uploading your form16. You can see the details

Hi, Excellent article. Very useful indeed.

Do kindly help address a query regarding completion of assessment when there is demand under u/s 156.

I have paid demand as per Demand u/s 156. Now after payment am I expected to revise ITR for the related AY & resend to Bangalore? Or is the ITR closed (completion of assessment) once demand is paid online.

Hi Team,

I just filed my return online via Quick e-file ITR (FORM ITR-1) however in Income from salary/pension I incorrectly mentioned the amount of my Total Tax Deducted instead of total income received, after realizing that I immediately filed my return again following the same procedure however in Personal Information (Return Filed under Section) I selected the option 17- Revised 139(5) and selected Revised option in whether revised or original section after which i was asked to mention the original Ack no & date.

All details were correctly entered after this and the ITR was submitted, now I have 2 ITR return forms which are successfully e-verified. Please let me know whether this is acceptable and whether I have done it correctly.

Regards,

Charlton

Hi Team,

Can you please help me on this..?

Regards,

Charlton

Looks like its done right. I assume this was for AY2016-17.

Hi,

I have filled ITR for AY 2013-14 in Dec 2014 but failed to send the same at CPC. I have sent the ITR now. So can I expect the acceptance of my ITR by CPC now. Do they consider it even after due date for sending ITR? Please reply. Thanks.

kindly sent the e-mail id to e-mail ITR acknowledgement

e-verification of ITR for FY 2015-16 is over by 31st January 2016 . Now you can only send ITR-V through like earlier times.

ITR-V is a one page document, which you need to sign in BLUE INK and send via ordinary post or speed post. You cannot courier the ITR-V.

You do NOT need to send any supporting documents along with the ITR-V. Just the one page signed ITR-V.

Address of CPC, Bangalore :

Post Bag No.1,

Electronic City Post Office,

Bengaluru, Karnataka 560100

Hi Team,

I just filed my return online via Quick e-file ITR (FORM ITR-1)however in Income from salary/pension I incorrectly mentioned the amount of my Total Tax Deducted instead of total income received, after realizing that I immediately filed my return again following the same procedure however in Personal Information (Return Filed under Section) I selected the option 17- Revised 139(5) and selected Revised option in whether revised or original section after which i was asked to mention the original Ack no & date.

All details were correctly entered after this and the ITR was submitted, now I have 2 ITR return forms which are successfully e-verified. Please let me know whether this is acceptable and whether I have done it correctly.

Regards,

Charlton

I believe you have done it right. No problems. Now in future your original return will always be shown as e-verified & only the revised ITR will be moved ahead. (In IT website)

Thank you so much. As of now both the returns are reflecting as EVC accepted, I guess that is done. right?

Yes you can relax . Keep your fingers crossed for returns to get processed.

Yes, whatever process has been followed by you is correct.

Original return will be replaced by Revised return filed.

Actually What rule says is:

In case you have filed your Income Tax Returns before the due date of filing of Returns mentioned u/s 139(1) but later on if you got realized that, there was remained any omission or mistake in filing your Income Tax Return, you can file a revised return under section 139(5) with stating correct particulars.

Revised return of Income Tax u/s 139(5) can be filed by an assessee any time before the expiry of 1 year from the end of the relevant assessment Year or before the completion of assessment (which is earlier).

So, What you have done is correct.

Thank you Sir.

The only thing I am worried about is last time after my EVC was successfully e-verified it was accepted by the the very next day however now it has been 3 days and I am still stuck on the same step.

I am from Kerala. I want to e-mail my ITR acknowledgement 2015-16 to Income Tax Department. Kindly give me the e-mail address. How can I do that

Cannot e-mail return. You can e-verify only. Or take printout & send by ordinary India post or Speed post. DO NOT USE COURIER.

Hello

i have filed my return for the AY 2014 and 2015 (Revised) as below

11/02/2016 Return Uploaded ITR-V / Acknowledgement received by CPC on

17/02/2016 Successfully e-Verified

But ITR has not processed by cpc bangalore and intimation u/s 143(1) also has not

been received till date i didn’t received the refund amount,

it’s been almost one month, what action should i take…kindly advice.

Thanks

I have e-filed my ITR-1 of AY 2015-16 for salary income and claimed deduction Relief us 89/90 for foreign salary income from Netherland. Because of that I received intimation us 143 (1) disallowing (mismatch) whatever deduction claimed us 89/90. when I checked with my company as this deduction in form 16 they said to file the revise return in ITV-2 to claim this deduction. Please advice. Thanks

Hey bro,

Even am in similar situation. What have you done to in this case?. Even i received intimation us 143(1). Foreign tax credit was not considered. Can you please let me know.

Thanks

I have filed my ITR-1 on 27-08-15 for assesmet year: 2015-16 and verified it electronically. In my refund status is shown DEMAND DETERMINED.

I hav got a notice u/s 143(1) that a net tax payable is Rs 2710, while in e filing detail and in 26AS detail and in Form 16 detail all entries are same and no tax credit mismatch is shown for my account.

what should i do?

Also i should have to get a refund of Rs 5010

According to Form 16 as well as Form 26AS total tax paid by me is Rs 31418 , but as computed by CPC is Rs 23564, while the aggeregate tax liability on me was Rs 26269.

My tax has been deducted as Rs 7854+7854+7855+7855=31418 in four consecutive months.MY net taxable income was Rs 502520.

There is s shortfall in prepaid tax of amount Rs 7854 as computed by CPC.

What should I do?

Did you have any compliance submission also..

you can reply in online mode also ..

The reason written there is Unsigned ITR-V, nothing else is written there

Did you do e-verification or did you send the ITR-V physically. if Physically it seems you have not signed the ITR-V

You can call up CPC Bangalore to find if you can still send ITR-V. Last date for ITR-Verfication was 31st Jan 2016

Contact number of CPC:

ITR-V Receipt Status, 1800-425- 2229 , 080-22546500

Hello,

I am in US so do we have any option to send ITR V document soft copy, if so how do we get email id.

No, this year Govt had started e-verification for which one need not send the hard copy of ITR-V.

Your signed hard copy of ITR-V has to be sent to CPC.

You can send it to relative in India who can speed post it to CPC.

Hi,

I have uploaded ITR on 30-Aug and even had e-verified. I have refund.

However, on the website status, it is showing as ‘Return Uploaded’ and same status since last 3/4 months.

I got a SMS saying, please upload ITR to eligible for refund.

I do not understand what is going on there.

anyone knows here?

If you have given email id you would have received some notice.

Please login to income tax website and check if there an order

You can also call CPC Banaglore

Refund /Refund re-issue/Rectification/Notification & Processing at 1800 425 2229

Hi,

I have files Income tax return for the assesment year 2015 – 2016 but i forgot to send the itr v form before due dateand i have sent 2 weeks back and it was recieved by income tax office, now the recit status is shown as ITR V recived after due date, and i got a message that ” non recipt of itr v for AY 2015 at CPC”.Please submit on or before january 31st 2016 else return will be invalid. I want to knwo whether i need to send the same ITR Vform which i sent 2 weeks back again to CPC office or do i need to do any revised return. I have asked my agent\ he said that there is no need to send anything again since they have uploaded already the recipt. Please help

Hi,

Please help…

Hello,

Can you please help on my ITR status. I have done the e-verification on 26th August. Still it is showing ‘ITRV Received’. Below are the details. Can you please check and help me on it.

12th August- Return uploaded

17th August – ITRV Received

26th August- EVC Accepted

26th August – Successfully e-verified.

It’s ok Gopal. No need to get worried.

Processing of ITR takes time. It also depends on which ITR you filed?

You can CPC Bangalore at 1800 425 2229 for clarification from 8:00am to 8:00pm from Monday to Friday

The reason written there is Unsigned ITR-V, nothing else is written there.

What is there?

If reason is Unsigned ITR-V that means you sent the ITR-V without signing,

If the 120 days from the date of e-Filing haven’t elapsed, simply print out a fresh copy of the ITRV, sign and send it back to CPC within 120 days from the date of e-Filing.

If 120 days have passed If ITR V is rejected because the same is unsigned, illegible, mutilated, bad quality or not as per specification it is deemed to have been not filed and the return is to filed once again followed by submission of ITR V .

Hello

I have e-filed the return and revised return on same day. Verified both electronically. EVC has been accepted for both. The revised return has been processed and the intimation recieved with no demand and no refund. However, in the intimation, the ITR type is getting displayed as original though the acknowledgement number is that of revised return. Is this fine? [Note – In the dashboard, it is showing the status as processed against the revised return]

It should be ok. But You can call CPC to verify.

For Refund /Refund re-issue/Rectification/Notification & Processing 1800 425 2229

Hi Ashwani

Curious to know what was the status against original return in the dashboard. Did you got any clarification from CPC

GOT D MSG DATED 17th that they rcvd ITR V .WHN CAN I EXPECT MY REFUND?

Your return would be processed now. Expect it next 1-3 months

Please clarify the following…

Any correction permissible in ITR 2014-15 after filing OF ITR…?

Any correction permissible in ITR 2015-16 after filing OF ITR & E-VERIFICATION(OF ITR DONE THROUGH NET BANKING)….

Filing of ITRs done on 26.11.2015 and E-verification done on 30.11.2015

Thanks

No as you have filed returns after the due date you cannot revise your returns. Our article Filing Income Tax Returns after deadline discusses it in detail.

Thankyou

Please clarify the following…

Any correction permissible in ITR 2014-15 after filing OF ITR…?

Any correction permissible in ITR 2015-16 after filing OF ITR & E-VERIFICATION(OF ITR DONE THROUGH NET BANKING)….

Thanks

Address:-Ajay Singh H.No30 Civil Hospital Campus Bhiwani – 127021

Hi,

While filing return of my TDS, mistakenly an incorrect bank account no. was uploaded in the software. Now, my TDS return status is through ECS is Failed due to incorrect account no.

Please tell me how to update the correct account no.

Many thanks

Hemant

Steps are shown in document https://incometaxindiaefiling.gov.in/eFiling/Portal/StaticPDF/Resolution_FAQ-refund_final.pdf

1. Logon on to IncomeTax site with your user ID and Password.

2. Go to MY Account Refund Reissue Request

3. You need to enter the necessary details such as CPC reference number, refund sequence number, and date of birth. Enter the following: CPC Communication Reference No: You would’ve received an “Intimation u/s 143(1)” or a “Rectification Order u/s 154” from the IT department informing you of the failed refund. The CPC Communication Reference No. is the number on the first page of this letter. It will be in the format CPC/1011/P2/xxxxxxxxxx where “xxxxxxxxxx” represents a ten digit number.

4. Click on Validate button

5. Assessee has two option to apply Refund Reissue- ECS or Paper.

6. ECS Mode: Select mode of Refund reissue,

7. Other option is Bank Account Details – If you click on Yes, there you can update your bank account details and click submit.

Hi,

I filed my income tax on 14/08/15 and e-verified on 15/09/15.Since then there is no update.

I asked for a refund, and on their website it shows “Not determined” and for acknowledgment generated last update is e-verified and EVC accepted on 16/09/15.

It’s been more than 1.5 months and there is no update.Almost all of my friends who filed ITR got update/refund within 15 days.But for me there is no update.What shall I do?

Thanks.

Wait. It takes around 3 to 6 months for processing of returns.

Hello

i have filed my return as below

17/08/2015 Return Uploaded ITR-V / Acknowledgement

14/09/2015 Successfully e-Verified

15/09/2015 EVC Accepted

17/09/2015 ITR processed refund determined and sent out to Refund Banker

but till date i didn’t received the refund amount, i have also received the acknowledgement and SMS also

it’s been almost one month, what action should i take…kindly advice.

You can check your refund status on the TIN-NSDL website by simply entering your PAN (permanent account number) number and the assessment year. The assessment year is 2015-16 for financial year 2014-15

Your Refund status is ‘Refund determined and sent out to Refund Banker’: This means your refund claim has been accepted by the income tax department and has been forwarded to the refund banker for processing. Taxpayers can view status of refund 10 days after their refund has been sent by the Assessing Officer to the Refund Banker. The refund banker service will give you the latest details of your refund that may include speed post tracking, error messages in case of incorrect bank details etc

Steps to take – Wait for 10 days for the refund to be credited. Do check your status again if refund is not credited

hi,

I have filed my Income tax return on 20/8/2015 and send the signed document through post on 31/8/2015.The online status shows ITR-v receipt received. I applied for refund,so when I go there and check the status it says “a.Your assessing officer has not sent this refund to Refund Banker”

b.If this refund has been sent by your Assessing Officer within the last week, you may wait for a week and again check status.

This status was shown from last two weeks.

Can you please help me with this?

Hi –

I have checked ITR-V received or not. There is 2 options right. When i click pan card and 2015-2016 assessment year it shows not e-file returns uploaded yet. But when i check with e-filing acknowledgement number it shows ITR-V received. How it possible with out upload returns how will i get acknowledgement number. Please reply me

Did you e verify your returns or not?

You can check the status of E Verify after logging in to income tax e filing website clicking Myacount->e-Filed Returns or Forms. You will the see the status and the acknowledgement number.

Hi Kirthi,

I have filed my TDS return on 31/08/15 for ITR1 and for the year 2015-2016 and sent it through speed post. I have checked the speed post status as delivered in speed post site after ten days But I have not received any mail regarding the receipt status of the ITR V since then. I have checked in my mail(Spam also) and also checked for the status of the receipt in the incometax efiling site, but the status is showing as “Return uploaded pending for E Verification”. I have called the income tax tollfree numerous times who were not responding and coming busy all the time. So after waiting for about a month, I have done the e verification through netbanking on 28/09/2015 hoping that this might be the problem. But still now I haven’t received any kind of document receipt mail or SMS and the status of the ITR V is now showing as successfully e verified and nothing else. So can you please help in finding out any other ways about the receipt status, I doubt now whether the document is received by the CPC dept or not. Please help!!

Hi,

Hope some one replies on my query

After E-Verification of ITR The Return would appear as successfully e-verified as shown in the image in the article E-verification of Income Tax Returns and Generating EVC through Aadhaar, Net Banking

Hi,

After sending the ITR through email, I got a message that the ITR has been recieved and I recieved an email from refunds.dr7@incometaxindiaefiling.gov.in that “This is to inform you that the income tax department has successfully completedothe account audit for thisequarter, and you are qualified2for a refund” and the refund was lower than what I filed for.

I am not sure whether this is a valid email or not. Could you confirm?

Very informative and useful article.thanks

Thanks. We appreciate you taking time to comment

I have couriered my ITR to Bengaluru on the given address via Speed Post. My document got delivered on 12-Sep-2015(as per speed post tracking record showing online). It’s been 13 days now(today is 25-Sep-2015) but I have not received any acknowledgement or any message from them, no status is showing in my income tax login also.

My CA said that they might have misplaced the document, I need to submit the document again.

How can they do this, It is such a critical department that needs to be handled very carefully. Do I need to courier my document again to Bengaluru?

You can call the CPC at 1800 425 2229 between 8:00 AM to 8 PM. The service will be available in English, Hindi and Kannada.

EN362021661IN

Booked at Booked On Destination

Pincode Tariff Article

Category Delivered at Delivered on

Maharanipeta S.O 03/09/2015 560100 40.00 Domestic NSH BANGALORE (560099) 07/09/2015

Detailed Track Events For EN362021661IN

Date Time Office Event

03/09/2015 10:11:59 Maharanipeta S.O Item Booked

03/09/2015 12:59:14 Maharanipeta S.O Item bagged for NSH VISAKHAPATNAM

03/09/2015 12:59:39 Maharanipeta S.O Bag Despatched to NSH VISAKHAPATNAM

03/09/2015 15:37:50 NSH VISAKHAPATNAM Bag Received

03/09/2015 15:38:06 NSH VISAKHAPATNAM Item Received

03/09/2015 15:38:06 NSH VISAKHAPATNAM Bag Opened

04/09/2015 02:20:48 NSH VISAKHAPATNAM Item bagged for NSH BANGALORE

04/09/2015 03:38:02 NSH VISAKHAPATNAM Bag Despatched to NSH BANGALORE

04/09/2015 21:46:41 SP TMO MUMBAI Bag Received

06/09/2015 02:44:36 NSH BANGALORE Bag Received

06/09/2015 15:10:24 NSH BANGALORE Item Received

06/09/2015 15:10:24 NSH BANGALORE Bag Opened

07/09/2015 10:30:00 NSH BANGALORE Item Delivered [To: CPC Income Tax Department

So finally in Four days the courier was delivered to CPC. What is the status of ITR-V Received?

i have filed the itr 1 all correctly but still i got the intimation just because tds credited and tds liable got difference with just one rupees. but in itr v it doesn’t shows to be as payable it’s nill. Do i have to revise it.

You can ignore the difference(tax payable or refund) upto Rs 100. You don’t have to revise it.

Hi,

I had sent my ITR-V form by speed post to Bangalore office two weeks back but have not received any acknowledgement from their end on my mail id or phone number. I even logged into my account and the status is still “Return Uploaded, pending for ITR_V,E-Verfication”. How long it typically takes for the status to be updated or receive an acknowledgement from them? Do I need to send it again?

There is nothing to worry.

CPC Bangalore dispatches an email acknowledgement on receipt of ITR V. It should reach within 4-5 days after sending ITR-V to Bangalore.

If your ITR-V is not been marked as received after 10 days, you can call 1800-425-2229 – Govt of India helpline from 9AM to 8PM

Hi,

My refund got declined saying that the account number is incorrect..when I am going on the website to fill the refund re issue form its says that “no refund has been returned” do I need to wait for 24-48 hrs and than apply or whats the procedure please advise

Hi,

I uploaded the ITR on 19/08/2015 and e-verified my ITR for year 2015/16 and then status changed to EVC accepted, but today I got a message that my ITRV rejected and reason is Unsigned ITR-V. Can anyone please explain me the exact reason. Do we have to digitally sign the ITR even if it is verified through Aadhar?

Your case is surprising. And even if they have to reject ITR because on Unsigned ITR-V it should come after 120 days.

Login to e filing, Click My Account->View Forms and Returns

click on the acknowledgement number, you’ll be able to see the reason for rejection.

The reason written there is Unsigned ITR-V, nothing else is written there.

AFTER SUCCESSFULLY E VERIFIED MY RETURN PROCESSED ON 19/08/2015, I RECEIVED INTIMATION THROUGH SMS ON MY REGISTER PHONE NO. BUT STILL NOT RECEIVED INTIMATION ON MY EMAIL ID. I REQUESTED THROUGH MY ACCOUNT TO RESEND INTIMATION. REPLY FROM INCOMETAX INTIMATION RESEND SUCCESSFULLY ON 24/08/2015. BUT STILL NO INTIMATION RECEIVED IN MY EMAIL INBOX.

check your ITR form if email id is mentioned in the ITR form. Or the email id is yours!

Hi,

I’ve received 11 number CPC(communication reference code) code and the website is accepting only 10 digit code. How should I resolve this issue?

Hi,

I’ve received 11 number CPC(communication) code and the website is accepting only 10 digit code. How should I resolve this issue?

Received SMS on 21Aug2015 -“ITR for AY 2015-16, Ack xxx has been processed. Order U/s 143(1) will be sent by email”.

I have not received any email since then. Today I requested for the order in the e-filing website under Account section. Did I make a mistake. should I have waited for some more time?

Hi

I filed the return and it is showing in my incometaxindiaefiling account as well. But I did not get any email confirmation for the same.

What needs to be done in this case?

Thanks

Kindly help address a query regarding completion of assesment when there is demand under u/s 156.

I have paid demand as per Demand u/s 156. Now after payment am I expected to revise ITR for the releated AY & resend to Bangalore? Or is the ITR closed (completion of assesment) once demand is paid online.

If there is no income tax demand for refund, can we use ITR-V as address proof for passport application

If the tax payable is zero(OR if demand and refund is zero), can I consider ITR-V as the assesment order. Can I use ITR-V as address proof for pass port

I filed IT for FY – 2013-2014. – as per this had to get refund

I filed revised IT for FY – 2013-2014. – as per this I paid extra tax

Sent both ack together to CPC.

Now original IT is processed and I got refund and for revised ITR, status shown is received.

Now I would like to cancel revised IT which I have filed. how can i do it without getting into any trouble.

Hi

This is the first time i am doing income tax rerurns so i filled itrv and sent it to cpc I didn’t get a acknowledgement mail from cpc instead i got a message to my registered mobile saying that they received my itrv so is it necessary that a mail should come from cpc or is it ok

And one more thing is when i checked in site still it is showing that my itrv is not received

So please help me what to do and when will be my money refunded is there anything that I still need to do

Please reply me

Congratulations for doing your income tax return.

A tax payer should send the signed copy of ITR-V to the CPC through speed post or ordinary post within 120 days from the date of filing. Once the CPC receives the ITR, it usually sends an email or an SMS acknowledging the ITR.

So you have received the SMS.

Give some days and check status again

If you haven’t received the acknowledgement, download the acknowledgement from the income-tax web portal by logging in through your online account. The same will be available under ‘E-filing processing status’ under the tab ‘My Account’

The receipt can also be checked by quoting your PAN and assessment year or by quoting the e-filing acknowledgement number on the ‘ITR-V Receipt Status’ tab under ‘Services’ section on the e-fling website,

You can also call the CPC call centre number 1800-4250-0025 (from 9am to 8pm) to enquire about the status of e-filing. For rectification and refund, the number is 1800-425-2229.

Hi Kirti,

I had leave my job with some personal reason , i worked from APR 2014- JUN 2015 for which i got form 16 and i have submitted the E filing on-line by . but in the Form ITR V as asking for this ” If the return has been prepared by a Tax Return Preparer (TRP) give further details as below:”

shall i put as in from 16 or the blank what it means . Advance thanks for help.

If you have filed the return yourself then you do not need to fill in the If the return has been prepared by a Tax Return Preparer (TRP)

Mainly a TRP (Tax Return Preparer) helps a person to file his income tax returns. Mainly a TRP shall

Prepare the return with due diligence;

Affix his signature on the return prepared by him;

Furnish the return with the Assessing Officer having the jurisdiction over the concerned assessee or to any other officer or agency as may be directed by the Resource Centre with the approval of the Board;

Hand over a copy of the return to the person whose return is prepared and furnished by him;

Retain a copy of the acknowledgement of having furnished the return;

Hi

Can you suggest, I hv’nt paid self assessment tax calculated while filing tax return and unfortunately submitted it. However it says you have to e-verify within 72 hours. I have received EVC on my mail but not verified till yet.

Is there any option to cancel this return upload as I have not verified through EVC? I wanted to fill-up my tax payment challan no before uploading my final return. Self-assessment tax is yet to be paid to generate challan no.

Kindly suggest.

PAN No AEIPV8761M . my refund not made so far.

For which Assessment Year are you talking Sir. You could check the refund status at Online REFUND STATUS

PANNoAEIPV8761M my refund not made so far.

I have received Intimation U/S 143(1). I also observed that in this there is no mismatch in Return I have filled and Calculation as per Income tax.

Request you to help me what to do.